Daily Gold Market Report

Unveiling Gold’s True Value:

Stability Across Markets and Time

(USAGOLD – 2/27/2024) Gold prices are up in early trading on Tuesday. Traders are short covering in the futures markets and some are perceived to be bargain hunting in the cash markets. Gold is trading at $2036.00, down $4.76. Silver is trading at $22.65, up 13 cents. Inspirante Trading Solutions explores a unique perspective on the value of gold, arguing that it should be viewed not just as a commodity measured in fiat currencies but as a primary unit of account and a true store of value. This viewpoint highlights gold’s ability to preserve wealth against the backdrop of fiat currency devaluation due to central bank policies and monetary expansion. By comparing the ratios of the Dow Jones Industrial Average, Nasdaq, and Russell 2000 indices to gold, it illustrates gold’s consistent purchasing power, despite fluctuations in the stock market. It also examines the ratio of average U.S. home prices to gold, showing that gold has maintained its purchasing power even as real estate prices have skyrocketed. Additionally, the stable relationship between the amount of gold needed to purchase a barrel of oil over decades, despite geopolitical and economic changes, underscores gold’s reliability as a measure of value across various sectors. This comprehensive analysis suggests that gold’s enduring worth is evident in its capacity to safeguard value in the face of inflation and market volatility.

Daily Gold Market Report

Gold’s Call Options Volatility Hits Historic Lows:

A Prelude to a Market Rally?

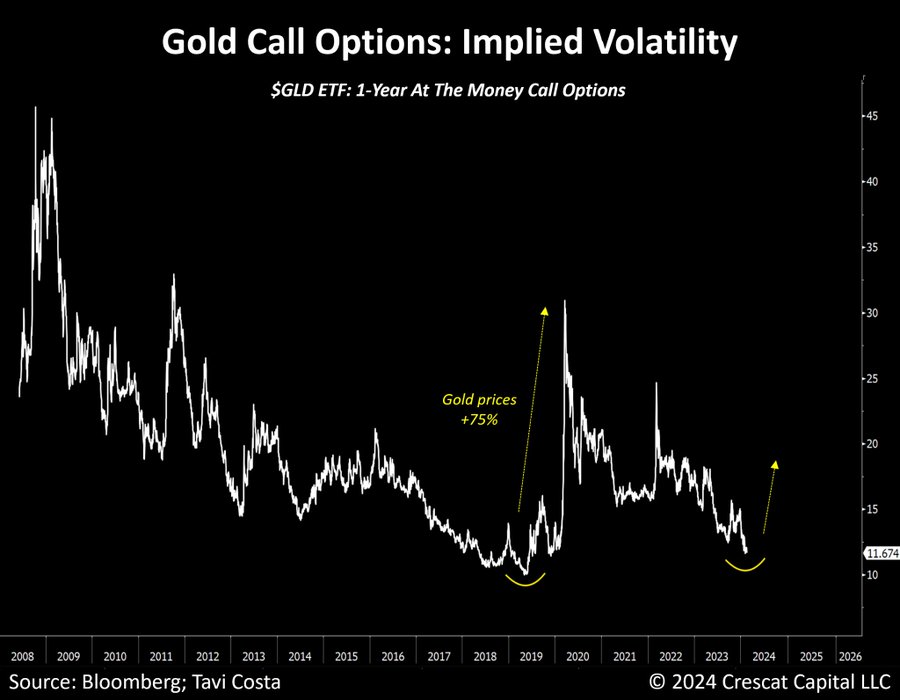

(USAGOLD – 2/26/2024) Gold prices are down slightly to start the week. Traders are looking for a fresh fundamental spark to drive price action. Gold is trading at $2026.89, down $8.51. Silver is trading at $22.55, down 40 cents. Tavi Costa of Crescat Capital recently highlighted on Twitter/X a significant drop in the implied volatility of call options on gold, marking one of its lowest points in history. This scenario is reminiscent of a past period that preceded a 75% rally in gold prices over subsequent years. Despite such potential gains seeming modest in the current speculative climate, the tweet suggests that a similar movement now could trigger long-awaited significant trends. Furthermore, Tavi points out a historical pattern where gold cycles align with those of other commodities, positively affecting the valuations of resource-rich emerging markets.

Daily Gold Market Report

The Evolution of Gold Investing:

From Anti-Bubble Asset to Bitcoin’s Partner in the BOLD Index

(USAGOLD – 2/23/2024) Gold prices continue to trade sideways to end the week. The gold market continues to struggling as expectations for the start of the Federal Reserve’s easing cycle continue to be pushed back. Gold is trading at $2025.73, up $1.43. Silver is trading at $22.75, down 1 cents. Charlie Morris of ByteTree recently wrote an article entitled “The Golden Anti-Bubble“, which explores the evolving relationship between gold, the Nasdaq, and other financial assets over the past decades, focusing on gold’s role as a diversifier and a ‘risk-off’ asset. Initially, during the dotcom bubble of the late 1990s, gold and the Nasdaq were uncorrelated, with gold entering a bull market following the Nasdaq’s peak in 2000. However, recent times have seen gold displaying correlations with both equities and bonds, particularly during the pandemic, challenging its traditional role as a diversification tool. He discusses gold’s performance in relation to various financial models, including TIPS (Treasury Inflation-Protected Securities), monetary versus consumer inflation, and the global money supply, suggesting that gold remains a valuable asset despite being currently undervalued according to some metrics. It also highlights the ByteTree’s Bitcoin and Gold Index (BOLD) (60% Bitcoin/ 40% Gold) strategy, which leverages rebalancing between bitcoin and gold to optimize returns, suggesting a modern approach to investing in gold. Despite gold’s strong fundamentals and central banks’ interest, investor engagement with gold ETFs has declined, presenting a paradox in gold investment behavior.

Daily Gold Market Report

Echoes of the 1970s:

Wall Street Braces for Inflation and Geopolitical Risks

(USAGOLD – 2/22/2024) Gold prices continue to trade sideways in early trading Thursday. Gold is trading at $2025.51, down $0.48. Silver is trading at $22.87, down 2 cents. A team of J.P. Morgan quantitative strategists, led by Marko Kolanovic, warns that the current market narrative, favoring a stable and balanced “Goldilocks” scenario, might shift towards a 1970s-style stagflation, with significant asset allocation implications. The 1970s were characterized by high inflation, geopolitical tensions, energy crises, flat equity markets, alongside superior bond performance, and an era that solidified gold’s reputation as a crucial asset for investors seeking to protect their wealth. The analysts highlight similarities with the present, including inflation waves and geopolitical conflicts in Eastern Europe, the Middle East, and the South China Sea, potentially leading to a second wave of inflation and market selloffs. They suggest that tensions, especially with China, could trigger a global economic impact, reviving the conflict inflation scenario of the 1970s. In such a situation, investors might pivot from equities to fixed-income assets seeking higher yields, as was the case from 1967 to 1980 when bonds outperformed stocks. By the end of the decade, gold prices had reached unprecedented levels, peaking at over $800 per ounce in January 1980. This represented an extraordinary rise from the $35 per ounce price fixed under the Bretton Woods system at the beginning of the decade.

Daily Gold Market Report

Gold’s Unexpected Rebound:

How It Overcame Higher Yields and a Strong Dollar

(USAGOLD – 2/21/2024) Gold prices are unchanged in early trading Wednesday. Gold is trading at $2028.06, up $3.65. Silver is trading at $23.01, up 1 cent. Despite a backdrop of higher bond yields, a stronger US dollar, and no major escalation in geopolitical tensions in the Middle East—conditions typically unfavorable for gold—the precious metal demonstrated resilience in early 2024. Gold’s dip below $2000 per ounce was short-lived, as it quickly rebounded, indicating strong buying interest even at historically high levels. David Scutt of City Index suggests this rebound has potential for further gains, particularly as the US dollar rally shows signs of fatigue amid rising inflation expectations. The inverse relationship between gold and the US dollar index (DXY) has been notably strong, hinting at a weakening dollar providing a tailwind for gold prices. Additionally, market-based inflation expectations are rising, which could further support gold as a hedge against inflation. Despite the adverse macro environment and volatility following US economic reports, gold’s recovery to its previous trading range suggests a bullish outlook, with buying opportunities on pullbacks towards $2008 seen as offering favorable risk-reward scenarios.

Daily Gold Market Report

MUFG Stands Firm on Gold:

A Bullish Outlook Amid Market Volatility and Geopolitical Tensions

(USAGOLD – 2/20/2024) Gold prices are posting gains after the holiday weekend in early trading Tuesday. Gold is trading at $2027.00, up $9.79. Silver is trading at $23.13, up 13 cents. MUFG, Japan’s largest bank and a significant voice in the commodities market, recently reiterated its 2024 Gold outlook, maintaining its price target of $2350/oz even after a market selloff, distinguishing itself from other financial institutions like UBS, which lowered its gold price forecast to $2200/oz. MUFG’s position is notable for several reasons: it’s based on research released post-selloff, it’s unaffected by US Dollar politics due to its non-US base and non-bullion dealer status, and it reflects confidence in gold’s resilience amid uncertain US monetary policy and inflation dynamics. Despite challenges from higher interest rates, MUFG underscores the importance of robust emerging market central bank purchases and gold’s role as a geopolitical hedge, factors central to its bullish stance. The bank acknowledges potential downside risks but remains constructive on gold, recommending a long position in anticipation of continued demand, especially from China and India, and gold’s safe-haven appeal amidst geopolitical tensions and economic uncertainties.

Daily Gold Market Report

UK and Japan Enter Technical Recessions:

The Case for Physical Gold Amidst Global Recessions

(USAGOLD – 2/16/2024) Gold prices experienced a slight decline from their overnight gains and faced modest selling pressure in early Friday trading. This shift occurred after a U.S. inflation report (PPI) came in higher than anticipated, and recent data on U.S. housing construction showed a larger-than-expected drop last month. Gold is trading at $2002.81, down $1.50. Silver is trading at $23.05, up 13 cents. As countries like the UK and Japan enter technical recessions, owning physical gold becomes increasingly important for several reasons. Gold has historically been regarded as a safe-haven asset, offering a hedge against inflation and currency devaluation that often accompany economic downturns. During recessions, investors seek stability, and gold’s intrinsic value provides a form of financial insurance against the volatility of stock markets and the weakening of fiat currencies. Additionally, gold’s scarcity and universal value mean it can serve as a store of wealth and a medium of exchange in times of economic uncertainty. As economies contract and central banks potentially implement measures like quantitative easing, which can lead to inflation, the appeal of gold, which cannot be artificially produced or inflated, becomes even more pronounced. Owning physical gold can be a prudent part of a diversified investment strategy during economic downturns.

Daily Gold Market Report

Silver’s Shining Forecast:

Poised for a Breakout in 2024 Amid Gold’s Stability

(USAGOLD – 2/15/2024) Gold prices remain steadfast around the crucial $2,000 per ounce mark following the release of retail sales data for January, which significantly underperformed market forecasts, along with a downward adjustment of December’s figures. Gold is trading at $2005.37, up $13.04. Silver is trading at $22.77, up 44 cents. A recent article by Damian Nowiszewski of Investing.com discusses the potential for silver to outperform gold in 2024, highlighting stable gold prices despite a hawkish Federal Reserve and forecasting a significant spike in silver demand. Analysts predict a bullish year for both metals, with silver expected to see increased demand, especially from the industrial sector. Technical analysis suggests both metals are in a consolidation phase, with potential for a breakout. The Silver Institute anticipates global silver demand to reach 1.2 billion ounces, driven by industrial and jewelry demand in India, with projections of silver prices reaching $30 per ounce by year-end. There are challenges for gold investment due to outflows from ETFs, competition from Bitcoin ETFs, and the effects of high inflation and economic slowdown on individual investors. Overall, silver’s potential is underscored by its anticipated demand surge and favorable technical indicators, suggesting it may be a more attractive option for investors in 2024.

“Meanwhile, silver also shows narrowed ranges, consolidating within the $22-23.50 per ounce range. If the retreat extends further south, investors should focus on a robust demand zone within the $21 per ounce range. An upward breakout from the current consolidation would signal there’s lot more to come, paving the way for a retest of $26 in the long term,” Nowiszewski suggests.

Daily Gold Market Report

US Inflation Challenges Persist:

But Gold Prices Fall Below $2000/oz!?

(USAGOLD – 2/14/2024) Gold prices have continued to decline due to continued selling pressure following significant losses on Tuesday, triggered by the release of a higher-than-expected U.S. inflation report. Gold is trading at $1990.83, down $2.32. Silver is trading at $22.12, up 1 cent. Both headline and core inflation rates for January exceeded expectations, with significant increases in services, particularly in medical care and insurance costs. Despite a decrease in energy prices, food and dining out remain expensive, with notable price jumps in full service and quick service meals. Rent and owner-equivalent rent prices continue to rise, along with auto insurance and travel costs, indicating that inflation is not easing as quickly as hoped. Core goods prices are showing signs of deflation, with notable drops in used car prices. Achieving a 2% inflation target is challenging, with various sectors experiencing different rates of price changes. Treasury yields are increasing, with the 10-year yield expected to test 5% again this year, reflecting a decrease in expectations for Federal Reserve rate cuts.

Daily Gold Market Report

Economic Crossroads:

The US’s Path to Preserving its Living Standards

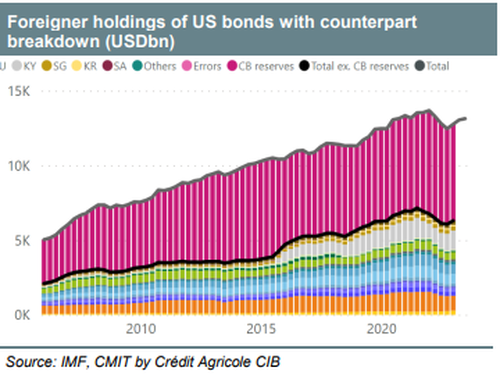

(USAGOLD – 2/13/2024) Gold and silver prices are lower, following a higher-than-expected U.S. inflation report. The still-high core CPI puts Fed May rate-cut hopes in doubt. Gold is trading at $2000.63, down $19.42. Silver is trading at $22.30, down 40 cents. In a recent podcast, VBL of GoldFix outlines the precarious position of the U.S. economy due to its reliance on external financing through U.S. Treasuries to sustain its standard of living. It explores the necessity of nationalizing foreign-held debt and enticing foreign investment with alternatives to U.S. Treasuries to maintain economic stability. He discusses the diminishing global appetite for U.S. Treasuries due to various factors, including geopolitical tensions and the need for countries to invest domestically. Valentin Giust Global Macro Strategist of Credit Agricole, also warns, “The US features a large Capital Accounts deficit, driven by a structural trade deficit [We spend too much] and despite a positive income balance. In other words, the US is structurally living beyond its means.”

Daily Gold Market Report

Unrealistic Optimism:

A Critical Look at CBO’s Economic Projections

(USAGOLD – 2/12/2024) Gold prices are modestly down and silver prices solidly up in early trading Monday. Gold is trading at $2018.79, down $5.47. Silver is trading at $22.79, up 17 cents. The latest Congressional Budget Office (CBO) projections are overly optimistic, even deeming them unrealistic in light of the current economic challenges. The CBO’s forecasts rely on assumptions that appear disconnected from reality, such as an unemployment rate peaking at 4.4%, inflation reducing to 2% and falling further within five years, 200 basis points of interest rate cuts in the next 10 months, and a continuous influx of immigration contributing $7 trillion to GDP. These projections overlook critical factors like the actual unemployment rate being higher when accounting for those not in the labor force, the unrealistic expectations of no recessions, and the overlooked impacts of government borrowing on interest rates. These projections may misguide fiscal and monetary policies, suggesting that savvy investors and the public should prepare for a less optimistic economic future. The expectation of no recessions and the disregard for ongoing financial crises, suggests a need for more realistic fiscal and monetary policies.

Daily Gold Market Report

China’s Economic Slowdown:

A Catalyst for Global Deflationary Trends

(USAGOLD – 2/08/2024) Gold prices experienced a slight decline in subdued early trading on Friday, as the unexpected news of deflation from China continued to exert downward pressure on the metals markets, concluding the trading week on a bearish note. Gold is trading at $2027.74, down $6.78. Silver is trading at $22.57, down 1 cent. As China’s economy slows, global investors anticipate that falling prices within the country will contribute to lower inflation rates worldwide due to excess capacity prompting Chinese exporters to reduce prices on international goods. This trend reported by Financial Times, marking the fastest decline in Chinese export prices since the 2008 financial crisis, signals potential deflationary pressures exported from the world’s largest exporter. China experienced its fastest annual drop in consumer prices in 15 years and a decrease in its producer price index, with significant implications expected for emerging markets closely tied to Chinese trade. Some analysts predict this could lead central banks in these markets to cut interest rates. Despite varying opinions on the impact of Chinese deflation on global prices, the situation highlights concerns over unfair competition for Western manufacturers and the strategic choices facing countries regarding their reliance on Chinese imports amidst potential trade protectionism.

Daily Gold Market Report

Mixed Fortunes for Gold ETFs:

North America and Europe See Declines, Asia Invests More

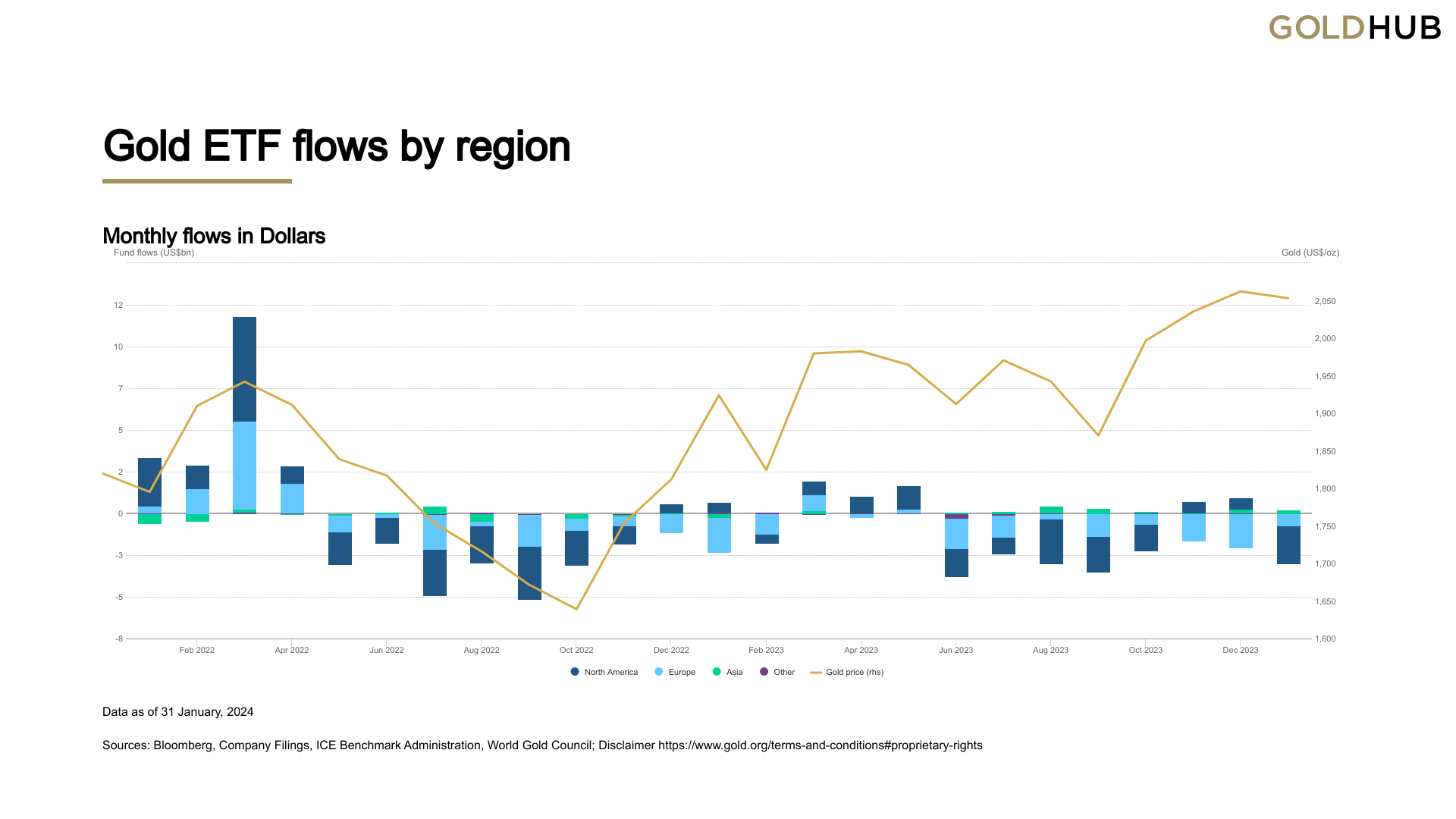

(USAGOLD – 2/08/2024) The gold market is facing ongoing challenges due to persistent selling pressure, as there has been little to no change in the U.S. labor market activities compared to last week. Gold is trading at $2033.67, down $1.69. Silver is trading at $22.53, up 31 cents. In January 2024, global gold-backed ETFs saw a significant outflow of 51 tonnes, marking the eighth consecutive month of net redemptions, predominantly in North America, as reported by the World Gold Council. This outflow amounted to a $2.8 billion reduction in value, decreasing the total gold ETF holdings to 3,175 tonnes and assets under administration to $210 billion. The decline was primarily attributed to a market pushback against early central bank rate cuts, which led to a decrease in gold prices and dimmed investor interest in gold ETFs. North American ETF holdings notably dropped to a four-year low, with a 36-tonne decrease to 1,606 tonnes, while European ETFs also experienced a decline, and Asian ETFs saw a modest increase in investor interest due to a demand for safe-haven assets amidst a fall in local equities and a weaker currency.

Daily Gold Market Report

Advocating for Silver’s Recognition:

A Call to Classify it as a Critical Mineral in Canada

(USAGOLD – 2/07/2024) Gold prices are holding steady in early trading on Wednesday, with no new fundamental developments to significantly influence the markets. Gold is trading at $2036.80, up 66 cents. Silver is trading at $22.36, down 6 cents. In a recent open letter, signed by executives from Canadian and international silver mining companies, advocates for the recognition of silver as a critical mineral in Canada. It outlines silver’s historical significance, its resurgence due to demand in electronics and renewable energy, and its vital role in the transition to a low-carbon economy including nuclear energy:

Daily Gold Market Report

China’s Golden Refuge:

Households Turn to Precious Metal Amid Property and Stock Market Woes

(USAGOLD – 2/06/2024) Gold prices are holding steady in early trading on Tuesday, with no significant new developments to influence daily price movements. Gold is trading at $2028.51, up $3.40. Silver is trading at $22.32, down 4 cents. In the face of a declining residential property market and failing developers like Evergrande, Chinese households are turning to gold as a safer investment option, marking a significant shift in their saving and investment strategies. The property bust and falling stock prices, exemplified by the Shanghai CSI 300 index’s near five-year lows (down 30% YTD), have eroded confidence in traditional investment avenues. With low yields on deposits and government bonds, gold has emerged as an attractive alternative. The increase in savings among Chinese households, now preferring to save rather than invest, has led to a surge in gold purchases, including jewellery, bars, and ETFs. This trend is bolstered by the People’s Bank of China’s steady gold buying, weak local asset markets, and a global political climate fostering uncertainty. Despite China being the world’s largest producer and consumer of gold, the persistent premium of Shanghai gold prices over international benchmarks and a spike in gold imports highlight a growing demand and a potential shift towards gold as a protective investment against asset deflation and economic instability in China.

Daily Gold Market Report

The Fed’s Policy Shift:

A Death Knell for Small Banks?

(USAGOLD – 2/05/2024) Gold and silver prices are sharply lower in early trading Monday, as most markets are bearish including a significant drop in the Chinese stock market. Gold is trading at $2017.39, down $22.37. Silver is trading at $22.37, down 32 cents. FX Hedge recently critiqued the Federal Reserve’s decision to impose an interest rate floor on the Bank Term Funding Program (BTFP) loans, equal to the interest rate on reserves. This move, intended to curb arbitrage that favored big banks, has inadvertently placed regional banks in jeopardy by increasing their borrowing costs and potentially leading to insolvency due to their reliance on the BTFP for credit. The piece argues that this policy change disadvantages small banks, exacerbates existing financial vulnerabilities, and may drive them into the arms of larger banks, effectively consolidating financial power.

Just last week, the stock of New York Community Bank, which took over the failed Signature Bank last year, plunged by 40% following its earnings report. Contrary to the anticipated profit of $260 million, the bank disclosed a loss of the same amount for the fourth quarter. Several smaller banks are significantly exposed to commercial real estate loans. Should defaults on these CRE projects persist, it might lead to increased stress on the banking sector.

Daily Gold Market Report

Gold Market Review 2023:

Surge in Demand, Record Prices, and Central Bank Influence

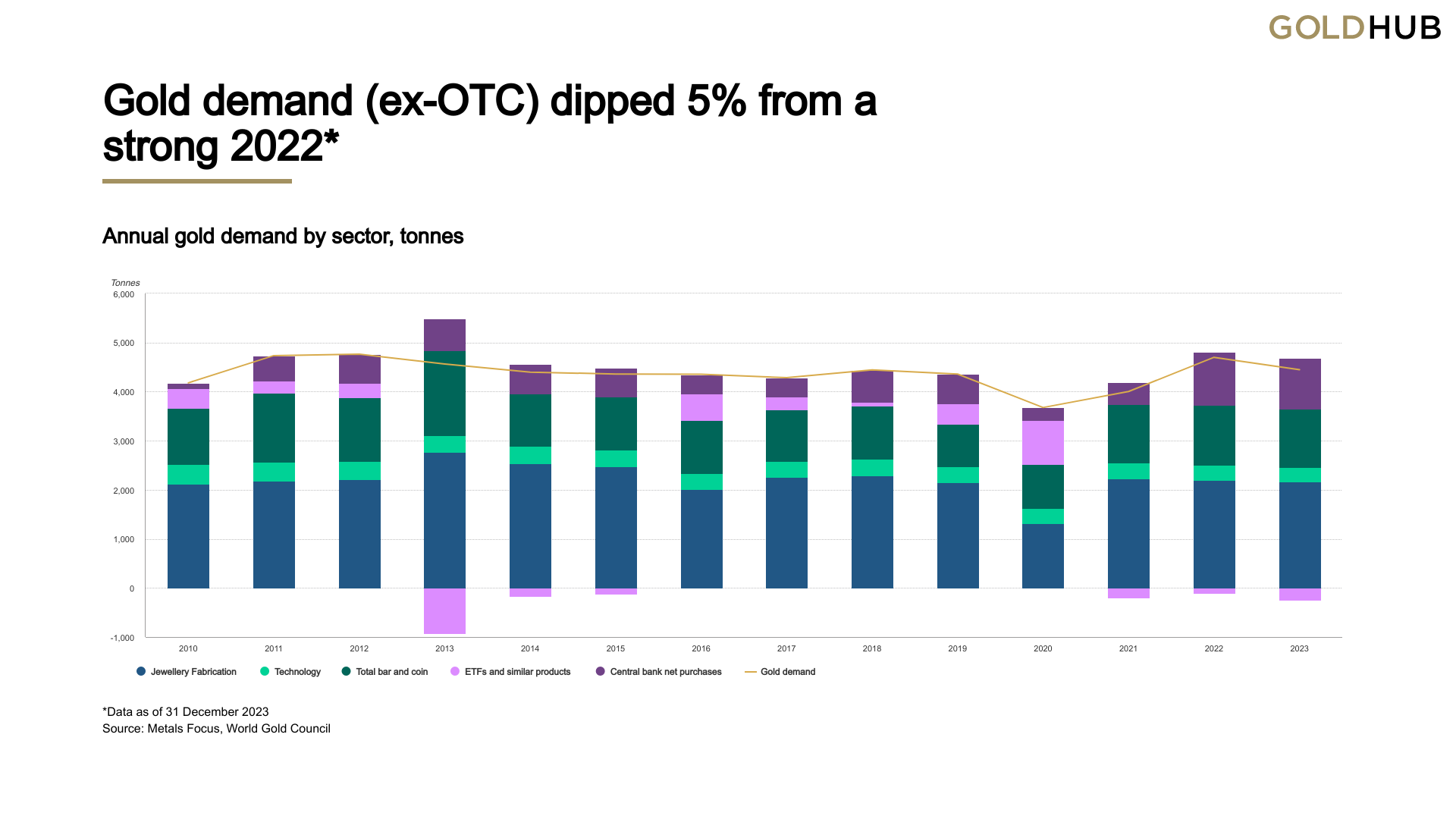

(USAGOLD – 2/02/2024) Gold and silver prices are sharply lower in early trading Friday, after strong U.S. jobs data shows solid gains. Gold is trading at $2031.90, down $23.09. Silver is trading at $22.57, down 61 cents. The World Gold Council reports that in 2023, total gold demand reached a record high of 4,899t, driven by strong central bank buying, steady jewelry consumption, and significant OTC and stock flows, despite a 5% decrease from 2022’s demand and substantial ETF outflows. Central banks nearly matched their 2022 record purchases, with annual net purchases of 1,037t. Global gold ETFs experienced a third year of net outflows, losing 244t, while annual bar and coin investment slightly contracted. Jewelry consumption remained robust at 2,093t, supported by China’s recovery, even amid high gold prices. However, the use of gold in technology fell below 300t for the first time. The LBMA gold price closed 2023 at a record high of US$2,078.4/oz, reflecting a 15% annual return and an 8% increase over the 2022 average price. Q4 gold demand was 8% above the five-year average but 12% lower year-over-year compared to Q4’22. Overall, annual mine production increased slightly, while recycling rose due to high gold prices, leading to a 3% increase in total gold supply.

Daily Gold Market Report

Fed Chair Powell Signals Caution:

No Immediate Rate Cuts Despite Inflation Ease

(USAGOLD – 2/01/2024) Gold prices have dipped slightly in Thursday’s early trading session, following outcomes from the recent Federal Reserve’s FOMC meeting, which leaned towards a more hawkish stance on U.S. monetary policy. Gold is trading at $2049.71, up $10.19. Silver is trading at $22.94, down 2 cents. The Federal Reserve decided to maintain the current interest rate range and signaled a cautious approach towards future rate cuts at thier policy meeting yesterday. Jerome Powell emphasized the need for more data to confirm a sustained downward trend in inflation before considering a rate reduction, particularly ruling out a cut in March. Despite a favorable pullback in inflation and a still-solid economy, Powell and the Federal Open Market Committee (FOMC) showed reluctance to quickly lower rates. The FOMC unanimously voted to keep the benchmark rate at a 22-year high of 5.25%-5.5% for the fourth consecutive meeting, removing a previous reference to further policy “firming”. Market expectations for a March rate cut decreased following Powell’s comments, affecting the S&P 500 and Treasury yields. Powell also addressed concerns about premature rate cuts and reiterated the Fed’s commitment to a gradual approach, waiting for clearer signs of inflation moving sustainably toward the 2% target. The article also notes concerns about an upcoming revision to inflation figures and the Fed’s ongoing asset portfolio reduction. Powell indicated that discussions about the balance sheet would begin in March, with decisions expected by mid-year.

USAGOLD Comment: Gold prices briefly shot up to $2050/oz during the meeting but have since faded. Gold is suspected to remain rangebound until the Fed ultimately decides to cut rates.

Daily Gold Market Report

Black Swan’s Taleb Sounds the Alarm:

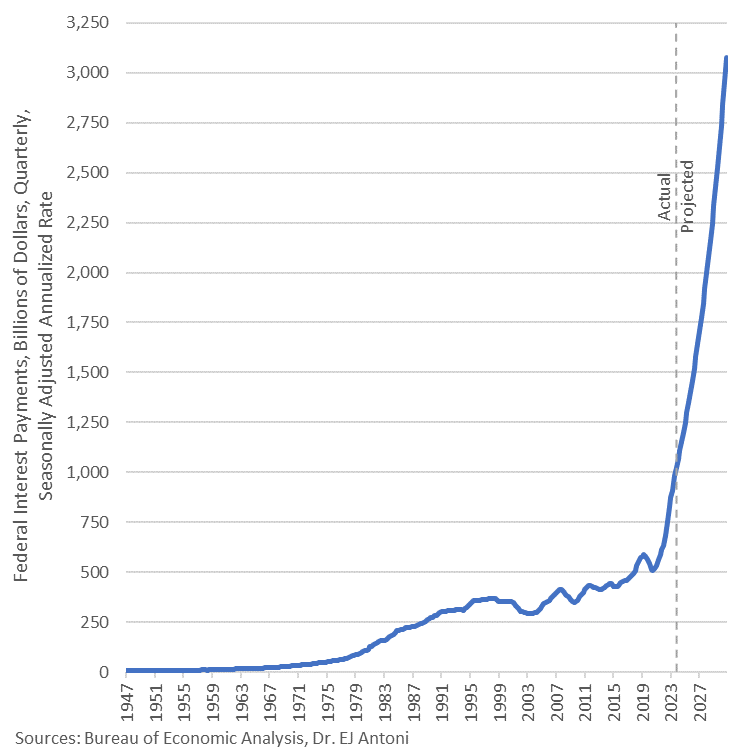

U.S. ‘Death Spiral’ Due to Mounting Debt Crisis

(USAGOLD – 1/31/2024) Gold prices are up in early trading Wednesday, ahead of the conclusion of the U.S. central bank monetary policy meeting. Gold is trading at $2048.10, up $11.09. Silver is trading at $23.22, up 5 cents. Nassim Nicholas Taleb, author of “Black Swan,” warned that the U.S. is facing a critical situation with its escalating national debt, which he describes as a “white swan” event – highly probable and potentially disastrous. Speaking at a Universa Investments event reported by Bloomberg, Taleb criticized the U.S. political system, particularly Congress, for continually extending the debt limit without addressing the underlying issue. He suggested that the increasing interconnectivity of the global economy makes the situation more precarious. This concern is echoed by other financial experts like former Treasury Secretary Robert Rubin and BlackRock Inc.’s Vice Chairman Philipp Hildebrand. Universa Investments, where Taleb advises, is known for its strategy of profiting from market downturns. Taleb expressed a gloomy view of the Western political system, indicating that a significant external intervention or an unlikely miracle might be necessary to reverse the debt spiral.

Daily Gold Market Report

Jamie Dimon’s Stark Warning:

U.S. Debt Nears ‘Cliff’ with Global Fallout Imminent

(USAGOLD – 1/30/2024) Gold prices are higher in early trading Tuesday, as the world anxiously awaits the U.S. military’s response. Gold is trading at $2045.90, up $12.67. Silver is trading at $23.26, up 6 cents. JPMorgan Chase CEO Jamie Dimon warns of a potential global market crisis due to the escalating U.S. government debt. He expressed these concerns at a Bipartisan Policy Center event, alongside former Speaker Paul Ryan. Dimon compares the current economic situation to the 1980s, highlighting the significantly higher debt-to-GDP ratio now, which is around 100% compared to 35% back then. He predicts that by 2035, this ratio could reach 130%. Dimon also emphasized the global impact of the U.S. debt, noting that countries like Japan, China, and the U.K. hold substantial portions of it. He stressed the importance of a stronger America and military for global security, and advocated for closer collaboration between the public and private sectors.

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

8:22 am Sat. April 20, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115