Back to our Introductory Information Packet

BlackSwansYellowGold

How gold performs during periods of deflation, disinflation, stagflation and hyperinflation

_____________________________________________________________________

Gold as a stagflation hedge

United States (the 1970s)

“The inability to predict outliers implies the inability to predict the course of history. … But we act as though we are able to predict historical events, or, even worse, as if we are able to change the course of history. We produce thirty-year projections of social security deficits and oil prices without realizing that we cannot even predict these for next summer — our cumulative prediction errors for political and economic events are so monstrous that every time I look at the empirical record I have to pinch myself to verify that I am not dreaming. What is surprising is not the magnitude of our forecast errors, but our absence of awareness of it.” –– Nicholas Taleb, The Black Swan – The Impact of the Highly Improbable

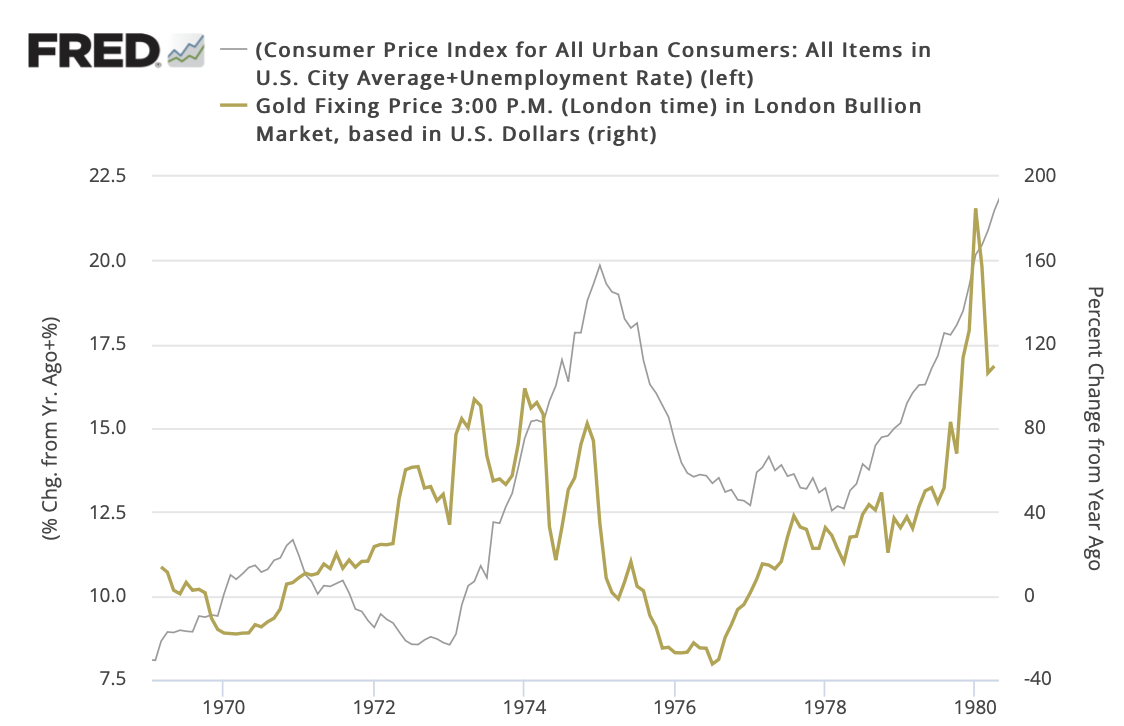

In the modern global fiat money system, when the economy goes into a major tailspin, both the unemployment and inflation rates tend to move higher in tandem. The word “stagflation” is a combination of the words “stagnation” and “inflation.” President Ronald Reagan famously added unemployment and inflation together in describing the economy of the 1970s and called it the Misery Index. As the Misery Index moved higher throughout the decade, so did the price of gold, as shown in the graph below.

In a recent interview, former Fed chairman Alan Greenspan warned that stagflation looms on the horizon for the United States:

“I would say we are in a bond market bubble and a bond market bubble really means is that prices are too high and when they move down long term interest rates move up. And if you take a look at the structure of not ‘price-earnings ratios’ but ‘earnings-price ratios’ in the stock market, you find that the critical issue of what engendered some of the strength in recent periods is essentially the decline in real long-term interest rates as it factored into the market. That is in the process of changing, and I think that the bond market bubble is now beginning to unwind and that is going to bring us ultimately into a state of stagflation and beyond that, it is very difficult to tell. This is not an easy economic outlook because there are too many variables which we haven’t seen in recent decades.”

At a glance, the chart tells the story of gold as a runaway stagflation hedge. The Misery Index more than tripled in that ten-year period, but gold rose by nearly sixteen times. There were instances during the period when the year-over-year increases in the price of gold surpassed 80%, and in early 1980 it surpassed 175%! Much of that rise has been attributed to pent-up pressure resulting from many years of price suppression during the gold standard years when the price of gold was fixed by government mandate. However, even after accounting for the fixed price, it would be difficult to argue that gold did not respond readily and directly to the Misery Index during the stagflationary 1970s.

Chart courtesy of St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration • • • Click to enlarge

In a certain sense, the U. S. experience in the 1970s was the first of the runaway stagflationary breakdowns following the abandonment of the gold standard in 1971. Since then, similar situations have cropped up from time to time in other nation-states. Argentina (the late 1990s) comes to mind, as does the Asian Contagion (1997), Mexico (1986), and most recently, Venezuela. In each instance, as the Misery Index rose, the citizen/investor who took shelter in gold preserved his or her assets as the crisis moved from one stage of deterioration to the next.

–– Michael J. Kosares

BlackSwansYellowGold Series

Gold as a deflation hedge

Gold as a disinflation hedge

Gold as a stagflation hedge

Gold as hyperinflation hedge

Gold as the portfolio choice for all seasons

A chronology of panics, mania, crashes and collapses

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

1-800-869-5115

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.