Gold struggles to attract investors as interest rates rise (?)

Financial Times/Chris Flood/1-8-2022

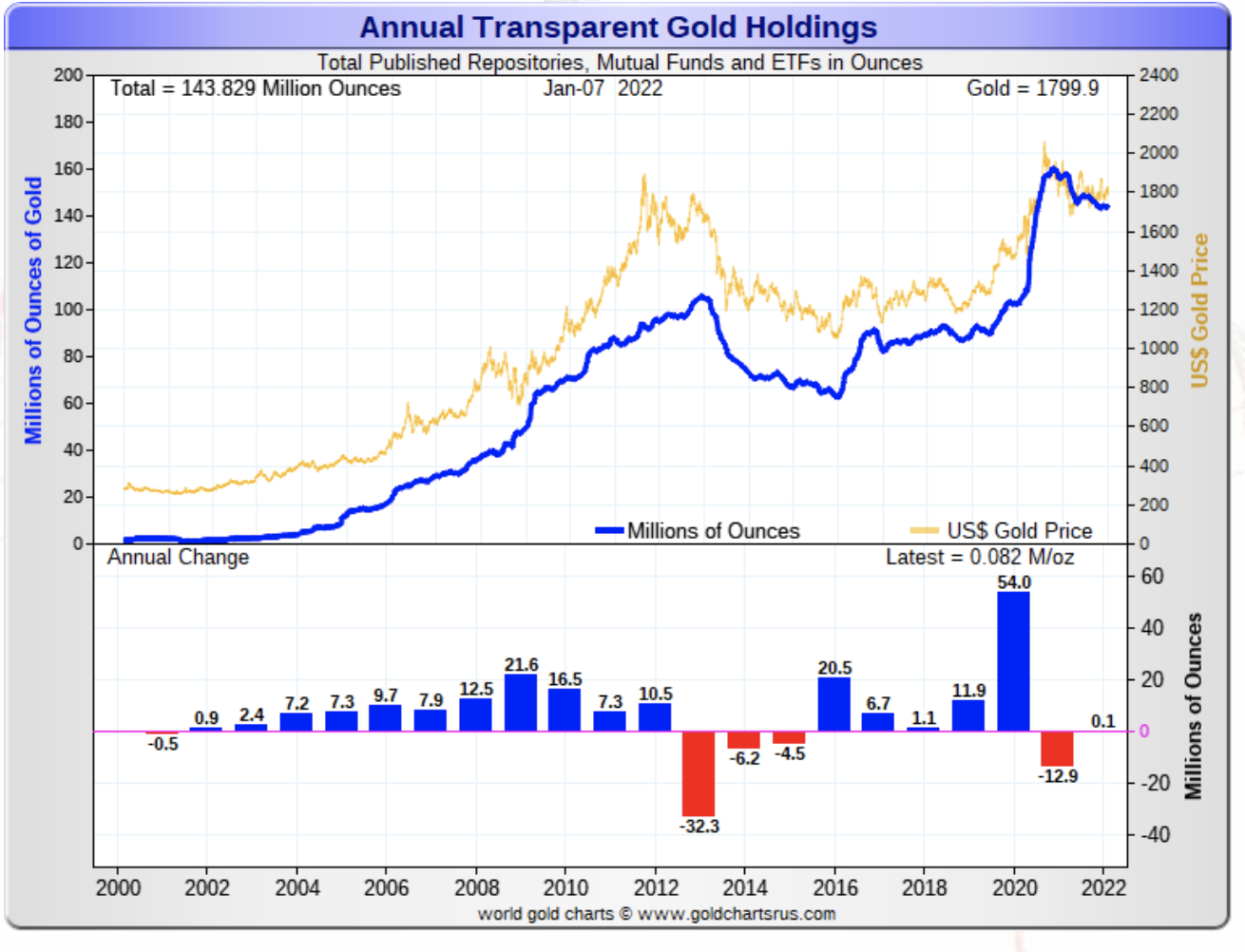

“Gold exchange traded funds were hit by net outflows of $9bn last year in a retreat that could herald a significant decline in investor appetite for the precious metal in 2022.”

USAGOLD note: This article tells only part of the story on gold ETFs and leaves out a few very important details. For one, withdrawals amounting to 9 billion from a nearly $260 billion pool is not particularly “heavy,” as indicated in Financial Times’ subhead. Secondly, the outflows come after one of the biggest years on record in 2020 for inflows – right at $54 billion – and, as such, probably justified. Third, the hedge funds and other institutions – the group that dominates gold ETF trading – are on the sidelines. They have not been aggressive buyers over the last 12 months but they haven’t been aggressive sellers either. Some would read that as a positive indicator given gold’s sideways to down year in 2021.