America still leads the world, but its allies are uneasy

Bloomberg/Nial Ferguson/6-17-2023

USAGOLD note: We’ve become accustomed to the mention of geopolitical tensions as a potential future driver of the gold price, but what that might mean remains distant and vague. In this deep dive, Ferguson assesses the current geopolitical framework. He worries about the fallout from the Rimland cracking and a developing global order of “separate silos”………

Daily Gold Market Report

Gold tracks higher attempting to establish technical support above the $1900 mark

Societe General says gold could appreciate by end of the year in ‘lumpy moves’

(USAGOLD – 6/26/2023) – Gold is tracking higher as it attempts to establish technical support above the $1900 mark. It is up $11 at $1934. Silver is up 37¢ at $22.88. Societe General has a positive prognosis for the gold market as outlined in its recently published Commodities Outlook concluding that gold’s rally is “not over yet.”

“…[With] the low-hanging fruit in the inflation fight already picked,” it says, “our strategists’ anticipation is that the gold market will have to price in higher forward CPI projections. As a result, gold could appreciate by the end of the year in lumpy moves as the market adjusts its forward inflation expectations with the macro newsflow. As an additional driver, in a scenario of moderating US rates, USD might weaken, which could buoy gold. Our strategists see all of this unfolding against the broader, intact theme of central banks diversifying their holdings away from fiat currencies, notably the USD, into gold.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“I find myself more and more relying for a solution of our problems on the invisible hand which I tried to eject from economic thinking twenty years ago.”

John Maynard Keynes

1946

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

–– A Gold Classics Library Selection ––

____________________________________________________________________________________

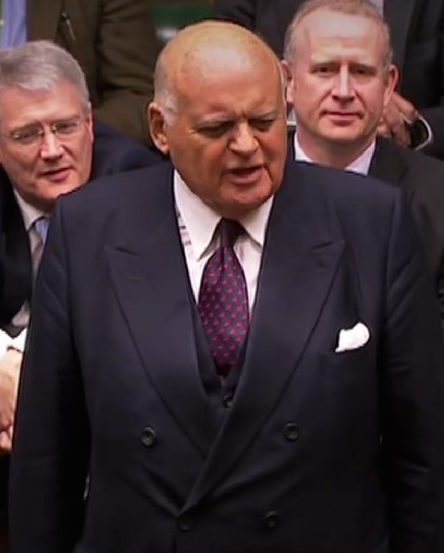

Britain’s Gold Sales ‘a Reckless Act’

(Sir Peter Tapsell’s speech before the House of Commons, June 16, 1999, on the partial sale of United Kingdom’s gold reserves)

We do not update our Gold Classics Library often, but when we do we try to choose items that have a timeless quality. This latest selection certainly meets that standard. It comes to us unexpectedly as a by-product of research for the recently published article, The Power of Gold Diversification, and with the kind permission of the United Kingdom Parliamentary Archives.

History’s indisputable verdict is that Tapsell was right and the British government wrong. The ensuing more than two decades featured a global financial crisis, a pandemic, low-to-zero-percent interest rates, scrambling central banks, and the consistent depreciation of global currencies against gold. Currencies did not glitter in the storm, and they could not have been mistaken for gold which rose relentlessly from $287 per ounce at the time of his speech to the current price of over $1800 (at one point reaching more than $2000 per ounce). Though Tapsell’s speech before the House of Commons failed to stop the sales, it goes down as one of the most eloquent appeals ever made on the merits of gold ownership for nation-states and individuals alike.

Favorite web pages

Charles DeGaulle’s famous ‘Criterion’ speech

____________________________________________________________________________________________________

Are you ready to add the criterion of value to your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Beware the Black Swan

‘There’s no clean way out.’

“The clan over the years’ matured and turned unruly,” writes Credit Bubble Bulletin’s Doug Noland. “Myriad severe development issues are increasingly on full display. The halcyon sandbox days are over for good, replaced by a confluence of insecurity, greed, and now constant infighting. To be sure, rich Uncle’s years of lavish generosity fostered a bunch of spoiled malcontents. The lax benefactor has come to realize he can no longer finance all the dysfunction and is desperate to craft a plan for exiting the relationship without unleashing mayhem. Some have structured their lives to stand on their own, while others’ very survival is at stake. All have developed bad habits, with some succumbing to deadly addictions. One camp says, ‘it’s time to get on with our lives without being further warped by all this charity money.’ Another is threatening to do harm to themselves. There’s no clean way out. Uncle fears calamity and harbors serious regret.”

Heightening the sense of impending danger, we would add our own observation that financial markets are full of eddies, crosscurrents, and strong undertows driven by excessive leverage and machine-based trading wherever the Fed might care to look. Today, the potential madness of machines is just as big a worry as the madness of crowds – their programming subject to the same frailties as their human creators. In fact, with algorithmic trading accounting for 60%-73% of U.S. equity trading, an argument could be made that machines now comprise the crowd.

“Since these automated strategies typically use artificial intelligence programs to analyze and react to market momentum, rather than economic fundamentals per se,” writes Gillian Tett points in a recent Financial Times editorial, “this tends to exacerbate a herding effect, not just in commodity markets but in any asset class. And since the institutions selling these derivatives bets need to hedge their own risks with other instruments, extreme robo-herding creates distortions across market niches that can suddenly unravel, causing wild volatility.” To make a very long story short, credit markets have a history of reacting unpredictably, and sometimes violently, to rising rates: Beware the Black Swan ……

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to hedge the madness of machines?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

DoubleLine’s Gundlach warns stocks are ‘exhibiting signs of a mania’

MarketWatch/Joy Wiltermuth/6-14-2023

“The stock market, frankly, is exhibiting signs of a mania, where you have a very concentrated part of the market’s that driving the entire train.” – Jeffrey Gundlach, DoubleLine Capital

__________________________

“Have you ever seen in some wood, on a sunny quiet day, a cloud of flying midges — thousands of them — hovering, apparently motionless, in a sunbeam? …Yes? …Well, did you ever see the whole flight — each mite apparently preserving its distance from all others — suddenly move, say three feet, to one side or the other? Well, what made them do that? A breeze? I said a quiet day. But try to recall — did you ever see them move directly back again in the same unison? Well, what made them do that? Great human mass movements are slower of inception but much more effective.” – Bernard Baruch

Larry Summers dubs Fed’s latest narrative ‘disturbing’

MarketsInsider/Zinya Salfiti/6-16-2023

USAGOLD note: A number of prominent economists found the Fed’s latest stance disturbing. If Summers is right that internal politics played a role in the Fed narrative, it will only further undermine the central bank’s already flagging credibility.

Goldman says markets are optimistic on pace of US infltion drop

Bloomberg/Joanna Ossinger/6-17-2023

“Inflation in the US won’t come down as quickly as markets are currently pricing, according to strategists at Goldman Sachs Group Inc.”

USAGOLD note: What bothers the Fed about the current inflation numbers is that core prices excluding food and energy, as shown below in the Fed favored inflation indicator, the PCE Index, are actually increasing even as the headline inflation rate continues to drop. Most of that drop, in fact, has to do with the drop in the cost of energy. The price of energy can accelerate suddenly and along with it other volatile sectors, though, and that is what is troubling the Fed. If it does, the rising cost will be tacked onto core prices

US Core PCE Index Annual Change

Chart courtesy of TradingEconomics.com

Short and Sweet

How much gold is enough?

Investors often ask about the percentage commitment one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a recent Seeking Alpha editorial, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” USAGOLD recommends, as it has for many years, a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

________________________________________________________________________________

Is diversification in the cards for your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Is the stock market rally for real?

MarketWatch/William Watts/6-16-2023

USAGOLD note: The Financial Times pointed out recently that this rally is essentially concentrated in seven high-tech stocks. Hartnett sees it as fragile but could stay elevated until Fed “reintroduces fear.”

Daily Gold Market Report

Gold turns to the upside as speculative selling takes a breather

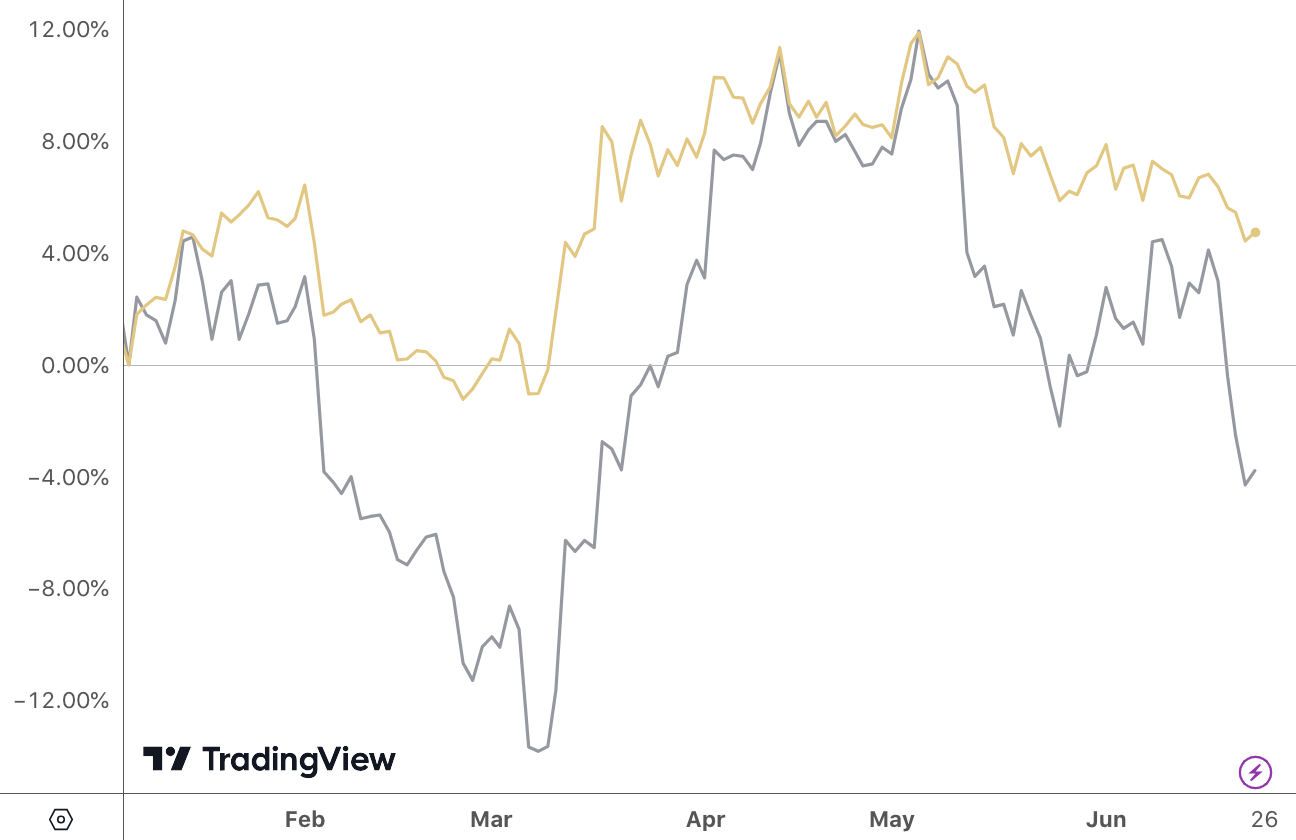

Gold is down 2% on the week, but up 5.1% on the year

(USAGOLD – 6/23/2023) – Gold turned to the upside as speculative selling from the rate-cut trade appeared to be taking a breather – at least in the early going. Gold is up $6 at $1922. Silver is up 16¢ at $22.45. Gold is down 2% on the week, and silver is down almost 6.5%. To put the price picture in perspective, gold year to date is up 5.1% (after all is said and done), and silver, the more volatile of the two metals, is down 6.6%.

Gold and silver price performance

(%, year to date)

Chart courtesy of TradingView.com • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We live in a technological golden age but in a monetary and fiscal dark age. While physicists discover the so-called God particle, governments print and borrow by the trillions. Science and technology may hurtle forward, but money and banking race backward.”

James Grant

Grant’s Interest Rate Observer

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gold stays gold, forever

HedgeNordic/Eugene Guzun/6-13-2023

USAGOLD note: Guzun adds that gold has returned 7.7% annually since 1971, the year the United States went off the gold standard.

Computer-driven trading firms fret over risks AI poses to their profits

Financial Times/George Steer and Laurence Fletcher/6-15-2023

USAGOLD note: An existential threat emerges for algo-based trading systems: Instantaneous reaction to fake news. Hedge funds say they’ve erected defenses but the fake Pentagon image and subsequent instantaneous plunge in stocks proves otherwise.

Wall Street isn’t buying what Powell, economists are forecasting

Bloomberg/Jess Menton, Alexandra Semenova and Elena Popina/6-15-2023

“Defying the odds, the world’s biggest stock market has recouped all losses caused by the most disruptive monetary-tightening campaign in a generation. And not even recession warnings or fresh monetary threats from Jerome Powell are stopping fund managers as they join the big artificial intelligence-fueled rally.”

USAGOLD note: Such is what happens when market participants know that the central bank is caught between a rock and a hard place. Powell has consistently chosen to fly like a dove when things go south – the stuff of reputation. As for Wall Street, with big bets in place on either side of the rate divide, someone is going to get burnt – perhaps badly.

Waller says bank failures may influence Fed on how much to raise interest rates

MarketWatch/Jeffry Bartash/6-16-2023

USAGOLD note: A solid indicator that problems still lurk in the banking system from an influential Fed governor.

Short and Sweet

We first introduced our readers to these nine lessons all the way back in 1999. They were passed along to us by the legendary commodity market analyst R.E. McMaster, formerly editor of The Reaper newsletter. The original source for the nine lessons was a highly regarded money manager who handled accounts for wealthy Greek and Mexican merchant families.

1. It is easier to make a fortune than keep it.

2. Intelligence is an inadequate substitute for wisdom. Wisdom fears, respects the unknown and fosters humility. Intelligence can lead to self-destructive arrogance and ultimate failure.

3. Risk must have premium, and we must understand it well.

4. There is no order. There is no formula. There is no equation that works all of the time. It works just long enough to fool just a few more of us just a little longer.

5. What we fail to remember is that a paper gain is just that. Paper. Worth nothing. Not until we say sell, and not until we get cash. Anything less is just that.

6. When the Bass Brothers in Texas write a check for real money, their money, to buy 25% of the Freeport McMoran Gold Series II, we take notice. When the Fidelity Magellan Fund buys a fifty-million in Dell computer, we yawn. So, should you. It is other people’s money.

7. Slick advertising budgets, powerful computers and few slabs of marble do not, by themselves, make a great financial institution.

8. Never invest in anything you do not feel comfortable with or understand well.

9. When a thousand people say a foolish thing, it is still a foolish thing.

Is the wisdom of a portfolio hedge in your future?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Forget a shooting match, economic warfare is enough to impoverish most of us

South China Morning Post/Alex Lo/6-13-2023

USAGOLD note: Lo goes on to say that the Center for Economic Policy Research the weaponization of the dollar and the introduction of a digital yuan “constitute the sharpest shock to the status quo since the collapse of the Brettonn Woods system 50 years ago.” What we present here is only a small portion of the analysis at the link.

Daily Gold Market Report

Gold marginally lower as summertime lull remains in full force

‘Gold’s price action less of an arrow and more of a feather’ – Ross Norman

(USAGOLD – 6/22/2023) – Gold is marginally lower this morning as markets continued to weigh the direction of Fed policy, and the summertime lull remained in full force. It is down $3 at $1931. Silver is down 2¢ at $22.70. Metals Daily’s Ross Norman offered an apt description of the current market in this morning’s Reuters gold report: “Gold’s price action is less of an arrow and more of a feather as it responds negatively to the latest hawkish tones coming from the Fed.” MKS Pamp’s Nicky Shiels told Ktco News yesterday that “[gold’s] been in no-man’s-land for too long, and the news cycle is simply slow, which usually implies a rerating lower in the near term.” She blames “predatory shorts” who entered after the last week’s strong housing report for gold’s recent $30 decline.