Gold gets back in the plus column after yesterday’s minor setback

Hemke cites ‘cup and handle’ chart breakout targeting much higher prices ahead

(USAGOLD – 3/3/2022) – Gold got back in the plus column this morning after yesterday’s minor setback as the commodities complex looked to post its strongest week since the 1960s and the Ukraine war entered its second week. It is up $5 at $1936. Silver is up 12¢ at $25.47. Gold is also being helped by a growing perception that the Fed might be restricted as to how aggressively it can fight inflation amidst the current economic and political uncertainties.

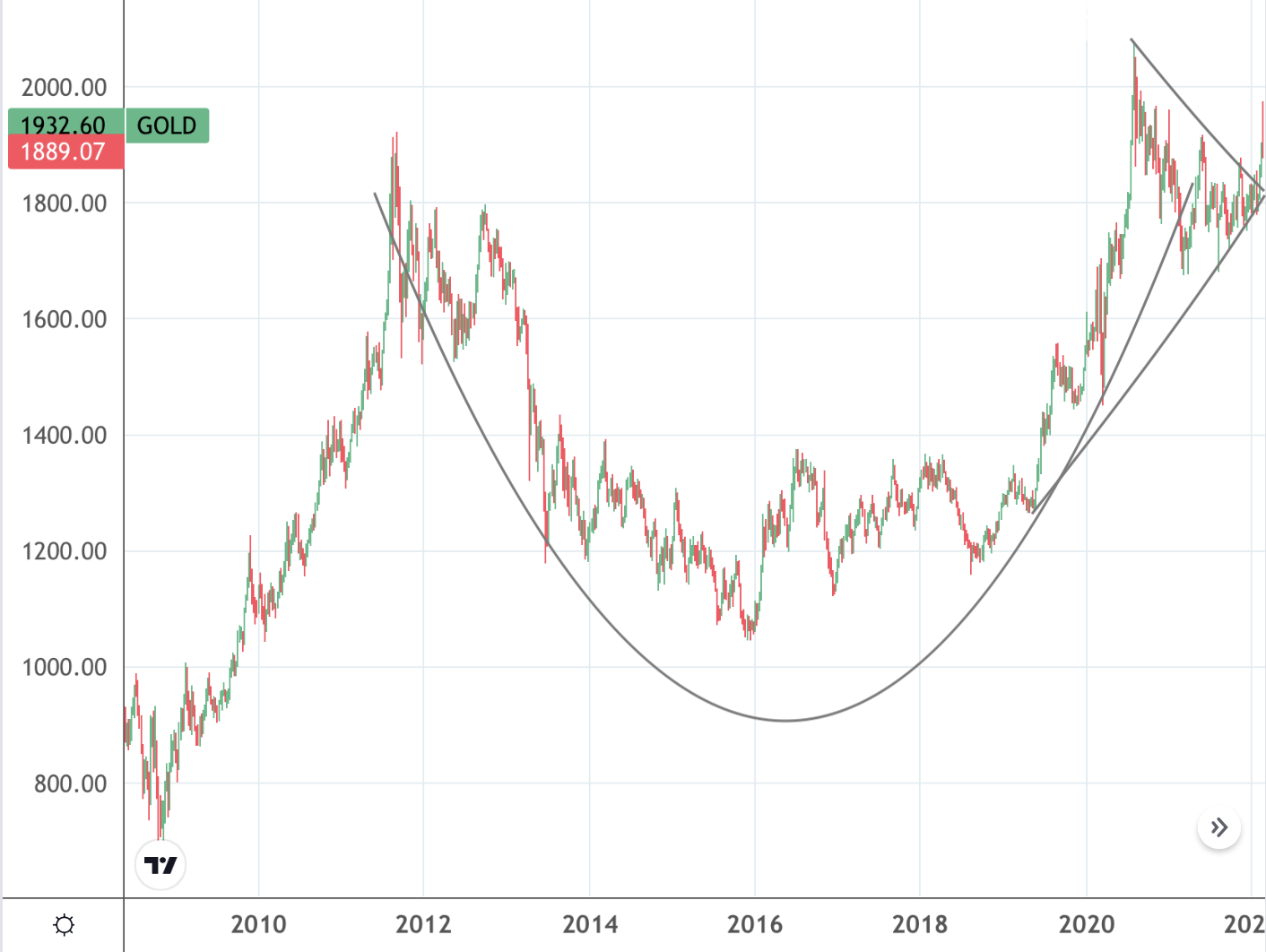

“[T]he move [for gold] above $1920,” says analyst Craig Hemke in a report posted at the Seeking Alpha website, “is important because that level represents the psychological resistance of having once been the all-time high seen back in September of 2011. Once above $1920, the next target becomes the $1960 level that served twice as stiff resistance in late 2020. However, $1960 will eventually be bested too, and once it is, the target becomes $2000. A gold price that begins with a ‘2’ handle will drive an even deeper awareness of the renewed bull market, and things will take on a life of their own from there. If you’re not sure you can foresee that, then maybe you should check the weekly chart below. This is a classic technical setup of a cup, handle, and breakout that typically targets much higher prices in the weeks and months ahead.”

Gold price

(Weekly, 2008-2022)

Chart courtesy of TradingView.com • • • Click to enlarge