Short and Sweet

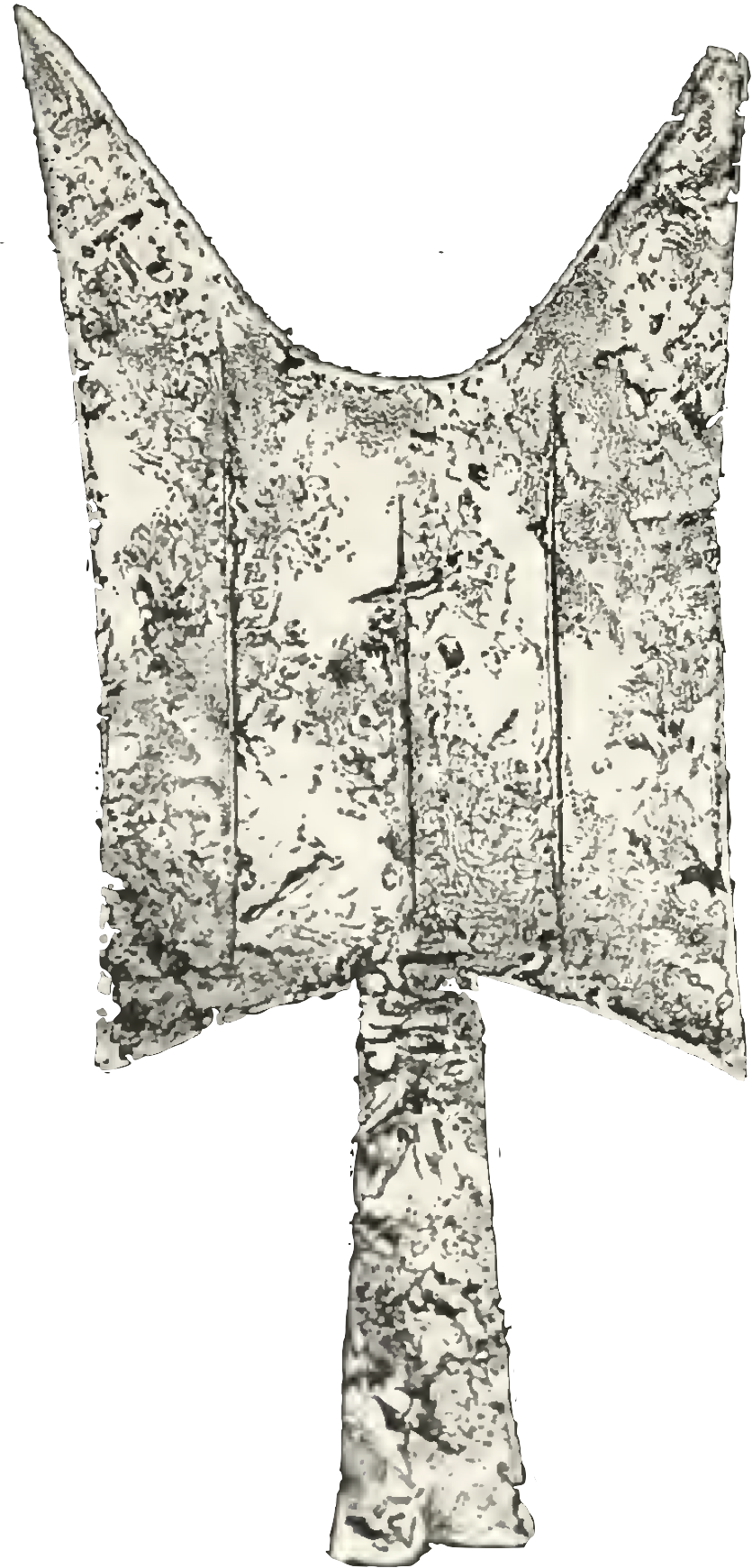

China’s monetary tradition and the origins of money

“The first step in theorizing correctly about money,” writes Mises Institute‘s Joseph T. Salerno, “is to understand that the value of money, like that of commodities, is never fixed and unchanging. Chinese philosophers who published the earlier Mohist Canons (468 B.C.~376 B.C.) grasped this crucial point. They recognized that metallic money, such as the ‘knife coins’ (pictured above) then in wide circulation, was valued and exchanged by weight and argued that the real value of money, despite its fixed face value, was not stable but fluctuated inversely with the prices of commodities. When commodity prices were high, money was ‘light’ or its purchasing power low; when prices were low, money was ‘heavy’ or its purchasing power high. Thus, if monetary conditions were such that the nominal prices of commodities were abnormally high, the real prices of commodities were not high, but rather money was ‘light’ or depreciated.”

According to Salerno, much of what we understand about sound money was first explored in ancient China, where metallic coinage was first introduced in the 12th century BC or earlier. Salerno’s article serves as an interesting introduction to Chinese monetary theory and philosophy. We recall that China was also the first country to experiment with paper money as an alternative to coins made from precious metals. As might be expected, those experiments led to several instances of runaway inflation.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? . . . To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of the world will come around to the gold-friendly view that central bankers have lost their marbles. We have no such timetable. The road to confetti is long and winding.” – James Grant, Grant’s Interest Rate Observer

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking to add some weight to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973