Wealthy investors aren’t convinced big stock market losses mean it’s a buy-the-dip moment

“It’s been a tough year to be an investor, and the wealthy are no exception. Losses in both stock and bond markets this year have made portfolio conversations between Wall Street investment advisors and clients more challenging. The most conservative portfolios have done as poorly if not worse than the riskiest portfolios, with bonds offering little in the way of protection. But if there’s a moment when the majority of wealthy, experienced investors call an all-clear on recent equities’ volatility and buy-the-dip in stocks, this isn’t looking like it.”

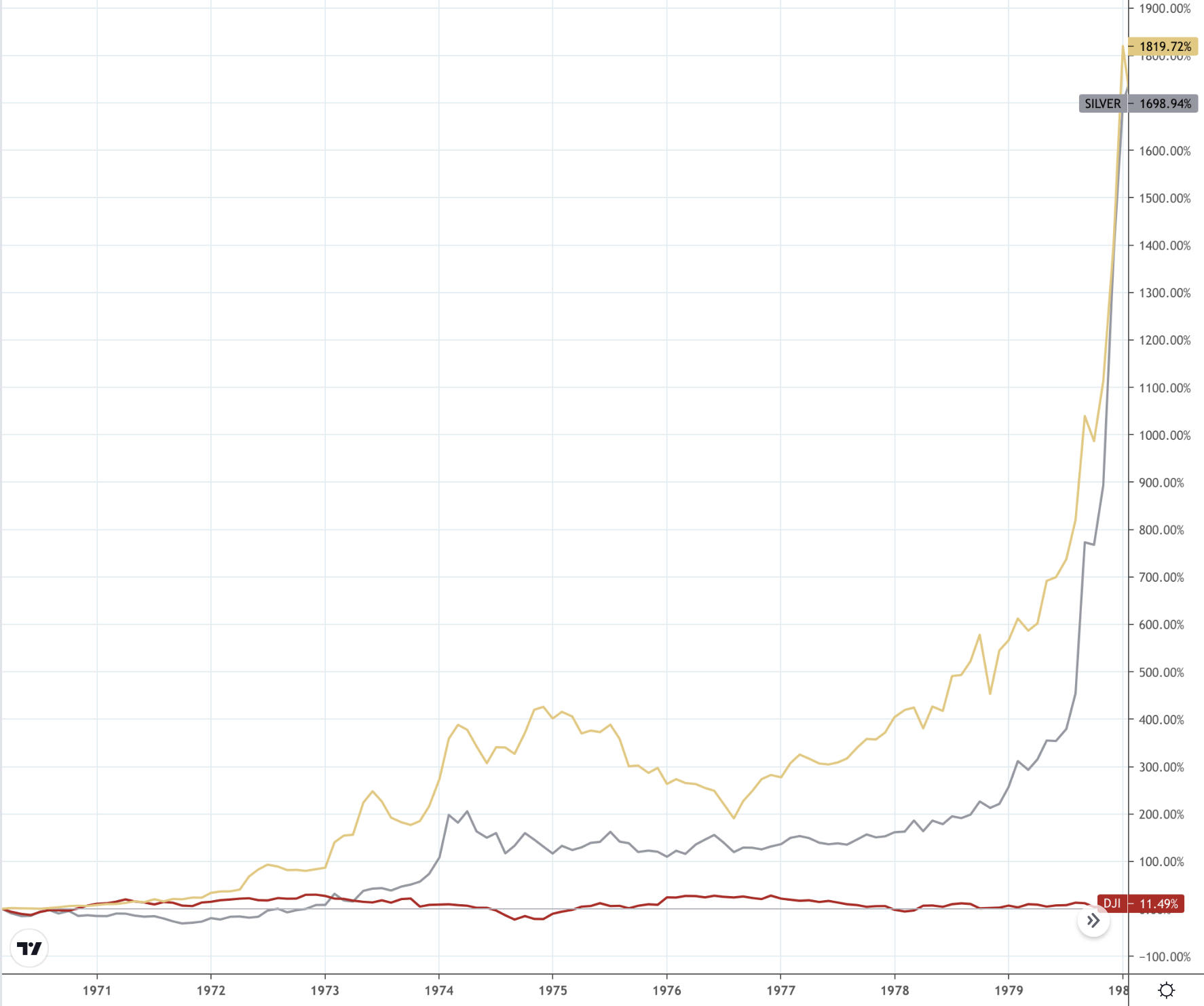

USAGOLD note: For certain, the current period is looking to the older crowd a lot like the 1970s. They are likely to recall that buying the dip did not work out all that well back then – a lesson many will pass on to younger members of the family, friends and acquaintances. Gold and silver, on the other hand, did quite well during the period, as the chart immediately below shows.

Gold, silver and stocks price performance

(%, 1971-1980)

Chart courtesy of TradingView.com • • • Click to enlarge