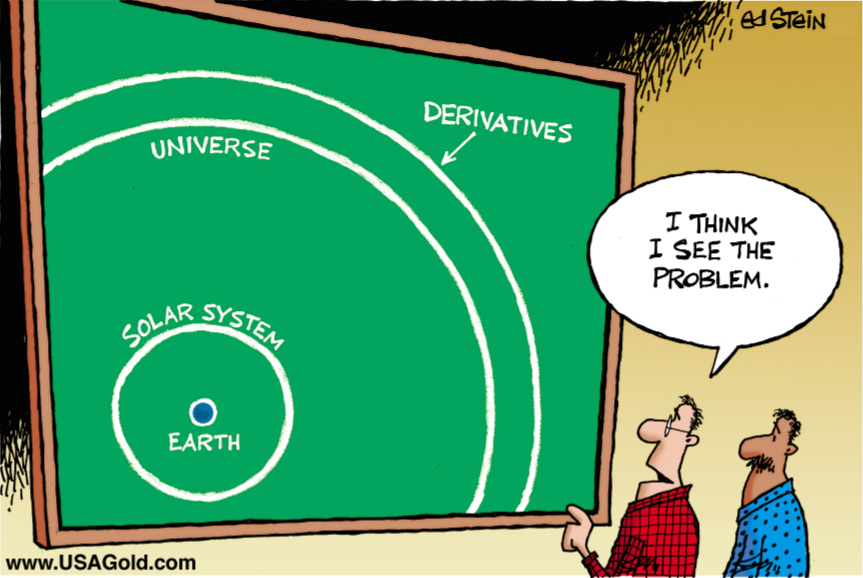

The risk of derivatives isn’t gone. It’s merely morphed.

“In the 10 years since Lehman’s failure, policymakers eagerly have pointed to initiatives that, they believe, made the financial system safer and a repeat of 2008 unlikely. That view is Panglossian.”

USAGOLD note: With attention focused on the trade wars, shrinking credit spreads, and the potential for a new emerging country debt crisis, the elephant in the room – the highly-leveraged, multi-trillion dollar derivative market – has been pushed discreetly into the closet. A Norwegian trader’s $132.6 million loss trading energy futures last week, though small potatoes in the world of derivatives, issued a warning how suddenly things can go wrong. This Bloomberg opinion piece tells why current safeguards are likely to fall short in the event of a larger and more widespread meltdown.

Repost from 9-6-2019