Author Archives: News

China’s gold binge extends to seventh month as holdings climb

Bloomberg/Sybilla Gross/6-7-2023

“China increased its gold reserves for a seventh straight month, signaling ongoing strong demand for the precious metal from the world’s central banks. China raised its gold holdings by about 16 tons in May, according to data from the People’s Bank of China…”

USAGOLD note: China has led the global central bank gold buying spree. Central bank gold buying was at a record pace in 2023 and it has remained strong in 2023. The chart below is quarterly and does not include China’s most recent purchases which have taken its total holdings to 2092 metric tonnes.

China Gold Reserves

Source: TradingEconomics.com

Wall Street economists are increasingly less worried about a 2023 recession

Yahoo!Finance/Josh Shafer/6-9-2023

USAGOLD note: There are few signs of a recession at this juncture – a hint here or there – but nothing concrete or lasting. Nevertheless, the warnings come almost daily.

Gundlach dials up his warning of a US recession

MarketInsider/Zahra Tayeb/6-7-2023

USAGOLD note: Gundlach is not moving off his warning of a severe recession. With new economic vulnerabilities surfacing regularly – anyone one of which could evolve to a full-out crisis in the event of a recession – sage-haven demand for gold is likely to intensify beyond the already high levels.

Treasury’s $1 trillion debt deluge threatens market calm

Bloomberg/Eric Wallerstein/6-7-2023

“Investors are bracing for a flood of more than $1 trillion of Treasury bills in the wake of the debt-ceiling fight, potentially sparking a new bout of volatility in financial markets.”

USAGOLD note: Until we get to the other side of the deep dark wood, we will put emphasis on the coming Treasury bond deluge.

US Treasury’s $1 trillion borrowing drive set to put banks under strain

Financial Times/Kate Duguid/6-6-2023

USAGOLD note: Erosion in the value of bond portfolios was the key catalyst in the collapse of SVB, First Republic, Signature Bank, and most notably Credit Suisse.

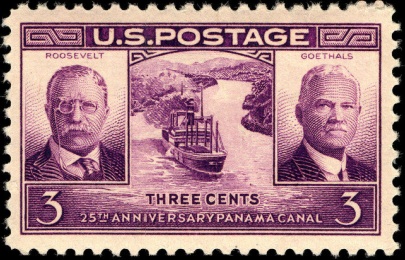

The Fed’s inflation fight faces a new challenge: A dry Panama Canal

Bloomberg/Laura Curtis, Ruth Liao and Michael McDonald/6-2-2023

USAGOLD note: One of those unforeseen circumstances that can wreak havoc with central banks’ monetary policy……The shift to El Nino weather patterns translates to severe drought in Panama – perhaps for months to come.

Fed chair spoke with UBS CEO amid banking crisis

“Powell’s calendar shows the abruptness with which the banking sector problems — which have since triggered three U.S. bank failures in addition to the UBS-Credit Suisse deal — erupted nearly three months ago.”

USAGOLD note: Investors worry about a black swan event, but what we have had thus far is a cluster of gray swans – abrupt but predictable mini-crises instigated primarily by highly publicized but poorly understood central bank policies. Nevertheless, collectively they have taken their toll and uncovered vulnerabilities that may yet instigate the next black swan. Mark Spitznagel, who with Nicholas Taleb (originator of the term “black swans.”) conducts business as Universa Investments, says that decades of easy money is leading to a “mega-tinderbox time bomb” in the financial system. “He just doesn’t know when the bomb will go off, ” according to a Wall Street Journal article published last weekend.

Trillion-dollar vacuum is coming for Wall Street rally

Yahoo!Finance-Bloomberg/Denitsa Tsekova and Ksenia Galoucho/6-3-2023

USAGOLD note: “As the tsunami approaches,” says Britain’s National Oceanography Centre, “water is drawn back from the beach to effectively help feed the wave.… A tsunami is short enough to have a rapid effect, in minutes, but long enough to carry enormous energy.”

Backlash against weaponized dollar is growing across the world

Bloomberg/Michelle Jamrisko and Ruth Carson/6-2-2023

USAGOLD note: We note with interest how quickly de-dollarization went from minor to major issue…… The rapid embrace of alternatives suggests a long-suppressed concern about the role the dollar plays in a nation-state’s economic independence.

Why Yellen doesn’t lose sleep over US borrowing

Yahoo!Finance-Bloomberg/Christopher Condon/5-31-2023

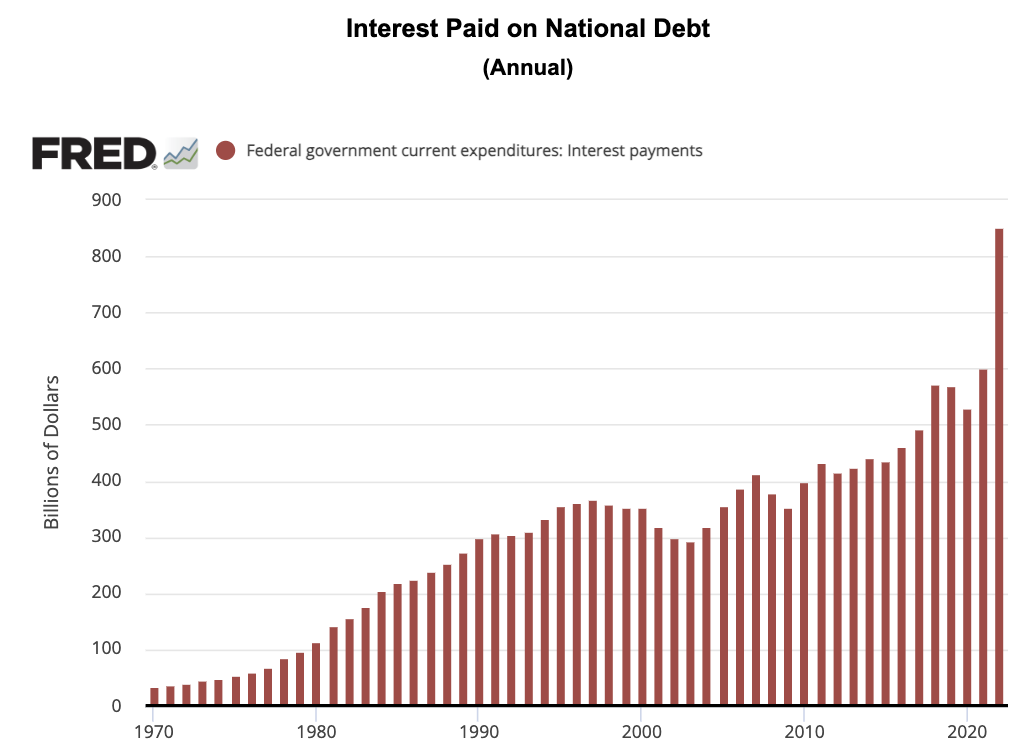

“One reason she’s sanguine is that Yellen is among a number of prominent economists to embrace an alternative method for measuring the sustainability of the nation’s debt. Instead of looking at the pile of outstanding bonds as a share of the economy’s output, she prefers the ratio of interest payments — crucially, after adjustment for inflation — to GDP.”

USAGOLD note: It is beyond our understanding how a Treasury Secretary could look at the level of the federal government’s interest payments without being alarmed. It’s because insiders like Yellen do not lose sleep over the national debt, that so many others do.

Sources: St. Louis Federal Reserve [FRED], Office of Management and Budget

The end of King Dollar? The forces at play in de-dollarisation

Yahoo!Finance-Reuters/Naomi Rovnick and Libby George/5-25-2023

USAGOLD note: Though the dollar is likely to remain the currency of choice in international transactions, its status as a reserve holding is in decline. Gold could be among the long-term beneficiaries if the trend continues. In fact, central bank gold demand set a record in 2022 and continues at a record pace in 2023. Reuters says “mushrooming alternatives could create a multipolar world.”

IMF says U.S. should tighten fiscal policy to help cut persistent inflation

Yahoo!Finance-Reuters/David Lawder/5-26-2023

USAGOLD note: Isn’t this the kind of advice IMF usually offers to countries like Argentina and Turkey? Needless to say, even if the politicians agree on a debt ceiling the spending will continue at a high level.

In Gold We Trust 2023

Incrementum/Ronald-Peter Stoferle and Mark J. Valek/May, 2023

“The full year 2022 was clearly positive for gold in all currencies, with the one exception of the US dollar. Gold in US dollars suffered from the marked appreciation of the dollar. On average, the price gain in other currencies was 7.2%. In the (former) safe-haven currency, the Japanese yen, the gold price rose by 13.7%. In euro terms, it was up 6%, for the 5th annual gain in a row, which ruthlessly reveals the glaring weakness of the European single currency. In the current year, 2023, gold is clearly in the plus in all listed currencies, on average by 8.7%.”

A debt-ceiling deal will spark a new worry: Who will buy the deluge of Treasury bills?

MarketWatch/Joy Wiltermuth/5-24-2023

USAGOLD note: If it’s not one thing, it’s another. This situation could seriously impact rates if sufficient demand doesn’t materialize. Then again, there is always the printing press if things get out of hand.

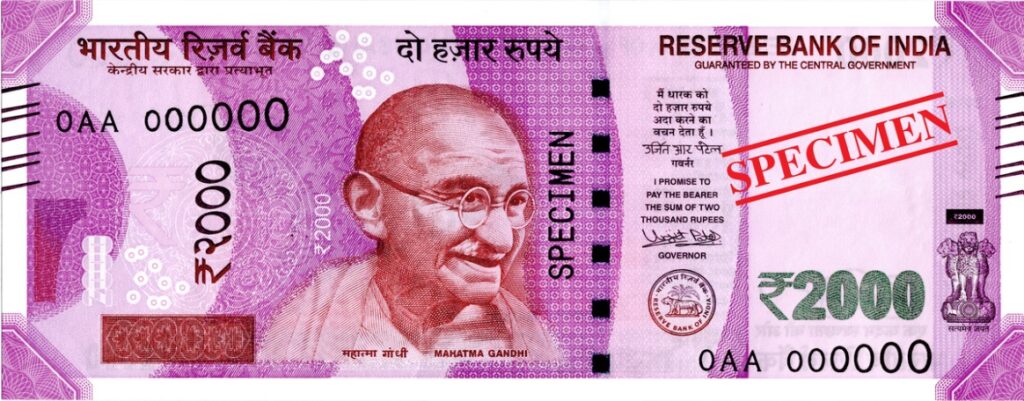

2000 rupee note withdrawal spurs purchase of gold and silver

HIndustanTimes/Staff/5-22-2023

USAGOLD note: In a separate article, Bloomberg mentioned that the 2000 rupee note withdrawal was “reminiscent of a shock demonetization exercise in 2016.”

__________________________________

Image attribution: Reserve Bank of India, GODL-India <https://data.gov.in/sites/default/files/Gazette_Notification_OGDL.pdf>, via Wikimedia Commons

The US Treasury may have to break the law to keep the world’s richest nation from default

Yahoo!Finance/Nate DeiCamillo/ 5-23-2023

USAGOLD note: A bizarre twist to the already bizarre debt ceiling soap opera ……

Fed rate path hinges on trade off between stable banks or prices

Bloomberg/Craig Torres/5-23-2023

“Federal Reserve policymakers are increasingly grappling with a critical question: How much should they weigh the adverse impact of their interest-rate hikes on banks against the goal of containing the fastest price increases in decades?”

USAGOLD note: Stark choice…… And, in our view, it’s not just the banks that the Fed needs to be worried about.

Why are central bank forecasts so wrong?

Financial Times/Chris Giles/5-18-2023

“The Bank of England is holding a ‘Festival of Mistakes’ this week, celebrating lessons learnt from financial disasters of the distant past. Some would argue that they, and their counterparts at other central banks, should focus on more recent errors.”

USAGOLD note: If their forecasts are wrong, can policy be far behind? James Grant recently called the Fed problem #1 in American finance, and Elon Musk slammed the Fed for being slow to raise rates and thinks it will now be too slow to lower them.

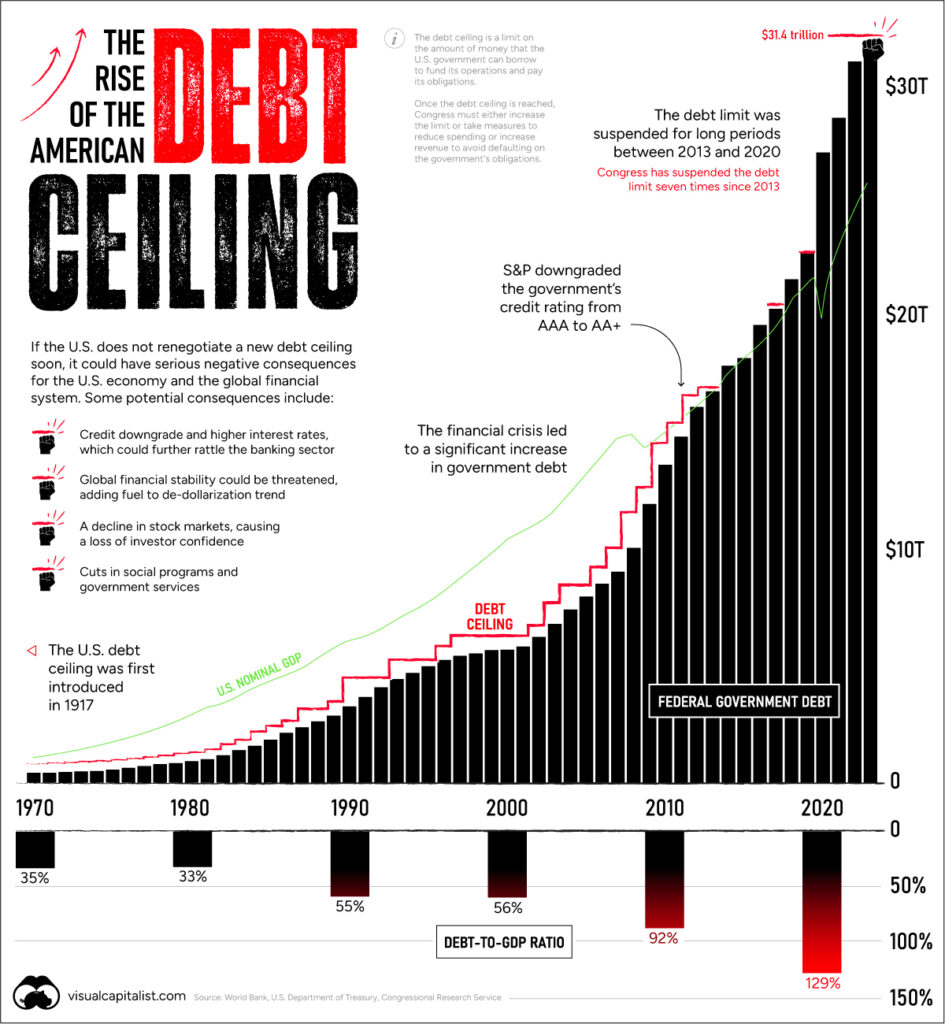

Charting the rise of America’s debt ceiling

USAGOLD note: For those curious about the history of the debt ceiling ………

The Visual Capitalist/Dorothy Neufeld and Nick Routley/5-17-2023

‘Raising the debt ceiling is nothing new. Since 1960, it’s been raised 78 times. In the 2023 version of the debate, Republican House Majority Leader Kevin McCarthy is asking for cuts in government spending. However, President Joe Biden argues that the debt ceiling should be increased without any strings attached. Adding to this, the sharp uptick in interest rates have been a clear reminder that rising debt levels can be precarious. Consider that historically, interest payments on the U.S. debt have been equal to about half the cost of defense. More recently, however, the cost of servicing the debt has risen, and is now almost on par with the defense budget as a whole.”

Investors most pessimistic so far this year, BofA survey shows

Bloomberg/Ksenia Galouchko/5-16-2023

“The mood among global fund managers soured further in May, with investors flocking to cash amid concerns that a recession and credit crunch are looming, according to Bank of America Corp.’s latest survey.”

USAGOLD note: Given the run of today’s posts, the pessimism is justified. The demand for gold worldwide is a further indication of the concern reflected in the BofA survey.