Monthly Archives: March 2022

EU and Russia in stand-off over rouble payments for gas

Financial Times/Harry Dempsey, Neil Hume, Natassia Astrasheuskaya, and Sarah White/3-29-2022

“Payments will be accepted in roubles only. Companies need to understand the changed market situation, the absolutely new reality that has emerged amid the economic war waged on Russia.” – Dmitry Peskov, Kremlin spokesperson

USAGOLD note 1: Perhaps the most important volley fired thus far in the new economic war. Who will blink first? This was the lead article in yesterday’s Financial Times. The other half of this equation is that Russia has threatened to pay its debts in roubles. Thus far, those payments have been made in other currencies, principally euros and US dollars.

USAGOLD note 2: Putin has decreed that “foreign buyers must pay in roubles for Russian gas from April 1, and contracts would be halted if these payments were not made,” according to a Reuters report this morning.

Image attribution: Samuel Bailey ([email protected]), CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

Will sanctioning Russia fuel financial contagion?

Project Syndicate/Hypolite Fofack/3-24-20212

“Beyond dampening output and causing already high inflation to spike further, these sanctions are heightening the risk of a financial crisis. Today’s increasingly complex global financial system amplifies this danger, because the magnitude of derivatives markets and the codependency of supply chains and payment chains make contagion more likely.”

USAGOLD note: We raised the prospect of unintended consequences to sanctions repeatedly here as well as the systemic risks. “The risks of globalization,” says Fofack, “may come to outweigh the benefits.” And we agree that derivatives greatly amplify the risk of a system wide breakdown.

G7 to crack down on Russia’s ability to sell its gold

Financial Times/James Politi and Sam Fleming/3-24-2022

USAGOLD note: Not sure what impact this G-7 effort will have on market thinking, if it has any at all. Russia has not indicated a willingness, at this juncture, to put its gold on the market.

Bond market game theory

Seeking Alpha/Craig Hemke/3-23-2022

USAGOLD note: For many years, economists have speculated on the impact of nation-states deciding to liquidate U.S. Treasuries en masse. Most of those discussions had to do with the dollar being unable to sustain its purchasing power. Now, with the steady rise in Treasury yields signaling perhaps the beginnings of such a liquidation, some, like Hemke, raise the prospect of the full-out event becoming a reality. For the most part, though, the selling thus far does not have to do so much with a decline of the dollar, as it does hedging the hard reality of a widening economic war.

Worst inflation in decades hammers fixed income markets

Bloomberg/Greg Ritchie and Finbarr Flynn/3-23-2022

USAGOLD note: Though bonds are often touted as a competitor to gold for safe-haven capital, they do not respond well to inflation. Gold, on the other hand, is widely viewed as an inflation hedge as well as a hedge, like U.S. Treasuries, against stock market uncertainty and systemic risks. Not a time, in short, to be complacent.

PCE Price Index

Highest reading in nearly 40 years, hefty increases in energy and food

Trading Economics/Staff/3-31-2022

“The personal consumption expenditure price index in the United States rose by 6.4% year-on-year in February of 2022, quickening from a downwardly revised 6.1% increase in January, reflecting steeper increases in prices of goods (9.6% vs 8.8% in January), while services rose at the same pace as in January (4.6%). Energy prices increased 25.7% while food prices were up 8.0%. Annual core PCE inflation which is Fed’s preferred measure of price changes rose 5.4% from a year ago, the highest since April of 1983 and slightly below market expectations of 5.5%, signaling persistent inflationary pressures.”

PCE Price Index

(%, year over year)

USAGOLD note: Keep in mind that these readings were logged before Russia’s invasion of Ukraine.

Gold trades quietly ahead of this morning’s PCE Price Index release

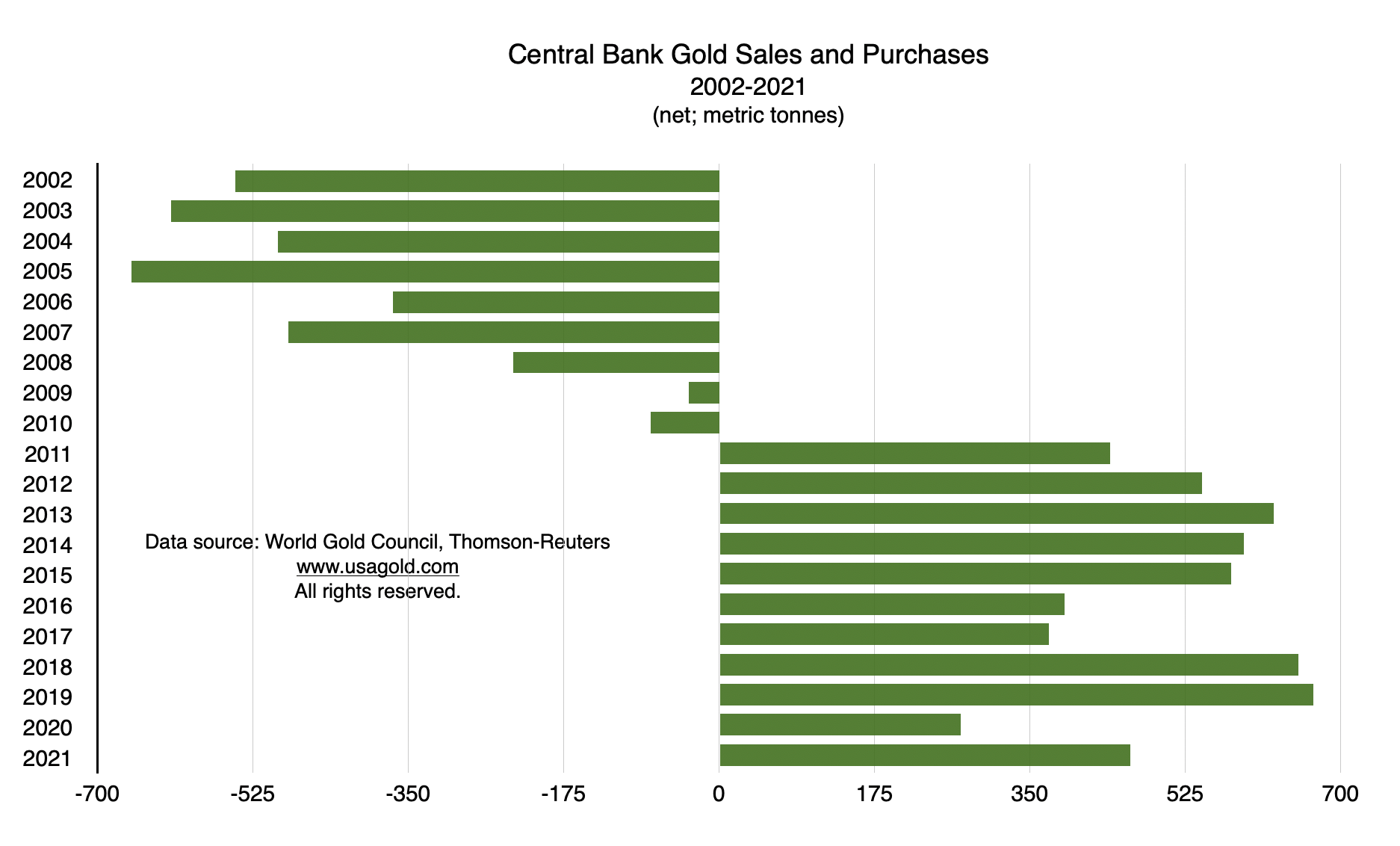

London-based Schroders sees potential for greatly amplified central bank demand

(USAGOLD – 3/31/2022) – Gold is trading quietly ahead of this morning’s release of the PCE Price Index – an indicator closely watched by policymakers and investors alike. It is down $3 at $1931. Silver is down 3¢ at $24.87. James Luke, commodity fund manager at London-based Schroders, sees the “significant turnaround in private investment demand from North America and Europe” as the real story in the gold market. At the same time, he thinks that trend could be amplified by strong central bank gold demand as a “knock-on effect” from “the unprecedented sanctioning of Russian central bank foreign currency reserves.”

“Broadly speaking,” he says in a piece posted at City AM, “many emerging market central banks hold less than 5% of their total foreign currency reserve holdings in gold – they mostly hold US dollars and other major currencies. The big question is whether a portion of those reserves could find their way into the gold market as central banks look to diversify. If countries like China, Saudi Arabia, the UAE, Brazil and others began to move their allocation towards the 20% market that large holders like Russia already have, the impact on the gold market would be very significant.”

Additional note: Though the Biden administration’s threat to release government oil stockpiles prompted a more than 5% price retreat overnight, the sellling has yet to carry over to the rest of the commodity complex.

Don’t trust the banks. Buy gold.

LinkedIn/Stephen Leeb/3-23-2022

“Do not trust the paper price being quoted for commodities. Evidence of resource scarcities is pervasive and can be seen on a chart of nearly any commodity. The commodity indexes I pay most attention to are spot indexes that report on actual prices paid by end-users. These are a better guide to what is going on than paper and future prices, which are subject to speculation and even manipulation.”

USAGOLD note: Leeb ends by saying that the best thing you can do for yourself right now is to buy protection and that means investing in gold and silver.

Gold and the CRB Index

(One year)

Chart courtesy of TradingEconomics.com

‘Aberrative silliness’

ZeroHedge/Tyler Durden/3-22-2022

USAGOLD note: One is reminded of the recent NetFlix movie phenom Don’t Look Up …… If one does not acknowledge the comet hurtling toward Earth, one’s peace and tranquility will not be disturbed. Sometimes, though, a little properly channeled anxiety is a good thing.

The bubble in gold and silver is about to begin

Munknee/Lorimar Wilson/3-18-2022

USAGOLD note: Wilson goes on to say that the World Economic Forum is calling for an asset bubble burst sometime between 2023 and 2025. “This,” he says, “means that the sky is the limit for gold and silver” with the risk that we head lower first. We recommend the link at the top for the full rationale.

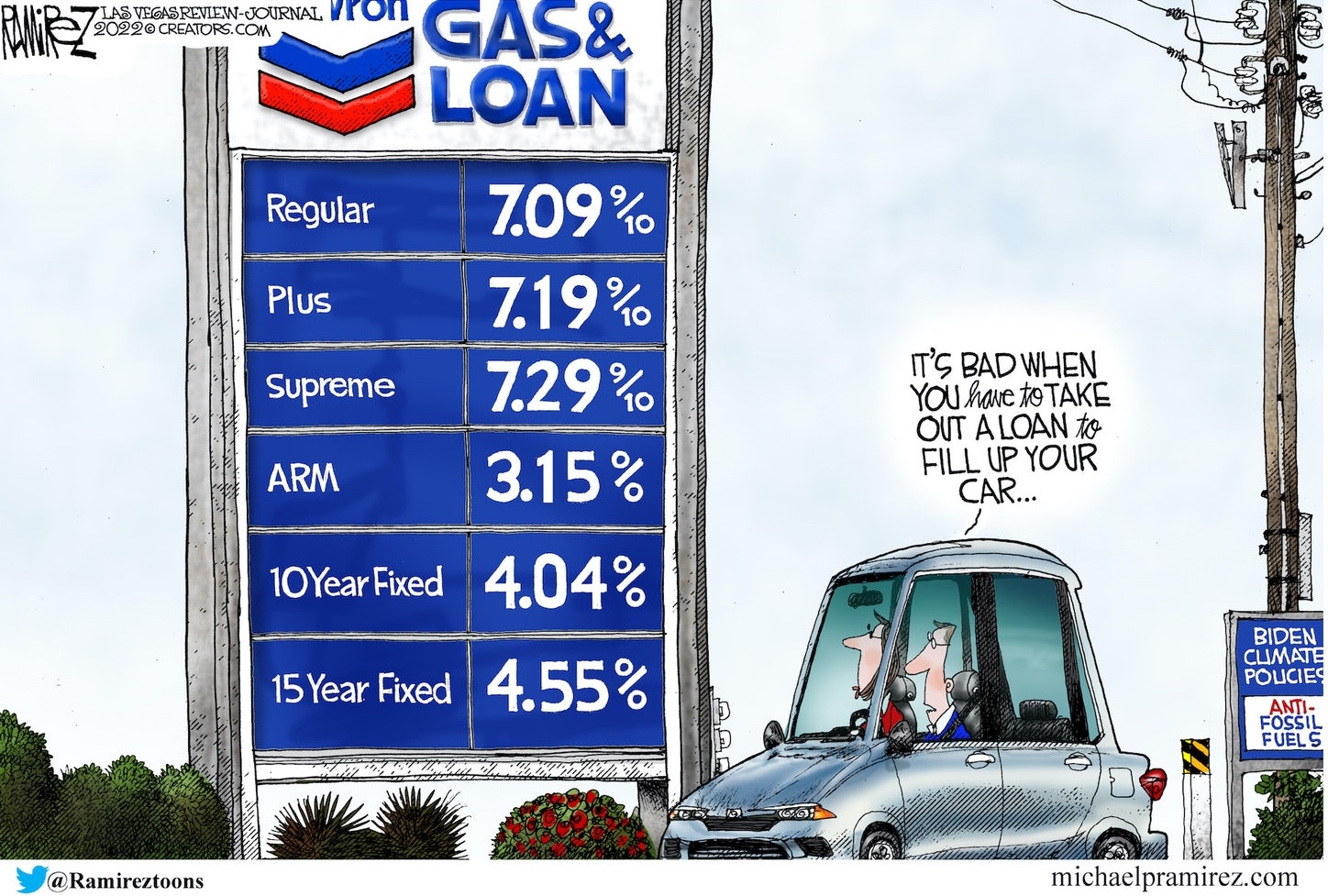

Markets are pushing Fed into developing economy territory

Bloomberg/Mohamed El-Erian/3-22-2022

USAGOLD note: The problem reduces to a Hobson’s choice: prolonged inflation or recession. We could end up with a combination of the two. None of this is new. El-Erian, though, does add something new to the mix – comparing Fed policy to that of a troubled emerging nation-state. The Fed he says might end up hoping for an “immaculate recovery.” Does not sound like the rational approach to the markets and economy central bankers so pride themselves in ……

Gold pushes higher on Russia’s announcement of ‘no breakthrough’ on ceasefire

Franklin Templeton says gold outperforming other ‘perceived safe-haven assets’

(USAGOLD –3/30/2022) – Gold pushed higher this morning as Russia announced “no breakthrough” in ceasefire talks and markets nervously awaited tomorrow’s PCE Inflation Index number. It is up $10 at $1932. Silver is up 20¢ at $25.05. A weaker dollar, particularly against the Japanese yen, is offering an assist in early US trading. Franklin Templeton research analyst Steve Land sees strong safe-haven gold coin and bullion demand as a key factor in assessing the metal’s future prospects.

“Gold has outperformed other perceived haven assets in February and March,” he says in a report posted yesterday at Seeking Alpha, “including US Treasuries (as heightened inflation diminished the appeal of bonds), the Japanese yen and the Swiss franc.…[P]remiums above spot prices have increased in several markets, reflecting a shortage of available physical supply relative to the demand. Gold has been performing well, but we still see a number of potential drivers that could move the metal even higher. In our view, gold may benefit from additional bouts of elevated market volatility and lingering concerns over the coronavirus’s economic impact. The Russia-Ukraine war has added further uncertainty to the global economy. A classic feature of gold is its very low correlation with other asset classes, supporting increased interest in owning it as a portfolio diversification tool in volatile markets.”

Gold price in Japanese yen, Swiss franc and US dollar

(One year, % gain)

Chart courtesy of TradingView.com

Editor’s note: Premiums in the silver market reflect an even greater imbalance between physical supply and demand than what we are seeing in gold. The chart illustrates gold’s largely overlooked performance against the three so-called safe haven currencies over the past 12 months – the US dollar (green), Japanese yen (red) and Swiss franc (black).

Washington’s ‘trigger-happy’ sanctions may push countries away from the dollar, says think tank

USAGOLD note: The Institute for the Analysis of Global Security joins a growing list of skeptics on the advisability and effectiveness of “sanctions and other economic punishments. One might suspect a further boost to the already growing market for gold among central banks and governments.

Don’t expect the war in Ukraine to end quickly

Financial Times/Gideon Rachman/3-21-2022

“‘Tell me how this ends?’ is one of those things that people say in films — and sometimes also in real life. It is the crucial question about the war in Ukraine — but one that is sometimes obscured by the sheer drama and horror of day-to-day events.”

USAGOLD note: Nobody, including Putin, believed that the war in Ukraine might become a Russian quagmire, but quagmire it is. Rachman raises issues that most of us would rather ignore. The tide of events, he suggests, might offer a different end game, but ultimately expect the worst – a prolonged war.

Stagflation is raising the risk of ‘lost decade’ for 60/40 portfolio of stocks and bonds, Goldman Sachs says

MarketWatch/Vivien Lou Chen/3-18-2022

“Rising stagflation risks in the U.S. and Europe are raising the possibility of a ‘lost decade’ for the 60/40 portfolio mix of stocks and bonds, historically seen as a reliable investing choice for those with moderate risk appetites. Such a ‘lost decade’ is defined as an extended period of poor real returns, says Goldman Sachs Group Inc.”

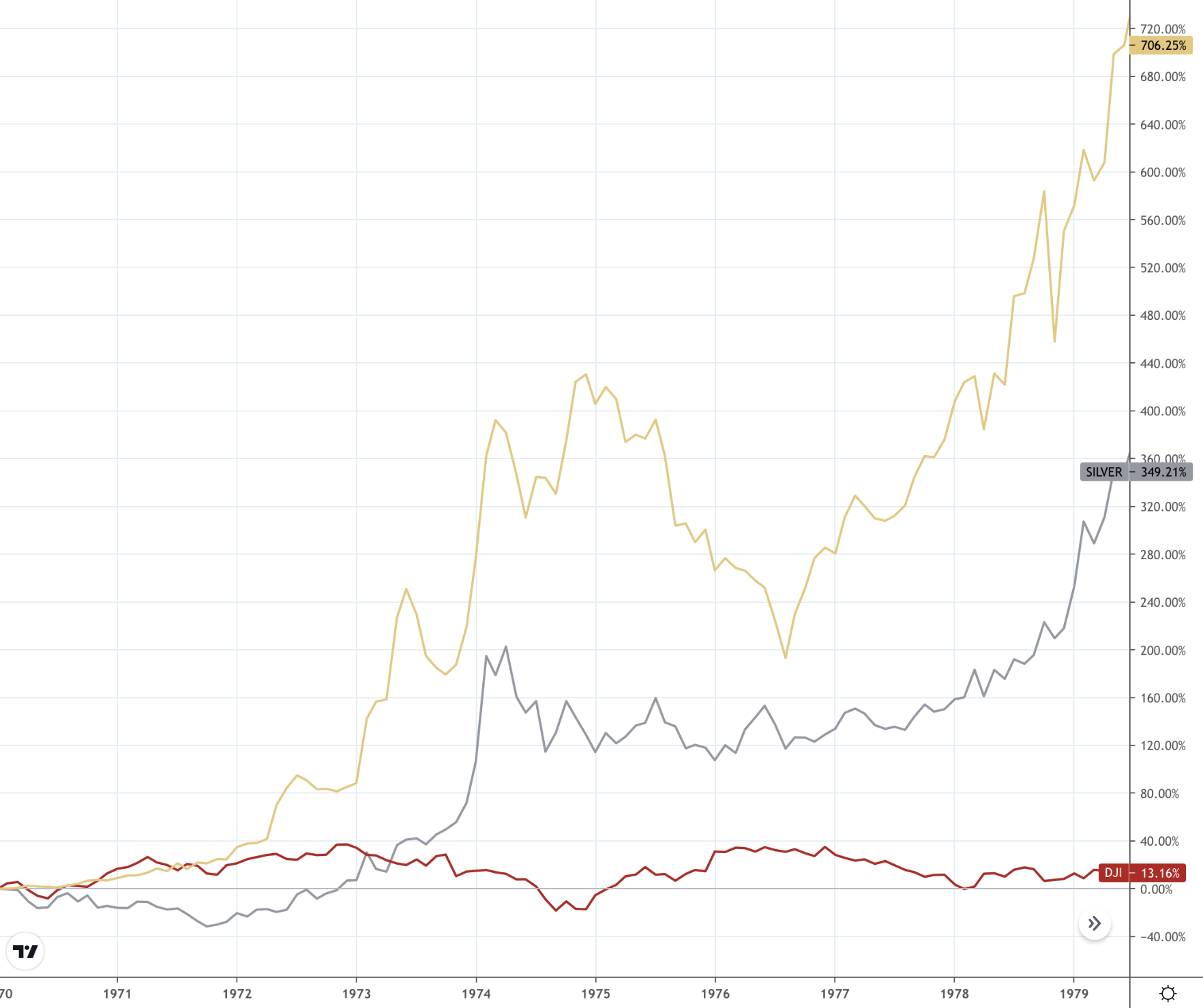

USAGOLD note: While stocks languished during the stagflationary 1970s rising about 13%, gold went on a tear rising over 700%.

Gold, silver and stocks during the stagflationary 1970s

Chart courtesy of TradingView.com

The world’s biggest commodities markets are starting to seize up

Bloomberg/Mark Burton and Alex Longley/3-18-2022

“It’s getting harder to deal in some of the world’s most important commodities as everything from geopolitical turmoil to exchange snafus prompt traders to rush for the exits, rapidly draining liquidity.”

USAGOLD note: For all the traders out there who wanted to see more volatility in financial markets in order to enhance trading opportunities, you got what you wished for. The question becomes whether or not the exchanges remain stable enough to reward the winners and punish the losers – equitably and fairly.

Gold continues to lose ground as ceasefire talks resume in Istanbul

‘The stars are aligning for gold,’ says Rickards

(USAGOLD – 3/29/2022) – Gold continued to lose ground in early trading following yesterday’s stiff, nearly $35 selloff as ongoing talks in Istanbul between Ukraine and Russia raised hopes of a ceasefire. It is down another $12 this morning at $1912. Silver is down 34¢ at $24.57. As we near Thursday’s all-important PCE Price Index release, inflation continues to be the primary concern in financial markets despite media focus on the Ukraine war. Expectations are that it will post a 0.8% increase for February – well over January’s 0.6% increase and approaching double-digits annualized. The dollar and bond market are both sharply lower this morning.

“The stars are aligning for gold,” writes James Rickards in a recent analysis at Daily Reckoning. “A combination of geopolitical tumult, supply chain problems and inflation all point to much higher gold prices. If you believe that the war in Ukraine will end soon, that global supply chains will heal quickly and that inflation is transitory, then you’re probably in for a rude awakening. In fact, none of those things is likely. Even if the shooting stops in Ukraine soon, something that is not at all assured, the geopolitical consequences will dominate events for years or decades.”

Russia no longer demanding Ukraine be ‘denazified’ in ceasefire talks

Financial Times/Max Seddon, Roman Olearchyk and Heny Foy/3-28-2022

“Russia is no longer requesting Ukraine be ‘denazified and is prepared to let Kyiv join the EU if it remains military non-aligned as part of ongoing ceasefire negotiations, according to four people briefed on the discussions.”

USAGOLD note: Russia’s position softening is most likely what’s behind today’s decline in gold and silver prices.

What traders think of U.S. led efforts to block gold transactions by Russia’s central bank

MarketWatch/MyraSaefong/3-24-2022

USAGOLD note: What Lundin says is logical. He adds that such liquidations would “create significant turmoil in the gold market since the [Federal Reserve] has demonstrated difficulty in actually finding and transporting the gold held for other nations.” In short, any gold the Fed cannot deliver would have to be sourced in the open market exacerbating an already tight physical supply situation. We would add that the bullion banks storing gold at the Bank of England will be similarly affected

Legendary investor Bill Gross warns the Fed will ‘crack the economy’ by hiking interest rates aggressively

MarketsInsider/Harry Robertson/3-21-2022

USAGOLD note: Gross joins the group of analysts who believes there are limits as to how aggressive the Fed can get under the current circumstances.