Monthly Archives: June 2023

Distressed US commercial property assets rise to $64 billion

Bloomberg/John Gittelsohn/6-22-2023

USAGOLD note: Another $155 billion in commercial real estate is potentially troubled. This is one of several grey swans circling the pond.

Middle East oil prices soar amid Chinese trading frenzy

Yahoo!Finance/OilPrice.com/6-23-2023

“At a time when global recession concerns have depressed global oil prices to pre-Ukraine war levels, prices of Middle Eastern oil have skyrocketed on soaring demand from Asian refiners in China to Japan as the market takes stock of heavy trading by the industry’s biggest names this month.”

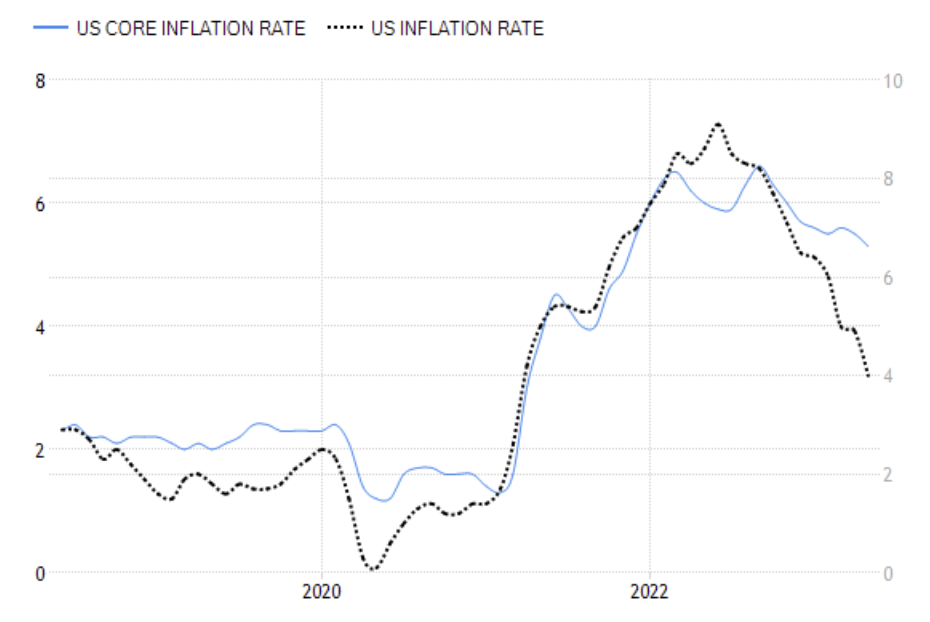

USAGOLD note: Depressed energy prices have been the key factor in keeping the headline inflation rate in check. With core inflation still running high at 5.3%, the Fed will be watching closely to see if this trend has staying power.

Chart courtesy of TradingEconomics.com • • • Click to enlarge

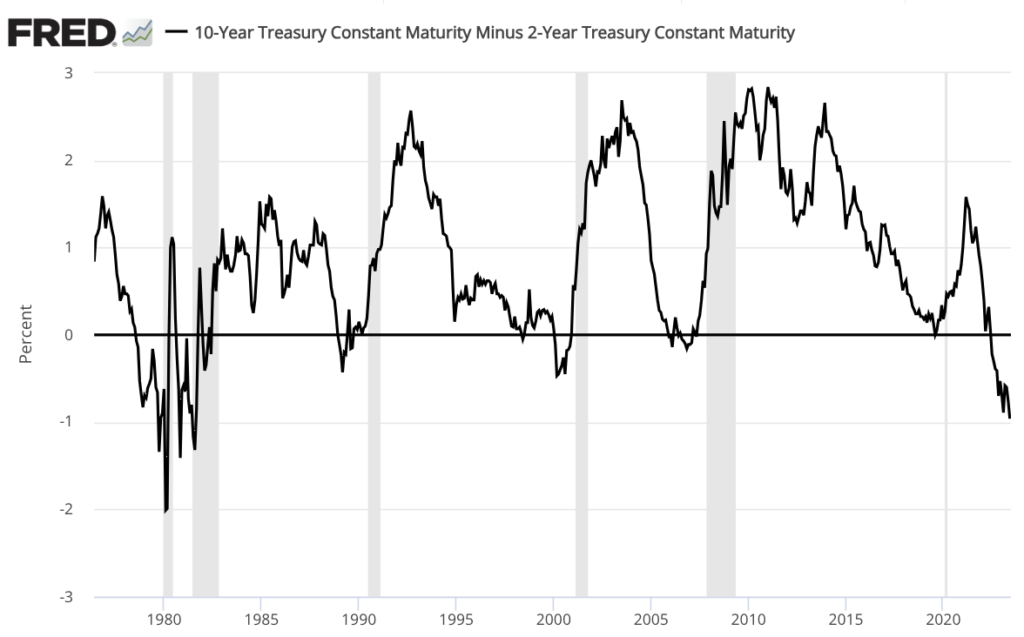

Treasury investors bet on US falling into recession

Financial Times/Kate Duguid/6-21-2023

“This situation, known as an inverted yield curve — most commonly measured as the difference between two- and 10-year Treasury yields — has preceded every recession in the past five decades.”

USAGOLD note: This is another of the warning signs individual investors are ignoring and perhaps the most telling.

Short and Sweet

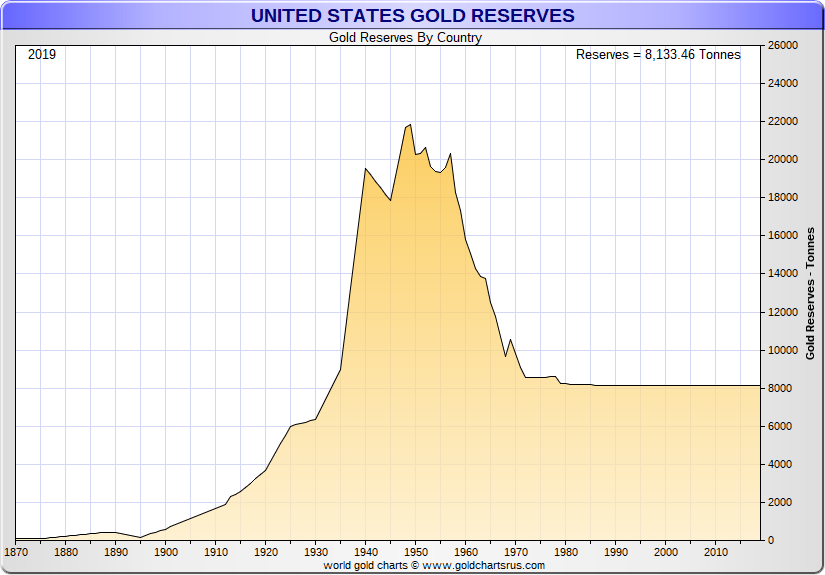

When the United States owned most of the gold on Earth

Chart courtesy of GoldChartsRUs

Few Americans know that the United States owned most of the official sector gold bullion on Earth just after World War II – about 22,000 metric tonnes or 80% of the world total. As part of the 1944 Bretton Woods Agreement, though, the United States allowed unrestricted redemptions from its reserves at the benchmark rate of $35 per ounce. Then, in the 1960s, a group of European countries, led by Germany and France, got the idea that U.S. trade and fiscal deficits had undermined the dollar, making gold a bargain at the $35 benchmark price. Steadily over the next decade, they exchanged dollars for gold at the U.S. Treasury’s gold window. By the early 1970s, 14,000 tonnes of gold – or 64% of the stockpile – had departed the U.S. Treasury never to return (See the chart above).

The transfer of gold finally ended in 1971 when President Nixon halted redemptions, devalued the dollar, and freed the greenback to float against other currencies. The era of global fiat money with the dollar as its centerpiece had begun. Gold transformed from its official role as backing the dollar to serving as a hedge against its depreciation. Since that role reversal, gold has risen in fits and starts from the $35 official benchmark in 1971 to a peak of over $1900 in 2011. It is trading now in the $1700-1800 range. For the central banks and private investors who redeemed their dollars for gold at $35 per ounce, the gains have been extraordinary – over 5000% at current prices or 8.2% annually compounded over the 49-year period. Simultaneously, the 1971 dollar has lost more than 84% of its purchasing power.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to protect the value of your savings over the long run?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

JPMorgan’s Kolanovic sees US stocks struggling without Fed cut

Bloomberg/Alexandra Semenova/6-22-2023

“[Kolanovic] cautioned that multiple expansion and eroding pricing power make the risk-reward for US equities unattractive, adding another area of concern is ‘increasing investor complacency’ ahead of a potential recession. ‘In short, the risk of another unknown unknown resurfacing appears high,’ he said.”

USAGOLD note: It is difficult to know with any degree of certainty which side is right in the debate on future stock market values. A judicious hedge lifts the ordinary investor above the fray……… The best approach, in our view, remains to hope for the best but plan for the worst.

Daily Gold Market Report

Gold marginally lower as we close first half and head into the long holiday break

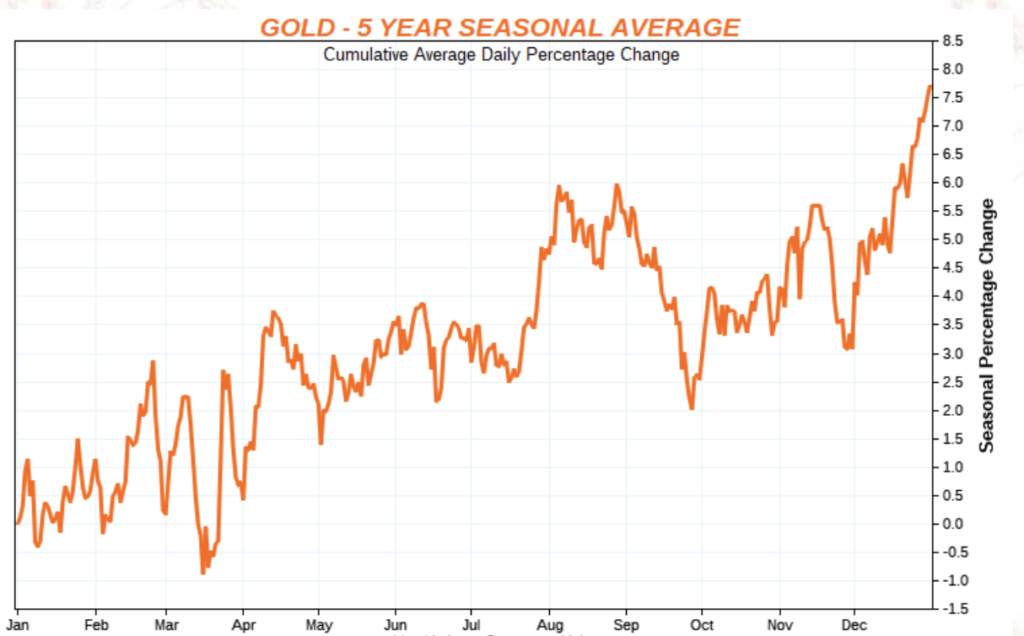

Lundin says we are fully into the seasonal doldrum of the metals

(USAGOLD 6/30/2023) – Gold is marginally lower as we head into a long holiday break. It is down $3 at $1907. Silver is up 17¢ at $22.48. The first half of the year has been a hard grind for gold, but it still managed to post a respectable 5.7% gain. Silver, always the more volatile of the two headline precious metals, was down 5.7%. Gold Newsletter’s Brien Lundin says, “we are fully into the seasonal doldrums for metals” with “much of the investing world on vacation or thinking about it.”

“Simply put,” he continues in an analysis released yesterday, “the only thing moving the gold market right now, or any other market for that matter, has been Fed rhetoric and actions. The expected pause in their June meeting had little lingering effect on gold, thanks to Powell and his compatriots ramping up the hawkish talk at that meeting and in the days since. In addition to that and the summer-time slowdown, we also have the deteriorating technical picture and the magnetic effect of the $1,900 price level.”

Chart courtesy of GoldChartsRUs

Investors keep bets on U.S. rates soon topping out, despite Powell’s hawkishness

Yahoo!Finance-Reuters/Davide Barbuscia/6-21-2023

USAGOLD note: Speculators are not buying Powell’s fire and brimstone……

China’s gold-buying boom is slowing sharply as economic woes hit retail demand

MarketsInsider/Filip De Mott/6-20-2023

USAGOLD note: Expanded only 24%? Given the Chinese people’s historic attachment to gold, most analysts will see the slowing demand at present as a lull in the dominant trend.

Persistent UK inflation should worry everyone

Bloomberg/Mohamed A El-Erian/6-21-2023

“There was nothing but worrisome news in Wednesday’s economic data releases for the UK. And the implications extend beyond Britain in a multifaceted way.”

Short and Sweet

Gold in the Age of Inflation

The star investment of the fifty-two year era and the most reliable store of value

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several months. The markets await more of it. Investors and consumers worry about more of it. The Fed thinks it is transitory. Others believe it will persist. That said, the current discussion ignores an established historical reality: We already live and have lived with it for a very long time. The Age of Inflation began in August of 1971 when the United States disengaged the dollar from gold and ushered in the fiat money era. Thereafter, the inflationary process has progressively eaten away at our wealth and the purchasing power of our money.

To mark the occasion of the fiat money system’s 52nd anniversary, we offer an instructive chart for those contemplating adding gold to their portfolios. It is a myth-buster showing that gold has decisively outperformed stocks during the fiat money era. Many will be surprised to learn that gold is up almost 4,800% since 1971, while stocks have played second fiddle at 3,633%. At the same time, consensus has it that cyclically, stocks are closer to a top than a bottom, and gold is closer to a bottom than a top.

Gold and stocks price performance

(In percent, 1971-2021)

Chart courtesy of TradingView.com • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Celebrate the 52nd anniversary of the fiat money system with a gold purchase.

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Daily Market Report

Gold marginally higher in lackluster summertime trading

Saxo Bank maintains a bullish outlook for the long run; sees headwinds short-term

(USAGOLD –6/29/2023) – Gold tracked marginally higher this morning in lackluster summertime trading. It is up $3 at $1913. Silver is up 17¢ at $22.93. Saxo Bank’s Ole Hansen says that though the short-term outlook for gold “remains challenged by the Fed’s prolonged battle with inflation,” it still has a bullish outlook for the longer tierm driven by a number of expectations – renewed dollar weakness, an eventual peak in interest rates, continued strong central bank demand, sticky inflation, and geopolitical tensions.

“On three earlier occasions during the past two decades,” Hansen points out in a detailed analysis released this morning, “a peak in US Fed funds rate supported a strong gold rally in the months and quarters that followed (See chart below), but with the timing of such a peak being postponed, short-term demand for ‘paper’ gold through ETFs and futures have suffered.… Total holdings in bullion-backed ETFs have seen a 42 tons reduction during the past month to 2888 tons, leaving it just 33 tons above a three-year low that was reached just before the March banking crisis triggered strong demand for havens, especially gold.”

Fed funds rate and gold price

Chart courtesy of TradingView.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“This is the cave in which inflation hides … our Fiat Lifestyle, where we simply declare into existence the manner in which we deserve to live. Declared into existence exactly like everything else in the Fiat World. Pulled into the present from our future selves and our children. Without a second thought.”

Ben Hunt

Epsilon Theory

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fed research reveals biggest culprit behind US inflation spike

Bloomberg/Ana Monteiro/6-21-2023

USAGOLD note: God forbid the culprit would be the central bank and its wayward money-printing policies. We all knew that logistics added to the problem. A recent study by the San Francisco Fed puts a number on that contribution – 60% of the price surge. One doubts the printing press was taken into account.

US core inflation is still unacceptably high for the Fed – and that means more pain for the economy, strategist Jim Bianco says

MarketsInsider/Zahra Tayeb/6-20-2023

“US core inflation is still too high for the Federal Reserve’s comfort – and that means more pain ahead for the economy as the central bank pushes ahead with monetary tightening to cool price pressures, according to Wall Street analyst Jim Bianco.”

USAGOLD note: Along with, should it unfold as Bianca is suggesting, the risk of shakier financial institutions, bankruptcies, and accompanying systemic risks.……

Short and Sweet

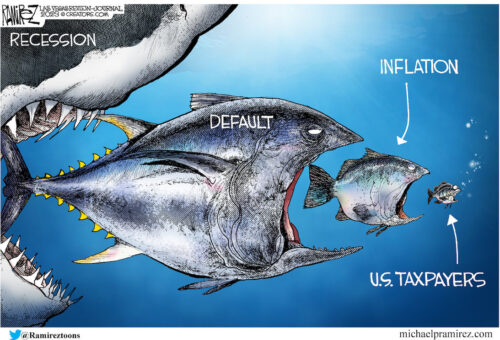

How to spot a bubble

‘Amount of leverage in U.S. equity markets now easily the highest in history.’

Cartoon courtesy of MichaelPRamirez.com

“If you want my opinion,” writes Hussman Fund’s John P. Hussman in a recent analysis, “I suspect that a near-vertical market plunge on the order of 25-35% is coming, probably quite shortly, most likely out of the blue, as in 1987, driven by nothing more than the sudden concerted effort of overextended investors to sell, and the need for a large price adjustment in order to induce scarce buyers to take the other side. As usual, no forecasts are necessary. … This dysfunctional behavior isn’t about any particular video game retailer. I suspect it’s actually about some sort of fragility or segmentation in order-flow mechanisms, possibly coupled with poorly managed derivatives exposure. As I used to teach my students, show me a financial debacle, and I’ll show you someone who had a leveraged, mismatched position that they were suddenly forced to close into an illiquid market. Though my concerns run far beyond the amount of leverage in the system, it isn’t helpful that the amount of leverage in the U.S. equity markets is now easily the highest in history.”

These days spotting the bubble is about as difficult as finding it in the Ramirez cartoon above. Hussman attacks Wall Street’s new rationalization of buying into the bubble, i.e., extreme valuations are justified by low interest rates. Those who are all-in for fear of missing out – blindly walking on air – are obviously the most vulnerable. When investing becomes a matter of faith, that faith will be tested. A solid diversification, we will add, would blunt the downside. Though investor margin debt is small compared to the leverage funds and institutions deploy in the market, it does serve as a bellwether for analysts looking for what might trigger a market crash. SentimenTrader’s Jason Goepfert recently posted a warning to his readers that at $831 billion, we are fast approaching a “year-over-year growth rate in [margin] debt – on both an absolute scale and relative to the change in stock prices – will compare with some of the most egregious extremes in 90 years.”

Are you worried about the egregious extremes in the stock market?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

Reliably serving physical gold and silver investors since 1973

Hedging failure exposes private equity to interest-rate surge

Bloomberg/Silas Brown, Abhinav Ramnarayan and Paula Seligs/6-20-2023

“Yet for all their savvy dealmaking, even the titans of private equity are getting caught out by the swift rise in interest rates — which is costing the companies they own billions in extra interest and threatens to push scores of them into default.”

USAGOLD note: Yet another sector facing the prospect of widespread default and imposing risks on the rest of the financial system…… Consider that their interest cost quintupled over the past 18 months.

Daily Gold Market Report

Gold pushes toward $1900 as recession worries fade

City Index: Market ‘technically driven with bears booking profits’

(USAGOLD – 6/28/2023) – Gold continued to push toward the $1900 mark as recession worries went into retreat and markets digested the prospect of more rate hikes moving into the second half of the year. It is down $7.50 at $1908.50. Silver is down 27¢ at $22.66. City Index’s Matt Simpson told Reuters this morning that “strong economic data strengthened the dollar and sent gold back towards its June low.” Current pricing, he says, appears to be “technically driven with bears booking profits.”

Notable Quotable

__________________________________________________________

“I have found throughout my long investment career that an investor needs to make very few investment decisions in their lifetime. The key is to identify a long-term trend as it begins to emerge, invest in that trend, ride it until it ends and another trend replaces it. As an example, U.S. stocks in the 50s and 60s, commodities in the 70s, Japanese stocks in the 80s, tech stocks in the 90s, commodities in the 2000s, and tech and paper assets in the 2010s. The next trend that is emerging will favor things or hard assets. This is what the gold markets are telegraphing now. This trend will be inflationary driven by resource shortages and a tsunami of money printing.” – James Puplava, Financial Sense, September 2020

__________________________________________________________

Murky world of global food trading is too important to ignore

Financial Times/Helen Thomas/6-20-2023

USAGOLD note: The “merchants of grain” move to become an even more dominant presence in the global economy……”Perhaps it was the ancient nightmare of the middleman-merchant that made them all so aloof and secretive.”

Gold ETFs enjoy further net inflows in May

“Inflows into gold-backed exchange-traded funds (ETFs) turned positive for the year to date thanks to robust investor activity in May, the World Gold Council (WGC) has said. These investment vehicles recorded net inflows of 19.3 tonnes in May, the third monthly increase in a row. The total value of inflows stood at $1.66 billion.”

USAGOLD note: Positive ETF flows are one of the indicators gold market analysts consistently point to as a signal the secular bull market has resumed. Let’s hope it holds.