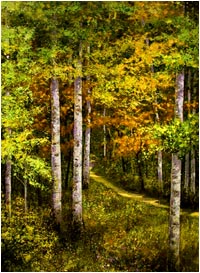

Trail Head...

an Archive

Walking the Gold Trail Using the

"Thoughts!" of ANOTHER

|

|

"Think now, if you are a person of "great worth" is it not better to acquire gold over years, at better prices? If you are one of "small worth", can you not follow in the footsteps of giants? I tell you, it is an easy path to follow!" --ANOTHER (THOUGHTS!) 1/10/98 [View early writings of ANOTHER and FOA at USAGOLD (5/1/98 - 9/3/98)] |

WELCOME to the Trail Head...the First Archive for "Walking the Gold Trail"

USAGOLD is pleased to offer these special pages of unfolding commentary that are sure to challenge conventional perceptions of the gold market and international monetary affairs. Content for these Gold Trail pages is in the hands our two anonymous authors, "ANOTHER" and "Friend of ANOTHER" (FOA); and based on our past association with these popular commentators, we are confident that the message will continue to be as fascinating and as worthy of careful study as anything you will find on the web today.

Through these special pages we can now "Walk the Gold Trail" of current events; anticipating the road ahead while leaving this easy-to-follow trail of commentary behind.

We encourage you to follow along (or to catch up), and then to join your friends at the USAGOLD Forum to share in the discussion. It should be noted that we do not edit or seek to alter ANOTHER and FOA's presentations; they appear here as submitted by the authors. With that, we have finished lacing on our own hiking boots, and stand ready to enter the yellow wood, taking the path less traveled by...

Access the USAGOLD Discussion Forum Archives to view daily commentary referenced by FOA.

February 2000 to June 2000 (Archive I) This archived commentary has been re-arranged and presented in chronological order so that you may begin reading, naturally, at the top. However, you may click here (Scroll To Bottom of Text) for the later commentary.

FOA (2/23/2000; 19:49:22MT - usagold.com msg#6)

Introduction

Hello everyone, I'm glad you could come along. My name is FOA.

I see a lot of old faces here,,,, and some new. If you are wondering

where we are,,,,,, your participating in one of our walks and

talks on "The

Gold Trail". You're one of many people who take the long

drive out of the city to come here. Some say it clears their mind

from things that are not real. Whatever the reason, it seems everyone

arrives here sooner or later. For myself, I have been hiking this

path for a good part of my life. I prefer it here, because from

this vantage point we can better grasp how the world works.

None of us are the first, nor will we be the last to take this

hike. Over time, various people and nations have been on this

path, perhaps going back a thousand years or so. During some periods

this same trail was followed right through the main stream of

society. While during other times, like today it has tracked far

away from the economic illusions in our modern world.

I see most of you have brought your laptops (computers) and cell

phones for internet access. Good. We will be looking at charts

and things as we go along. Also, one of our rules here is that

no one can offer their credentials of track records to each other.

Out here we all are the same with no exception. Just real people

taking in the world events as they happen around us. Besides,

one's past accomplishments and financial success are about what

happened yesterday, not tomorrow. And understanding the future

is what time on this trail all about. We will only look back at

past events and commentary to gain perspective, understand ourselves

and find reasoning. A process that helps all of us think more

clearly in this world gone mad.

And one more thing before we get started: some of you were asking

who I am. And I also heard those city slickers in the back joking

about how this was all "so lame". Well, to address the

second item first,,,,, more than a few of you slick dudes have

left this trail complaining that the hike made their brain hurt

worse than the old leg muscles. We'll see if you new ones are

still joking after walking a few miles! Oh yes, I see you're wearing

hard sole dress shoes. Now that "is" lame! (smile)

Back to the first question: all of you already know me. Just look

in a mirror and see for yourself. I'm the butcher, baker and bricklayer,,,,,,

doctor, lawyer and the banker. From the Texas oil man to the yardman

in Hollywood, I represent the thoughts, feelings and perceptions

that many people have, but never express. After we share some

time on the trail, many of you may find that most of this understanding

and knowledge of FOA was already with to you to begin with. Truly,

it was the years of exposure to "Western life" that

has obscured our good reasoning.

Mine is also a world perspective that offers thoughts and views

as seen though the eyes of others from many lands. Sometimes it's

through the eyes of Another. Oh yes, one more thing,,,,, I'm American

to the core! "Born in the USA" and still living a "very"

private life in my home there.

Onward

We must view the world in a broad context, just as much as in

a detail perspective. The larger perception can be just like looking

at a river the valley from the ridge above. From far away it's

easy to see what direction national trends are flowing. The whole

body moves as one, always towards the sea. The problem comes when

we get too close and interpret things using only a small river

section in front of us. More often than not, the white water we

see only hides a deeper flowing truth.

In like sense, national governments and society in general, are

the same as those boulders and eddies in the river. Seen up close,

they sometimes give the impression that the river is flowing up

stream or sideways, when it's only one small section of a larger

political will. The same is true in the modern gold markets. The

largest part of the river could be flowing in one direction with

an unstoppable purpose, but the various swirls and eddies make

it look like it's going in circles.

Further

Within every social order, people have conflicting factions that

try to dominate the whole. But if one can understand and pinpoint

the logic and reasoning of several dominate groups, we can get

a grasp for the overall eventual flow. We have seen through out

history and in our modern life that the human spirit, most always

reaches for and leans towards natural conclusions to ages old

problems. There is something in us that makes mankind flow this

way. Time and again we build up our emotional will. Then in a

great flood we literally overwhelm the branches and rocks that

distort our progress through this stream of life.

Today, it seems that the need for this natural flow has been perceived

by several of the worlds large groups. We see this in the progress

of the gold market to date and is something we have been discussing

publicly for several years now. We have given many different perceptions

of this changing modern gold market. Each appropriate to it's

own period of time. Indeed, they were snapshots of political will,,,,

each taken in the context of the moment,,,,, all documenting the

evolution of gold as a new force,,, a new player in the world

today.

Truly, the stream is being prepared for the great flood that must

come, will come!

We rest now

Our most broad view, expressing our strongest position is this:

From ten or perhaps twenty years ago a political will, a concept

was being formed that would today change the economic architecture

and power structure of the world. Within this change, gold would

undergo one of the most visible transformations since it was first

used as money. We expect that starting three or four years ago,

the actual gold market itself, started responding to this sea

change. As such, in our time, physical gold will enter the greatest

bull phase in it's human use history.

This my friends is the very trail we walk today. During our hikes

and fireside chats, we will point out this political will, consider

the logic and express our reasoning for this position. All the

while, observing the "river current" in the form of

events that will soon confirm our view. Indeed, as Another always

said, "time will prove all things".

At times we will walk looking backwards, as we pull up many of

our old posts and discussions, detailing the whys and what-fors.

Why we said what we said, then. I hope these walks will be as

interesting for all of you as it will be for me. When not writing

here, I can be sometimes seen discussing gold on the USAGOLD forum

as "Trail Guide".

And lastly, I wish to thank Mr. Michael Kosares for creating this

fine venue. Displaying all of the creative, professional talents

of the Centennial group of people, this entire site is a testimony

to their forward thinking ability which is so lacking in most

precious metals companies. With this in mind and considering our

changing world, a relationship with them today will most certainly

benefit the investor in the long run. Possibly in a way one may

more fully appreciate later. I encourage you to support your future

as well as this USAGOLD free site.

"the human river flows for the will of no man,,,, it takes

our precious time as it's own

our lives are spent learning how it does pass,,,,, yet it will

never know how we have grown"

We walk this new Gold Trail together, Yes? Thank you for reading,,,,,,

FOA / your Trail Guide

FOA (2/26/2000; 11:13:56MT - usagold.com msg#7)

Foundation

https://www.usagold.com/halldiscussion.html

A Day Walk

If I had a nickel for every time we thought the dollar was finished,

I would have a bunch of nickels! Remember back in the early 80s

or even further back into the 70s. All we heard was how the dollar

was finished and going to crash and burn. Books about hyper inflation

and the need for gold / swiss francs were all over the place.

I read all of them to gain perspective and also acted on some

of their advice. Made some money on it too. But even then, something

just didn't completely ring true about the whole scenario. Indeed,

in hind sight, gold never did return above $800, the dollar didn't

hyper inflate and most of the world kept using the dollar as a

reserve.

Today, we can more fully understand why so much of that early

insight failed to deliver.

True, the dollar was seen as a basket case back then. It had just

been pulled from it's gold bond and prices were going up all around

us. However, because the world had been on a simi dollar / gold

standard, all nations that had previously signed onto using the

US buck as their currency reserve now did so with even more resolve.

More important, it seamed than using gold itself was out of the

question as every country's Central Bank brought dollars as fast

as we printed them. The dollar still settled most all trade accounts

while dollar reserve buying made an obvious show of support for

this world system. No matter how much bad press was offered, they

were staying on track and they have continued to do so right up

into the 90s!

But all of this flew into the face of what every economist was

saying, back then. The common understanding of the era was: if

the US didn't stop over printing it's money, we would all experience

a major price inflation,,,,,, and no one could stop it! Again,

"major" inflation didn't happen and to ask a further

question: if the dollar system was so bad, why didn't the world

just dump the reserve system and refrain from using it further?

In other words, let the dollar be "the US dollar" but

don't use it as a backing for your own money system.

Thick Brush Now

Going against the logic of "sound money": through out

all the currency turbulence of the 70s and 80s era (including

today), the US never did reign in the over printing of it's currency.

It continued almost non stop money supply expansion for it's local

economy and in addition sent a good portion of it's cash all over

the world. On and on the US trade deficit continued to do it's

work of feeding ever more US cash into foreign economic systems.

We printed paper currency by borrowing it into existence,,,,,,

used it to purchase real goods overseas ,,,,,, while foreign governments

actively soaked up this dollar flood by expanding their own money

supply.

Like this: When you buy an item externally, a dollar is sent overseas

to pay for it. Usually, through the world currency trading arena,

that dollar is converted into the local currency of the nation

which the goods came from. But more often than not,,,,,,, as we

print that dollar out of thin air, the foreign government takes

the dollar into it's reserve account and prints one of their units

for deposit in the local economic system. They do this because:

if the foreign CB didn't save the dollar as a currency reserve

,,,,,, and sent it back into the world currency markets to "buy"

an existing unit of their money supply,,,,, this action would

drive up their currency value vs the dollar and make the price

their goods non-competitive in world markets. In other words,

a US citizen couldn't use a printed (borrowed) dollar to buy an

item for $10.00 that outside the "dirty float" of exchange

intervention would cost $15.00.

This is how the "dollar reserve process" inflates the

money supply world wide as we (USA) run a trade deficit for our

benifit. It keeps the dollar exchange rate higher than it would

naturally be thus allowing a US citizen to buy goods at a cheaper

price than our expanding money supply and implied currency value

would normally dictate. A process in and of itself that invites

still more dollars to flow out and purchase still more external

goods. Had foreign CBs not taken so many dollars, the ever expanding

US money supply would have long ago impacted currency exchange

rates and forced a major price inflation internally (in the US).

Yes, the major inflation so many saw coming,,, back then,,,,,

would have arrived,,,,, then.

So why did these other CBs do it? The standard explanation was

that this created a market for their goods here in the US. Yes

that's true, but it begs the question; did no one in their land

want to buy goods manufactured locally,,,,,, and pay for them

with the same printed money supply? Why is it the US could inflate

it's money supply to buy cheaper goods externally for no more

than the price of printed paper? But, in the same country our

paper was sent to, they couldn't print their own currency to buy

their own goods? Why couldn't they raise their real standard of

living somewhat using the same process like the US,,,,,, and doing

so without the burden of inflation or importing foreign currencies?

Again, why would our printed, inflated money movements not create

price inflation for us (USA) in goods purchased externally? What

if they (foreign goods producing countries) printed an amount

of their money equal to the inflow of dollars,,,, but, without

holding paper dollars as reserves to back it,,,,, brought the

exact same goods from themselves. Common prevalent economic theory

says price inflation would result? Or would it? Or better said:

why them and not us?

Into the deep woods again

Again, and as above,,,,, In the 70s, it was widely held that the

dollar reserve system forced other countries to inflate their

local currencies, thereby importing dollar price inflation. But,

as time went by,,,,, indeed a decade or two now,,,,,, the same

process continued non stop, with no change. It seemed that some

"other" countries had found a "new way" to

somewhat circumvent the dilemma. Or was this "new way"

something sold to them in order to extend the dollar system's

timeline?

Many of the lesser third world countries experienced a combination

of sporadic hyper inflation and deflation as we forced the dollar

reserve system down the throats of their citizens. Their people's

living standard constantly fell as they worked ever harder to

produce more goods in return for more of our printed dollars.

But, instead of using the extra inflow of dollars (positive trade

balance) to buy their own currencies in the local system,,,,,

thereby keeping their currency strong,,,,, they used that dollar

flow as collateral to borrow (from IMF and international banks)

more dollars from the world dollar float (mostly called Eurodollars).

The lure (or the hard sell) was that they could build up their

infrastructure,,, increasing their production efficiencies (human

productivity's),,,, thereby raising the national standard of living.

Further, they were sold the unneeded idea that even if they didn't

completely use the dollar surplus to borrow more, they should

hold those dollars in reserve (buy and hold US treasuries) and

print more of their own money!

Again, it seemed they had no advocate to push for their own best

interest. No one told them that their people already worked cheaply

enough to more than offset the competitive loss of a stronger

local currency. No one told them that with a strong local currency

structure,,,,( that using the dollar surplus to buy their own

currency would create),,,,,,,, would allow them to borrow in their

own capital markets. A more go slow approach that builds long

term benefits. This process would free them from the entanglements

of making international debt payments in another money. Indeed,

the costs of those involvement's later proved overwhelming!

Now the trail becomes more open

For third world countries their international dollar debt exposure

eventually locked them into a servitude to the dollar reserve

system. Despite all their natural and human resources, currency

involvement had taken a lion share of any productivity increases

and increased lifestyle this modern world offered.

However, it did help the cause for the dollar reserve system.

By creating an ever growing international debt in dollars, eventual

dollar demand to service this debt would only increase. Thereby

keeping it's value artificially high. In addition, any left over

floating dollars quickly took the form of US treasury debt held

in these small countries treasuries. There they were used to further

hyper inflate their own currency supply.

For the more developed gold owning countries of the G-7, they

had a different question in mind. Again, if taking in inflated

dollar reserves was the act of importing US dollar inflation into

ones local economy,,,,, and in the process creating a market for

your goods overseas,,,, why not just print your own currency without

taking in dollars,,,,,, and in doing so give the same buying power

the US citizens have in your market,,,,,, to your own people?

If it's not price inflationary to take in part of a world "inflated

dollar supply" and create jobs for your people locally,,,,,,

why would it be any more inflationary to print your own currency

outright? Indeed, why does one need a dollar inflow to legitimize

the same money inflation process? That being currency inflation

to create jobs?

Why should we (as dollar asset

holders) think about this question? Because someone else is and

doing something about it today!

Back to a marked trail

Today,,,,,, and after all of this,,,, the dollar never did crash

from price inflation. At least nothing like what was expected

earlier in the last two decades.

The dollar reserve system was never going to fail then because

the major world economic powers were willing to use (waste) all

the productive efforts of the worlds people to keep it running.

Looking back we now understand the thinking behind this. Without

the dollar acting as a reserve, we would have had to go back to

a gold system. There was no other currency structure strong enough

or deep enough to carry the load.

But, gold had been proven to be much to easy to circumvent as

a national or world currency. It seemed human dynamics would never

allow an economic system that operated on a pay as you go process

without gold debt. If history had proven anything it was that

if we have a money,,,, fiat or gold,,,,,, we are going to lend

it, borrow it and in the process create debt. Yes, even using

gold!

Even if we have a pure gold system, human nature will find a way

to turn it into securities. In doing so we will,,,,, come hell

or high water,,,,,, lend more gold than we have and borrow more

than we can pay back. One has but to return to the history books

to see it all in plain print. Over and over again, we start with

a solid gold foundation and soon degrade it into trash. It's not

just the American way,,,,, it's the world's way.

Because the modern world had progressed into the efficiencies

of using high speed digital fiat currencies, no one at that time

or today, was willing to crash the whole system by returning to

gold. I suspect that the worlds richest would have lost a lot,

but so to would "us regular" people. Even with our savings

in the form of a "digital illusion", at least we had

a job to go to and a dream in our bank account. Removing the dollar

and returning to gold would have erased the illusion and temporarily

shut down the jobs.

So, dollar hyper inflation never arrived and gold did not make

it's run because world CBs bet your productive efforts on supporting

the dollar reserve. In the process, the US standard of living

was raised tremendously on the backs of most of the worlds working

poor. But this is not about to last!

A broad view from the ridge

Not long after the US defaulted on it's gold loans,,,, dollars

held as gold certificates,,,,,, major thinkers began the long

process of forming another world currency. One that would not

maintain the fiction of a gold standard with the somewhat fixed

gold prices inherent in such a system. The creation was distorted,

to say the least. Just as the River in my first post was often

seen in distortion, so too was this currency issue. It began with

the European Currency Unit (ECU) and has later progressed to it's

present state of the Euro.

After operating on a fiat system for 20+ years people are starting

to realize that the only thing that backs a currency is the real

productive efforts of their people. Yes, over time we always borrow

more than out productive efforts can pay back and proceed to crash

the money system.

But what else is new? (smile)

We call this a money's "timeline" and it's as new an

idea a life, death and taxes! Time and debt age any money system

until it dies. The world moves on. Only this time gold is going

to play a different part in the drama. We will all watch it unfold.

It seems people saw something else that would make the Euro unique.

Paid up assets also stand behind circulating money. Indeed, if

someone owes a $100,000 dollar piece of land , has a good producing

job and borrowed $50,000 against his land,,,,,, the world is likely

to circulate that debt note as a fiat land backed currency. But,

if his gold (the land) is worth $1 million in a free physical

market,,, AND RISES FURTHER IF CURRENCY SUPPLY OUTPACES REAL PRODUCTION,,,,,,,

and his other debts are relatively low ,,,,,, the same note would

circulate just as effectively if the $50,000 was borrowed against

his name alone.

In essence, the jump into the Euro is more based on a new currency

that is more honest in dealing with our historic human dynamics.

Let's try not lying to ourselves and admitting that gold alone

in a currency will not remove our will to borrow and lend and

therefore eventually defraud each other! Would it not be better

to at least not shackle the money to gold. Indeed, a real physical

freegold market will constantly be devaluating any fiat currency

over a long term. While removing the need for CBs to maintain

fixed exchange structure through a dirty float against gold.

But, the most important aspect is in the escape valve gold would

provide to developing countries with positive trade flows. Those

that wish to settle their debts outside the currency arena using

gold as a settlement. Or, if they wish, to buy gold in the open

market with their trade reserves.

The secret to all of this is in the "Legal Tender laws".

Allowing gold to be used as a Legal Tender,,,, "for the settlement

of all debts public and private",, but changing international

law such that no form of debt can force it's payment in gold!

This opens a one way street for gold and a two way street in fiat

currencies. No one will lend gold because they cannot force it's

return in the courts, thereby making gold a physical only international

currency. Yet, on the other hand, we all must borrow in this modern

world and currencies will be the only avenue for this. Creating

a demand (and added value) for them in addition to general use

demand.

The first thought many will have is that everyone will just buy

gold to make debt payments, driving out fiat currencies. But remember,

if you have debts they will be in currency settlement only. One

will weigh the cheapest form for repayment! Gold in this atmosphere

will be completely free to trade, become extremely expensive and

stay that way. Not to mention that it's sale as a commodity (outside

it's money use) on the private level will be well taxed.

We rest now

True there is a lot more to this story. Some posters have been

discussing it publicly for some time on the USAGOLD forum. If

you want a wonderful background reading on what "Freegold"

would mean,,, get your laptops out tonight and read the link above. There is also considerable

agitation voiced against this view.

First read all of:

Aristotle (2/7/2000; 7:15:24MDT - Msg ID:24589) It begins! -----* Executive Summary --an Outline of Observations *-----

My position: The world is going

to change it's currency system before long and this will greatly

impact the wealth of dollar asset holders. Not to mention physical

gold holders. As a note for further consideration and talks,,,,,

we have talked before about the "Texas Railroad Commission"

and how it once declared oil a public utility and later controlled

it's production. In the future, international law must declare

all large gold reserves to be "public utilities" in

the countries they reside. Mines will be very profitable and good

investments after they recover from the destruction of our existing

paper gold market. Still, their total production will be controlled

and somewhat taxed. Small private operations will more likely

be heavily taxed.

We will pick up the pace later (smile). Eventually getting to

oil and the markets today.

Fires out.

Thanks for reading,,,,,, FOA/ your Trail Guide

FOA (2/28/2000; 10:18:13MT - usagold.com msg#8)

First walk

The real hike begins

In my last post "Foundation", we raised several questions

as we walked. Some were implied and others were direct. But all

were mentioned to give pause to think. Today I'll offer my thoughts

from an old study.

By 1971 the remnants of our gold exchange system had two major

forces working against it.

First:

The US had printed way more dollars than it had gold to redeem

them. This didn't even take into account the fact that Americans

couldn't exchange the native part of the money supply for gold.

The whole concept of physical bullion keeping officials from printing

too much money became shot full of holes. The reality of our modern

day dictated that any major world power, not just the USA could

eventually override the precedent of a money supply tied to a

fixed price of gold.

It seemed that as powers became super powers and nations represented

larger people blocks, their ability to just walk away from a stated

monetary policy increased. Thereby negating the good effects of

gold on a system.

The US had changed it's gold backing policy once before as hard

times attacked the local economy. After the 1929 downturn began

to gut the wealth of almost everyone, we just took gold out of

the INTERNAL money system and added that supply for backing the

EXTERNAL money system (foreign dollars). Indeed, all American

gold was called in from US citizens. So, for anyone that owned

real gold (in their hands), the historic dynamics of retaining

ones wealth in gold during a "debt destroying black hole

experience" was removed. Further, the "gold force"

was not allowed to do it's job of cleaning out all the "dead

wealth" created through the prior process of inflating the

money supply.

Of the many excellent writers on the USAGOLD forum. I think some

would see that the "hard times" of economic contraction

are created in the first place by not adhering to a golden monetary

system. I agree. But looking at it today, whether it's before

the fact or after the fact, society just will not work within

a system that fully kills off bad debt. Even if one separates

society into two groups,, "controllers" and "the

rest of us", it's still the way the world has functioned

from the beginning. So, the perception I have received as to how

policy will evolve in the future presumes human dynamics will

continue as they always have.

Also:

Having changed the rules once (1933) already. We (USA) later proceeded

on the same road again. By 1971, we were making dollars at a rate

that virtually assured another change in the gold backing game.

Indeed, it was becoming obvious that gold could not control the

will of a large nation.

Second:

In addition, the very system itself offered no discipline. Think

about it. Accepted policy dictated that a nation's gold was held

in the same geographic economic block that utilized the money

said gold was to represent and control. If that block held the

gold and the "real money substitutes" under the same

society roof, there was no impartial authority to control how

the rate of gold could be exchanged for dollars! A natural, fair

$X dollars for X amount of gold exchange rate could be changed

at will and for the economic will! For a true gold system to really

work, gold would have to be stored and it's conversion rate controlled

in a separate nation from the country that printed the money.

Without that separation, a large modern power could "using

local law, take it out of the system" or "not ship it's

gold" if the money supply increased too much. Indeed, this

first item was followed by the second and is exactly what happened

after 1971.

So, our modern society was quickly proving that it was incapable

of maintaining a monetary function of gold if it was intertwined

in any official fiat currency mix. Even if the currency represented

an outright gold receipt in storage and supposedly redeemable

through force of international law!

The trail is heading uphill now

Few people can fully accept or consider that oil became the backing

for world dollars after gold was removed in 71. But that is exactly

what happened in theory and practice. Using some earlier writing,

I'll tie them into what we are saying today. I'm going to repost

some of my comments

(between ---- marks) from the USAGOLD forum archives. Starting with FOA (1/15/00; 14:58:12MDT - Msg ID:22961).

---- my friend, they were not using this concept as a real "commodity money play" in the "gold standard perception". At that time we were buying local oil with "fiat dollars" (made so by the 1933 internal gold confiscation) and foreign oil with "gold dollars". But, as you pointed out, dollar production was so far past it's "gold backing" that it was obvious they (USA) were pegging dollar printing to oil prosperity, not gold reserves. Still, with London gold and oil mostly settled in dollars, the foreign dollar oil pricing fully well expected to cash in unneeded dollars for gold. As we can see, reality and present day events of that time were as "mismatched" as today! All of the dollars success was ultimately made possible because oil could (and was) priced so far below it's "economic worth" to the world. At that time, even our Middle East friends had no idea just how useful oil would (and had) become to maintaining the world economic base.--------

Having read that (and keeping

it in mind), I return to the implied questions of my "Foundation"

post below. "Why in the world did foreign governments, especially

Europeans, eventually go along with supporting a now fiat dollar

reserve system after 71?"

Well, the whole notion of using any paper money is in the confidence

that we can eventually trade it for something,,,,, Beer, food,

clothes, cars, etc.. Gold was always in the money mix to insure

that we could get these items at a somewhat standard price. Still,

most of society thinks along the immediate line that: "I

don't care where the fiat money comes from or what it's backed

by,,,, especially if I can get something well below today's value

cost,,,, and it benefits me, now!"

This is where oil made the jump from being "just a commodity"

to "the major world necessity that can and did back the dollar".

Prior to the US going off gold in 71, our whole economic structure

was expanding because we were gaining massive leverage through

cheap oil. Back then, oil was literally changing our lifestyle

for the better, and doing so because it's dollar price was so

incredibly low relative to what science was doing with it. Modern

science had made oil worth so much more than we paid for it, we

could extrapolate our debt and money supply growth far into the

future and still figure that productive increases would cover

it. In effect, the US was targeting it's economy and money value

to future oil flow value, not gold. Here is the same thought in

my post:

------ the new found prosperity from cheap dollar oil was being used to justify mountains of dollar debt. As long as a barrel of oil could be used to produce more relative real wealth than the dollars used to buy it represented, dollar inflation worked in the only political measurement that counted. "An increase in the standard of living"!--------

The only problem was that if we continued this route, two things had to give: we would have to leave the gold standard because our money supply was exploding (relative to gold supply) and find a new source of oil because ours was running out. Again, here's more from my old post

-------At that time (prior to 71) we were buying local (internal) oil with "fiat dollars" (made so by the 1933 internal gold confiscation) and foreign oil with "gold dollars".-----

------ , dollar production was so far past it's "gold backing" that it was obvious they (USA) were pegging dollar printing to oil prosperity. Still, with London gold and oil mostly settled in dollars, the foreign dollar oil deals fully well expected to cash in unneeded dollars for gold.--------

In the eyes of our official

thinkers then,,,, For the local US economy to mature we needed

to get off the gold standard,,,,,,,, get the world to accept fiat

dollars backed by oil,,,, and find more oil that could deliver

triple dollar value for every dollar we paid! It was a tall order

and one that would require a major adjustment. The transition

through out the 70s was rough to say the least.

More from my post:

-----------they (usa) were already shipping so many dollars out and any more would further aggravate the "possible gold drain perception". This was everyone's problem then as the industrialized world wanted to still get gold if needed, but they also liked the "non inflationary" (relative to that time) expansion of the dollar base as it expressed the new oil economy and it's real goods produced wealth. The US wanted new oil reserves to be "Local" (the Americas), because it could be paid in "fiat 33" cash (internal dollars were not backed with gold after 1933) , not the more golden "foreign cash". Both our neighbours to the north and south ever asked for much gold. In this light they acted like the local oil companies that received post 1933 dollars for oil (as mentioned above). Yet, to get these new reserves for fiat 33, they had to prevent the very cheap Middle East oil from supplying it all if dollar (oil) prices were higher. --------

------- First and foremost, everyone was caught flatfooted as the dollar broke from gold. Like I said above, the industrial world loved the dollar expansion in the oil context presented. (They were) Caught between what appeared as a good system based on cheap oil and the loss of gold delivery ------

------ Even as we left gold behind (1971) and oil went up (1978), the system still worked (at higher prices) because oil was perhaps delivering $100.00 worth of value and being brought for $30.----------------

In a somewhat convoluted way,

by leaving the gold bond, it forced all world oil prices higher.

Advancing the search for new (still cheap by value return standards)

oil and paying for it using dollars backed by not only oil payment

settlement in dollars but the continued purchase of supply "well

under world use value".

G-7 countries knew that initially they would have to sell some

gold in a controlled burn that would allow gold to seek a higher

level after the dollar / gold break. However, once oil producers

understood that gold was going to be "managed" at reasonable

levels, the continued pricing of oil in dollars and it's flow

was assured for some time. Allowing the exchange of dollars for

gold on the world markets,,,, as needed and wanted.

This also appealed to major countries outside the US because it

addressed the "second" problem I listed in the beginning.

That being the geographic location of a currency's real backing

asset. With most of the world oil reserves located outside the

US,,,,,, and the US slowly running out of it's domestic reserves,,,,,,,

using oil as a backing dynamic somewhat controlled the "free

will" of the US. If indeed, the US backed away from managing

a cheap gold market or ran it's printing press too fast,,,,,,

oil prices could be managed upward in a devaluation of the dollar.

No, not the best of policy concepts for the world, but better

than perceiving that the US "Fort Knox" gold was a control

on money printing!

Going back to the initial logic of my "Foundation" post,

this was the context that G-7 countries "brought into"

as they accepted and supported the new fiat dollars without gold.

Like I said, the alternative would be a real mess to behold and

this position brought time. Time to conceive and introduce a new

world reserve structure.

It worked in a broken pattern for a number of years. Oil and gold

defied all predictions of higher prices as they retreated from

every advance. Central banks gorged themselves with worthless

dollar reserves and prevented a hyperinflation of the dollar in

the process. They did this, because they knew that gold had the

ability to completely replace any and all loss of dollar reserve

value once a new system was in operation.

Cutting across the field and returning to today's trail

Nations today, with little gold holdings seemed to have no clue

to where this was all going. To a degree, the US used them as

they took in dollars and never brought gold at all. They must

be thinking that the dollar can be expanded forever and never

lose value! To this end, they have based their entire social and

economic order on selling goods to the US for a dream in return.

Yet, after all these years they are only now seeing that foreign

dollars are worthless when the US only runs a trade deficit that

will not reverse. The real risk today is now being understood.

The American economy will only slow down from a hyperinflation,,,,,

and that will be caused from a shift from the dollar reserve function!

Trapped holding dollars and no gold to compensate, these other

nations are headed for real trouble.

Again, thoughts from my Foundation post

Euroland thinkers (today) are beginning to see where they really

don't need dollars in reserve to retain market share in the US.

Just as I asked: "if the US is just pumping it's money supply

to build a bubble,,,, flooding the world with inflated dollars

that we must buy to engage exchange rates..... With the Euro in

play,, why do I need to hold their dollars to legitimize the further

creation of my own currency? I can buy gold as a "wealth

asset" to hold as a physical reserve and print my own money

supply....... It's the same difference and at least I have a reserve

that

" " IS NOT FLOWING FROM AN IRREVERSIBLE TRADE DEFICIT

" " !

In better words:

The Euro float is still too small to receive a massive dumping

of unneeded dollars. Indeed, the more the US tries to discredit

the Euro,,,, the greater the risk of a "Washington Agreement

#2" where the BIS / ECB uses unneeded reserve dollars to

BYPASS the paper markets and massively buy "real PHYSICAL

gold". In fact, all they have to do is enter the market in

a minor way and the entire paper gold arena will go up in flames.

So, Is the Euro falling? Or is the dollar running away as a liquidity

crisis threatens it's use?

Are we at the very doorstep of a crash in the US markets and it's

dollar?

All caused by an evolving transition from the dollar reserve system?

We have some old writings on this subject and will examine them

later.

We make camp here

FOA/ your Trail Guide

FOA (03/02/00; 20:15:21MT - usagold.com msg#9)

A Clear Path

It's a nice day to get outside! Let's walk a while.

Think back at our recent history of gold and one can build a better

perspective of this "new gold market".

Onward:

After the 1971 gold window was closed, the gold market didn't

immediately feel the effects of major physical buying. At least

until 1976. Most of the world remained shocked that the dollar

was no longer backed, but perception remained that eventually

gold would be brought back into the official money system. Yes,

the dollar did drop in value but not so much that it would destroy

the reserve system.

The world remained tied to using dollar reserves even though gold

no longer backed them. Oil prices began their long march upward,

but most of these early advances were more so political statements,

rather than related to the dollar problem. Oil states, flush with

cash, were able to convert dollars into bullion at still reasonable

prices (as could everyone else). In addition, rising oil revenues

were running well ahead of bullion prices and goods inflation.

Producers saw little reason to overly rush into gold because some

thinkers still held the prospect of a later dollar / gold relink.

Especially so as gold began to sink in price after the US made

it legal to own again (for US citizens).

By early 1976, gold was heading for $100 an ounce and making dollar

holders less nervous. At that price gold was only a little more

than double it's last official price of $42 per oz.. It seemed

that the US had achieved what was largely unspoken at the time:

---------- By taking the dollar off the gold exchange system, it provoked a large increase in the dollar price of oil. As I just pointed out, most of those early price rises were political. But not all of it. There was some marking of oil to the free price of gold in a attempt to replicate any lost bullion value. Still, initially, oil prices more than made up for their (producers) now accepting fiat "greenbacks".

Oil was then and is now the life blood of our "new oil economy". For the US, this rising price set in motion a massive effort to find new untapped reserves that were unusable with the low prices an earlier gold dollar generated. Prior, without a rising oil price, the US faced the real prospect of running out of local oil and having to accept the reality of eventually importing Middle East crude for close to 100% of it's needs. What many only speculated about in the late 60s, later became reality as the Middle Eastern reserves did indeed prove large enough to supply and cheap enough to pump for everyone's needs. Their reserves would outlast and underprice our reserves, as long as we paid them in gold dollars. -----------------------

I pointed out in my "First

Walk" post how oil was indeed taking over the job as an asset

backing the dollar. Even with the first increases in dollar oil

prices, the world and the producers were very willing to accept

a dollar value based on an expanding "new oil economy".

At least until mid 1976!

Look over here:

Of course, during this time there was plenty of "background

noise" on the world stage. There always is and it usually

distorts the picture just enough to keep us from seeing what was

really happening. Like looking at a river up close, in the rapids,

instead of far away. But, in 1976 :

------The IMF convened a monetary summit in Jamaica and ratified "The Jamaica Accords" in April. For some major people, this paper was the reality that drove home the golden point. The Accords formally recognized the managed floating currency system for the duration. Marking a turning point in how national super powers effect fiat currency use in our new modern economy. But more importantly, gold was "demonetized" as a reserve asset! -------------

Most everyone immediately grasped

what this meant; "that gold would no longer back the currencies

as it did in the old gold exchange system". However, for

some 15 years to come, no one fully understood what was really

said! In the Accords, the wording stated that gold would remain

a " " Reserve Asset" "! Indeed, as a non currency,

real wealth "reserve asset", this world class money

was set free to become a backing for any economy. Even one based

on a new reserve system. This my friends, was the key to perceiving

what would later happen in the world gold markets. We'll get back

to it later.

It's no secret why gold went wild from it's lows that year. For

the first time since the 71 break, really big demand was driving

the market. No it wasn't just the public's buying of coins and

small bars. Nor was it the futures traders with their paper orders

that caused gold to rise so much. It was the wholesale scramble

by huge dollar holders trying to buy some of those "reserve

assets" before it's price went sky high. This buying was

in the form of 400 oz bars,,,,,,, lot's of them at a time! Some

Central Banks slowly sold into the storm in a effort to manage

the demand. Politics and the media did a good job of telling the

story as they saw it. But the real reason for the managed rise

was to demonstrate to oil producers and other dollar holders that

everyone couldn't convert if they brought physical all at once.

Had some banks not sold, gold would have gone into the thousands,

and in the process destroyed the dollar long before it's date

was due. Without a reserve system to replace it, our world economy

would have crashed and burned.

Further along the path:

Without the prospects of gold ever backing the fiat money system

again, a good portion of the next oil price hikes (late 70s) were

dollar related. It wasn't until the mid 80s that two things occurred

to lower oil prices for an extended period of time.

First-----

The incredible rise in oil prices once again took away some of

the pressing need for producers to buy gold. Oil itself was compensating

for price inflation. Not to mention that gold was seen as still

relatively high. Further, the gold marketplace itself was evolving

into more of a contract market than a physical one. Offering hope

that financial demand could be channelled away from becoming physical

demand.

Europe, London and the US had all joined together in a quiet effort

to better manage the price of gold. All in an effort to once again

buy time for the dollar. From a US perspective, this time was

needed to "work out" the dollars problems. From a Europe

/ BIS perspective, it was time used to build a dollar replacement.

Did both of these power blocks know what the other was doing?

I think they fully well did. But as is usually the case in warfare,

the generals on each side think the other doesn't have a chance.

Truly, the net effect of this joint effort resulted in a stalled

gold market, even though the reasons for it differed.

Second------

Once the evolution of this supposedly free gold market was seen

by oil as backing the value of the dollar (with a stalled gold

price), production was increased in the mid 80s. The combination

of OPEC's added supply and the new supply created by the price

induced US drilling, all forced oil prices down. The whole process

was seen in the media as the world's dealing with OPEC and forcing

the dollar down their throats in the process. But no one ever

made the connection that they didn't have to take dollars for

settlement and the world would still buy oil. But support the

dollar for a purpose they continued to do!

Oil still had it's political ups and downs over the years and

the same reflected in it's prices. But supply was mostly assured

from a level to falling gold price. During the next ten years

form 85 through 95, few really noticed that although gold and

oil charted in the same direction, they never flowed in the same

direction. Nor did they grasp how the gold market was engineered

to supply gold for this very reason.

With most of the dollar oil problem licked, the G-7 began an effort

to keep the dollar in play. Even though it's debt had aged it

and it's timeline was running out. In 1985 they started a series

of currency moves that would last until the early 90s. From the

"Plaza Accords" (85) to the "Louvre Accords"

(87), it was all an effort to stall and stretch out any crisis

of the dollar. It seemed that no matter how much the dollar was

inflated or how much debt was built upon it, it would be supported

for all the world to see. Not even the gold market would be allowed

to reflect any portion of this ongoing currency crisis. Showing

their full colours in managing this "new gold market",

the $500 price in late 87 was quickly brought down. Indeed, the

evolution from a bullion marketplace into a mostly "new paper

marketplace" was well underway. The later fall in price after

reaching a Gulf War peak, was even more stunning.

It was right about here, in the early 90s that some major players

began to stop trading gold. Instead they started slowly buying

physical. It seems they finally understood what the "Jamaica

Accords" of so long ago really meant. Indeed, it was worth

leaving all the "winnings to come" on the table! Because,

no matter how high dollar assets would go, physical gold was destine

to go much, much higher.

In December of 1991, twelve members of the original "European

Economic Community", now called the EU (European Union) signed

the "Maastricht Treaty". It spelled out the process

where they would establish a full currency union, called the EMU

(European Monetary Union).

Once the EMU process was signed into law, we could see that there

was indeed a purpose behind the formation of the "European

Economic Community" in the early 70s. Because it closely

followed the 1972 "Smithsonian Agreements", signed in

Washington, declaring the dollar / gold break an official act

by the US. Nor was it a coincidence that the very first discussion

of a Pan Euro currency block in the form of a "European Economic

Unit" was first heard of in 1976. The date of the "Jamaica

Accords". The EEU, a precursor to the Euro, soon became official

in the early 80s.

On January 1 1999, the Euro was born. On the headlines of almost

every paper, the new Euro currency immediately became the topic

of speculation. How high or low would it go,,,,,,, will it last,,,,,,

what good is it,,,, and on and on. Yet, completely hidden from

view and outside most speculator interest, one important item

was overlooked. Once this competing reserve currency was formed,

the two major power blocks of the world no longer shared the purpose

of maintaining a paper gold market! Established, maintained and

supported for the purpose of absorbing the demand for gold, it's

price damping effects were no longer needed.

What an overview:

From a Euroland viewpoint, the dollar no longer needed to be supported

by a low gold price. With the Euro in place and holding a large

portion of the worlds new, non currency "reserve asset"

for support, they no longer had a reason to buy at $280 or sell

at $480. Indeed, they told the world they were backing out of

the paper gold game with the Washington Agreement. We fully expect

that during the 5 year time frame of that agreement, physical

gold will soar from lack of supply as they trade it outside the

London dominated paper markets. We also expect a convoluted workout

of the left over contract markets as they fluctuate between $0

and $infinity. Further, the greenback could now go as high or

as low as world traders would like to take this now "on it's

own" currency.

From an oil producer viewpoint, with the physical gold market

now only a shadow of the total "paper gold market",

they can now only float a few dollars in sufficient amounts back

into physical gold. With half the gold market supporting players

retreating into the Euro umbrella, the present market will revert

to little more than a paper float. With this in mind, it should

be no surprise to anyone that crude prices began rising almost

immediately after the EMU. Eventually, even $30 oil will disrupt

world dollar debt to a point where the dollar exchange rate collapses.

Forcing a run from dollar settlement and into Euro or a Euro +

gold pricing basket for crude.

Prior to this they watch the same drama today you and I see. An

ongoing dollar liquidity crisis that had long ago reached the

end of it's timeline. Now it grows worse, brought about by not

only the loss of most of it's Euroland financing function,,, but

also it's Pan European support. Truly, this crisis demand will

drive the dollar ever higher. A hyperinflationary trigger, not

completely unlike the one facing Japan today. Day after day one

has but to watch the US Fed ever pumping reserves in a effort

to reflate a world dollar tire that's full of Euro holes!

From a gold bullion viewpoint: the Jamaica Accords signalled a

permanent shift from holding gold and fiat currencies in competition

with each other. Yet, the eventual good effects of such a shift

would only happen once the sick dollar system was killed by it's

debt load. Untill 1999, one of the two world's power blocks had

a purpose in keeping it alive. Until a fall back replacement could

be formed, a dead dollar would leave gold alone in the currency

roll and sent the world into a depression. Truly, with talk of

the EMU falling apartin 1997, oil wasn't the only entity that

would have bid on gold if the Euro had failed.

But it didn't. Soon, bullion will return to doing what it did

centuries ago. Representing the value of the worlds assets and

productive wealth. Only, with the world having far more in the

way of modern things than ever before in it's history, "Freegold"

trading as a "reserve asset" will be valued as never

before.

You ask, what are the dynamics of such a position?

How are world investors prepared for this event?

I'll tell you my view,,,,,,, next time on the trail!

Thank you for walking with me,,,,,,, FOA/ your Trail Guide

FOA (03/10/00; 10:51:52MT - usagold.com msg#10)

A Fireside Talk

We have walked a ways since our last chat, 03/02/00. Let's expand

on what was said in each of these rambling talks.

"Introduction Post"

To understand gold we have to look at it through worldly eyes,

in a very "broad context". This is important because

gold has a better history of storing true net worth over people's

lifetimes. More so in a generational sense, not just in the decades

span most of us choose to see it in.

Even though fiat currencies often record it as a poorly performing

asset in the relative short run, it has far outperformed every

paper money system. That's because every paper money system has

eventually died from old age while gold lives on.

During both the short and long haul, physical gold is wealth insurance

for our extended families. This holds true because even holding

gold in the early successful stages of a currency's life, war,

politics and natural disasters can work to destroy any nation's

assets. This includs ones personal wealth that's denominated in

the business structure of said destroyed society. Gold mines included!

Over time, one could never compare the returns of investing in

stocks and bonds to owning gold. This is simply because when gold

is entangled in currency schemes, it's fiat value is falsely presented

while the currency system ages. Only the commodity use of gold

is reflected, not it's much higher wealth "reserve asset"

function.

However, this present era has become one of those unique periods

in paper money history when gold will take a great leap in value

during the relative short term. Perhaps we can define it as being

between 1990 and 2010. Having covered the accumulation phase of

the first ten years already, the next five should be one for investors

to just sit back and watch. The last five will be a time where

we spend some of our physical gold wealth.

This will occur in a transition from an ageing currency that's

still entangled in gold valuation schemes and politics, into a

new currency reserve system that's positioning itself to let gold

run. In this new venue, we are going to see gold become a world

class "reserve asset" that's not tied directly to any

official money system.

Again, once physical gold is swept clear from paper moneys, it's

value in real life terms will soar.

The modern gold era never changed. Banks lend the currency that

is invested in South Sea - like companies. Then the companies

and governments create ever more currency debt at the request

of the populous. At first the currency is a receipt for gold,

then it becomes a receipt for more receipts. Then more currency

is created to save these same failing debts receipts, but no gold

is there to back it! The endless cycle goes on, all the while

hiding our modern value of gold in the process. As the game reaches

the end, we even begin to think that the "natural things"

and "real things" of life are not the only wealth. Rather,

a contract can also be held as one's life savings. It will end!

As paper debt increases, it ages the currency by always generating

more "fiat receipts" than human production can ever

service. Then, at the end of the "currency timeline",

in a great flood of human emotions, we reach for "natural

conclusions" to a non retractable financial problem!

One of the conclusions we reach are that physical gold can replace

the lost values we once placed in fiat debt and equity, even the

loses in paper gold and gold equity! In this drama these same

fiat values that we once traded as wealth receipts can no longer

be valued at par with real earth things. Once at this point we

reach for natural real wealth on a epic scale.

In the process the entire society, including the government structure

and it's outgoing money system are all carried with us in an emotional

flood to the sea. Sweeping away the whole format of our worlds

currencies and real wealth. We will watch this new format unfold.

This is why so many fail to see why one should hold physical gold

at this time, in this closing era. They ask, why now? What is

different from 20 or 60 years ago? Seeing only the jewellery value

of gold in contrast to past official fiat currency rates (dollar

at $42 in gold) as enough appreciation to be fair. We think a

move to $600 is enough and invest for that outcome. Locking ourselves

out of the real surge.

These questions and perceptions arise because we can only review

the recent history of gold. As such it was unnaturally priced

in the fiat currencies of pounds and dollars, not traded "next

to the currencies" and valued as a "real wealth"

"reserve asset". In a price discovery process such as

is coming, gold in the past would have reflected all the great

wealth advances that have happened sence the early ages of European

gold coinage.

Again, for most of us this recent period offers only a fiat value

comparison and leads us to accept it's present low fiat valuation.

Yet, gold's fiat values over this era were only relative to it's

manipulated price during an extended Anglo-Saxon currency timeline.

A period that saw the dollar take over the pound's role of representing

and dominating all world wealth. Including gold wealth!

During this whole period, gold's value did have small shifts up

and down. Even our recent 20+ years are representative of these

small shifts. Yet, because of our fiat perceptions we see these

moves as large bull and bear runs for the metal. While all the

time a truly great value leap in gold was building, waiting for

the present dollar lifetime to end. Once the dollar gold entanglements

are ended, gold's relative worth in modern world wealth and production

abilities will return. In our modern day, the old adage that "gold

is worth a mans suit" will prove far, far too low a value.

While we think about this, I'm going to eat some fresh trout.

Then, tonight, under the stars we can come closer and extend the

next "Foundation post" and others.

FOA/ your Trail Guide

FOA (03/10/00; 17:00:46MT - usagold.com msg#11)

A Fireside Talk (continued)

Hiking a gold trail usually requires us to ramble on as we walk

mentioning any points, commenting on good views and taking notes

as we proceed. But, after the end of several days on a trail,

around a quiet fire, we put it all together. This is the format

we take. Our first fireside talk was just posted. It and these

(continued) posts will expand on our walking "Thoughts"

before we continue the hike.

"Foundation Post"

From several viewpoints we proposed the same question: Why did

so many of the world's nations continue to support a dollar reserve

system after it went off the gold exchange standard?

They definitely had a choice; continue to use the dollar or go

back to using gold. They choose to use the dollar! I pointed out

how this policy flew in the face of common sense, and especially

did so as the US only embarked on a policy of continued monetary

expansion. In effect, inflating the whole world's currency systems

right up into the end of 1997.

My point was that their actions can only be justified from a position

of "buying time". Most of the major World and European

countries had economies and currencies that could stand on their

own in a competitive world. Yes, their transition from a dollar

reserve would have been painful. But, compare that loss to the

percentage of lifestyle gain they paid as a tax to the US by artificially

maintaining the dollar exchange rate. Their Central Banks support

polices were a decision to waste their citizens productive efforts

in a process that held together a failing currency system.

They could not be this dumb! As I pointed out in the Foundation

post:

-----For the more developed gold owning countries of the G-7, they had a different question in mind. Again, if taking in inflated dollar reserves was the act of importing US dollar inflation into ones local economy,,,,, and in the process creating a market for your goods overseas,,,, why not just print your own currency without taking in dollars - - In doing so give the same buying power the US citizens have in your market,,,,,, to your own people?------------

The other side; why not create

a market for your own goods by selling them to your own citizens,

using your own currency as a reserve?

Clearly, after 1971 the result of a failed dollar reserve system

would have delivered a healthy dose of "real" price

inflation to the US. Not just the 10% or 13% we experienced! But

at least for the major European countries, with their money systems

expanding on their own over the next 20+ years, their citizens

would have brought their own lifestyles somewhat relative to their

efforts. At least this was more reasonable than paying slave taxes

in the form of dollar support. Or maybe it wasn't ?

Indeed, the whole world would have slipped further down the inflationary

scale had the dollar failed. Everyone's lifestyle would have slipped

a lot more than it did. More in the US, less in Europe. But more

importantly, the whole international house of trade would have

slowed tremendously without some form of world currency reserve.

It's possible, that once we left the reserve system, the return

to an increasing momentum of world trade flows would not have

been seen again for several generations. Such is the case a world

financial fracture on this scale could have created.

Yet they didn't return to gold! In the eyes of many, gold had

been discredited as a controlling force that could regulate world

finances and trade flows. Yes, gold was an option then, but we

had just seen how modern superpowers can just walk away from the

discipline of gold. In my post:

----Even if we have a pure gold system, human nature will find a way to turn it into securities. In doing so we will - - come hell or high water - - lend more gold than we have and borrow more than we can pay back. One has but to return to the history books to see it all in plain print. Over and over again, we start with a solid gold foundation and soon degrade it into trash. It's not just the American way,,,,, it's the world's way. ------------------

It seems the only explanation

for the continued support of the dollar came in the form of "buying

time": time to recreate a world reserve currency. But this

time, make it subject to a whole group of diverse nations of conflicting

political wills. In this format no one country can call the shots

for the world. In addition, take away the need to compete with

gold. Let gold be a supporting "reserve asset" that

trades in a free market, unlent and non monetary so as to circumvent

it's manipulation.

In this position a modern digital fiat currency can only represent

the productive efforts of the nation blocks it represents. No

different from the fiat schemes we have endured for 60+ years.

Only this time without an illusion of gold backing and it's discipline.

As such, a free market for gold will, on a ongoing basis, constantly

devalue any and all currencies of the world. Just as in a somewhat

similar concept where the stock markets of the world today currently

discount the inflation of their local currencies.

Perhaps the payoff will be worth the past sacrifice of so many

productive assets and savings. Perhaps we will never know just

how far the world would have sunk had they written off the dollar

back then. Without that knowledge as a measuring stick, we cannot

compare if the recent loss was worth it.

Today, dollar support is winding down in the growing shadow of

a Euro currency. This will eventually have a tremendous negative

impact on all paper assets denominated in dollars. Whether they

are viewed as hard paper assets or soft, the coming price inflation

will wreck the use of dollar trading vehicles. Hard gold, owned

as physical gold will make all the difference in the world.

Next, how oil was used to mask the motives of building the Euro,

even as it supported it's creation. We will next extend the "First

Walk" post. But first, more logs on the fire.

FOA/ your Trail Guide

FOA (03/11/00; 08:26:08MT - usagold.com msg#12)

A Fireside Talk (further

continued)

Expanding from the: "First Walk Post"

Many political problems confronted any drive towards an EMU. In

order to build a consensus for a Pan European currency, the architects

had to have time, years of it. The last thing they needed was

a world-wide economic downturn brought on by a failing dollar

system. Working between 1976 and 1982, the software for such a

system was only just beginning to really take shape. It was a

slow, hard process because during this period and many years prior,

the dollar was already experiencing convulsions. They needed at

least another ten years, but without something to make the dollar

more acceptable even five years was too long.

Working within a large group of nations required painstaking discussion

of all ideas out in the open, so their agenda had to offer something

for everyone. In addition, this new currency could not be seen

as a competition for dollar use, otherwise the US would most certainly

try to split the group.

It's important to understand that most of the world wanted to

at least see another currency that could share some of the dollar's

function. It didn't have to replace it. To this end, most every

country gave some philosophical and political support in it's

creation. But, by supporting a dollar that was now completely

removed from any commodity backing system, would require the help

of some major players.

Another group was extremely interested to see how this new currency

would turn out. The major world oil producers. Prior to 1971,

they were secure in selling oil for US gold dollars, even if it's

true worth in a modern oil economy wasn't completely understood.

At least gold had a long history of eventually defining it's value

as equal to modern advances. Better said, if oil did more for

the economy, then that increased value would be reflected in a

stable value of gold. But after 1976 they found themselves selling

a resource for far more than they realized it would bring and

doing so in dollars of unknown future value. In the unfolding

economics of it all, these people saw the same thing we did.

From my "First Walk" post:

------Prior to the US going off gold in 71, our whole (USA) economic structure was expanding because we were gaining massive leverage through cheap oil. Back then, oil was literally changing our lifestyle for the better, and doing so because it's dollar price was so incredibly low relative to what science was doing with it. Modern science had made oil worth so much more than we paid for it, we could extrapolate our debt and money supply growth far into the future and still figure that productive increases would cover it (the lost value due to money inflation). In effect, the US was targeting it's economy and money value to future oil flow value, not gold.-------------

After 1976 they (oil producers)

jumped into gold but soon found that their excess dollar flow

could never even partially be shifted into gold as it was traded

on this new commodity arena. For them, gold wasn't just a "trade",

it was payment in the form of real "reserve assets".

Oil assets for gold assets! If the CBs hadn't sold into the storm,

gold would have went to the moon from oil flow alone. So they,

and everyone else soon found out that there was a world of difference

between trading "gold dollars for real gold" at your

Central Bank and "buying commodity gold in a trading arena".

In truth, the gold market was only a free market for commodity

trading. It was never allowed to trade as a "wealth reserve

asset".

The options were few. Buy gold outright and see it's price run

past it's "money for oil" value, or include gold in

a currency basket for payment of oil. In essence saying: "straighten

this currency problem out or you will be the one buying high priced

gold"! They optioned for a third way. Continue to sell oil

for ever cheaper dollars, all the while waiting for something

to replace the failed reserve system. So they watched as the US

said they would fix the dollar and Europe said they would replace

it.

It was clear that the US would continue printing money as long

as it got oil flow at a price that created an increase in American

lifestyles. To this end, the dollar economy would eventually crash

if oil was not priced cheaply in dollars. In addition, pricing

oil in a currency basket with gold would just as easily crash

the system. It was here, between 1980 and 1985 that both the US

and Euroland proved that they could keep gold on an even level

if oil could play the game.

Higher oil prices had indeed brought forth more oil flow and crude

reserves for the US. This alone did wonders to extend the US dollar

economy and the extra load of debt it was building. From this

position alone, producers could justify supporting dollar settlement

for oil, but only for a decade or so. The US and Britain were

busy building a contract gold marketplace that would channel money

away from real gold, thereby freeing up more physical to partially

exchange for excess world dollars their oil imports produced.

Still, this didn't explain all of the game. It brought time for

the EMU to build, but who was going to carry all the eventual

excess dollars that would flow from a booming US? By 1986 a booming

US economy was the result of still cheap oil. It was being sold

to them and everyone for expensive dollars that flooded the world

in an ongoing trade deficit!

From my "First Walk" post:

------It worked in a broken pattern for a number of years. Oil and gold defied all predictions of higher prices as they retreated from every advance. Central banks gorged themselves with worthless dollar reserves and prevented a hyperinflation of the dollar in the process. They did this, because they knew that gold had the ability to completely replace any and all loss of dollar reserve value once a new system was in operation. -------------

In this new format (post 1982),

the US and it's dollar system would only work if oil was sold

to them cheaply and in dollars. It's no secret that cheap oil

is created by opening the valves. But, dollar settlement without

gold was a political agreement just waiting for a reason to change

it's mind. Foreign Central Bank support for the dollar was the

key that kept this temporary condition working. Still, without

the added kicker of a world cheap gold price along with a significant

revaluation of that gold in the future, oil would have went for

settlement in a Euroland basket of currencies + gold, long ago.

The US had already proven that it could not be trusted with any