Short & Sweet

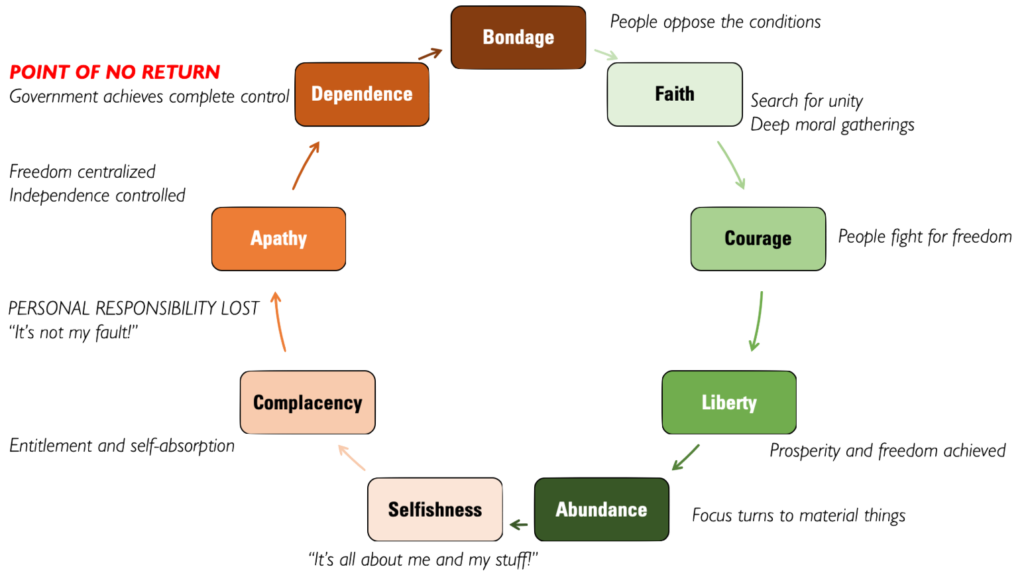

Tytler’s Cycle

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.” – Alexander Fraser Tytler, Scottish historian, (1747-1813)

_______________________________________________________________________

To end right, start right.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

_______________________________________________________________________

Image attribution: J4lambert, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>,

via Wikimedia Commons

Short & Sweet

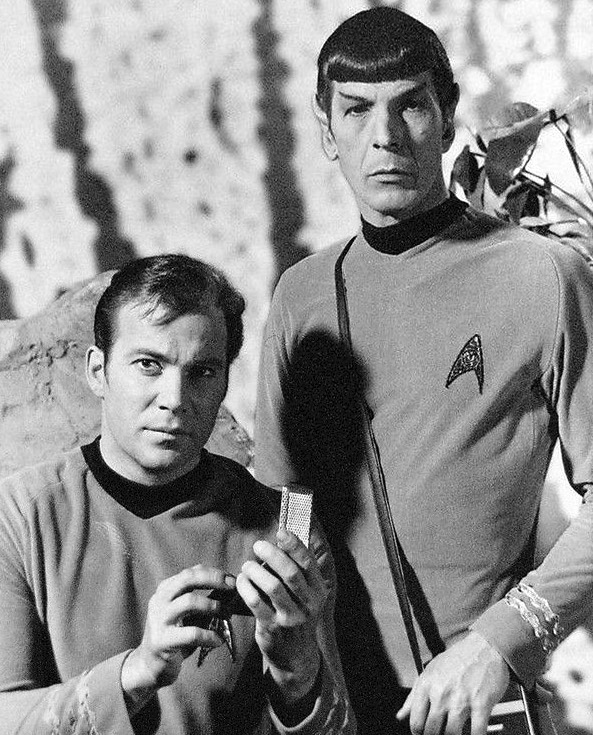

Computer software gone mad

Similarly, in early 2017 Financial Times told the story of the textbook, The Making of a Fly: The Genetics of Animal Design. It started out selling for $113 per copy at Amazon – that is until the governing algorithm misfired between two third-party sellers. The price then skyrocketed to $23 million before someone took note and fixed the problem. We forget that computer software, and this applies to Wall Street’s trading apparatus as readily as it does the Amazon pricing platform, is only as reliable and intelligent as the code by which it is instructed to operate. The practical equivalent to Mr. Spock’s solution in the financial realm is to store sufficient capital in the form of gold and silver coins detached from potentially rebellious electronic circuitry.

Worried about the possibility of computer algorithms running amok in financial markets?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Gold Relativity

Do not take your eye off the prize

Gold’s value is relative. It doesn’t really matter how many digits it takes to express the price. Its true value lies in what those digits represent in terms of purchasing power. During the post-World War I hyperinflation in Germany, for example, a 20-mark gold coin in 1918 purchased the equivalent of twenty marks worth of goods and services in the marketplace. By 1924 that same 20-mark gold coin (weighing roughly one-quarter troy ounces) provided the purchasing power of nearly 25 billion paper marks.

By pointing out this example of gold’s constancy, we do not intend to imply that the United States is headed the way of the Weimar Republic. What we do mean to say, though, is that those who track the nominal value of gold by itself without taking into account the current and future value of the currency in which it is measured take their eye off the prize.

What are the intentions of the central bank and federal government, we should ask ourselves, and what will be the likely effect on the purchasing power of the currency?

Ready to add purchasing power constancy to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Super-rich doomsday preppers ahead of the times

And the not-so-super-rich are following in their footsteps

“Survivalism,” Evan Osnos once wrote in an article for The New Yorker, “the practice of preparing for a crackup of civilization, tends to evoke a certain picture: the woodsman in the tinfoil hat, the hysteric with the hoard of beans, the religious doomsayer. But in recent years, survivalism has expanded to more affluent quarters, taking root in Silicon Valley and New York City, among technology executives, hedge-fund managers, and others in their economic cohort.”

We have always taken exception to the mainstream media’s portrayal of the ordinary gold owner as “the woodsman in the tinfoil hat”. . . etc. Many among the media are utterly amazed to learn that people like Steve Huffman (Reddit, CEO), Peter Thiel (PayPal founder), and the long roster of other luminaries mentioned in this New Yorker article are identified as “preppers” in one capacity or another. They would probably be even more amazed to learn that many of this same group are likely to be gold and silver owners. We say “likely” because precious metals owners by and large are a group reluctant to advertise their ownership.

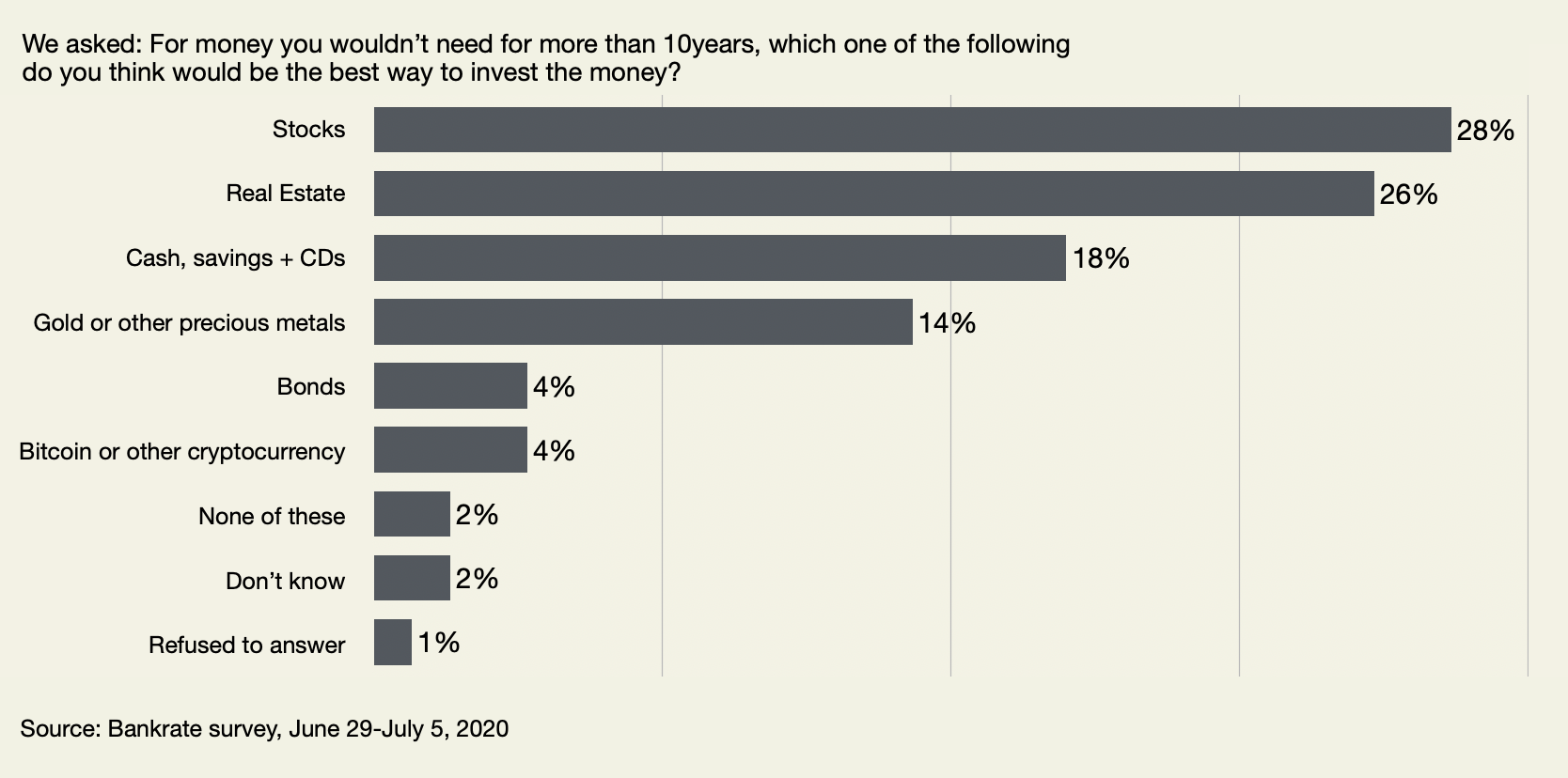

As it is, they take a place alongside a wide range of Americans who own precious metals – physicians and dentists, nurses and teachers, plumbers, carpenters, and building contractors, business owners, attorneys, engineers, and university professors (to name a few.) We know because that is the description of our clientele here at USAGOLD. Gold ownership, in short, is pretty much a Main Street endeavor. In a 2020 Bankrate survey, one in seven investors (14%) chose gold or other precious metals as the best place to park money they wouldn’t need for more than ten years – making it the fourth most popular category. Similarly, a 2020 Gallup poll found that 17% of American investors rated gold the best investment “regardless of gender, age, income or party ID. . .” One might assume that if Bankrate or Gallup took a similar poll today, even more investors would give the precious metals a thumbs up given what has occurred over the past year.

Those well-to-do preppers, as it turns out, were uncannily ahead of the times. Over the years, large numbers of the not-so-super-rich followed in their footsteps – setting up “bugout” retreats in the countryside and small-town America (though for reasons unforeseen in the article) while a good many fled the big cities permanently for safer environs. That mindset – the general flight to safety – has echoed loudly in the precious metals markets. The World Gold Council reports global retail gold investment demand running at record levels in 2022. As for silver, the Silver Institute, a research organization not given to hyperbole, recently reported an eye-catching 36% increase in physical silver investment for 2021.

Bankrate Survey of Investors

Chart courtesy of BankRate.com • • • Click to enlarge

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

NEWS & VIEWS

Forecast, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

We invite your interest in our popular monthly newsletter.

Prospective clients welcome.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

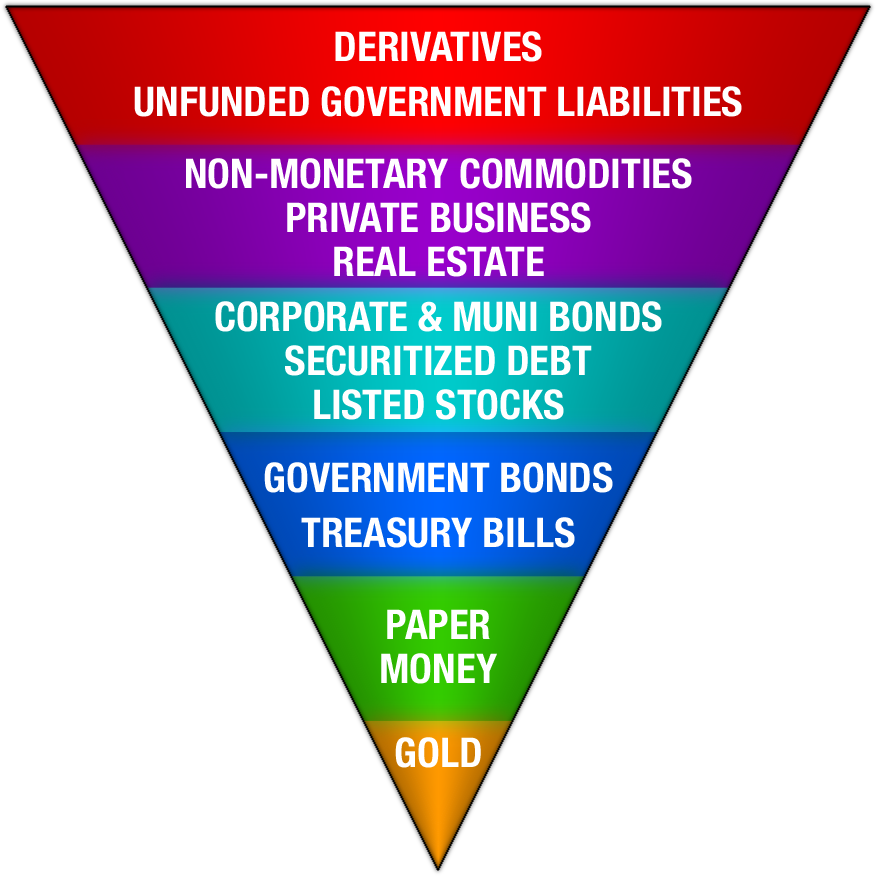

The Exter Inverted Pyramid of Global Liquidity

“[Exter’s Inverted] Pyramid stands upon its apex of gold, which has no counter-party risk nor credit risk and is very liquid. As you work higher into the pyramid, the assets get progressively less creditworthy and less liquid. . .[In a financial crisis] this bloated structure pancakes back down upon itself in a flight to safety. The riskier, upper parts of the inverted pyramid become less liquid (harder to sell), and – if they can be sold at all – change hands at markedly lower prices as the once continuous flow of credit that had levitated those prices dries up.” – Lewis Johnson, Capital Wealth Advisor’s Lewis Johnson

____________________________________________________________________________________________

Short and Sweet

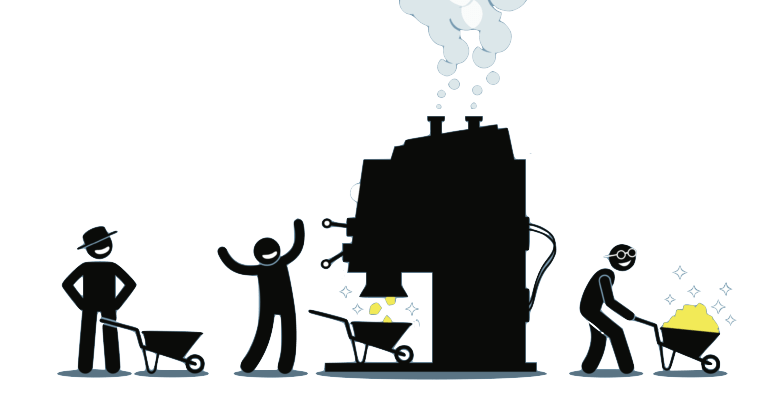

Of wheelbarrows and runaway inflation

As Crescat Capital’s Kevin Smith and Tavi Costa point out in a client alert, the U.S. government issued $4.4 trillion of debt in fiscal year 2020, and $2.4 trillion, or 54%, was purchased by the Federal Reserve. They believe that $300 billion per month in quantitative easing will be needed to cover the upcoming tab as opposed to the current $120 billion per month. “Global central bank money printing is one of the primary drivers of the gold price,” they say. “Our current valuation target for gold based on the level of central bank assets and the inelastic supply of above-ground gold is $3,200/oz. Note, this is a rising target.”

“Really smart investors,” says Morning Porridge’s Bill Blain, the London-based commentator, “are increasingly hedging their wealth created from financial assets (stocks and shares) by putting much of their allocations into Alternatives: outright real assets or cash flow driven assets, assets that are likely to retain value while still paying attractive returns. (The cost is lower liquidity). The idea is that if crisis ever comes, then owning the wheelbarrow might be better than owning the mountains of worthless cash it’s carrying (to cite the classic example of inflationary danger from Weimar Germany…)” If runaway inflation truly does materialize, a wheelbarrow full of gold and silver might be an even better option ……

Looking to load up your wheelbarrow?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Past gold bull markets have begun with a surge in the money supply

If the Fed looks for inflation, it will find it in the money supply – something that did not occur with authority in the aftermath of the 2008 credit crisis. From June 2019, the money supply has grown by $7.1 trillion. During the financial crisis that began in 2008, the Fed sterilized its money creation by routing liquidity back to its coffers in the form of commercial bank excess reserves. This strategy kept the inflation rate from running out of control. Now, the additional infusions associated with the pandemic combined with the earlier money creation is feeding into the benchmark inflation rate. Since 2020, prices have risen 26.4%. The Fed’s recently launched bank rescue plan could also eventually feed into the money supply and more inflation down the road.

“Every gold bull market over the last 50 years has begun with a catalyst that propelled significant growth in the money supply,” writes Manning & Napier, the money management firm, in a report posted at Seeking Alpha titled The Value of Gold in a Portfolio. “Each of those prior bull markets was proceeded by substantial US dollar money supply growth, making monetary expansion a key indicator. It is important to note that this alone does not guarantee a gold bull market, as there are many other variables at play. … We see the status of each of these economic factors, money supply growth, inflation, and real interest rates, as supportive of higher gold prices ahead. Policymakers have been remarkably forceful in responding to Covid-19, resulting in substantial recent money supply growth in the US, and they appear willing to continue to throw money at the crisis in the year ahead.”

Gold and the money supply

(1971 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you worried about the future value of your savings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Copernicus on the debasement of money

“Although there are countless scourges which in general debilitate kingdoms, principalities, and republics, the four most important (in my judgment) are dissension, [abnormal] mortality, barren soil, and debasement of the currency. The first three are so obvious that nobody is unaware of their existence. But the fourth, which concerns money, is taken into account by few persons and only the most perspicacious. For it undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” – Copernicus, Essay on the Coinage of Money (1526)

Few know that Copernicus applied his genius to the insidious effects of currency debasement. The ground-breaking essay linked above probably influenced both John Maynard Keynes (See below) and Thomas Gresham of “bad money drives out good” fame. Supply Side Blog’s Ralph Benko says Copernicus’ essay “has been translated into English several times yet those translations remained difficult to obtain for students of the monetary arts and sciences. It has remained mostly the property of elite historians.” Above we link Edward Rousen’s translation that you might keep company with the knowledgeable elite.

It cost 8¢ to mail a one-ounce letter in 1973 as indicated by the commemorative Copernicus stamp shown above. It costs 55¢ today – an illustration of his assertion that currency debasement “undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” The post office increased the cost of mailing a letter by 5¢ – to 55¢ – beginning in 2019.

“By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.” – John Maynard Keynes, The Economic Consequences of Peace (1919)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to protect your savings from being confiscated in a covert manner?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

‘Wannabes’ and ‘Gonnabes’ not the real thing

‘Put differently, as long as humans remain tangible, it is likely that they maintain a desire to hold real and tangible assets. Very few companies on the US stock exchange, for example, are older than 50 years. By comparison, gold has existed for thousands of years and any gold coin or gold bar will most likely outlive any company and their stocks and bonds. Put together, it is unlikely that a company that sells claims on gold, such as a gold ETF, will beat physical gold’s longevity.” – Dick Baur, Professor of Finance, University of Western Australia (Why ‘digital gold’ won’t ever kill off the real thing)

Wannabe and gonnabe paper gold and silver will never pass for history’s time-honored store of value – nor will it be mistaken for actual gold coins or bars stored nearby should the cold wind blow. By the way, adding the word, blockchain, to a paper gold product might enhance its marketing appeal, but it changes nothing in terms of its usefulness to the true safe-haven investor. The instrument is still paper gold and little more than a price bet.

Don’t wannabe a ‘wannabee’?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

“The first stop of $10,000 is actually not that far away.”

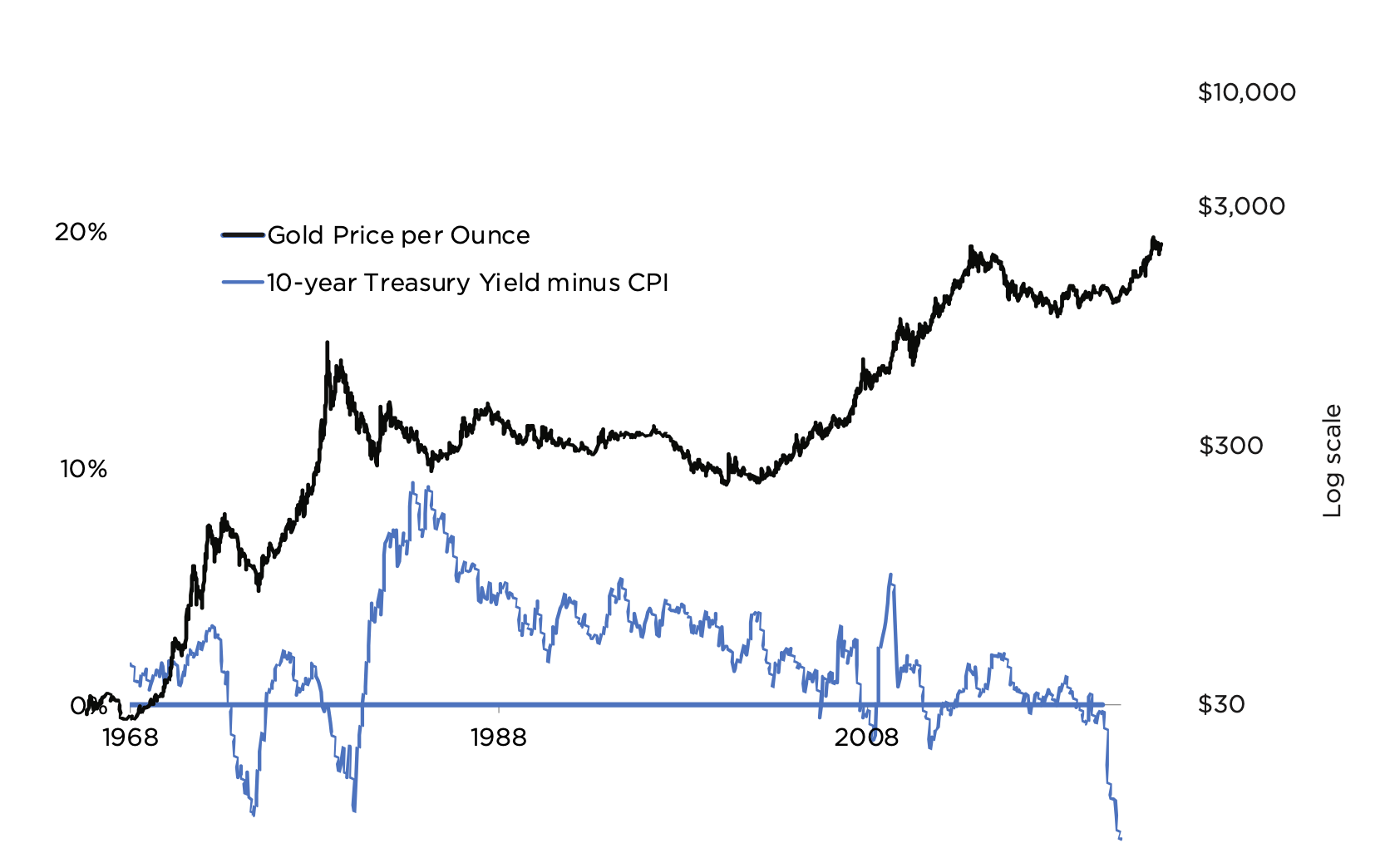

One of the more intriguing analyses of the gold market comes from Myrmikan Research’s John Oliver. He inquires into gold’s rangebound behavior under these extraordinary circumstances and concludes, “what propels gold into the multi-thousands of dollars per ounce—is sharply rising rates that destroy the value of the Fed’s assets and make further federal deficit spending impossible. Without a political reason to buy the dollar, it will seek out its economic value.” It’s all in the math, and more specifically, he says that when looking at gold, investors “are going to have to get used to logarithmic scales.” In early 2022, Myrmikan projected a gold price of $5000 per ounce at some point down the road to give one-third backing to the Fed’s balance sheet. Now, says Oliver, it would take a gold price in excess of $11,000 to achieve the same backing. Consulting projections on gold’s logarithmic chart, he says, “the first stop of $10,000 is actually not that far away.”

Gold and 10-year Treasury yield minus CPI

(Log scale)

Chart courtesy of Myrmikan Research

________________________________________________________________________

Do precious metals look undervalued to you?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Older investors buying gold and silver remember the 1970s

‘The emotional scars of inflation will shake the foundations of western societies.’

Diane Coyle, Cambridge University

“Until this year, inflation in advanced economies,” writes Diane Coyle in a MarketWatch article titled The Emotional Scars of Inflation Will Shake the Foundations of Western Societies, “like the United States and the United Kingdom had been so low for so long that one needed to be well into middle age to remember what living through the price surges of the late 1970s was like. It was bad.… But the headline numbers do not reveal the toll that high inflation takes.” Market analysts tend to crunch the numbers without giving much thought to the net effect of economic maladjustment – like inflation – on daily life and the culture in which it occurs. Coyle, who is a professor of public policy at Cambridge University, makes reference to the 1970s and the German nightmare inflation of the 1920s, which continues, she says, to have “an impact on economic policy-making to this day.” Too, we would attribute a large proportion of the robust demand for gold and silver coins over the past year to older investors who remember the debilitating effects of the 1970s stagflation – and how well investors did who purchased those items in the early part of the decade.

_________________________________________________________________

Do you remember the 1970s?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

China’s monetary tradition and the origins of money

“The first step in theorizing correctly about money,” writes Mises Institute‘s Joseph T. Salerno, “is to understand that the value of money, like that of commodities, is never fixed and unchanging. Chinese philosophers who published the earlier Mohist Canons (468 B.C.~376 B.C.) grasped this crucial point. They recognized that metallic money, such as the ‘knife coins’ (pictured above) then in wide circulation, was valued and exchanged by weight and argued that the real value of money, despite its fixed face value, was not stable but fluctuated inversely with the prices of commodities. When commodity prices were high, money was ‘light’ or its purchasing power low; when prices were low, money was ‘heavy’ or its purchasing power high. Thus, if monetary conditions were such that the nominal prices of commodities were abnormally high, the real prices of commodities were not high, but rather money was ‘light’ or depreciated.”

According to Salerno, much of what we understand about sound money was first explored in ancient China, where metallic coinage was first introduced in the 12th century BC or earlier. Salerno’s article serves as an interesting introduction to Chinese monetary theory and philosophy. We recall that China was also the first country to experiment with paper money as an alternative to coins made from precious metals. As might be expected, those experiments led to several instances of runaway inflation.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? . . . To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of the world will come around to the gold-friendly view that central bankers have lost their marbles. We have no such timetable. The road to confetti is long and winding.” – James Grant, Grant’s Interest Rate Observer

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking to add some weight to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Gold in the age of high-speed electronic trading

“The best thing you can do is know how to have a balanced portfolio.”

Ray Dalio, Bridgewater Associates

In an article headlined Robots conquered stock markets/Now they’re coming for bonds and currencies, Bloomberg finance reporter Lananh Nguyen tells us: “In the most liquid equity markets, more than 90 percent of trades are executed electronically, according to estimates from Greenwich Associates. That compares with 79 percent in global foreign exchange, 44 percent in U.S. Treasuries and 26 percent in U.S. corporate bonds, with the most room for growth in the latter two markets, according to [Kevin] McPartland at Greenwich.” [Link] Just this year, Morgan Stanley and Goldman Sachs requested counterparties forgive rogue, machine-driven trades that caused a $41 billion flash crash in a matter of seconds. Though concentrated in a single stock, such anomalous events serve as a cautionary tale on how a full-out, machine-driven panic might evolve on a larger scale.

Because gold does not rely on the performance of another party, it is detached from the matrix of interlocking counter-party risk and occupies a unique place on the financial balance sheet as an asset of last resort and the final arbiter of value. That is why nation-states and central banks hold large amounts of it on their own balance sheets and why funds and institutions are more and more moving to it as an offset against other trading strategies. Investors have always viewed gold as a reliable hedge against inflation and deflation. In the years to come, they might very well come to know it as an effective hedge against computer-generated financial mayhem as well.

____________________________________________________________________

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Palantir buys $50.7 million in gold bars

Firm offering ‘insights’ to the intelligence community hedging black swan events

The prospect of sleeping better at night played largely in Palantir Technologies’ $50.7 million purchase of gold last month – 28,000 troy ounces in 100-ounce bars. In a move that surprised Wall Street, the Denver-based firm founded by Peter Thiel and Alex Karp said it purchased the gold as a hedge against “a future with more black swan events.” It is interesting to note in the context of black swan events that among Palantir’s many data-based products, it offers the AI-ready Gotham operating system – a program, according to its website, that surfaces “insights from complex data for global defense agencies, the intelligence community, disaster relief organizations, and beyond.”

“Risk,” says US Global Investors’ Frank Holmes in a piece posted at Seeking Alpha, “is precisely the reason why Palantir Technologies decided to make an investment in gold. … [N]amed for the all-seeing crystal balls in Lord of the Rings – [Palantir] is also allowing customers to pay for its software in gold.” Holmes also cites a National Inflation Association subscriber note that the company’s decision “is only the beginning of what will soon be many major corporations diversifying their U.S. dollar cash into gold.”

In a detailed article posted at ETF Trends on the Palantir acquisition, Jared Dillian recommends a way of viewing gold we have advocated since the publication of the first edition of The ABCs of Gold Investing in 1996. “As gold investors (I hold a bunch),” he suggests, “maybe we should stop thinking about gold as a trade or an investment and start thinking about it as an insurance policy.”

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Feel a need to hedge the black swan event?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

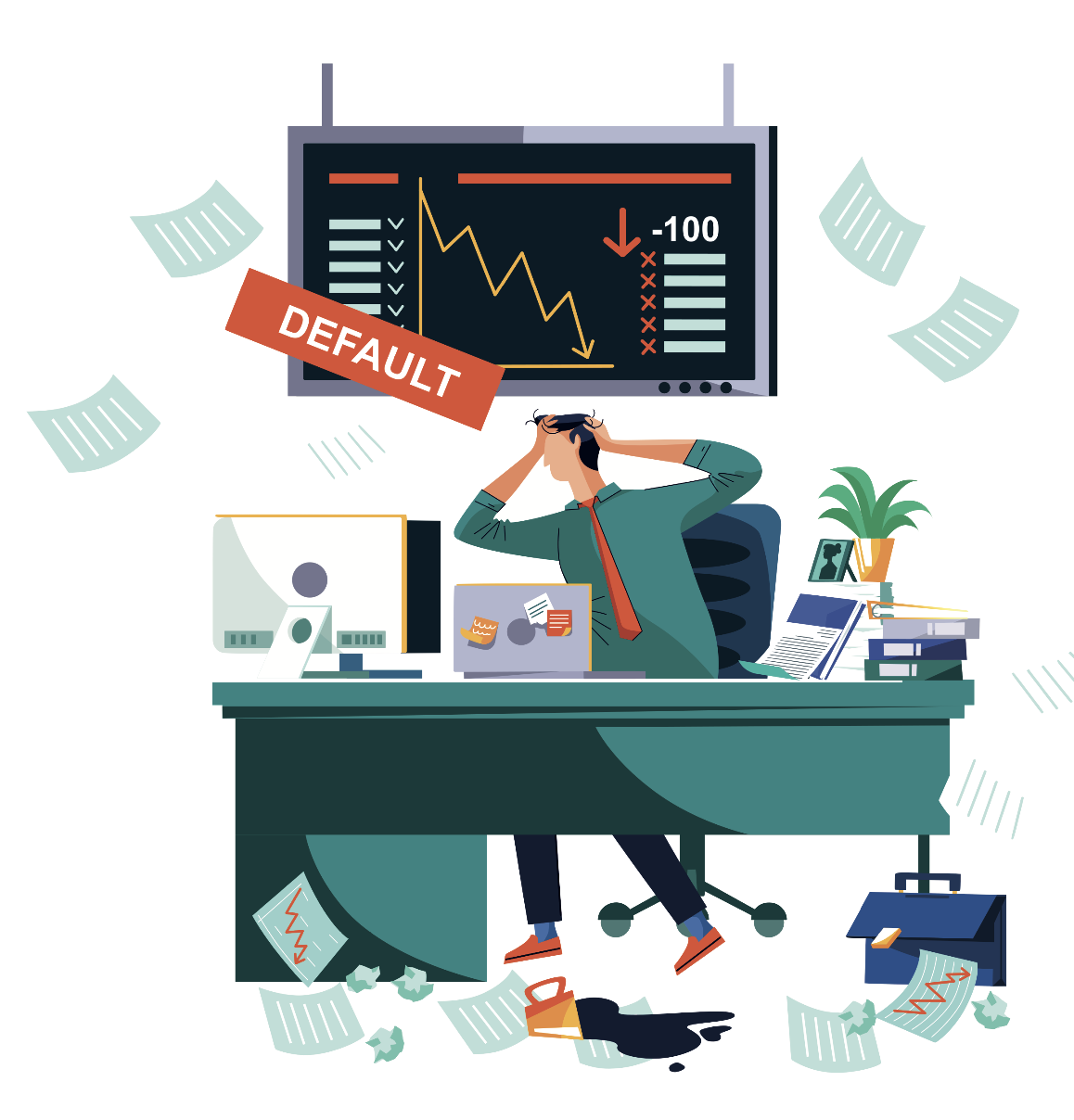

Blowing up the “Everything Bubble”

“What the average person fails to understand,” writes Lance Roberts in an analysis posted at the Real Investment Advice website, “is that the next ‘financial crisis’ will not just be a stock market crash, a housing bust, or a collapse in bond prices. It could be the simultaneous implosion of all three. Whatever causes that change in sentiment is unknown to me or anyone else. I am not saying with certainty it will happen, as I hope sanity prevails and actions are taken to mitigate the consequences. Unfortunately, history suggests such is unlikely to be the case.” And, we might add, it is not likely the damage will be restricted to the United States In fact, an implosion in one location could cause corresponding meltdowns in multiple locations. Easy money and heavy leverage have greatly influenced price levels in all markets heightening rollover risks. And then there’s the derivative problem with notional exposure estimated at more than $1 quadrillion, according to Investopedia.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you ready for the ultimate derivatives moment?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

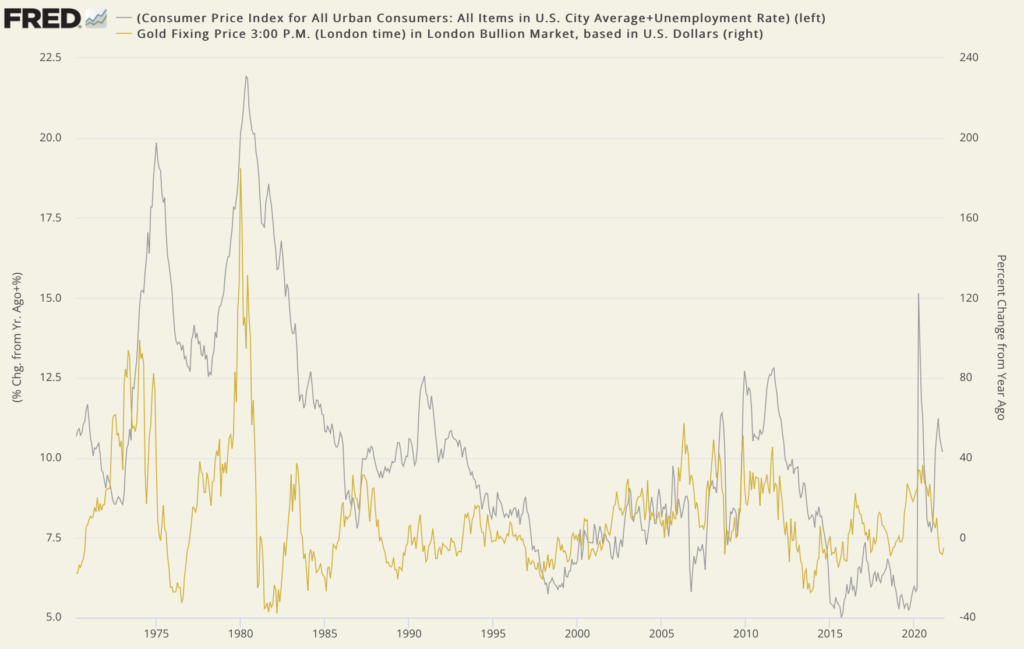

Gold and the Misery Index

Stagflation could force ‘a macro rotation into the precious sector’

Since the launch of the fiat money era in the early 1970s, when economies have gone very wrong, the unemployment and inflation rates have skyrocketed. On the campaign trail in the late 1970s, then-presidential candidate Ronald Reagan added the two numbers together and famously named the result the Misery Index. Subsequently, the Misery Index became the bellwether for stagflation – the combination of economic stagnation and runaway inflation.

With stagflation rising once again to the top of investor concerns, the Misery Index has made something of a comeback. Accordingly, we thought it would be a matter of interest to build a chart showing changes in the index plotted against changes in the price of gold. Though we had an inkling of the result, the uncanny long-term correlation between the two data sets took us by surprise. At a glance, the chart tells the story of gold as a runaway stagflation hedge. Gold also closely tracked the index more recently during the 2008 credit crisis and the 2020 pandemic-driven breakdown. Curiously, though, it has lagged the surge in the Misery Index over the past year and a half. This divergence probably has to do with Wall Street until recently largely buying into the Fed’s contention that inflation is transitory.

With the word “transitory” now officially banned from the Fed lexicon, the financial world is suddenly forced to consider the dual nature of stagflation and adjust investment portfolios accordingly. MKS Switzerland’s Nicki Shiels recently advised that a “stagflation would force a macro rotation out of typical reflation assets or commodities like oil and copper, and into the precious sector.”

“There’s going to be a realization in early 2022,” says Weiss Ratings’ Mike Larson in a report posted at Finbold, “that the Fed is not going to be able to be aggressive. People need to realize that this Fed is very tentative. It’s a Fed that has a lot of political pressure to favor the employment side of its mandate over inflation. … I don’t think it’s going to be a runaway where you’re talking about $4,000 gold, but you know, $2,200, $2,300 or $2,400, somewhere in that range, I think in sort of a corresponding moving silver, I think it is likely on the table. And again, it’s going to come from the release of that Fed fear, pressure valve, whatever that’s been keeping people from, getting involved.”

Misery Index and Gold

(% change, year over year, 1971- to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration

Click to enlarge

(For a real-time version of the Misery Index-Gold chart, please visit USAGOLD’s Gold Trends and Indicators.)

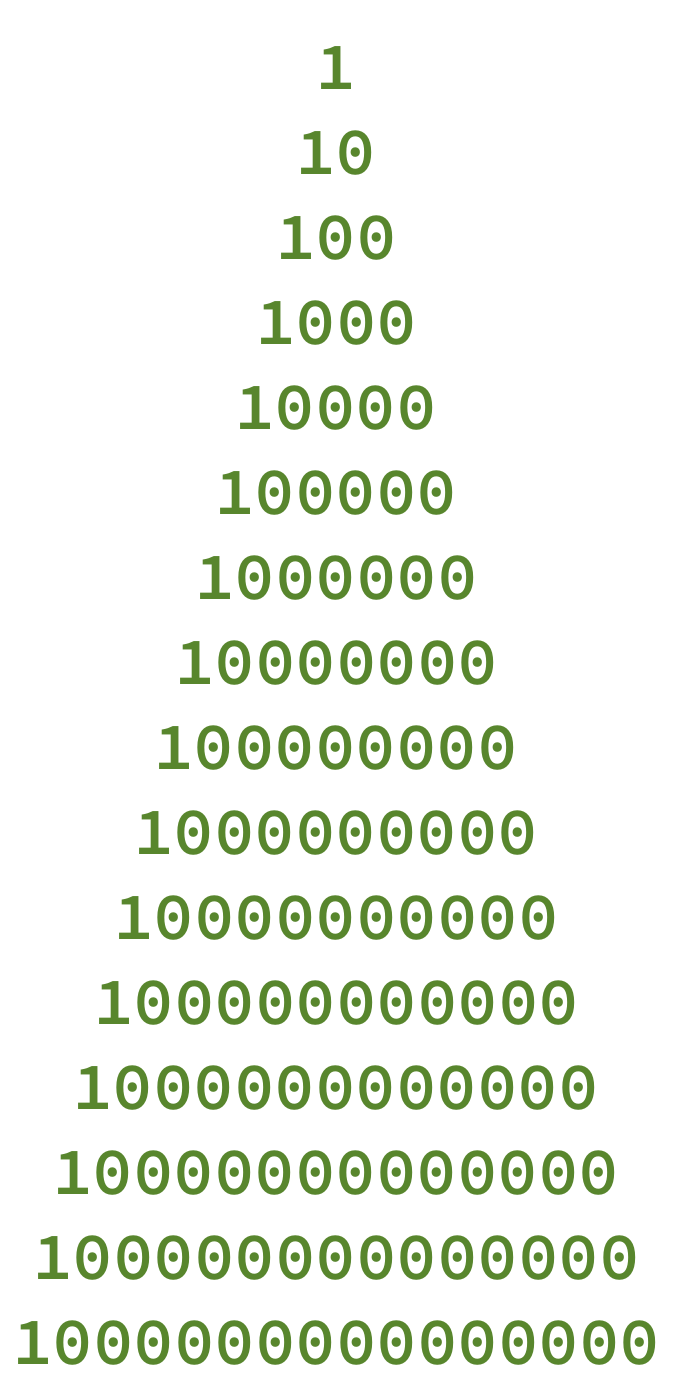

Short and Sweet

Thinking in big numbers

“[T]hink of it [big numbers],” she says, “in terms of time, like Richard Panek, a professor at Goddard College in Vermont and a Guggenheim fellow in science writing. There are 1 million seconds in roughly 11½ days. There are 1 billion seconds in around 31 years. And there are 1 trillion seconds in around 31,000 years.”

Do you find the Biden administration’s approach to big numbers a bit unnerving?

Short and Sweet

The core problem is the debasement of the currency

“The strategies, in which portfolios hold 60% stocks and 40% bonds, have produced just two down years since 2007,” writes Bloomberg’s Michael Mackenzie and Liz McCormick. “… But it posted losses in September and November and is down 0.4% so far in December, just as the Federal Reserve started signaling a hawkish shift.” The bottom line is that both sectors – stocks and bonds – are overvalued, as we are constantly warned in financial reports these days. One analyst said: “In this environment, we think 60/40 is pretty dangerous.” Inflation undermines the value of the very currency in which those assets are denominated. So the problem at its core is the debasement of the currency.

Switzerland-based analyst Claudio Grass, who receives considerable attention among market watchers for his insights on monetary policy, holds what many would consider a controversial view on the Fed’s tapering program. He believes that “most investors can see through the political narrative and the ‘packaging’ of the central bank’s decisions. They realize they can depend on continued support and that there’s no reason to fear that the monetary expansionism of the last decade will be reversed anytime soon. And they are justified in their assumptions.”

“Of course,” he concludes in a short analysis posted at the Gavekal website, “as might have been expected from the track record of central planners this ‘strategy’ is extremely short-sighted. Keeping the money faucets open and persisting in maintaining an environment of extremely low rates is only postponing the inevitable. As conservative, rational investors and precious metals owners clearly understand and have seen coming for a very long time, this myopic approach might put off a recession over the next weeks or months, but it is has created much larger, deeper, systemic risks, ranging all the way from an inflationary crisis to the potential for actual currency collapse.”

Thinking that the 60/40 portfolio has seen better days?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

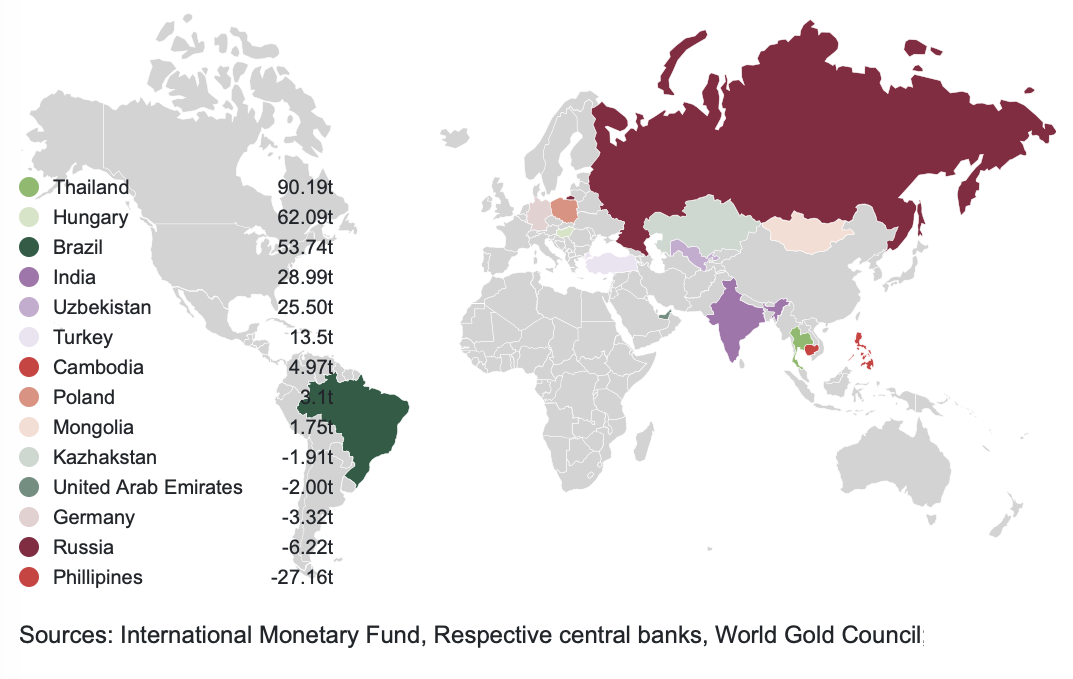

Short and Sweet

Central banks are buying the dips in gold prices

Map courtesy of the World Gold Council

A Bloomberg report last summer on burgeoning official sector gold demand received scant attention among gold analysts. What makes it a matter of better than casual interest, though, is that the central banks appear to be buying the dip in prices this year – a preference that, if it continues, could carry longer-term implications for gold market fundamentals. Most notably, Brazil – the world’s ninth-largest economy – announced purchasing a hefty 41.8 tonnes of the metal in recent years. Similarly, Poland has made plans to add 100-tonnes of gold to its coffers “over the course of a few years.”

Credit Suisse’s global equity analyst Andrew Garthwaite takes note of the trend in a recent report reviewed at ZeroHedge and offers a glimpse of the rationale behind the purchases. “Gold is a hedge against extreme financial deleveraging,” he says. “The level of government debt, deficit, and corporate debt is extreme. We continue to believe that if the TIPS yield gets much above zero, that would start to cause the markets to worry about a debt trap and that in turn could lead to a major risk-off trade. This could then prompt a Fed response driving down real yields (and debasing money).… We think this will also cause central banks to buy more gold (as currencies are being debased). Central banks account for 12% of gold demand. If all central banks had a minimum of 10% in gold, then gold demand would increase 1.6x, on our calculations.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Time to buy the dip?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

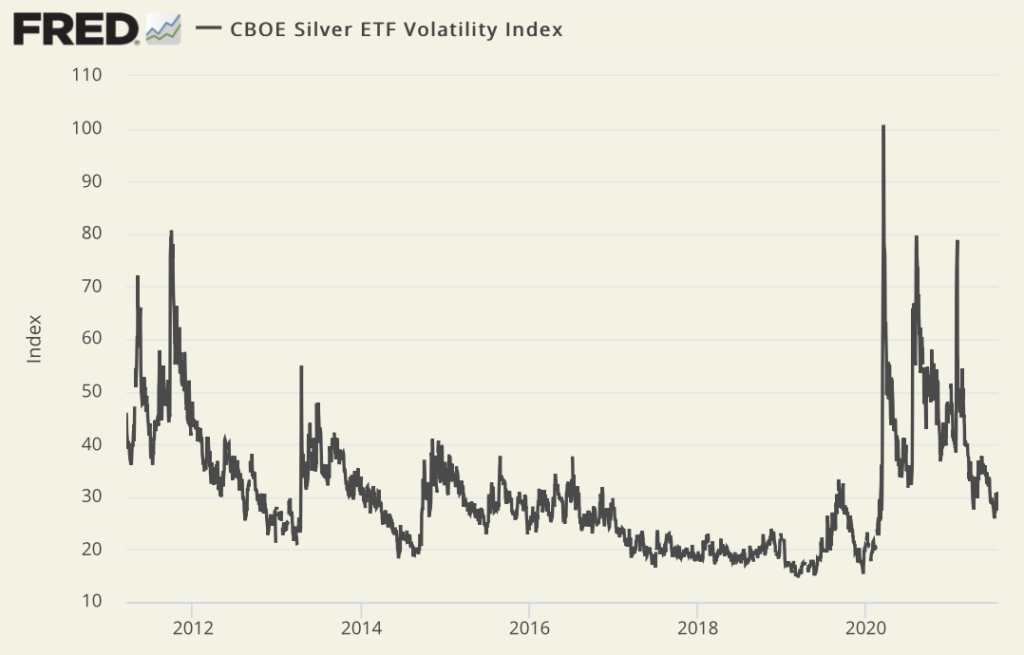

Short and Sweet

Silver could be setting up for a repeat of 2020’s explosive rally

Silver’s performance over the past month offers a reminder of the metal’s volatility. Commodity analyst Andrew Hecht, whose experience in the silver market stretches back to the 1970s as a trader with Salomon Brothers, is well aware of the metal’s long history of radical ups and downs. “Silver volatility,” he writes in a recent Seeking Alpha article, “can be explosive. Meanwhile, the price action can also be coma-like, lulling market participants into a false sense of security for long periods. Silver’s history is full of false technical breakouts and breakdowns…Silver is a unique metal as it is part industrial, part investment asset. It experiences long periods of coma-like price action. Still, when it moves, as the price did not 2020, few commodities compare to the precious metal when it comes to percentage moves.” Hecht reminds readers of silver’s performance in 2020 when “bearish price action gave way to an explosive rally.” (Silver went from the $12 level in March to $29 by early August.) He goes on to say that “[t]he recent price dynamics could be setting up for a repeat performance given the rising level of inflation across all markets.”

Silver Volatility Index

Sources: St. Louis Federal Reserve [FRED], Chicago Board Options Exchange

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to add a little white metal to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

1:41 pm Thu. April 25, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115