Monthly Archives: January 2023

No one wins with a world split into two rival political-economic blocs

South China Morning Post/Anthony Rowley/1-22-2023

USAGOLD note: Rowley considers a new alignment of nations as the world splits into two camps – one led by the United States, the other by China. “Beijing is in a relatively strong position to consolidate and strengthen its position while the US and its allies struggle with long-standing economic problems,” he says. We are not sure how much of that assessment is grounded in reality. The economic problems on both sides are profound.

Yellen dismisses minting $1 trillion coin to avoid federal default

MarketWatch/Andrew Duehren/1-22-2023

“Treasury Secretary Janet Yellen said the Federal Reserve likely wouldn’t accept a $1 trillion platinum coin if the Biden administration tried to mint one to avoid breaching the debt limit, dismissing an idea that has been floated to circumvent Congress on the issue.”

USAGOLD note: Why do some choose to believe that outrageous solutions do not come with equally outrageous consequences? The best solution is to abolish the debt ceiling. It serves no practical purpose.

Gold buys owe much to central bank buying

Bloomberg/Liam Denning/1-20-2023

USAGOLD note: Bloomberg commodity columnist Liam Denning weighs in on what’s going on in the gold market…… Central bank buying is certainly a factor, but what are the reasons for that buying?

Gold trades to the downside ahead of tomorrow’s rate decision

WGC reports strongest gold demand in over a decade led by central banks

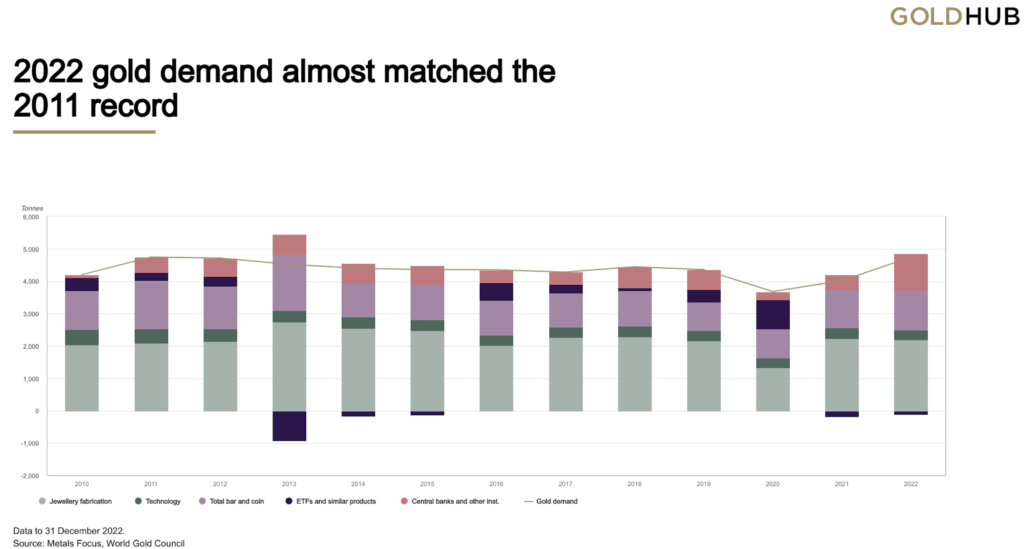

(USAGOLD – 1/31/2023) – Gold is trading to the downside this morning ahead of tomorrow’s Fed decision and press conference. It is down $9 at $1917. Silver is down 27¢ at $23.42. Wall Street expects the Fed to strike a more dovish tone, but there is a minority worried about a hawkish surprise. The World Gold Council reports the strongest demand for gold in over a decade. “Colossal central bank purchases,” it says in its full-year demand trends report for 2022, “aided by vigorous retail investor buying and slower ETF outflows, lifted annual demand to an 11-year high.” Investment demand for gold coins and bars grew by 10% to 1,107 tonnes. Central bank buying was at a 55-year high of 1,136 tonnes.

Chart courtesy of the World Gold Council • • • Click to enlarge

A fatal conceit

Alhambra Investments/Joseph Y. Calhoun/1-22-2023

USAGOLD note: What you just read, if you accept it as accurate and we do, is the best argument for diversification – and that diversification, if history is a teacher, should include gold and silver…… Some practical advice at the link.

Inflation complacency

Credit Bubble Bulletin/Doug Noland/1-20-2023

USAGOLD note: We agree with Noland’s assessment. After all is said and done, the Fed at its core is dovish.

What’s behind fall in US yields? Fed hope, growth fear

Bloomberg/Martin Ademmer and Bjorn Van Roye/1-24-2023

“For the US central bank, the burden of controlling elevated inflation falls increasingly on hopes for favorable supply shocks.”

USAGOLD note: And that could go either way. A one-paragraph, no-nonsense summary of the Fed’s latest policy conundrum……

Chart courtesy of TradingEconomics.com

Sentiment speaks: $2428 target for gold

Seeking Alpha/Avi Gilbert/1-17-2023

USAGOLD note: Elliot Wave analyst Gilbert reprises a long history of successful gold calls to give extra credibility to his bullish $2428 target ……

Gold trades sideways ahead of this week’s Fed decision and press conference

Schroders says gold does well during recessions returning 28% on average

(USAGOLD – 1/30/2023) – Gold is trading sideways this morning as the markets remain cautious ahead of Wednesday’s Fed rate decision and press conference. It is down $2.50 at $1928. Silver is up 9¢ at $23.76. If a recession is in the cards, then what might we expect from gold? Schroders, the London-based investment firm, has some answers. Gold, it says in a report released last week, “tends to do well in absolute and relative terms during US recessions.” It has returned 28% on average and outperformed stocks by 37%.

“One observation we would make is that when the policy responses to US have been particularly loose/accommodative, the gold price performance has been most explosive,” says the firm. “This was the case in 1973 (when Arthur Burns was Federal Reserve governor) and was also the case in 2008 and 2020. We think policy responses to future US recessions will also be highly accommodative and involve a return to combined fiscal/monetary support.”

Gold and recessions

(Shaded bars = recessions)

Chart courtesy of TradingView.com • • • Click to enlarge

Brazil and Argentina to start preparations for a common currency

Financial Times/Michael Stott and Lucinda Elliot/1-22-2023

USAGOLD note: The dollar rebellion gains new adherents – the two largest economies in South America, and that makes for an interesting headline. That said, Argentina might find it difficult to give up its money printing ways – something that will no doubt be required in a monetary union along the lines of the European Union. In short, discussions about a currency union at some point will necessarily get down to the nitty-gritty of government spending, deficits, money printing – and most importantly, monetary sovereignty. Austerity has never been one of Argentina’s strong suits, and that fact of life, in our view, is likely to keep this new currency union in the discussion stage for a long time to come.

The stock market is about to be flipped upside down as inflation rebounds

MarketsInsider/Matthew Fox/1/21/2023

USAGOLD note: This is not the kind of future the Fed has in mind……Of all the big banks, Bank of America is the most bearish by far. The bank is bullish on gold.

Investors contradict Fed officials on US interest rate reversal

Financial Times/Kate Duguid and Colby Smith/1-21-2023

USAGOLD note: The tug of war between Wall Street and the Fed proceeds…… The “disconnect” described could be in force for some time to come.

Summers warns of 1970s crisis if central banks relent on rates

Bloomberg/Phillip Aldrick/1-20-2023

“Going soft on inflation will plunge economies back into the recessionary depths of the 1970s and have “adverse effect on working people everywhere,” former US Treasury Secretary Larry Summers warned.”

USAGOLD note: We have made consistent reference to the 1970s Fed strategy that kept interest rates below the inflation rate – a policy that fostered stagflation and a strong gold market. The Fed, in our view, is not going soft, it is already soft on inflation and has been since it first surfaced as a problem several months ago.

Gold trades sideways ahead of next week’s Fed decision

Bill Blain: Buy gold now to finance future bottom-fishing in other markets

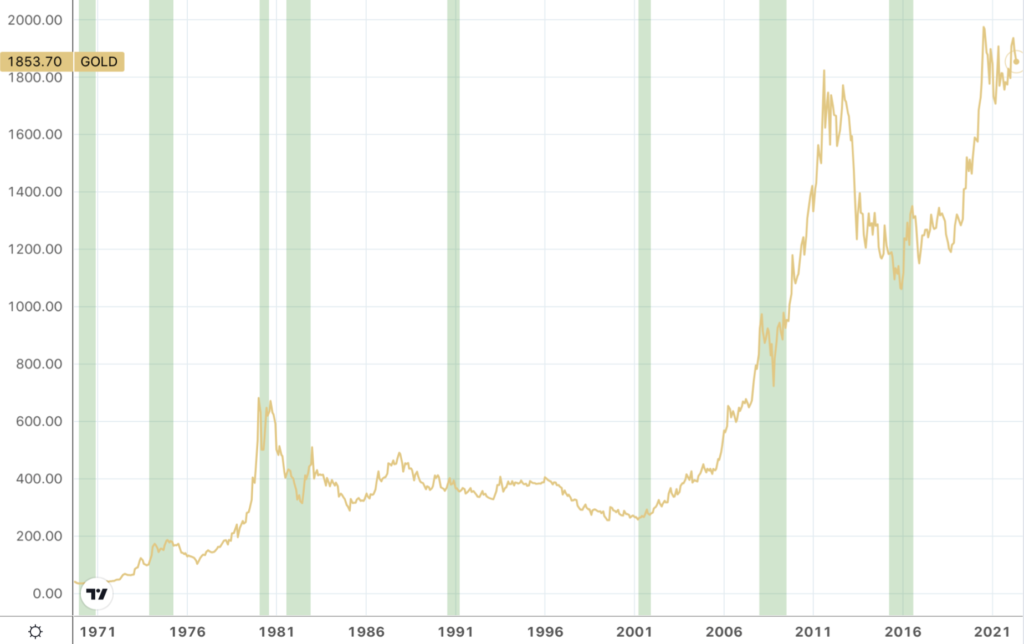

(USAGOLD – 1/27/2023) –Gold is trading sideways as we go into the weekend and next week’s Fed decision. It is up $2 at $1933.50. Silver is down 19¢ at $23.79. Morning Porridge’s Bill Blain believes having some gold stuck away to finance future bottom fishing in other markets is a good thing. “That’s when the liquidity of gold is a marvelous thing,” he says. “In times of market uncertainty it’s a beneficial asset to hold.” (In the chart below, please note the price levels during times of economic uncertainty.)

“My colleague Ashley Boolell, Shard’s head of commodities, reckons gold is going to a new record level this year,” he says in a lengthy analysis on gold posted at Zero Hedge yesterday, “fuelled by a number of factors – not least being the ongoing market uncertainty. Each time we get another unexpected market number, or a corporate shock, it chips way confidence. In uncertain markets gold is seen as the safe-haven investment – especially when there is the threat of the technical US default on the back of the debt-ceiling being blocked by the Alt-Right of the Republican Party.”

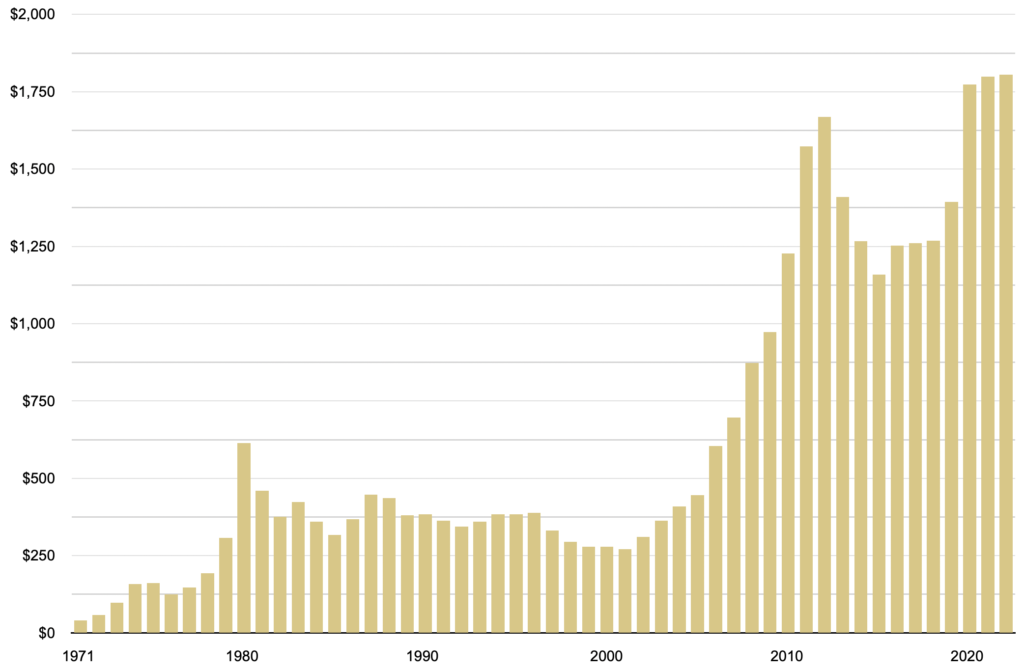

Gold annual average prices

(1971 – 2022)

Great power conflict puts the dollar’s exorbitant privilege under threat

Financial Times/Zoltan Pozsar/1-20-2023

USAGOLD note: Zoltan Pozsar, the head of short-term rate strategy at Credit Suisse, believes that China’s deepening ties with OPEC+ and BRICs+ will alter the “existing world order” and “eventually lead to ‘one world, two [monetary] systems.’” Investors, he says, will have to discount new risks. If he is correct that the dollar’s exorbitant privilege could be undermined, it will carry important implications for gold.

Silver prices could touch a 9-year high in 2023 — with a bigger upside than gold

USAGOLD note: Big rallies in the silver price often come out of the blue without warning, rhyme or reason. The best approach to owning silver is to accumulate it in physical form sans leverage and wait for the potential price spike. At $30, silver would provide a hefty return for most USAGOLD clientele who own the metal. Even as it is, silver is up 34.5% from September 2022’s bottom at $17.75 per ounce – a more than respectable gain that has not gotten a lot of play in the financial press.

Investors are holding near-record levels of cash

USAGOLD note: For the first time in years, investors are able to garner a decent return on money markets. That’s no small matter. Wall Street, no doubt, is chomping at the bit for that cash to wash like a great wave into the stock market, but that money could also sit where it is for a long time to come. Merryn Somerset Webb, a senior columnist at Bloomberg Opinion, thinks cash holdings might be another dead end for investors. “If you are holding cash,” she says, “it is only a temporary king.” She says that inflation, which erodes the value of cash, will be with us for the long haul and that investors should look to gold, as an alternative.

Global oil demand set to reach record high as China reopens, IEA says

Financial Times/Tom Wilson/1-18-2023

USAGOLD note: Should oil prices start higher, as some predict, it could bode well for the rest of the commodity complex, including precious metals, but undermine hoped-for restraint on monetary policy.

Gold retreats after bumping against $1950 level in overnight trading

Dalio says dollar-dominated world order and globalized economy are ‘fading away’

(USAGOLD – 1/26/2023) – Gold retreated after bumping against the $1950 level in overnight trading. It is down $11 this morning at $1938. Silver is down 21¢ at $23.80. A key factor in gold’s pricing of late has been the return of hedge fund interest. “Hedge funds meanwhile have been near constant buyers since early November,” writes Saxo Bank’s Ole Hansen in a report issued earlier this week, “and during this time the net long has jumped from a 3.9 million ounce net short to a 9.3 million ounce net long, a nine-month high.” With greater hedge fund involvement in play, we should not be surprised at increased volatility and technical trading at key chart numbers.

Ray Dalio, who founded the world’s largest hedge fund, says the world order is shaping up in ways similar to the pre-World War II era, with “each country’s populism and nationalism growing in preparation for greater conflicts.” In the process, he says in an article on the Modern Diplomacy website, “the era of a ‘dollar-dominated world order and a globalized economy was ‘fading away.’ We are now going to have the major powers and their allies form economic, currency, and military blocs.” Mature economies, he says, “have run up very large debts and have developed a dependence on their central banks to print money to buy the government debts,” he said. The increase in debt monetization “will mean that holders of debt assets will get bad inflation-adjusted returns.” Dalio is a long-time advocate of gold ownership.

Gold and silver prices

(October 2022 to present)

Chart courtesy of TradingView.com

James Grant: ‘I’m somewhat of a broken record on gold’

themarketNZZ/Christopher Gisiger interview of James Grant/1-17-2023

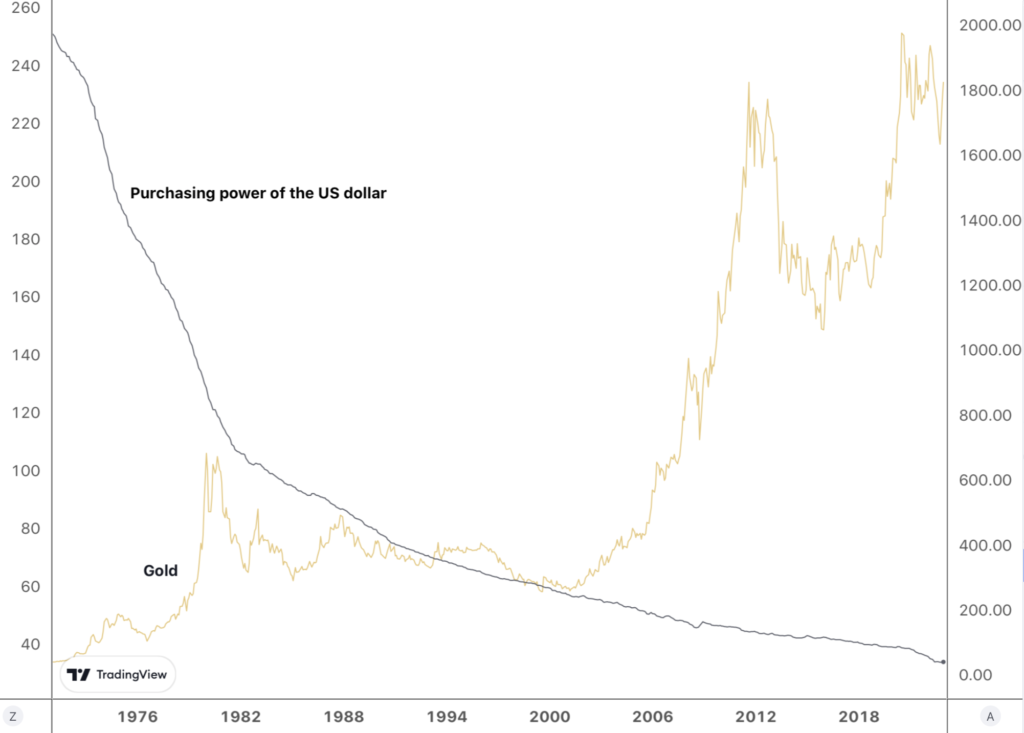

USAGOLD note: If you’ve never exposed yourself to James Grant’s unique brand of deep thinking on the economy and financial markets, you might find opportunity in this interview with Christopher Gisiger. Grant has always been an advocate of gold ownership, and nothing has changed on that score. “Allow me to suggest that I’m somewhat of a broken record on gold,” he confesses. “I’m going to continue with this broken record and observe that people have not yet come to terms with the essential inherent weaknesses of the monetary system that has been in place since 1971.” A point well taken as illustrated by the chart below.

Grant’s Interest Rate Observer

Gold and the purchasing power of the US dollar

(USD as measured by the consumer price index)

Chart courtesy of TradingView.com