The USAGOLD Website

A guiding light for our current and would-be clientele since 1997

Welcome newcomers!

When the USAGOLD website was established in 1997, there was no Google, no Facebook, no I-Tunes, no Amazon. Instead there was just a handful of scattered websites trying to figure what this new technology was all about and how it could be used to some advantage. We were among that group. Our idea of innovation in those early days was two spinning globes on either side of the USAGOLD logo. We marveled at it; considered it state of the art.

But being among the first on the internet to have spinning globes was not our only achievement. We were also among the first to sponsor a Daily Market Report (1997), a Discussion Group (1997), Live Prices and Charts (2007) and a Mobile Website (2011) – to mention just a few of our ground-breaking internet ventures. We await the next wave of innovation so that we can offer even more value to our regular visitors.

Through our 26-year presence on the world wide web, the philosophy underlying our website has always been a simple one – to act as a guiding light for our current and prospective clientele by providing a state of the art information portal coupled with a reliable and competitive brokerage service. We had and still have no aspirations beyond that, and that pinpoint focus has paid dividends beyond anything we would have imagined in 1996.

From a humble beginning, we have grown to almost 800,000 visitors per month currently and there have been times when that count has been significantly higher. USAGOLD today remains one of the most highly referenced and visited web portals in the gold business. We once had a client tell us of visiting the Gold Souk in Dubai and being surprised that so many merchant stalls had USAGOLD on their computer screens.

If you would like to gain a better understanding of what USAGOLD has to offer to you as a current or prospective client, the menu at the top of the page is a good place to start.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Reliably serving physical gold and silver investors since 1973

How to choose a gold firm

It may be the most important choice you make as a gold owner

It is surprising how many prospective investors simply dive into gold and silver investing without much in the way of a consumer inquiry. That lack of simple due diligence has ended up costing a good many investors thousands of dollars, and sometimes even hundreds of thousands before the damage is detected.

Here you will find some brief but useful guidelines

to help you choose the right gold and silver company.

To end right, start right.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

|

ORDER DESK Reliably serving physical gold and silver investors since 1973 |

Thinking about buying gold and silver?

Gold in six easy lessons

1. Don’t buy it because you need to make money; buy it to protect the money you already have.

2. Don’t look at price as a barrier; look at it as an incentive.

3. Don’t buy the paper pretenders; buy the real thing in the form of coins and bullion.

4. Don’t fall prey to glitzy TV ads; do your due diligence instead.

5. Don’t allow naysayers to divert your interest; allow yourself the right to protect your interests as you see fit.

6. Don’t forget the golden rule: Those who own the gold make the rules!

Ready to become a member of the ruling class?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

USAGOLD

Quality service & portfolio guidance since 1973

USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the gold industry’s oldest and most respected names. The firm’s unblemished, zero-complaints record and solid reviews with the Better Business Bureau testify to the exceptional customer service and professional excellence which sets it apart from the competition.

USAGOLD specializes in gold and silver coins and bullion delivered to our client’s safekeeping. For over 49 years, we have resolutely advocated owning precious metals for asset preservation purposes rather than speculation. Admittedly, this philosophy does not resonate with all prospective gold and silver owners, but if it does with you, we think you will find our firm a kindred spirit.

____________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

_______________________________________________________________

To end right, start right.

Choose the right portfolio mix with the right firm at the right price.

Choose

USAGOLD

Coins & bullion since 1973

_______________________________________________________________

_______________________________________________________________________________________________________________

The Investment of Kings and the King of Investments

The Investment of Kings and the King of Investments

From the small investor just starting out to the high-net-worth individual hedging a multi-million dollar portfolio, we have helped many thousands add precious metals to their holdings in our nearly 50 years in the gold business – safely, economically and with the investor’s goals in mind.

No matter the size of your investment kingdom, we can help!

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

New to precious metals?

We put this page together just for you.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

We first introduced our readers to these nine lessons all the way back in 1999. They were passed along to us by the legendary commodity market analyst R.E. McMaster, formerly editor of The Reaper newsletter. The original source for the nine lessons was a highly regarded money manager who handled accounts for wealthy Greek and Mexican merchant families.

1. It is easier to make a fortune than keep it.

2. Intelligence is an inadequate substitute for wisdom. Wisdom fears, respects the unknown and fosters humility. Intelligence can lead to self-destructive arrogance and ultimate failure.

3. Risk must have premium, and we must understand it well.

4. There is no order. There is no formula. There is no equation that works all of the time. It works just long enough to fool just a few more of us just a little longer.

5. What we fail to remember is that a paper gain is just that. Paper. Worth nothing. Not until we say sell, and not until we get cash. Anything less is just that.

6. When the Bass Brothers in Texas write a check for real money, their money, to buy 25% of the Freeport McMoran Gold Series II, we take notice. When the Fidelity Magellan Fund buys a fifty-million in Dell computer, we yawn. So, should you. It is other people’s money.

7. Slick advertising budgets, powerful computers and few slabs of marble do not, by themselves, make a great financial institution.

8. Never invest in anything you do not feel comfortable with or understand well.

9. When a thousand people say a foolish thing, it is still a foolish thing.

Is the wisdom of a portfolio hedge in your future?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

CLIENT ALERT

Beware MS70, MS69, PF70 ‘Perfect’ + ‘Certified’ + ‘First-Strike’ + ‘First-Release’ Gold and Silver American Eagles and American Buffalos

In 2006, the US Mint produced its first-ever .9999 fine gold coin in the form of the popular American Buffalo. The goal was to offer investors an American-made alternative to popular pure gold products like Canadian Maple Leafs, Austrian Philharmonics, and gold bars. While numerous dealers (USAGOLD was one) offered Buffalos as an alternative bullion coin at a competitive rate, the novelty of the coins coupled with feverish demand helped spawn a whole new spinoff in the gold business – the independently graded contemporary bullion coin.

On the surface, there is nothing wrong with having one’s contemporary bullion coins graded and housed permanently in hard plastic containers. It is when these items are then promoted as exceptionally rare and desirable and priced at very high, and often unsustainable, premiums over their gold content that it becomes a problem. In reality, as you will read below, the graded item, in most cases, is not substantially different (except for the container) from the typical bullion coin purchased daily by thousands of investors around the world.

After Buffalo hype wore off, our feeling was that this promotion, like many others that came before it, would fade away with waning interest. Yet here we stand many years later, rather than fading away, it has expanded and proliferated to include American Gold Eagles, American Silver Eagles, and US Mint Commemoratives. One need only search MS70 or PF70 “Perfect” American Eagles to see just how many companies offer these fictional “numismatics.” (MS is an abbreviation for mint state and PF for proof)

At USAGOLD, we could not be more emphatic in our warning against paying significant premiums above the metal content for these products. This includes common contemporary items sold as “first-strike,” “early issue,” “first release,” Mint State 69, Mint State 70, Proof 69, and Proof 70, as graded by the independent grading services, including the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC). Below we have published the U.S. Mint’s official statement regarding “First Strike”/”First Release” designations and production quality controls.

|

Coin dealers and grading services may use these terms in varying ways. Some base their use on the dates appearing on United States Mint product packaging or packing slips, or on the dates of product releases or ceremonial coin strike events. Consumers should carefully review the following information along with each dealer’s or grading service’s definition of “first strike” or “first release” when considering purchasing coins with these designations. The United States Mint has not designated any coins or products as “first strikes” or “first releases,” nor do we track the order in which we mint coins during their production. The United States Mint strives to produce coins of consistently high quality throughout the course of production. Our strict quality controls assure that coins of this caliber are produced from each die set throughout its useful life. Our manufacturing facilities use a die set as long as the quality of resulting coins meets United States Mint standards and then replace the dies, continually changing sets throughout the production process. This means that coins may be minted from new die sets at any point and at multiple times while production of a coin is ongoing, not just the first day or at the beginning of production. United States Mint products are not individually numbered and we do not keep track of the order or date of minting of individual coins. Any dates on shipping boxes are strictly for quality control and accounting purposes at the United States Mint. The date on the box represents the date that the box was packed, verified and sealed, and the date of packaging does not necessarily correlate with the date of manufacture. The date on shipping labels and packing slips for coins that are sent directly to United States Mint customers from our fulfillment center is the date the item was packed and shipped by the fulfillment center. The other numbers on the shipping label and packing slip are used for tracking the order and for quality control. |

The statement of ‘consistently high quality throughout the course of production’ is critical. For example, at one of the top grading services, 100% of the one-ounce gold 2021 American Eagle (Type 2) business strikes submitted for review graded either Mint State 69 or Mint State 70 – the two highest grades at the services. Almost 95% of submissions received a Mint State 70 grade, the ultimate rating. As for the 2021 silver American Eagle one-ounce coins (Type 2), 99.9% of submissions made the top grades of Mint State 69 and Mint State 70, and a similar percentage of proof silver Eagles made the top grades of Proof 69 and Proof 70.

With the mint continually producing new coins at the same high quality that they always have, year after year, there is literally an ENDLESS supply of product. To be clear, you do not have to avoid buying these coins altogether. You just have to avoid paying an egregious dealer premium to do so. In fact, if you were so inclined as to desire ownership of graded bullion coins for future numismatic potential, we’d recommend simply purchasing bullion coins from us at our competitive premiums and submitting them to be graded (certified) on your own.

Content last updated on 11-12-2021

_______________________________________________________________________________________________________________

Looking to include gold and silver in your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Need more information? Try –

What you need to know before you launch your gold and silver IRA

A telephone call from an old client and friend

‘Gold shone with the placid certainty of received tradition’

“I had the happy occasion recently of receiving a telephone call from an old client and friend – a physician safely retired near the sea and alongside one of the South’s oldest golf clubs. It was good to hear from this student of the markets – one of life’s steady and thoughtful practitioners. Back at the turn of the century, Doc foresaw much of what would happen economically in the United States and purchased what he considered enough gold to see him through it.”

[For the rest of Doc’s story we invite you to visit this link.]

___________________________________________________________________

Interested in starting the gold ownership process on the right footing?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Client Testimonial

“Thank you! It has been a pleasure doing business with your Company! You’ve treated the small investor (me) just like you would a millionaire. Best wishes, and I hope I can make some purchases in the future.” – L.W., Savannah, Georgia

We also treat millionaires . . . well. . . like millionaires – whether they admit to being millionaires or not [smile].

We receive unsolicited testimonials like L.W.’s routinely. Please see our Client Testimonials page for more feedback, and be sure to visit the Better Business Bureau for even more in the way of FIVE-STAR reviews. Don’t do business with any gold company until you have checked it out.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interested in gold but struggling to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

USAGOLD

CLIENT ALERT

Which is better?

A gold or silver ETF or outright ownership of the real thing?

Not a day goes by that one gold ETF or another is reporting strong gains to its stockpile. Most of those gains come from financial institutions and hedge funds boosting their portfolio positions. We applaud Wall Street’s move to gold. At the same time, though an ETF might make sense for funds and institutions, it might not be the best choice for private investors interesting in owning gold for long-term asset preservation purposes.

Gold ETFs, says Simon Black of the SovereignMan website, are “purely a financial product that defeats the entire purpose of owning gold to begin with. Why turn one of the best, longest-standing physical assets in the history of the world into a paper asset? With this type of debt instrument, you don’t actually own the gold yourself. You become a creditor with nothing more than a claim on someone else’s gold.”

At USAGOLD, we have an alternative you might want to consider ……

The Precious Metals Safe Storage Advantage

At the same time, given the exclusive preferred referral storage rate you receive by opening your storage account through USAGOLD, the annual cost to maintain your holdings is comparable (and often lower) to what most ETF vendors charge in annual fees. All the while, your metal is stored safely and fully insured at one of America’s oldest, largest and respected independent depositories – a firm with which we personally have done business for decades. To get started, we invite you to go to the link immediately below and fill out the application.

Account Form – Precious Metals Storage Account

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Gold is attempting to stabilize this morning just below the $1800 mark

‘It is time to be bullish on gold.’

(USAGOLD – 1/7/2022) – Gold is attempting to stabilize this morning just below the $1800 mark following yesterday’s Fed-related sell-off. It is down $1 at $1791.50 as we close out the first week of the year. Silver is off 4¢ at $22.20. Gold’s rangebound trading continues to perplex investors and analysts alike, but UK-based analyst Charlie Morris sees it as a passing phase. “It is time,” he says, “to be bullish on gold.”

“Just as investors were confused by gold’s weak 2021,” he predicts in his Atlas Plus newsletter, “they will be surprised by its buoyant 2022. Too many have written it off, which is ridiculous when you come to think of it. Hundreds of years of human economic history, yet investors get bored when it takes a short break. … I mean, who would bother owning gold when there’s a boom in growth stocks?” he asks. “The point here is that booms eventually come to an end, and the last time this happened in March 2000, gold enjoyed one hell of a run thereafter.”

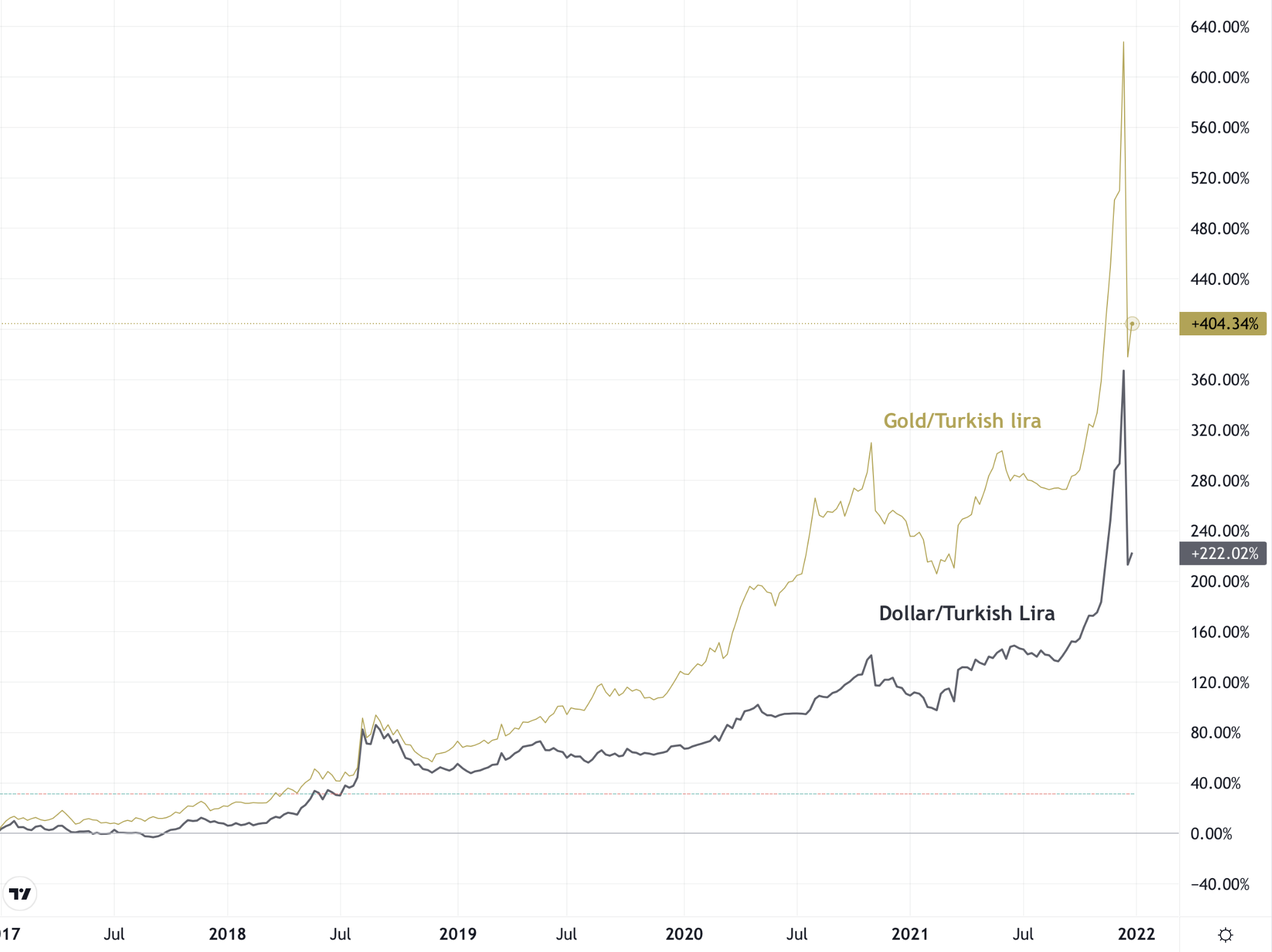

Chart of the Day

Gold and the U.S. Dollar in Turkish Lira

(%, 2017-2021)

Chart courtesy of TradingView.com

Chart note: The ill-fated Turkish lira has received a great deal of attention in the financial press of late. In Turkey, the government has introduced a series of measures “to persuade millions of Turks to turn their backs on dollars and gold and put their savings in lira,” according to a recent report in Financial Times. One Turkish analyst quoted in that article asks the essential question: “Why would you hold Erdogan dollars when you can hold real dollars?”……..Or even better, as the chart above shows, real gold. Over the past five years, gold is up over 400% in the Turkish lira, and the dollar is up almost 225%.

Better Business Bureau Five Star Review

––––––––––––––––––––––––––––––––––––––––––––––––––

Recent Better Business Bureau Client Review

Scorecard: 31 five star reviews. Zero complaints.

A+ rating. Accredited since 1991.

“We were first time gold investors. In search for information we came across their web site, which is excellent. When we contacted them, Jonathan Kosares lead us through the process. He provided information, suggested gold coins, but did not direct how we invested. He is always available to answer questions. The service has been excellent. Their business practices have been outstanding. We have absolute faith the company. They are the best investment company we have ever dealt with.”

John G.

[Link]

USAGOLD Recommendation: The precious metals industry is unique in the financial industry in that it is not subject to oversight or regulation by third-party government entities like the SEC or CFTC. As such, marketplace forums and feedback sites often serve as a replacement for investors attempting due diligence. While several options can be found, by far the most impartial and least susceptible to vested influence is the Better Business Bureau. When looking at a company’s BBB profile, don’t focus solely on the rating. To be honest, pretty much everybody has an ‘A’ or ‘A+’ rating. What is far more important to assess is the number and nature of complaints, number and caliber of positive and negative reviews, longevity with the BBB, as well as the number of ‘stars’ given a company through the actual customer review system.

––––––––––––––––––––––––––––––––––––––––––––––––––

Doc foresaw

‘Gold shone with the placid certainty of received tradition’

I had the happy occasion recently of receiving a telephone call from an old client and friend – a physician safely retired near the sea and alongside one of the South’s oldest golf clubs. It was good to hear from this student of the markets – one of life’s steady and thoughtful practitioners. Back at the turn of the century, Doc foresaw much of what would happen economically in the United States and purchased what he considered enough gold to see him through it.

Vanity Fair’s Matthew Hart offers this masterfully written overview of those early years of the 21st century:

“An ounce of gold cost $271 in 2001. Ten years later it reached $1,896 – an increase of almost 700 percent. On the way, it passed through some of the stormiest periods of recent history, when banks collapsed and currencies shivered. The gold price fed on these calamities. In a way, it came to stand for them: it was the re-discovered idol at a time when other gods were falling in a heap of subprime mortgages and credit default swaps and derivative products too complicated to even understand. Against these, gold shone with the placid certainty of received tradition. Honored through the ages, the standard of wealth, the original money, the safe haven. The value of gold was axiomatic. This view depends on the concept of gold as unchanging and unchanged – nature’s hard asset.”

It was in that time frame when gold was stuck in the $300 to $400 per ounce price range (a time not unlike our own when gold has been stuck in the $1200 to $1300 range), that Doc transferred roughly $500,000 of his net worth into gold coins. His goal, like most of our clientele, was not to become wealthy through gold ownership but to protect the hard-earned wealth he had already attained. “I still have all the gold I purchased from you,” he said simply. “Every ounce of it. It’s now worth well over $2,000,000. I want to thank you again for your book* and your advice. It made a great difference to me as you may have gathered.”

(Ed note: At the interim top – the $1896 Matthew Hart mentions above – Doc’s holdings reached a value well over $3,000,000!)

“That,” I said, “is the kind of story we enjoy hearing around here, Doc. I’m happy for you. Happy gold could help you like it did.”

“We had some very interesting conversations back in the day,” he said with a chuckle, “and gold did for me what we thought it would, what you said it would.”

We get a steady stream of phone calls like Doc’s, but it is always good to hear real-life tales about gold’s role in preserving our clients’ assets. The fact of the matter, though rarely discussed, is that gold ownership has as much to do with personal philosophy as it does finance and economics – though by that I do not mean to diminish the importance of financial markets, or politics for that matter, in our everyday lives. Things, though, do need to be kept in perspective and gold helps toward that goal – once one understands its true nature.

In many ways, gold ownership, as Doc would likely attest, is a rational portfolio decision that suits the times, but it is also a life-style decision. As Richard Russell, the late purveyor of the Dow Theory Letters once put it, “I still sleep better at night knowing that I hold some gold. If or when everything else falls apart, gold will still be unquestioned wealth.” And one that helps you sleep well no matter what happens on Wall Street or in Washington D.C.

– Michael J. Kosares

Originally appeared in our monthly newsletter (News & Views) July 2015. Re-edited 2020.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset-preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes and, as such, USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here. (Please see our Risk Disclosure here.)

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold [Third Edition]. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.

DeGaulleCriterionSpeech

Gold Classics Library Selection

Charles DeGaulle’s “Criterion” Speech

“No currency can compare, either by a direct or an indirect relationship, real or imagined, with gold”

Editor’s note: Charles DeGaulle’s “Criterion” speech remains perhaps the most eloquent short discourse ever delivered on gold’s historical role as the final arbiter of value. In 1965, when these words were first uttered at the Palais de l’Élysée, DeGaulle’s intent was to explain why France and other European countries believed it necessary to convert their dollar holdings to gold and have the bullion delivered within European borders for safekeeping. Were the French president alive today to witness the growth of American trade imbalances, their translation to U.S. sovereign debt and gold’s coincident price performance, he certainly would have felt a sense of vindication. Following DeGaulle’s original example, millions around the world from that era forward have owned gold as a standard of reliability – a “criterion” as he put it – against which “no currency can compare.”

by Charles DeGaulle

Obviously, there are other consequences to this situation. There is, in particular, the fact that the United States, for want of having necessarily to pay in gold, at least totally, for their negative balances of payment in accordance with the old rules, that required countries to take the required steps, sometimes rigorously, to remedy their imbalance, is suffering year after year from a deficit balance. No less because the total of their commercial exchanges is to their disadvantage. Quite the opposite! Their material exports always exceed their imports. But that is also the case for dollars, exports of which are always in excess of imports. In other words, capital sums are being built up in America, by means of what should really be called inflation, which, in the form of dollar loans granted to countries or to private individuals, are being exported. As, in the United States itself, the increase in currency circulation that results from this makes investments within the country less remunerative, there is an increasing trend there to invest abroad.

This leads, for certain countries, to a sort of expropriation of some of their companies. Certainly, such a practice has greatly facilitated, and still encourages to a certain extent, the multiple and considerable aid that the United States is providing to a large number of countries, to be used for their development, and from which we, on other occasions, have ourselves widely benefited. But circumstances are such today that we can even wonder how far the problem would go if the countries that hold dollars wanted, sooner or later, to change them into gold? Although such a general movement would never take place, it is still the fact that there is an imbalance that is, to a certain extent, fundamental.

For all these reasons, France is in favor of the system being changed. We know that France said this, in particular, at the Tokyo Monetary Conference. Given the universal jolt that a crisis in this field would probably cause, we have every reason to hope that the steps to avoid it are taken in time. We therefore believe it to be necessary for international exchanges to be established, as was the case before the world’s great misfortunes, on an unquestionable monetary basis, that does not carry the mark of any particular country.

What basis? Indeed, we cannot see that, in this respect, there can be any other criterion, any other standard, than gold. Oh, yes! Gold, which never changes its nature, which can be shaped into bars, ingots or coins, which has no nationality and which is eternally and universally-accepted as the unalterable fiduciary value par excellence. Moreover, despite everything that could be imagined, said, written, done, as huge events happened, it is a fact that there is still today no currency that can compare, either by a direct or an indirect relationship, real or imagined, with gold. Without doubt, we could think of imposing on each country the way it should behave within its borders. But the supreme law, the golden rule — we can truly say — that should be reapplied, with honor, to international economic relationships, is an obligation to make up, between one monetary zone and the next, by effective deliveries and withdrawals of precious metals, the balance of payments resulting from their foreign exchanges.”

Source: The World Gold Council; Charles De Gaulle, 1971, 4, pp. 325-342, esp. 330-334. The English translation of this excerpt is drawn from Lacoutre, 1991, p. 381; Excerpt from a press conference of French President Charles de Gaulle at the Palais de l’Élysée calling for the return of a ‘gold exchange standard’; February 4, 1965

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

12:34 pm Fri. April 19, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115