Gold Classics Library

A Gold Classics Library Selection

A Layman’s Guide to Golden Guidelines for Wise Money Management

by R.E. McMaster, former editor of The Reaper newsletter

There is an old saying that not all that glitters is gold — as in the gold coins many of you have held in your hands. There is another kind of gold that inhabits the practical wisdom of the ages. In today’s “go-get-’em,” “read-it-and-forget-it” world of everyday web browsing, it can be a challenge to separate the run of the mill from the meaningful. It is with that thought in mind we offer this compendium of the rules and laws of finance and investment by long-time market analyst R.E. McMaster. Formerly the writer/editor of the widely-circulated The Reaper newsletter, McMaster is known for his occasional forays into the realm of economic philosophy and history. I think you will agree with me that these skillfully condensed descriptions are indeed meaningful — a wellspring of knowledge worth reading, re-reading, and passing along to friends and family, especially the kids and grandkids.

(Illustrations by Ed Stein)

A Gold Classics Library Selection

Uses and Abuses of Gresham’s Law in the History of Money

by Robert Mundell, Nobel Prize for Economics, 1999

Now deceased, Dr. Robert Mundell, the highly influential Columbia University economist, was well-known for his advocacy of a gold component in monetary systems, including circulating gold coinage. But he also has written voluminously on a wide range of other topics. As early as 1961, Mundell proposed reducing tax rates and improving monetary discipline as the best means to achieve greater and more stable economic growth. His theories on this subject led to the Kennedy tax cuts, which propelled the U.S. economy of the 1960s and later became the supply-side basis for much of Reaganomics. Mundell also wrote early on of the constant realignment problems which would attend a world monetary system of free-floating currencies. His prescient work on the desirability of regional currencies was, in fact, fundamental to the creation of the euro. When Mundell was awarded the 1999 Nobel Prize for economics, Princeton University economist Peter Kenen said, “Bob was modeling the world of the 1990s through the work he did in the 1960s.” Our thanks go to Dr. Mundell for his kind permission to reprint Uses and Abuses of Gresham’s Law in the History of Money in its entirety.

–– A Gold Classics Library Selection ––

____________________________________________________________________________________

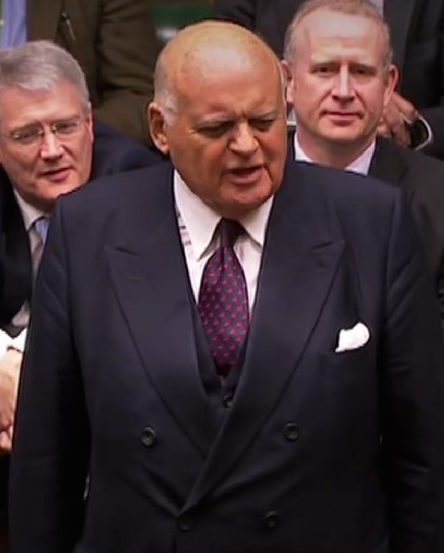

Britain’s Gold Sales ‘a Reckless Act’

(Sir Peter Tapsell’s speech before the House of Commons, June 16, 1999, on the partial sale of United Kingdom’s gold reserves)

We do not update our Gold Classics Library often, but when we do we try to choose items that have a timeless quality. This latest selection certainly meets that standard. It comes to us unexpectedly as a by-product of research for the recently published article, The Power of Gold Diversification, and with the kind permission of the United Kingdom Parliamentary Archives.

History’s indisputable verdict is that Tapsell was right and the British government wrong. The ensuing more than two decades featured a global financial crisis, a pandemic, low-to-zero-percent interest rates, scrambling central banks, and the consistent depreciation of global currencies against gold. Currencies did not glitter in the storm, and they could not have been mistaken for gold which rose relentlessly from $287 per ounce at the time of his speech to the current price of over $1800 (at one point reaching more than $2000 per ounce). Though Tapsell’s speech before the House of Commons failed to stop the sales, it goes down as one of the most eloquent appeals ever made on the merits of gold ownership for nation-states and individuals alike.

A Gold Classics Library Selection

Extraordinary Popular Delusions And The Madness Of Crowds

Charles Mackay in his Extraordinary Popular Delusions and Madness of Crowds, written in 1841, unwittingly provides us one of the better studies of modern market behavior. I doubt Mackay would have guessed that his book would be read, digested and taken as revelation by readers in the 21st century. At the same time, he probably would have not been surprised that the pull of the same dark gravity that caused people to throw their fortunes at tulip bulbs in Holland, or land they never had a hope of seeing in the New World, would be omnipresent in the age of computers, instantaneous communication, and the nearly infinite availability of market analysis. The highly successful speculator and gold investor Bernard Baruch (1870-1965) put his blessing on this book as one of the secrets to his success on Wall Street.

Said Baruch:

“Have you ever seen in some wood, on a sunny quiet day, a cloud of flying midges — thousands of them — hovering, apparently motionless, in a sunbeam? …Yes? …Well, did you ever see the whole flight — each mite apparently preserving its distance from all others — suddenly move, say three feet, to one side or the other? Well, what made them do that? A breeze? I said a quiet day. But try to recall — did you ever see them move directly back again in the same unison? Well, what made them do that? Great human mass movements are slower of inception but much more effective.”

So we bring you Charles Mackay and his Extraordinary Popular Delusions with our own sense of mission. If the rising generations now receiving their education, or even their more jaded elders, find application in their own investment philosophy, then the purpose of this Gold Classic Library entry has been served. Complicated and timelessly revealing, here you will find examples of herd behavior, delusion, mania, craftiness, and financial loss and gain. Solomon taught us that there are no new things under the sun. Mackay teaches us how we might recognize the signs and that the crowd gone mad is a matter to be reckoned with in almost every era.

–– A Gold Classics Library Selection ––

____________________________________________________________________________________

Fiat Money Inflation in France

How It Came, What It Brought, and How It Ended

Andrew Dickson White ends his classic historical essay on hyperinflation, “Fiat Money Inflation in France,” with one of the more famous lines in economic literature: “There is a lesson in all this which it behooves every thinking man to ponder.” This lesson — that there is a connection between government over-issuance of paper money, inflation, and the destruction of middle-class savings — has been so routinely ignored in the modern era that enlightened savers the world over wonder if public officials will ever learn it. In this essay, Dickson White explores France’s hyperinflation at the end of the 18th century in exhaustive detail – its politics, its economics, and the social consequences which led, in the end, to Napoleon’s rise as emperor. It also details gold’s performance as a hedge during the period – a history that explains the French people’s ongoing attachment to gold from that period through the modern era

1812 Napoleon 1 (Bonaparte) 40 franc gold coin

Gold Classics Library

A Gold Classics Library Selection

Money and politics in the land of Oz

The extraordinary story behind the extraordinary story of

The Wonderful Wizard of Oz

by Professor Quentin Taylor, Rogers State University

Year in, year out, Money and politics in the land of Oz is among our most highly-visited Gold Classics Library selections. Here is the extraordinary story behind the extraordinary story of ‘The Wonderful Wizard of Oz’. Most have seen the movie version of this allegorical tale published in 1900, an election year, but few are aware of what the various characters, places and things represented in the mind of Frank Baum, the tale’s author. Though ‘The Wonderful Wizard of Oz’ was written 120 years ago, the themes will be recognizable to those with an interest in golden matters today. While many today consider gold an instrument of financial and personal freedom, in Baum’s tale, it is painted as a villain — the tool of oppression. So, as you are about to see, we have come full circle, and gold has traveled a yellow brick road of its own.

Ready to travel the yellow brick road?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

A Gold Classics Library Selection

Pompous Prognosticators

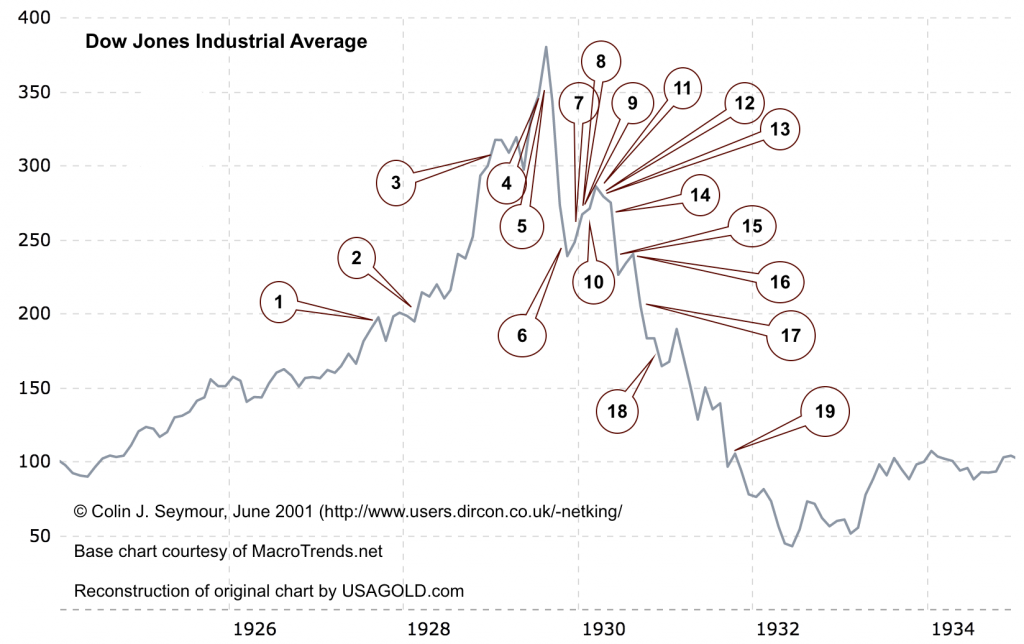

Optimism abounds as stock market crashes – 1928 to 1932

by Colin J. Seymour

May 2001 (Rev. August 29, 2001)

This classic study posted on the USAGOLD website in 2001 has received thousands of visits over the years. Seymour captures the essence of a period in stock market history not unlike our own through quotes from major market players, economists, and analysts from John Maynard Keynes to Bernard Baruch, Irving Fisher, and many other notables.

Worried about bubbling sentiment in today’s stock market?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

Howgoldcreated-Kurlich

A Gold Classics Library Selection

A Gold Classics Library Selection

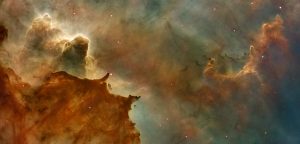

How Gold Is Created

In a supernova in the depths of space, long, long ago…

by Robert Kurlich

According to Dr. Neal deGrasse Tyson, author of Death by Black Hole and Other Cosmic Quandries, all gold on Earth started out in the center of a star; he says stars are “in the business of cosmic alchemy.”

Click here to read and hear more about the fascinating origin of gold

For another small article, see also NASA’s Picture of the day — On the Origin of Gold.

(R. Nemiroff & J, Bonnell) – “Where did the gold in your jewelry originate? No one is completely sure. The relative average abundance in our Solar System appears higher than can be made in the early universe, in stars, and even in typical supernova explosions. Some astronomers have recently suggested that neutron-rich heavy elements such as gold might be most easily made in rare neutron-rich explosions such as the collision of neutron stars. Since neutron star collisions are also suggested as the origin of short duration gamma-ray bursts, it is possible that you already own a souvenir from one of the most powerful explosions in the universe.”

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

1-800-869-5115

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Seymour’sPompousPrognosticators(2001)

A Gold Classics Library Selection

Pompous Prognosticators

Optimism abounds as stock market crashes – 1928 to 1932

by Colin J. Seymour

May 2001 (Rev. August 29, 2001)

Chart locations are an approximate indication only. For relvance to 2001, scroll down to “Fast forward”

1. “We will not have any more crashes in our time.” – John Maynard Keynes in 1927 [NB: The authenticity of this one is a little suspect]

2. “I cannot help but raise a dissenting voice to statements that we are living in a fool’s paradise, and that prosperity in this country must necessarily diminish and recede in the near future.” – E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

“There will be no interruption of our permanent prosperity.” – Myron E. Forbes, President, Pierce Arrow Motor Car Co., January 12, 1928

3. “No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquility and contentment…and the highest record of years of prosperity. In the foreign field there is peace, the goodwill which comes from mutual understanding.” – Calvin Coolidge December 4, 1928

4. “There may be a recession in stock prices, but not anything in the nature of a crash.” – Irving Fisher, leading U.S. economist, New York Times, Sept. 5, 1929

5. “Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months.” – Irving Fisher, Ph.D. in economics, Oct. 17, 1929

“This crash is not going to have much effect on business.” – Arthur Reynolds, Chairman of Continental Illinois Bank of Chicago, October 24, 1929

“There will be no repetition of the break of yesterday… I have no fear of another comparable decline.” – Arthur W. Loasby (President of the Equitable Trust Company), quoted in NYT, Friday, October 25, 1929

“We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices.” – Goodbody and Company market-letter quoted in The New York Times, Friday, October 25, 1929

6. “This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan… that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years.” – R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

“Buying of sound, seasoned issues now will not be regretted” – E. A. Pearce market letter quoted in the New York Herald Tribune, October 30, 1929

“Some pretty intelligent people are now buying stocks… Unless we are to have a panic — which no one seriously believes, stocks have hit bottom.” – R. W. McNeal, financial analyst in October 1929

7. “The decline is in paper values, not in tangible goods and services…America is now in the eighth year of prosperity as commercially defined. The former great periods of prosperity in America averaged eleven years. On this basis we now have three more years to go before the tailspin.” – Stuart Chase (American economist and author), NY Herald Tribune, November 1, 1929

“Hysteria has now disappeared from Wall Street.” – The Times of London, November 2, 1929

“The Wall Street crash doesn’t mean that there will be any general or serious business depression… For six years American business has been diverting a substantial part of its attention, its energies and its resources on the speculative game… Now that irrelevant, alien and hazardous adventure is over. Business has come home again, back to its job, providentially unscathed, sound in wind and limb, financially stronger than ever before.” – Business Week, November 2, 1929

“…despite its severity, we believe that the slump in stock prices will prove an intermediate movement and not the precursor of a business depression such as would entail prolonged further liquidation…” – Harvard Economic Society (HES), November 2, 1929

8. “… a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.” – HES, November 10, 1929

“The end of the decline of the Stock Market will probably not be long, only a few more days at most.”

– Irving Fisher, Professor of Economics at Yale University, November 14, 1929

“In most of the cities and towns of this country, this Wall Street panic will have no effect.”

– Paul Block (President of the Block newspaper chain), editorial, November 15, 1929

“Financial storm definitely passed.” – Bernard Baruch, cablegram to Winston Churchill, November 15, 1929

9. “I see nothing in the present situation that is either menacing or warrants pessimism… I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress.” – Andrew W. Mellon, U.S. Secretary of the Treasury December 31, 1929

“I am convinced that through these measures we have reestablished confidence.” – Herbert Hoover, December 1929

“[1930 will be] a splendid employment year.” – U.S. Dept. of Labor, New Year’s Forecast, December 1929

10. “For the immediate future, at least, the outlook (stocks) is bright.”

– Irving Fisher, Ph.D. in Economics, in early 1930

11. “…there are indications that the severest phase of the recession is over…” – Harvard Economic Society (HES) Jan 18, 1930

12. “There is nothing in the situation to be disturbed about.” – Secretary of the Treasury Andrew Mellon, Feb 1930

13. “The spring of 1930 marks the end of a period of grave concern…American business is steadily coming back to a normal level of prosperity.” – Julius Barnes, head of Hoover’s National Business Survey Conference, Mar 16, 1930

“… the outlook continues favorable…” – HES Mar 29, 1930

14. “… the outlook is favorable…” – HES Apr 19, 1930

15. “While the crash only took place six months ago, I am convinced we have now passed through the worst — and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us.” – Herbert Hoover, President of the United States, May 1, 1930

“…by May or June the spring recovery forecast in our letters of last December and November should clearly be apparent…” – HES May 17, 1930

“Gentleman, you have come sixty days too late. The depression is over.” – Herbert Hoover, responding to a delegation requesting a public works program to help speed the recovery, June 1930

16. “… irregular and conflicting movements of business should soon give way to a sustained recovery…” – HES June 28, 1930

17. “… the present depression has about spent its force…” – HES, Aug 30, 1930

18. “We are now near the end of the declining phase of the depression.” – HES Nov 15, 1930

19. “Stabilization at [present] levels is clearly possible.” – HES Oct 31, 1931

20. “All safe deposit boxes in banks or financial institutions have been sealed… and may only be opened in the presence of an agent of the I.R.S.” – President F.D. Roosevelt, 1933

Fast forward… year 2001

Future of US economy “very bright”-Fed’s Broaddus

“Despite the current slowdown, however, intermediate and longer-term prospects for the U.S. economy are still very bright” – Federal Reserve Bank of Richmond President Alfred Broaddus, in a speech to the Virginia Housing Coalition, June 14, 2001.

Treasury Secretary Sees ‘Golden Age’- “[the country is] on the edge of a golden age of prosperity… I think we’re not doing badly for the kind of correction that we’re in right now… It’s easy to find gloom and doom, but consumers are hanging in there, their spending rates are still quite good… The contraction occurred … in the investment sector, where we had an overexpansion.” – Treasury Secretary Paul O’Neill, on ABC’s “This Week.”, Sunday June 24, 2001.

Economy Likely Up Over Next Year – Commerce Secretary Don Evans “Over maybe the next year, I certainly expect it (U.S. economic growth) to return to those kind of levels of (potential) growth” [between 3.0 percent to 3.5 percent] – US Commerce Secretary Don Evans to a Washington news conference, Wednesday August 29, 2001.

Aren’t these just a little disturbing after reading the prognostications from 1927-1933?

Colin Seymour – http://colinjs.com/finan/prognost.htm

References:

Many of the above quotations don’t have a reference to a source that you could look up in a library, such as a newspaper from the relevant era, or a learned journal, or a book complete with ISBN or Library of Congress numbers. We should therefore always be cautious in accepting the face value of such quotes. Nevertheless, I am sure most of these things were really said or something very close.

http://www.provide.net/~aelewis/gold/goldbear.htm

http://hv.greenspun.com/bboard/q-and-a-fetch-msg.tcl?msg_id=0016hr

http://sane.org.za/news_may99/money_matters.htm

http://www.srsr.org/toppage12.htm

http://www.sterling-asset.com/chrtmar99.htm

http://csf.colorado.edu/longwave/oct99/msg01538.html

“Only Yesterday” by Frederick Lewis Allen and “The Great Crash 1929” by John Kenneth Galbraith (mainly HES quotes) [thanks to Susan J. Barretta]

For Further Reading:

Black Thursday: October 24, 1929 [Newspaper headlines]

The 1929 crash [Newspaper headlines with charts]

Bang! went the doors of every bank in America

“… on March 6, 1933, Franklin Roosevelt, just sworn in for his first term as President, suddenly shut all 18,000 banks in America, aiming to overhaul them as fast as possible, and so reestablish people’s faith in government and America’s banking system…”

Depression, Radio and FDR

“Soon after his inaugural address, on March 12, 1933 Roosevelt held his first chat in an effort to quell the rising national panic over the banking crisis. By March 4th 5,000 banks had closed their doors and 36 States had suspended banking completely. Approximately $2.5 billion in individual savings were lost. Consequently, people were withdrawing their savings in droves, a situtation that only worsened the problem”

The Great Depression and the New Deal

“… when the banks reopened, the American public entrusted them with their money once more, which actually made the banks solvent. Merely by restoring public confidence in the banking system of America, Roosevelt saved it…”

Understanding How Glass-Steagall Act Impacts Investment Banking and the Role of Commercial Banks

“… by 1933 the U.S. was in one of the worst depressions of its history. A quarter of the formerly working population was unemployed. The nation’s banking system was chaotic. Over 11,000 banks had failed or had to merge, reducing the number by 40 per cent, from 25,000 to 14,000. The governors of several states had closed their states’ banks and in March President Roosevelt closed all the banks in the country…”

BANKING ACT OF 1935

“AN ACT To provide for the sound, effective, and uninterrupted operation of the banking system, and for other purposes”

Main Causes of the Great Depression [Gusmorino, Paul A., III., (May 13, 1996)]

The Great Depression 1920s-1941

Copyright © 2001 by Colin Seymour. All Rights Reserved. Reprinted by USAGOLD with permission of Mr. Seymour. No further reproduction without permission.

Reprinted with permission.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

1-800-869-5115

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Greenspan-PaulHearingsRecord(2000-2002)

A Gold Classics Library Selection

1997-1999 transcripts

2000-2002 transcripts

2003-2005 transcripts

The Alan Greenspan-Ron Paul Congressional Exchanges

(2000-2002)

Transcripts of the historic hearings before the U.S. House of Representatives’ Committee on Financial Services during question & answer sessions, 1997-2005

2000

2/17/2000

Dr. PAUL. Thank you, Mr. Chairman.

Good morning, Mr. Greenspan. I understand that you did not take my friendly advice last fall. I thought maybe you should look for other employment, but I see you have kept your job.

I am pleased to see you back, because at least you remember the days of sound money, and you have some respect for it. Even though you do describe it as nostalgia, you do remember the days of sound money. So I am pleased to have you here.

Of course, my concern for your welfare is that you might have to withstand some pummeling this coming year or two when the correction comes, because of all the inflation that we have undergone here in the last several years.

But I, too, like another Member of this committee, believe there is some unfairness in the system, that some benefit and others suffer. Of course, his solutions would be a lot different than mine, but I think a characteristic of paper money, of fiat money, is that some benefit and others lose.

A good example of this is how Wall Street benefits. Certainly Wall Street is doing very well. Just the other day, I had one of my shrimpers in my district call me and say he is tying up his boat. His oil prices have more than doubled and he cannot afford it, so for now he will have to close down shop. So he suffers more than the person on Wall Street. So it is an unfair system.

This unfairness is not unusual. This characteristic is well-known, that when you destroy and debase a currency, some people will suffer more than others. We have concentrated here a lot today on prices. You talk a lot about the price of labor. Yet, that is not the inflation, according to sound money economics.

The concern the sound money economist has is for the supply of money. If you increase the supply of money, you have inflation. Just because you are able to maintain a price level of a certain level, because of technology or for some other reason, this should not be reassurance, because we still can have our mal-investment, our excessive debt and borrowing. It might contribute even to the margin debt and these various things.

So I think we should concentrate, especially since we are dealing with monetary policy, more on monetary policy and what we are doing with the money.

It was suggested here that maybe you are running a policy that is too tight. Well, I would have to take exception to that, because it has been far from tight. I think that we have had tremendous growth in money. The last three months of last year might be historic highs for the increase of Federal Reserve credit. In the last three months, the Federal Reserve credit was increasing at a rate of 74 percent at an annual rate.

It is true, a lot of that has been withdrawn already, but this credit that was created at that time also influenced M3, and M3 during that period of time grew significantly, not quite as fast as the credit itself, but M3 was rising at a 17 percent annual rate.

Now, since that time, a lot of the credit has been withdrawn, but I have not seen any significant decrease in M3. I wanted to refer to this chart that the Federal Reserve prepared on M3 for the past three years. It sets the targets. For three years, you have never been once in the target range.

If I set my targets and performed like that as a physician, my patient would die. This would be big trouble in medicine, but here it does not seem to bother anybody. And if you extrapolate and look at the targets set in 1997 and carry that set of targets all the way out, you only missed M3 by $690 billion, just a small amount of extra money that came into circulation. But I think it is harmful. I know Wall Street likes it and the economy likes it when the bubble is getting bigger, but my concern is what is going to happen when this bubble bursts? I think it will, unless you can reassure me.

But the one specific question I have is will M3 shrink? Is that a goal of yours, to shrink M3, or is it only to withdraw some of that credit that you injected through the noncrisis of Y2K?

Mr. GREENSPAN. Let me suggest to you that the monetary aggregates as we measure them are getting increasingly complex and difficult to integrate into a set of forecasts.

The problem we have is not that money is unimportant, but how we define it. By definition, all prices are indeed the ratio of exchange of a good for money. And what we seek is what that is. Our problem is, we used M1 at one point as the proxy for money, and it turned out to be very difficult as an indicator of any financial state. We then went to M2 and had a similar problem. We have never done it with M3 per se, because it largely reflects the extent of the expansion of the banking industry, and when, in effect, banks expand, in and of itself it doesn’t tell you terribly much about what the real money is.

So our problem is not that we do not believe in sound money; we do. We very much believe that if you have a debased currency that you will have a debased economy. The difficulty is in defining what part of our liquidity structure is truly money. We have had trouble ferreting out proxies for that for a number of years. And the standard we employ is whether it gives us a good forward indicator of the direction of finance and the economy. Regrettably none of those that we have been able to develop, including MZM, have done that. That does not mean that we think that money is irrelevant; it means that we think that our measures of money have been inadequate and as a consequence of that we, as I have mentioned previously, have downgraded the use of the monetary aggregates for monetary policy purposes until we are able to find a more stable proxy for what we believe is the underlying money in the economy.

Dr. PAUL. So it is hard to manage something you can’t define.

Mr. GREENSPAN. It is not possible to manage something you cannot define.

7/25/2000

Dr. PAUL. Thank you, Mr. Chairman.

Mr. Greenspan, I have a couple of questions today. One is a general question. I want to get a comment from you dealing with the Austrian free market explanation of the business cycle. I will lead into that, as well as a question about the productivity statistics that are being challenged in a few places.

But first off, I would like to lead off with a quote that I think is important that we should not forget about our past history. ”Every new era in our history”-and we have had several-”has been based upon the exaggerated enthusiasm and the inflationary forces set in motion by some single new industry or industrial activity.” This was written by Businessweek in 1930, a couple of days after the crash.

Also, I would like to remind my colleagues about surpluses, and I know we look forward to all the surpluses. First, that portion of the national debt we pay the interest on is still going up. So there is a question about if we have true surpluses. But even if we did, I would like to remind my colleagues that we were, as a country and as money managers, reassured in the 1920’s that our surpluses in the 1920’s would serve us well, and it did not predict what was happening in the 1930’s.

Basically, the way I understand the Austrian free market explanation of a business cycle is once we embark on inflation, the creation of new money, we distort interest rates and we cause people to do dumb things. They overinvest, there is malinvestment, there is overcapacity and there has to be a correction, and the many good members or well-known members of the Austrian school, I am sure you are well aware of them, Mises, Hayek and Rothbord, as well as Henry Hazlitt, have written about this, and really did a pretty good job on predicting. It was the reason I was attracted to their writing, because certainly, Mises understood clearly that the Soviet system wouldn’t work.

In the 1920’s, the Austrian economic policy explained what would probably come in the 1930’s. None of the Austrian economists were surprised about the bursting of the bubble in Japan in 1989, and Japan, by the way, had surpluses. And of course, the best prediction of the Austrian economists was the breakdown of the Brettan Woods agreement, and that certainly told us something about what to expect in the 1970’s.

But the concerns from that school of thought would be that we still are inflating. Between 1995 and 1999, our M 3 money supply went up 41 percent. It increased during that period of time twice as fast as the GDP, contributing to this condition that we have. We have had benefits as a reserve currency of the world, which allows us to perpetuate the bubble, the financial bubble. Because of our huge current account deficit, we are now borrowing more than a billion dollars a day to finance, you know, our prosperity, and most economists, whether they are from the Austrian school or not, would accept the notion that this is unsustainable and something would have to happen.

Even recently I saw a statistic that showed total bank credit out of the realm of day-to-day activity in control of the Fed is increasing at the rate of 22 percent. We are now the biggest debtor in the world. We have $1.5 trillion foreign debt, and that now is 20 percent of the GDP, and these statistics concern many of the economists as a foreboding of things to come.

And my question dealing with this is, where do the Austrian economists go wrong? And where do you criticize them and say that we can’t accept anything that they say?

My second question deals with productivity. There are various groups that have said that our statistics are off. Estevao and Lach claim, and this was written up in the St. Louis Fed pamphlet, that the temps aren’t considered and that distorts the views. Stephen Roach at Morgan Stanley said we don’t take into consideration overtime. Robert Gordon of Northwestern University says that 99 percent of the productivity benefits were in the computer industry and had very little to do with the general economy, and therefore, we should not be anxious to reassure ourselves that the productive increases will protect us from future corrections that could be rather serious.

Mr. GREENSPAN. Well, I will be glad to give you a long academic discussion on the Austrian school and its implications with respect to modern views of how the economy works having actually attended a seminar of Ludwig Mises, when he was probably 90, and I was a very small fraction of that. So I was aware of a great deal of what those teachings were, and a lot of them still are right. There is no question that they have been absorbed into the general view of the academic profession in many different ways, and you can see a goodly part of the teachings of the Austrian school in many of the academic materials that come out in today’s various journals, even though they are rarely, if ever, discussed in those terms.

We have an extraordinary economy with which we have to deal both in the United States and the rest of the world. What we find over the generations is that the underlying forces which engender economic change themselves are changing all the time, human nature being the sole apparent constant throughout the whole process. I think it is safe to say that economists generally continuously struggle to understand which particular structure is essentially defining what makes the economy likely to move in one direction or another in the period immediately ahead, and I will venture to say that that view continuously changes from one decade to the next. We had views about inflation in the 1960’s, and in fact, the desirability of a little inflation, which we no longer hold any more, at least the vast majority no longer hold as being desirable.

The general elements which contribute to stability in a market economy change from period to period as we observe that certain hypotheses about how the system works do not square with reality. So all I can say is that the long tentacles, you might say, of the Austrian school have reached far into the future from when most of them practiced and have had a profound and, in my judgment, probably an irreversible effect on how most mainstream economists think in this country.

Dr. PAUL. You don’t have time to answer the one on productivity, but in some ways, I am sort of hoping you would say don’t worry about these Austrian economists, because if you worry too much about them, and these predictions they paint in the past came true, in some ways we should be concerned, and I would like you to reassure me that they are absolutely wrong.

Mr. GREENSPAN. Let me distinguish between analyses of the way economies work and forecasts people make as a consequence of those analyses. The remarkable thing about the behavior of economies is they rarely square with forecasts as much as one should hope they did. I know there is a big dispute on the issue of productivity data. I don’t want to get into that. We would be here for the rest of the month. I think the evidence, in my judgment, is increasingly persuasive that there has been an indeed underlying structural change in productivity in this country.

2001

2/28/2001

Mr. PAUL. Thank you.

Welcome, Mr. Chairman. In the last few weeks, you have received a fair amount of criticism and suggestions about what to do with interest rates and the economy, and I think that is going to continue, because I suspect that we are moving into what you call-you do not call it a ”recession,” but a ”retrenchment.” I guess that may be a new word.

But anyway, there will be a lot of suggestions as to what you should do, and I do not want to presume to make a suggestion, what interest rates should be, but I would like to address more the system that you have been asked to manage, because in many ways I think it is an unmanageable system, and yet it is key to what is happening in our economy. We have a system that you operate where you are continuously asked to lower interest rates.

I would like to remind my colleagues and everybody else that when you are asked to lower interest rates, you are asked in reality to expand the money supply, because you have to go out and buy something. You buy debt. So every time somebody says, ”lower the interest rates,” they say ”inflate the money supply.” I think that is important.

You had a little conversation before about the money supply, and conceded it is important, but you admit you don’t even know what a good proxy is, so it is very difficult to talk about the money supply. I am disappointed that we don’t concentrate on that, talk about it more, even to the point now that we are-that you no longer make projections. I think this is admission almost of defeat.

There is no requirement for you to say, well, we are going to expand the money supply at a precise rate, so we are past that point of a tradition that has existed for a long time. But I think it is an unmanageable system and it leads to bad ideas and bad consequences, because we concentrate on prices, which is a consequence of the inflation of the money supply. Therefore, if a PPI is satisfactory, we neglect the fact that the money supply is surging, and doing a lot of mischief. Therefore we say, ”Well, maybe if we just slow up the economy. If we slow up the economy, it is going to take care of the inflation.”

I think we are really missing the point. You did mention a couple of words in your testimony today that I thought were important acknowledging that there are problems in the economy that we have to address. You talked about ”excesses” and ”imbalances” and the need for ”retrenchment.”

I believe what is important is that we connect the excesses and the imbalances to the policy that you operate, because I think that is key. Instead of being reassured that the PPI is OK, if we would have looked at the excesses, maybe there would have been an indication that there was a problem in the overspeculation in the stock market.

But here we have a monetary system that creates a speculation where NASDAQ goes to 5,000, and then we have a lot of analysts telling us it is a good buy, yet you now are citing the analysts as saying there is going to be a lot of growth. I am not sure which analyst you are quoting, but I am not sure that would be all that reassuring. But I think we should really talk about the money supply and what we are doing.

In 1996, you expressed a concern about ”irrational exuberance in the stock market,” and I think that was very justified. But since that time, the money supply measured by M3 went up $2.25 trillion. The stock market, of course, has soared. I see the imbalances as a consequence of excessive credit. The system has defects in it.

You are expected to know what the proper interest rate is. I don’t think you can know it, or the Federal Reserve can know. I think only the market can dictate the proper interest rate. I don’t think you know what the proper money supply is. You admit you don’t even have a good proxy for measuring the money supply. Yet that is your job, and yet all we ever hear is people coming and saying, ”Mr. Greenspan, if you want to avert a downturn, if you want to save us, just print more money.” That is essentially what this system is doing.

Now, the one question I have, quickly, is your plan that you mentioned in the Senate about using other securities like State bonds and foreign bonds, and others in order for you to buy more debt to monetize. I think it is ironic with a $5.7 trillion national debt, we are running out of things to buy.

Mr. GREENSPAN. Just remember that of that $5.7 trillion, a very large part is held in trust funds of the United States Government, so that the net debt is really $3.5 trillion, of which the Federal Reserve owns more than $500 billion.

Mr. PAUL. Could it be an advantage to make some of that marketable, rather than going out and buying municipal bonds, foreign debtor-state bonds?

Mr. GREENSPAN. No, because-I don’t want to get into the accounting processes here, but if you are dealing with a unified budget accounting system, all of that debt is intragovernmental transfers and essentially is a wash. You have to have external securities to affect the economy.

What we were discussing in the remarks with respect to what the Federal Reserve is looking at is what type of securities we could use for so-called ”repurchase agreements” which are collateralized. In other words, when we engage in an open market operation through a repurchase agreement, what we have now is Federal Government securities as collateral. The question is, if we don’t have them, what other kinds of collateral would we use? We are therefore talking about, for example, State and local securities.

But the crucial issue there is that to the extent that we use securities which are more risky than the Federal Government’s, we basically just take more collateral to offset that. So we can maintain the same degree of risk. And what we are trying to evaluate is various different types of securities which we can employ solely for the purpose of protecting the transaction from default.

7/18/2001

Dr. PAUL. [Presiding.] You mention about the Keynesian approach to economics of a few decades ago, believing that they could eliminate the business cycle; and your conclusion is, really you can’t, because you can’t control human nature. And I agree that you can’t control human nature and I agree that human nature and subjectivity is very important.

But I would also argue that businessmen are human beings and enjoy human nature-they are rational humans, and they react in a rational way to interest rates and the signals they get from you and the Federal Reserve. And therefore, when interest rates are artificially kept low, they will do precisely what they have done; they generate to overcapacity. And, of course, in a recession, this has to be liquidated and we are now in that stage. It doesn’t surprise the hard money school that we are in this phase of liquidating this overcapacity, and it should be; but we

would also argue that the Fed may be doing exactly the wrong thing.

Everybody criticizes you. Nobody comes to you and says, ”Oh, Mr. Greenspan, you print too much money; you generate too much credit; your interest rates are too low.” But the argument from this other school is saying that, precisely the opposite.

It says that because, in the past, you manipulated interest rates, you have caused the boom, therefore, you have made it a certainty that we would have a recession. And literally, by quickly resuming the inflation, the debasement of the currency, that sometimes works and sometimes it doesn’t work and that we are now in a period where it isn’t working.

It didn’t work in Japan, and this is part of human nature too, or the way the businessman responds. One time he responds the way you want and the next time he does not. So, is there a possibility that you recognize that maybe interest rates were manipulated in the wrong direction, and maybe if we had to live with a fiat currency, it would have been better, since 1990, to take the average rate of the overnight rate and just make it 4.5 percent, just left it there, rather than doing this and causing all these gyrations?

I would like you to comment on this, these ideas about monetary policy, in the hopes that maybe we can avoid what we in the hard money school see as a very serious problem and one that could get a lot worse, where we do not revive our economy, just as Japan has not been able to revive theirs.

Mr. GREENSPAN. Mr. Chairman, so long as you have fiat currency, which is a statutory issue, a central bank properly functioning will endeavor to, in many cases, replicate what a gold standard would itself generate.

If you take the period in the United States where the gold standard was functioning as close as you can get to its ideal, which would be from probably 1879 probably through the turn of the century, you had a number of business cycles in that period. And in many respects, they had very much the same characteristics that

we just observed in the last couple of years: the euphoria that builds up when the outlook improves and people overextend themselves and the markets shut them down.

Well, what shut down the market was the very significant rise in real, long-term interest rates in 1999, and in that regard, that is the way a gold standard would have worked. So I would submit to you that the presumption that if you have a hard currency regime, you will somehow alter human nature any more than a fiat

currency one will, I will suggest that that does not happen.

I certainly agree with you that if we would just pump out liquidity indefinitely, the distortions that would occur in the system would be very difficult to pull back together. I submit that is not what we do, and indeed, I would argue that given the fact that we have a fiat currency and that is the law of the land, we do as good a job as one can do in the context of the issues that you raise.

2002

2/27/02

Mr. PAUL. Thank you, Mr. Chairman.

Welcome, Chairman Greenspan. I wanted to start by referring to a speech you gave in January at the American Numismatic Society where you spoke profoundly about monetary policy and said that central bankers have had relative success over the past decades, and it raises hopes that the fiat monetary system can be managed in a responsible way. So I think you’re still at the point of hoping that this system will work. I maintain that the jury is still out on whether or not fiat money will work over the long-term.

And then you followed it up by saying, in case it didn’t work, and I don’t know whether you had tongue-in-cheek or not about this, but you said that we might have to go back to sea shells and oxen as our medium of exchange.

And then you reassured everybody that the discount window would have an adequate supply of oxen. Chairman Oxley, if we get to this point, which I suspect we will someday, I ask you that we have hearings to debate the issue of what medium of exchange we have before the Fed starts using oxen as a medium of exchange.

Chairman OXLEY. Are you referring to the Chairman here?

Mr. PAUL. Yes, I hope that you will at least consider that. But I think it is an important point and I want to relate that to the Enron issue, because in many ways, I think the system that you have been asked to manage is similar to being asked to manage an Enron system. Because Congress is notoriously in favor of deficit spending, we’re currently expanding the national debt at $250 billion a year, and we have nearly a $6 trillion debt.

Now we create that debt by buying votes. We spend a lot of money. Then the Federal Reserve comes in and they buy that debt in order to maintain the interest rate that they think is the right interest rate. And they take that and use it as an asset. You put it in the bank. You call this debt that we created an asset, and you use it as collateral for our Federal Reserve notes. So that’s a pretty good scheme, and I think in the moral terms, as well as the economic terms, it’s very similar to how Enron operates. I’m not convinced the system works very well because a lot of people here praise you for the adequate amount of liquidity and that’s what inflation is: create more money, lower interest rates. Every time you ask for liquidity, and every time you ask for lower interest rates, you’re asking for inflation of the money supply. I think that what we fail to do is to ask about the cost. Do we ever concern ourselves about the people who have had two-thirds of their income removed because they happened to be savers and living off interest? We gouge them with inflation, the loss of purchasing power, and taxes. A lot of people in this country have suffered from this particular system.

Now the analogy I would like to draw is something you said in your testimony on page 13, and you have mentioned several times now that Enron may be a good lesson, and I think it is. And I’m not for more of this regulation by SEC. I think you’re correct that derivatives provide a market tool that is worthwhile, but you also said the Enron decline is an effective illustration of the vulnerability of a firm whose market value largely rests on capitalized reputation, with very little on no physical assets. That’s exactly what our monetary system is all about, and that’s why I believe the dollar is vulnerable. We in Congress do not have a responsibility to run Enron. Some other government has the responsibility to deal with fraud. We have a responsibility to the dollar, and I think that’s what we fail so often to address around here.

In addition, you said that Enron provides encouragement that the force of market discipline can be counted on over time to foster a much greater transparency. That’s exactly what the market does with money. If you look at the rapid and the sudden devaluations of the fiat currencies around the world, such as what happened to us in 1979 and 1980, that was the market coming in and forcing vulnerability and transparency on us. Now gold gives you a hint as to what’s happening. Gold has sent a mild message in this past year. In spite of the fact that central banks and others continually sell and loan out gold and push the price of gold down, there is a message there.

So I would ask you, can you see any corollary whatsoever on what you’re asked to do in running our monetary system to that which Enron was involved in?

Mr. GREENSPAN. I hope there are fundamental differences. First, dealing with essentially a fiat currency, what it is that we are doing is that the currency is granted value by fiat of the sovereign, as it is said in the textbooks. The issue there is that in years past, there has been considerable evidence that fiat currencies have been mismanaged in general, and that inflation has been too often the result. What I was mentioning in the speech that you were referring to is the fact there is some evidence that we’re learning that lesson, learning how to manage a fiat currency. I’ve always had some considerable skepticism about whether that in the long run can succeed, but I must say to you that the evidence of recent decades is that it has been succeeding. Whether that continues is a forecast which I can’t really project on.

The Enron situation is essentially one in which there was an endeavor to imply that earnings were much greater than they really were, that increasing debt was hidden. I can think of no reason to have done what they did with their off-balance sheet transactions other than to obscure the extent of the debt they had, and what essentially was squandered in that process was the reputational capital which they had succeeded in achieving over a period of time. And I don’t perceive that anything that we are doing as a Central Bank involves anything related to that. I hope that where we need to be transparent and indicate what we are doing we do so, and we do so except in those areas where it, as I mentioned to you previously, inhibits the ability to actually function as a Central Bank.

But as I say in summary, I hope your analogy is inappropriate.

Mr. PAUL. I guess we’ll all keep hoping.

7/17/2002

The gentleman from Texas, Dr. Paul.

Dr. PAUL. Thank you, Mr. Chairman. Welcome, Chairman Greenspan. I have listened carefully to your testimony, but I get the sense I may be listening to the chairman of the board of Central Economic Planning rather than the Chairman of a Board that has been entrusted with protecting the value of the dollar.

I have, for quite a few years now, expressed concern about the value of the dollar, which I think we neglect here in the Congress, here in the committee, and I do not think that the Federal Reserve has done a good job in protecting the value of the dollar. It seems that maybe others are coming around to this viewpoint, because I see that the head of the IMF Mr. Koehler, has expressed a concern and made a suggestion that all the central bankers of the world need to lay plans for the near future to possibly prop up the dollar. So others have this same concern.

You have in your testimony expressed concern about the greed factor on Wall Street, which obviously is there, and you implied that this has come out from the excessive capitalization, excessive valuations, which may be true. But I think where you have come up short is in failing to explain why we have financial bubbles. I think if you have fiat money and excessive credit, you create financial bubbles, and you also undermine the value of the dollar, and now we are facing that consequence.

We see the disintegration of some of these markets. At the same time, we have potential real depreciation of the value of our dollar. We have pursued rampant inflation of the money supply since you have been chairman of the Federal Reserve. We have literally created $4.7 trillion worth of new money in M-3. Even in this last year with this tremendous burst of inflation of the money supply, it has gone up, since last January, over $1 trillion. You can’t have anything but lower value of that unit of account if you keep printing and creating new money.

Now, I would like to bring us back to sound money, and I would want to quote an eminent economist by the name of Alan Greenspan who gives me some credibility on what I am interested in. A time ago you said, ”in the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value without gold. This is the shabby secret of the welfare state that tirades against gold. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.”

But gold always has always had to be undermined if fiat money is to work, and there has to be an illusion of trust for paper money to work. I think this has been happening for thousands of years. At one time the kings clipped coins, then they debased the metals, then we learned how to print money. Even as recently as the 1960s, for us to perpetuate a myth about our monetary system, we dumped two-thirds of our gold, 500 million ounces of gold, on to the market at $35 an ounce, in order to try to convince people to trust the money.

Even today, there is a fair amount of trading by central banks in gold, the dumping of hundreds of tons of gold, loaning of gold, for the sole purpose of making sure this indicator of gold does not discredit the paper money, and I think there is a definite concerted effort to do that.

My questions are twofold relating to gold. One, I have been trying desperately to find out the total amount of gold either dumped and sold on the markets by all the central banks of the world, or loaned by the central banks of the world. This is in hundreds and hundreds of tons. But those figures are not available to me. Maybe you can help me find this.

I think it would be important to know since all central banks still deal with and hold gold, whether they are dumping or loaning or buying, for that matter. But along this line, I have a bill that would say that our government, our Treasury, could not deal in gold and could not be involved in the gold market, unless the Congress knows about it.

That, to me, seems like such a reasonable approach and a reasonable request, but they say they don’t use it, so therefore, we don’t need the bill. If they are not trading in gold, what would be the harm in the Congress knowing about handling and dealing with this asset, gold?

Mr. GREENSPAN. Well, first of all, neither we nor the Treasury trades gold. My impression is that were we to do so, we would announce it. It is certainly the case that others do. There are data published monthly or quarterly which show the reported gold holdings in central banks throughout the world, so you do know who holds what.

The actual trading data, I don’t think is available, although the London Gold Exchange does show what its volume numbers are, and periodically individual central banks do indicate when they are planning to sell gold, but they all report what they own. So it may well be the case that you can’t find specific transactions, I think, but you can find the net results of those transactions, and they are published. But as far as the United States is concerned, we don’t do it.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

ORDER DESK

1-800-869-5115 Ext#100

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Greenspan-PaulHearingsRecord(1997-99)

A Gold Classics Library Selection

1997-1999 transcripts

2000-2002 transcripts

2003-2005 transcripts

The Alan Greenspan-Ron Paul Congressional Exchanges

(1997-1999)

Transcripts of the historic hearings before the U.S. House of Representatives’ Committee on Financial Services during question & answer sessions, 1997-2005

Editor’s Note: With Alan Greenspan’s long tenure as chairman of the Federal Reserve seemingly coming to a close, we thought it appropriate to assemble this remarkable and extended dialogue with Representative Dr. Ron Paul for the benefit of our Gilded Opinion readers. Alan Greenspan, one of the most recognizable figures on the American financial scene, does not need a lengthy introduction, nor do I need to restate what so many have already said about his long influence on the markets and the economy as a whole.

Few know, though, of Alan Greenspan’s long connection with the gold market. Since the publication of the famous tract, “Gold and Economic Freedom,” in 1966, Mr. Greenspan has enjoyed a special, if controversial, status among gold owners and advocates — one to which Congressman Ron Paul refers frequently in the following exchanges. Dr. Ron Paul, the Texas Congressman, also occupies a special place with gold owners and advocates because of his outspoken and unwavering support of gold ownership as well as a gold-based monetary system.

In putting this page together, I was struck with Dr. Paul’s ability to cut through the political gamesmanship that necessarily comes with being chairman of the Fed to Alan Greenspan, the man and political/economic philosopher. What emerges is a powerful figure conflicted between the practical manager charged with operating within the current fiat monetary system and the philosopher-academic with a “nostalgia,” as he puts it, for the days of the gold standard. Without Dr. Paul’s incisive questioning, I doubt that this aspect of the Greenspan character would have found its way to the public venue and the historical record. Though the relationship appears adversarial at first blush, one also detects a certain amount of mutual respect and interest. Says Dr. Paul of the exchanges: “My questions are always on the same subject. If I don’t bring up the issue of hard money vs. fiat money, Greenspan himself does.”

It is our hope that the assemblage of this testimony which took place over a nearly nine year period will be useful to those looking for a deeper understanding of the monetary system under which we now operate and of Alan Greenspan’s views with respect to it. We also hope it will add spice to the biography of one of the more enigmatic figures to grace the American political stage at the turn of the 21st century.

In closing, I would like to pass along an anecdote reported by SmartMoney’s Donald Luskin in a 2002 interview of Ron Paul. Paul told Luskin the story of his owning an original copy of “Gold and Economic Freedom,” (which I reference above) and asking Greenspan to sign it. While doing so, Paul asked him if he still believed what he wrote in that essay some 40 years ago. That tract, written during Greenspan’s days as a devotee of Ayn Rand, is a strongly worded, no-holds-barred attack on fiat money and the central banks as an engine of the welfare state. It also endorses the gold standard as a deterrent to politicians’ penchant for running deficits and printing money. Greenspan — enigmatic as ever — responded that he “wouldn’t change a single word.” — Michael J. Kosares

3/5/1997

Mr. PAUL. Thank you, Mr. Chairman.

Mr. Chairman, I want to bring up the subject again about the CPI. We have talked a lot about the CPI and an effort to calculate our cost-of-living in this country, and specifically here, to measure how much we are going to increase the benefits that we are responsible for. But in reality, is not this attempt to measure a CPI or a cost-of-living nothing more than an indirect method or an effort to measure the depreciation of a currency? And that we are looking at prices, but we are also dealing with a currency problem.

When we debase or depreciate a currency we do get higher prices, but we also have malinvestment. We have distorted interest rates. We contribute to deficits. And also, we might not always be looking at the right prices. We have commodity prices, which is the usual conceded figure that everybody talks about as far as measuring inflation. But we might at times have inflated prices in the financial instruments.

So to say that inflation is under control and we are doing very well, I would suggest that we look at these other areas too, if indeed we recognize that we are talking about the depreciation of a currency.

One other thing that I would like to suggest, and it might be of interest to my colleagues, is that one of the characteristics of a currency of a country that depreciates its currency systematically is that the victims are not always equal. Some suffer more than others. Some benefit from inflation of the currency and the debasement of the currency. So indeed, I would expect the complaints that I hear. I would suggest that maybe this is related to monetary policy in a very serious manner.

The consensus now in Washington, all the important people have conceded that we should have a commission. But when we designate a commission, this usually means everybody knows what the results are. I mean, nobody complains that the CPI might under-calculate inflation or the cost-of-living for some individuals, which might be the case. So we have this commission.

But is it conceivable that this is nothing more than a vehicle to raise taxes? the New York Times just this week editorialized in favor of this because it raised taxes, and also it cuts benefits, and they are concerned about cutting benefits. But would it not be much more honest for Congress to deal with tax increases in an above-board fashion, especially if we think the CPI is not calculable? I think it is very difficult.

Also, I think that if it is a currency problem as well, we cannot concentrate only on prices. There have been some famous economists in our history who say, look to the people who talk about prices because they do not want to discuss the root cause of our problem, and that has to do with the inflation of the monetary system or the depreciation of the currency.

Mr. GREENSPAN. Dr. Paul, the concept of price increase is conceptually identical, but the inverse of the depreciation of the value of the currency. The best way to get a judgment of the value of the currency as such, if one could literally do it, is to separate the two components of long-term nominal interest rates into an inflation premium component and a real interest rate component. The former would be the true measure of the expected depreciation in the value of the currency.

We endeavor to capture that in these new index bonds that have been issued in which the Consumer Price Index, for good or ill, is used to approximate that. It does not exactly, and I think that is what I have been arguing with respect to the commission is to take the statistical bias out of the CPI and get a true cost-of-living index.

It is certainly the case that that is a measure of inflation. There are lots of different measures of inflation. I would argue that commodities, per se, steel, copper, aluminum, hides, whatever, used to be a very good indicator of overall inflation in the economy when we were heavily industrialized. Now they represent a very small part of the economy and services are far more relevant to the purchasing power of the currency than at any time, so that broader measures of price, in my judgment, are more relevant to determining what the true rate of inflation is.

Mr. PAUL. Can the inflated prices in the financial instruments not be a reflection of this same problem?

Mr. GREENSPAN. They are. This is a very important question and one which I was implicitly raising: do asset price changes affect the economy? And the answer is clearly, ”yes.” What you call it, whether it is inflation or not inflation, that is a nomenclature question. But the economics of it clearly means that if one is evaluating the stability of the system, you have to look at product prices, that is, prices of goods and services, and asset prices, meaning prices on items generally which have rates of return associated with them.

Mr. PAUL. Much has been said about your statements regarding the stock market and I wanted to address that for just 1 minute. In December when you stated this, of course, the market went down and this past week there was as sudden drop. The implication being that if you are unhappy with it, they assume that you will purposefully push up interest rates. But really since the first time you made that statement it seems that almost the opposite has occurred. M3 actually has accelerated, to my best estimate in the last 2 months it has gone up at a 10 percent rate. The base actually has perked up a little bit. Prior to this time it was rising at less than a 5 percent rate and now it is rising a little over 8 percent.

But then too we have another factor which is not easy to calculate, and that is what our friends in the foreign central banks do. During this short period of time they bought $23 billion worth of our debt. We do know that Secretary Rubin talks to them and that maybe there is an agreement that they help you out; they buy some of these Treasury bills so you do not have to buy quite so many.

Mr. GREENSPAN. There is no such agreement, Dr. Paul.

Mr. PAUL. You read about that though.

Mr. GREENSPAN. Sometimes what you read is not true.

Mr. PAUL. OK, we will get your comments on that. But anyway, they are accommodating us, whether it is policy or not. Their rate of increase on holding our bills are rising at over 20 percent, and even these 2 months at maybe 22 percent.

My suggestion here and the question is, instead of the sudden policy change where you may increase interest rates, it seems like to me that you may be working to maintain interest rates from not rising. Certainly, you would have a bigger job if we had a perfect balance of trade. I mean, they are accumulating a lot of our dollars and they are helping us out. So if we had a perfect balance of trade or if their policies change, all of a sudden would this not put a tremendous pressure on interest rates?

Mr. GREENSPAN. We have examined the issue to some extent on the question of what foreign holdings of U.S. Treasuries have done to U.S. interest rates. I think the best way of describing it is that you probably have got some small effect in the short run when very large changes in purchases occur. There is no evidence over a long run that interest rates are in any material way affected by purchases.

The reason, incidentally, is that they usually reflect shifts–in other words, some people buy, some people sell. Interest rates will only change if one party or the other is pressuring the market. There is no evidence which we can find which suggests that that is any consistent issue, so that the accumulation of U.S. Treasury assets, for example, is also reflected in the decumulation by other parties. We apparently cannot find any relationship which suggests to us that that particular process is significantly affecting—-

Mr. PAUL. For the past 2 years, the accumulation has been much greater.

Mr. GREENSPAN. That is correct, it has been.

Mr. PAUL. Thank you.

7/22/97

Dr. PAUL. Thank you, Mr. Chairman.

I think the Banking Committee must be making progress, because even others now bring up the subject of gold, so I guess conditions are changing. But I might just suggest that the price of gold between 1945 and 1971 being held at $35 an ounce was not much reassurance to many that the future did not bode poorly for inflation. So the price of gold being $325 or $350, ten times what it was a few years back, should not necessarily be reassurance about what the future holds. Unlike my colleague from the other side accusing you of searching for gloom, I might wonder whether or not we might be hiding from some of it? So I thought that the last thing I would suggest is that we lack monetary stimulus and all we need is a little more monetary stimulus, and all of a sudden we are going to take care of the problems. And by the way, the problems that are described are the problems that I am very much concerned about, but I come up with a different conclusion on why we are having those problems.

Earlier, I made the case in my opening statement that quite possibly we are using the wrong definitions and we are looking at the wrong things, and we continue to concentrate and to reassure ourselves that the Consumer Price Index is held in check, and therefore things are OK and there is no inflation. Real interest rates and the long bond remain rather high, so there is a little bit of inflationary expectation still built into the long-term bond. But the consumer prices might be inaccurate, as Sindlinger points out, and they may become less important right now because of the various technical things going on.

And also I made the suggestion that the money-supply calculations that we use today might not be as appropriate as they were in the past, because I do not think there is any doubt that we have all the reserves and all the credit and all the liquidity we need. I mean, it is out there. It might not be doing what we want it to do, but there is evidence that it is there. The marginal debt today was reported at $113 billion, just on our stocks. So there is no problem with getting the liquidity. My argument is that what if we looked at the prices of stocks as your indicator as you would look at the CRB? I mean, we would have a rapidly rising CRB-or any commodity index. It would be going up quite rapidly. For instance, in the past 3 months, we had a stock price rise of 25 percent. If it continued at that rate, we would increase the stock prices 100 percent in one year. If that was occurring in the commodities or Consumer Price Index, I know you would be doing something.

My question and suggestion is maybe we ought to be doing something now, because there is a lot of credit out there doing something else, causing malinvestment, causing deficits and debt to build up, and that there will be a correction. We have not repealed the business cycle. So we have to expect something from this.

I think there are some interesting figures about what has happened to the stock market. In 1989, Japan’s stock market had a greater value than our stock market does. Our market now is three times more valuable in terms of dollars than Japan. We have 48 percent of the value of all the stocks in the world, and we put out 27 percent of the output. So, there is a tremendous amount of marking up of prices, a tremendous amount of credit. So, instead of being lacking any credit, I think we have maybe an excess amount. I would like to know if you can reassure us that we have no concerns about this malinvestment, that we do not have excess credit and that these stock prices are not an indicator that might be similar to a Consumer Price Index?

Mr. KENNEDY. What?

Mr. GREENSPAN. Let me first say, Dr. Paul, it is certainly the case that if you look at the structure of long-term nominal Government interest rates, there is still a significant inflation premium left. In the 1950’s and the 1960’s, we had much lower nominal rates, and the reason was that the inflation premium was clearly quite significantly less. I think we will eventually get back there if we can maintain a stable noninflationary environment. I do not think we can remove the inflation premium immediately, because it takes a number of years for people to have confidence that they are dealing with a monetary policy which is not periodically inflationary.

To follow on the conversation I was having with Congressman Frank, the type of conversation we have at the Federal Open Market Committee is indeed the type of conversation that is coming from both of you. In other words, we are trying to look at all of these various forces and recognize where the stable relationships are and those which tell us about what is very likely to occur in the months, the quarters, and hopefully, in the years ahead.

It is a very intensive evaluation process, especially during a period when there seem to be changes in the longer-term structure which we do not yet know are significant or overwhelming. But we are experiencing changes which lead us to spend a considerable amount of time trying to evaluate what is going on. But we would be foolish to assume that all of history has somehow been wiped from the slate and that all of the old relationships, all of the problems that we have had in the past, have somehow in a period of a relatively few years, disappeared. The truth of the matter is that we suspect that there are things that are going on. We do not know yet how important they are. But we are keeping a very close evaluation of the types of events that are occurring, so that we can create what we believe to be the most appropriate monetary policy to keep this economic expansion going in a noninflationary way, because that is what is required to keep growth going.