Back to our Introductory Information Packet

Who invests in gold?

In the first of our Six Keys to Successful Gold Ownership, we challenge the misconception, often perpetuated by the media, that individuals who own gold are somehow outside the American mainstream. Nothing, as you are about to read, could be further from the truth.

Private individuals invest in gold

Contrary to the less than flattering picture sometimes painted by the mainstream press, the people we have helped become gold owners are among those we rely upon most in our daily lives – our physicians and dentists, nurses and teachers, plumbers, carpenters and building contractors, business owners, attorneys, engineers and university professors (to name a few.) In other words, gold ownership is pretty much a Main Street endeavor.

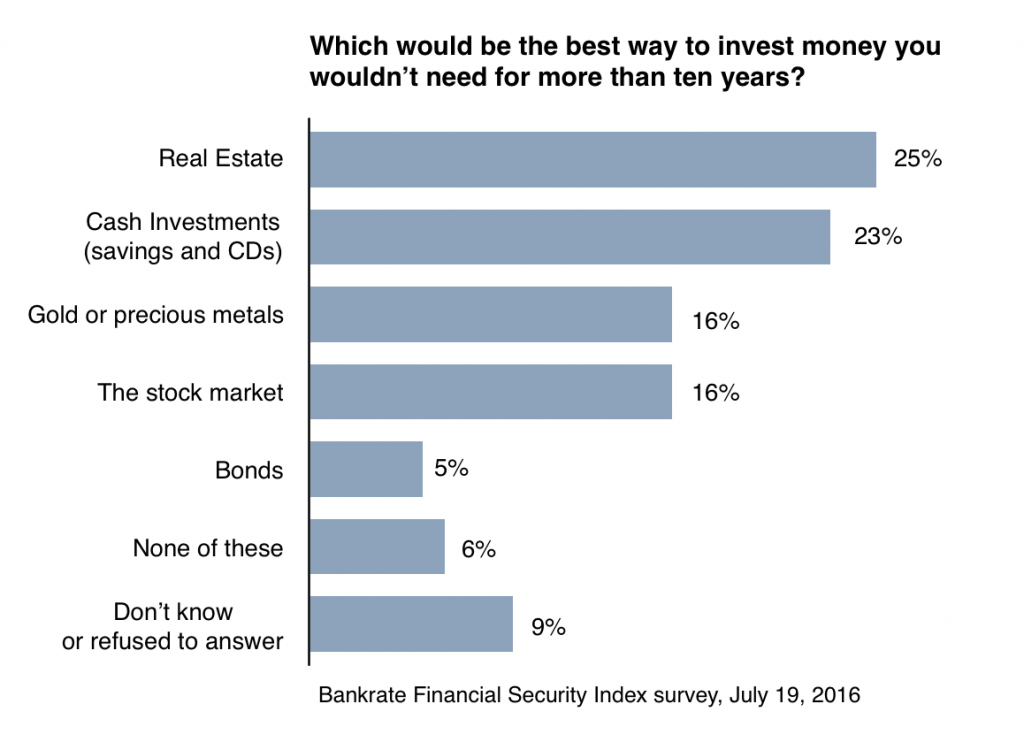

In a recent Bankrate Survey, one in six investors (16%) chose gold as the best place to park money they wouldn’t need for more than ten years – the same number that chose stocks. Another 6% chose bonds, while 25% chose real estate, and 23% said they would simply bank the money. To the typical Wall Streeter, these results represent a world turned upside down. CNBC’s Jim Cramer took one look and lamented, “As someone who has lived and breathed stocks for most of my life, this is a horrendous finding. But it’s not surprising.” Similarly, a Gallup poll found that 34% of American investors rated gold the best investment “regardless of gender, age, income or party ID. . .” In that survey, investors rated gold higher than stocks, bonds, real estate and bank savings.

Institutions and hedge funds invest in gold. . . .

Funds and institutions, so-called professional investors, have poured large amounts of capital into gold over the last few years through ETFs, straight-up physical ownership in the form of bullion, and paper ownership in the form of futures and options. In fact, institutional involvement may be unprecedented at this juncture and it is not just the high-profile gold advocates who appear regularly in media interviews pumping capital into the market, but hundreds of funds and institutions from one end of the globe to the other.

According to Australia’s Macquarie Bank, almost 3000 tonnes of gold in physical form sit on the balance sheets of Chinese commercial banks and financial institutions – a surprising revelation. In the West, inventories at gold ETFs, the favored gold ownership vehicle for professional investors, have gone from 2050 tonnes in late 2015 to approaching 2800 tonnes now.

“Investment demand,” says ETF Trends in a recent report titled, An In-Depth Look into Gold ETF’s Resurgence and Sustainability, “remains robust as an increasing number of institutional investors, sovereign wealth funds and central banks seek gold as a potential source of return and diversification to traditional stock and bond portfolios.”

Central banks invest in gold. . . .

The World Gold Council reports that “The past decade has seen a fundamental shift in central banks’ behaviour with respect to gold, prompted by reappraisal of its role and relevance after the 2008 financial crisis. Emerging market central banks have increased their official gold purchasing, while European banks have ceased selling, and the sector now represents a significant source of annual demand for gold. Central Banks sold 7,853 tonnes of gold between 1987 and 2009; between 2010 and 2016 they bought 3,297 tonnes.” In 2017, central banks added another 371 tonnes to their total holdings.

Most of the media coverage on central bank involvement in the gold market concentrates on purchases, but the bigger story, in our view, is their withdrawal from the market as sellers. The nearly full stoppage in sales since 2009 is the result of public pressure from citizen groups and a realization among central bankers, since the 2008 crisis, that gold is an important asset of last resort for national reserves.

Billionaires invest in gold. . . .

The Visual Capitalist recently published an infographic listing four well-known billionaires who invest in gold. Included in the list were Jacob Rothschild (of the famous Rothschild family which has long had an interest in gold going back centuries), David Einhorn (Greenlight Capital), Ray Dalio (Bridgewater Associates, the world largest hedge fund by assets) and Stanley Druckenmiller (Duquesne Family Office, formerly portfolio manager at the Soros Quantum Fund). Not included on the list, but someone who probably should have been is John Paulson who also owns a significant gold position. All five are fund managers who garner significant attention in Wall Street circles and, with the exception of Jacob Rothschild, are frequent subjects of media interviews, television appearances and the like.

“Not surprisingly, the value of paper money has been debased as countries have sought to compete and generate growth by lowering the value of their currencies – the Euro and the Yen depreciated by over 12% against the US Dollar during the course of the year and Sterling by 5.9%. The unintended consequences of monetary experiments on such a scale are difficult to predict.” – Lord Jacob Rothschild

“If you don’t own gold…there is no sensible reason other than you don’t know history or you don’t know the economics of it.” – Ray Dalio

“We believe that the increasingly adventurous monetary policy is good for gold.” – David Einhorn

And for good reason!

Though we cover the rationale for gold ownership in a future installment in this series, the following extract from The Bank of England Handbook on “The Role of Gold” popped-up in our research and we thought it a worthy conclusion to this section on Who Invests in Gold:

“– the ‘war chest’ argument – gold is seen as the ultimate asset to hold in an emergency and in the past has often appreciated in value in times of financial instability or uncertainty;

– the ultimate store of value, inflation hedge and medium of exchange – gold has traditionally kept its value against inflation and has always been accepted as a medium of exchange between countries;

– no default risk – gold is ‘nobody’s liability’ and so cannot be frozen, repudiated or defaulted on;

– gold’s historical role in the international monetary system as the ultimate backing for domestic paper money.”

What is striking about this summary of gold’s virtues is how readily it applies to all the groups mentioned above – central banks, institutions and funds as well as billionaires and individual investors. As above, so below.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.