Today’s top gold news and opinion

1/23/2024

Gold: Will 2024 be a Breakout Year on Rate Cut Hopes? (CME Group)

After decades as net sellers, central banks became net buyers of gold after the financial crisis

Gold slides on trimmed US rate cut bets, rallying equities (Reuters)

Market sees 41.6% chance of a March rate cut

PRECIOUS METALS FORECASTS 2024 : Ross Norman Metals Daily, London (LinkedIn)

GOLD = Average $2166 High $2300 Low $2000

Today’s top gold news and opinion

1/22/2024

Moody’s points to further pain after surge in corporate defaults (FT)

“High funding costs, together with tighter financing conditions . . . prompted a rise in corporate defaults during 2023”

Bitcoin Will Never Be ‘Money’ Precisely Because It’s Nothing Like Gold (Forbes)

T”In reality, money is quiet. Or should be. Good money is never talked about, nor are returns written about with glee.”

US Prepares Rule Forcing Banks to Tap Fed Discount Window (Bloomberg)

Michael Hsu says idea is to create a ‘fire drill’ for trouble

Today’s top gold news and opinion

1/19/2024

Data dependent precious metals continue their bumpy ride (Saxo)

Silver continues to trade near a ten-month low relative to gold

China’s Gold Market in 2023: Demand improved and premiums rose (World Gold Council)

The Shanghai Gold Benchmark Price PM (SHAUPM) in RMB, surged by 17% in 2023

Gold drifts higher as Middle East tension attracts safe-haven inflows (Reuters)

Atlanta Fed president open to cut U.S. interest rates sooner…

Today’s top gold news and opinion

1/18/2024

Gold retreats to over one-month low after data dims rate-cut hopes (Reuters)

Palladium lowest since 2018

Gold Resurgence: Central Banks, Market Turmoil, and the Unfolding Financial Paradigm (Commodity Discovery Fund)

The spotlight now rests on the United States, prompting speculation about potential explicit or implicit gold revaluation in the future.

US banking giants shed over 17,000 employees in turbulent year (Reuters)

Trouble on the street…

Today’s top gold news and opinion

1/17/2024

It Won’t Be a Recession—It Will Just Feel Like One (WSJ)

TThe bad news is that, for a lot of people, it is still going to feel like a recession.

Beijing tells some investors not to sell as Chinese stock rout resumes (FT)

TTraders say process of easing and then reimposing informal curbs is undermining market confidence first weeks of the new year.

Gold on steroids? Bitcoin, gold correlation surges in 2023 (Coin Telegraph)

Bitcoin and gold recorded strong performances in 2023 amid geopolitical uncertainties and rising interest rates

Daily Gold Market Report

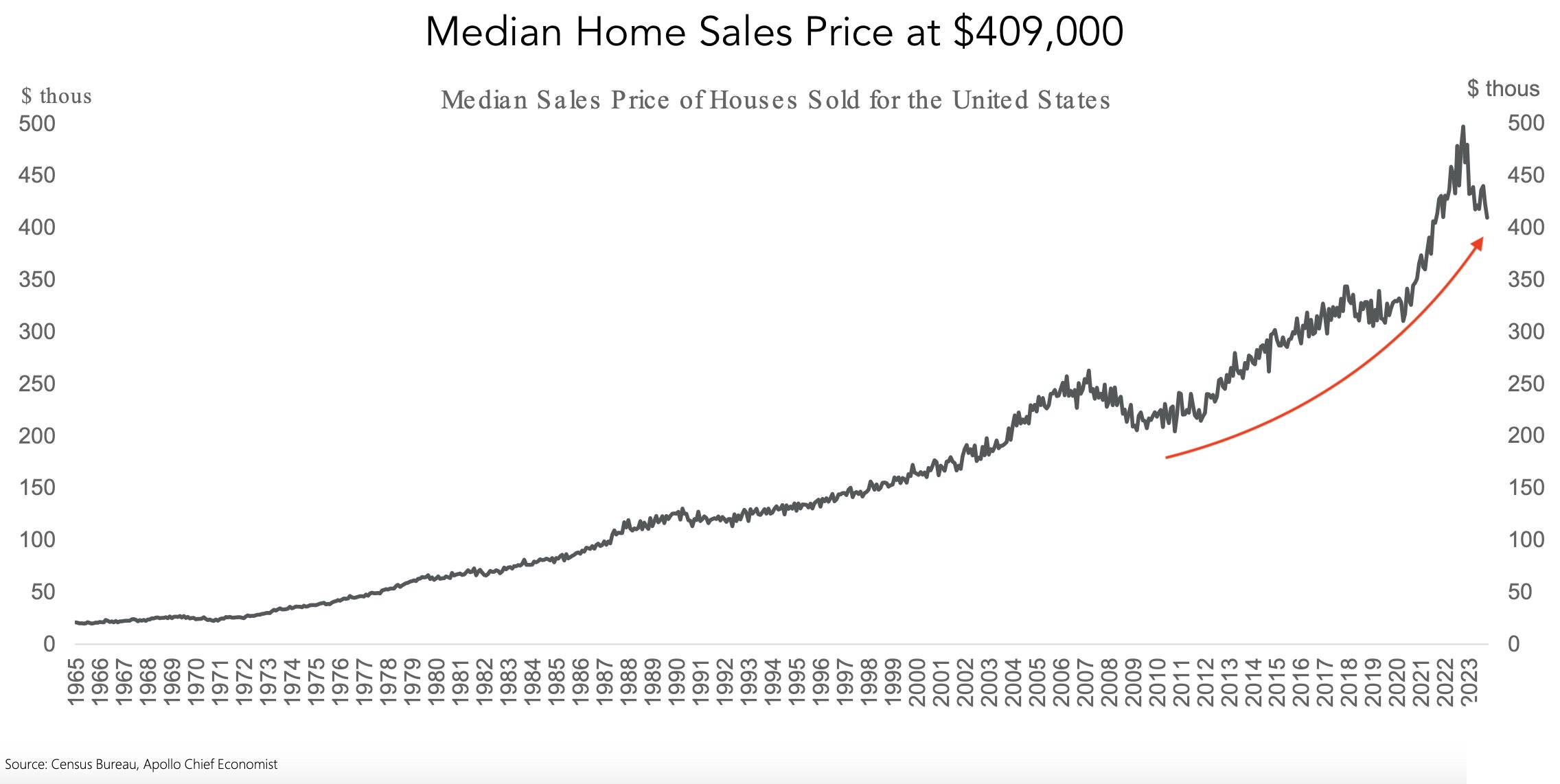

2024 Housing Market Downturn:

Prices Fall and Buyers Hesitate

(USAGOLD – 1/17/2024) The gold market is facing challenges in gaining positive momentum, while robust consumption in December maintains support for healthy economic activity. Gold is trading at $2018.73, down $9.71. Silver is trading at $22.63, down 29 cents. Median house prices have fallen nearly 9% since June 2022, indicating a nationwide trend. Despite a decline to a median of $410,000, housing remains unaffordable for many, exacerbated by high mortgage rates. “Redfin’s homebuyer demand index paints a sobering picture for 2024, showing a 9% year-over-year decrease and a staggering 40% drop from 2022 levels. Google Trends data reveals that the search interest in “homes for sale” is at an index level of 47, nearly half of the levels witnessed in the peak pandemic home-buying boom of 2021,” Toni Grzunov of isoldmyhouse.com reports. Could the continued decrease in housing prices revive interest among buyers, or does it indicate deeper issues in the market? As homebuilders reduce prices aggressively, is it possible for their methods to guide traditional home sellers, or are new homes and existing homes on divergent paths? As 2024 unfolds, the real estate market stands at a pivotal point. It remains to be seen if the willingness of sellers to lower prices will create a more equitable and affordable market environment.

Today’s top gold news and opinion

1/16/2024

Goldman Sees India’s Rising Affluent Class Buy Up Premium Goods (Bloomberg)

The country’s affluent class is expected to nearly double to 100 million people within three years

Why the launch of bitcoin ETFs threatens the market for gold (Market Watch)

The bitcoin ETFs are a sign that a new asset class is “emerging into the public’s investable category in a compliant way, just like what gold did about 20 years ago”

Uranium prices hit 12-year high as governments warm to nuclear power (FT)

Prices for the commodity dubbed “yellowcake” have jumped about 12 per cent to $65.50 per pound over the past month

Today’s top gold news and opinion

1/12/2024

Why “Inflation Hedge” Gold is Falling, Despite Hot US CPI (City Index)

Both the long- and shorter-term technical pictures for gold remain constructive for a retest or break of $2075 resistance.

Indiana Bill Would Treat Gold and Silver as Legal Tender (Tenth Admendment Center)

Exempt both from assessment and taxation under Indiana’s property tax statute and from the state gross retail tax..

The Periodic Table of Commodity Returns (2014-2023) (Visual Capitalist)

In a departure from other commodities, gold jumped over 13%, driven by investor demand and central bank purchases.

Today’s top gold news and opinion

1/11/2024

2023 Commodities Report: Winners And Losers In The Global Market (Forbes)

Gold was the number one commodity and only one of two that finished the year in the black, copper being the other commodity

To the Governor: New Jersey Passes Bill to Remove Sales Taxes from Gold and Silver (Tenth Admendment Center)

“In effect, states that collect taxes on purchases of precious metals are inherently saying gold and silver are not money at all.”

Bank of Canada files for ‘digital dollar,’ other related trademarks (Toronto Sun)

In Dec. 13 and Dec. 19 filings, the bank asserted ownership of “digital dollar,” “digital Canadian dollar” and “central bank digital currency”

Today’s top gold news and opinion

1/10/2024

The Bond Market Rally Is Overlooking a Soaring $2 Trillion Debt Problem (Bloomberg)

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before

SEC Blames Hack for Incorrect Post About Bitcoin ETF Approval (WSJ)

“It’s a hack,” a spokeswoman for the SEC said.

China’s forex, gold reserves expected to increase in 2024 (China Daily)

The country’s official reserves in gold surged by the largest amount in eight years in 2023.

Today’s top gold news and opinion

1/9/2024

COT: Weakest commodities conviction since 2015 (SAXO)

Hedge funds holding the smallest end of year net long across 24 major commodities since 2015

Palladium price falls as concern EVs will destroy demand returns to the fore (Mining)

Palladium prices fell by 3% on Thursday as concern the take-up of electric vehicles will destroy long-term demand

Sustainability 101: The Advantages of Recycling Over Mining (Noble6)

Sam Sabin is currently spearheading the development of Sabin Metal Corporation’s sustainability program, focusing on responsible processing for critical metals.

Today’s top gold news and opinion

1/8/2024

Perth Mint’s gold and silver sales hit four-year low in 2023 (NASDAQ)

Yearly sales of gold coins and minted bars fell to 665,889 ounces in 2023, down 40% compared to 2022, while silver sales were down 36% from 2022 levels at 14.9 million ounces.

Gold Fever At Dubai Airport Amid Record Sales For Its Biggest Retailer (Forbes)

The main duty-free retailer at the world’s busiest international airport, Dubai International, has reported a new all-time revenue record with sales in 2023 reaching 7.885 billion UAE dirhams ($2.16 billion)

Gold glitters amidst geopolitical uncertainty (LGT)

A further rise in geopolitical risk could fuel an increase in gold prices from current levels

Today’s top gold news and opinion

1/5/2024

Gold steadies as traders await jobs data for Fed cues (NASDAQ)

Fed meeting released on Wednesday showed officials were convinced inflation was coming under control

Will Gold Dazzle or Disappoint in 2024? (ETF)

Investors confront compelling cases both for and against gold and related ETFs.

Whether It’s Solid Gold or an ETF, Tokenizing Assets Demands Interoperability (NASDAQ)

Tokenized gold and other precious metals are a logical asset class for tokenization

Today’s top gold news and opinion

1/4/2024

The Hottest Property in Gold Mining Is Copper (WSJ)

Gold miners recently celebrated the precious metal fetching its highest price ever and they are reinvesting much of that windfall in copper.

Royal Mint sees 7% uptick in investors (Portfolio Advisor)

Investors used a variety of methods to enter the precious metal market, with 77% using either the Mint’s digital platform, DigiGold, or purchasing fractional coins and bars.

An insight into Russia’s view on gold (Macleod Finance)

Golden rouble 3

Today’s top gold news and opinion

1/3/2024

Gold begins new year restrained by stronger dollar (Reuters)

Rate cuts could lift gold to record highs

Gold in 2024 (Goldmoney)

It is hardly surprising, bearing in mind that gold is legal money and currencies are credit with counterparty risk.

Americans Understand Inflation (Daily Reckoning)

Gold ‘Cheap’ at $2050

Today’s top gold news and opinion

1/2/2024

Christian Brenner: And That’s When Gold Comes In (FINEWS)

Gold is increasingly being used as a hard asset, like cash, as a backup to protect against IT failures and cybercrime

China’s net gold imports via HK rise (Business Recorder)

Total gold imports via Hong Kong were up 37% at 46.049 tons compared to last month and up 120.9% from last year

On New Year’s Eve 1974, You Could Own Gold Again (Forbes)

On December 31, 1974, the federal government once again permitted Americans to own gold.

Today’s top gold news and opinion

12/21/2023

Gold gains traction among country’s investment options (China Daily)

Wealth preservation and security exceeded in importance to increasing the value of China’s wealth

Using AI to inform next-generation trading strategies (Fow)

AI tools can deliver immediate value that can be used to improve services and internal processes, often through the automation of complex tasks

Warren’s surveillance legislation is tailor-made to help big banks (CoinTelegraph)

Warren’s Digital Asset Anti-Money Laundering Act would shut crypto providers down, playing into the hands of the banking industry.

Today’s top gold news and opinion

12/18/2023

Costco gold bars were a hot holiday buy — while they lasted (Business Insider)

Sales of the one-ounce bars are limited to two per membership and sell out “within a few hours.”

Falling inflation might not dent gold’s rally (FT)

TPrecious metal can gain even if the US economy heads to a soft landing

Peak Gold—Evidence And Implications (Forbes)

Experts think peak gold may have been reached in 2018. In that year, production fell by 1%.

Today’s top gold news and opinion

12/152023

Gold touches 10-day high as Fed hints at lower US rates next year (Reuters)

Palladium advances 11% in best session since March 2020

Bank of America: Bullish on gold into summer (CNBC)

The “Halftime Report” Investment Committee debate their top metal picks

China’s gold market in November: premium elevated, gold reserves rose further (WGC)

Pushing its reported gold reserves up by 12t to 2,226t

Today’s top gold news and opinion

12/14/2023

Gold’s premature FOMO surge leaves it short-term challenged (Saxo)

Gold remains on track for its best year since 2020

A Paradigm Shift in Japan’s Gold Market (SMBA)

Gold is garnering more attention in Japan than ever before

Monthly Gold Compass December 2023 (Incememtum)

Data Visualized as of end of November