A Gold Classics Library Selection

1997-1999 transcripts

2000-2002 transcripts

2003-2005 transcripts

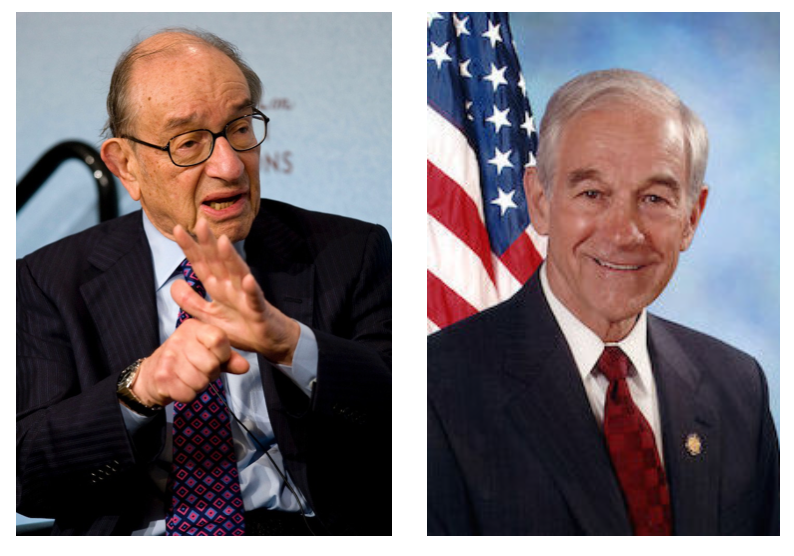

The Alan Greenspan-Ron Paul Congressional Exchanges

(1997-1999)

Transcripts of the historic hearings before the U.S. House of Representatives’ Committee on Financial Services during question & answer sessions, 1997-2005

Editor’s Note: With Alan Greenspan’s long tenure as chairman of the Federal Reserve seemingly coming to a close, we thought it appropriate to assemble this remarkable and extended dialogue with Representative Dr. Ron Paul for the benefit of our Gilded Opinion readers. Alan Greenspan, one of the most recognizable figures on the American financial scene, does not need a lengthy introduction, nor do I need to restate what so many have already said about his long influence on the markets and the economy as a whole.

Few know, though, of Alan Greenspan’s long connection with the gold market. Since the publication of the famous tract, “Gold and Economic Freedom,” in 1966, Mr. Greenspan has enjoyed a special, if controversial, status among gold owners and advocates — one to which Congressman Ron Paul refers frequently in the following exchanges. Dr. Ron Paul, the Texas Congressman, also occupies a special place with gold owners and advocates because of his outspoken and unwavering support of gold ownership as well as a gold-based monetary system.

In putting this page together, I was struck with Dr. Paul’s ability to cut through the political gamesmanship that necessarily comes with being chairman of the Fed to Alan Greenspan, the man and political/economic philosopher. What emerges is a powerful figure conflicted between the practical manager charged with operating within the current fiat monetary system and the philosopher-academic with a “nostalgia,” as he puts it, for the days of the gold standard. Without Dr. Paul’s incisive questioning, I doubt that this aspect of the Greenspan character would have found its way to the public venue and the historical record. Though the relationship appears adversarial at first blush, one also detects a certain amount of mutual respect and interest. Says Dr. Paul of the exchanges: “My questions are always on the same subject. If I don’t bring up the issue of hard money vs. fiat money, Greenspan himself does.”

It is our hope that the assemblage of this testimony which took place over a nearly nine year period will be useful to those looking for a deeper understanding of the monetary system under which we now operate and of Alan Greenspan’s views with respect to it. We also hope it will add spice to the biography of one of the more enigmatic figures to grace the American political stage at the turn of the 21st century.

In closing, I would like to pass along an anecdote reported by SmartMoney’s Donald Luskin in a 2002 interview of Ron Paul. Paul told Luskin the story of his owning an original copy of “Gold and Economic Freedom,” (which I reference above) and asking Greenspan to sign it. While doing so, Paul asked him if he still believed what he wrote in that essay some 40 years ago. That tract, written during Greenspan’s days as a devotee of Ayn Rand, is a strongly worded, no-holds-barred attack on fiat money and the central banks as an engine of the welfare state. It also endorses the gold standard as a deterrent to politicians’ penchant for running deficits and printing money. Greenspan — enigmatic as ever — responded that he “wouldn’t change a single word.” — Michael J. Kosares

3/5/1997

Mr. PAUL. Thank you, Mr. Chairman.

Mr. Chairman, I want to bring up the subject again about the CPI. We have talked a lot about the CPI and an effort to calculate our cost-of-living in this country, and specifically here, to measure how much we are going to increase the benefits that we are responsible for. But in reality, is not this attempt to measure a CPI or a cost-of-living nothing more than an indirect method or an effort to measure the depreciation of a currency? And that we are looking at prices, but we are also dealing with a currency problem.

When we debase or depreciate a currency we do get higher prices, but we also have malinvestment. We have distorted interest rates. We contribute to deficits. And also, we might not always be looking at the right prices. We have commodity prices, which is the usual conceded figure that everybody talks about as far as measuring inflation. But we might at times have inflated prices in the financial instruments.

So to say that inflation is under control and we are doing very well, I would suggest that we look at these other areas too, if indeed we recognize that we are talking about the depreciation of a currency.

One other thing that I would like to suggest, and it might be of interest to my colleagues, is that one of the characteristics of a currency of a country that depreciates its currency systematically is that the victims are not always equal. Some suffer more than others. Some benefit from inflation of the currency and the debasement of the currency. So indeed, I would expect the complaints that I hear. I would suggest that maybe this is related to monetary policy in a very serious manner.

The consensus now in Washington, all the important people have conceded that we should have a commission. But when we designate a commission, this usually means everybody knows what the results are. I mean, nobody complains that the CPI might under-calculate inflation or the cost-of-living for some individuals, which might be the case. So we have this commission.

But is it conceivable that this is nothing more than a vehicle to raise taxes? the New York Times just this week editorialized in favor of this because it raised taxes, and also it cuts benefits, and they are concerned about cutting benefits. But would it not be much more honest for Congress to deal with tax increases in an above-board fashion, especially if we think the CPI is not calculable? I think it is very difficult.

Also, I think that if it is a currency problem as well, we cannot concentrate only on prices. There have been some famous economists in our history who say, look to the people who talk about prices because they do not want to discuss the root cause of our problem, and that has to do with the inflation of the monetary system or the depreciation of the currency.

Mr. GREENSPAN. Dr. Paul, the concept of price increase is conceptually identical, but the inverse of the depreciation of the value of the currency. The best way to get a judgment of the value of the currency as such, if one could literally do it, is to separate the two components of long-term nominal interest rates into an inflation premium component and a real interest rate component. The former would be the true measure of the expected depreciation in the value of the currency.

We endeavor to capture that in these new index bonds that have been issued in which the Consumer Price Index, for good or ill, is used to approximate that. It does not exactly, and I think that is what I have been arguing with respect to the commission is to take the statistical bias out of the CPI and get a true cost-of-living index.

It is certainly the case that that is a measure of inflation. There are lots of different measures of inflation. I would argue that commodities, per se, steel, copper, aluminum, hides, whatever, used to be a very good indicator of overall inflation in the economy when we were heavily industrialized. Now they represent a very small part of the economy and services are far more relevant to the purchasing power of the currency than at any time, so that broader measures of price, in my judgment, are more relevant to determining what the true rate of inflation is.

Mr. PAUL. Can the inflated prices in the financial instruments not be a reflection of this same problem?

Mr. GREENSPAN. They are. This is a very important question and one which I was implicitly raising: do asset price changes affect the economy? And the answer is clearly, ”yes.” What you call it, whether it is inflation or not inflation, that is a nomenclature question. But the economics of it clearly means that if one is evaluating the stability of the system, you have to look at product prices, that is, prices of goods and services, and asset prices, meaning prices on items generally which have rates of return associated with them.

Mr. PAUL. Much has been said about your statements regarding the stock market and I wanted to address that for just 1 minute. In December when you stated this, of course, the market went down and this past week there was as sudden drop. The implication being that if you are unhappy with it, they assume that you will purposefully push up interest rates. But really since the first time you made that statement it seems that almost the opposite has occurred. M3 actually has accelerated, to my best estimate in the last 2 months it has gone up at a 10 percent rate. The base actually has perked up a little bit. Prior to this time it was rising at less than a 5 percent rate and now it is rising a little over 8 percent.

But then too we have another factor which is not easy to calculate, and that is what our friends in the foreign central banks do. During this short period of time they bought $23 billion worth of our debt. We do know that Secretary Rubin talks to them and that maybe there is an agreement that they help you out; they buy some of these Treasury bills so you do not have to buy quite so many.

Mr. GREENSPAN. There is no such agreement, Dr. Paul.

Mr. PAUL. You read about that though.

Mr. GREENSPAN. Sometimes what you read is not true.

Mr. PAUL. OK, we will get your comments on that. But anyway, they are accommodating us, whether it is policy or not. Their rate of increase on holding our bills are rising at over 20 percent, and even these 2 months at maybe 22 percent.

My suggestion here and the question is, instead of the sudden policy change where you may increase interest rates, it seems like to me that you may be working to maintain interest rates from not rising. Certainly, you would have a bigger job if we had a perfect balance of trade. I mean, they are accumulating a lot of our dollars and they are helping us out. So if we had a perfect balance of trade or if their policies change, all of a sudden would this not put a tremendous pressure on interest rates?

Mr. GREENSPAN. We have examined the issue to some extent on the question of what foreign holdings of U.S. Treasuries have done to U.S. interest rates. I think the best way of describing it is that you probably have got some small effect in the short run when very large changes in purchases occur. There is no evidence over a long run that interest rates are in any material way affected by purchases.

The reason, incidentally, is that they usually reflect shifts–in other words, some people buy, some people sell. Interest rates will only change if one party or the other is pressuring the market. There is no evidence which we can find which suggests that that is any consistent issue, so that the accumulation of U.S. Treasury assets, for example, is also reflected in the decumulation by other parties. We apparently cannot find any relationship which suggests to us that that particular process is significantly affecting—-

Mr. PAUL. For the past 2 years, the accumulation has been much greater.

Mr. GREENSPAN. That is correct, it has been.

Mr. PAUL. Thank you.

7/22/97

Dr. PAUL. Thank you, Mr. Chairman.

I think the Banking Committee must be making progress, because even others now bring up the subject of gold, so I guess conditions are changing. But I might just suggest that the price of gold between 1945 and 1971 being held at $35 an ounce was not much reassurance to many that the future did not bode poorly for inflation. So the price of gold being $325 or $350, ten times what it was a few years back, should not necessarily be reassurance about what the future holds. Unlike my colleague from the other side accusing you of searching for gloom, I might wonder whether or not we might be hiding from some of it? So I thought that the last thing I would suggest is that we lack monetary stimulus and all we need is a little more monetary stimulus, and all of a sudden we are going to take care of the problems. And by the way, the problems that are described are the problems that I am very much concerned about, but I come up with a different conclusion on why we are having those problems.

Earlier, I made the case in my opening statement that quite possibly we are using the wrong definitions and we are looking at the wrong things, and we continue to concentrate and to reassure ourselves that the Consumer Price Index is held in check, and therefore things are OK and there is no inflation. Real interest rates and the long bond remain rather high, so there is a little bit of inflationary expectation still built into the long-term bond. But the consumer prices might be inaccurate, as Sindlinger points out, and they may become less important right now because of the various technical things going on.

And also I made the suggestion that the money-supply calculations that we use today might not be as appropriate as they were in the past, because I do not think there is any doubt that we have all the reserves and all the credit and all the liquidity we need. I mean, it is out there. It might not be doing what we want it to do, but there is evidence that it is there. The marginal debt today was reported at $113 billion, just on our stocks. So there is no problem with getting the liquidity. My argument is that what if we looked at the prices of stocks as your indicator as you would look at the CRB? I mean, we would have a rapidly rising CRB-or any commodity index. It would be going up quite rapidly. For instance, in the past 3 months, we had a stock price rise of 25 percent. If it continued at that rate, we would increase the stock prices 100 percent in one year. If that was occurring in the commodities or Consumer Price Index, I know you would be doing something.

My question and suggestion is maybe we ought to be doing something now, because there is a lot of credit out there doing something else, causing malinvestment, causing deficits and debt to build up, and that there will be a correction. We have not repealed the business cycle. So we have to expect something from this.

I think there are some interesting figures about what has happened to the stock market. In 1989, Japan’s stock market had a greater value than our stock market does. Our market now is three times more valuable in terms of dollars than Japan. We have 48 percent of the value of all the stocks in the world, and we put out 27 percent of the output. So, there is a tremendous amount of marking up of prices, a tremendous amount of credit. So, instead of being lacking any credit, I think we have maybe an excess amount. I would like to know if you can reassure us that we have no concerns about this malinvestment, that we do not have excess credit and that these stock prices are not an indicator that might be similar to a Consumer Price Index?

Mr. KENNEDY. What?

Mr. GREENSPAN. Let me first say, Dr. Paul, it is certainly the case that if you look at the structure of long-term nominal Government interest rates, there is still a significant inflation premium left. In the 1950’s and the 1960’s, we had much lower nominal rates, and the reason was that the inflation premium was clearly quite significantly less. I think we will eventually get back there if we can maintain a stable noninflationary environment. I do not think we can remove the inflation premium immediately, because it takes a number of years for people to have confidence that they are dealing with a monetary policy which is not periodically inflationary.

To follow on the conversation I was having with Congressman Frank, the type of conversation we have at the Federal Open Market Committee is indeed the type of conversation that is coming from both of you. In other words, we are trying to look at all of these various forces and recognize where the stable relationships are and those which tell us about what is very likely to occur in the months, the quarters, and hopefully, in the years ahead.

It is a very intensive evaluation process, especially during a period when there seem to be changes in the longer-term structure which we do not yet know are significant or overwhelming. But we are experiencing changes which lead us to spend a considerable amount of time trying to evaluate what is going on. But we would be foolish to assume that all of history has somehow been wiped from the slate and that all of the old relationships, all of the problems that we have had in the past, have somehow in a period of a relatively few years, disappeared. The truth of the matter is that we suspect that there are things that are going on. We do not know yet how important they are. But we are keeping a very close evaluation of the types of events that are occurring, so that we can create what we believe to be the most appropriate monetary policy to keep this economic expansion going in a noninflationary way, because that is what is required to keep growth going.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Dr. PAUL. So, you are saying the stock price index is of a lot less value than the commodity price index or the Consumer Price Index?

Mr. GREENSPAN. I would say our fundamental purpose is to keep inflation, meaning basically the underlying general price index, stable, because that is the most likely factor which will create financial stability overall. As I have said in previous commentary and discussions before this subcommittee, we of necessity look at the whole financial system, but it has always been our conclusion that the central focus is on the stability of product prices as the crucial determinant in the system, which if you solve that one, you are likely to solve the others as well.

Dr. PAUL. Thank you, Mr. Chairman. I have two brief points to make, then I have a couple of questions.

First, your comment about the deficit is very important in keeping interest rates high. It seems to me that the level of Government spending has to be even more important, because if you have a $2 trillion budget, and you tax that money out of the system, that is very detrimental, just as detrimental as if you borrowed out of the economy. So I think the level of spending is probably more important.

And as a follow-up to the question from the gentleman from Washington on the currency, we certainly do export a lot of our currencies. More than 60 percent ends up in foreign hands. And it serves a great benefit to us because it is like a free loan. It is not in our own country, it does not bid up prices, So we get to export our inflation. At the same time, they are willing to hold our debt; central banks are holding $600 billion worth of our debt. So again, we get to export our inflation, and the detriment is the consequence of what we are seeing in Southeast Asia.

But the real problem, though, is not the benefits that we receive temporarily, but the problem is when those dollars come home, like in 1979 and 1980, and then we have to deal with it because it is out of your hands, this money has been created. So I think we should not ignore that.

But my first question has to do with Mexico. It is bragged that we had this wonderful bailout of Mexico three years ago, and yet Mexico still has some of its same problems. They have tremendous bank loans occurring right now. The peso has weakened. Last month it went down 5 percent. Since the conditions are essentially the same, my question to you is when do you anticipate the next currency crisis in the Mexican peso?

And then another question that I would like to get in as well has to do with a follow-up with the gentleman from Massachusetts dealing with the inequity in the distribution of income. And in your statement you come across almost hostile or fearful that wages might go up. And I understand why you might be concerned about that, because you may eventually see the consequence of monetary inflation, and it will be reflected in higher wages. But where has the concern been about the escalation of value of stocks? People are expecting them to go up 30 percent a year. They are benefiting, but labor comes along and they want to get a little benefit. They want to raise their salaries 5 or 10 percent. Unlike the other side, I think the worst thing to do is interfere in the voluntary contract and mandate an increase in wages and give them minimum wage rates. That is not the answer.

But to understand the problem I think is very important. This is a natural consequence. They want to share as well, and this is a natural consequence of monetary inflation is that there is an equal distribution of income.

I would like you to address that and tell me if there is any merit to this argument and why you seem to have much greater concern about somebody making a few bucks more per hour versus the lack of concern of a stock market that is soaring at 30 percent increases per year.

Mr. GREENSPAN. Let me say that when I believe that there are trends within the financial system or in the economy generally which look to me and to my colleagues to be unsustainable and potentially destructive of the economic growth, we get concerned.

I am not aware of the fact that if I see things which I perceive to be running out of line, that I have not expressed myself. At least some people have asserted that I have expressed myself more often than I should. And I have commented on innumerable occasions, as I have, in fact, done today, that there are certain values in the system which by historical standards, are going to be difficult to sustain. And I am concerned about that, because it potentially is an issue which relates to the long-term values within the economy.

I have no concern whatever about the issue of wages going up. On the contrary, the more the better. It is only when they are real wages, whether they are wages which are tied to productivity or related to productivity gains. But wages which are moving up more than the rate of inflation, for example, I think are highly undesirable, and indeed to the extent that we do not get real wage increases, we do not get increases in standards of living. So I am strongly in favor of any increase in real wages and not strongly in favor at all of wages that go up and are wiped out by inflation.

Dr. PAUL. But the real wage is down compared to 1971. You have a little flip here or so, but since 1971 it is down.

Mr. GREENSPAN. Part of that issue, Congressman, is a statistical problem. I do not believe the real wage is truly down since 1971.

Dr. PAUL. But we cannot convince our workers of that. At least in my district they are not convinced by some statistic.

Mr. GREENSPAN. Let me put it this way: Productivity after the early 1970’s flattened out fairly dramatically, and that slowed real wage increases very dramatically as well. And to the extent that the sense in which earlier generations experienced significant increases in standards of living during the 1950’s and 1960’s and the early post-World War II period, of course productivity was advancing rapidly. That came to a dramatic end in the early 1970’s and persisted until very recently. And if people were concerned about that, they should be, and they should have been, and we should have been, as I think we were.

Dr. PAUL. Do you have a comment on when the next Mexico crisis is going to occur?

Mr. GREENSPAN. Yes. I am not concerned about a crisis in Mexico at this particular stage. I think they are doing reasonably well. The peso at this particular stage is floating appropriately. I do not see any immediate crisis at the moment. And while I do not deny that, as in any country, things can go askew, they have come out of the 1995 crisis frankly, somewhat better than I expected they would.

1998

7/22/1998

Dr. PAUL. Thank you, Mr. Chairman.

Mr. Greenspan, over a period of time, the dollar has been weak. If you look at it from 1971 until now, the curve is obviously downward. If you look at the last three years, the dollar has been relatively strong, and some people consider this a problem. Even our Government, our Fed and Treasury, just recently thought our dollar was too strong.

Of course, in free markets, the purchasing power of money is never tampered with, but under today’s conditions it was felt that it was too strong in relationship to the yen. Of course, we intervened and had some effect to the currency markets.

When do you suppose the time would be appropriate for the money managers to intervene in a much more aggressive manner, if the dollar continues to be very, very strong, and pressure is put on the Federal Reserve, political pressure, to say, ”We cannot sell our goods, we want some help”? Can you foresee that? And not a token amount of interference, intervention in the market, but a major intervention in the market to change the direction of the dollar, can you foresee that in the near future?

Mr. GREENSPAN. Congressman, let’s first emphasize that we do consult with the Treasury and ultimately the Secretary of the Treasury is the legally authorized determiner of the extent to which intervention occurs or doesn’t occur. The Secretary has indicated on numerous occasions that it is fundamental values which will determine the value of the dollar and other currencies, and over the long run, intervention doesn’t do very much one way or the other. I think that the evidence over the years has demonstrated that that particular statement is clearly sustainable.

I can’t anticipate what particular policies will be under hypothetical circumstances. It is an important question, there is no doubt. But overall, the presumption that somehow we, meaning the monetary authorities, the Fed and the Treasury, can somehow alter the value of a currency in a significant manner when fundamentals are going in the opposite direction is an illusion. We cannot.

Dr. PAUL. So in a way what we have done just recently was just wasted money, since we do know that intervention does not have much effect? Why do we bother on occasion–

Mr. GREENSPAN. First of all, we don’t waste money. We are taking a position in a currency, and very often over the years we turn out to actually have a profit in the process. When you intervene, you don’t spend the money. You are just taking an investment position or a speculative position.

Dr. PAUL. Unless that currency happens to go down, which it well could.

Mr. GREENSPAN. Yes. That is certainly the case, and if you do it in large volume, then the answer is there are speculative risks. We have taken very few of those.

The very few times which we intervened, and we have not intervened for years until this most recent event occured, was when we believed that the markets were unstable and that intervention might have an impact. You need both of those conditions to exist. It was the judgment of the Secretary of the Treasury, to which we agreed, that action taken would have the effect of breaking a pattern of a very quick run in the currency. I don’t think any of us believed it would have more than a temporary impact.

Dr. PAUL. A very quick question. You seem to welcome, and you have been quoted as welcoming, a downturn in the economy to compensate for the surge and modest growth in the economy. Is it not true that in a free market, with sound money, you never welcome a downturn in the economy? You never welcome the idea of decreased growth, and you don’t concern yourself about this? And yet, here we talk about when is the Fed going to intervene and turn down the economy?

It seems that there is a welcoming effect to the fact that the Southeast Asia has tampered-you know, price pressures. Couldn’t we make a case that the free market would operate a lot better than the market we use today?

Mr. GREENSPAN. I think you have to define what you mean by a ”free market.” If you have a fiat currency, which is what everyone has in the world–

Dr. PAUL. That is not free market.

Mr. GREENSPAN. That is not free market. Central banks, of necessity, determine what the money supply is. If you are on a gold standard or other mechanism in which the central banks do not have discretion, then the system works automatically.

The reason there is very little support for the gold standard is the consequences of those types of market adjustments are not considered to be appropriate in the 20th and 21st century. I am one of the rare people who have still some nostalgic view about the old gold standard, as you know, but I must tell you, I am in a very small minority among my colleagues on that issue.

Dr. PAUL. So I guess we have to accept the downturns?

Mr. GREENSPAN. No. We are not accepting downturns, nor do I think we look at it as desirable. What we do look at is an economy which is running at a pace which is unsustainable over the long run and will eventually run off the tracks and create significant disruption. So we do not look forward to a weakening in growth. All we are concerned about is a pattern of growth which is sustainable.

In other words, when we talk about our goal as maximum sustainable economic growth, the ”maximum” and the ”sustainable” are both crucial elements to that. We can get a maximum growth in the short run, which is not going to help anybody over a longer-term period. That we would consider to be an unacceptable or undesirable pattern of growth.

Dr. PAUL. Thank you.

1999

2/24/1999

Dr. PAUL. Thank you, Mr. Chairman.

Mr. Greenspan, a lot of economists look to the price of gold as an indicator and as a monetary tool. It has been reported that you might even look at the price of gold on occasion.

Last summer on a couple of occasions here when you were talking before the committees on securities and on derivatives you mentioned something that was interesting. You said that central banks stand ready to sell gold in increasing quantities should the price rise, which I thought was rather interesting.

Then I followed up with a letter to you to ask you whether or not our central bank might not be involved in something like that, in the gold market. And you did answer me and stated that since the 1930’s the Federal Reserve has had no authority to be involved with the gold markets.

I am quite confident that the Treasury has authority to be in gold markets, but you stated that the Federal Reserve did not. But this contradicts some reports that have been made by some Federal Reserve officials that said that the New York Fed was very much involved in the London gold pool from 1961 to 1971. But your answer implied that the Fed has never been involved since the 1930’s, which I think is interesting.

The reason why this could be of importance is that we do know that our Treasury was supporting a fixed price of gold at $35 an ounce in the 1960’s, so therefore the price of gold of $35 an ounce was totally useless in predicting what might happen and what did happen in the 1970’s. So if central banks stand ready to lease and sell gold in increasing amounts should the price rise, we are more or less, you know, in a time when the gold price is probably so-called fixed; and we do know that the evidence is there that central banks do loan gold, they sell gold. So could it be that the price of gold today is less valuable to the economists, who think that gold could help us, in thinking that maybe we are in a period of time comparable to what we had in the 1960’s?

Mr. GREENSPAN. I think the price of gold has, over the decades, been a generally usable indicator of what the level of inflation has been. Obviously, during the period of an active gold standard, which was really prior to World War I, the price level pretty much locked itself in to the gold price. In fact, by definition it did.

The issue of buying and selling gold as the price changes is indeed exactly what we used to do. We used to, at a certain thing called the gold points, which was the price of gold plus the transportation cost differentials, we, that is, the United States Treasury, stood ready to buy and sell gold at a spread, as indeed all other participants in the gold standard did. So in that regard that was exactly what was happening.

But, needless to say, since we have gone off the gold standard, and especially since 1973, there has been basically a general float of the dollar vis-a-vis gold, which means that the gold price is like another commodity’s price.

Nonetheless, like a lot of commodity prices, and perhaps better than most, it has been useful, in my judgment, in trying to get some sense of what inflationary pressures have evolved in this country.

Dr. PAUL. Even if the central banks, who are the major holders of gold, are willing to sell gold in order to manipulate the price or hold the price at a certain level? We are not on a gold standard, so what would the motivation be?

Mr. GREENSPAN. They are not doing it for purposes of fixing the gold price. They are looking for it to reduce their stock of gold when they have sold on the grounds that: one, it costs to store the gold; and, two, it didn’t obtain any interest. So they perceived it to be a poor asset to hold. But the purpose was not to manipulate the price of gold.

Dr. PAUL. Another quick question on another subject, on Argentina. You stated earlier that you have been studying this and will answer the question about whether Argentina can use the dollar as their currency. It has been reported that there was a consideration, and I surely hope this is not true, that the Federal Reserve could become the lender of last resort, and they would have access to the discount window.

Along that line, how does it work when a foreign country dollarizes and they expand their credit through fractional reserve banking? Does that put an obligation on us and can that interfere with the dollar’s value?

Mr. GREENSPAN. That is a good question, Congressman. The answer is no. We view monetary policy in the United States as for the United States. We have no interest in, nor does the Treasury, of being a lender of last resort outside the United States.

Dr. PAUL. Outside the IMF?

Mr. GREENSPAN. The issue of whether or not another country wishes to use the American dollar as its medium of exchange is theirs to make. They can do it unilaterally. Panama did. Liberia did. If they choose to do that, that is their sovereign right to do that. But we have no obligation in that regard.

Clearly, we do sense some obligation with respect to our Latin American colleagues for the same reason that we have had relationships with all of our trading partners. Their interests do concern us, and we would like them to be prosperous. To the extent that we are helpful in trade negotiations or other negotiations, that is fine. But lender of last resort, no.

7/22/1999

Dr. PAUL. Thank you, Mr. Chairman. I appreciate this opportunity.

First, I would like to say that I hope the Humphrey-Hawkins requirement continues; I think that is important. I do also note that frequently at these hearings we don’t talk much about monetary policy, which is the purpose of the meeting. We frequently talk about taxes and welfare spending.

I would like to concentrate more on the monetary policy and the value of the dollar. There are some economists who in the past, such as Mises, von Hayek, as well as Friedman have emphasized that inflation is a monetary phenomenon and not a CPI phenomenon, it is not a labor cost phenomenon. When we incessantly talk about this, whether it is the Federal Reserve, the Treasury, Congress, or the financial markets, we really distract from the source of the problem and the nature of our business cycle.

I certainly agree that technology has given us a free ride and has allowed us this leverage, but we have also been permitted a lot of inflation, that is, the increase in the supply of money and credit. Since 1987, we have had a tremendous increase in money. The monetary base has doubled; M3 has gone up $2.5 trillion. This money has gone into the economy, but we have reassured ourselves that the CPI has been stable so therefore everything is OK. Yet the CPI has gone up 44 percent since 1987.

Real growth in the GDP has not been tremendous. It is about 2.3 per year. But we have had a tremendous increase in capitalization of our stock market going from $3.5 trillion up to $14 trillion. That is where the money is going. This generates revenues to the Government. This has helped us with our budgetary problems.

At the same time, we ignore the fact that hard money people emphasize that not everybody benefits, and there has been a lot of concern expressed that people are left behind, farmers are left behind, the marginal workers are left behind. Some people suffer more from a higher CPI than others. These are all monetary phenomena that we tend to ignore.

But you have admitted here today and in the past that the business cycle is alive and well and that we shouldn’t ignore it-in your opening statement, you said that we should be especially alert to inflation risks. I think that we certainly should be. And you have expressed concern today and at other times about the current account deficit, and this is getting worse, not better. Our trade balances are off. But I would suggest maybe we have seen some early signs of serious problems because foreign central bank holdings now of our dollars have dwindled to a slight degree. In 1997, they were holding over $650 billion and they are slightly below $600 billion. At the same time, we have seen the income from our investments dwindle to a negative since 1997. So I think the problems are certainly there.

But I would like to talk a little bit more about, or ask you a question about, this balance of trade and the value of the dollar, because history shows that these dollars eventually will come back. And you have assumed that, that they will, but that essentially the problem that we got into in 1979 and 1980, there is no guarantee that that won’t happen again. That means that the markets will drive interest rates up, we will have domestic inflation, the value of the dollar will go down.

My question is, what will your monetary policy be under the circumstances? In 1979 and 1980, you were-not you, but the Fed-was forced to take interest rates as high as 21 percent to save the dollar. My suggestion is, it is not so much that we should anticipate a problem, but the problem is already created by all of the inflation in the past twelve years and that we have generated this financial bubble worldwide and we have to anticipate that. When this comes back, we are going to have a big problem. We will have to deal with it.

My big question is, why would you want to stay around for this? It seems like I would get out while the getting is good.

Mr. GREENSPAN. Dr. Paul, you are raising an issue which a significant number of people have been raising over the years and for which, frankly, we are not quite sure what the answers are. It is by no means clear, for example, that one can trace the increase in money supply, which presumably has not reflected itself in CPI, into stock values. A lot of people say it is happening and a lot of people assume that is what it is, but the evidence is not clear by any means.

Dr. PAUL. May I interrupt, please? Did you not write that that was the case with the 1920’s and that was the problem that led to our Depression?

Mr. GREENSPAN. No, I didn’t raise the issue that it was in effect the money supply, per se. What I was arguing many, many years ago, and I still think, is that in 1927 involving ourselves with an endeavor to balance the flow of gold in favor of Britain at that time, we did create a degree of monetary ease which was one of the possible creators of speculation in the market in 1928 and 1929. What is not evident in today’s environment is anything like that is going on.

We cannot trace money supply to a speculative bubble. If a bubble, in fact, turns out to be the case, after the fact, we will have a considerable amount of evaluation of where it came from. But as I have said before this committee and, indeed, before the Congress on numerous occasions, we are uncertain as to the extent to which there is a bubble because, as I said in my prepared remarks, to presume there is a bubble of significant proportions at this particular stage and that the bubble isn’t significant doesn’t have any meaning; we have to be saying that we know far more than the millions of very sophisticated investors in the markets. And I have always been very reluctant to conclude that.

We do know that a significant part of the rise in prices reflects rising expected earnings, and a goodly part of that is a very major change in the view of where productivity is going. What we do not know is whether it is being overdone or to what extent it is being overdone.

I have always said I suspect it is, but firm, hard evidence in this area is very difficult to come by. It is easy to get concerned about it on the basis of all sorts of historical analogies, but when you get to the hard evidence, we do know that inflation is a monetary phenomenon, but what we have a very great difficulty in knowing is how to measure what that money is.

Remember, M2, M1, all of that are proxies for the money that people are talking about when they are referring to money being the creator of inflation. We have had great difficulty in filtering out of our database a set of relationships which we can call true money. It is not MZM, that is, money with zero maturity, it is not M2, it is not M1, it is not M3, because none of those work in a way which would essentially describe what basically Hayek and Friedman and others have been arguing, and I think quite correctly, on this issue.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.