Author Archives: USAGOLD

Short and Sweet

Gold in the Age of Inflation

The star investment of the fifty-two year era and the most reliable store of value

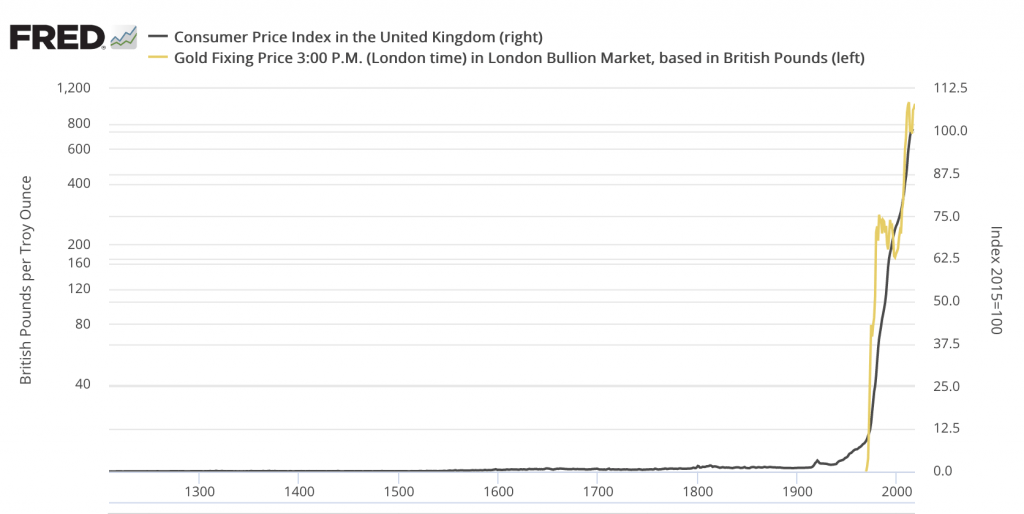

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several months. The markets await more of it. Investors and consumers worry about more of it. The Fed thinks it is transitory. Others believe it will persist. That said, the current discussion ignores an established historical reality: We already live and have lived with it for a very long time. The Age of Inflation began in August of 1971 when the United States disengaged the dollar from gold and ushered in the fiat money era. Thereafter, the inflationary process has progressively eaten away at our wealth and the purchasing power of our money.

To mark the occasion of the fiat money system’s 52nd anniversary, we offer an instructive chart for those contemplating adding gold to their portfolios. It is a myth-buster showing that gold has decisively outperformed stocks during the fiat money era. Many will be surprised to learn that gold is up almost 4,800% since 1971, while stocks have played second fiddle at 3,633%. At the same time, consensus has it that cyclically, stocks are closer to a top than a bottom, and gold is closer to a bottom than a top.

Gold and stocks price performance

(In percent, 1971-2021)

Chart courtesy of TradingView.com • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Celebrate the 52nd anniversary of the fiat money system with a gold purchase.

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

How to spot a bubble

‘Amount of leverage in U.S. equity markets now easily the highest in history.’

Cartoon courtesy of MichaelPRamirez.com

“If you want my opinion,” writes Hussman Fund’s John P. Hussman in a recent analysis, “I suspect that a near-vertical market plunge on the order of 25-35% is coming, probably quite shortly, most likely out of the blue, as in 1987, driven by nothing more than the sudden concerted effort of overextended investors to sell, and the need for a large price adjustment in order to induce scarce buyers to take the other side. As usual, no forecasts are necessary. … This dysfunctional behavior isn’t about any particular video game retailer. I suspect it’s actually about some sort of fragility or segmentation in order-flow mechanisms, possibly coupled with poorly managed derivatives exposure. As I used to teach my students, show me a financial debacle, and I’ll show you someone who had a leveraged, mismatched position that they were suddenly forced to close into an illiquid market. Though my concerns run far beyond the amount of leverage in the system, it isn’t helpful that the amount of leverage in the U.S. equity markets is now easily the highest in history.”

These days spotting the bubble is about as difficult as finding it in the Ramirez cartoon above. Hussman attacks Wall Street’s new rationalization of buying into the bubble, i.e., extreme valuations are justified by low interest rates. Those who are all-in for fear of missing out – blindly walking on air – are obviously the most vulnerable. When investing becomes a matter of faith, that faith will be tested. A solid diversification, we will add, would blunt the downside. Though investor margin debt is small compared to the leverage funds and institutions deploy in the market, it does serve as a bellwether for analysts looking for what might trigger a market crash. SentimenTrader’s Jason Goepfert recently posted a warning to his readers that at $831 billion, we are fast approaching a “year-over-year growth rate in [margin] debt – on both an absolute scale and relative to the change in stock prices – will compare with some of the most egregious extremes in 90 years.”

Are you worried about the egregious extremes in the stock market?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

Reliably serving physical gold and silver investors since 1973

Short & Sweeet

‘The world is being tested to the extreme.’

Protecting and building wealth in a new financial era

“Remember what we’re looking at. gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.” – Alan Greenspan, November 2014

Interest Rate Observer’s James Grant referred to the current period as a “wild time in money.” Credit Suisse’s Zoltan Pozcar warned that “this crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971.” Mohamed El-Erian likened the Fed’s current monetary policy to that of a developing country central bank. “The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves,” said long-time market analyst Lawrence Lepard, “are nothing short of a monetary earthquake.” Larry Fink, who manages BlackRock, the world’s largest investment fund, said the invasion marked “a turning point in the world order” and the end of globalization. Finally, George Soros went to the dark side calling Russia’s invasion of Ukraine “the beginning of World War III with the potential to destroy our civilization.”

If we have indeed embarked upon a new and turbulent financial era, as the above suggests, investors will be tasked with protecting and building their wealth under extraordinary and unpredictable circumstances. “History,” says James Grant, “would counsel us to be humble, prepared to listen and interpret correctly.” Swiss-based investment analyst Claudio Grass took a similarly philosophical approach (and one that we have counseled over many years). “It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance,” he said. “The real counter-question now is ‘What is your peace of mind worth?’” Long-time money manager Stephen Leeb believes “the world is being tested to the extreme…Right now, as individuals, the best thing you can do for yourself is to buy protection, and that means investing in gold. Even under the best scenarios, a lot of turmoil lies ahead before we reach the other side, and gold will be the best way to get through it in good shape.”

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

–– A Gold Classics Library Selection ––

____________________________________________________________________________________

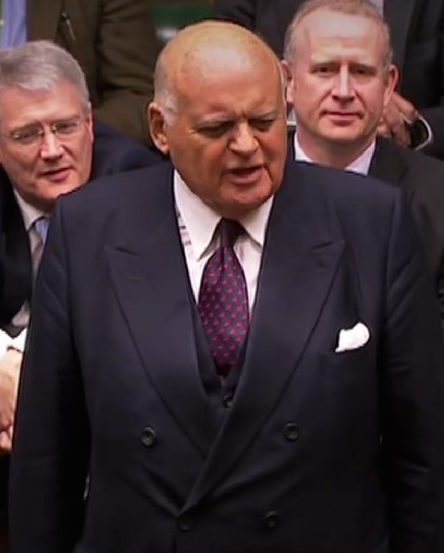

Britain’s Gold Sales ‘a Reckless Act’

(Sir Peter Tapsell’s speech before the House of Commons, June 16, 1999, on the partial sale of United Kingdom’s gold reserves)

We do not update our Gold Classics Library often, but when we do we try to choose items that have a timeless quality. This latest selection certainly meets that standard. It comes to us unexpectedly as a by-product of research for the recently published article, The Power of Gold Diversification, and with the kind permission of the United Kingdom Parliamentary Archives.

History’s indisputable verdict is that Tapsell was right and the British government wrong. The ensuing more than two decades featured a global financial crisis, a pandemic, low-to-zero-percent interest rates, scrambling central banks, and the consistent depreciation of global currencies against gold. Currencies did not glitter in the storm, and they could not have been mistaken for gold which rose relentlessly from $287 per ounce at the time of his speech to the current price of over $1800 (at one point reaching more than $2000 per ounce). Though Tapsell’s speech before the House of Commons failed to stop the sales, it goes down as one of the most eloquent appeals ever made on the merits of gold ownership for nation-states and individuals alike.

Favorite web pages

Charles DeGaulle’s famous ‘Criterion’ speech

____________________________________________________________________________________________________

Are you ready to add the criterion of value to your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Beware the Black Swan

‘There’s no clean way out.’

“The clan over the years’ matured and turned unruly,” writes Credit Bubble Bulletin’s Doug Noland. “Myriad severe development issues are increasingly on full display. The halcyon sandbox days are over for good, replaced by a confluence of insecurity, greed, and now constant infighting. To be sure, rich Uncle’s years of lavish generosity fostered a bunch of spoiled malcontents. The lax benefactor has come to realize he can no longer finance all the dysfunction and is desperate to craft a plan for exiting the relationship without unleashing mayhem. Some have structured their lives to stand on their own, while others’ very survival is at stake. All have developed bad habits, with some succumbing to deadly addictions. One camp says, ‘it’s time to get on with our lives without being further warped by all this charity money.’ Another is threatening to do harm to themselves. There’s no clean way out. Uncle fears calamity and harbors serious regret.”

Heightening the sense of impending danger, we would add our own observation that financial markets are full of eddies, crosscurrents, and strong undertows driven by excessive leverage and machine-based trading wherever the Fed might care to look. Today, the potential madness of machines is just as big a worry as the madness of crowds – their programming subject to the same frailties as their human creators. In fact, with algorithmic trading accounting for 60%-73% of U.S. equity trading, an argument could be made that machines now comprise the crowd.

“Since these automated strategies typically use artificial intelligence programs to analyze and react to market momentum, rather than economic fundamentals per se,” writes Gillian Tett points in a recent Financial Times editorial, “this tends to exacerbate a herding effect, not just in commodity markets but in any asset class. And since the institutions selling these derivatives bets need to hedge their own risks with other instruments, extreme robo-herding creates distortions across market niches that can suddenly unravel, causing wild volatility.” To make a very long story short, credit markets have a history of reacting unpredictably, and sometimes violently, to rising rates: Beware the Black Swan ……

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to hedge the madness of machines?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

How much gold is enough?

Investors often ask about the percentage commitment one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a recent Seeking Alpha editorial, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” USAGOLD recommends, as it has for many years, a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

________________________________________________________________________________

Is diversification in the cards for your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

We first introduced our readers to these nine lessons all the way back in 1999. They were passed along to us by the legendary commodity market analyst R.E. McMaster, formerly editor of The Reaper newsletter. The original source for the nine lessons was a highly regarded money manager who handled accounts for wealthy Greek and Mexican merchant families.

1. It is easier to make a fortune than keep it.

2. Intelligence is an inadequate substitute for wisdom. Wisdom fears, respects the unknown and fosters humility. Intelligence can lead to self-destructive arrogance and ultimate failure.

3. Risk must have premium, and we must understand it well.

4. There is no order. There is no formula. There is no equation that works all of the time. It works just long enough to fool just a few more of us just a little longer.

5. What we fail to remember is that a paper gain is just that. Paper. Worth nothing. Not until we say sell, and not until we get cash. Anything less is just that.

6. When the Bass Brothers in Texas write a check for real money, their money, to buy 25% of the Freeport McMoran Gold Series II, we take notice. When the Fidelity Magellan Fund buys a fifty-million in Dell computer, we yawn. So, should you. It is other people’s money.

7. Slick advertising budgets, powerful computers and few slabs of marble do not, by themselves, make a great financial institution.

8. Never invest in anything you do not feel comfortable with or understand well.

9. When a thousand people say a foolish thing, it is still a foolish thing.

Is the wisdom of a portfolio hedge in your future?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

The more things change, the more they stay the same

The criticism leveled at gold over the past few months brings to mind an old Murray Rothbard quote from the early 1970s, when the internet was not around to challenge the constant stream of negative press on gold. He included it in the intriguingly titled pamphlet, What Has Government Done to Our Money:

Even when gold was trading at $35, its adversaries were predicting lower prices ($10 per ounce), and even then, under the flimsiest of arguments. Its ‘industrial” nonmonetary price? How is that different from its monetary price? Ultimately in that first leg of gold’s long-term secular bull market during the 1970s, it went well over $800 per ounce – a far (very far) cry from $10!

The lesson in all this? The more things change, the more they stay the same. Gold’s critics have not changed their tactics over the years, and they are not likely to anytime soon. But one thing has changed: Now there is a wealth of information available for you to make your own assessment beginning with this website.

Image courtesy of the Mises Institute

What Has Government Done To Our Money/Murray Rothbard/Mises.org/Pdf download

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to defy predictions of gold’s demise?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Short & Sweet

American colonists among the first to embrace MMT

Though, as Mihm explains, Massachusetts’ original paper currency introduced in 1690 functioned reasonably well in terms of holding its value, some of its successors did not do so well. Years later, a paper currency inflation during and after the American Revolutionary War gave a now-famous phrase a prominent place in the American lexicon – “not worth a Continental.” Mihm’s article refers to the period in Massachusetts around 1690 as a “crude forerunner” of Modern Monetary Theory, and it is an interesting read.

“The Congress issued six million dollars of continentals in 1775, and the issues increased each year. One hundred and forty millions were issued in 1779. As prices rose, the government found that it needed more and more dollars to finance its expenditures. More money was printed. This added supply of dollars led to further depreciation in the infamous spiral of inflation. At the outset, the continental had circulated at par with a dollar of specie. By 1780, over one hundred continental dollars were required to exchange for one specie dollar; Congress had printed continentals until they were worth almost nothing.” – Murray N. Rothbard, Faith and Freedom, (1950) as published at the Mises Institute,

Want to hedge the possibility of your savings becoming ‘not worth a Continental?’

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Favorite Web Pages

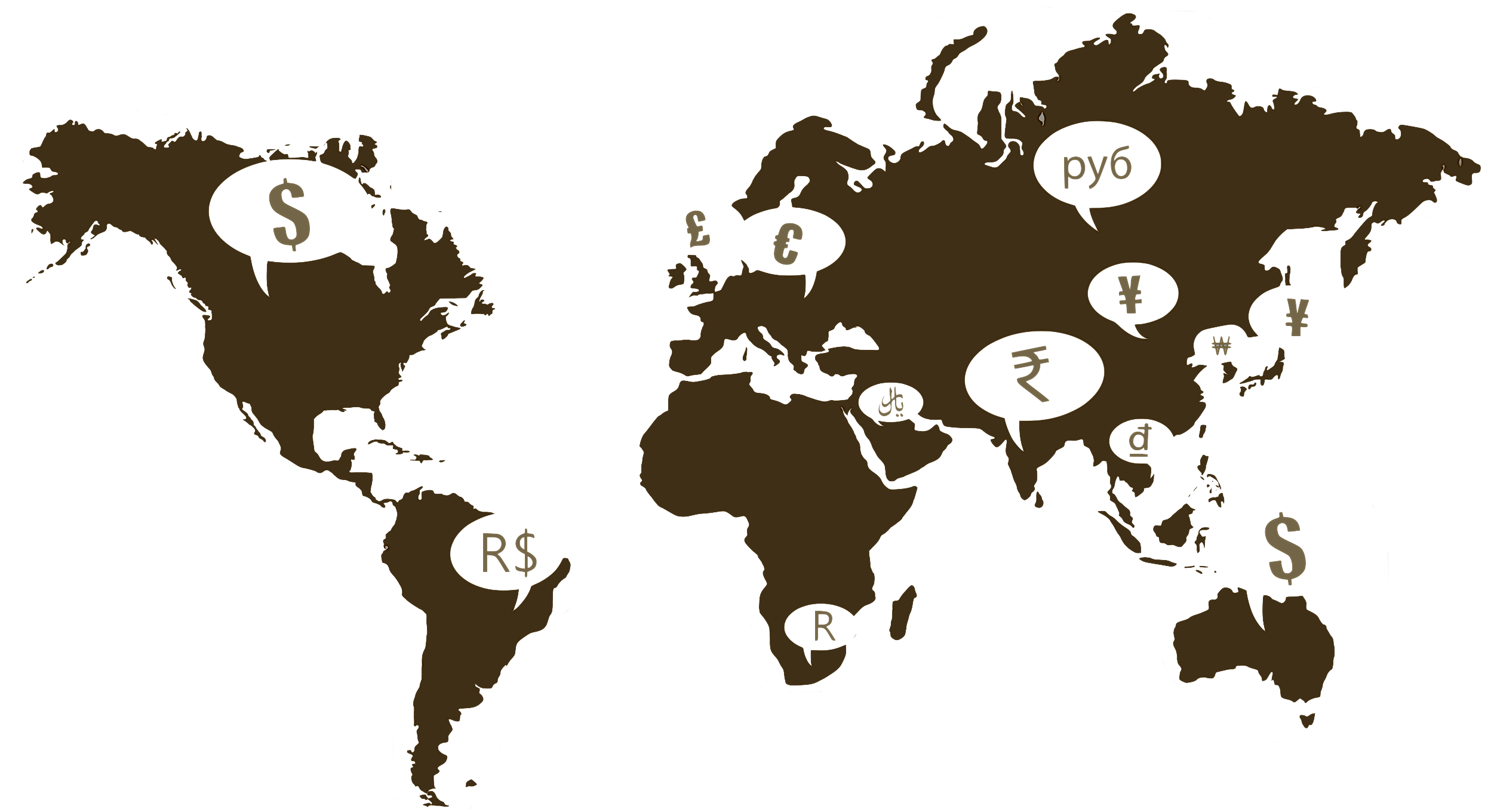

Gold Charts in Various Timelines and Currencies

Euro, Chinese yuan, British pound, Japanese yen, Swiss franc, Indian rupee, Australian dollar, Canadian dollar, U.S. dollar

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

USAGOLD was among the first to offer charts that tracked gold in various currencies and timelines. These live charts have always attracted a steady stream of U.S. and international visitors. As a result, we recently streamlined and upgraded the page to make it more user-friendly and included more currencies in the mix.

We invite your visit and bookmark.

Short and Sweet

Blinded by the Money Illusion

“Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be.” – Janet Yellen, Former Federal Reserve chairwoman

With those words, Janet Yellen, now the Secretary of the Treasury and facing an even worse crisis than the one referenced above, put investors around the world on notice, though probably not in the way she intended. In the past, such smug assurances from public officials have been enough to send contrarian villagers heading for the safety of the nearby woods. The informed student of financial history knows that panics, manias, crashes, and collapses are as common to investment markets as hurricanes to Caribbean beaches. To think that suddenly we have banished their recurrence for ‘our lifetimes’ smacks of the kind of misguided hubris that contributed directly to the 2008 meltdown and subsequent untold financial hardship. Just about the time most everyone comes to the conclusion nothing could go wrong, everything goes wrong …… and in a hurry, as we have discovered over the course of the past two years.

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Howe says this Fourth Turning will go to 2030

“To be clear, the road ahead for America will be rough,” writes Neil Howe, author of the modern classic, The Fourth Turning (1997), in a recent analysis posted at Hedgeye. “But I take comfort in the idea that history cycles back and that the past offers us a guide to what we can expect in the future. Like Nature’s four seasons, the cycles of history follow a natural rhythm or pattern. Make no mistake. Winter is coming. How mild or harsh it will be is anyone’s guess, but the basic progression is as natural as counting down the days, weeks, and months until Spring.”

For those who, like me, buy into Howe’s notion of a Fourth Turning, the problem is to get to the other side of the woods with our assets reasonably intact. “Currently, this period began in 2008,” he points out, “with the Global Financial Crisis and the deepening of the War on Terror, and will extend to around 2030. If the past is any prelude to what is to come, as we contend, consider the prior Fourth Turning which was kicked off by the stock market crash of 1929 and climaxed with World War II.” Eventually, he says, we will find our way to a first turning – a time of renewal – but we will be sorely tested before we get there. The precious metals have offered solid protection through the first half of the Fourth Turning. Gold is up 145% since the collapse of Lehman Brothers in September 2008 – the event most analysts associate with the start of the crisis. Silver is up 165%. In both instances, the greatest price acceleration occurred in the early years of the crisis.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking for a way to get to the other side of the deep, dark wood?

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Economic insecurity is becoming the new hallmark of old age

“In the United States,” writes Katherine S. Newman and Rebecca Hayes Jacobs for The Nation, “economic security in old age was seen, for a long time, as both a social issue and a national obligation. From the birth of Social Security to the end of the 20th century, the common assumption has been that we have a shared responsibility to secure a decent retirement for our citizens. Yet that notion is weakening rapidly. Instead, we have started to hear echoes of the mantra of self-reliance that characterized welfare ‘reform’ in the 1990s: You alone are in charge of your retirement; if you wind up in poverty in your old age, you have only your own inability to plan, save, and invest to blame.”

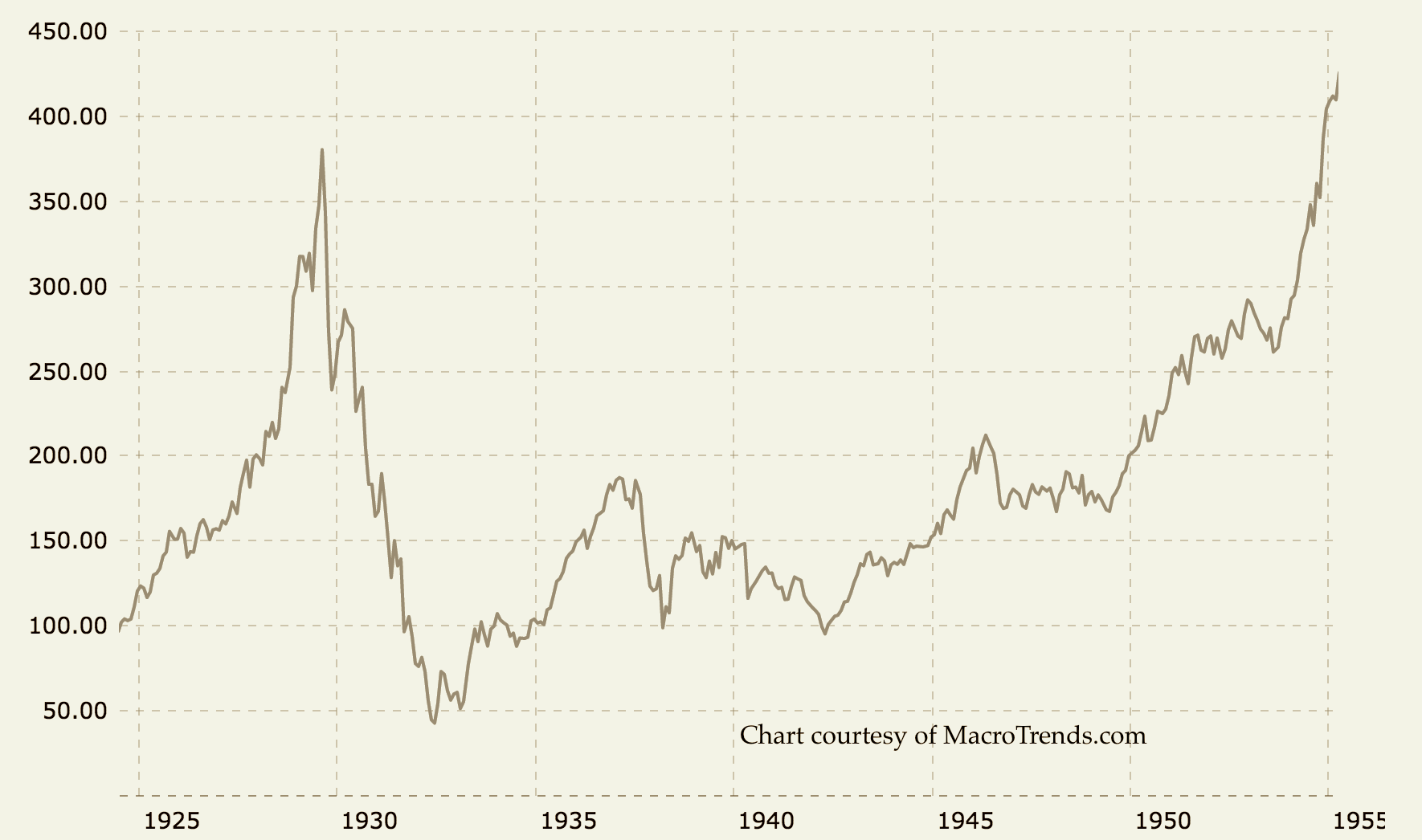

Dow Jones Industrial Average

(1925-1955)

Chart courtesy of MacroTrends.net • • • Click to enlarge

Some compare today’s stock market psychology to the period just before 2008. Others compare it to the 1920s when everything was hunky-dory until suddenly it wasn’t – perhaps a more apt comparison. Too many are “all-in” with respect to stocks in their Individual Retirement Accounts hoping to accumulate as much capital as possible without regard to the potential downside. As the chart above amply illustrates, the stock market did not recover from the losses accumulated between 1929 and 1933 until the mid-1950s, almost 25-years later – a fragment of stock market history lost to time.

Some will rely on the fact that stocks recovered nicely once the Fed launched the 2009 bailout. We should keep in mind though that many prominent Wall Street analysts have warned that the Fed no longer has the firepower it did then. The financial markets and economy are much more vulnerable as a result – all of which brings us back to the notions of self-reliance and taking personal responsibility for our retirement plans. If you find yourself among the group that thinks hedging a stock market downturn to be in your best interest, we can help you effectively structure a gold and silver diversification as part of your retirement plan to hedge that possibility.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you ready to hedge a potential Wall Street meltdown in your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Gold as the ‘generational trade’

Billionaire investor says it will reach $3000 to $5000 as secular bull market resumes

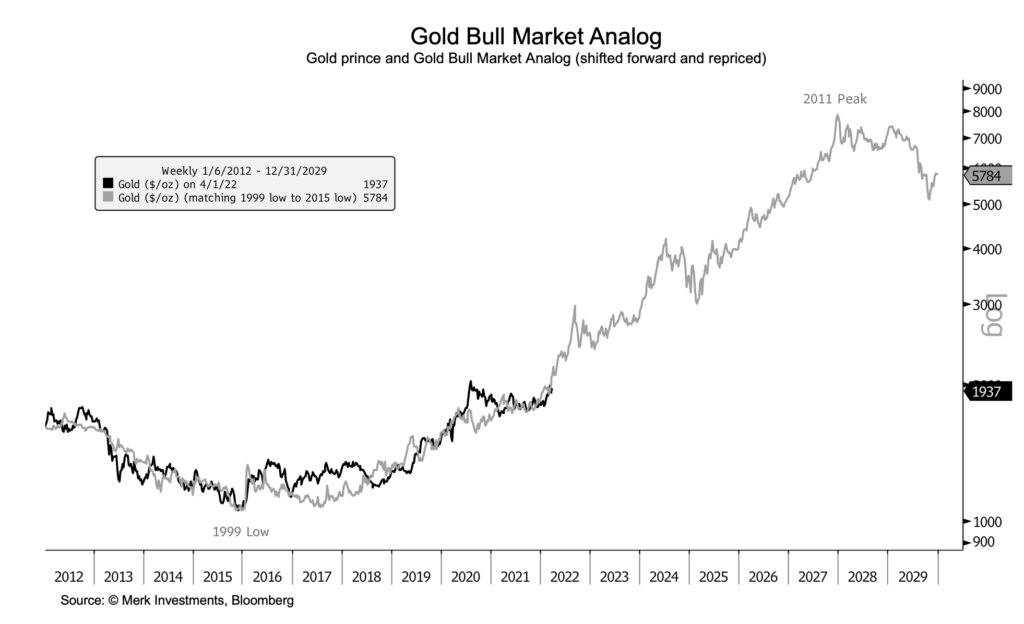

Chart courtesy of Merk Investments • • • Click to enlarge

Wall Street-based billionaire and financier Thomas Kaplan (who once said, “I’m no insect; gold is a great way to make a lot of money.”) is among the group of analysts who believes gold is in the early stages of a new leg in its long-term secular bull market. In 2020, he expanded on the notion in a groundbreaking interview with Stansberry Research’s Daniela Cambone. Though Kaplan made his fortune in the mining business, he is also an Oxford-trained historian (with a Ph.D.) capable of putting gold’s current price trend in the context of a longer-term cycle – one he believes has not yet reached full maturity. (Please see chart above.) His comments, we think you will agree, offer a refreshing perspective at a time when it is sorely needed and when short-termism seems to dominate investor psychology.

“Let’s put it this way,” he says, “gold still remains on Wall Street and in the west probably the most under-owned, least crowded trade in the global financial markets. … The era in which gold was the asset which people loved to hate and hated to love is starting to come to an end. We’re still in the very early innings. It’s still a smart money trade as opposed to a big passive money trade but that’s about to happen.” Merk Investments’ “Gold Bull Market Analog” chart (shown above), which tracks the progress of the current bull market against the one that began in 1999, supports and illustrates Kaplan’s argument. The next leg up, he believes, will be driven by what he calls “bold-faced” names now involved in the gold business. Kaplan mentions Warren Buffett (who at the time of the interview had just purchased stock in mining giant Barrick Gold, Mohamed El Erian, Mark Mobius, Ray Dalio, Paul Tudor Jones, Jeffrey Gundlach, and Kenneth Rogoff. (Long-time readers of this daily newsletter will recognize that list of notables as abbreviated.)

“The difference is this,” he says. “The market is now ready for the next leg of the gold bull market. The first leg was the one that took us up 12 consecutive years in a row regardless of whether there were inflation fears, deflation fears, whether there was a glut of oil or a shortage of oil, political stability or political instability, dollar weakness, dollar strength. It didn’t matter. Every year for 12 years gold went up. The next move is going to be a third wave, a long wave that lasts for a decade or fifteen years, maybe more … I think that you really are looking at a complete paradigm shift that will make gold the generational trade.” From there, Kaplan goes on to say that gold will reach $3000 to $5000 in the years to come.

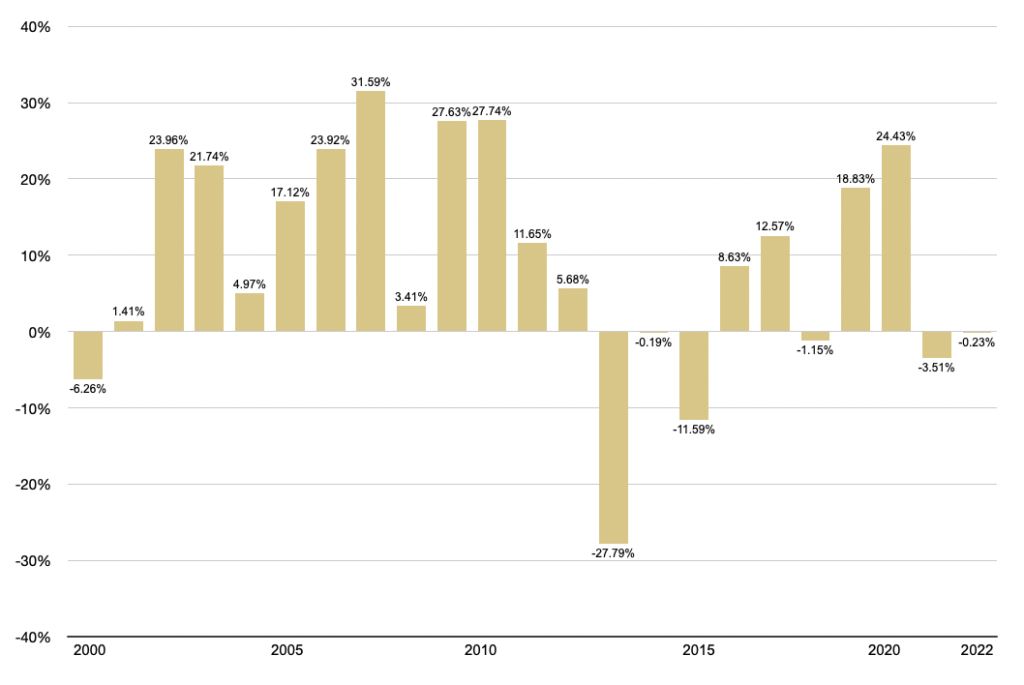

Gold Annual Returns

(Year over year, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration

Are you ready to make the ‘generational trade’ part of your holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Gold’s secular bull market: 2003-2022

‘Each price correction and consolidation period has been a buying opportunity’

“The last government to doubt gold’s value got burned,” says veteran commodity analyst Andrew Hect in a report posted at Seeking Alpha. “At the turn of this century, the United Kingdom decided to part with one-half of its gold reserves. Ironically, London is the hub of the international gold market, so the UK sent a signal that gold had seen better days. In a series of auctions, the UK sold around 300 metric tons at prices mainly below the $300 per ounce level. Since 2003, gold never traded below $300 per ounce. Since 2010, the price has not ventured below $1,000, and since 2020, the price has remained above $1450 per ounce. … In 1999, gold reached a bottom at $252.50 per ounce. Since then, each price correction and consolidation period has been a buying opportunity in gold. The over two-decade-long bullish trend continues to take gold to higher highs.”

Gold price

(Weekly prices, 2000-2022)

Chart courtesy of TradingView.com

Thinking gold?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

‘No one questions its value. . .’

Image courtesy of the British Museum Collection/Lydia, croesid, ca 550 BC

Are you ready to add unquestioned value to your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Top ten producers, in metric tonnes

2004 – 2022

Source: U.S. Geological Survey

Short & Sweet

‘Advice doesn’t have to be complicated to be good.’

“The world is complex,” writes analyst Safal Nivetchak. “Consider the various reasons floating around explaining the market’s fall in the last two months – war, inflation, interest rates, FII selling, China, supply chain disruptions, weak GDP, and over valuations. This is not a complete list, but enough to suggest that the world is complex. And so are financial markets. How do you deal with such complexity in your wealth creation journey without losing your sanity? Have an investment process that is elegant in its simplicity.” We found the down-to-earth practicality contained in Nivetchak’s advisory of enormous value, particularly for young investors searching for guidance on the road to building wealth – something appealingly analog in an increasingly complex digital age.

Though he never mentions gold, many successful investors see it as part and parcel of the keep it simple portfolio approach. He offers a memorable quote from Dutch computer science pioneer Edsger Dijkstra: “Simplicity requires hard work to achieve it and education to appreciate it.” Nivetchak ends by quoting Steve Jobs on keeping it simple: “… It’s worth it in the end because once you get there, you can move mountains.” Says Nivetchak, “That’s also true for investing for wealth creation. In practicing simplicity, and staying the course, over time you can also move mountains.”

_________________________________________________________________