|

ORDER DESK Great prices. Quick delivery. All the time. Prefer e-mail to get started?

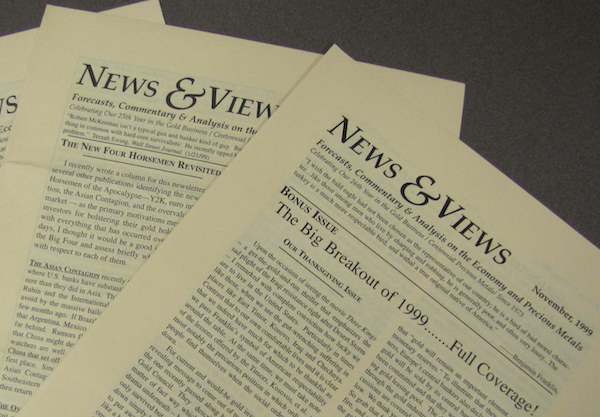

News & Views is the contemporary, web-based version of our client letter which traces its beginnings to the early 1990s as a hard-copy newsletter mailed to our clientele. The "Big Breakout of 1999" headlined in the November, 1999 issue of our newsletter moved the gold price from $250 to $325 per ounce. It was a major event. The times have changed, but our mission has not. Simply put, it is to deliver value to our readers in the form of cutting-edge Forecasts, Commentary and Analysis on the Economy and Precious Metals. The very same mission that has been displayed in our banner for over twenty-five years. |

November, 2013 |

|||||

|

How to prepare your portfolio Editor's Note: In this wide-ranging interview conducted by Peak Prosperity's Chris Martenson, currency expert and author James Rickards offers much clarity and some welcome grounding in what has become a very confusing and unpredictable market environment. Fed policymakers, he says, "think they are dialing a thermostat up and down, but they're actually playing with a nuclear reactor -- and they could melt the whole thing down." Rickards speculates on gold's role in the coming global realignment and the price levels necessary to restore lost confidence in the financial system. MK Chris Martenson: Welcome to this Peak Prosperity Podcast. I am your host, Chris Martenson. Now, let us be clear about something. We are living in the most unusual economic and financial circumstances of all time, in my opinion. Perhaps we have even become accustomed to them. Our baselines have shifted, and we have begun maybe to believe that it is normal for central banks to intervene in all markets at all times. Maybe we even believe they have everything under control. To help us keep our bearings and provide essential perspective necessary to keep a level head during tilted times, today we are speaking with Jim Rickards, seasoned financer, risk manager, and author of the recent bestseller, "Currency Wars," as well as the upcoming book, "The Death of Money, The Coming Collapse of the International Monetary System," scheduled to be published early 2014. Jim is best known for his expertise in describing how currency wars are one of the most destructive and feared outcomes in international economics, and that history shows that they always end badly. He warns that today we are engaged in a new currency war posing risks that every prudent individual and maybe nation should be aware of. Recent central bank actions from the U.S. to Japan have shown that the "race to the base" has entered high gear. Now I have invited Jim here to help us understand what is most likely to come next and provide that essential context. Jim -- hey, welcome! It is a real pleasure to have you back. Jim Rickards: Thank you, Chris. Chris Martenson: Now, earlier this month, you went on record predicting the Fed would not taper. Well, congratulations! You just earned some major prognosticating credit. What was your rationale behind that call? Jim Rickards: You know, Chris, it was actually very straightforward. I mean, going back to May, when Ben Bernanke first raised the issue of tapering, of course, there were speculations about it all summer. But if you listened to what Bernanke said -- and they said this many times, other governors, the Federal Reserve Bank president said -- if the economy performs in accordance with our forecast, we are going to taper, we know it is reduced asset purchases. They actually raised it the other way around. They said we are going to reduce asset purchases if the economy performs in accordance with our forecast. Well, the market is focused on the first part, that they were going to reduce asset purchases, but ignored the conditionality, ignored the second part, which is if the economy performs. They always said it was data dependent. And they put out a forecast. Now, a couple of things. The Fed has the worst forecasting record in economics. If you go back, every year they produce an economic forecast that is one year forward. So in 2009, they projected 2010; in 2010, they projected 2011, and so on. If you go back and look at those forecasts for the last four years, they were all wrong. They were not only wrong, but they were wrong by orders of magnitude, meaning the Fed was predicting 3% growth when it came in at 1.5%. And they were predicting 3.5% percent growth and it came in at 2%. They were always wrong. So the first thing about Fed forecast is, you should assume it is wrong, and it always is. And then if you looked at the actual data, it was coming in lousy. The August employment report was way below expectations, consumer confidence collapse, mortgage applications collapse, etc. And so all I did was take the Fed at their word. They said if the data is bad, we are not going to taper. And the data was bad. So I said they are not going to taper, and I said it repeatedly. I said it in interviews on Twitter, and speeches, etc. I did not think it was that difficult. I did not think I was going out on a limb. Now, everyone else, or almost everyone else, was surprised. And they all woke up Thursday morning and they were doing these posts and wanted to know gee, how could we be wrong? The Fed fooled us. And my answer is, you were not fooled by the Fed. You fooled yourself because it was a lot of wishful thinking. And it was a lot of sense that oh, I go back to the green shoots. The economy is getting better, etc. So I just took the Fed at their word. They said if the data was bad they were not going to taper. The data was bad. So to me, it was an easy call. Chris Martenson: It is interesting. I am reading a lot of other headlines that suggest the economy is getting stronger. We just heard about record auto sales -- back to pre-slump levels, at any rate. The housing marketing and existing home sales are way up. Of course, that might be institutional buyers, at least emboldened if not enriched in part by all of that Fed money sloshing out there. Do you think if the data did come in worse that we might see the opposite? The Fed would un-taper, in fact, increase their asset purchases – is that in the cards? Jim Rickards: Well, one of the things I said about the tapering decision, I said that they were not going to taper, but it was a close call. You have to admit that the Board of Governors was divided, and President Bullard of the St. Louis Fed said today it was a very close call. So I think that is fair. But I also said if they did taper -- I did not think they would; but if they did taper – I projected they would reserve course and increase asset purchases by the middle of next year. And that is still on the table. And by the way, the Fed has said that. This is not guesswork. See, Chris, this is the difference between QE3 and QE2. The mistake that the Fed made in QE2, they put a specific dollar amount, a specific time limit on it. They announced it in September of 2010. They launched it in November 2010. And they said by June 2011, we are going to purchase $600 billion worth of intermediate-term Treasury securities. The problem was, the minute you announce an amount and a date, which they did, the market immediately discounts it. In a stock market rally in September and October of 2010, based on the announcement effect alone, the problem was the market says well, fine. It is over in June. What else have you got? In other words, by putting a time limit and a dollar amount limit on it, they got the top up front. But then the market immediately said what comes next? And they did not have a next. So they did Operation Twist.

But sure, we could head into a recession early 2014. And if we do, they might actually increase asset purchases. So you cannot rule that out. But I just take it one month at time. I've got to take the Fed at their word. They said it depends on the data. So just look at the data and draw some logical conclusions. Chris Martenson: Well, Jim, how extraordinary is this circumstance? I mean, let's take one-step back. I look at this and I see that the Fed is now not even really providing guidance anymore because their guidance is it depends if the data goes up or down. They are going to be in a reactive mode, which is hardly good verbal guidance. And they are not providing any concrete guidance in any way, shape, or form. They did set a couple of targets. Maybe it was 6.5% unemployment. Maybe it was 2% inflation. But Bernanke has been providing some nebulous wiggle room around those as well. How extraordinary is this to be printing $85 billion a month with basically no guidance on how long it might continue? Jim Rickards: It is more than extraordinary, Chris. It is a very good question. It is actually impressive. There has never been anything like this. You go back to the Great Depression, and scholars including Ben Bernanke have studied that very closely, and they said that the problem was we went into -- we had a business cycle. We had a bubble. It burst in 1929. There was deflation. There was depression. And the Fed blundered. The Fed kept money too tight in 1927-1928, and that caused the Great Depression. And they did not loosen up fast enough. So they are like generals fighting the last war. They said A-ha! We figured out the Great Depression. The Feds should have printed money! So now come all the way forward to 2008-2009. They said, We are not going to make that mistake twice. We are going to print lots and lots of money. But it never occurred to them that they were making a new mistake. In other words, who says that printing money was the answer in 1933? Maybe it was; maybe it was not. Actually, there were other things going on. There was what is called 'regime uncertainty,' which is, business people did not know what the investment climate was going to be like and they kind of went to the sidelines. And that is what I see happening now.

The reason the economy is not moving is because on the consumer side you have still got the leveraging going on. And then you can drive an economy with investment. But if you were going to commit, say – let us say you were going to commit $5 billion of capital to a ten-year infrastructure structure project, and that was your job inside of some major corporation. And you had to figure that out. Well, what are you healthcare costs going to be? What are your taxes going to be? What is the environmental regulation going to be? You have no idea. And so businesses are just saying Look, I will move to the sidelines; hang on to my cash. Maybe I will invest in India or Malaysia or someplace. I am not going to invest in the United States because I do not know what the deal is. Well, that is continuing, because of gridlock, because the Republicans and Democrats do not want to work together, because the White House is sort of taking this "my way or the highway" approach. You just do not know. Today we have an announcement from the EPA that they are using unprecedented regulatory powers to impose greenhouse gas emissions limitations on new power plants. Now, you do not have to get into that debate, or at least I do not. I mean, I do not want to argue whether that is a good idea or a bad idea. I am just making a point that when you wake up in the morning, there is a massive new regulation, and you do not know what is coming next. As a businessperson, you do not want to invest in that environment. So consumption is de-leveraging. Investment is flat to down because no one knows what the deal is. Government spending is being cut because of the sequester. So none of the components of GDP is really contributing, with the possible exception of exports, which is where the currency war has come in. So we are like a four-cylinder car that is not firing on three cylinders, maybe all four. So it is not surprising we are in this kind of malaise. I would expect it to continue. We have structural problems. The Fed is trying to address it with cyclical solutions, meaning liquidity solutions. But you cannot solve a structural problem with a liquidity solution. You need a structural solution. I do not see any on the table. So I would expect we are just going to chug along with this kind of 1%-1.5% growth as far as the eye can see. Chris Martenson: Now, hang on, here. We are talking about high government deficits, stubborn unemployments, low interest rates, ultra-low interest rates, and low growth. This sounds a lot like Japan. I thought that Bernanke had a solution for us not to turn into Japan.

The model now is, we look like Japan. For example, in 2008, what should have happened is the major bank should have been shut down. It should have been nationalized by the government, stockholders wiped out, management fired, and some of them put in jail. Bondholders should have taken a haircut. The government should have stripped out the bad assets, put them in some kind of trust for the American people, sell them gradually over 20 years, and then take what is left, which would be a clean bank with new management and a new balance sheet, IPO because you do not want the government going into the banks forever. You just want do this temporary solution. IPO it and put some clean banks out there that can make some loans. Instead, what did we do? We preserved them. We preserved the bad assets. We preserved the bad management. We propped them up. We gave them subsidies in the form of zero interest rate policy, etc. We did exactly what Japan did, which was, we did not confront the problem. There was cronyism, alienism, the government taking care of their buddies in the private sector, etc. So we did not clean up the messes. So we should not expect a different result. We should expect the same result, which is a decade or more of low growth. I mean, look at every year since 2008. In 2009, people talked about green shoots. In 2010, Secretary Geithner talked about the 'recovery summer.' In 2011, the economists were projecting stronger growth in the second half; same thing in 2012. They were wrong every single time. Well, the reason they are wrong is because they are using the wrong model. They are assuming this is a normal cyclical recovery where you go down, and then you cut rates, and then you go back up again. That is not what we have. We are in a depression. And we are going to stay in a depression until there are structural changes. But I do not see any on the horizon. So I would just say we are in a depression as far as the eye can see. By the way, people keep saying, when is this recovery going to take off and get a little more robust? And when is growth going to go up to 3.5%? We could actually have a recession in 2014. I mean I have got news for people: This recovery is four years old. The average recovery is about 55-56 months. And this one is – we are 48 months into it. So we might very well have a recession next year. Chris Martenson: As we wait for our mythical third-half recovery to come along, I am noting that we have equities at all-time highs, not just in the U.S. but across the globe. The German DAX is at all-time highs. We have got bonds priced to perfection. Both of those seem inconsistent with the idea that we might be long in the tooth in this particular recovery or that there might be a recession on the horizon. To me, it feels bubblicious. I am looking at price/earnings ratios on some of the headline equities out there that are back to 1999 levels. It feels priced to perfection. But as you mentioned that the data is anything but perfect at this moment in time, where do you see this going? Jim Rickards: I think stocks will continue to grow. I agree, it is a bubble. But the thing you have to remember about bubbles is they can go on for a long time. Just because you can step back and see it is a bubble does not mean it will not get more bubbly, so to speak. So I think stocks will continue to rally on Fed money printing. It will crash at some point, but it does not mean tomorrow. It does not mean next month. So I think stocks will do well through the end of the year, particularly because of the no-tapering decision. I would not invest in them, but a lot of people are. And I think they will grow higher before they crash. The bond market is a different story, because everyone says the bond market is priced to perfection. It has got nowhere to go but down. But people do not really pay attention to the difference between nominal rates and real rates. I agree that nominal rates are close to all-time lows. But real rates are actually still high. You go back to 1980, for example. We had 13% bond rates, but inflation was 15%, meaning the real rate was negative 200 basis points. That is cheap. In other words, that is really monetarily easy to say, Gee, how can you have that with 13% interest rates? So the answer is, inflation was 15%. Now today, the ten-year note is kind of around 2.7% or thereabouts, and inflation is only 1%. So we have positive real rates of 175 basis points, which is very steep. So I think rates are very high. Nominal rates are low, but real rates are high. And that is where the action is. I could see the ten-year note going all the way down to 80 basis points, which is where it is in Japan. That would be one of the greatest bond market rallies in history. So this is what Bill Gross and others are saying, which is, they are seeing deflation. They are seeing the Fed's efforts to create negative real rates. And bond rates could actually come down in nominal space because they are really quite high in real space. Chris Martenson: Well, that leaves the equity market sort of hanging out over a cliff at this point in time. And so I want to turn our attention now to what all of this impact might be on the emerging markets. We have certainly seen the Fed, the ECB, Bank of Japan. This liquidity has come out. It is sloshing around. We have the usual dynamic hot money that needs somewhere to go. The carry trade is just alive and well. And this can be extraordinarily disruptive for the thinner, more peripheral markets. I understand you have had a recent experience of going to the periphery and having some interesting talks there. I wonder if you could give us your take on the dynamic of all this money printing on the rest of the world. Jim Rickards: Sure. I spent a couple of weeks in South Africa two weeks ago. And I am actually heading out to Eastern Europe. I will be in Warsaw, Vienna, and Bratislava next week. So I am spending quite a bit of time in emerging markets. And they just feel thoroughly abused at this point. The Fed is trying to wash its hands of emerging markets. The Fed has said, and I say the same; I mean, Bernanke himself and other Federal Reserve Bank presidents and members of the Board of Governors have said, Look, our job is to run the U.S. economy. And you emerging markets, you are kind of on your own. You have got your own central banks. You figure out monetary policy. Well, it is not that easy. The dollar is the leading reserve currency. Most of these countries maintain a large portion of their reserves in dollars. Dollar capital markets are the largest in the world. These dollar hot-money inflows race in and race out. South Africa, the currency went from eight to the dollar almost to eleven to the dollar in a matter of months, and now it is heading back down again. The rand is getting stronger because of the tapering decision. So it is highly disruptive and almost begging these countries to put on capital controls. I mean, what are they supposed to do -- raise interest rates to defend their currencies when unemployment is high? That does not really make sense. But they sort of have no choice because of what the Fed is doing. So I think the Fed is risking creating a crisis in emerging markets, sort of a replay of what happened in 1997 with Thailand. I do not think they understand it. I do not think they understand the interconnectedness, and the vulnerability, and the critical state and nature of the global monetary system. And they think they are dialing a thermostat up and down, but they are actually playing with a nuclear reactor. And they could melt the whole thing down. So it is an extremely dangerous state of affairs. But I do have a lot of sympathy with the emerging markets. They are trying to do the right thing. But we do not have a gold standard. We do not have a dollar standard. We do not have fixed exchange rates. We have got floating exchange rates that are being manipulated by the Fed. So I do not think you can blame the emerging markets for feeling they are victims at this point, because it is risk on/risk off, money in/money out, every other day it seems. And you are right. When it looked like the Fed was going to taper, interest rates were going higher. People were unwinding the carry trade. They borrowed dollars. So you are effectively short the dollar. They convert to these emerging market currencies. They plunge into these stock and bond markets in places like India, South Africa, Indonesia, Thailand, and elsewhere. They make a nice spread. They leverage the trade and make a lot of money. The minute you think interest rates are going to go up, you want to unwind the trade. So they dump the emerging markets assets, dump the emerging markets currencies, pay back their dollar loans, and unwind the carry trade. And then these places are in shock. And then all of the sudden the Fed does not taper. It is like oh, put the trade back on again. Here we come. I just think it is hard to blame the emerging markets when they are really just on the receiving end of Fed dollar and currency and interest-rate manipulation. And I do think the Fed is risking some kind of a global meltdown because they do not understand that dynamic. Chris Martenson: Well the Fed is -- I believe I am not even paraphrasing much -- but they basically said, emerging markets are on their own. Just washing their hands, saying oh, you guys have your policies; we have ours. But it is not that simple, is it? Jim Rickards: Not at all. I mean, that ignores the extent to which the dollar is not just our currency. It is a global reserve currency to the extent to which -- and by the way, these capital markets are not that big. You look at the size of them relative to capital flows and dollars, and they are tiny. Even a big country like Australia -- an important country, but those capital markets are small relative to what we are accustomed to in the U.S. and even in Europe. And so when investors decide they want in, this is a flood of money. And I do think some of these countries may have to get a little more creative. I have been in Korea and Australia. I recently met with government officials in both countries. And I said well, what you want to do? If you want to cheapen your currency, the best way to do that is print money and buy gold. That way you can target an exchange rate and keep the gold instead of buying more dollars and dominated bonds. So no one is doing that, of course. But there are more creative ways. Or just issue bonds in your local currency. If the capital markets want your paper, well, give it to them. But then put the money to good use. Do not waste it, of course, but build infrastructure projects or do things that are going to add economic productivity and prosperity in your country. So there are some creative solutions. But they are not being used. What the central banks are doing is, they are just kind of sucking it up and learning to live with a strong currency, which is good. I mean, that is what Germany and Singapore have done successfully. And I think we are seeing that in Korea. Or in the case of Australia and Brazil, they are joining the currency wars, cutting rates, trying to cheapen their currency even as we are trying to cheapen the dollar. All that does is get you inflation. Actually, Brazil is a very interesting case because in 2011-2012, Brazil fought the currency wars by cutting rates, trying to cheapen their currency at the time when the U.S. was trying to cheapen the dollar. And I said at the time, that is not going to work. All you are going to do is get inflation. And that is exactly what happened. Brazil got the inflation. Now Brazil is having to raise rates to try to cap down the inflation. And the same thing is going to happen in Australia. So some countries are doing it right. I would say Singapore, Korea, and Canada are good examples. Some countries are doing it wrong. I would say Australia; Brazil has kind of changed course recently, but they have got it wrong for a couple years. And other countries are just baffled. Thailand, South Africa, some of these other emerging markets. They are looking for stability and they are not finding it. Chris Martenson: Well, is that not sort of par for the course? In a game of international currency wars, everybody cannot win. And so it sounds like you are describing countries that are trying to find relative advantage in a game that is ultimately zero sum. So the big kid on the block probably has some additional advantages. We have got Japan in the process of doubling its monetary base in two years. We have got the U.S. Fed recommitted to providing liquidity far out into the horizon. Unless the laws of economics have been rewritten, these actions, they have to come to an end sooner or later. So my question is, how does this all end? Will it be self-selected or do you think it might be forced upon everybody by some market event? Jim Rickards: It will end in a collapse of the International Monetary System. And when I say that, that is not really meant to be a provocative statement. The International Monetary System has collapsed three times in the past hundred years. It collapsed in 1914. It collapsed again in 1939. And it collapsed in 1971. So these things do happen. They have not happened recently, but they do have a tendency to happen. And when it happens, it is not the end of the world. It does not mean we all go live in caves and eat canned goods. What it means is that you have to reboot the system. That means the major economic powers have to get together and sit down at a table and rewrite the rules of the game. So I spend a lot of time thinking about what the future of International Monetary System will look like after this collapse. I think that is the most likely outcome. One of the things I have said about currency wars is that we are not always in a currency war, but when we are, they can last for a very long time. They can last for 10 or 15 years. That is what happened in the 1930s, and that is what happened in the 1970s, as I describe in my book. And so, this currency war just started in 2010. And here we are in 2013. A lot of people said about my book, Jim, how did you know that this currency war would be going on in 2013? And I said, Well, first of all, it started in 2010; I think we are going to be talking about it in 2014 and 2015. Currencies wars do not have a logical ending because it is just back and forth and back and forth. And it is actually worse than a zero sum game. It is a negative sum game because you actually destroy wealth and create suboptimal outcomes and inefficiencies by the currency war itself. So it is a disaster state of affairs. I do not expect it to be over anytime soon, because, as I say, countries just keep fighting back and forth. What I do expect to come out of it is inflation first and then finally a collapse. Chris Martenson: And this collapse, what will this look like in your mind – are we going to see this playing out in the bond market, in the actual currency markets?

But the problem, is the Fed printed trillions of dollars without a liquidity crisis. What is going to happen when we do have a liquidity crisis, which I expect in the next couple years where there is a 2008 panic starting again? What are they going to do, print $6 trillion, $9 trillion? There is a limit on what they can do. And so at some point, it is going to get handed over to the IMS, and they are going to have to print SDRs (the special drawing rights). That is the IMS world money. Because none of the central banks have clean balance sheets at this point. They look like hedge funds. And so it really is a loss of confidence. Confidence is the key word. A loss of confidence in paper money, and that confidence is going to have to be restored somehow. And there are really only two ways. One is the SDR, which no one understands. So maybe they can re-liquify the world by printing SDRs and that will create massive inflation, but no one will really understand where it is coming from. And the other way is gold, which would restore confidence. But to have a non-deflationary price of gold, you are looking at $7,000 an ounce, very possibly higher, maybe as high as $9-10,000 an ounce. I know that sounds extreme. But it is really just eighth-grade math, if you look at the money supplies and look at the physical amount of gold. People say you cannot have a gold standard because there is not enough gold. Well, that is not true. There is always enough gold; it is just a question of price. So the theoretical question is, what is a non-deflationary price for gold if you have to go back to a gold standard? And the answer is, it's north of $7,000 and up. So that is the kind of thing that you might see. It is not what any central bank wants. It is not what the elites want. But it is the kind of thing you could get if you had to restore confidence. So that is what the future of the International Monetary System will look like. But right now, the Fed is still behind the wheel, and they are still driving the bus over the cliff. Chris Martenson: As we look across the currency landscape, we note that Kissinger did something quite smart in arranging the petrodollar, meaning that all oil was traded in dollars, effectively. And that held for a long time. And we are seeing early signs that that is unwinding, with China and Russia both starting to navigate towards trading in different currencies, pieces like that. So, as I have been noticing, to connect these dots, a lot of gold has been flowing from West to East. China has been buying a lot. Russia has recently announced, at least officially, that they have got a pretty decent hoard now at the central level. Do you think that this flow of gold from West to East, is that intentional at this point in time on the part of the players in the East? Are people connecting dots in the way you are and looking forward and saying we do not know but eventually this all might be reset around gold? So he who has the gold will be a relative winner in this game? Do you think that is being played out some official level? Jim Rickards: Of course. And this is what we said. If you go back to the first two chapters in Currency Wars, that book came out in 2011. But we described a war game that was conducted by the Pentagon at a top-secret weapon laboratory outside of Washington. And I was one of the designers of that game and one of the participants, and helped to recruit other people who played in that game. And this was in 2009. So it was four years ago. And what we said at the time was that Russia and China would acquire gold and move towards a gold-backed currency, not the ruble or the yuan. There is no way the Russian ruble or the Chinese yuan are anywhere close to being reserve currencies. That is not on the table. But you could have a new currency backed by gold. Or you could have an SDR backed by gold in which the people with the most gold would have the largest clout, if you will, in the new International Monetary System.

Now, I like to remind people that you cannot have a strong national security without a strong currency. And if the Treasury, the Fed, and the White House are undermining the dollar, they are also undermining U.S. National Security. So that is exactly what it going on. But it is a long game. The problem with markets today is that I find everyone has a two-second attention span. Gold goes down 4% one day and everyone is like oh, it is the end of gold or whatever. No, gold is volatile; it will remain volatile. But the long-term trend is much higher because of these forces that we just described. Chris Martenson: So what options then do nations or individuals have really for surviving these currency wars? What advice would you give to somebody who lives in Japan, which is actively debasing its currency, or to the U.S? What do individuals do here? Jim Rickards: Well, the individual should own gold. I recommend 10% gold for the conservative investor and 20% gold for the aggressive investor; not more than that. I mean, you have some people that are 50% in gold or 100% in gold; I do not think that is really smart or necessary. If you have 10% to 20% and gold goes down a little bit, you are not going to get hurt too badly. And if it goes up, as I expect, that is really going to ensure and insulate the rest of your portfolio. So I think you do not have to be helpless. You do not have to be a victim. I think if you have a million dollars, you should have $100,000 in gold. If you have a $100,000, you should have $10,000 in gold. If you have $10,000 dollars, go buy one American Gold Eagle, which is a little more than 10%. But the point is, have some gold, and whatever happens in all these other markets, you will have the insurance you made to protect yourself. Chris Martenson: Thank you so much for your time today, Jim. I am interested in helping people find more of your work so they can follow you. And also, if you could, tell us when they can look forward to your book coming out. Jim Rickards: Sure. Thank you ,Chris. Of course, Currency Wars is still selling very well. So that is available from Amazon. My new book, The Death of Money, the publication date is April 8, 2014. So it is finished, but we are going through the editing process right now. So that will be out on the bookshelves on April 8. And in the meantime, if people are interested, they can follow me on Twitter. My handle is @jamesgrickards, middle initial G, last name, R-I-C-K-A-R-D-S. So just go to @jamesgrickards. And my Twitter feed is open, meaning you do not actually have to join Twitter. You can, of course, and you can join the conversation. But you can just find online @jamesgrickards. And I put out a study, a stream of commentary on Capital Markets and International Monetary System. Chris Martenson: Well, as always, Jim, just brilliant stuff. Thank you so much for your time today. Jim Rickards: Thank you, Chris. __________________

I would like to thank Peak Prosperity's Adam Taggart for his kind permission to reprint this important interview

|

||||

Editor: Michael J. Kosares, founder of USAGOLD and author of The ABCs of Gold Investing - How to Protect and Build Your Wealth With Gold.

Editor: Michael J. Kosares, founder of USAGOLD and author of The ABCs of Gold Investing - How to Protect and Build Your Wealth With Gold. Now, when they got to QE3, they learned from their mistake. QE3 has no end date and no amount. They are buying an amount per month. They spend $85 billion per month. We know that. But they did not say whether they could increase it, decrease it, extend it -- and the answer is, they can. They have kept all those options on the table. So we actually do not know what they are going to do, except to say they have said it is data dependent. So my advice is, just watch the data.

Now, when they got to QE3, they learned from their mistake. QE3 has no end date and no amount. They are buying an amount per month. They spend $85 billion per month. We know that. But they did not say whether they could increase it, decrease it, extend it -- and the answer is, they can. They have kept all those options on the table. So we actually do not know what they are going to do, except to say they have said it is data dependent. So my advice is, just watch the data.

Jim Rickards: It is actually exactly like Japan. It is ironic, because you go back to 2000 – even 2007 – 2008. Public officials -- Bernanke in particular, the Board of Governors in particular – said over and over, We are not going to repeat the mistakes of Japan. Well, guess what, we have repeated every single mistake of Japan. We are Japan. And that is why people saying that forecasting is hard. I like to say forecasting is easy; what is hard is getting the model right. If you get the model right, the forecasting is easy. But most people do not get the model right.

Jim Rickards: It is actually exactly like Japan. It is ironic, because you go back to 2000 – even 2007 – 2008. Public officials -- Bernanke in particular, the Board of Governors in particular – said over and over, We are not going to repeat the mistakes of Japan. Well, guess what, we have repeated every single mistake of Japan. We are Japan. And that is why people saying that forecasting is hard. I like to say forecasting is easy; what is hard is getting the model right. If you get the model right, the forecasting is easy. But most people do not get the model right. Jim Rickards: It will play out in all markets. When I say collapse, it is a loss of confidence in paper money. Take the Fed, for example. The Fed has printed almost $3 trillion since 2007. Now, that is without a liquidity crisis. I mean, we did have a liquidity crisis in 2008. And the first round -- I would say QE1 was a legitimate central-bank response to liquidity crisis. But QE2 and QE3, we will look back over them and we will see them as enormous blunders in one of the greatest failed experiments in economic history.

Jim Rickards: It will play out in all markets. When I say collapse, it is a loss of confidence in paper money. Take the Fed, for example. The Fed has printed almost $3 trillion since 2007. Now, that is without a liquidity crisis. I mean, we did have a liquidity crisis in 2008. And the first round -- I would say QE1 was a legitimate central-bank response to liquidity crisis. But QE2 and QE3, we will look back over them and we will see them as enormous blunders in one of the greatest failed experiments in economic history. We were pretty much laughed at and ridiculed at the time. But since then, Russia has increased its gold reserves by two-thirds. They have gone from about 600 tons to over 1,000 tons. China has increased its gold reserves by a multiple from 1,000 tons to some number; no one knows the exact number, but that is the estimate. The best research I have been able to apply to it says somewhere between three and four thousand tons. So no, there were things that played out exactly as we predicted in 2009. It is all in the book. It was put in front of the Pentagon from a national security perspective.

We were pretty much laughed at and ridiculed at the time. But since then, Russia has increased its gold reserves by two-thirds. They have gone from about 600 tons to over 1,000 tons. China has increased its gold reserves by a multiple from 1,000 tons to some number; no one knows the exact number, but that is the estimate. The best research I have been able to apply to it says somewhere between three and four thousand tons. So no, there were things that played out exactly as we predicted in 2009. It is all in the book. It was put in front of the Pentagon from a national security perspective.