In Loving Memory of Michael J. Kosares: A 50-Year Legacy of Gold Advocacy

It is with great sadness and a heavy heart that I share that my father, Michael J. Kosares, owner and founder of USAGOLD, passed away last Thursday (September 7, 2023) after a multi-year battle with cancer. He was 75 years old. After fifty years of dedication and devotion to the precious metals business, my father only hung-up his hat just a few weeks ago when he was physically no longer able to work.

Despite countless professional accolades over the course of his storied career, he was never one to boast, nor one to seek out acknowledgement or praise. For him, true success came in a well written article – one he deemed ‘had what it took’ to make a lasting impact, not necessarily just for our company, but for our industry as a whole, for our colleagues, for our clients, for our subscribers and site visitors, and for really anyone and everyone who took an interest in precious metals and encountered his work. He was an unwavering and tireless advocate for gold and silver ownership throughout his career, educating generations of investors on the merits of owning physical metals as a means to preserve and protect their wealth during turbulent economic times. From his hardcopy newsletter, ‘News & Views’, to three editions of his educational treatise, ‘The ABC’s of Gold Investing,’ to volumes of original content delivered via our website over the past 25 years, he spent five decades on the vanguard of gold market news, analysis, and commentary. A truly gifted writer, he made economics accessible, displaying again and again a remarkable ability to simplify even the most complex subjects for his readers. He would take on vast and complicated financial topics, distill them down to the salient points, weave in an interesting history lesson, and top it all off with a bit of clever humor – leaving his readers not only informed and enlightened, but truly entertained.

To say he will be missed is certainly an understatement. To answer ‘was his career a success?’, look no further than the countless individuals who know his name, have been inspired by his work and have benefitted from his wisdom. He leaves behind an exemplary legacy, and one I am deeply honored to carry forward.

Jonathan Kosares

COO/Owner – USAGOLD

[email protected]

Daily Gold Market Report

Retirement

USAGOLD’s founder and former chief executive officer, Michael J. Kosares will be retiring in full over the next few weeks. As such, the Recommended Headline News and Opinion page, as well as the monthly Top Ten Headlines email service will both go on a brief hiatus. We will also be using this time to retool our Daily Market Report service, as we work to build a cohesive and consistent cross-platform presentation of all of USAGOLD’s original market commentary, analysis and opinion-based content. Our plan is to re-introduce all these services simultaneously in mid to late September.

––––––––––––––––––––––––––––––––

Gold grinds lower on China concerns and the prospect of higher rates

Saxo Bank sees the carrying cost as keeping a liked on the metal’s short-term prospects

(USAGOLD – 8/15/2023) – Gold continued to grind lower this morning as concerns about China’s economy and further rate increases pressed on short-term prospects. It is down $4 at $1905.50. Silver is down 17¢ at $22.50. Saxo Bank’s Ole Hansen sees the high cost of carry as one of the chief headwinds keeping a lid on the metals’ short-term prospects. “It’s clear,” he says in an analysis posted late last week, “that the bulk of the increase from next to nothing back in 2021 to the current 5.8% has been driven by the rising funding cost of holding a position in gold.”

“Looking at correlations to other markets,” he adds, “the biggest input currently is coming from movements in the dollar, and the greenback has seen broad strength this past week supported by higher bond yields adding downside pressure to the Japanese yen while other Asian currencies have struggled amid the aforementioned weakness in Chinese economic data. Apart from dollar strength hurting sentiment, we continue to see asset managers and long-term investors reducing their exposure to gold through ETFs. Since the May peak that followed the March banking crisis, total holdings in ETFs have slumped by 109 tons to 2821 tons and the lowest since January 2000.”

Daily Gold Market Report

Gold level this morning as the summer grind continues

Market Herald’s Robertson sees gold in a win-win situation

(USAGOLD – 8/14/2023) – Gold is level this morning at $1916.50 in subdued, featureless trading. Silver is off 2¢ at $22.76. The slow summer grind continues. It has been a perplexing time for gold, with many of the verities that have propelled the price in the past stood on their head, but Market Herald’s Coreen Robertson looks at the probabilities ahead and sees gold in a win-win situation.

“It maybe doesn’t like it, maybe isn’t the most exciting, but [gold] does well in that unicorn scenario of growth with low inflation,” she says in an interview recently posted at Stockhouse. “The other option is that we get a recession right now. So the two sides of the spectrum for a while, we’ll just continue down the middle, which is where we’ve been forever, not knowing which way we’re going to go. But when we do eventually choose a path, it’s either going to be the unicorn or it’s going to be the recession. And as we discussed before, gold very reliably does well in a recession. So I kind of think that no matter what happens, gold is well supported either as part of a broad metals bull market or because investors buy it in a recession.”

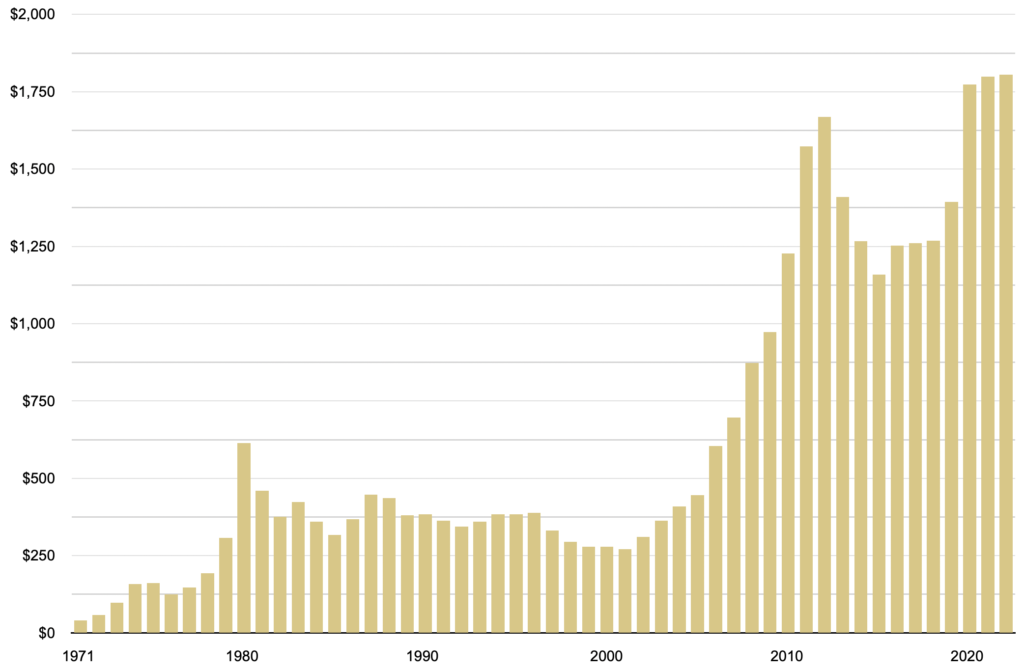

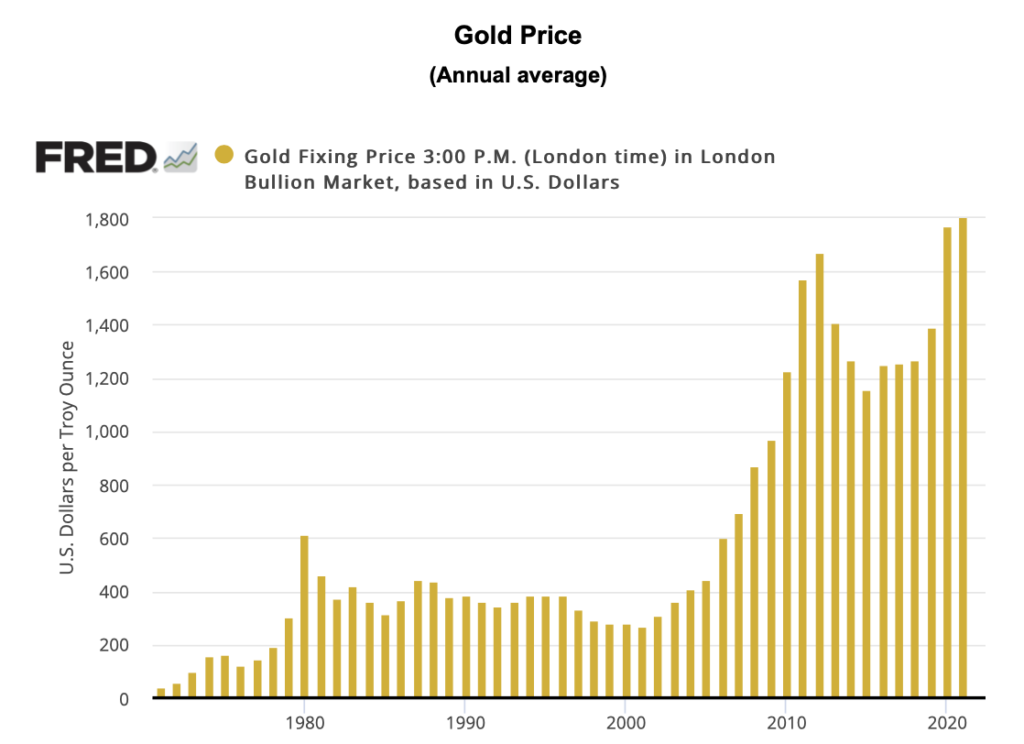

Average Gold Price

(1971-2022)

Chart by USAGOLD • • • Data source: Macrotrends.net

Daily Gold Market Report

Gold edges higher in quiet summertime trading

JPM forecasts $2175 gold price by year-end 2024, Poland buys more gold

(USAGOLD – 8/11/2023) – Gold edged higher in quiet summertime trading as yesterday’s benign inflation report failed to motivate traders and probably any real change of heart among Fed governors. Gold is up $6 at $1920.23. Silver is down 3¢ at $22.76. Since the June 1 beginning of the summer doldrums, gold is down 2.33%, and silver, always the more volatile of the two metals, is down 6.55%. JP Morgan weighed in on gold this morning. As reported by YahooFinance, it expects the metal to hit $2012 by the middle of next year and $2175 by year-end based mainly on a complete reversal of Fed policy from hiking to cutting rates and continued central bank stockpiling. Buttressing JPM’s call on central bank buying, Poland announced yesterday boosting its reserves by another 22.4 tonnes in July. Since January, it has added 72 tonnes to its holdings.

Gold and silver price performances

(Summer months, June 1, 2023 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold trades to the upside as markets await today’s consumer price report

Bloomberg says report will reveal a wave of disinflation

(USAGOLD – 8/10/2023) – Gold is trading to the upside this morning as the markets await today’s consumer price report. It is up $7.50 at $1924.50. Silver is up 18¢ at $22.88. Bloomberg economists say today’s numbers will reveal a wave of disinflation “driven mainly by the deteriorating economic landscape.” OCBC Forex strategist Christopher Wong told Reuters this morning that “Outlook for gold would regain shine when markets move in to price in greater probability of rate cuts and U.S. dollar softness. And this hinges on how entrenched the disinflation trend is.”

Market analyst James Hyerczk framed the inflation-gold–trader triangulation neatly in an overview posted at Forex Empire yesterday. “Navigating these waters teeming with unpredictability is challenging,” he says. “While certain Federal Reserve members hint at a cessation to the rate hikes, others postulate the necessity of more hikes to curb inflation. As all eyes turn to the imminent CPI revelation, gold and silver stand sentinel, mirroring the market’s faith, or the lack thereof, in the robustness of the economy.”

United States Inflation Rate

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold level as traders retreat to the sidelines ahead of tomorrow’s CPI report

‘Inflation is cooling, but prices are high, and Americans can feel it.’

(USAGOLD – 8/9/2023) – Gold is level this morning as traders took to the sidelines ahead of tomorrow’s pivotal inflation report. It is unchanged at $1928. Silver is down 8¢ at $22.78. According to Trading Economics, the consensus opinion is that CPI will come in at 4.1% annualized – down sharply from June’s 4.9%. Bloomberg ran a headline this morning that George Orwell might have appreciated: “Inflation is cooling, but prices are high, and Americans can feel it.”

China added gold to its national stockpile for the ninth straight month with analysts saying the PBOC is “just getting started,” according to a KitcoNews report. Similarly, the World Gold Council reports that gold bar and coin investment in the Middle East reached a ten-year high in the second quarter of 2023. Commerzbank says that gold needs rate hike expectations to “disappear” before it resumes its climb. The investment bank expects that to happen during the fourth quarter returning the metal to the $2000 level. [Source FXStreet]

Daily Gold Market Report

Gold drifts lower on sinking Chinese economy, caution ahead of inflation data

Mish Shedlock comments on favorable chart set-up for gold

(USAGOLD – 8/8/2023) – Gold drifted lower in early trading as China reported double-digit declines in both imports and exports, and investors took to the sidelines ahead of Thursday’s inflation data. It is down $11 at $1927. Silver is down 24¢ at $22.96. Mish Shedlock, the widely read editor of MIshTalk, recently had a few brief but supportive comments on the current technical set-up for gold. He says neither triple tops (like the one prominently displayed on the current gold chart) nor bottoms tend to hold. “If that view is correct,” he says, “gold is headed higher. Seasonally speaking, gold is heading into a favorable time of year. Finally, this has been a long 3-year consolidation period, with gold not too far from record highs.” He ends with some straightforward advice: “If you have faith in central banks, sell your gold. Otherwise, I suggest hanging on to it.”

Gold price

(Five year)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold trades cautiously to the downside ahead of inflation reports, bond sales

World Gold Council reports solid coin and bar demand for Q2-2023

(USAGOLD – 8/7/2023) – Gold is trading cautiously to the downside as it begins a week that includes the all-important consumer and wholesale inflation reports. It is down $7 at $1939. Silver is down 21¢ $23.50. Also on the agenda is a massive offering of Treasury notes and bonds, sure to be closely monitored by bond market participants.

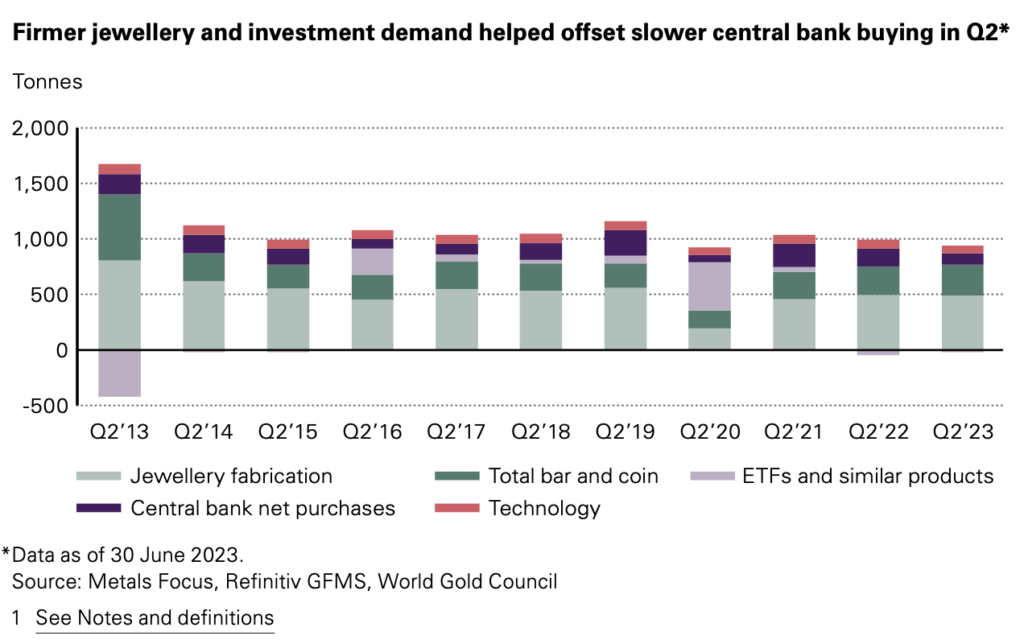

The World Gold Council reports a net deceleration in central bank purchases during the second quarter (year over year) but a solid increase in bar and coin demand (+6%). Despite the decline in central bank demand from above-average in last year’s second quarter, WGC still sees it as “resolutely positive.” Total demand is up 7% over the same quarter last year.

Chart courtesy of the World Gold Council • • • Click to enlarge

Daily Gold Market Report

No DGMR today or tomorrow. Back Monday.

Below is yesterday’s report.

––––––––––––––––––––––––––––––––––

Gold marginally higher as Fitch downgrades US credit rating

Rating drop comes as the Treasury Department gears up for heavy debt issuance

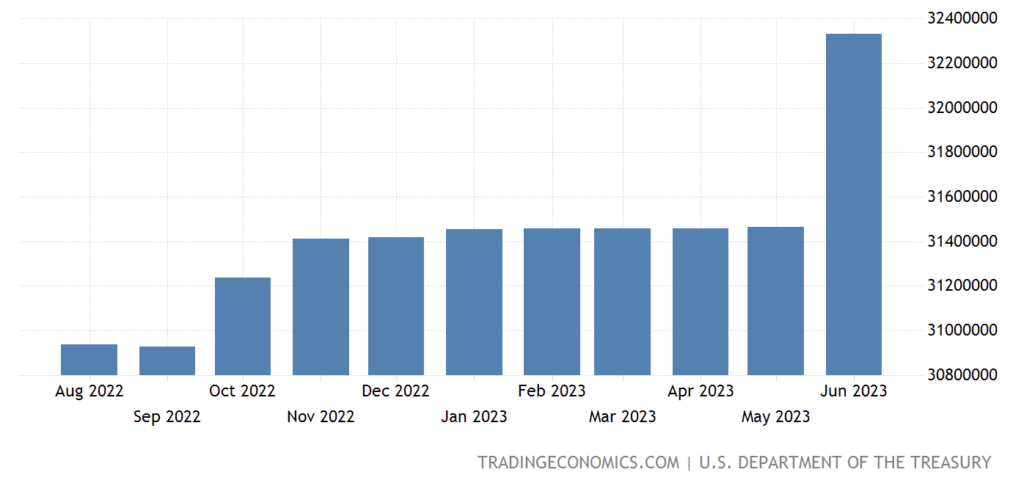

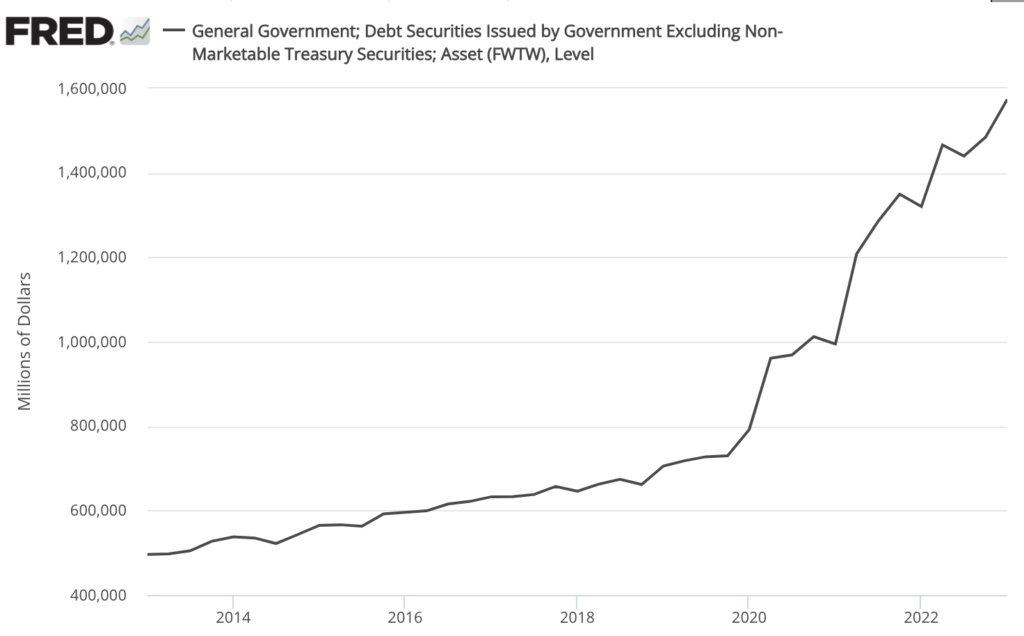

(USAGOLD – 8/2/2-23) – Gold was marginally higher in today’s early going as markets mulled over Fitch’s downgrade of US debt from AAA to AA+. The rating service cited tax cuts, greater fiscal spending, economic shocks, and continuing political gridlock as reasons for the rating demotion. Gold is up $2 at $1949. Silver is up 3¢ at $24.40. Fitch’s downgrade comes just as the Treasury Department gears up for a heavy debt issuance of $102 billion to replenish its coffers following the debt ceiling battle earlier this year. As shown in the chart below, the additions to the national debt in June were already notable.

“Last time S&P downgraded in 2011, the markets went nuts, although we are not seeing the same type of reaction in the early going, but things bear watching,” Marex analyst Edward Meir told CNBC this morning. Wells Fargo’s John LaForge told KitcoNews that “he expects growing debt in the U.S. to be a major bullish factor for gold that could support higher prices for at least the next three years.”

US Government Debt

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold down in lackluster trading pushed by stronger dollar

Credit Suisse sees new record high for later in year, then $2355

(USAGOLD – 8/1/2023) – Gold is down this morning in lackluster trading pushed for the most part by a stronger dollar. It is down $10 at $1957. Silver is down 29¢ at $24.54. Credit Swiss is not allowing the summer drag alter its bullish stance on the yellow metal.

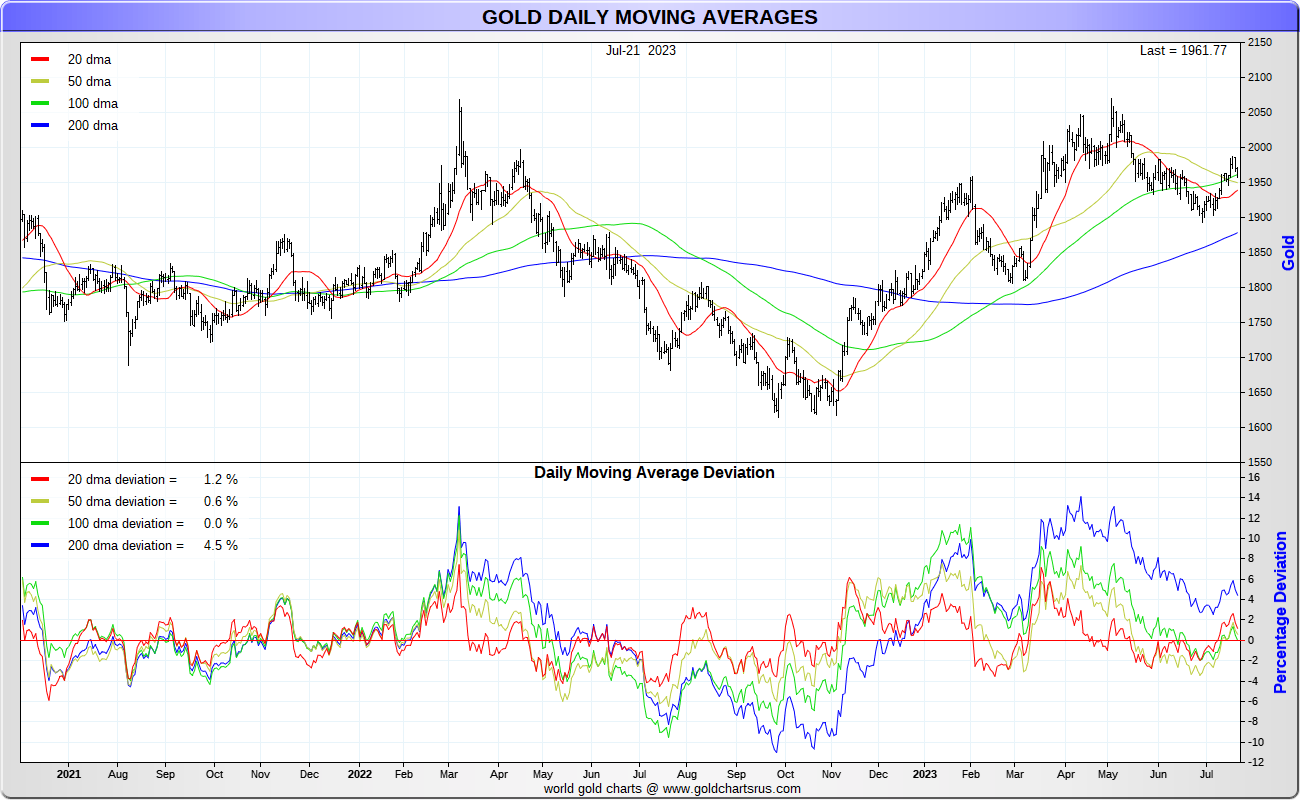

“We maintain our long-held view,” it says in an advisory released yesterday, “for a major floor to be found the key rising 200-DMA of $1,883 and for an eventual retest of major resistance at the $2,063/2,075 record highs to be seen. We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move to $2,150 next, then $2,355/65.”

Chart by USAGOLD • • • Data source: Macrotrends. net

Daily Gold Market Report

Gold off to a slow start to begin the week

Morris finds relevance in central banks buying gold ‘out of choice’ not official dictate

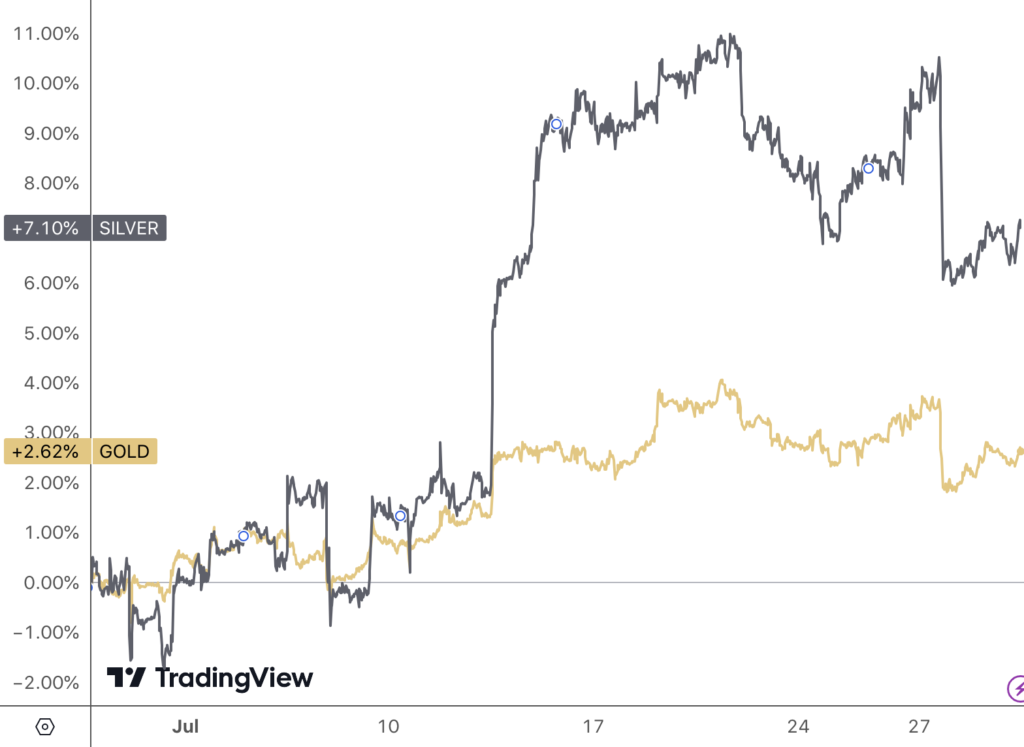

(USAGOLD – 7/31/2023) – Gold is off to a slow start to begin the week in sluggish summertime trading. It is level at $1961.50. Silver is up 5¢ at $24.46. On the month, gold is up 2.6% and silver is up a notable 7.1%. Charlie Morris, the UK-based financial analyst, offers an interesting take on the strong demand for gold among central banks.

“The remarkable thing,” says Charlie Morris in his most recent Atlas Pulse newsletter, “is that the gold standard withered in the 1970s, and other than the recent rumors surrounding a gold-backed BRICS currency, there has been no official need for central banks to own gold. They do so out of choice. It is remarkable how an informal gold standard of sorts is returning despite it being formally vanquished half a century ago. It means that gold is once again relevant despite that not being written down in the statute books.”

Gold and silver price performances

(%, July 2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold takes positive turn as Japan signals reversal of dovish monetary policy

‘The desire for gold is the most universal and deeply rooted commercial instinct of the human race.’

Gerald Loeb, Wall Street trader

(USAGOLD – 7/28/2023) – Gold took a positive turn this morning as Japan signaled it might begin reversing its dovish monetary policy – a move that surprised markets and sent the Japanese yen sharply higher in overseas markets. Gold is up $10 at $1959. Silver is up 19¢ at $29.39. “If inflation has indeed returned to Japan, which we believe it has,” says State Street’s Michael Metcalf, “the BoJ will find itself needing to raise rates just as hopes for interest rate cuts rise elsewhere. This should be a medium-term positive for the JPY [Japanese yen], which remains deeply undervalued.”

We came across this passage from a Dominic Frisby essay earlier this week and thought it worth passing along:

“The experience of beauty, whether derived from nature, art, music or even mathematics, correlates with activity in the emotional brain, the medial orbitofrontal cortex. Beauty has long been associated by philosophers with truth and purity – also qualities commonly associated with gold. Our instinct for gold and the emotions it inspires from beauty to desire are basic. There has not been a culture in history that did not appreciate the value of gold. It is a primal instinct. ‘The desire for gold,’ said Wall Street trader Gerald Loeb, ‘is the most universal and deeply rooted commercial instinct of the human race.’” [Source: MoneyWeek]

Daily Gold Market Report

Gold pushes higher in Fed aftermath

JPMorgan sees gold hitting ‘fresh records in 2024’

(USAGOLD – 7/27/2023) – Gold pushed higher in the aftermath of yesterday’s Fed hike and press conference. It is up $5 at $1978.50. Silver is up 13¢ at $25.12. The market reaction to yesterday’s events was generally subdued as Chairman Powell emphasized future decisions would be data-driven leaving market sentiment pretty much where it was prior to the meeting – up in the air and open to interpretation.

JP Morgan sees the Fed turning dovish by the second quarter of next year – a shift it believes will push gold to new record levels during 2024. “We’re in a very prime place,” says Greg Shearer, the firm’s director of commodities research, “where we think gold ownership and long allocation to gold and silver is something that acts as both a late cycle diversifier and something that will perform as we look to the next sort of 12, 18 months.… There is an eagerness here to really buy in and diversify allocation away from currencies.” [Source: Yahoo!Finance-Bloomberg]

Daily Gold Market Report

No DGMR today. Back tomorrow – 7/27/2023

Below is yesterday’s report

______________

Gold trades higher in run-up to Fed rate decision, press conference

Crescat predicts a powerful new wave of gold demand driven by a flood of government debt

(USAGOLD – 7/25/2023) – Gold is trading higher in the run-up to tomorrow’s Fed rate decision and press conference. It is up $7 at $1964. Silver is up 32¢ at $24.75. Crescat Capital’s Kevin Smith and Tavi Costa believe that the United States is immersed in a mounting debt problem that is weakening the dollar and creating an environment that will divert capital away from Treasuries and into gold.

“We believe a powerful new demand wave for gold is coming in the short term from both institutional and retail investors,” they say in a recent analysis posted at Zero Hedge. “In aggregate, global central banks are already ahead of the curve as they have been accumulating the monetary metal recently as a reserve asset in preference over USTs. Gold is a haven asset that can provide an inflation hedge while also offering strong absolute and relative real return potential in the stagflationary hard-landing environment that our models are now forecasting.”

Sources: St. Louis Federal Reserve [FRED], Board of Governors Federal Reserve

Daily Gold Market Report

Gold cautiously higher ahead of Wednesday’s rate decision

Ned Davis Research goes bullish on gold, bearish on US dollar

(USAGOLD) – 7/24/2023) – Gold is cautiously higher ahead of this week’s Fed meeting scheduled to culminate Wednesday with a rate decision and press conference. It is up $5 at $1969.50. Silver is up 4¢ at $24.73. Ned Davis Research recently downgraded the U.S. dollar from neutral to bearish, according to a Market Watch report late last week, and upgraded gold from neutral to bullish.

“When a global slowdown has been lacking,” says Tim Hayes, the firm’s chief global investment strategist, “the dollar has declined at a per annum rate of -1% whereas gold has gained 10% per annum…” Hayes points to an important technical indicator as further evidence of the changing dollar-gold scenario. In January, gold achieved “a golden cross, when its 50-day moving average rose above the index’s 200-day moving average, while the U.S. dollar saw a death cross.” Since the January crossover, gold is up 7.75%, and the US dollar index is down 2.2%.

Daily Gold Market Report

Gold moderately lower as investors brace for next week’s Fed policy meeting

Citibank says it only a matter of time until gold posts ‘fresh’ all-time highs

(USAGOLD – 7/21/2023) – Gold is moderately lower in quiet summertime trading as investors brace for next week’s Fed policy meeting. It is down $8 at $1964. Silver is down 3¢ at $24.79. A sharp drop in the Japanese yen (-1.1%) is not helping matters. Citibank is bullish on gold for the near term, according to a Bloomberg report published this morning, saying it has already benefited from loosening monetary policy, record inflows into ETFs, and increased asset allocation. As a result, it is only a matter of time, says the bank, until the metal posts “fresh” all-time highs. The report points out that prices for the metal have already posted new highs in every other G-10 and major emerging market currency this year. Silver, it says, will benefit from “demand for a store of wealth.”

Daily Gold Market Report

Gold nudges higher as traders remain cautious ahead of Fed

Wisdom Tree says gold could hit record high of $2500 over next twelve months

(USAGOLD – 7/20/2023) – Gold nudged higher this morning as traders remained cautious ahead of next week’s Fed rate decision. It is up $6 at $1984.50. Silver is up 7¢ at $25.27. “Chairman Powell’s press conference is the key focus,” Nationwide Life’s Kathy Bostjancic told Bloomberg this morning. “Powell and the FOMC have muddled their message to the markets. He has an opportunity to provide clearer guidance next week.” Wisdom Tree, the Dublin-based investment firm, says gold could hit a record high of $2500 per ounce within the next twelve months.

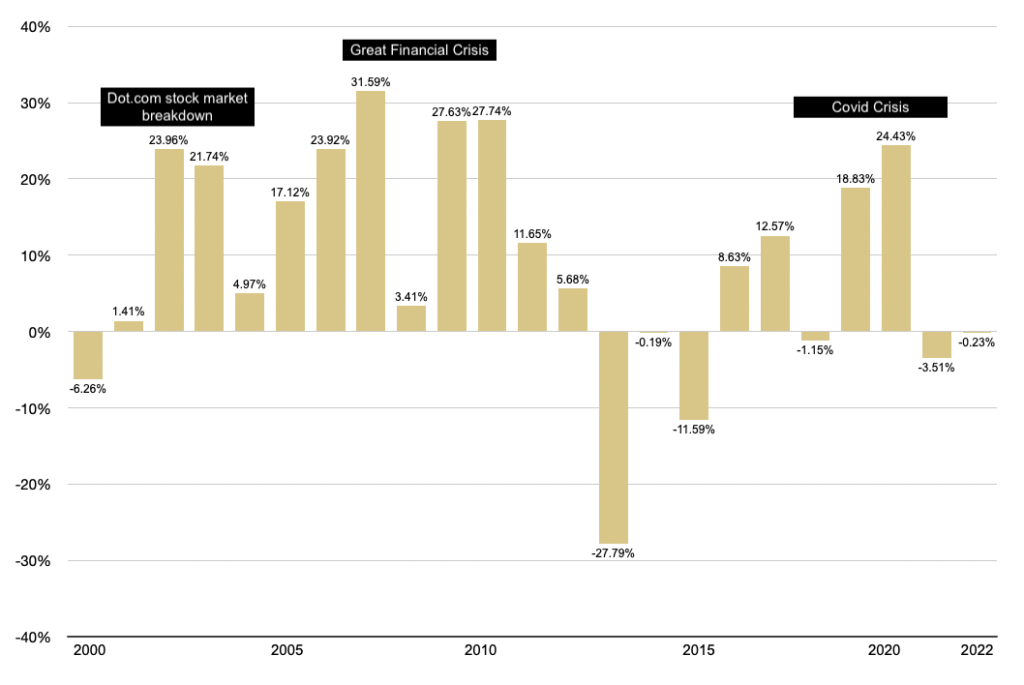

Citing the possibility of a recession as central banks continue to raise rates, Nitesh Shah, head of commodities trading at the firm, sees gold’s role as a portfolio safe haven coming into play. “Gold,” he says, “tends to perform well in times of economic stress.… [W]hen composite leading indicators turn strongly negative, gold performs positively while equities tend to be negative. Gold also outperforms Treasuries, which are seen as competing defensive assets.” [Source: TrustNet]

Gold percentage gains during times of economic stress

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge

Daily Gold Market Report

Gold down marginally as future Fed policy keeps traders on hold

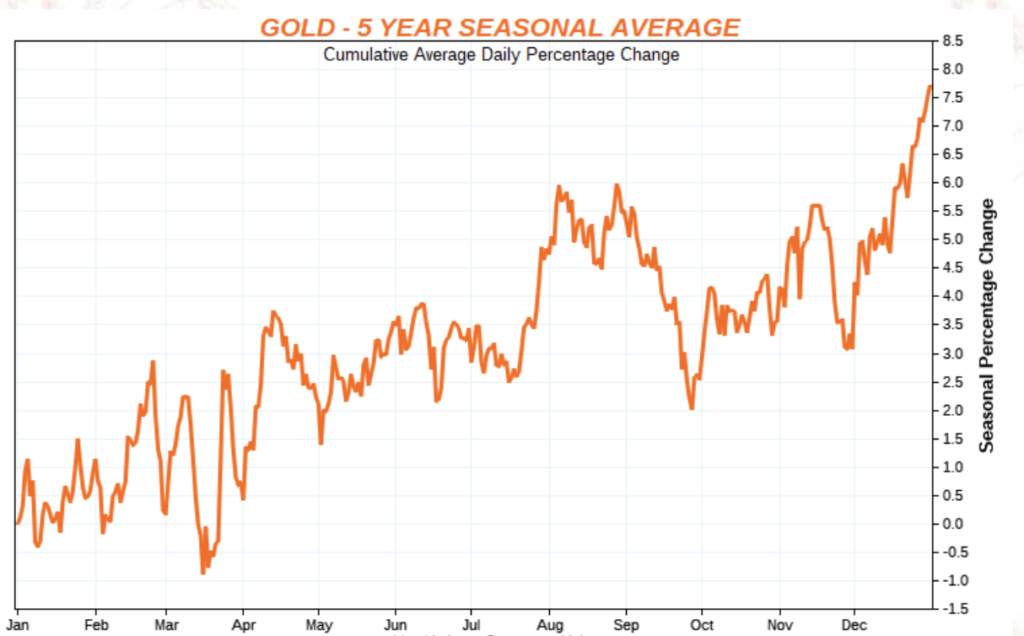

Lundin says gold may be emerging from summertime lull ahead of schedule

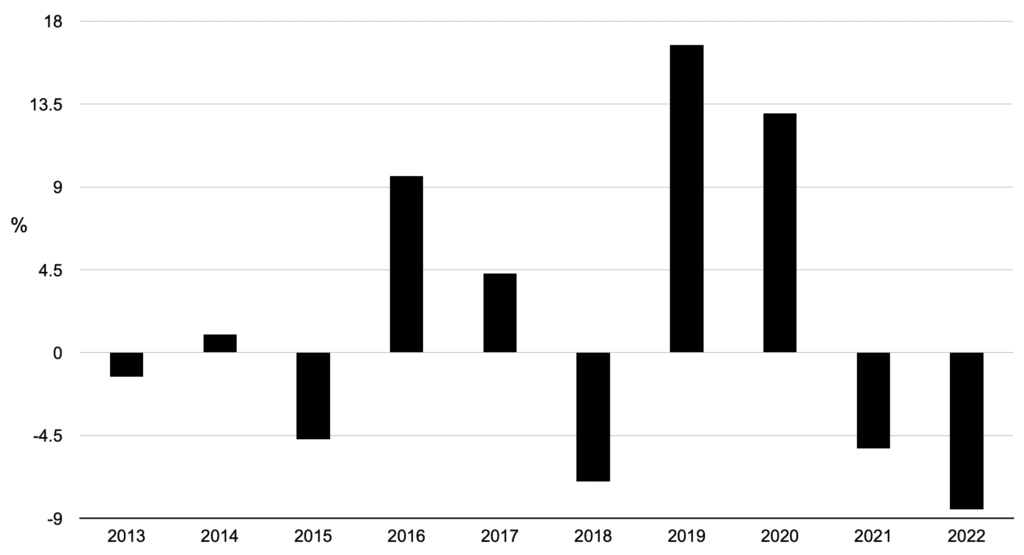

(USAGOLD –7/19/2023) – Gold is down marginally in early trading as future Fed policy kept traders on hold. It is down $3 at $1978.50. Silver is up 3¢ at $ 25.16. Financial Times reports this morning that big banks are turning more bearish on the dollar as expectations of a soft landing grow. In keeping with that sentiment, Gold Newsletter’s Brien Lundin sees signs that “gold may be violating the typical seasonal trend by rallying ahead of schedule.”

“If seasonality were the only factor in play for gold,” he says, “I would expect gold to languish another couple of weeks or longer. But seasonal trends join a long list of other factors – for gold and every other asset class – in being overwhelmed by the influence of Federal Reserve monetary policy.… But a funny thing seems to be happening, right now, on the path to Powell & Co.’s next promised rate hikes. With inflation falling according to plan, the markets are looking beyond the central bankers’ next over-reaction via continued hikes and considering the big picture.”

Editor’s note: Though summertime trading has a history of being sluggish, it doesn’t always mean the price will drop. Over the past decade, gold’s performance has been evenly split – five down years and five up years.

Gold’s price performance June through August

(2013-2022)

Chart by USAGOLD [All Rights Reserved]

Daily Gold Market Report

Gold turns higher on shifting rate sentiment

Poszar: Gold back as a ‘theme’ as global ‘monetary divorce’ from the dollar gathers pace

(USAGOLD – 7/18/2023) – Gold turned higher this morning on continued dollar weakness and a general feeling that the Fed’s tightening campaign is nearing an end. It is up $9 at $1966. Silver is up 7¢ at $24.95. Treasury Secretary Yellen added to the shifting sentiment by saying yesterday that a cooling labor market was imposing disinflationary pressures on the economy.

Zoltan Poszar, the widely-followed ex-Credit Suisse analyst, told Bloomberg over the weekend that the global financial system is now engaged in a “monetary divorce” from the US dollar. “You know, these topics: de-dollarization, the re-monetization of gold, using central bank digital currencies to build out, to knit out a de novo financial system, you know, the petroyuan and the renminbi invoicing of commodities and traded goods going forward,” he explains.

And how will gold fare under such circumstances? “Gold,” he says, “is definitely something that’s coming back as a theme… we are seeing this more and more in the data that especially the countries that are not geopolitically aligned to the US are shunning Treasuries and shunning the dollar and they are buying gold instead.”

Daily Gold Market Report

Gold is off to a quiet start after last week’s strong showing

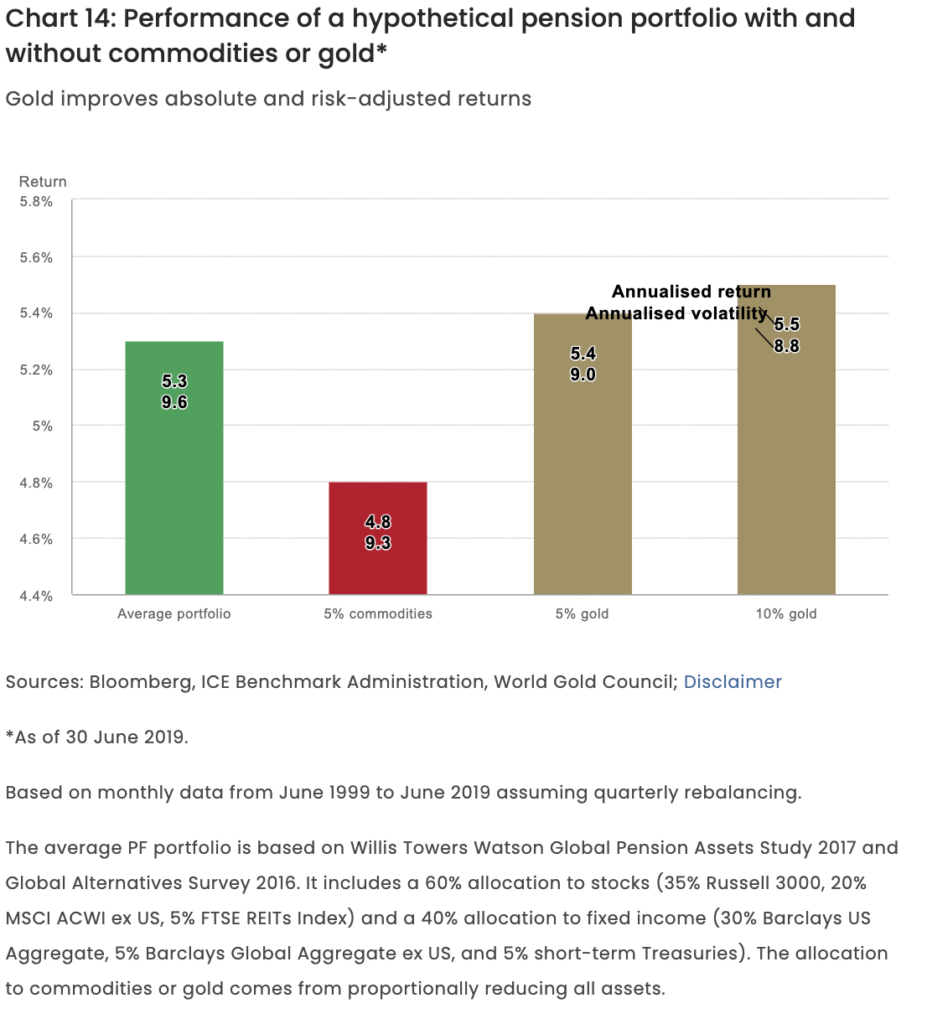

MarketWatch’s Arends says a portfolio that owns gold performs better than one that doesn’t

(USAGOLD – 7/17/2023) – Gold is off to a quiet start after last week’s strong showing. It is up $2.50 at $1960.50. Silver is down 12¢ at $24.91. MarketWatch columnist Brett Arends says that so far this year, you would have been better off in a portfolio that included a 10% gold diversification than one that didn’t. Moreover, it has outperformed the traditional 60/40 portfolio consistently for a very long time. He goes on to say that it isn’t so much that gold is a “great long-term investment on its own” but that it tends to do well when stocks and bonds don’t.

“The first thing is that over the past century,” he says in a recent column, “including some gold in your portfolio alongside stocks and bonds has genuinely added value. It has produced higher average returns, less volatility and fewer of those disastrous ‘lost decades’ where your portfolio ended up whistling Dixie.… The portfolio including 10% gold has beaten the traditional 60/40 by an average of 0.4 percentage point a year since President Richard Nixon finally killed the gold standard in 1971.”

Chart courtesy of the World Gold Council

Daily Gold Market Report

No DGMR today through Friday. Back Monday. Below is yesterday’s report.

Golf trades to the upside in advance of tomorrow’s inflation report

Kentucky farmer unearths valuable hoard of US gold coins

(USAGOLD – 7/11/2023) – Gold is trading to the upside this morning before tomorrow’s inflation report. It is up $11 at $1939. Silver is up 9¢ at $23.26.Trading Economics puts the consensus expectation at 3.1% following May’s 4% reading. Core inflation is expected to come in at 5%, and that is the number that has policymakers worried. May’s reading was 5.2%. One very lucky Kentucky farmer recently unearthed a valuable hoard of 700 Civil War-era gold coins in his cornfield. Though the hoard has not been precisely valued, it includes eighteen 1863 $20 Liberty gold coins that could be worth as much as $100,000 each at auction. “The man whose name and location have not been revealed,” reports the National Post, “can be heard on a short video breathlessly exclaiming ‘this is the most insane thing ever,’ while digging the coins out of the dirt.”

Daily Gold Market Report

Gold drifts sideways ahead of Wednesday’s inflation report

increased number of countries repatriate gold from London vaults

(USAGOLD – 7/10/2023) – Gold is drifting sideways ahead of Wednesday’s inflation report with a significant drop in the headline number from 4% to 3.1% the consensus expectation. It is down $1 at $1926.50. Silver is down 3¢ at $23.13. An Invesco survey of central banks and sovereign wealth funds finds that an increased number of countries are repatriating gold from London vaults and other storage facilities, according to a Reuters report posted yesterday.

Invesco found that two developments over the past year triggered the shift – sanctions on Russia’s gold and currency reserves and a belief that “inflation in the coming decade will be higher than in the last.” Of the 85 sovereign wealth funds and 57 central banks surveyed, 68% said they were keeping their reserves at home compared to 50% in 2020.” Gold repatriation removes bullion from the leasing pool, which has acted as a drag on the gold price in the past. “We did have it held in London,” said one central banker, “but now we’ve transferred it back to [our] own country to hold as a safe haven asset and to keep it safe.”

Daily Gold Market Report

Gold inches higher ahead of today’s all-important unemployment, payrolls numbers

Goehring & Rozencwajg sets long-term price target for gold at $12,000 to $15,000 (!!)

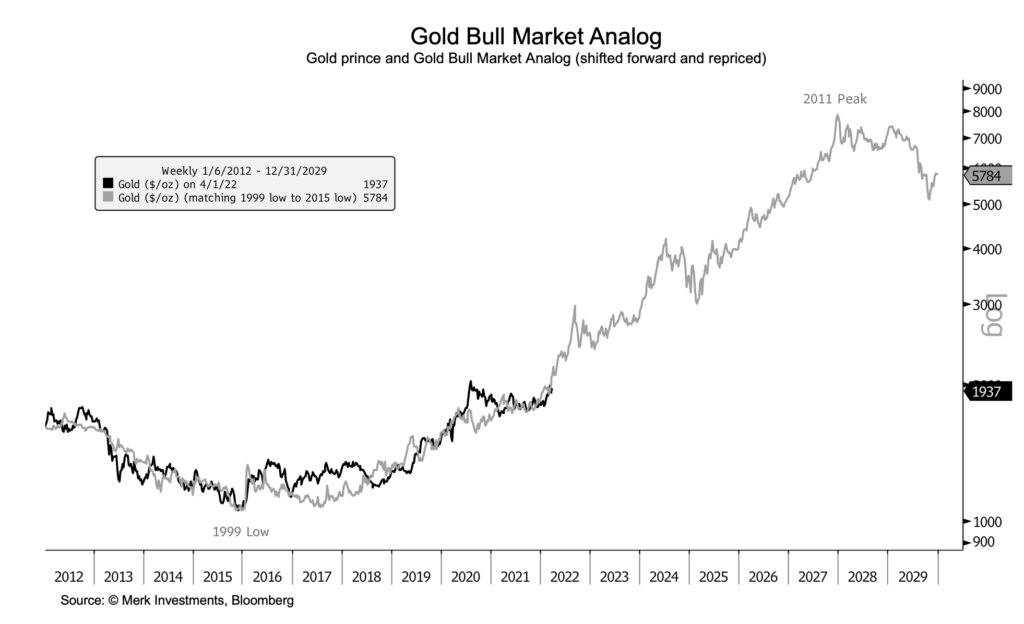

(USAGOLD – 7/7/2023) – Gold inched higher in early trading ahead of today’s all-important unemployment and payrolls numbers. It is up $6 at $1919.50. Silver is up 4¢ at $22.79. The bond market continued its plunge, with yields surpassing critical upside levels – 4% on the 10-year and 5% on the two-year. Goehring & Rozencwajg, the natural resource investment firm, caught our attention recently with a long-term gold price target of $12,000 to $15,000 an ounce. It’s been out of the gold market over the last two years, it says, but now it is getting back in.

“We think that gold has entered into a new phase of this bull market,” says Adam Rozencwajg in a recent interview. “It probably started in the third and fourth quarter of last year, and it really revolves around central banks’ behavior as much as anything else. I think it’s going to propel gold much much higher in this leg of the bull market.” As for the ultra-high price target, Rozencwajg says, “That’s always been our long-term price forecast on gold.”

Chart courtesy of Merk Investments • • • Click to enlarge

Daily Gold Market Report

Gold looks to solidify support just above the $1900 level

New survey shows Millenials have discovered gold

(USAGOLD – 7/6/2023) – Gold is moderately higher this morning as it looks to solidify support just above the $1900 level. It is up $12 at $1929.50. Silver is up 10¢ at $23.31. It could be a seesaw day in markets as traders brace for tomorrow’s unemployment and payrolls numbers. A recent State Street Global Advisors survey offers some insights into investor participation in the gold market.

“The study,” reports Vettafy, “includes more than 1,000 investors with at least $250,000 in investable assets. It showed a fifth of those own some type of gold exposure at an average of 14% of their portfolio. Just under half of those investors have gold exposure through ETFs. And a slight majority maintain exposure through physically holding the metal or owning gold mining stocks. Notably, 17% of Millennials surveyed had gold in their portfolios compared to 10% of Generation X and Baby Boomer respondents..… Nearly seven in 10 investors in the survey said they hold gold as a hedge against inflation and economic downturns.”

Daily Gold Market Report

Gold stuck in rangebound trading

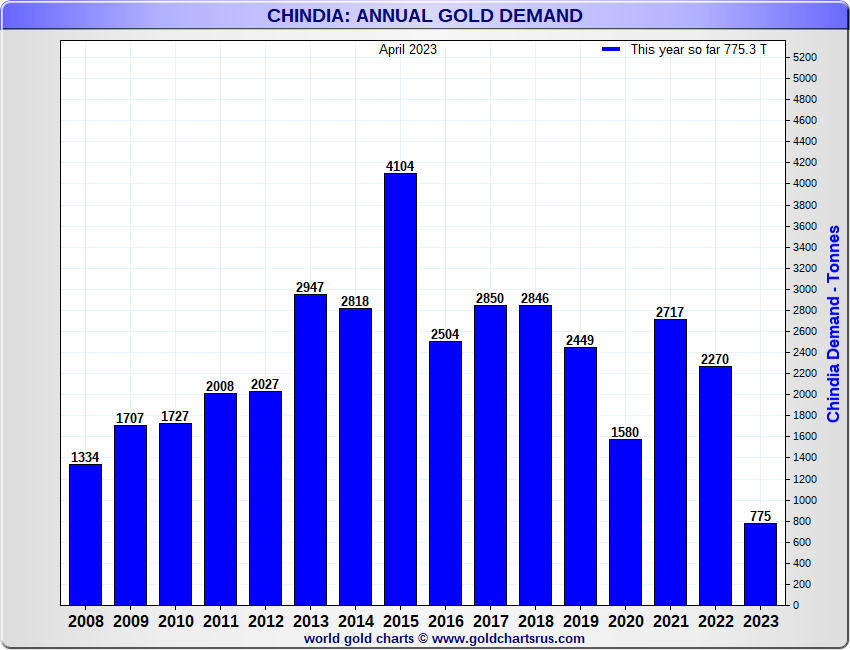

China and India account for 50% of annual gold demand

(USAGOLD – 7/5/2023) – Gold is marginally higher in quiet, rangebound trading, still dominated by rate and inflation concerns. It is up $3 at $1930. Silver is down 13¢ at $22.89. The “Great Gold Migration” from West to East has been a foundational element in gold’s strong showing over the past several years. Asia’s share of annual global demand has gone from 45% to 60% over the past three decades. China and India, the two largest consumers of physical gold, now account for almost 50% of global demand.

“The steady eastward migration of gold over the last three decades,” says Eric Gozenput in an article published last week at Value Walk, “underlines Asia’s growing economic prowess and its long-held belief in gold as an unwavering store of value. As the world moves into an increasingly uncertain future, this trend serves as a valuable lesson in financial resilience and the timeless value of gold.”

Chart note: According to the World Gold Council, the gold supply was 4,755 tonnes in 2022. Mine production was 3,612 tonnes.

Daily Gold Market Report

Gold marginally lower as we close first half and head into the long holiday break

Lundin says we are fully into the seasonal doldrum of the metals

(USAGOLD 6/30/2023) – Gold is marginally lower as we head into a long holiday break. It is down $3 at $1907. Silver is up 17¢ at $22.48. The first half of the year has been a hard grind for gold, but it still managed to post a respectable 5.7% gain. Silver, always the more volatile of the two headline precious metals, was down 5.7%. Gold Newsletter’s Brien Lundin says, “we are fully into the seasonal doldrums for metals” with “much of the investing world on vacation or thinking about it.”

“Simply put,” he continues in an analysis released yesterday, “the only thing moving the gold market right now, or any other market for that matter, has been Fed rhetoric and actions. The expected pause in their June meeting had little lingering effect on gold, thanks to Powell and his compatriots ramping up the hawkish talk at that meeting and in the days since. In addition to that and the summer-time slowdown, we also have the deteriorating technical picture and the magnetic effect of the $1,900 price level.”

Chart courtesy of GoldChartsRUs

Daily Market Report

Gold marginally higher in lackluster summertime trading

Saxo Bank maintains a bullish outlook for the long run; sees headwinds short-term

(USAGOLD –6/29/2023) – Gold tracked marginally higher this morning in lackluster summertime trading. It is up $3 at $1913. Silver is up 17¢ at $22.93. Saxo Bank’s Ole Hansen says that though the short-term outlook for gold “remains challenged by the Fed’s prolonged battle with inflation,” it still has a bullish outlook for the longer tierm driven by a number of expectations – renewed dollar weakness, an eventual peak in interest rates, continued strong central bank demand, sticky inflation, and geopolitical tensions.

“On three earlier occasions during the past two decades,” Hansen points out in a detailed analysis released this morning, “a peak in US Fed funds rate supported a strong gold rally in the months and quarters that followed (See chart below), but with the timing of such a peak being postponed, short-term demand for ‘paper’ gold through ETFs and futures have suffered.… Total holdings in bullion-backed ETFs have seen a 42 tons reduction during the past month to 2888 tons, leaving it just 33 tons above a three-year low that was reached just before the March banking crisis triggered strong demand for havens, especially gold.”

Fed funds rate and gold price

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold pushes toward $1900 as recession worries fade

City Index: Market ‘technically driven with bears booking profits’

(USAGOLD – 6/28/2023) – Gold continued to push toward the $1900 mark as recession worries went into retreat and markets digested the prospect of more rate hikes moving into the second half of the year. It is down $7.50 at $1908.50. Silver is down 27¢ at $22.66. City Index’s Matt Simpson told Reuters this morning that “strong economic data strengthened the dollar and sent gold back towards its June low.” Current pricing, he says, appears to be “technically driven with bears booking profits.”

Daily Gold Market Report

Gold turns to the upside in quiet summertime trading

‘Where did all the silver go?’

(USAGOLD – 6/27/2023) – Gold turned to the upside in quiet summertime trading this morning as the prospect of more aggressive rate policies overseas weighed on dollar sentiment. It is up $5 at $1930. Silver is up 11¢ at $22.97. Pointing to record declines in silver vaulted in both London and New York, Wisdom Tree asks: Where did all the silver go? Then answers: To “retail dominated markets.”

“Despite initial enthusiasm for the metal among both investor segments (institutions and retail investors) immediately after the Ukraine war,” says the Dublin-based investment firm, “investment became bifurcated as the year progressed. Investment in bar and coin (net physical investment ex-exchange-traded product (ETP)), which was mainly retail investment, rose to new highs of 332.9 million ounces (10,356t), a 22% rise over the year and the fifth consecutive year of gain. In sharp contrast, ETPs saw their largest net outflows since 2011, down 11% year-on-year. Silver ETP investing is still very much driven by the institutional community.”

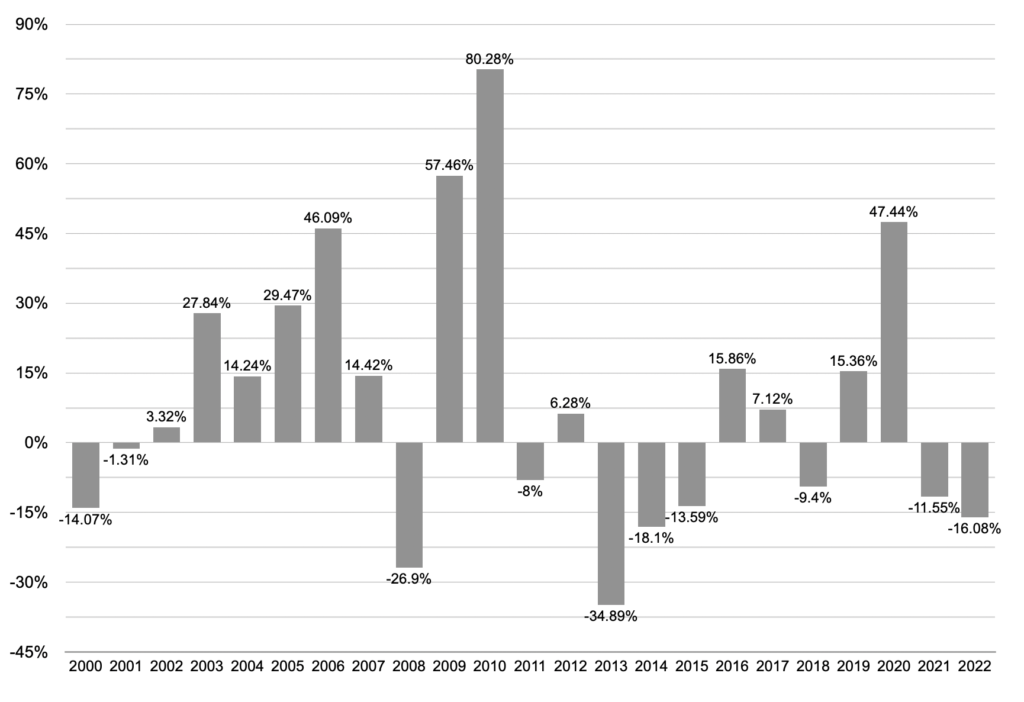

Silver annual returns

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge

Daily Gold Market Report

Gold tracks higher attempting to establish technical support above the $1900 mark

Societe General says gold could appreciate by end of the year in ‘lumpy moves’

(USAGOLD – 6/26/2023) – Gold is tracking higher as it attempts to establish technical support above the $1900 mark. It is up $11 at $1934. Silver is up 37¢ at $22.88. Societe General has a positive prognosis for the gold market as outlined in its recently published Commodities Outlook concluding that gold’s rally is “not over yet.”

“…[With] the low-hanging fruit in the inflation fight already picked,” it says, “our strategists’ anticipation is that the gold market will have to price in higher forward CPI projections. As a result, gold could appreciate by the end of the year in lumpy moves as the market adjusts its forward inflation expectations with the macro newsflow. As an additional driver, in a scenario of moderating US rates, USD might weaken, which could buoy gold. Our strategists see all of this unfolding against the broader, intact theme of central banks diversifying their holdings away from fiat currencies, notably the USD, into gold.”

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

9:04 pm Fri. April 19, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115