Monthly Archives: July 2022

The dollar bulls are looking increasingly like a cult

Bloomberg/Jared Dillian/7-19-2022

USAGOLD note: So is the dollar in a mania? Dillian sees signs that it might be and worries that there will come a time when it falls out of favor. “That is what inevitably happens when sentiment gets extremely hot,” he says, “and it may be happening now.” With that in mind, one must also take into account the extraordinary leverage at work in the currency markets. The Office of Comptroller of the Currency reports notional derivative exposure in FX trading at $43.6 trillion – second only to interest rate derivatives. In other words, though it might seem far-fetched at this juncture, there is potential for a downside just as fearsome as the upside.

No DMR today

We will update later if anything of interest develops. The following is Friday’s report.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gold closes out a hapless week dominated by a speculative US dollar frenzy

Bridgewater’s Prince says investors need to prepare for a decade of stagflation

(USAGOLD – 7/15/2022) – Gold continued its trek to the downside in early trading as it closed out a hapless week dominated by a speculative frenzy and run-up in the US dollar index. It is down $4 on the day at $1708.50 and 2% on the week. Silver is up 2¢ on the day and down 4.1% on the week. In an opinion piece published in Financial Times this morning, Bob Prince, Bridgewater Associates’ co-chief investment officer, says that investors need to prepare for a decade of stagflation by shifting away from “vulnerable equity and equity-like exposure.”

“Historically, equities have been the worst-performing asset in stagflationary periods,” writes Prince, “because they are vulnerable to both falling growth and rising inflation. Other predominantly growth-sensitive assets like credit and real estate also perform poorly. Nominal bonds are closer to flat in such environments.… Within these monetary policy regimes, the relative returns of assets still align with their biases, with index-linked bonds, gold, and commodities giving investors better relative returns regardless of how policymakers respond.” Bridgewater Associates is the world’s largest hedge fund.

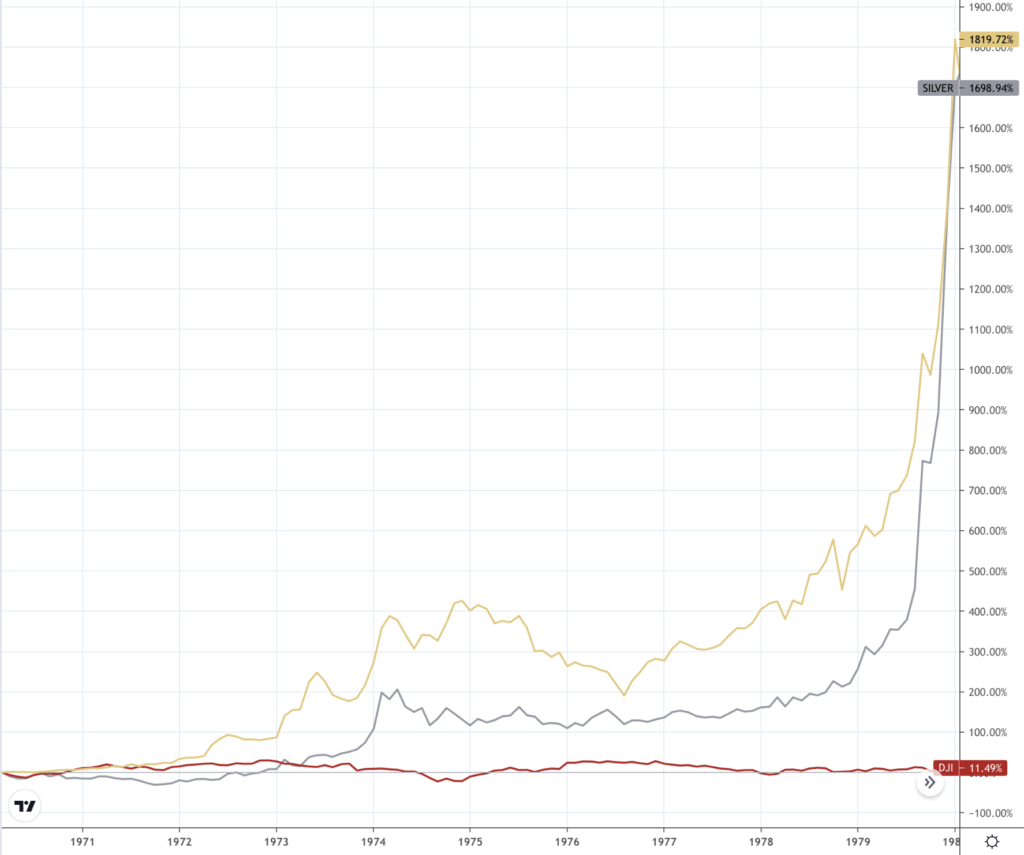

Editor’s note: To illustrate Prince’s point, we return to a chart posted previously with this report. It shows the performances of gold, silver, and stocks during the 1970s, the last time investors faced a stagflationary shock. Gold rose 1820%, silver 1699%, and the DJIA 11.5%

Gold, silver, and stocks performance

(%, 1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Gold and silver, like other commodities, have an intrinsic value, which is not arbitrary, but is dependent on their scarcity, the quantity of labour bestowed in procuring them, and the value of the capital employed in the mines which produce them.”

David Ricardo

British political economist (1772-1823)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The return of the European Union’s debt problem

Statista/Katherina Bucholz/6-23-2022

“On average, European Union countries had a gross government debt of roughly 88 percent of GDP in 2021. This average disguises real differences between EU countries, however. Whereas Greece had a government debt of 193 percent last year, Estonia came last in the ranking with a debt of only 18 percent in GDP equivalent.”

You will find more infographics at Statista

USAGOLD note: With interest rates on the rise, the problems associated with servicing and repaying EU sovereign debt are once again in the forefront – particularly for Europe’s southern tier.