Gold trades quietly ahead of this morning’s PCE Price Index release

London-based Schroders sees potential for greatly amplified central bank demand

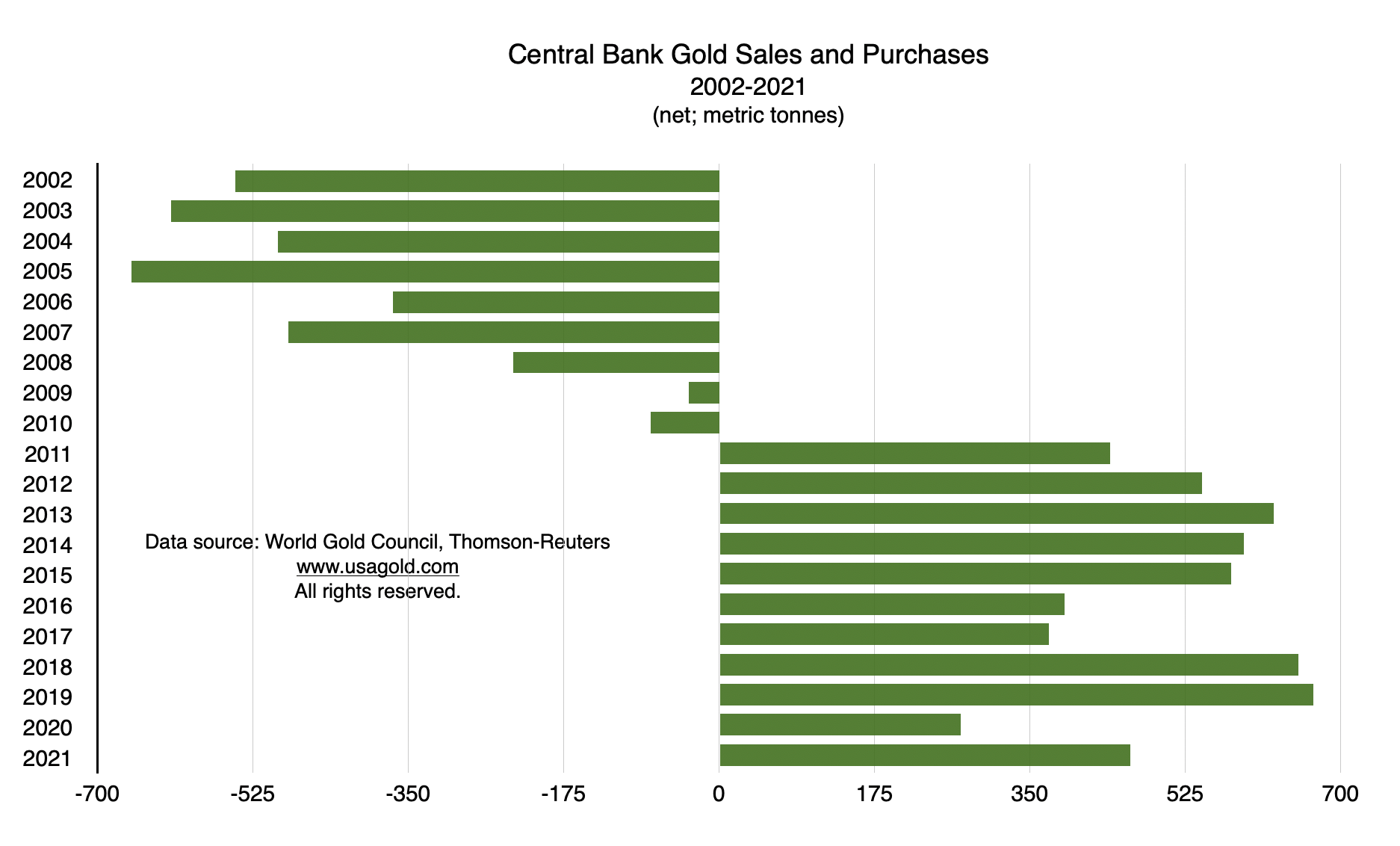

(USAGOLD – 3/31/2022) – Gold is trading quietly ahead of this morning’s release of the PCE Price Index – an indicator closely watched by policymakers and investors alike. It is down $3 at $1931. Silver is down 3¢ at $24.87. James Luke, commodity fund manager at London-based Schroders, sees the “significant turnaround in private investment demand from North America and Europe” as the real story in the gold market. At the same time, he thinks that trend could be amplified by strong central bank gold demand as a “knock-on effect” from “the unprecedented sanctioning of Russian central bank foreign currency reserves.”

“Broadly speaking,” he says in a piece posted at City AM, “many emerging market central banks hold less than 5% of their total foreign currency reserve holdings in gold – they mostly hold US dollars and other major currencies. The big question is whether a portion of those reserves could find their way into the gold market as central banks look to diversify. If countries like China, Saudi Arabia, the UAE, Brazil and others began to move their allocation towards the 20% market that large holders like Russia already have, the impact on the gold market would be very significant.”

Additional note: Though the Biden administration’s threat to release government oil stockpiles prompted a more than 5% price retreat overnight, the sellling has yet to carry over to the rest of the commodity complex.