Author Archives: USAGOLD

Short & Sweet

When paper money dies, precious metals prevail.

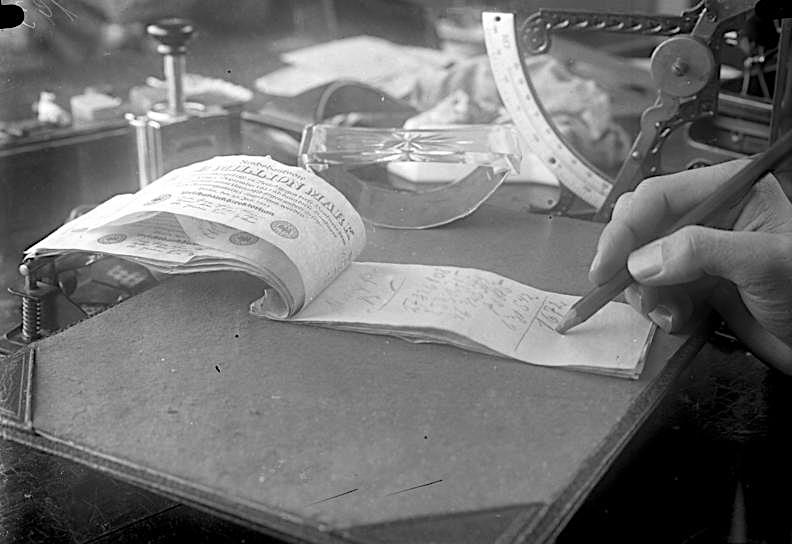

The lessons learned from the nightmare German hyperinflation of 1923

“They’ll print money until they run out of trees.”

Jim Rogers, investor and financial commentator

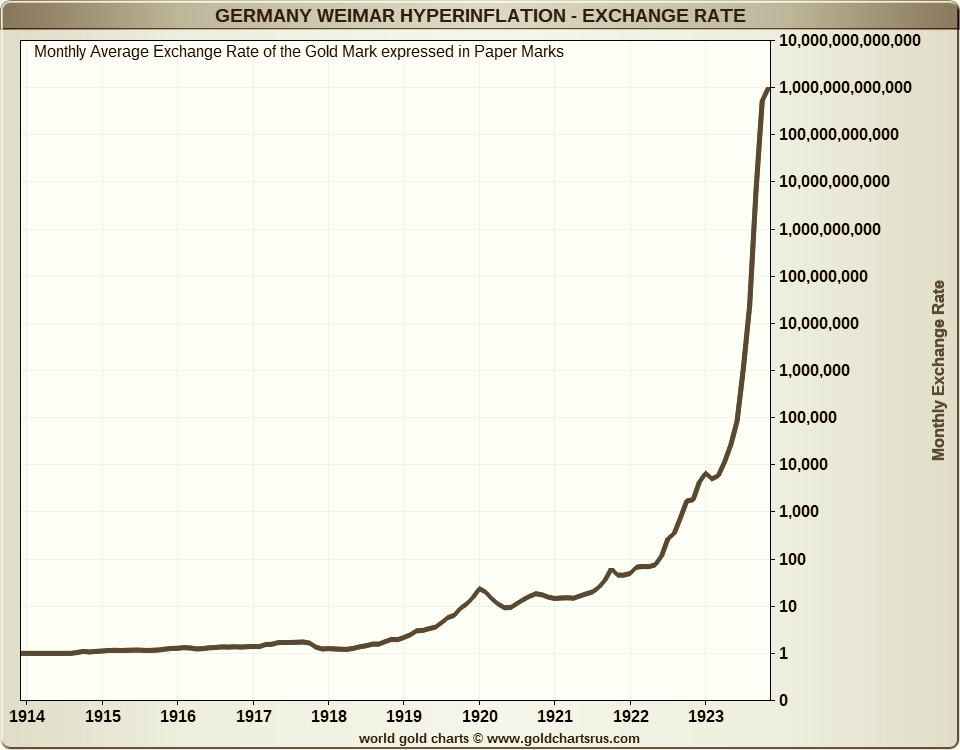

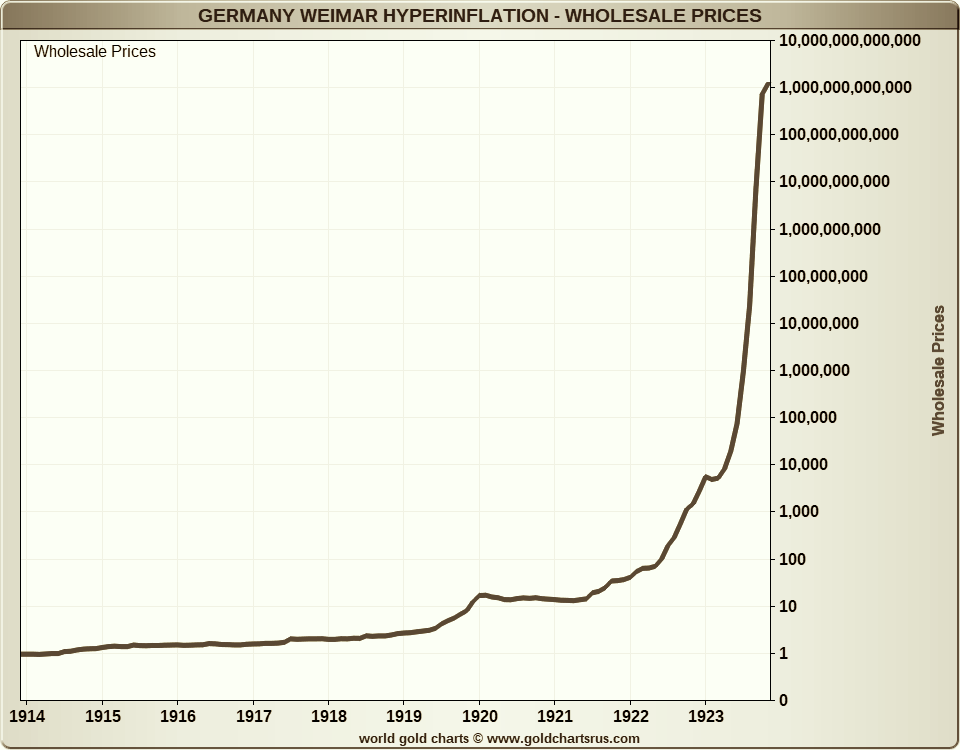

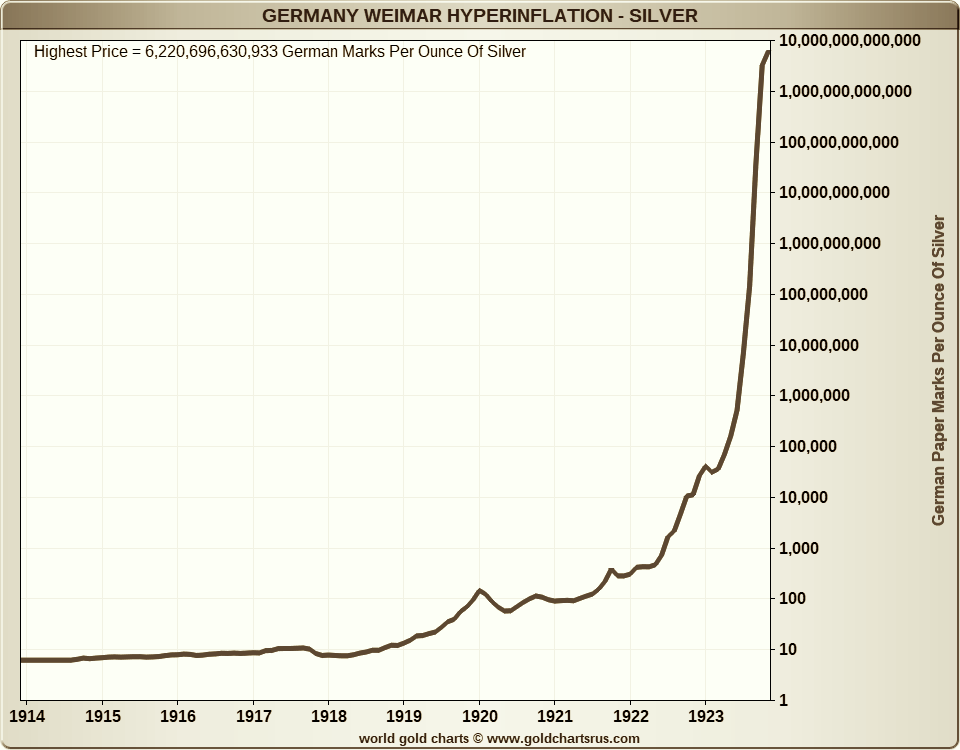

Not many investors are seriously concerned about hyperinflation in the United States at this juncture. At USAGOLD, we, too, see it as an outlier – something that could happen but not a probability. But that’s the thing about hyperinflations. Rarely does the handwriting appear unmistakably on the wall. Not many were worried about hyperinflation in Germany in 1923 when it struck out of the clear blue. When disaster did strike, however, it came with a vengeance. Prices shot up in 1921. Then just as quickly – within the space of a year – they ran out of control. By 1923, an individual’s life savings could not purchase a cup of coffee. We ran into the following charts researching another matter at the GoldChartsRUs website. The one unsettling aspect they all have in common is their verticality – an indication of how quickly and conclusively the inflationary catastrophe swept through the German economy.

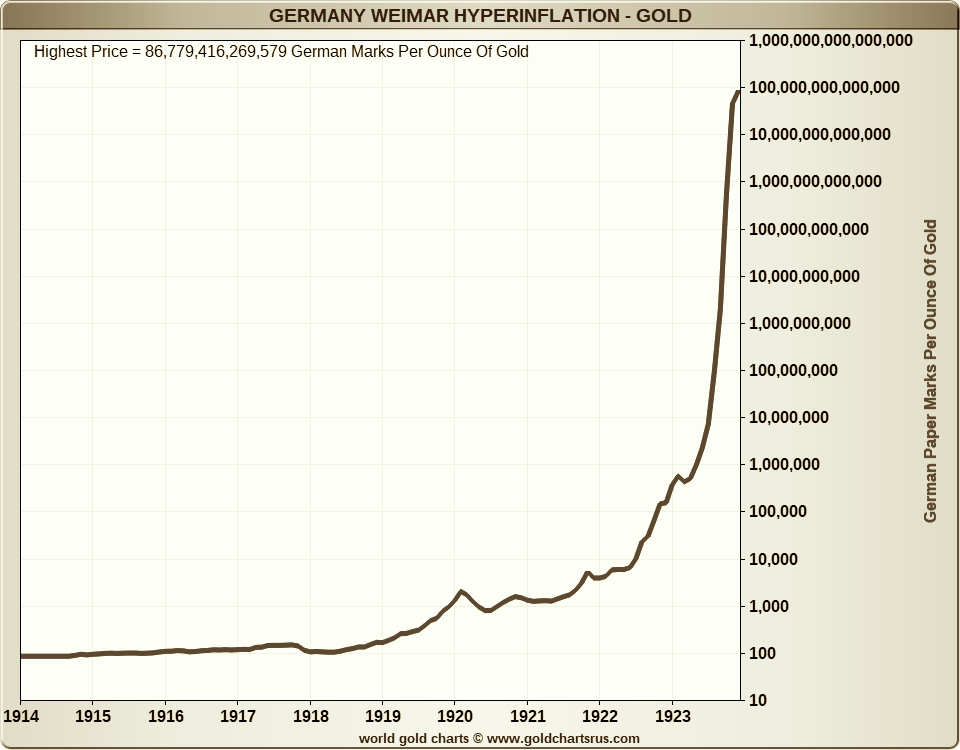

The first and second charts reflect the severe debasement of the German mark at the time. The third and fourth show how gold and silver performed as a hedge. In effect, what could have been purchased with an ounce of gold or silver before the debacle, could have been purchased at any time as it worsened and finally when it ended a few years later. Few, as stated above, predict an inflationary disaster on the level of the Weimar Republic. Still, it is good to know that by preparing for the lesser version of inflation, one prepares for the nastier versions as well.

Charts courtesy of GoldChartsRUs • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interested in preserving your purchasing power in even the worst-case scenario?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Image (top): Paper German marks converted to notepad, 1920s Weimar Republic. Attribution/ Bundesarchiv, Bild 102-00193 / CC-BY-SA 3.0, CC BY-SA 3.0 DE <https://creativecommons.org/licenses/by-sa/3.0/de/deed.en>, via Wikimedia Commons

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

Ubiquity, complexity, and sandpiles

Contemplating the impact of that last grain of sand

For a long while, John Mauldin (Mauldin Economics) has been one of the more thoughtful big picture analysts – someone whose work we read regularly. In a recent reflection posted at the GoldSeek website, he begins with a section on a Brookhaven National Laboratories study of sandpiles. Researchers attempted to ascertain at which point, and to what degree, the last grain of sand falling on the pile causes disequilibrium and the collapse of the pile. It found that the impact of the last grain of sand varied. It “might trigger only a few tumblings or it might instead set off a cataclysmic chain reaction involving millions.”

“We cannot accurately predict when the avalanche will happen,” Mauldin concludes. “You can miss out on all sorts of opportunities because you see lots of fingers of instability and ignore the base of stability. And then you can lose it all at once because you ignored the fingers of instability. You need your portfolios to both participate and protect. Don’t blindly buy index funds and assume they will recover as they did in the past. This next avalanche is going to change the nature of recoveries as other market forces and new technologies change what makes an investment succeed. I cannot stress that enough. Don’t get caught in a buy-and-hold, traditional 60/40 portfolio. Don’t walk away from it. Run away.”

So why would the story of the last grain of sand hitting the pile before it begins to dissemble be important? “The peculiar and exceptionally unstable organization of the critical state,” says Mark Buchanan, who wrote a book on catastrophes of all kinds (and referenced by Mauldin), “does indeed seem to be ubiquitous in our world. Researchers in the past few years have found its mathematical fingerprints in the workings of all the upheavals I’ve mentioned so far [earthquakes, eco-disasters, market crashes], as well as in the spreading of epidemics, the flaring of traffic jams, the patterns by which instructions trickle down from managers to workers in the office, and in many other things.” There comes a breaking point a which time the result is uncontrollable.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Worried about the sandpiles building in various markets?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

The next great monetary experiment

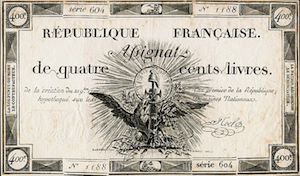

Daily Reckoning’s Brian Maher warns of the potential consequences of modern monetary theory. “This MMT sounds like a recipe for immense inflation, even hyperinflation,” he says. “You are spending all this money directly into the economy. It will drive consumer prices through the attic roof, you say. This is crackpot. A witch’s sabbath of inflation would surely result. Yes, but here the MMT crowd meets you head on… They agree with you. They agree MMT could cause a general inflation, possibly even a hyperinflation.” [Link to full article]

Modern Monetary Theory (MMT), we would add to Maher’s observation, is neither modern nor a theory. John Law, the Scottish financier, tried a version of it almost exactly 300 years ago (1717-18) in France.* He did so with the blessing of the French monarchy and with a rationale very similar to MMT’s proponents today. MMT entails, simply put, a federal government fiscal policy without spending limits coupled with the power to print whatever money is required to finance any deficits. In the end, Law’s theories (to his surprise if we are to believe the historical account) bankrupted the French people and the government, reduced the economy to ashes, and created such a distaste for paper scrip among the citizenry that it took 80 years for France to reintroduce paper money as a circulating medium.

In The Story of the Greatest Nations (1900), Edward S Ellis and Charles F. Home tell of the public mania that engulfed the French people and led to ultimate financial ruin for thousands:

“The shrewder speculators* became alarmed. They began to sell their shares of stock, and hoard in gold the enormous wealth they had acquired. This resulted in a demand on the government for metal in exchange for its paper, and soon the government had no metal to give. Then the crash came. Those who had the government paper could buy nothing with it. Those who held the Mississippi stock could scarce give it away. It was worthless. The government itself refused to accept its own paper for taxes. A few lucky speculators had made vast fortunes; but thousands of families, especially among the wealthier classes, were ruined.”

That snippet provides a hint as to the steps taken by those who survived Law’s version of modern monetary theory. For those to whom all of this has a distinct ring of familiarity, perhaps a judicious hedge makes some sense. A number of analysts have made the argument that we do not have to wait for the formal launch of modern monetary theory. It is already here.

* Please see this link for a summary of Law’s Mississippi Company land scheme.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to move from education to action?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

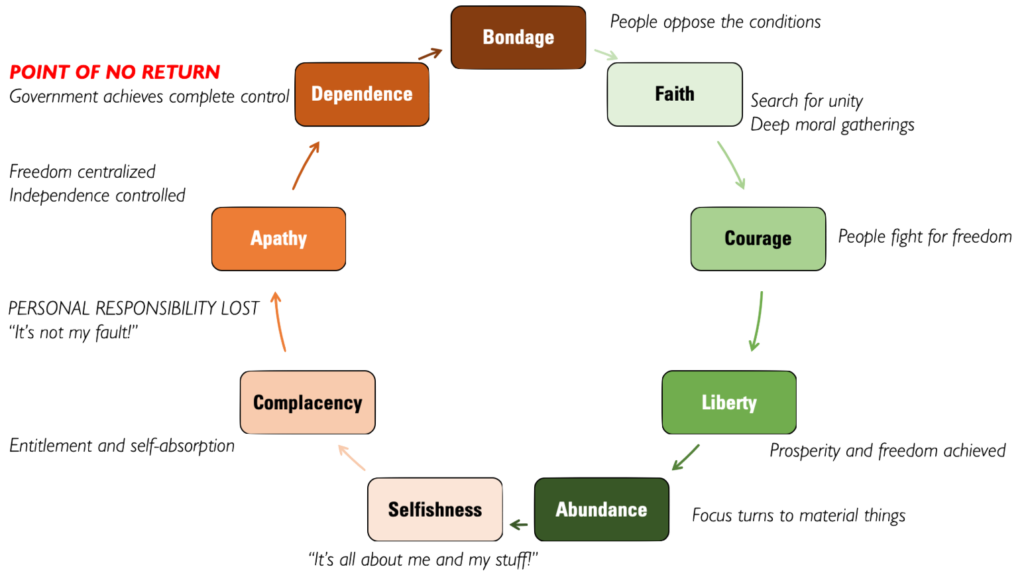

Tytler’s Cycle

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.” – Alexander Fraser Tytler, Scottish historian, (1747-1813)

_______________________________________________________________________

To end right, start right.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

_______________________________________________________________________

Image attribution: J4lambert, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>,

via Wikimedia Commons

Short & Sweet

Computer software gone mad

Similarly, in early 2017 Financial Times told the story of the textbook, The Making of a Fly: The Genetics of Animal Design. It started out selling for $113 per copy at Amazon – that is until the governing algorithm misfired between two third-party sellers. The price then skyrocketed to $23 million before someone took note and fixed the problem. We forget that computer software, and this applies to Wall Street’s trading apparatus as readily as it does the Amazon pricing platform, is only as reliable and intelligent as the code by which it is instructed to operate. The practical equivalent to Mr. Spock’s solution in the financial realm is to store sufficient capital in the form of gold and silver coins detached from potentially rebellious electronic circuitry.

Worried about the possibility of computer algorithms running amok in financial markets?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Gold Relativity

Do not take your eye off the prize

Gold’s value is relative. It doesn’t really matter how many digits it takes to express the price. Its true value lies in what those digits represent in terms of purchasing power. During the post-World War I hyperinflation in Germany, for example, a 20-mark gold coin in 1918 purchased the equivalent of twenty marks worth of goods and services in the marketplace. By 1924 that same 20-mark gold coin (weighing roughly one-quarter troy ounces) provided the purchasing power of nearly 25 billion paper marks.

By pointing out this example of gold’s constancy, we do not intend to imply that the United States is headed the way of the Weimar Republic. What we do mean to say, though, is that those who track the nominal value of gold by itself without taking into account the current and future value of the currency in which it is measured take their eye off the prize.

What are the intentions of the central bank and federal government, we should ask ourselves, and what will be the likely effect on the purchasing power of the currency?

Ready to add purchasing power constancy to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Super-rich doomsday preppers ahead of the times

And the not-so-super-rich are following in their footsteps

“Survivalism,” Evan Osnos once wrote in an article for The New Yorker, “the practice of preparing for a crackup of civilization, tends to evoke a certain picture: the woodsman in the tinfoil hat, the hysteric with the hoard of beans, the religious doomsayer. But in recent years, survivalism has expanded to more affluent quarters, taking root in Silicon Valley and New York City, among technology executives, hedge-fund managers, and others in their economic cohort.”

We have always taken exception to the mainstream media’s portrayal of the ordinary gold owner as “the woodsman in the tinfoil hat”. . . etc. Many among the media are utterly amazed to learn that people like Steve Huffman (Reddit, CEO), Peter Thiel (PayPal founder), and the long roster of other luminaries mentioned in this New Yorker article are identified as “preppers” in one capacity or another. They would probably be even more amazed to learn that many of this same group are likely to be gold and silver owners. We say “likely” because precious metals owners by and large are a group reluctant to advertise their ownership.

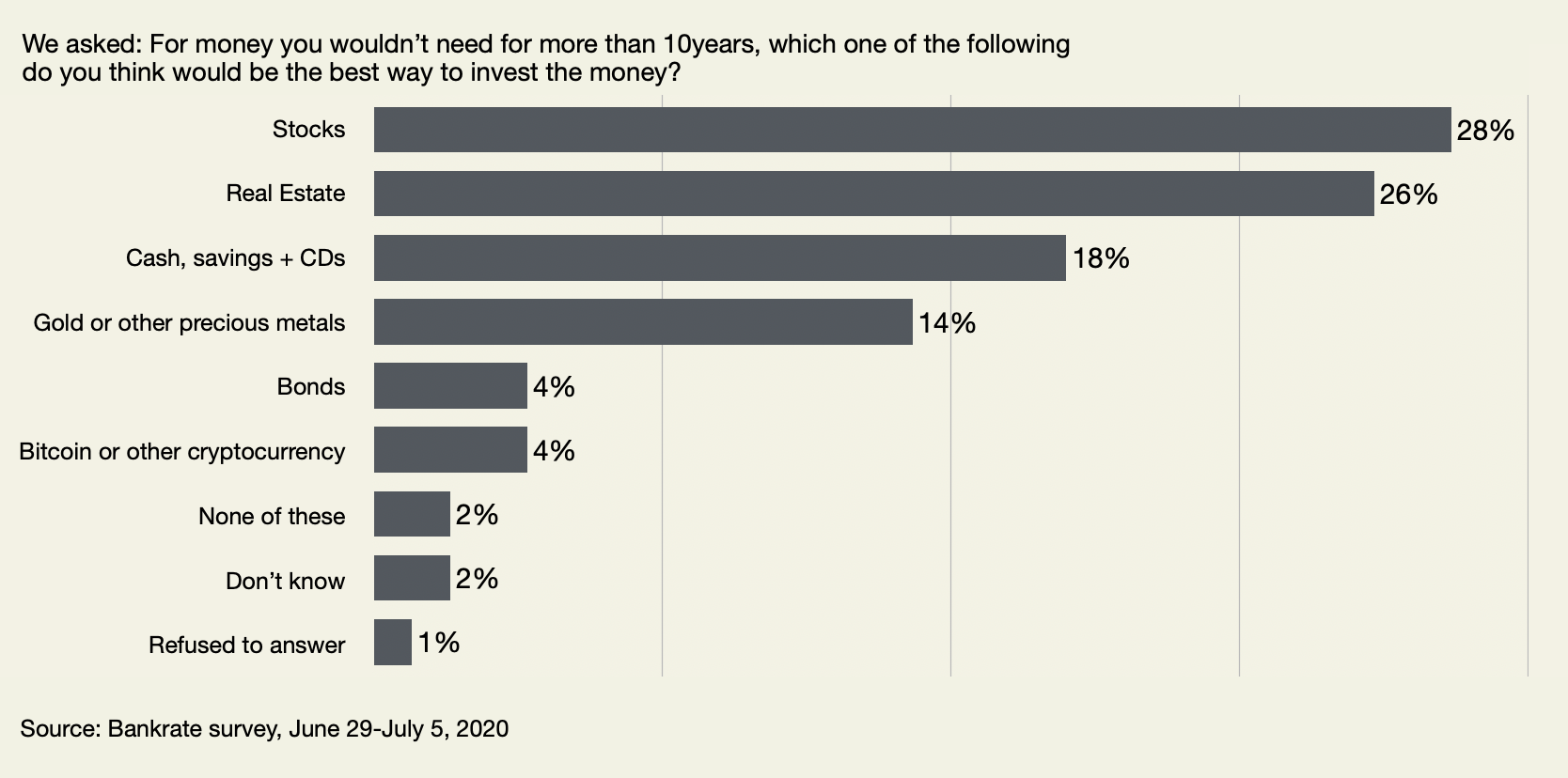

As it is, they take a place alongside a wide range of Americans who own precious metals – physicians and dentists, nurses and teachers, plumbers, carpenters, and building contractors, business owners, attorneys, engineers, and university professors (to name a few.) We know because that is the description of our clientele here at USAGOLD. Gold ownership, in short, is pretty much a Main Street endeavor. In a 2020 Bankrate survey, one in seven investors (14%) chose gold or other precious metals as the best place to park money they wouldn’t need for more than ten years – making it the fourth most popular category. Similarly, a 2020 Gallup poll found that 17% of American investors rated gold the best investment “regardless of gender, age, income or party ID. . .” One might assume that if Bankrate or Gallup took a similar poll today, even more investors would give the precious metals a thumbs up given what has occurred over the past year.

Those well-to-do preppers, as it turns out, were uncannily ahead of the times. Over the years, large numbers of the not-so-super-rich followed in their footsteps – setting up “bugout” retreats in the countryside and small-town America (though for reasons unforeseen in the article) while a good many fled the big cities permanently for safer environs. That mindset – the general flight to safety – has echoed loudly in the precious metals markets. The World Gold Council reports global retail gold investment demand running at record levels in 2022. As for silver, the Silver Institute, a research organization not given to hyperbole, recently reported an eye-catching 36% increase in physical silver investment for 2021.

Bankrate Survey of Investors

Chart courtesy of BankRate.com • • • Click to enlarge

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

NEWS & VIEWS

Forecast, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

We invite your interest in our popular monthly newsletter.

Prospective clients welcome.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

CLIENT ALERT

Beware MS70, MS69, PF70 ‘Perfect’ + ‘Certified’ + ‘First-Strike’ + ‘First-Release’ Gold and Silver American Eagles and American Buffalos

In 2006, the US Mint produced its first-ever .9999 fine gold coin in the form of the popular American Buffalo. The goal was to offer investors an American-made alternative to popular pure gold products like Canadian Maple Leafs, Austrian Philharmonics, and gold bars. While numerous dealers (USAGOLD was one) offered Buffalos as an alternative bullion coin at a competitive rate, the novelty of the coins coupled with feverish demand helped spawn a whole new spinoff in the gold business – the independently graded contemporary bullion coin.

On the surface, there is nothing wrong with having one’s contemporary bullion coins graded and housed permanently in hard plastic containers. It is when these items are then promoted as exceptionally rare and desirable and priced at very high, and often unsustainable, premiums over their gold content that it becomes a problem. In reality, as you will read below, the graded item, in most cases, is not substantially different (except for the container) from the typical bullion coin purchased daily by thousands of investors around the world.

After Buffalo hype wore off, our feeling was that this promotion, like many others that came before it, would fade away with waning interest. Yet here we stand many years later, rather than fading away, it has expanded and proliferated to include American Gold Eagles, American Silver Eagles, and US Mint Commemoratives. One need only search MS70 or PF70 “Perfect” American Eagles to see just how many companies offer these fictional “numismatics.” (MS is an abbreviation for mint state and PF for proof)

At USAGOLD, we could not be more emphatic in our warning against paying significant premiums above the metal content for these products. This includes common contemporary items sold as “first-strike,” “early issue,” “first release,” Mint State 69, Mint State 70, Proof 69, and Proof 70, as graded by the independent grading services, including the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC). Below we have published the U.S. Mint’s official statement regarding “First Strike”/”First Release” designations and production quality controls.

|

Coin dealers and grading services may use these terms in varying ways. Some base their use on the dates appearing on United States Mint product packaging or packing slips, or on the dates of product releases or ceremonial coin strike events. Consumers should carefully review the following information along with each dealer’s or grading service’s definition of “first strike” or “first release” when considering purchasing coins with these designations. The United States Mint has not designated any coins or products as “first strikes” or “first releases,” nor do we track the order in which we mint coins during their production. The United States Mint strives to produce coins of consistently high quality throughout the course of production. Our strict quality controls assure that coins of this caliber are produced from each die set throughout its useful life. Our manufacturing facilities use a die set as long as the quality of resulting coins meets United States Mint standards and then replace the dies, continually changing sets throughout the production process. This means that coins may be minted from new die sets at any point and at multiple times while production of a coin is ongoing, not just the first day or at the beginning of production. United States Mint products are not individually numbered and we do not keep track of the order or date of minting of individual coins. Any dates on shipping boxes are strictly for quality control and accounting purposes at the United States Mint. The date on the box represents the date that the box was packed, verified and sealed, and the date of packaging does not necessarily correlate with the date of manufacture. The date on shipping labels and packing slips for coins that are sent directly to United States Mint customers from our fulfillment center is the date the item was packed and shipped by the fulfillment center. The other numbers on the shipping label and packing slip are used for tracking the order and for quality control. |

The statement of ‘consistently high quality throughout the course of production’ is critical. For example, at one of the top grading services, 100% of the one-ounce gold 2021 American Eagle (Type 2) business strikes submitted for review graded either Mint State 69 or Mint State 70 – the two highest grades at the services. Almost 95% of submissions received a Mint State 70 grade, the ultimate rating. As for the 2021 silver American Eagle one-ounce coins (Type 2), 99.9% of submissions made the top grades of Mint State 69 and Mint State 70, and a similar percentage of proof silver Eagles made the top grades of Proof 69 and Proof 70.

With the mint continually producing new coins at the same high quality that they always have, year after year, there is literally an ENDLESS supply of product. To be clear, you do not have to avoid buying these coins altogether. You just have to avoid paying an egregious dealer premium to do so. In fact, if you were so inclined as to desire ownership of graded bullion coins for future numismatic potential, we’d recommend simply purchasing bullion coins from us at our competitive premiums and submitting them to be graded (certified) on your own.

Content last updated on 11-12-2021

_______________________________________________________________________________________________________________

Looking to include gold and silver in your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Need more information? Try –

What you need to know before you launch your gold and silver IRA

Favorite web pages

Daily gold and silver price history

1968 to present

Our Daily Gold and Silver Price History pages are among the heaviest traffic pages at the USAGOLD website. The archived data is licensed from the ICE Benchmark Administration and the London Bullion Market Association and Netdania Creations and run from 1968 to present. FOREX prices for the day are posted as a live feed and then frozen at the end of each trading day. These pages are frequented by data gatherers of all descriptions from professors and their students to market professionals and investors – all interested in gold’s price performance both over the long run and within specific time constraints for their own research purposes.

Daily Gold and Silver Price History is another of the quiet pages at USAGOLD that garners significant global interest particularly when the market is moving or breaking news warrants more than average interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion, and analysis as it happens.

We invite your visit. We encourage your bookmark.

USAGOLD’s

Daily gold and silver price history pages

A Gold Classics Library Selection

Extraordinary Popular Delusions And The Madness Of Crowds

Charles Mackay in his Extraordinary Popular Delusions and Madness of Crowds, written in 1841, unwittingly provides us one of the better studies of modern market behavior. I doubt Mackay would have guessed that his book would be read, digested and taken as revelation by readers in the 21st century. At the same time, he probably would have not been surprised that the pull of the same dark gravity that caused people to throw their fortunes at tulip bulbs in Holland, or land they never had a hope of seeing in the New World, would be omnipresent in the age of computers, instantaneous communication, and the nearly infinite availability of market analysis. The highly successful speculator and gold investor Bernard Baruch (1870-1965) put his blessing on this book as one of the secrets to his success on Wall Street.

Said Baruch:

“Have you ever seen in some wood, on a sunny quiet day, a cloud of flying midges — thousands of them — hovering, apparently motionless, in a sunbeam? …Yes? …Well, did you ever see the whole flight — each mite apparently preserving its distance from all others — suddenly move, say three feet, to one side or the other? Well, what made them do that? A breeze? I said a quiet day. But try to recall — did you ever see them move directly back again in the same unison? Well, what made them do that? Great human mass movements are slower of inception but much more effective.”

So we bring you Charles Mackay and his Extraordinary Popular Delusions with our own sense of mission. If the rising generations now receiving their education, or even their more jaded elders, find application in their own investment philosophy, then the purpose of this Gold Classic Library entry has been served. Complicated and timelessly revealing, here you will find examples of herd behavior, delusion, mania, craftiness, and financial loss and gain. Solomon taught us that there are no new things under the sun. Mackay teaches us how we might recognize the signs and that the crowd gone mad is a matter to be reckoned with in almost every era.

Short and Sweet

Copernicus on the debasement of money

“Although there are countless scourges which in general debilitate kingdoms, principalities, and republics, the four most important (in my judgment) are dissension, [abnormal] mortality, barren soil, and debasement of the currency. The first three are so obvious that nobody is unaware of their existence. But the fourth, which concerns money, is taken into account by few persons and only the most perspicacious. For it undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” – Copernicus, Essay on the Coinage of Money (1526)

Few know that Copernicus applied his genius to the insidious effects of currency debasement. The ground-breaking essay linked above probably influenced both John Maynard Keynes (See below) and Thomas Gresham of “bad money drives out good” fame. Supply Side Blog’s Ralph Benko says Copernicus’ essay “has been translated into English several times yet those translations remained difficult to obtain for students of the monetary arts and sciences. It has remained mostly the property of elite historians.” Above we link Edward Rousen’s translation that you might keep company with the knowledgeable elite.

It cost 8¢ to mail a one-ounce letter in 1973 as indicated by the commemorative Copernicus stamp shown above. It costs 55¢ today – an illustration of his assertion that currency debasement “undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” The post office increased the cost of mailing a letter by 5¢ – to 55¢ – beginning in 2019.

“By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.” – John Maynard Keynes, The Economic Consequences of Peace (1919)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to protect your savings from being confiscated in a covert manner?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

‘Wannabes’ and ‘Gonnabes’ not the real thing

‘Put differently, as long as humans remain tangible, it is likely that they maintain a desire to hold real and tangible assets. Very few companies on the US stock exchange, for example, are older than 50 years. By comparison, gold has existed for thousands of years and any gold coin or gold bar will most likely outlive any company and their stocks and bonds. Put together, it is unlikely that a company that sells claims on gold, such as a gold ETF, will beat physical gold’s longevity.” – Dick Baur, Professor of Finance, University of Western Australia (Why ‘digital gold’ won’t ever kill off the real thing)

Wannabe and gonnabe paper gold and silver will never pass for history’s time-honored store of value – nor will it be mistaken for actual gold coins or bars stored nearby should the cold wind blow. By the way, adding the word, blockchain, to a paper gold product might enhance its marketing appeal, but it changes nothing in terms of its usefulness to the true safe-haven investor. The instrument is still paper gold and little more than a price bet.

Don’t wannabe a ‘wannabee’?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

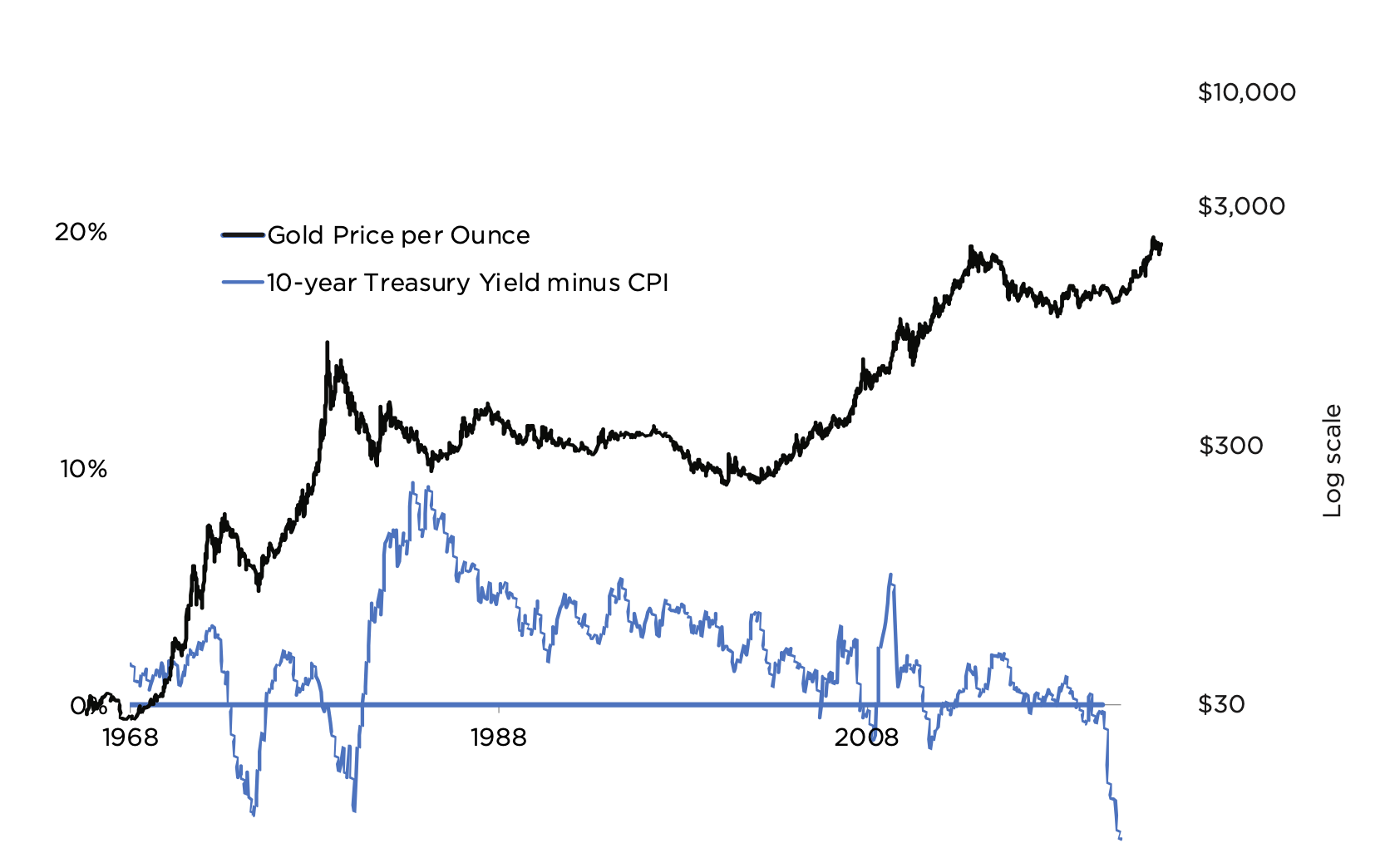

“The first stop of $10,000 is actually not that far away.”

One of the more intriguing analyses of the gold market comes from Myrmikan Research’s John Oliver. He inquires into gold’s rangebound behavior under these extraordinary circumstances and concludes, “what propels gold into the multi-thousands of dollars per ounce—is sharply rising rates that destroy the value of the Fed’s assets and make further federal deficit spending impossible. Without a political reason to buy the dollar, it will seek out its economic value.” It’s all in the math, and more specifically, he says that when looking at gold, investors “are going to have to get used to logarithmic scales.” In early 2022, Myrmikan projected a gold price of $5000 per ounce at some point down the road to give one-third backing to the Fed’s balance sheet. Now, says Oliver, it would take a gold price in excess of $11,000 to achieve the same backing. Consulting projections on gold’s logarithmic chart, he says, “the first stop of $10,000 is actually not that far away.”

Gold and 10-year Treasury yield minus CPI

(Log scale)

Chart courtesy of Myrmikan Research

________________________________________________________________________

Do precious metals look undervalued to you?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Older investors buying gold and silver remember the 1970s

‘The emotional scars of inflation will shake the foundations of western societies.’

Diane Coyle, Cambridge University

“Until this year, inflation in advanced economies,” writes Diane Coyle in a MarketWatch article titled The Emotional Scars of Inflation Will Shake the Foundations of Western Societies, “like the United States and the United Kingdom had been so low for so long that one needed to be well into middle age to remember what living through the price surges of the late 1970s was like. It was bad.… But the headline numbers do not reveal the toll that high inflation takes.” Market analysts tend to crunch the numbers without giving much thought to the net effect of economic maladjustment – like inflation – on daily life and the culture in which it occurs. Coyle, who is a professor of public policy at Cambridge University, makes reference to the 1970s and the German nightmare inflation of the 1920s, which continues, she says, to have “an impact on economic policy-making to this day.” Too, we would attribute a large proportion of the robust demand for gold and silver coins over the past year to older investors who remember the debilitating effects of the 1970s stagflation – and how well investors did who purchased those items in the early part of the decade.

_________________________________________________________________

Do you remember the 1970s?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

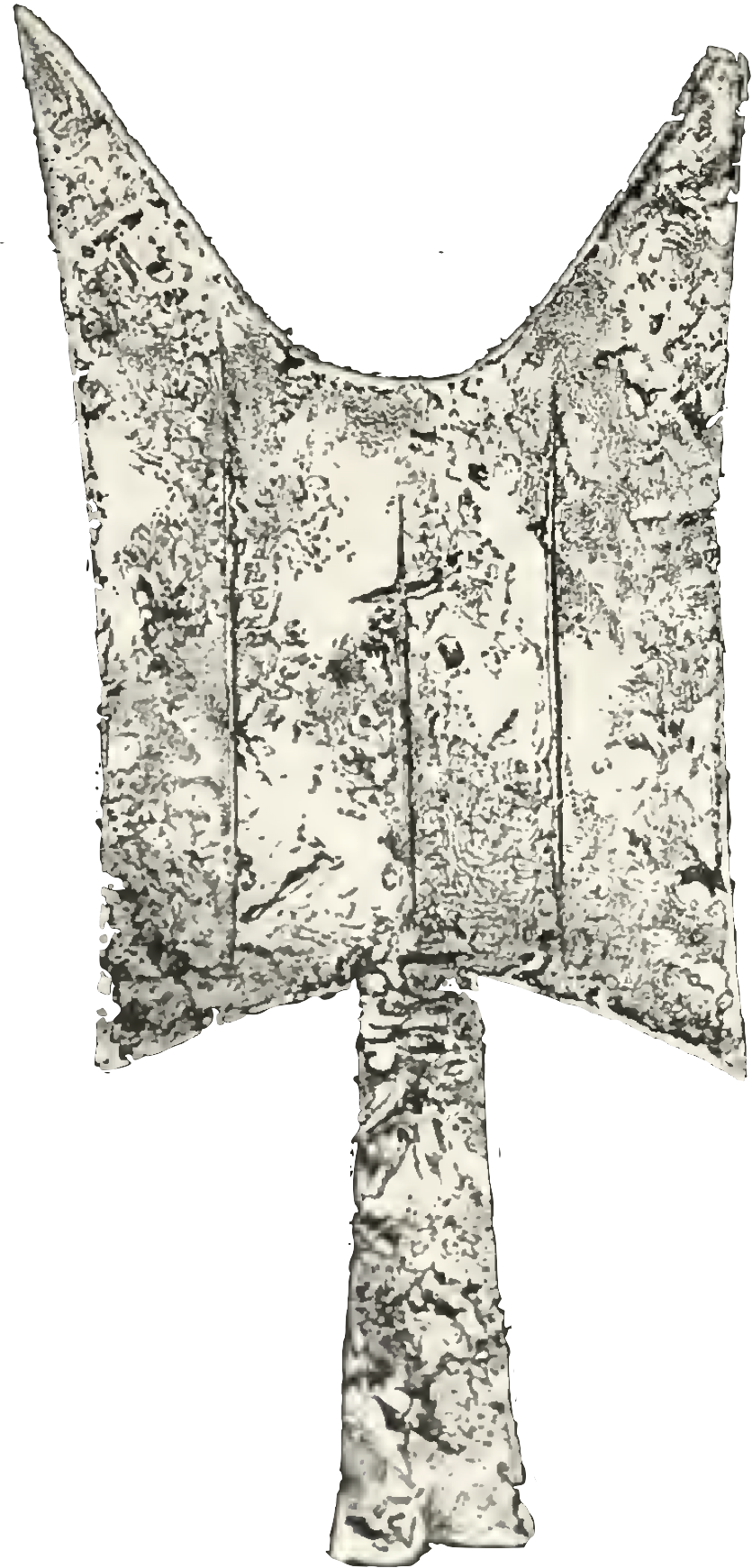

Short and Sweet

China’s monetary tradition and the origins of money

“The first step in theorizing correctly about money,” writes Mises Institute‘s Joseph T. Salerno, “is to understand that the value of money, like that of commodities, is never fixed and unchanging. Chinese philosophers who published the earlier Mohist Canons (468 B.C.~376 B.C.) grasped this crucial point. They recognized that metallic money, such as the ‘knife coins’ (pictured above) then in wide circulation, was valued and exchanged by weight and argued that the real value of money, despite its fixed face value, was not stable but fluctuated inversely with the prices of commodities. When commodity prices were high, money was ‘light’ or its purchasing power low; when prices were low, money was ‘heavy’ or its purchasing power high. Thus, if monetary conditions were such that the nominal prices of commodities were abnormally high, the real prices of commodities were not high, but rather money was ‘light’ or depreciated.”

According to Salerno, much of what we understand about sound money was first explored in ancient China, where metallic coinage was first introduced in the 12th century BC or earlier. Salerno’s article serves as an interesting introduction to Chinese monetary theory and philosophy. We recall that China was also the first country to experiment with paper money as an alternative to coins made from precious metals. As might be expected, those experiments led to several instances of runaway inflation.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? . . . To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of the world will come around to the gold-friendly view that central bankers have lost their marbles. We have no such timetable. The road to confetti is long and winding.” – James Grant, Grant’s Interest Rate Observer

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking to add some weight to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

–– A Gold Classics Library Selection ––

____________________________________________________________________________________

Fiat Money Inflation in France

How It Came, What It Brought, and How It Ended

Andrew Dickson White ends his classic historical essay on hyperinflation, “Fiat Money Inflation in France,” with one of the more famous lines in economic literature: “There is a lesson in all this which it behooves every thinking man to ponder.” This lesson — that there is a connection between government over-issuance of paper money, inflation, and the destruction of middle-class savings — has been so routinely ignored in the modern era that enlightened savers the world over wonder if public officials will ever learn it. In this essay, Dickson White explores France’s hyperinflation at the end of the 18th century in exhaustive detail – its politics, its economics, and the social consequences which led, in the end, to Napoleon’s rise as emperor. It also details gold’s performance as a hedge during the period – a history that explains the French people’s ongoing attachment to gold from that period through the modern era

1812 Napoleon 1 (Bonaparte) 40 franc gold coin

Short and Sweet

Gold in the age of high-speed electronic trading

“The best thing you can do is know how to have a balanced portfolio.”

Ray Dalio, Bridgewater Associates

In an article headlined Robots conquered stock markets/Now they’re coming for bonds and currencies, Bloomberg finance reporter Lananh Nguyen tells us: “In the most liquid equity markets, more than 90 percent of trades are executed electronically, according to estimates from Greenwich Associates. That compares with 79 percent in global foreign exchange, 44 percent in U.S. Treasuries and 26 percent in U.S. corporate bonds, with the most room for growth in the latter two markets, according to [Kevin] McPartland at Greenwich.” [Link] Just this year, Morgan Stanley and Goldman Sachs requested counterparties forgive rogue, machine-driven trades that caused a $41 billion flash crash in a matter of seconds. Though concentrated in a single stock, such anomalous events serve as a cautionary tale on how a full-out, machine-driven panic might evolve on a larger scale.

Because gold does not rely on the performance of another party, it is detached from the matrix of interlocking counter-party risk and occupies a unique place on the financial balance sheet as an asset of last resort and the final arbiter of value. That is why nation-states and central banks hold large amounts of it on their own balance sheets and why funds and institutions are more and more moving to it as an offset against other trading strategies. Investors have always viewed gold as a reliable hedge against inflation and deflation. In the years to come, they might very well come to know it as an effective hedge against computer-generated financial mayhem as well.

____________________________________________________________________

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Palantir buys $50.7 million in gold bars

Firm offering ‘insights’ to the intelligence community hedging black swan events

The prospect of sleeping better at night played largely in Palantir Technologies’ $50.7 million purchase of gold last month – 28,000 troy ounces in 100-ounce bars. In a move that surprised Wall Street, the Denver-based firm founded by Peter Thiel and Alex Karp said it purchased the gold as a hedge against “a future with more black swan events.” It is interesting to note in the context of black swan events that among Palantir’s many data-based products, it offers the AI-ready Gotham operating system – a program, according to its website, that surfaces “insights from complex data for global defense agencies, the intelligence community, disaster relief organizations, and beyond.”

“Risk,” says US Global Investors’ Frank Holmes in a piece posted at Seeking Alpha, “is precisely the reason why Palantir Technologies decided to make an investment in gold. … [N]amed for the all-seeing crystal balls in Lord of the Rings – [Palantir] is also allowing customers to pay for its software in gold.” Holmes also cites a National Inflation Association subscriber note that the company’s decision “is only the beginning of what will soon be many major corporations diversifying their U.S. dollar cash into gold.”

In a detailed article posted at ETF Trends on the Palantir acquisition, Jared Dillian recommends a way of viewing gold we have advocated since the publication of the first edition of The ABCs of Gold Investing in 1996. “As gold investors (I hold a bunch),” he suggests, “maybe we should stop thinking about gold as a trade or an investment and start thinking about it as an insurance policy.”

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Feel a need to hedge the black swan event?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973