NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 46th year in the gold business

February 2019

Will 2019 be the year of the big breakout for gold?

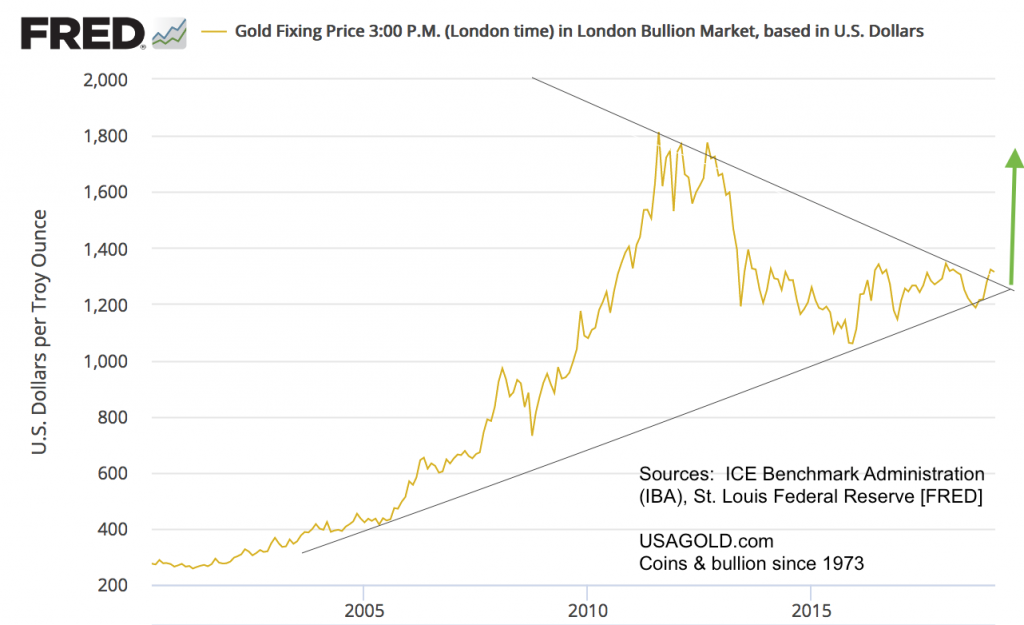

In each of the last three years, gold has gotten off to a strong start only to fizzle as the year moved along. Will 2019 be the year gold finally breaks the pattern? A good many investors, fund managers and analysts think that 2019 might very well be the year when gold breaks the restraints and pushes to higher ground. One of those is Carter Worth of Cornerstone Macro in New York who CNBC’s Melissa Lee refers to as “the chart master.” In a recent interview with Lee, Worth referred to the long-term chart below saying that there is “a well-defined set-up and a lot of tension” which he says is going to resolve to the upside – “a breakout to all-time highs.” With respect to gold’s relationship to the dollar, Worth says “Gold’s got its own momentum now. . .It is all setting-up for higher gold prices and trouble for equities, trouble for the economy.”

The far Left’s next great monetary experiment – MMT

“This MMT sounds like a recipe for immense inflation, even hyperinflation, says Daily Reckoning’s, Bill Maher. “You are spending all this money directly into the economy. It will drive consumer prices through the attic roof, you say. This is crackpot. A witch’s sabbath of inflation would surely result. Yes, but here the MMT crowd meets you head on… They agree with you. They agree MMT could cause a general inflation, possibly even a hyperinflation.”

Modern Monetary Theory (MMT) is neither modern nor a theory. John Law, the Scottish financier, tried a version of it exactly 300 years ago (1717-18) in France.* He did so with the blessing of the French monarchy and with a rationale very similar to MMT’s proponents today. In the end, Law’s theories (to his surprise if we are to believe the historical account) bankrupted the French people and the government, reduced the economy to ashes, and created such a distaste for paper scrip among the citizenry that it took 80 years for France to reintroduce paper money as a circulating medium.

“The shrewder speculators* became alarmed. They began to sell their shares of stock, and hoard in gold the enormous wealth they had acquired. This resulted in a demand on the government for metal in exchange for its paper, and soon the government had no metal to give. Then the crash came. Those who had the government paper could buy nothing with it. Those who held the Mississippi stock could scarce give it away. It was worthless. The government itself refused to accept its own paper for taxes. A few lucky speculators had made vast fortunes; but thousands of families, especially among the wealthier classes, were ruined.” – Edward S. Ellis and Charles F. Home, The Story of the Greatest Nations (1900)

* Please see this link for a summary of Law’s Mississippi Company land scheme.

Funds, institutions push gold ETF stockpiles to the highest level in five years

When this year’s Davos conference attendees boarded their private jets for the long ride home, they left the Swiss mountain resort with a sense that all is not well in the global economy and that financial markets might be in for some unpleasant times. That sense of foreboding has big money, led by some of the top names in the money management business, paring its exposure to stock and bond markets and deploying that capital in the gold market. Gold ETFs, the favorite haunt for funds and institutions taking a stake in the gold market, have started the year by adding 72 tonnes of gold to their stockpiles. The influx has pushed the combined ETF total to 2,513 tonnes, the highest level since 2013.

China builds up gold reserves in shift away from dollar

As reported in the South China Morning Post:

“Yi Gang, the current central bank governor, said in 2013 when he headed the State Administration of Foreign Exchange (SAFE) that Beijing was unable to diversify significantly into gold because the gold market is too small for China’s US$3 trillion foreign reserves. But things may start to change – though it remained to be seen whether the modest gold purchases in the last two months represented a fundamental shift in China’s attitude towards the precious metal, analysts said.”

I mentioned this South China Morning Post article in a recent Daily Market Report, but I did not pass along or comment on the portion highlighted above, which may be the most interesting aspect of Xin and Yeung’s report. To give you an idea of China’s dilemma with respect to gold, and perhaps an inkling of just how undervalued gold is at current prices, consider that all the gold ever mined, according to World Gold Council data, is worth about $7.5 trillion at a $1250 gold price. China, in other words, could buy 40% of all the world’s gold with its $3 trillion in reserves.

The market value of the 8,133.5 tonne U.S. gold reserve at $1250 per ounce is $335 billion. Thus, China could buy America’s gold reserve almost ten times over, or put another way, could swap its entire dollar reserves for the stockpile at $12,500 per ounce.

If by this time you have come to the conclusion that something is critically out of joint in this mathematical construct, you are correct. It is the price of gold.

Silver forecast: Shortage to send silver prices soaring above $20 in 2019

Surprisingly, since gold and silver started their uptrend late last summer, both are up the same number – roughly 13%. In other words, silver has not outperformed gold as many thought it would. – at least so far. That doesn’t mean it won’t in the future. The gold-silver ratio is still nearly 83 to one and still bumping along near its highs since 1970. “That could all be changing now,” writes Jason Hamlin in a Silver Phoenix article, “as silver has become increasingly attractive to investors looking for undervalued asset classes or safe-haven investments. Silver is benefiting from the persistent trade war, government shutdown, weakening dollar and a more dovish Federal Reserve.”

Venezuela’s hyperinflation by the charts and numbers

When a combination of currency debasement and inflation strikes an economy, the effects can be sudden and severe, as indicated in the two charts shown below. I had to smile when I read this matter-of-fact summation of the situation from Trading Economics (not that I fail to empathize with how these numbers translate to everyday life for Venezuela’s average citizen).

“Consumer prices in Venezuela jumped 1,300,000 percent year-on-year in November of 2018, up from a 833,997 climb in October, according to estimates from Venezuela’s opposition-led congress. Inflation rate in Venezuela averaged 3,268.55 percent from 1973 until 2018, reaching an all time high of 833,997 percent in October of 2018 and a record low of 3.22 percent in February of 1973. The USDVEB traded at 248,520.9000 on Wednesday January 23. Historically, the Venezuelan Bolivar reached an all time high of 248,520.90 in August of 2018 and a record low of 0.05 in January of 1989.”

It does not take a great deal of imagination to contemplate what the effects might have been on the price of gold in Bolivars. The charts below tell the tale of hyperinflation in Venezuela.

Gold and silver price predictions from prominent players for 2019

During the month of January, pundits and prognosticators cast the runes on gold and silver prices for the upcoming year. We collected their predictions and accompanying analysis at the page linked below and invite your visit. Though the early-in-the-year prediction frenzy is now pretty much over, we will update the page as new entries surface.

[LINK]

We invite you to bookmark. We invite your return visit.

Gold sentiment reading on the mend, climbing “pretty steadily”

Recently, we touched base with Sentiment Trader’s Jason Goepfert to ask about his latest reading on gold market sentiment. We thought it might be a good time to check to see if there were any changes now that the price is approaching the $1300 level. He graciously sent over the chart posted below along with the following comment: “Our measure reached a point of maximum pessimism in August and has been climbing pretty steadily ever since. It reached the upper end of neutral recently before falling off a bit. Bull markets tend to see optimism stay above 40 during the pullbacks so the next one will be interesting to watch. We got the surge off of the extreme pessimism, and now if it can hold above 40ish and starting bouncing again, it would argue strongly that the longer-term trend has changed for the better.”

U.S. Mint posts strongest American Eagle bullion gold coin sales in two years

Last month, the mint sold a low 3000 troy ounces in gold Eagles and 490,000 in silver Eagles. Sales typically slow down in December as the Mint and market wholesalers gear up for the new year. The solid gains over January of last year indicate growing interest among investors as we head into the new year. January is typically a strong month for sales in both the gold and silver categories as collectors and investors step-up purchases of coins bearing the new year’s date.

Central bank gold demand highest in 50 years

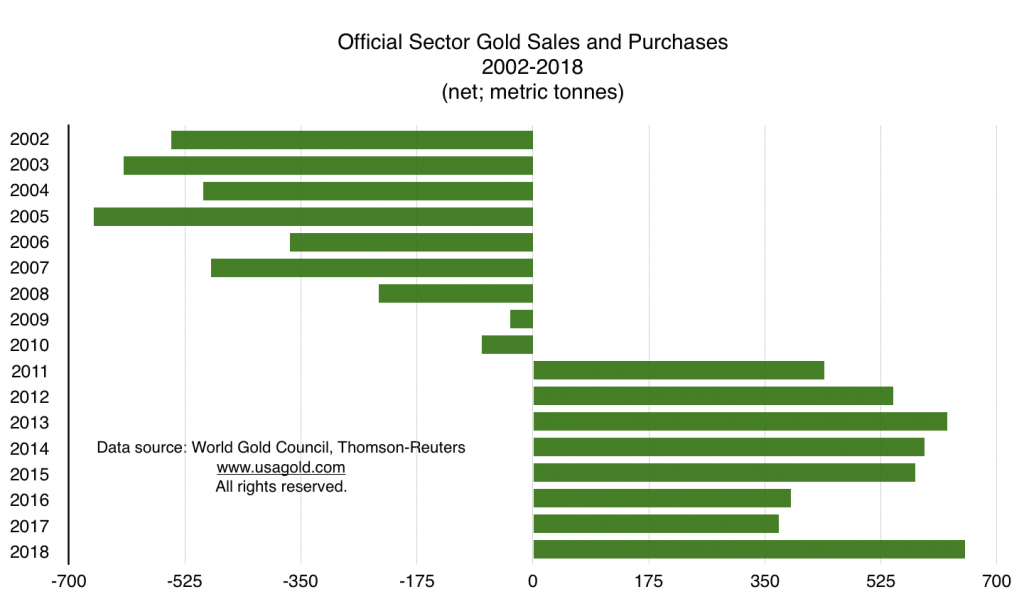

Many analysts credit the Washington Gold Agreement of 1999 as the seminal document at the heart of gold’s secular bull market. In it the top central banks agreed to gradually curtail the sale and lease of gold reserves – two activities that kept the price rangebound for much of the 1990s. At the time, gold was stuck in the $270 to $300 price range. From there, it never looked back. Fast forward to 2011 and we begin to see central banks moving from the net seller side of the gold fundamentals ledger to become net buyers. Some analysts applauded the simple retreat from sales and leases as a major victory for gold bulls. The move to becoming net buyers was icing on the cake. In 2018, central bank gold purchases reached their highest level in fifty years according to World Gold Council data – a profound development the machinations of which have yet to be fully digested in the marketplace.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold [Third Edition]. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.