Short and Sweet

Of wheelbarrows and runaway inflation

As Crescat Capital’s Kevin Smith and Tavi Costa point out in a client alert, the U.S. government issued $4.4 trillion of debt in fiscal year 2020, and $2.4 trillion, or 54%, was purchased by the Federal Reserve. They believe that $300 billion per month in quantitative easing will be needed to cover the upcoming tab as opposed to the current $120 billion per month. “Global central bank money printing is one of the primary drivers of the gold price,” they say. “Our current valuation target for gold based on the level of central bank assets and the inelastic supply of above-ground gold is $3,200/oz. Note, this is a rising target.”

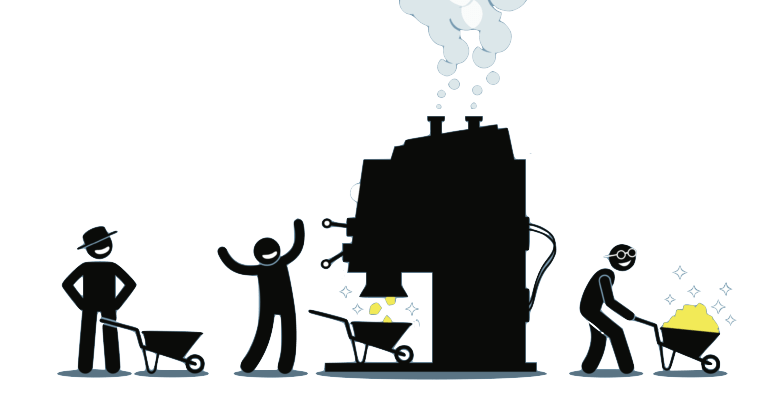

“Really smart investors,” says Morning Porridge’s Bill Blain, the London-based commentator, “are increasingly hedging their wealth created from financial assets (stocks and shares) by putting much of their allocations into Alternatives: outright real assets or cash flow driven assets, assets that are likely to retain value while still paying attractive returns. (The cost is lower liquidity). The idea is that if crisis ever comes, then owning the wheelbarrow might be better than owning the mountains of worthless cash it’s carrying (to cite the classic example of inflationary danger from Weimar Germany…)” If runaway inflation truly does materialize, a wheelbarrow full of gold and silver might be an even better option ……

Looking to load up your wheelbarrow?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973