NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 46th year in the gold business

March 2019

Gold in the age of high-speed electronic trading

“The best thing you can do is know how to have a balanced portfolio.”

Ray Dalio, Bridgewater Associates

“The Flash Boys story put in jeopardy billions of dollars of

Wall Street profits and a way of financial life.”

Michael Lewis

What’s the line in that popular song. . . . “Are you happy in this modern world?”

In an article headlined Robots conquered stock markets/Now they’re coming for bonds and currencies, Bloomberg finance reporter Lananh Nguyen tells us: “In the most liquid equity markets, more than 90 percent of trades are executed electronically, according to estimates from Greenwich Associates. That compares with 79 percent in global foreign exchange, 44 percent in U.S. Treasuries and 26 percent in U.S. corporate bonds, with the most room for growth in the latter two markets, according to [Kevin] McPartland at Greenwich.” [Link]

“These algos,” said hedge fund guru Stanley Druckenmiller toward the end of last year, “have taken all the rhythm out of the market and have become extremely confusing to me. And when you take away price action versus news from someone who’s used price action news as their major disciplinary tool for 35 years, it’s tough, and it’s become very tough. I don’t know where this is all going.” In other words, human investors have become strangers in a strange new land of computerized trading and investing.

“The best thing,” warns Ray Dalio the famed hedge fund operator, “is don’t play the game, because it is pros against you. We spend hundreds of millions of dollars a year to get an edge, and others do that too. So it’s very difficult for the individual investor to assume that he [or she] can pick something better. The best thing you can do is know how to have a balanced portfolio … because you ain’t going to win that game.” Dalio heads up Bridgewater Associates, the largest hedge fund in the world. He is a long-time advocate of gold ownership and his fund holds a significant position in the precious metal.

In the event of a major software-driven panic

Just this past January, Morgan Stanley and Goldman Sachs requested counterparties forgive rogue, machine-driven trades that caused a $41 billion flash crash in a matter of seconds. Though concentrated in a single stock, such anomalous events serve as a cautionary tale on how a full-out, machine-driven panic might evolve on a larger scale.

Because gold does not rely on the performance of another party, it is detached from the matrix of interlocking counter-party risk and occupies a unique place on the financial balance sheet as an asset of last resort and the final arbiter of value. That is why nation states and central banks hold large amounts of it on their own balance sheets and why funds and institutions are more and more moving to it as an offset against other trading strategies.

Investors have always viewed gold as a reliable hedge against inflation and deflation. In the years to come, they might very well come to know it as an effective hedge against computer-generated financial mayhem as well.

Gold’s parabolic rise remains intact

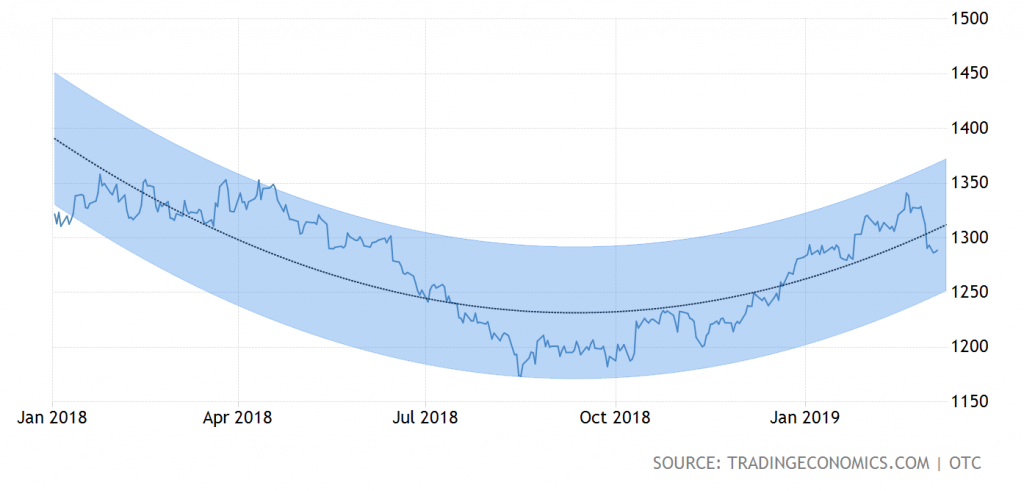

Gold, the old saying goes, likes to take the stairs up and the elevator down. The first chart (shown below) illustrates the process. Since its most recent elevator drop which began towards the end of February, gold seems to have consolidated at least for now above the $1275-$1285 support zone.

Technical analyst Clive Maund sees the recent drop as part of a larger process – a parabolic rise as illustrated in our second chart. “The rather sharp drop in gold late last week,” he says, “especially on Friday, came as something as a shock to many investors in the sector, yet as we will proceed to see it was set up to react back here or soon, and a period of consolidation or reaction at around this level will actually put it in a better technical condition to mount a sustainable breakout above the key $1400 level. On its latest 7-month chart the 1st point to observe is that gold is still well within our parabolic uptrend, whose lower boundary is coming into play and providing support, as is the rising 50-day moving average, with additional support being generated by premature sellers in the small Pennant pattern that formed during the first half of January. This is why it closed well off the lows on Friday, and why it could now resume the upward path again soon . . .” (Please see his Gold Market Update for the full analysis.)

Chart courtesy of TradingEconomics.com

The return of quantitative easing

Suddenly, investors are returning to a safe-haven mindset following reports of abrupt slowdowns in both China and Europe. The central banks of both countries have moved quickly to announce stimulus measures and support for their banking systems in policy U-turns reminiscent of past quantitative easing programs. Those announcements, rather than instilling confidence in the markets, created a sense that the oft-predicted global slowdown might actually have begun. The economic gloom gained momentum when the Labor Department released a jobs report, suggesting that the U.S. economy might be slowing as well. Gold and silver responded immediately with surprisingly strong price advances.

“The global picture continues to be quite concerning,” Columbia Threadneedle’s Gene Tannuzzo told Bloomberg recently. “Europe might be on the edge of recession now, and China has had the slowest growth in a decade. If that continues, there will certainly be an impact to the U.S. economy and we could possibly see QE in 2020.”

Along these lines, Fed vice chairman Richard Clarida resurrected the specter of quantitative easing for the United States in a late February speech. “[T]he FOMC could,” he said, “establish a temporary ceiling for Treasury yields at longer maturities by standing ready to purchase them at a preannounced floor price.” In a Bloomberg article, Interest Rate Observer’s James Grant said that the Fed vice chair’s speech “acknowledged no doubts that radical monetary policy has worked, that it will continue to work and that it may well become more radical.” Clarida, he says, “was pushing no novel agenda of his own” and that his views were “institutional.”

Worry about the return of your money,

not just the return on it

“To be fair, the fiscal side of our current system has been nonexistent. We’re not all dead, but Keynes certainly is. Until governments can spend money and replace the animal spirits lacking in the private sector, then the Monopoly board and meager credit growth shrinks as a future deflationary weapon. But investors should not hope unrealistically for deficit spending any time soon. To me, that means at best, a ceiling on risk asset prices (stocks, high yield bonds, private equity, real estate) and at worst, minus signs at year’s end that force investors to abandon hope for future returns compared to historic examples. Worry for now about the return of your money, not the return on it. Our Monopoly-based economy requires credit creation and if it stays low, the future losers will grow in number.”

Bond-fund guru Bill Gross posted that piece of advice in his Investment Outlook column back in 2016. It still applies today – maybe even more so now than it did then. In the wealth game, emphasize defense when you need to, offense when it makes sense. At all times, remain diversified. And by that, we mean real diversification in the form of physical gold and silver coins and/or bullion outside the current fiat money system. There is nothing wrong with owning stocks and bonds. Realize though that these assets are denominated in the domestic currency. If it erodes in value, the underlying value of those assets erodes along with it. A proper diversification addresses that problem now and in the future. Bill Gross, by the way, has recommended buying gold on a number of occasions over the years.

Ignoring America’s abyss of debt

“The United States isn’t Greece,” says The American Conservative‘s Barbara Boland, “but its fiscal condition is worsening and right now there’s no willpower to make it any better. This was expressed with brutal honesty by President Trump, who admitted in December that the prospect of a debt crisis doesn’t bother him because ‘I won’t be here’ when it blows up.” Unfortunately, that has been the attitude among politicians since most of us can remember and precisely why we are in the position in which we find ourselves today. There is a direct long-term correlation between the federal debt and gold expressed in the chart above. There might not be a political remedy at the moment to deficit financing and the dangers it imposes, but happily, there are defensive measures one can apply within his or her personal finances.

“Silver, not gold, is the portfolio insurance to buy now”

So read the headline for a recent MarketWatch article on silver. We at USAGOLD have long advocated adding silver to the mix for portfolio insurance purposes especially at times like the present when the silver-gold ratio is high (now 85 to 1). At the same time, we do not advocate silver to the exclusion of gold, but more as an adjunct through which the investor conceivably can get more bang for his or her buck, if silver outperforms gold to the upside.

Meanwhile, the U.S. Mint has once again shut down production of the popular silver American Eagles after a surge of demand since the start of the year. Coin World reports that “Market fluctuations have resulted in a temporary sellout of 2018 and 2019 silver bullion. Production at the Mint’s West Point facility continues, and when sales resume, silver bullion will be offered under allocation. The Mint is working closely with its suppliers in order to meet the demand of its authorized purchasers.”

Posted sales for February are 2,157,500 one-ounce American Silver Eagles after 4,017,500 in sales for January. The combined months surpass the first two months of 2018 by a substantial margin and indicate rising interest among investors. As of this writing, USAGOLD has ample supply and our pricing has not yet been affected. That, though, is subject to change without notice. In the past instances of U.S. Mint suspensions and allocation programs, premiums have moved higher – sometimes overnight and without any prior warning.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold [Third Edition]. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.