Monthly Archives: August 2021

The looming stagflationary debt crisis

Project Syndicate/Noriel Roubini

Repost from 7-9-2021

“In April, I warned that today’s extremely loose monetary and fiscal policies, when combined with a number of negative supply shocks, could result in 1970s-style stagflation (high inflation alongside a recession). In fact, the risk today is even bigger than it was then…At some point, this boom will culminate in a Minsky moment (a sudden loss of confidence), and tighter monetary policies will trigger a bust and crash.”

USAGOLD note: Dr. Doom, as he is known on Wall Street, sees symptoms of a breakdown already in motion wherever he looks. He goes so far in this analysis to say that in the end we will get a melding of the 2008 debt crisis and the 1970s stagflation – pretty much a banana republic-style breakdown.

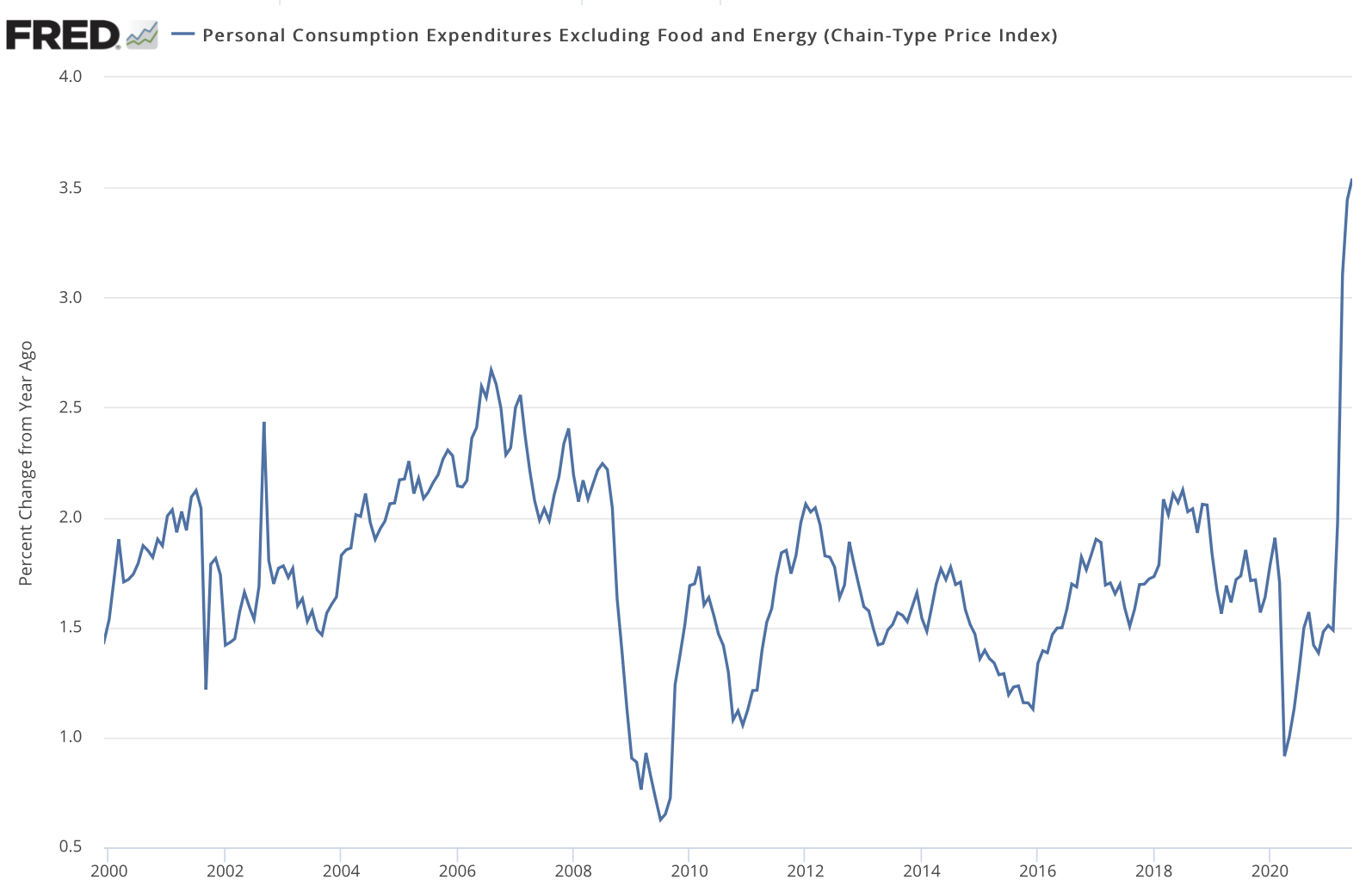

Key inflation indicator up 3.5% year over year in June for fastest gain since 1991

Repost from 8-2-2021

“An inflation indicator that the Federal Reserve uses as its key guide rose 3.5% in June, a sharp acceleration that was nonetheless right around Wall Street expectations, the Commerce Department reported Friday.”

USAGOLD note: The PCE Index including food and energy was up 3.9%. With the typical one-year certificate of deposit drawing 0.6% (at best), the dive into negative real rates of return is accelerating quickly.

Sources: St. Louis Federal Reserve, U.S. Bureau of Economic Analysis

China’s net gold imports via Hong Kong rebound in June

Repost from 7-28-2021