Author Archives: USAGOLD

We are no longer updating this page.

We invite you to visit its replacement at the following link:

The USAGOLD Website

A guiding light for our current and would-be clientele since 1997

Welcome newcomers!

When the USAGOLD website was established in 1997, there was no Google, no Facebook, no I-Tunes, no Amazon. Instead there was just a handful of scattered websites trying to figure what this new technology was all about and how it could be used to some advantage. We were among that group. Our idea of innovation in those early days was two spinning globes on either side of the USAGOLD logo. We marveled at it; considered it state of the art.

But being among the first on the internet to have spinning globes was not our only achievement. We were also among the first to sponsor a Daily Market Report (1997), a Discussion Group (1997), Live Prices and Charts (2007) and a Mobile Website (2011) – to mention just a few of our ground-breaking internet ventures. We await the next wave of innovation so that we can offer even more value to our regular visitors.

Through our 26-year presence on the world wide web, the philosophy underlying our website has always been a simple one – to act as a guiding light for our current and prospective clientele by providing a state of the art information portal coupled with a reliable and competitive brokerage service. We had and still have no aspirations beyond that, and that pinpoint focus has paid dividends beyond anything we would have imagined in 1996.

From a humble beginning, we have grown to almost 800,000 visitors per month currently and there have been times when that count has been significantly higher. USAGOLD today remains one of the most highly referenced and visited web portals in the gold business. We once had a client tell us of visiting the Gold Souk in Dubai and being surprised that so many merchant stalls had USAGOLD on their computer screens.

If you would like to gain a better understanding of what USAGOLD has to offer to you as a current or prospective client, the menu at the top of the page is a good place to start.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Reliably serving physical gold and silver investors since 1973

Short & Sweet

‘He clung to that which he could really trust, really own, really control’

In an analysis posted at Daily Reckoning, Jeffery Tucker offered an opinion on inflation shared by a good many economists and investors. “Gradually,” he writes, “we’ve come to see the light. There will be no rolling back those price increases in general. There will be declines in the pace of increase here or there but overall prices have shifted upward, permanently.” With that in mind, he shares some family history: “There is nothing we can take for granted in this inflationary crazy economic environment, no rules of thumb that can really guide us. My father was a thrifty man, a truly great man, but also a believer in long-term value and truth. Yes, he loved gold and silver coins too, and very much so. He accumulated them throughout his life. As I look at that today, it is extremely obvious that this was one of his best financial decisions. He was never a day trader or a rah-rah techno champion. He clung to that which he could really trust, really own, really control. That seems like a good way to think even now.”

_______________________________________________________________________

Looking for something you can really trust, really own, really control?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

How to choose a gold firm

It may be the most important choice you make as a gold owner

It is surprising how many prospective investors simply dive into gold and silver investing without much in the way of a consumer inquiry. That lack of simple due diligence has ended up costing a good many investors thousands of dollars, and sometimes even hundreds of thousands before the damage is detected.

Here you will find some brief but useful guidelines

to help you choose the right gold and silver company.

To end right, start right.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Two legendary central bankers embrace gold

In The End of Alchemy (2017), Mervyn King, the former governor of the Bank of England, writes of central banks’ frustration in dealing with the persistently stagnant global economy. “Central banks,” he says, “have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced. . . [W]ithout reform of the financial system, another crisis is certain – sooner rather than later.”

“Our problem,” Alan Greenspan once said, “is not recession which is a short-term economic problem. I think you have a very profound long-term problem of economic growth at the time when the Western world, there is a very large migration from being a worker into being a recipient of social benefits as it is called. And this is legally mandated in all of our countries.” The western world, he concludes, is headed to “a state of disaster.”

It is interesting to note that both Greenspan and King, two of the most respected central bankers in modern times, have embraced gold since leaving their respective posts. The former Fed chairman has consistently suggested that gold is “a good place to put money these days given the policies of governments.”

The former governor of the Bank of England says that he is “very struck by the fact that over many, many years, central banks, governments and individuals have always, despite the protestations of economists, held some gold in their portfolio…[W]hen unexpected things happen, particularly when governments rise and fall, then gold is a means of payment that everyone is always prepared to accept. And I think that’s why even central banks have always had a role in their portfolios for gold.”

_____________________________________________________________________________

Are you ready to embrace gold?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Market Overview

Landscape mode is recommended for mobile phone viewing.

Market Data by TradingView

Delayed data except FOREX

|

ORDER DESK Reliably serving physical gold and silver investors since 1973 |

Short and Sweet

Only real intrinsic money survives the test of time

Here is a timeless observation from the now-deceased Richard Russell (Dow Theory Letter):

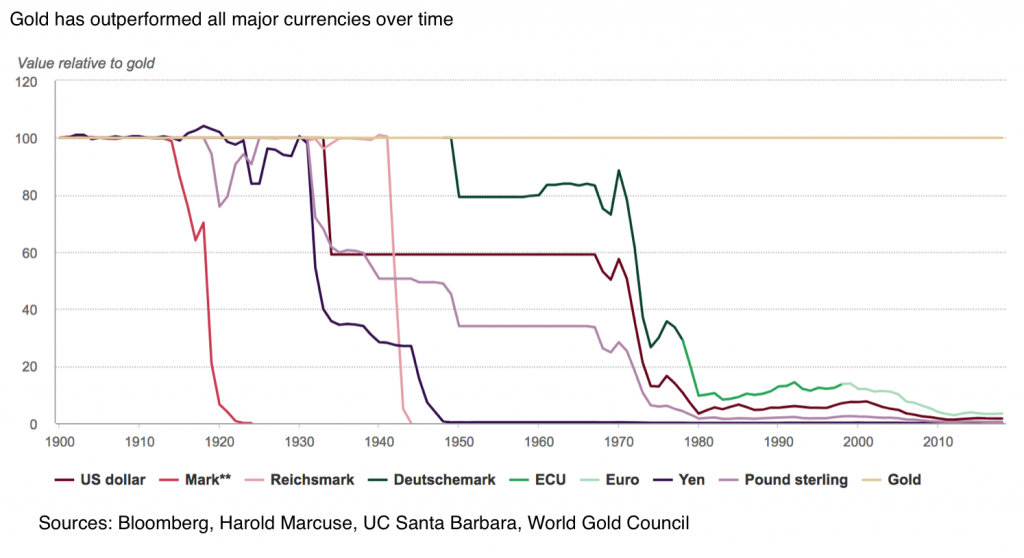

“Paper money is now being created wholesale throughout the world. Stated simply, all paper currency is now valued against each other. But more important, ultimately ALL paper is ultimately valued against the only true, intrinsic money – gold. In world history, no irredeemable paper currency has ever survived. Since all the world’s currency is now irredeemable (in gold), this means that in the end, the only form of money that will survive is real intrinsic money – gold. It’s not a question of whether gold will survive, it’s a question of when the world’s current paper money will deteriorate and finally die. I can tell you that irredeemable paper will not survive – but obviously I can’t tell you when it will die. The timing is the only uncertainty.”

The chart below from the World Gold Council speaks to Russell’s point. It shows the performance of various currencies – past and present – against gold over the long term. When the end comes, as the chart illustrates, it can come abruptly and without warning. For those who stick to the proposition that gold is not really an inflation hedge, or that it is not really a safe-haven against currency debasement, the chart offers instruction. For those who already own gold as a safe-haven, it provides justification. For those who do not own gold, it serves as an incentive. As the old saying goes: All is well until it isn’t.

Chart courtesy of the World Gold Council

________________________________________________________________________

Ready to begin or add to your precious metals holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Thinking about buying gold and silver?

Gold in six easy lessons

1. Don’t buy it because you need to make money; buy it to protect the money you already have.

2. Don’t look at price as a barrier; look at it as an incentive.

3. Don’t buy the paper pretenders; buy the real thing in the form of coins and bullion.

4. Don’t fall prey to glitzy TV ads; do your due diligence instead.

5. Don’t allow naysayers to divert your interest; allow yourself the right to protect your interests as you see fit.

6. Don’t forget the golden rule: Those who own the gold make the rules!

Ready to become a member of the ruling class?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Inflation is a process not an event

But history, as we are learning now, shows runaway inflation can come suddenly and without warning

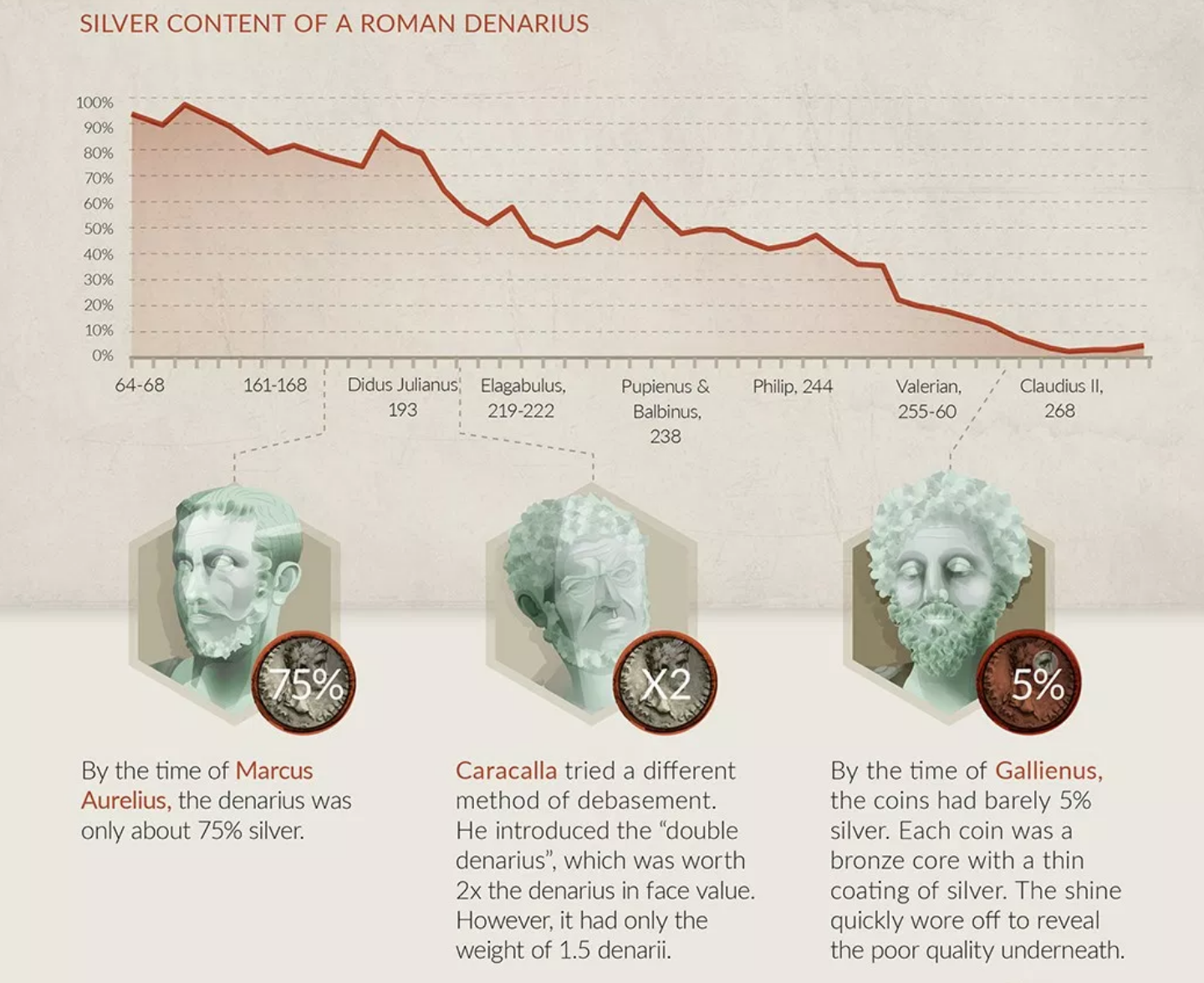

Image courtesy of Visual Capitalist • • • Click to enlarge

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius. The Roman citizen who had the wisdom to hedge that process by going to gold at nearly any point along the way ended up preserving some portion, if not all, of his or her wealth. Those who did not suffered its debilitating effects. In the inflationary process, the line between cause and effect is not always a straight one, and its timing difficult to discern. History teaches us, though, that when runaway inflation does arrive, it comes suddenly, without notice, and with a vengeance. That is why it pays to view gold as a permanent and constantly maintained aspect of the investment portfolio. “A change of fortune,” Ben Franklin tells us, “hurts a wise Man no more than a change of the Moon.”

_________________________________________________________________

(Related please see: News & Views Special Report / March 2020 / Hedging the decline and fall of a currency – The baseline case for gold hasn’t changed much in 1700 years)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

USAGOLD

Quality service & portfolio guidance since 1973

USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the gold industry’s oldest and most respected names. The firm’s unblemished, zero-complaints record and solid reviews with the Better Business Bureau testify to the exceptional customer service and professional excellence which sets it apart from the competition.

USAGOLD specializes in gold and silver coins and bullion delivered to our client’s safekeeping. For over 49 years, we have resolutely advocated owning precious metals for asset preservation purposes rather than speculation. Admittedly, this philosophy does not resonate with all prospective gold and silver owners, but if it does with you, we think you will find our firm a kindred spirit.

____________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

“Bear markets are sneaky beasts. . .”

King World News called the late, great Richard Russell – who regaled us with his wisdom in the Dow Theory Letter for nearly half a century – “the greatest financial writer in history.” We can only guess what Russell would have had to say about the current state of affairs, but the quote above provides a clue. Never predictable in his opinions, he was rock solid on one axiom throughout his career – the necessity and transcendence of gold as a permanent component of the well-balanced investment portfolio. As he said, so often, it helped him sleep at night.

Looking to prevent the beastly bear from sneaking up on your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

_______________________________________________________________

To end right, start right.

Choose the right portfolio mix with the right firm at the right price.

Choose

USAGOLD

Coins & bullion since 1973

_______________________________________________________________

Short and Sweet

Worry about the return ‘of’ your money, not just the return ‘on’ it

There is an old saying among veteran investors to worry not just about the return on your money but the return of your money. In the wealth game, emphasize defense when you need to, offense when it makes sense. At all times, remain diversified. And by that, we mean real diversification in the form of physical gold and silver coins and/or bullion outside the current fiat money system – not just an assortment of stocks and bonds denominated in the domestic currency. Keep in mind – if the currency erodes in value, the underlying value of those assets erodes along with it. A proper, genuine diversification addresses that problem now and in the future.

Are you ready to deploy genuine diversification in your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

_______________________________________________________________________________________________________________

The Investment of Kings and the King of Investments

The Investment of Kings and the King of Investments

From the small investor just starting out to the high-net-worth individual hedging a multi-million dollar portfolio, we have helped many thousands add precious metals to their holdings in our nearly 50 years in the gold business – safely, economically and with the investor’s goals in mind.

No matter the size of your investment kingdom, we can help!

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

Short & Sweet

The true nature of inflation

“The nature of inflation is widely misunderstood and misinterpreted,” writes analyst Dave Kranzler in an Investing.com overview, “‘Inflation’ and ‘currency devaluation’ are tautological—they are two phrases that mean the same thing. … Dollar devaluation has been occurring since the early 1970’s. The value of the dollar relative to gold (real money) has declined 98%. In 1971, $40,000 would buy a 4,000 square foot home in a good suburb. Now it takes $700,000 on average to buy that same home. Price inflation is the evidence of currency devaluation. The CPI is not a real measure of price inflation. The CPI is methodically massaged – starting with the Arthur Burns Federal Reserve (it was his idea) to hide the real degree of currency devaluation from all of the money that has been printed since 1971.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Worried about what currency devaluation is doing to the value of your savings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Structuring your portfolio for the rest of the 2020s

“Precious metals are and always have been the ultimate insurance,” says Pro Aurum’s Robert Hartman in an interview with Claudio Grass. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

There are essentially two broad schools of thought alive and well in the gold market. The first holds that crisis is around the corner and, as a result, precious metals should be owned to profit from the event. The second holds that crisis is a permanent fixture in the market dynamic and that the portfolio should always include precious metals as the ultimate safe haven. The first buyer sees precious metals as investment products, i.e., buy now and sell later when the time is right. The second considers gold and silver, like Hartmann, as insurance products to be held for the long run. Some combine the two, allocating one part of their precious metals portfolio for trading purposes and another as a permanent, or semi-permanent, store of value. The novice precious metals owner must decide where he or she stands in this regard because it determines, in turn, which products to include in the portfolio and to what degree.

Investors often ask about the percentage commitment one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a Seeking Alpha editorial last fall, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” As it has for many years, USAGOLD recommends a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

Looking to structure your portfolio for the rest of the 2020s?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

New to precious metals?

We put this page together just for you.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

New smart money queues up in the gold market

First institutions and funds came over to gold’s corner, then central banks. Now, a whole new grouping of professional investors – pension funds, private wealth management, insurance companies, and sovereign wealth funds. “It’s a bit like what happened to big tech,” says highly respected economist Mohammed El-Erian. “People like [gold] because it’s defensive. People like it because it’s a reflation trade. People like it because it’s inflation protection. What we are starting to see with the narrative about gold is starting to be like the narrative about big tech. It gives you everything.” These groups bring considerable purchasing power and market savvy to the table. One immediate result might be more buying interest on price dips. Another might be a better blend of investment psychology and objectives that could have a settling effect on the market overall.

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973