Back to our Introductory Information Packet

BlackSwansYellowGold

How gold performs during periods of deflation, disinflation, stagflation and hyperinflation

_____________________________________________________________________

Gold as a hyperinflation hedge

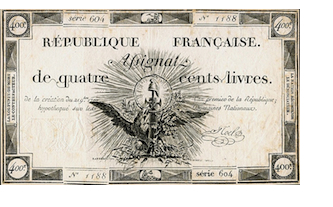

France (1790-1795)

“The inability to predict outliers implies the inability to predict the course of history. . .But we act as though we are able to predict historical events, or, even worse, as if we are able to change the course of history. We produce thirty-year projections of social security deficits and oil prices without realizing that we cannot even predict these for next summer — our cumulative prediction errors for political and economic events are so monstrous that every time I look at the empirical record I have to pinch myself to verify that I am not dreaming. What is surprising is not the magnitude of our forecast errors, but our absence of awareness of it.” –– Nicholas Taleb, The Black Swan – The Impact of the Highly Improbable

“There is a lesson in all this which it behooves every thinking man to ponder.”

The lesson that there is a connection between government over-issuance of paper money, inflation and the destruction of middle-class savings has been routinely ignored in the modern era. White’s essay tells the story of how good men – with nothing but the noblest of intentions – can drag a nation into monetary chaos in service to a political end. Still, there is something else in White’s essay – something perhaps even more profound. Democratic institutions, he reminds us, well-meaning though they might be, have a fateful, almost predestined inclination to print money when backed against the wall by unpleasant circumstances.

Episodes of hyperinflation ranging from the first (Ghenghis Khan’s complete debasement of the very first paper currency) through the most recent (the debacle in Venezuela) all start modestly and progress almost quietly until something takes hold in the public consciousness that unleashes the pent-up price inflation with all its fury. Once the inflationary genie is out of the bottle, it is difficult to get back in. Frederich Kessler, a Berkeley law professor who experienced the 1920s nightmare German Inflation first-hand, gave this description some years later during an interview published in Ralph Foster’s book, “Fiat Paper Money: The History and Evolution of Our Currency” (2008):

“It was horrible. Horrible! Like lightning it struck. No one was prepared. You cannot imagine the rapidity with which the whole thing happened. The shelves in the grocery stores were empty. You could buy nothing with your paper money.”

Towards the end of “Fiat Money Inflation in France,” White sketches the price performance of the roughly one-fifth ounce Louis d’ Or gold coin:

“The louis d’or [a French gold coin weighing.1867 net fine ounces] stood in the market as a monitor, noting each day, with unerring fidelity, the decline in value of the assignat; a monitor not to be bribed, not to be scared. As well might the National Convention try to bribe or scare away the polarity of the mariner’s compass. On August 1, 1795, this gold louis of 25 francs was worth in paper, 920 francs; on September 1st, 1,200 francs; on November 1st, 2,600 francs; on December 1st, 3,050 francs. In February 1796, it was worth 7,200 francs or one franc in gold was worth 288 francs in paper. Prices of all commodities went up nearly in proportion. . .

Examples from other sources are such as the following — a measure of flour advanced from two francs in 1790, to 225 francs in 1795; a pair of shoes, from five francs to 200; a hat, from 14 francs to 500; butter, to, 560 francs a pound; a turkey, to 900 francs. Everything was enormously inflated in price except the wages of labor. As manufacturers had closed, wages had fallen, until all that kept them up seemed to be the fact that so many laborers were drafted off into the army. From this state of things came grievous wrong and gross fraud. Men who had foreseen these results and had gone into debt were of course jubilant. He who in 1790 had borrowed 10,000 francs could pay his debts in 1796 for about 35 francs.”

Those two short paragraphs speak volumes of gold’s safe-haven status during a tumultuous period and may raise the most important lesson of all to ponder: the role of gold coins in the private investment portfolio.

––Michael J. Kosares

BlackSwansYellowGold Series

Gold as a deflation hedge

Gold as a disinflation hedge

Gold as a stagflation hedge

Gold as hyperinflation hedge

Gold as the portfolio choice for all seasons

A chronology of panics, mania, crashes and collapses

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

1-800-869-5115

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.