Author Archives: USAGOLD

Short and Sweet

Blowing up the “Everything Bubble”

“What the average person fails to understand,” writes Lance Roberts in an analysis posted at the Real Investment Advice website, “is that the next ‘financial crisis’ will not just be a stock market crash, a housing bust, or a collapse in bond prices. It could be the simultaneous implosion of all three. Whatever causes that change in sentiment is unknown to me or anyone else. I am not saying with certainty it will happen, as I hope sanity prevails and actions are taken to mitigate the consequences. Unfortunately, history suggests such is unlikely to be the case.” And, we might add, it is not likely the damage will be restricted to the United States In fact, an implosion in one location could cause corresponding meltdowns in multiple locations. Easy money and heavy leverage have greatly influenced price levels in all markets heightening rollover risks. And then there’s the derivative problem with notional exposure estimated at more than $1 quadrillion, according to Investopedia.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you ready for the ultimate derivatives moment?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“[T]he object of speculation may vary widely from one mania or bubble to the next. It may involve primary products, especially those imported from afar (where the exact conditions of supply and demand are not known in detail), or goods manufactured for export to distant markets, domestic and foreign securities of various kinds, contracts to buy or sell goods or securities, land in the country or city, houses, office buildings, shopping centers, condominiums, foreign exchange. At a late stage, speculation tends to detach itself from really valuable objects and turn to delusive ones. A larger and larger group of people seeks to become rich without a real understanding of the processes involved. Not surprisingly, swindlers and catchpenny schemes flourish.”

Robert Z. Aliber and Charles P. Kindleberger

Manias, Panics and Crashes – Anatomy of a Typical Financial Crisis (2001)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

A telephone call from an old client and friend

‘Gold shone with the placid certainty of received tradition’

“I had the happy occasion recently of receiving a telephone call from an old client and friend – a physician safely retired near the sea and alongside one of the South’s oldest golf clubs. It was good to hear from this student of the markets – one of life’s steady and thoughtful practitioners. Back at the turn of the century, Doc foresaw much of what would happen economically in the United States and purchased what he considered enough gold to see him through it.”

[For the rest of Doc’s story we invite you to visit this link.]

___________________________________________________________________

Interested in starting the gold ownership process on the right footing?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Client Testimonial

“Thank you! It has been a pleasure doing business with your Company! You’ve treated the small investor (me) just like you would a millionaire. Best wishes, and I hope I can make some purchases in the future.” – L.W., Savannah, Georgia

We also treat millionaires . . . well. . . like millionaires – whether they admit to being millionaires or not [smile].

We receive unsolicited testimonials like L.W.’s routinely. Please see our Client Testimonials page for more feedback, and be sure to visit the Better Business Bureau for even more in the way of FIVE-STAR reviews. Don’t do business with any gold company until you have checked it out.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interested in gold but struggling to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Daily Gold Market Report

Gold descends toward the $1800 level

Standard Chartered sees gold as ‘closing in on oversold territory’

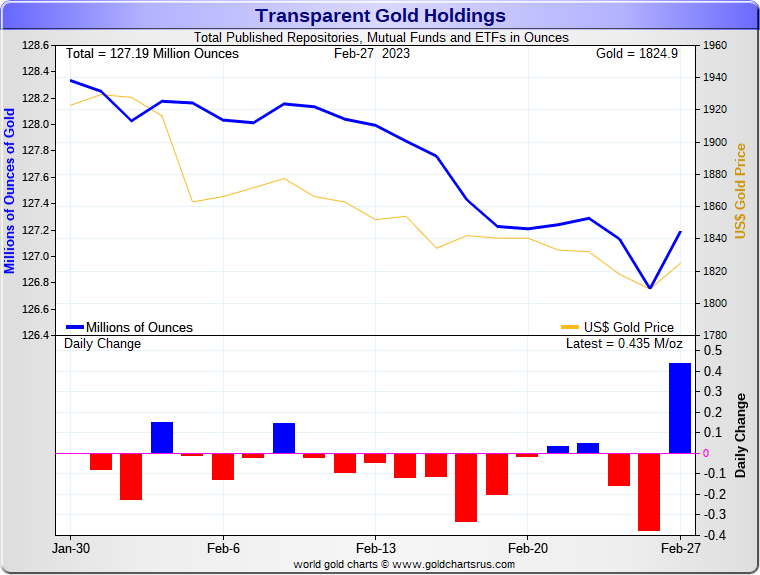

(USAGOLD – 2/28/2023) – Gold descended toward the $1800 level in today’s early going as it looks to close out what’s been an unforgiving month. It is down $8 at $1811.50. Silver is down 8¢ at $20.62. Gold’s month-lomg selloff began in early February when it ran into technical resistance at $1960 and gathered momentum as investors added worry about a more hawkish Fed to the mix. Standard Chartered’s Suki Cooper sees gold as “closing in on oversold territory” and puts the next support level at $1788. ETF outflows, she says in a client note cited by Kitco News, have been one of the culprits in gold’s retreat with a reduction of 20 metric tonnes thus far in February, “and 11 tonnes materializing in the last four sessions.”

Chart courtesy of GoldChartsRUs

Favorite web pages

Black SwansYellowGold

A chronology of panics, mania, crashes, and collapses

–– 400 BC to present ––

Those who think it can’t happen here, or that it’s different this time around, should take note of the number of black swan events in American history alone. The record is formidable. Gold ownership is traditionally a form of battening down the hatches against these recurring storms and, for the minority who adhere to it, an effective and ever-ready defense. Historian Stanford University historian Niall Ferguson summed up what a good many were thinking in the wake of the 2008 meltdown when he said, “Those few goldbugs who always doubted the soundness of fiat money – paper currency without a metal anchor – have in large measure been vindicated. But why were the rest of us so blinded by money illusion?” Why indeed. . . And why is that blindness still at play in the current crisis?

Gold Classics Library

A Gold Classics Library Selection

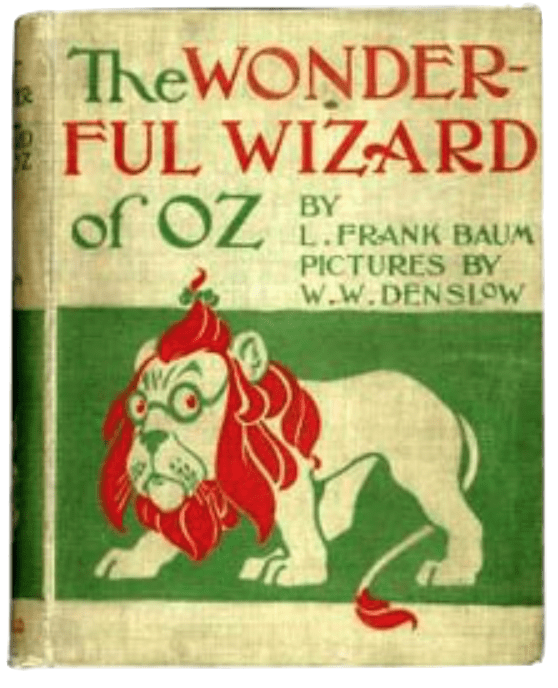

Money and politics in the land of Oz

The extraordinary story behind the extraordinary story of

The Wonderful Wizard of Oz

by Professor Quentin Taylor, Rogers State University

Year in, year out, Money and politics in the land of Oz is among our most highly-visited Gold Classics Library selections. Here is the extraordinary story behind the extraordinary story of ‘The Wonderful Wizard of Oz’. Most have seen the movie version of this allegorical tale published in 1900, an election year, but few are aware of what the various characters, places and things represented in the mind of Frank Baum, the tale’s author. Though ‘The Wonderful Wizard of Oz’ was written 120 years ago, the themes will be recognizable to those with an interest in golden matters today. While many today consider gold an instrument of financial and personal freedom, in Baum’s tale, it is painted as a villain — the tool of oppression. So, as you are about to see, we have come full circle, and gold has traveled a yellow brick road of its own.

Ready to travel the yellow brick road?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

“Wisdom is not a product of schooling but of the lifelong attempt to acquire it.”

Albert Einstein

We invite you to review past issues of our monthly newsletter. It’s worth the visit.

Short & Sweet

Gold and the Misery Index

Stagflation could force ‘a macro rotation into the precious sector’

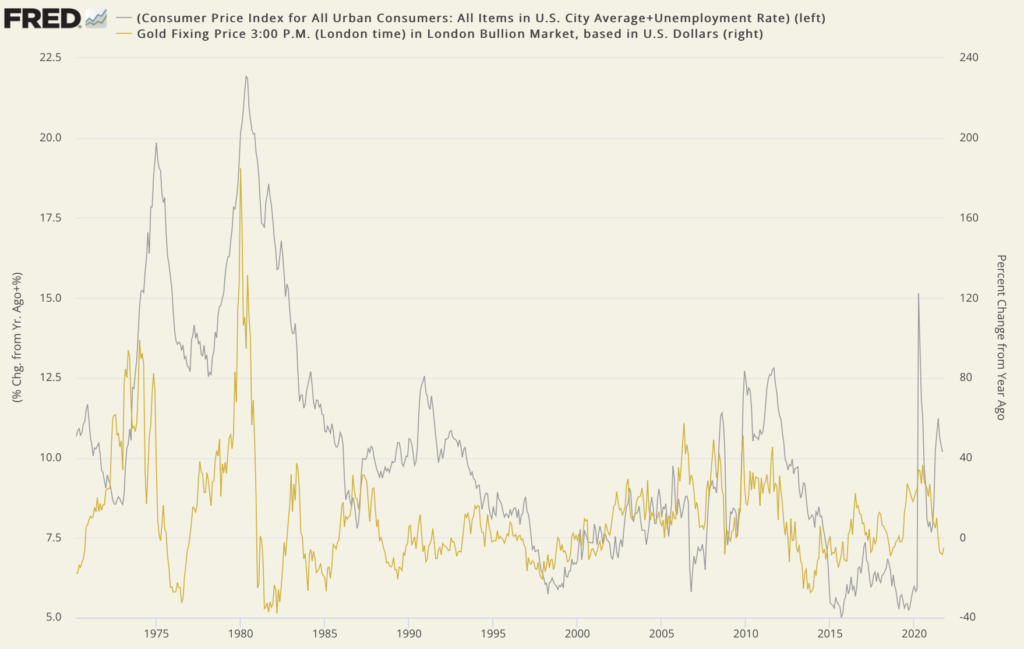

Since the launch of the fiat money era in the early 1970s, when economies have gone very wrong, the unemployment and inflation rates have skyrocketed. On the campaign trail in the late 1970s, then-presidential candidate Ronald Reagan added the two numbers together and famously named the result the Misery Index. Subsequently, the Misery Index became the bellwether for stagflation – the combination of economic stagnation and runaway inflation.

With stagflation rising once again to the top of investor concerns, the Misery Index has made something of a comeback. Accordingly, we thought it would be a matter of interest to build a chart showing changes in the index plotted against changes in the price of gold. Though we had an inkling of the result, the uncanny long-term correlation between the two data sets took us by surprise. At a glance, the chart tells the story of gold as a runaway stagflation hedge. Gold also closely tracked the index more recently during the 2008 credit crisis and the 2020 pandemic-driven breakdown. Curiously, though, it has lagged the surge in the Misery Index over the past year and a half. This divergence probably has to do with Wall Street until recently largely buying into the Fed’s contention that inflation is transitory.

With the word “transitory” now officially banned from the Fed lexicon, the financial world is suddenly forced to consider the dual nature of stagflation and adjust investment portfolios accordingly. MKS Switzerland’s Nicki Shiels recently advised that a “stagflation would force a macro rotation out of typical reflation assets or commodities like oil and copper, and into the precious sector.”

“There’s going to be a realization in early 2022,” says Weiss Ratings’ Mike Larson in a report posted at Finbold, “that the Fed is not going to be able to be aggressive. People need to realize that this Fed is very tentative. It’s a Fed that has a lot of political pressure to favor the employment side of its mandate over inflation. … I don’t think it’s going to be a runaway where you’re talking about $4,000 gold, but you know, $2,200, $2,300 or $2,400, somewhere in that range, I think in sort of a corresponding moving silver, I think it is likely on the table. And again, it’s going to come from the release of that Fed fear, pressure valve, whatever that’s been keeping people from, getting involved.”

Misery Index and Gold

(% change, year over year, 1971- to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration

Click to enlarge

(For a real-time version of the Misery Index-Gold chart, please visit USAGOLD’s Gold Trends and Indicators.)

Favorite web pages

BlackSwansYellowGold

BlackSwansYellowGold

How gold performs during periods of deflation,

disinflation, stagflation and hyperinflation

“That men do not learn very much from the lessons of history is

the most important of all the lessons of history.”

–– Aldous Huxley ––

Though Huxley’s observation is readily applied to humanity collectively, it does not apply so easily to individual investors. As justification, we offer the ongoing (and long-term) success of the USAGOLD website as well as the soaring statistics on the growth of private gold ownership over the past decade both in the United States and abroad, inspired directly by the lessons learned from financial market upheaval. The following short essays are dedicated to the safe-haven gold investor who, like noted financial author Nicholas Taleb, believes that it is just as important to prepare for what we cannot foresee as what we can.

BlackSwansYellowGold Series

Gold as a hyperinflation hedge

Gold as the portfolio choice for all seasons

A chronology of panics, mania, crashes and collapses

(400 BC to present)

USAGOLD

CLIENT ALERT

Which is better?

A gold or silver ETF or outright ownership of the real thing?

Not a day goes by that one gold ETF or another is reporting strong gains to its stockpile. Most of those gains come from financial institutions and hedge funds boosting their portfolio positions. We applaud Wall Street’s move to gold. At the same time, though an ETF might make sense for funds and institutions, it might not be the best choice for private investors interesting in owning gold for long-term asset preservation purposes.

Gold ETFs, says Simon Black of the SovereignMan website, are “purely a financial product that defeats the entire purpose of owning gold to begin with. Why turn one of the best, longest-standing physical assets in the history of the world into a paper asset? With this type of debt instrument, you don’t actually own the gold yourself. You become a creditor with nothing more than a claim on someone else’s gold.”

At USAGOLD, we have an alternative you might want to consider ……

The Precious Metals Safe Storage Advantage

At the same time, given the exclusive preferred referral storage rate you receive by opening your storage account through USAGOLD, the annual cost to maintain your holdings is comparable (and often lower) to what most ETF vendors charge in annual fees. All the while, your metal is stored safely and fully insured at one of America’s oldest, largest and respected independent depositories – a firm with which we personally have done business for decades. To get started, we invite you to go to the link immediately below and fill out the application.

Account Form – Precious Metals Storage Account

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

– USAGOLD’s widely acclaimed monthly client letter –

NEWS &VIEWS

Forecasts, Commentary and Analysis on the Economy and Precious Metals

The contemporary, web-based version of our client letter traces its beginnings to the early 1990s as a hard-copy newsletter mailed to our clientele. Its principal objectives have always been the same – to keep our clients informed on important developments in the gold market, condense the available gold-based news and opinion into a brief, readable digest, and to counter the traditional anti-gold bias in the mainstream media. That formula has won it a five-figure subscription base. In addition to our regular newsletters, we occasionally publish in-depth special reports that focus on events and developments of interest to gold owners. Valued for their insight, accuracy and reliability, our publications are linked and reprinted by a large number of websites both in the United States and around the globe.

______________________________________________________________________________________

Looking to get informed and stay informed on the gold market?

TRY A FREE SUBSCRIPTION TO OUR MONTHLY CLIENT LETTER.

No strings attached. Prospective clients welcome!

Short and Sweet

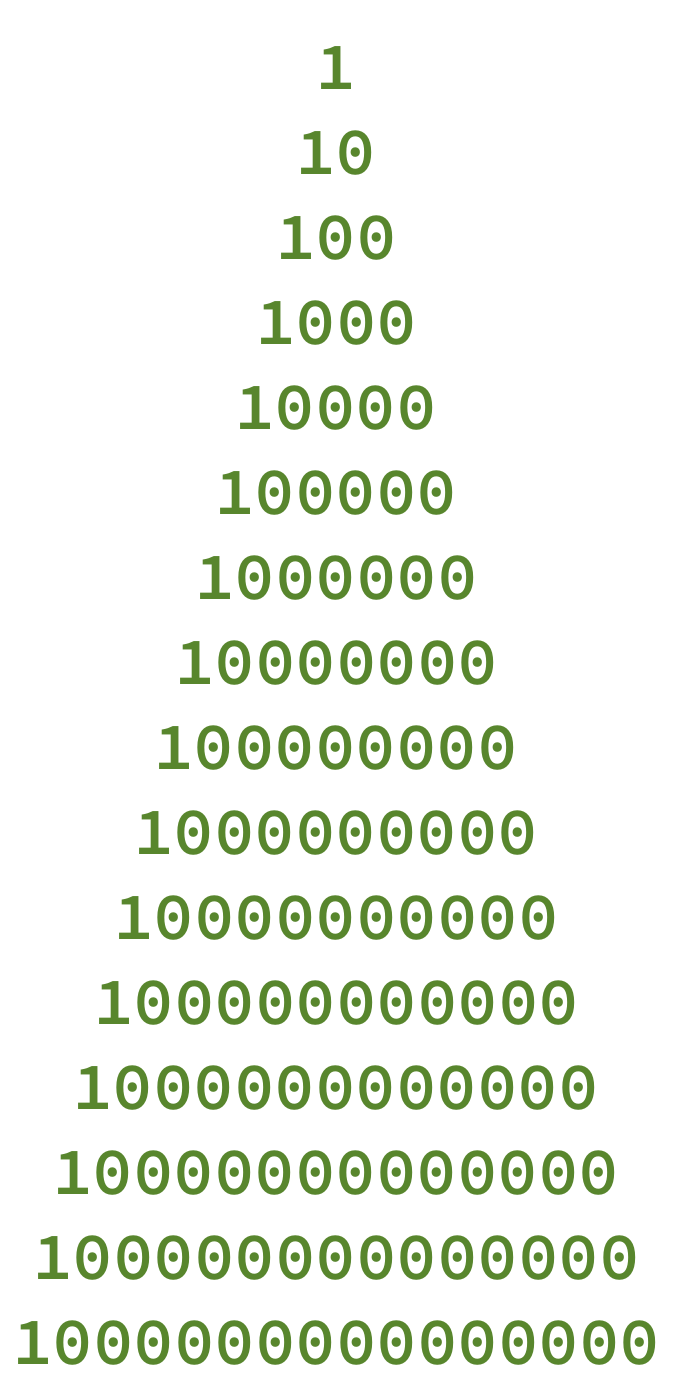

Thinking in big numbers

“[T]hink of it [big numbers],” she says, “in terms of time, like Richard Panek, a professor at Goddard College in Vermont and a Guggenheim fellow in science writing. There are 1 million seconds in roughly 11½ days. There are 1 billion seconds in around 31 years. And there are 1 trillion seconds in around 31,000 years.”

Do you find the Biden administration’s approach to big numbers a bit unnerving?

Open access to the February edition of our client letter

Image courtesy of Visual Capitalist • • • Click to enlarge

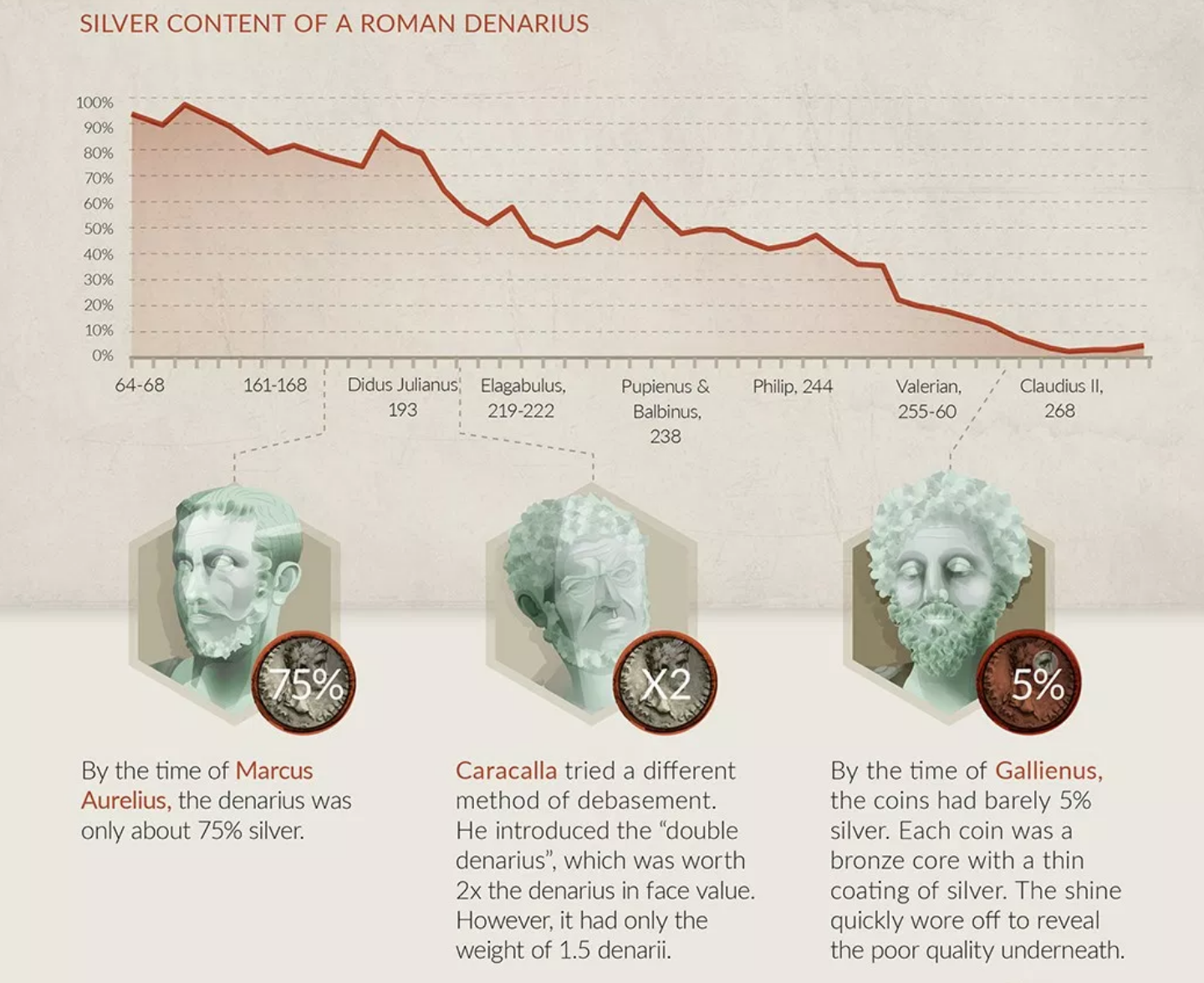

The February edition of News & Views explores the essence of inflation through a distant example – Rome in the fourth century AD – and then brings that history current with an overview of what is happening in the United States today. We sometimes forget that inflation is a process, not an event. Rome’s inflation and currency debasement proceeded in fits and starts and unfolded over centuries. However, when runaway price inflation struck, it delivered its ill effects emphatically during individual lifetimes – sometimes within a few short years. If you would like to gain a better understanding of inflation and what you can do to protect your wealth against it, the February edition of News & Views is an excellent place to start.

Hedging the decline and fall of a currency

The baseline case for gold hasn’t changed much in 1700 years

“Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” – John Maynard Keynes, The Economic Consequences of Peace (1919)

FREE SUBSCRIPTION!

To subscribe, please enter your e-mail address below. Prospective clientele are welcome.

Short and Sweet

The core problem is the debasement of the currency

“The strategies, in which portfolios hold 60% stocks and 40% bonds, have produced just two down years since 2007,” writes Bloomberg’s Michael Mackenzie and Liz McCormick. “… But it posted losses in September and November and is down 0.4% so far in December, just as the Federal Reserve started signaling a hawkish shift.” The bottom line is that both sectors – stocks and bonds – are overvalued, as we are constantly warned in financial reports these days. One analyst said: “In this environment, we think 60/40 is pretty dangerous.” Inflation undermines the value of the very currency in which those assets are denominated. So the problem at its core is the debasement of the currency.

Switzerland-based analyst Claudio Grass, who receives considerable attention among market watchers for his insights on monetary policy, holds what many would consider a controversial view on the Fed’s tapering program. He believes that “most investors can see through the political narrative and the ‘packaging’ of the central bank’s decisions. They realize they can depend on continued support and that there’s no reason to fear that the monetary expansionism of the last decade will be reversed anytime soon. And they are justified in their assumptions.”

“Of course,” he concludes in a short analysis posted at the Gavekal website, “as might have been expected from the track record of central planners this ‘strategy’ is extremely short-sighted. Keeping the money faucets open and persisting in maintaining an environment of extremely low rates is only postponing the inevitable. As conservative, rational investors and precious metals owners clearly understand and have seen coming for a very long time, this myopic approach might put off a recession over the next weeks or months, but it is has created much larger, deeper, systemic risks, ranging all the way from an inflationary crisis to the potential for actual currency collapse.”

Thinking that the 60/40 portfolio has seen better days?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

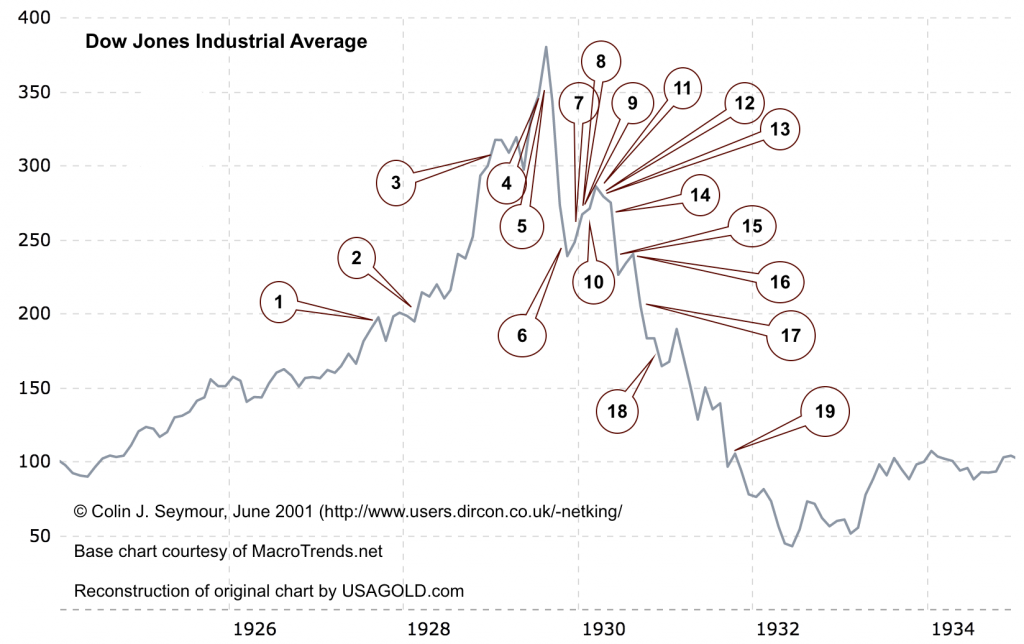

A Gold Classics Library Selection

Pompous Prognosticators

Optimism abounds as stock market crashes – 1928 to 1932

by Colin J. Seymour

May 2001 (Rev. August 29, 2001)

This classic study posted on the USAGOLD website in 2001 has received thousands of visits over the years. Seymour captures the essence of a period in stock market history not unlike our own through quotes from major market players, economists, and analysts from John Maynard Keynes to Bernard Baruch, Irving Fisher, and many other notables.

Worried about bubbling sentiment in today’s stock market?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

Favorite web pages

Gold Trends and Indicators

Live charts that make it easy to monitor gold market history and correlations

Our Gold Trends and Indicators page was first constructed many years ago to serve a specific need. At the time, there was no single place a client, or prospective client, could go to monitor statistical categories and correlations relevant to gold ownership. This page filled that need with interactive, automatically updating charts that featured gold’s annual returns; one-year, ten-year, and long-term price charts; correlations like gold and the purchasing power of the dollar, gold and the S&P 500 and gold and the volatility index (to name a few); and, real rates of return over the long term on gold and the dollar. It remains a favorite reference among serious investors and students of the gold market to this day. We believe it to be particularly useful to the prospective gold buyer who wants to understand the history of gold under various circumstances as part of the due diligence process.

Gold Trends and Indicators is another of the quiet pages at USAGOLD that garners significant global interest particularly when the market is moving or breaking news warrants more than average interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion, and analysis as it happens.

We have recently added to new correlation charts:

• The Misery Index and Gold

• The Fed’s Balance Sheet and Gold

__________________________________________________________________________________

We invite you to also check out our other chart page:

Monetary Trends and Indicators

Charts offered in conjunction with the St. Louis Federal Reserve and the ICE Benchmark Administration

Gold in the Attic

Every once in a while, we rummage around USAGOLD’s creaky old attic and dust off a golden vignette from our storied past. Here is a longer piece that first appeared in our monthly client letter in December 2015. It considers how the celebrated British economist John Maynard Keynes might have reacted to the current economic predicament in which we find ourselves – particularly in light of the money-printing response to the coronavirus-related breakdown. Some have criticized me for lending credence to the work of Keynes, but I try to look past the politics to the man and his philosophy, and from there, make my own judgment as to the value of his work. This particular piece garnered a very large audience when it was first published, and it still resonates with readers six years later.

Keynes on the menace of printing money

How the celebrated economist might have structured his portfolio today

“I find myself more and more relying for a solution of our problems on the invisible hand which I tried to eject from economic thinking twenty years ago.” – John Maynard Keynes, 1946

Originally published December 2015

One wonders what Keynes might have thought of that declaration. What we came to call Keynesian economics in the years that followed had little to do with the economic picture the most celebrated economist of the 20th century had painted. The free-wheeling post-Bretton Woods system reached its zenith in the aftermath of the 2008 crisis under the baton of Fed chairman Ben Bernanke who directly monetized government debt to the tune of trillions of dollars, bailed out an incorrigible financial sector, and made saving at the bank a virtue of the past. When Keynes decried the debauching of the currency, this was exactly what he was talking about. Subsequently, central bankers the world over would follow Bernanke’s example.

Far from the laissez-faire economics Keynes endorsed at the end of his life, we have ended up with the exact opposite: A command economy directed by the state and fueled by the beneficent paper money machine of the world’s central banks. Today the world economy floats on a sea of paper money backed by nothing but the promises of the governments that issued it and with little in the way of policy options except to do more of the same. Debasing the currency is no longer something to hide in the back corners of central bank policy but to be trotted out in full view of everyone, including the financial markets. Countries, in fact, compete with each other to see who can devalue their currency fastest. As Richard Russell, the recently deceased critic of central bank policies, put it: “Inflate or die!”

Keynes would be buying gold hand over fist

How might Keynes, as famous for his investing prowess as he was for his advice to politicians, have reacted to these circumstances in his own investment portfolio? Writing in the Wall Street Journal, Richard Hurowitz, publisher of the Octavian Report, offers some interesting conjecture on that score:

“Keynes understood that sound money and stable exchange rates were necessary conditions for world prosperity and peace. Contrary to popular belief, he believed that currency devaluations were counterproductive in most cases, their benefits often outweighed by increased domestic costs and the undermining of sovereign credit. ‘There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency,’ Keynes observed in 1919. He consistently argued that a sound currency was critical to a functioning free economy. He understood that such a currency would ultimately create much greater wealth than the endless and vicious cycle of improvisational debasement we see playing out globally today.

Were Keynes alive today, he would likely be arguing along with German Chancellor Angela Merkel for more monetary discipline and a return to a more balanced international system. No doubt, however, his neo-Keynesian acolytes would be dismissing his concerns as hopelessly outdated and reactionary.

Keynes was an economic theorist, but he was also a clear-eyed market analyst and a passionate and committed speculator for his own account and for Cambridge University. If he took in today’s economic vista of near-zero interest rates and quantitative easing, it is clear that he would be buying gold hand over fist—regardless of what his disciples might think.”

The economic consequences of inflationism

Those of you who read this newsletter regularly will recognize the quote from Keynes about the dangers of currency debasement. It occupies a place of prominence at the top of the page (see upper left column). Keynes first penned those words as a young man in The Economic Consequences of Peace (1919) – a treatise published in the aftermath of World War I. It argued leniency for defeated Germany and its allies, but it also warned of what he called the “menace of inflationism” in the defeated central European countries.

Here, for the record, is that quote in its entirety:

“By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

It will not escape the notice of the reader that Keynes’ description of the inflationary process eerily fits the set of social and economic circumstances in which we find ourselves today. Whether or not the advanced economies will proceed from asset inflation to rapid price inflation – remains to be seen, but we should not overlook the fact that the ground has been prepared and the seed sown. In 1919, when Keynes wrote those words, money printing in Germany, its point of reference, had yet to produce price inflation. In fact, the German economy experienced deflation in the period 1920-1921. In the end, though, Keynes was right. By 1922 the hidden forces of economic law were unleashed. Hyperinflation gripped the German economy suddenly and with a vengeance.

I believe Hurowitz is right about Keynes and gold. He would have understood the wolf hammering on the door and adjusted accordingly – both in his personal finances and as an advisor to governments. I keep coming back to former Fed chairman Alan Greenspan’s comment last October that “Gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments.”

__________________________________________________________

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.

Page Upgrade

Gold Charts in Various Currencies and Timelines

Now features interactive bar charts of the gold price in Euro, Chinese yuan, British pound, Japanese yen, Swiss franc, Indian rupee, Australian dollar, Canadian dollar, US dollar. These charts update in real-time with date interval, percent change, and log format user options available.