Monthly Archives: January 2023

Investors are holding near-record levels of cash and may be poised to snap up stocks

USAGOLD note: It’s been so long since investors have received a decent return on their money that they are mesmerized by its sudden materialization. Persistent inflation, though, will undermine those returns. Then some might find further diversification to be in their best interest.

Saudi Arabia says its open to settling trade in other currencies

Bloomberg/Abeer Abu Omar and Manus Cranny/1-17-2023

USAGOLD note: Saudi Arabia’s gesture follows important talks between Saudi Arabia and China on the issue of oil invoicing. Many will deem it important that Finance minister Mohammed Al-Jadaan delivered his comments at the Davos conference – the annual gathering of the world’s business and political elite. It obviously wanted to deliver a message.

BoA warns hot inflation could run rampant for another 10 years

Yahoo!Finance/Jing Pan/1-12-2023

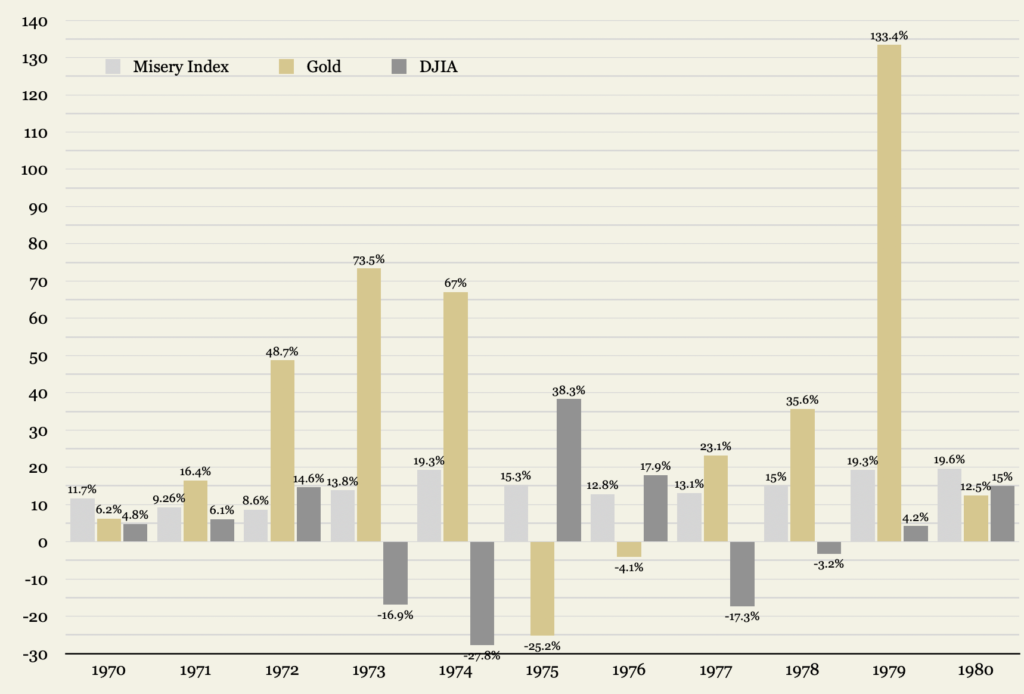

USAGOLD note: Bank of America’s assessment is in keeping with the 1970s scenario……. The big investment bank is on a bearish roll (see below).

Gold turns to the downside in featureless trading

Gold posts record high in Japan, Switzerland exports 524 tonnes to China in 2022

(USAGOLD – 1/25/2023) – Gold turned to the downside this morning in featureless trading ahead of next week’s Fed meeting. It is down $12 at $1928. Silver is down 21¢ at $23.53. Jerry Grantham returned to the fray this morning to predict a bleak future for the stock market – a further 17% decline in 2023.

A few gold notes to start your day…… Australia’s Perth Mint, which enjoys a strong market for its wares in East Asia, reports record bullion product sales in 2022. Switzerland, where the world’s primary precious metals refineries are located, exported 524 tonnes of gold to China last year, the highest level since 2018. Gold prices posted a record high in Japan yesterday amidst inflation and recession concerns. Goldman Sachs says China’s reopening is a gamechanger for gold and oil…and the US dollar. Last, the US national debt is now six times larger than it was at the start of the century and is expected to grow at a rate of $1.3 trillion per year for the next decade. And that is a conservative estimate…

US debt default ‘likely’ in second half of 2023: Bank of America

Yahoo!Finance/Dan Weil/1/14-2023

“’We think it is likely that by late summer or early fall, the federal government will temporarily be forced to default on a portion of its daily obligations for a time ranging between a couple of days to a few weeks,’ he wrote in a commentary.”

USAGOLD note: So says Bank of America’srates strategist Ralph Axel. Usually these disputes resolve themselves before any permanent damage is done, but this time around it is being given more gravity, given the agreements supposedly made between the new speaker of the House and the rebel faction of the Republican party.

The chimera of post pandemic, postwar return to monetary normal

MisesInstitute/Brendan Brown/1-12-2023

USAGOLD note: An alternative view on where we are headed monetarily from a leading economist on the international monetary system and senior fellow at the Hudson Institute…… “Normal for this regime,” he says, “is virulent monetary inflation” – despite what is being said.

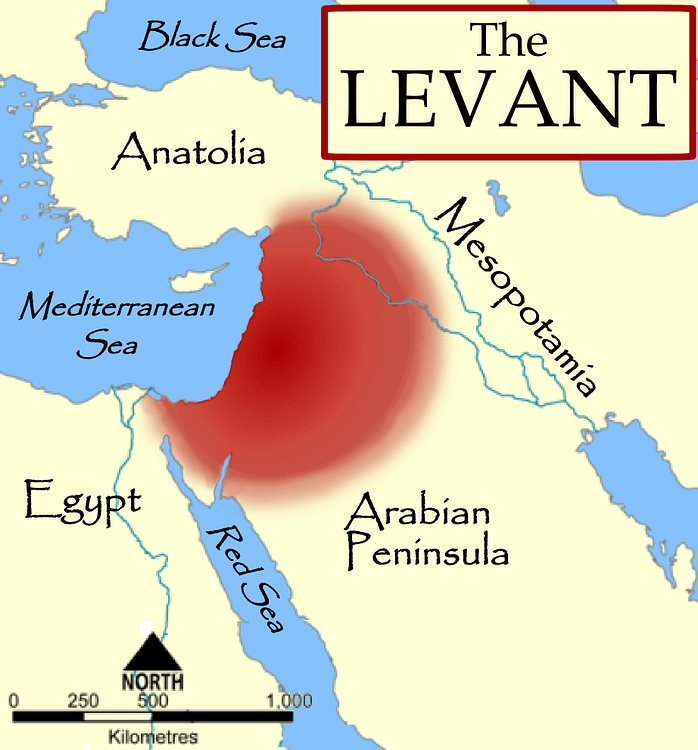

3600-year-old silver pieces confirmed as first money used in the Levant

AncientOrigins/Nathan Falde/1-11-2023

USAGOLD note: Before gold, silver was the circulating medium of exchange, and savers hoarded it. The “coins” were minted in Turkey then shipped to the Levant where it was used as currency.

____________________________________

Map courtesy of MapMaster, (2021, February 21). Map of the Levant. World History Encyclopedia. Retrieved from https://www.worldhistory.org/image/13269/map-of-the-levant/

Russians buy record number of gold bars in 2022, Vedomosti reports

USAGOLD note: Not to mention that the country is at war that is not going as planned, the rouble is down and the inflation rate is running at double digits. Russia’s citizens bought 67 tonnes of gold in 2022.

Gold gains as investors worry about possible government debt default

EWT analyst Gilbert says gold is poised for major rally, sees $2428 as next target

(USAGOLD – 1/24/2023) – Gold gained ground in early trading as investors began to worry about the knock-on effects of a possible federal government debt default. It is up $8.50 at $1941. Silver is up 28¢ at $23.79. State Street CEO Ron O’Hanley told Bloomberg that a showdown in Congress over the debt limit could cause a “fair amount of damage [in the bond market] well before you saw a default.” O’Hanley says the risks of a deadlock are greater this time around because “people believe that this is the only way they can get their message across.” State Street is one of the world’s largest asset management and custodial firms.

Avi Gilbert, the Elliot Wave Theorist who gained a significant following with his call for a sharp drop in gold after it hit record highs in 2011, now says that the metal is poised for a major rally. “Back in 2011,” he explains in an analysis posted recently at Seeking Alpha,” I utilized a 100+ year structure in gold to identify the topping target for gold. And, I used the same structure to identify a bottoming target for the correction I expected, even before that correction began. So, now I am going to provide you my next target on the upside – and that is $2,428.”

Gold, Dow Jones and Misery Index

(1970-1980 period of stagflation)

Precious Metals Outlook 2023

MKS Pamp Group/Staff/January 2023

“Our macro view is to play for a slower Fed and rising stagflation & recession risks which will ensure both peak US$ and peak real US yields. Inflation will fall, but not to target and the recoveries will be uneven and will ultimately disappoint. That setup has already ensured Gold pivoted from trading defensively for most of 2022, to trading offensively where dips are actively capitalized on, establishing a new technical bull trend after the Fed ended its 75bp hiking regime in November 2022.”

USAGOLD note: A detailed review of the prospects for precious metals in 2023 from Swiss refiner MKS Pamp Group – includes gold, silver, platinum, and palladium base case, bullish case and bearish case scenarios.

The gathering storm

The New York Sun/Editorial staff/1-12-2023

USAGOLD note: The monetary storm continues to gather on the horizon, and it will be a long time, if ever in our view, before Congress does anything to detach from the fiat money bandwagon.

Gold is getting its glitter back

Bloomberg/Merryn Somerset Webb/1-15-2023

USAGOLD note: Webb says the market has “kneecapped” the idea of cryptocurrency rivaling gold and says if you want to own gold, you will need to buy gold.”That being the case,” she adds,” the question is not have you too much, but have you enough — the very same question the head of the PBoC is clearly asking himself right now.”

U.S. budget deficit triples to $85 billion in December

MarketWatch/Jeffrey Bartash/1-12-2023

“The U.S. budget deficit tripled to $85 billion in December from a year earlier, reflecting somewhat higher spending and a small decline in tax receipts.… Some of the extra outlays stem from the U.S. paying higher interest rates on its mountain of debt.”

USAGOLD note: As of 1/11/2023, the national debt stands at $31,375,141,998,674.97 – and it has almost doubled over the past decade. The national debt, as Ross Perot colorfully called it, is the crazy aunt in the attic. It is rarely a topic of discussion these days in the mainstream media and Washington political circles.

Aggregate National Debt

(Through 1/11/2023)

Source: tradingeconomics.com

Gold starts week on a quiet note

Gold Newsletter’s Lundin says gold is in a ‘largely unrecognized’ bull market

(USAGOLD 1/23/2023) – Gold is starting the week on a quiet note as markets in general remain in a quandary over Fed policy and the possibility of a recession. It is up $2 at $1930. Silver is down 23¢ at $23.81. It is helpful to keep in mind that since gold’s triple bottom in early November, it is up almost 18%. It is up 5.5% since the start of the year. Gold Newsletter’s Brien Lundin sees gold’s steady performance of late as the start of a ‘largely unrecognized’ bull market.

“[T]he metal is consistently finding reasons to rise, as opposed to excuses to fall,” he says in a recent alert, “If you’ve been reading my stuff for very long, you know that I hold this as one of the most important hallmarks of a bull market. When the market is interpreting even potentially bearish news as bullish, that’s a bull market. Thus, even when the Dow is losing 600 points as it did yesterday, gold barely budged. All of this is good and bodes well for the future.”

Connecting a few dots

USAGOLD note: Hathaway’s latest. He says 2022 was the year gold built “a solid base, in technical terms, for a strong advance to new record highs against the supposedly invincible U.S. dollar.”

Move over cryptocurrency, gold could have the last laugh this year

South China Morning Post/Anthony Rowley/1-15-2022

USAGOLD note: While the mainstream financial media continues to characterize gold as a short-term speculative play, the essential market for the metal is among those who see it as a long-term safe haven against the obvious turbulence in the economy, and hence financial markets. That group runs the gamut of participants from private individuals to big funds and institutions to central banks – all owning the metal for essentially the same reasons, and it has little to do with its speculative potential. Rowley suggests that the purchases that have been made thus far “may only be the tip of the iceberg.” An important read at the link……

The best inflation-fighting investment for 2023 offers 3 other advantages vs. the stock market, says this analyst

MarketWatch/Barbara Kollmeyer/1-12-2023

“While inflation has been a key concern for investors over the past 2 years, and will continue to be an important consideration for the coming year, we believe that there are more reasons to consider allocations to commodities than just inflation.” – Nitesh Shah, Wisdom Tree

USAGOLD note: A brief, but compelling argument for commodities ownership for 2023. Shah believes that with bond yields having peaked, “gold has another headwind removed.”

Fed’s no-rate-cut mantra rejected by markets seeing recession

Bloomberg/Liz McCormick and Craig Torres/1-11-2023

USAGOLD note: Chandler describes a Wall Street attitude toward the Fed a far cry from what it was under the Greenspan and Bernanke chairmanships. In those days, Wall Street did not dare fight the Fed. Now, it is in full defiance.

Gold drifts lower in follow-up to yesterday’s dollar-driven advance

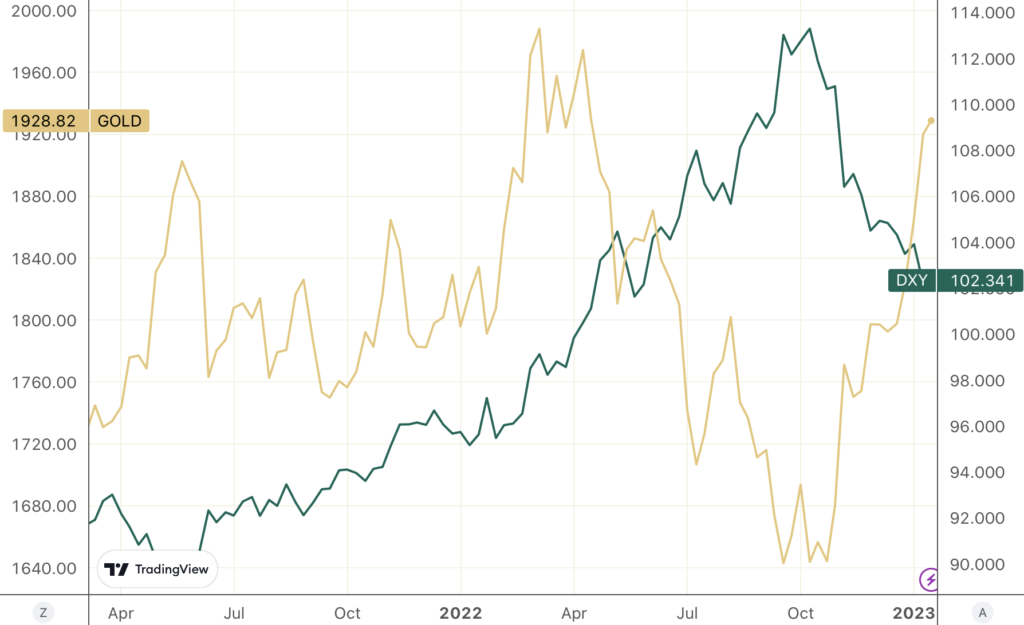

Pozsar sees US dollar’s exorbitant privilege under assault

(USAGOLD –1/20/2023) – Gold is drifting marginally lower in the follow-up to yesterday’s strong, dollar-driven advance. It is down $4 at $1931. Silver is up 12¢ at $24.03. Gold’s upside since the turn of the year, during which it has gained almost 6%, has been accompanied by a groundswell of opinion that the greenback’s strong two-year advance is in the early stages of a reversal. Zoltan Pozsar, the head of short-term rate strategy at Credit Suisse, believes that China’s deepening ties with OPEC+ and BRICs+ will alter the “existing world order” and “eventually lead to ‘one world, two [monetary] systems.'”

Investors, he says in an opinion piece published this morning by Financial Times, have to discount new risks. “In finance,” he concludes,” everything is about marginal flows. These matter the most for the largest marginal borrower — the US Treasury. If less trade is invoiced in US dollars and there is a dwindling recycling of dollar surpluses into traditional reserve assets such as Treasuries, the ‘exorbitant privilege’ that the dollar holds as the international reserve currency could be under assault.” If Pozsar is correct, it will carry important implications for gold.

Gold and the US Dollar Index

(2021 to present)|

Chart courtesy of TradingView.com • • • Click to enlarge

Investors turn to gold as rally in the precious metal continues

MoneyWeek/Kalpana Fitzpatrick/1-9-2023

USAGOLD note: A solid introduction to the rationale for private gold ownership from a UK-based magazine that has recommended gold to its readers for years – a good weekend read, especially for newcomers.