What you need to know before you invest in gold

Some initial guidelines for first-time investors from one of America’s top gold experts

Online interview of Michael J. Kosares, founder of USAGOLD and author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold (Third Edition)

Updated Q2-2023

Question. Should I invest in gold coins or gold bullion?

Answer. We probably get that question more than any other — pretty much on a daily basis. The answer, however, is not as straightforward as you might think. The initial answer is an easy one – if you intend to take possession of your gold, purchasing gold bullion coins is likely the preferred option. Gold bullion bars typically require some level of independent authentication in order to liquidate, whereas bullion coins trade without much in the way of hindrances. The original rationale at the advent of the ‘bullion coin’ market was that they would offer a competitive price alternative to bullion bars, and they still do.

Q. Which gold coins should I buy?

A. That depends on your goals. We typically answer that question with one of our own, “Why are you interested in buying gold?” If your goal is simply to hedge financial uncertainly and/or capitalize on price movement, then the contemporary bullion coins just mentioned will serve your purposes. On the other hand, those approaching gold more as a safety-net and/or asset-preservation tool often see value in the added privacy and liquidity advantages associated with the ‘historic bullion’ coin category – coins minted before 1933 – that still trade at modest premiums to the underlying spot price of gold, track the gold price, and enjoy strong liquidity internationally.

Q. When should I invest in gold?

A. The short answer is ‘When you need it.’ Gold, first and foremost, is wealth insurance. You cannot approach it the way you approach stock or real estate investments. Timing is not the real issue. The first question you should ask yourself is whether or not you believe you need to own gold. If you answer that question in the affirmative, there is no point in delaying your actual purchase or waiting for a more favorable price, which may or may not materialize. Cost averaging can be a good strategy. The real goal is to diversify so that your overall wealth is not compromised by economic dangers and uncertainties like the kind generated by the 2008 financial crisis or the current inflation-stagflation threat.

Q. Why not wait for the necessity to arise, then invest in gold?

A. In the past, whenever concern about a financial and economic breakdown spread, there were episodes of gold coin bottlenecks and actual shortages. In 2008-2009 at the height of the financial crisis, for example, demand was so great that the national mints could not keep up with it. The flow of historic gold coins from Europe was also insufficient to meet accelerating demand both there and in the United States. Premiums shot up on all gold and silver coins, and a scramble developed for what was available. We experienced similar supply tightness during the 2020 pandemic lockdowns. There is an old saying that the best time to invest in gold and silver is when everything is quiet. I would underline that sentiment. The demand for newly minted bullion coins is up dramatically due to the pandemic stimulus and rescue programs globally, and the premium on the American Silver Eagle is now at record levels. When market sentiment is tightly wound like it is now, the best strategy is to act in advance of the next wave of crisis, if for no other reason than to save on acquisition costs. At present, there are still a number of bullion items that can be acquired at normal premium levels, and if you contact us, we can provide some guidance on your acquisitions.

Q. Can you give us a profile of the typical gold investor?

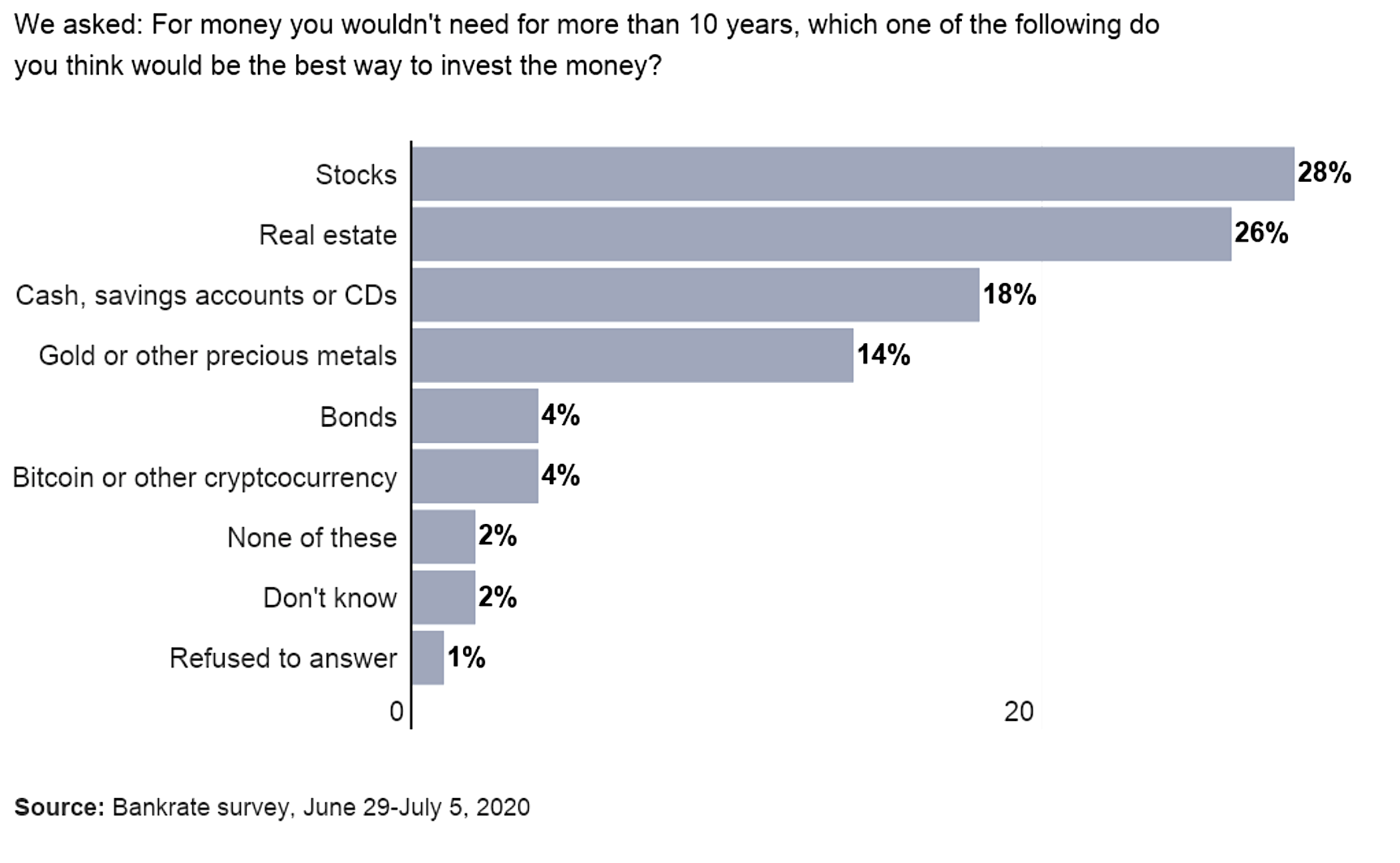

A. Gold owners are a group of people we have come to know very well in our nearly 50 years in the precious metals business. Contrary to the less than flattering picture sometimes painted by the mainstream press, the people we have helped become gold owners are among those we rely upon most in our daily lives – our physicians and dentists, nurses and teachers, plumbers, carpenters, and building contractors, business owners and executives, attorneys, engineers and university professors (to name a few.) In other words, gold ownership is pretty much a Main Street endeavor. A recent Gallup poll found that 16% of American investors rated gold as the best investment. By comparison, 21% of those polled rated stocks and mutual funds as the best investment. A recent Bankrate survey produced similar results, with 14% choosing gold as the best place to park funds for more than ten years.

Data source: Bankrate/Claes Bell • • • Click to enlarge

Q. What about high net worth investors?

A. Traditionally, wealthy, aristocratic European and Asian families have kept a substantial percentage of their assets in gold as a protective factor. However, the long-term economic picture for the United States has changed enormously over the past several years. As a result, that same philosophy has taken hold in the United States, particularly among those interested in preserving their wealth both for themselves and for their families from one generation to the next. In recent years, we have helped many family trusts diversify with gold coins and bullion at the advice of their portfolio managers. Few people know that the United States is the third-largest consumer market of gold after China and India.

Q. You frequently mention gold as insurance. What do you mean by that?

A. Gold’s baseline essential quality is its role as the only primary asset that is not someone else’s liability. That separates gold from the majority of capital assets, which in fact, do rely on another’s ability to pay, like bonds and bank savings, or the performance of the management, or some other delimiting factor, as is the case with stocks. The first chapter of The ABCs of Gold Investing ends with this: “No matter what happens in this country, with the dollar, with the stock and bond markets, the gold owner will find a friend in the yellow metal — something to rely upon when the chips are down. In gold, investors will find a vehicle to protect their wealth. Gold is bedrock.” For a helpful review of gold’s role in preserving assets under various worst-case economic scenarios, we recommend spending some time with BlackSwansYellowGold, linked below.

|

BlackSwansYellowGold Series “That men do not learn very much from the lessons of history is |

Q. What percentage of my assets should I invest in gold?

A. If you were to take a cross-section of advisors who recommend gold as part of an investment portfolio, you would find their preferred level of diversification would range between 5% and 30%. Of course, how high you go within that range depends upon how concerned you are about the current economic, financial, and political situation. Analyst Michael Fitzsimmons offered an interesting take on how much gold is enough in a recent Seeking Alpha editorial, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.”

Q. In your book, you state: “Who you do business with is one of the most important aspects of gold investing.” Why is that?

A. A solid, professional gold firm can go a long way in helping the investor shortcut the learning curve. A good gold firm can help you avoid some of the problems and pitfalls encountered along the way and provide some direction. It can help you in the beginning and through the course of your gold ownership in making additions to your portfolio and liquidations. A solid companion piece to the interview you are now reading is How to Choose a Gold Firm offered on this website. It provides clear guidelines for newcomers and is well worth the five or ten minutes it takes to read it.

Q. How can the average investor distinguish between the good gold firms and the bad?

A. First and most important: Check the Better Business Bureau’s profile on a company before doing business with it. Check not only its rating but the number of complaints lodged against it and how those complaints were handled. A consistent record of complaints can be a warning sign even if it has managed to keep an A+ rating. Every first-time investor should take this simple and straightforward step, but it is amazing how many ignore it. Second, choose a gold firm that has a solid track record. Ten years in business is good; fifteen years or more is even better. Third, choose a firm committed to keeping you informed, i.e., one that is interested in answering your questions now and keeping you informed in the future. If a salesperson gives you short shrift or hits you with a heavy sales pitch, take it as a warning.

Q. Can you briefly describe what you believe investors make the biggest mistake when starting out as gold owners?

A. The biggest trap investors fall into is buying a gold investment that bears little or no relationship to their objectives. Take safe-haven investors, for example. That group makes up 90% of our clientele and probably 75% of the current physical gold market. Most often, the safe-haven investor simply wants to add gold coins to his or her portfolio mix. Still, too often, this same investor ends up instead with a leveraged (financed) gold position, a handful of exotic rare coins, or a position in an ETF that amounts to little more than a bet on the gold price. These have little to do with safe-haven investing, and most investors would be well-served to avoid them.

A diversified approach to the precious metals portfolio works best.

USAGOLD can help you achieve the right balance.

Q. What about the high-profile gold companies that advertise on talk radio and cable television?

A. The same vetting rules outlined earlier apply. Check them out. Too often, investors make the mistake of believing that the gold firm that sponsors their favorite political commentator is also the best place to make their gold purchases. National media campaigns are expensive, and those costs are usually covered in the prices investors pay for their gold and silver coins. In some instances, that markup can be twice the underlying metal value. Take care that you are not paying too much for your gold and that you are buying the gold items best suited to meeting your goals.

Q. What about buying precious metals online?

A. Once again, the same vetting rules outlined earlier apply. Some of the most visible online gold businesses have lengthy complaint records at the Better Business Bureau.

Q. How has the rising rate environment affected the gold market?

A. Positively. Rates are on the rise because inflation is on the rise and gold has always been viewed as a reliable long-term inflation hedge. In addition, rising rates have presented significant problems for banks and financial institutions – a situation that has put the focus on gold’s well-known status as a safe haven. These two drivers have created significant demand through the range of investors from individuals, to funds, institutions, and central banks. The Bankrate survey of investors cited above is telling in this regard. One in six chose gold as the best place to park money they would not need for the next ten years, the same number that chose stocks.

Q. What is your view of gold stocks?

A. Many of our clients own gold stocks, and we believe they have a place in the portfolio. However, it should be emphasized that gold stocks are not a substitute for real gold ownership, that is, in their physical form as coins and bars. Instead, stocks should be viewed as an addition to the portfolio after one has truly diversified with gold coins and bullion. Gold stocks can act opposite the investor’s intent, as some justifiably disgruntled mine company shareholders learned in the recent past when their stocks failed to perform as the price rose. There is no such ambiguity involved in actual ownership of gold coins and bullion. When gold rises, they rise with it.

Q. What about gold futures and options contracts?

A. Futures and options contracts are generally considered among the most speculative arenas in the investment marketplace. The investor’s exposure to the market is leveraged, and the moves both up and down are greatly exaggerated. Something like 9 out of 10 investors who enter the futures/options market come away losers. For someone looking to hedge their portfolio against economic and financial risk, this is a poor substitute for owning the metal itself.

Q. What are the pitfalls of gold ETFs?

A. Since, for one reason or another, it is difficult to take delivery from any of the ETFs, they are generally viewed as a price bet and not actual ownership of the metal. Most gold investors want possession of their gold because they are buying it as a hedge against an economic, financial, or political disaster. When disaster strikes, it does not do you much good to have your gold stored in some distant facility by a third party. For this reason, over the past couple of years, the trend even with hedge fund operators has been away from the ETFs. (For further reading, please see our special report. Should I buy a gold ETF?)

Q. Please summarize — What is the best approach for the safe-haven investor?

A. If you want to protect yourself against inflation, deflation, stock market weakness, and potential currency problems — in other words, if you want to hedge financial uncertainties, there is only one portfolio item that will serve you in all seasons and under most circumstances — gold coins and bullion. Make sure you do your homework on the company with which you choose to do business and ensure that the gold ownership vehicle you choose truly reflects your goals and aspirations.

Though this interview will help you start safely on the road to gold ownership, it is just an overview. If you would like more detailed information, I would recommend Six Keys to Successful Gold and Silver Ownership, which details the who, what, when, where, why, and how of gold ownership. You can also shortcut the learning curve by contacting our offices and asking to speak with one of our expert client advisors, who will be happy to answer your questions and help you get off to a solid start.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

1-800-869-5115

[email protected]