Short and Sweet

‘I expect a true crash to take a decade of stock market gains.’

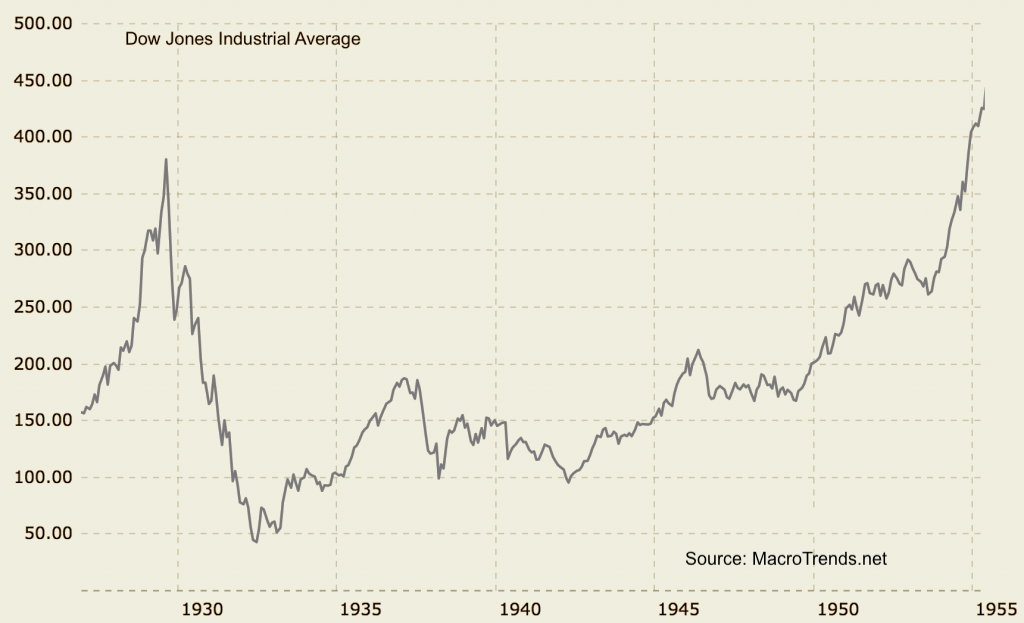

“‘If the pandemic doesn’t pop this bubble then, of course, it will be something else that eventually accomplishes this,’ says [Universa Investments’ Mark Spitznagel in a MarketWatch report], “reiterating his long-held belief that easy-money central banks and the bubble they continue to pump will eventually lead to a major global reversal. How bad could it get when it really goes sideways? ‘I expect a true crash to take back a decade [worth of stock-market gains],’ he told The Wall Street Journal last month.'” Spitznagel is a protege of Nicholas Taleb of The Black Swan fame. Some would consider his prediction going overboard. We should keep in mind, though, that from 1929 to 1933 the stock market lost almost 90% of its value. It did not return to its 1929 highs until 1955 – 26 years later. In short, what he is suggesting is not without historical precedent.

Chart courtesy of MacroTrends.net

Are you looking to solidify your hard-earned wealth for the long run?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7