Today’s top gold news and opinion

10/13/2023

US inflation higher than expected in September (FT)

Will the Fed raise again?

US Treasury Debt Dynamics ‘Very Unfavorable,’ IMF Official Says (Bloomberg)

US on an ‘unsustainable’ fiscal path with big deficits

Social Security Benefits Will Rise 3.2% In 2024, While Top Tax Jumps 5.2% (Forbes)

Small boost compared to the 8.7% cost-of-living adjustment (COLA) for 2023

Today’s top gold news and opinion

10/12/2023

The Case for Gold in Defined Contribution Asset Allocations (World Gold Council)

Portfolios of equities and bonds has come under increasing pressure

ExxonMobil agrees to buy shale group Pioneer in $59.5bn deal (FT)

Biggest acquisition since it was formed through the merger of Exxon and Mobil in 1999

Argentina’s Black Market Peso Rate Tops 1,000 Per Dollar (Bloomberg)

Was near half that level in July…

Today’s top gold news and opinion

10/11/2023

Chinese Gold Versus World Market Surges Again After Holiday Week (Bloomberg)

Second-highest premium on record compared to the international benchmark

U.S. banks need TARP 2.0: A trapped asset relief program (American Banker)

Privatize profits and socialize losses

Consumers starting to buckle for first time in a decade, former Walmart U.S. CEO Bill Simon warns (CNBC)

Lag effects becoming realized…

Today’s top gold news and opinion

10/10/2023

Americans Are Still Spending Like There’s No Tomorrow (WSJ)

Concerts, trips and designer handbags are taking priority over saving for a home or rainy day..

Israel’s central bank sells $30 billion in foreign reserves after shekel slides to seven-year low (CBNC)

The shekel had already weakened by 10% so far in 2023

Gold Holds Gains as Markets Mull Rate Pause, Middle East Crisis (Bloomberg)

Precious metal may have already seen its quarterly low

Today’s top gold news and opinion

10/9/2023

America is now paying more in interest on its record $33 trillion debt than on national defense (Yahoo)

Who holds the IOUs..

Wall Street Isn’t Sure It Can Handle All of Washington’s Bonds (WSJ)

Testing the bond market..

Attack on Israel likely to boost appeal of gold, safe-haven assets (Reuters)

Hedge against international turmoil

Today’s top gold news and opinion

10/6/2023

Treasury rout bolsters view that Fed will call time on rate rises (FT)

Market odds of another increase by year-end drop to 30%

How a CBDC Created Chaos and Poverty in Nigeria (Mises)

A failed experiment..

Flexport Plans to Lay Off 30% of Workforce (WSJ)

Global shipping demand is declining

Today’s top gold news and opinion

10/5/2023

The congressional push to create $650 billion (Axios)

$650 billion in Special Drawing Rights (SDRs)

Long Bonds’ Historic 46% Meltdown Rivals Burst of Dot-Com Bubble (Bloomberg)

Duration exposure fuels painful losses

Mortgage demand drops to the lowest level since 1996, as interest rates head toward 8% (CNBC)

Refis are down too..

Today’s top gold news and opinion

10/4/2023

3.5-Day Workweek? (Forbes)

Jamie Dimon Predicts AI Could Make It Happen

Gold Glitters In China’s Financial Storm (Forbes)

Sales of bars and coins are up 30% compared to last year

If The Bond Markets Aren’t Scaring You Yet, They Should Be (Politico)

Yield-mageddon in the US

Today’s top gold news and opinion

Recommended Headline News & Opinion

DAILY LINKS

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

10/3/2023

America’s Looming Debt Spiral (Bloomberg)

Short video on the problem

When Will the Fed Stop Raising Rates? That’s the Trillion-Dollar Question for Bond Investors (WSJ)

Lock-in higher rate long term debt?

Welcome to the Great Internet Splintering (Market Insider)

New, healthier era of social media

Today’s top gold news and opinion

Recommended Headline News & Opinion

DAILY LINKS

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

10/2/2023

Comex Gold Ends the Quarter 3.80% Lower at $1848.10 — Data Talk (WSJ)

Year-to-date it is up $28.40 or 1.56%

The debt-fueled bet on US Treasuries that’s scaring regulators (FT)

Selling futures and buying bonds

Like crypto or not, central banks need to prepare, BIS innovate head says (Blockworks)

Tokenization could be revolutionary

Today’s top gold news and opinion

Recommended Headline News & Opinion

DAILY LINKS

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

9/29/2023

200 Years of Global Gold Production, by Country (ELEMENTS)

Great visual

Talk about striking gold! Britain’s oldest coin hoard is discovered in Buckinghamshire dating back 2,173 years (Dailymail)

Made in 150BC

aXedras and the Royal Canadian Mint collaborate on digitalization of provenance and product integrity (Newswire)

More trends of digitalization of gold

Today’s top gold news and opinion

Recommended Headline News & Opinion

DAILY LINKS

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

9/28/2023

Must-watch: Singapore Reserves Revealed insight into the country’s rainy day fund (CNA)

Insight into the country’s rainy day fund

Gold hastens retreat on higher-for-longer rate bets (Reuters)

Soft landing?…

Costco is selling gold bars and they are selling out within a few hours (CNBC)

$1.50 Hotdog and an ounce of gold

In Loving Memory of Michael J. Kosares: A 50-Year Legacy of Gold Advocacy

It is with great sadness and a heavy heart that I share that my father, Michael J. Kosares, owner and founder of USAGOLD, passed away last Thursday (September 7, 2023) after a multi-year battle with cancer. He was 75 years old. After fifty years of dedication and devotion to the precious metals business, my father only hung-up his hat just a few weeks ago when he was physically no longer able to work.

Despite countless professional accolades over the course of his storied career, he was never one to boast, nor one to seek out acknowledgement or praise. For him, true success came in a well written article – one he deemed ‘had what it took’ to make a lasting impact, not necessarily just for our company, but for our industry as a whole, for our colleagues, for our clients, for our subscribers and site visitors, and for really anyone and everyone who took an interest in precious metals and encountered his work. He was an unwavering and tireless advocate for gold and silver ownership throughout his career, educating generations of investors on the merits of owning physical metals as a means to preserve and protect their wealth during turbulent economic times. From his hardcopy newsletter, ‘News & Views’, to three editions of his educational treatise, ‘The ABC’s of Gold Investing,’ to volumes of original content delivered via our website over the past 25 years, he spent five decades on the vanguard of gold market news, analysis, and commentary. A truly gifted writer, he made economics accessible, displaying again and again a remarkable ability to simplify even the most complex subjects for his readers. He would take on vast and complicated financial topics, distill them down to the salient points, weave in an interesting history lesson, and top it all off with a bit of clever humor – leaving his readers not only informed and enlightened, but truly entertained.

To say he will be missed is certainly an understatement. To answer ‘was his career a success?’, look no further than the countless individuals who know his name, have been inspired by his work and have benefitted from his wisdom. He leaves behind an exemplary legacy, and one I am deeply honored to carry forward.

Jonathan Kosares

COO/Owner – USAGOLD

[email protected]

Daily Gold Market Report

Gold drifts lower on sinking Chinese economy, caution ahead of inflation data

Mish Shedlock comments on favorable chart set-up for gold

(USAGOLD – 8/8/2023) – Gold drifted lower in early trading as China reported double-digit declines in both imports and exports, and investors took to the sidelines ahead of Thursday’s inflation data. It is down $11 at $1927. Silver is down 24¢ at $22.96. Mish Shedlock, the widely read editor of MIshTalk, recently had a few brief but supportive comments on the current technical set-up for gold. He says neither triple tops (like the one prominently displayed on the current gold chart) nor bottoms tend to hold. “If that view is correct,” he says, “gold is headed higher. Seasonally speaking, gold is heading into a favorable time of year. Finally, this has been a long 3-year consolidation period, with gold not too far from record highs.” He ends with some straightforward advice: “If you have faith in central banks, sell your gold. Otherwise, I suggest hanging on to it.”

Gold price

(Five year)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold trades cautiously to the downside ahead of inflation reports, bond sales

World Gold Council reports solid coin and bar demand for Q2-2023

(USAGOLD – 8/7/2023) – Gold is trading cautiously to the downside as it begins a week that includes the all-important consumer and wholesale inflation reports. It is down $7 at $1939. Silver is down 21¢ $23.50. Also on the agenda is a massive offering of Treasury notes and bonds, sure to be closely monitored by bond market participants.

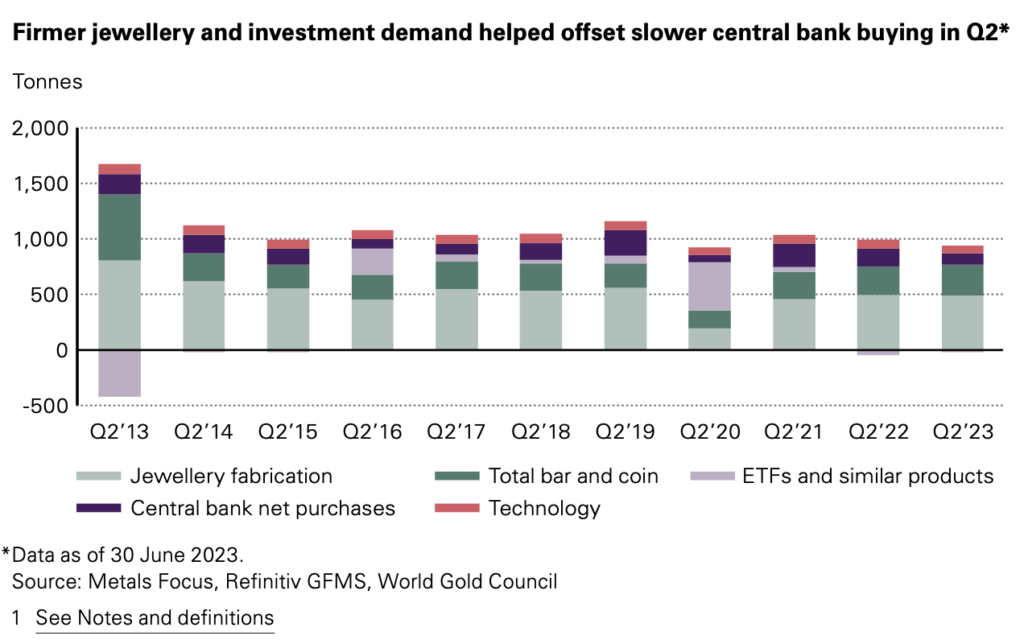

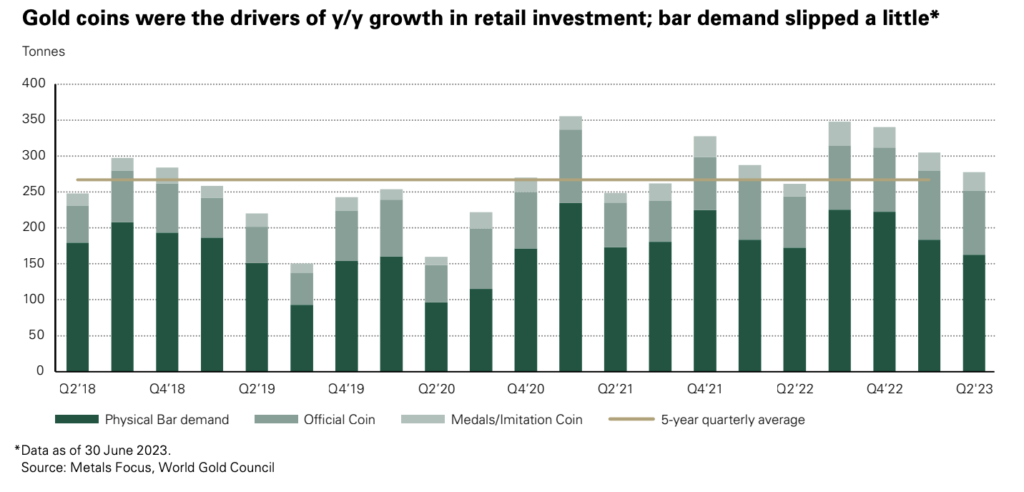

The World Gold Council reports a net deceleration in central bank purchases during the second quarter (year over year) but a solid increase in bar and coin demand (+6%). Despite the decline in central bank demand from above-average in last year’s second quarter, WGC still sees it as “resolutely positive.” Total demand is up 7% over the same quarter last year.

Chart courtesy of the World Gold Council • • • Click to enlarge

We are no longer updating this page.

We invite you to visit its replacement at the following link:

Gold demand trends Q2 2023 – World Gold Council

––World Gold Council/Staff/8-1-2023

“Central bank buying slowed in Q2 but remained resolutely positive. This, combined with healthy investment and resilient jewellery demand, created a supportive environment for gold prices.”

USAGOLD note: Bar and coin demand increased by 6% year over year in the second quarter.

Chart courtesy of World Gold Council

The USAGOLD Website

A guiding light for our current and would-be clientele since 1997

Welcome newcomers!

When the USAGOLD website was established in 1997, there was no Google, no Facebook, no I-Tunes, no Amazon. Instead there was just a handful of scattered websites trying to figure what this new technology was all about and how it could be used to some advantage. We were among that group. Our idea of innovation in those early days was two spinning globes on either side of the USAGOLD logo. We marveled at it; considered it state of the art.

But being among the first on the internet to have spinning globes was not our only achievement. We were also among the first to sponsor a Daily Market Report (1997), a Discussion Group (1997), Live Prices and Charts (2007) and a Mobile Website (2011) – to mention just a few of our ground-breaking internet ventures. We await the next wave of innovation so that we can offer even more value to our regular visitors.

Through our 26-year presence on the world wide web, the philosophy underlying our website has always been a simple one – to act as a guiding light for our current and prospective clientele by providing a state of the art information portal coupled with a reliable and competitive brokerage service. We had and still have no aspirations beyond that, and that pinpoint focus has paid dividends beyond anything we would have imagined in 1996.

From a humble beginning, we have grown to almost 800,000 visitors per month currently and there have been times when that count has been significantly higher. USAGOLD today remains one of the most highly referenced and visited web portals in the gold business. We once had a client tell us of visiting the Gold Souk in Dubai and being surprised that so many merchant stalls had USAGOLD on their computer screens.

If you would like to gain a better understanding of what USAGOLD has to offer to you as a current or prospective client, the menu at the top of the page is a good place to start.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Reliably serving physical gold and silver investors since 1973

‘Last hike of the cycle’: economists predict Federal Reserve is done with interest rate rises

Financial Times/Colby Smith/7-26-2023

USAGOLD note: The tussle between an adamant Fed and a dubious Wall Street continues ………

FOMZZZZ… But an inflation spike could wake us yet

Bloomberg/John Authers/7-27-2023

“The Fed promised us a nonevent and it delivered — give or take a few comments. The Federal Open Market Committee did indeed raise the benchmark fed funds rate by 25 basis points to the highest level in 22 years at 5.5%. But as that outcome had been rated a 99% probability when Wednesday dawned, it came as no surprise.”