Author Archives: MK

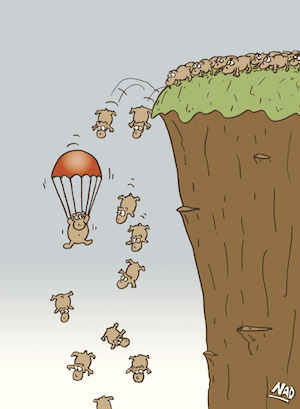

Protecting your tail: The ONLY thing an investor should not fail to do

Absolute Return/Nassim Nicholas Taleb/ 8-11-2015

“Uncertainty should not bother you. We may not be able to forecast when a bridge will break, but we can identify which ones are faulty and poorly built. We can assess vulnerability. And today the financial bridges across the world are very vulnerable. Politicians prescribe ever larger doses of pain killer in the form of financial bailouts, which consists in curing debt with debt, like curing an addiction with an addiction, that is to say it is not a cure. This cycle will end, like it always does, spectacularly.” – Nassim Nicholas Taleb

MK note: When it comes to protecting one’s tail, nothing protects like the same item that has protected tails from time immemorial – gold coins and bullion. Complicated advisor-reliant strategies might work, or they might not work, and you shouldn’t certainly undertake any strategy you do not fully understand. Gold works – simply, directly, historically and without complications.

Legendary hedge fund manager Stanley Druckenmiller goes for the gold

Stanley Druckenmiller generated gains of more than 30% annually on his Duquesne Capital hedge fund over a thirty year period. He is estimated to be worth nearly $3 billion. In 2010, Druckenmiller, like his mentor George Soros, closed his hedge fund and opened a family office. In recent months, Druckenmiller has consistently warned of a possible stock market crash and economic breakdown. In a speech before the Lost Tree Club in January, he said:

“[T]he point I was making earlier is there was a great enabler [to the 2007-2008 financial crisis], and that was the Federal Reserve pushing people out of the risk curve. And what I just can’t understand for the life of me, we’ve done Dodd-Frank, we got 5000 people watching Jamie Dimon when he goes to the bathroom. I mean all this stuff going on to supposedly prevent the next financial crisis. And if you look at the real root cause behind the financial crisis, we’re doubling down. Our monetary policy is so much more reckless and so much more aggressively pushing people in this room and everybody else out of the risk curve that we’re doubling down on the same policy that really put us there and enabled those bad actors to do what they do. Now no matter what you want to say about them, if we had had five or six percent interest rates, it would have never happened because they couldn’t have gotten the money to do it.”

In other words, Druckenmiller believes that the Fed has inflated another financial bubble, and now, if his investment portfolio is an indicator, he believes it is about to burst. As you can see in the table below (with thanks to Zero Hedge), Druckenmiller is acting on his concerns with a major position in gold. In fact, Duquesne’s gold holdings far outweigh any other single investment in its portfolio. Granted it owns paper gold rather than the real thing in the form of coins and bullion, but at the same time, the strong gold position tells us unambiguously where one of the most successful investors in modern history believes the financial markets are going and how one should go about hedging it. Returning to our opening paragraph, I want to re-emphasize that Druckenmiller is now investing his own money for his own benefit and that of his family.

Later in his appearance Druckenmiller says, “This is crazy stuff we’re doing. So I would say you have be on the alert to that ending badly.”

The new yuan reference rate – more a controlled scuttle than a free float

The Telegraph today, as part of an Ambrose Evans-Pritchard opinion piece on China’s yuan devaluation, offers a useful explanation of how the PBoC intends to manage its new floating exchange rate mechanism.

PBoC will set a reference rate daily in U.S. dollars and allow the yuan to float in a band of 2% on either side of that rate. It will then either buy or sell dollars “to steer the rate” presumably in the direction it deems most agreeable. Thus far that steering has taken a turn on the road that goes downhill. Overnight, China once again managed the float downward – another 1%. That makes the plunge over four per cent since launch date. PBoC says this mechanism is more reflective of free market forces.

But is it?

Managing a currency within a band is far from allowing a currency to float freely, and why would any central bank these days embark on a policy like this unless it were to weaken the currency’s value. Had China’s intentions been otherwise, this new mechanism would have been unnecessary. No, China simply wants to manage its devaluation of the yuan – more a controlled scuttle than a free float.

The Fiat Yuan

Seth Lipsky/The New York Sun/8-11-2015

“If the Communist Chinese devalue the yuan against a dollar that is appreciating against gold, has the yuan gone up or down? We ask because the leading story on the New York Times Web site this morning reports not only that the Chicom authorities ‘sharply devalued’ the renminbi but also that the move ‘could raise geopolitical tensions and weigh on growth elsewhere.’ We ran the Times’ entire text through the Sun’s old hand-crank Von Mises brand language-specie prose separator. It failed to find any mention of — or even allusion to — gold.”

Further on

“In China, in any event, it has disclosed a bubble in stocks and certain other assets that has crested in recent years. What this adds up to, according to a wire from David Malpass, one of the fastest and shrewdest economists on the beat, is a ‘de-linking’ of the yuan and the dollar. He reckons that the Chinese communists are ‘laying the groundwork for a yuan bloc and closer relationships with other Asian currencies.’ By our lights this is but another consequence of the failure of the Congress to exercise its constitutional power to coin money and regulate the value thereof and of foreign coin and to fix the standard of weights and measures.”

Go here for the full editorial – Well worth the few minutes it takes to read it.

MK note: Seth Lipsky, the editor of the New York Sun, offers an interesting take on the yuan devaluation. This piece was written before Chinese authorities devalued the yuan again – another 1.3% earlier today after nearly 2% the day before. Yesterday, I posted that the markets were likely to now put “the specter of further yuan devaluations. . .on the front burner.” I agree with David Malpas’ interesting framework to all of this. This is looking more like a mechanism than the one-off to which the PBOC alluded in its accompanying public relations release. I had to chuckle at Lipsky’s concluding question. . . . . .

MK note 2: Zeroing-in on the chart, isn’t it interesting how the yuan gold price mirrors exactly the dollar price? One wonders if the de-pegging of the yuan from the dollar is connected in policy terms to the opening of the Shanghai Fix later this year. China says it wants a say in the gold price and that’s why it established its own fix outside of London and New York’s purview. If the price of gold in yuan goes higher, it adds value to both Chinese gold reserves, which are likely much higher than recently announced, and to the asset structure of the Chinese people and banks that are hoarding it. In fact the low announcement may have been in anticipation of the devaluation strategy. Too, if the yuan price goes higher, it could force the dollar price higher in order to discourage arbitrage of physical metal globally into China. All of this is speculation, of course, and not to be taken as golden gospel. The complexities, though, are intriguing and food for thought.

Extracts published with The New York Sun‘s permission.

–– To register, go here. ––

China selling U.S. Treasuries

I should have added to my earlier post on the devaluation that China is not selling gold reserves to underwrite its economic losses. It is selling U.S Treasuries. This is something that is being underplayed at the moment and should be receiving considerably more attention, particularly in the context of the devaluation. Over the last five quarters, China has sold $520 billion of its forex reserves most of that in the form of U.S. Treasuries. This retreat on China’s part will have ramifications in the United States with respect to the Fed policy and the dollar’s future purchasing power. From a Barron’s piece by Randall Forsythe,

“As for the present conundrum, there’s an $800 billion gap between the $1.1 trillion the Treasury is borrowing to cover the budget gap and the roughly $300 billion overseas investors are buying, [MarketMavens’ Stephanie] Pomboy calculates. Banks, corporations and households have been doing little to fill that gap, preferring higher-yielding securities, so ‘it would appear the heavy lifting has been done by long-only bond managers extending duration and specs rushing to cover their shorts,’ she writes.

But Pomboy has little doubt that the Fed will step in to fill the gap left by others. In other words, debt monetization, a fancy term for printing money to cover the government’s debts, which in polite circles these days is called ‘quantitative easing.'”

Yesterday, Alan Greenspan issued a warning about bond market liquidity. “We have a pending bond market bubble,” he says. By the way, to put that $520 billion in context, for a mere $111 billion China could have purchased the total global mine production of gold (3133 tonnes) for 2014. Numbers like that also provide insight into gold’s historic undervaluation at this juncture.

China devaluation, gold falters then spikes higher

OPINION

In the immediate aftermath of China’s devaluation announcement, gold declined, but as the import of the new yuan mechanism sunk-in, the price spiked higher. Why? Obviously the other side of the devaluation coin is that the dollar would be forced higher which would be gold negative, but there are a couple of other factors at work, and gold’s reaction is not what some might have expected.

1. In a recent News & Views Special Report we suggested that the Shanghai stock market crash would be an inducement for greater gold demand in China – a nation whose citizenry already has an attachment to the metal. That has already happened with Shanghai Gold Exchange draw downs in the first week of August posting their third biggest week in history. This devaluation will only add to gold’s luster among the Chinese people as the currency loses purchasing power, and one can only wonder what the draw downs will look like in the weeks ahead. In fact, devaluation is likely to become an even greater driver to gold demand in China than stock market weakness. You will recall that when the United States devalued the dollar in the early 1970s, both the demand for the metal and its price moved significantly higher over a decade long period, while stocks languished.

2. The Federal Reserve will have to think twice about raising rates in an environment where global currencies are at war with each other and devaluation – formal or not – remains the principle weapon at nation states’ disposal. Deflation is already a concern in the United States. A rate hike at this point might serve as a dagger to the heart of the wobbly U.S. economy and the Fed – particularly this Fed – will be loathe to unsheathe it. If it were to raise rates now, after China’s devaluation, it might be considered the greatest blunder in Fed history. In a Bloomberg interview yesterday, Fed vice chairman Stanley Fischer stated that the U.S. central bank is now looking at employment and inflation as inducements for policy changes. He went on to say that inflation and inflation expectations are well below Fed targets, and a factor in Fed thinking. Fischer’s comments will likely change the checklist Wall Street has been monitoring for the past several years – and could even induce some not so subtle changes to the algo formulae employed in trading various markets, including gold.

3. China’s interest is in a return to a cheap yuan, and the specter of further yuan devaluations will now be on the front burner. The currency war has just been pushed to the next level with echoes of the 1997 Asian currency crisis, only this time the value of gold as a hedge is well-known in all corners of the globe and embraced by a significantly greater number of people than it was at any time in the past.

“In a weak global economy, it will take a lot more than a 1.9 percent devaluation to jump-start Chinese exports. That raises the distinct possibility of a new and increasingly destabilizing skirmish in the ever-widening global currency war. The race to the bottom just became a good deal more treacherous.” – Stephen Roach, Yale University (formerly Morgan Stanley Asia expert)

4. The purpose of the new regime in China is to ramp-up exports. If China is successful, it will push up raw material imports which in turn will boost commodity prices in dollar terms, the exact opposite of the conditions that have driven commodities lower across the boards.

I suspect that China’s new yuan policy will become a place marker. China kick-started this new yuan trading mechanism as a means to combating disinflation, systemic market risks, risks to the banking system, etc. It implies economic difficulty, but China is not alone in either the economic situation this policy is meant to counter, or the means by which it hopes to navigate it over the long run. In other words, same circumstances dictate the same policies – in China, in the United States, in Europe in the emerging world – and, all around, these policies in turn encourage gold ownership in the form of coins and bullion. And perhaps that is why gold unexpectedly got off the dime in the wee hours of a late summer Tuesday evening, 2015. MK

Final note: Once again, we do not advocate speculation in the precious metals, but rather believe that gold and silver should be purchased as portfolio insurance and an alternative savings vehicle IN ALL NATION STATES, i.e. against ALL CURRENCIES.

China quietly dumps $520 billion in reserves, probably Treasuries, in little over a year

Financial Times/Gabriel Wildau/8-2-2015

“Strategists led by Nikolaos Panigirtzoglou [JP Morgan] in London estimate capital outflows amounted to $520bn combined over the past five quarters. ‘The current capital outflow episode in China is a more sustained and severe episode relative to those seen in the past,’ they wrote.”

MK note: Not widely reported, China’s $520 billion sale of reserves over the past 1.25 years is a big number. Some would call it a dump, probably of U.S. Treasuries, and an important indicator of a potential reversal in policy. The $520 billion represents about 15% of China’s peak $3.99 trillion in reserves. Goldman Sachs analysts looking at the same situation said, “But even if we adjust for these factors, net capital outflows might conceivably have run around -$200bn, an acceleration from Q1 and beyond anything seen historically.” And TD at ZeroHedge added this: “Granted, this [Goldman’s $200 billion] is smaller than JPM’s $520 billion number but this also captures a far shorter time period. Annualizing a $224 billion outflow in one quarter would lead to a unprecedented $1 trillion capital outflow out of China for the year.”

Confused about gold and the DJIA? Don’t be.

Thoughtful question from would-be gold owner/my answer

Michael,

I have been reviewing your web site and am impressed.

I currently have about $750,000 in cash, money market funds, equities and bonds. I am 74 and my wife is 72. We are both retired.The only fixed income we receive is $21,000 per year from social security, and $7,000 per year in bookkeeping fees earned by my wife. Our living expenses are about $75,000 per year leaving us a shortfall of about $36,000 per year. Our total net worth is about $2,200,000 (home is $1,500,000 of that).

When I read your article Choosing a Gold Firm about 3 weeks ago, I felt motivated to jump in to the gold market. However, it seems that the value of an ounce of gold has dropped to about $1,100. What confuses me is the fact that the DJIA, is right now less than it was at the first of the year. Based on what I thought I knew, I expected to see gold soaring, but the reverse is the case.

What should I do? Is gold at a bottom? Should I get in now, or wait?

BN

Charleston, SC

______________________

Hello, BN.

Gold rarely goes by a predetermined schedule. Some would say it is rather obstinate. It goes where it wants to go in its own time and there are all sorts of forces at play with respect to its pricing – a situation of which I am sure you are fully aware. I have never believed that people should own gold because they think it is going to soar in price in the short term. Gold is first and foremost portfolio insurance and a longer-term alternative savings plan where asset preservation is a key objective. Secondarily, it is an investment for capital gain. As a result, if one goes into gold ownership with the attitude that it is simply a workable alternative to stocks or bonds, then short term price fluctuations should not serve as discouragement to either current or would be owners.

None of the conditions that caused gold to rise from the $300 level to the $1800 level pre- and post-crisis have changed, and ultimately they could reassert themselves down the road perhaps in ways most of the analysts never dreamed. The reasons for owning gold are as strong today as they’ve ever been and perhaps even stronger given the socialized, artificial values at work in other markets.

It is unfortunate that you have come to this place in your life (at 74) only to find that your savings will not do for you what you had hoped and I empathize with that. Investors are forced into speculation in stocks, real estate and other ventures when they should be living off a fair annual return on their bank savings. I don’t think those circumstances are likely to change any time soon. If I were to guess at this juncture, I would say that even if we do get increases in interest rates, they will be small and nearly inconsequential and you will be in no better position than you are now.

From my perspective, gold is among the most undervalued of the major portfolio assets at this juncture. I am not the only one who believes that. Recently Interest Rate Observer’s James Grant announced “Mr. [Gold] Market is having a sale.” Similarly, Tocqueville’s John Hathaway commented that “Evidence suggests the bull market in gold is far from finished.” (More on that “Evidence” in an upcoming News & Views. Sign-up here to receive your complimentary issue by e-mail when released.) Contrary to characterizations in the mainstream financial media, global physical demand is soaring in the wake of the recent artificial price drop and very strong among our firm’s clientele. Web site visits to USAGOLD have increased markedly and inquiries are at a level not seen for years.

In short, a large segment of the public believes gold is a buy at these prices. Much of this is due to a major change in financial market psychology that has evolved over the past several years. Now there is a very large group of people out there who believe in gold, and not just in the United States. That belief cannot be suppressed no matter how hard the mainstream press tries. An equally large contingent understands that markets supported artificially are ultimately doomed to failure and potential collapse once the props come down.

In the end, you will need to make a decision on three matters:

1. “Do I believe that the current economic situation warrants hedging?”

2. “Do I believe that gold is the hedge that will get the job done for me?”

3. “Do I own enough gold with respect to my total portfolio to make a difference?”

If the answers in respective order are yes – yes – no, then you should add more gold to your portfolio and it should be in the proper form – gold coins held in your possession.

My continuing golden wishes to you and family,

MK

James Grant tells why he owns gold coins

ValueWalk/7-23-2015

“[G]old is an investment in monetary and financial disorder – not a hedge. You look around the world and you see exchange rates are properly disorderly, when you look around the world of lending and borrowing — we are in a regime of price control by another name, so-called zero percent rates and quantitative easing by the world central banks – we are in one of the most radical periods of monetary experimentation in the annals of money,”

USAGOLD note: James Grant has a way with words. He gets our attention by telling us gold is not a hedge and while cleverly telling us that it is a hedge. Grant goes on to say in the linked Kitco interview that he owns Krugerrands, tells us why he believes gold is a buy in the wake of the latest correction [“Mr. Market having a sale. . .”] and that he is “bullish indeed” on the future price of gold. I should add that the Krugerrand is one of several options on the gold coin market and a visit with one of our associates can help clarify the choices.

Australia’s Perth Mint says gold price smash started on COMEX

USAGOLD note: Looks like gold’s drop probably the result programmed trading taking advantage of thin weekend conditions in the paper gold market. As we have noted here, the Shanghai Exchange is physical delivery market in kilo bar form. For someone to commit to that kind of physical selling, they would have to have the bars in stock, ready for delivery. As Suchecki shows at link above the Shanghai price drop followed the COMEX accelerated trading.

Chinese mystery puzzle

Where did all their mine production go? They didn’t export it. 2270 tonnes mined from 2009-2014. Where is it?? I’m on the list that doesn’t believe the number announced today.

ZeroHedge may be right with this take:

“[W]e await for the PBOC to start leaking incremental gold holding data every month (and especially in months when the market crashes) which will bring us ever closer to what China’s true gold holdings are.”

A strong number would have propelled gold and the yuan higher – not what you might want having just thrown everything but the kitchen sink at the crashing Shanghai market. China in the end is an export economy, much like Japan. It’s stock market value relies on exports. The strong yuan is futuristic, not intended for the present.

This announcement may have been timed for effect, but just as state-sponsored support for stocks elicits a response opposite the intended effect, so too will the weak gold reserves number. It could also have been part of a long-term plan (more likely) which takes us back to ZeroHedge’s suggestion. With time, it will become clearer what is on the agenda.

I doubt in the end that China’s gold buyers (or stock sellers) will be much affected by this announcement (if that’s what it is). The reaction in the gold market has been marginal – could just as well be a carryover in the latest chapter of the interest rate saga as it is the release of China’s gold number.

MK

Greece4

This will be my last comment on Greece for awhile. It’s time to move on.

In my view, it was a mistake for the prime minister to force Varoufakis’ resignation. I thought he had executed his strategy brilliantly right up until his last public comment wherein, following the referendum, he made Greece’s problem Europe’s problem: “‘No’ is a big `yes’ to democratic Europe,” he said, “It’s a no to the vision of Europe an infinite cage for its people. It is a loud yes to the vision of the Eurozone as a common area of prosperity and social justice.” (Look to American history and how the states’ debts were handled by the new federal government following the Revolution with Hamilton at Treasury. Quite a different strategy from the one Europe is executing.)

Varoufakis’ Sunday statement was probably the final straw and what brought down the collective wrath of Europe’s guiding lights. It appears the EU/IMF/ECB made Varoufakis dismissal a prerequisite for new talks. In my view, Varoufakis had them in his sights and Tsipras is letting them go. . . . . One man’s opinion.

The result might have been difficult for Greece, but no route for Greece will be a safe or easy one. For Greece, leaving the euro – monetary sovereignty – remains the best option. It would join a group of ten nation states within the EU that has its own currency including the United Kingdom, Sweden, Denmark, Switzerland and Poland. Why hasn’t that option been discussed seriously? All the talk I’ve seen revolves around a complete split from the Union or outright expulsion. Is that really necessary?

We shall see how the talks proceed and how the Greek government does without him. Keep in mind, that Varoufakis is as far from me politically as one can get, so I am not defending him from an ideological point of view. I think, as he says, he did what he thought was right for the Greek people and he was oh so close to getting it done. He might be back if Greece decides to go it alone. . . . .

Greece, China Update

Whacky 12-hour period for the markets, likely more to come as New York opens. Stay tuned.

Surprise. Varoufakis quits. Greece to submit new bailout proposal to EU leaders. Someone must not have liked Varoufakis’ position post referendum as quoted in a previous post. This is looking more and more like “the same old, same old.” Tsirpas is holding out for a better deal for Greece, but one wonders if that is possible under the circumstances and all of this was a sound and fury signifying nothing.

Yet, hope springs eternal. The markets reacted across the boards, but not violently. Gold initially ran higher then almost immediately moved back down based on dollar perceptions. We should all remember that gold doesn’t always react to these kinds of situations as one might think it should. After the Lehman Brothers collapse in September, 2008 gold tracked sideways to down. It was not until after the full effects of the 2008 crisis were fully digested – in 2009 through 2012 – that gold began to move higher. Gold demand, on the other hand, was another story entirely. It ran strong from the very start of the crisis in September, 2008 as investors correctly perceived the need for a safe haven under severe disinflationary circumstances and the threat of further systemic contagion.

Separate from the mess in Europe, the situation in China also warrants attention. Chinese authorities overnight threw everything but the monetary kitchen sink at the runaway Shanghai stock market crash (down 30% since mid-June) largely to no avail. For those of us who still champion free markets, the actions of the Chinese government and central bank, in stepping in to save the Chinese stock market, were the antithesis of how markets should operate in order to remain healthy. The Peoples’ Bank of China will cover stock sales with printing press money in the hopes of propping up that market. Another way to put it is that the PBoC is offering liquidity to anybody who wants out. Judging from the Exchange’s price performance, a good many are taking up the PBoC on its offer. Intraday, the Shanghai Exchange’s strong rise and almost immediate collapse tells you that there is more water yet to run under the bridge. We will be monitoring the situation in China closely in the days ahead. (Please see previous post below on China situation).

Meanwhile, in little Puerto Rico another black swan can be seen paddling around the financial markets’ pond. It has already defaulted on its debts, but something tells us, that we haven’t heard the end of that particular story. One wonders, with all of this happening at zero percent interest rates and massive central bank liquidity flooding markets everywhere, what might happen if interest rates were suddenly to begin rising.

Greece3

Mohammed A. El-Erian/Bloomberg

“By heeding their government’s advice and voting ‘No’ in the referendum on Sunday, Greek citizens sent an unambiguous message. Much like the fictional Americans portrayed in the movie “Network” who threw open their windows and shouted out, ‘I’m as mad as hell and I’m not going to take this anymore,’ the Greeks are demanding that the rest of Europe acknowledge their distress.

At this stage, however, only a handful of European leaders seem willing to listen; and even fewer appear willing to deliver the sort of relief that Greece desperately needs. The implications will be felt primarily in Greece, but also in Europe and beyond.”

Greece2

EARLY REACTION

“JPMorgan Chase & Co. economists said a Greek departure from European monetary union is now probable after the country’s electorate rejected the austerity needed to secure international assistance.” Barclay’s agrees. (Bloomberg)

Euro down 1.3¢ vs $ / 3:17 MDT (Link USAGOLD Live page)

Deputy finance minister says Greece wants to keep euro (Reuters)

MK note: Beginning to come into focus how Greece is going to play this. The ball is in the EU’s court from Greek government’s perspective. Emergency EU summit scheduled for Tuesday. Merkel, Hollande, Tusk attending. Draghi, ECB to step aside for now, let politicians take lead.

Greece 1

Greeks reject demands for more austerity/ Associated Press / 7-5-2015

MK Note: With 70% of the vote counted, 60%+ had voted “No”. The Interior Ministry projects that the margin would hold, according to the AP report linked above. Varoufakis immediately projected the vote onto the whole of the EU. “‘No’ is a big `yes’ to democratic Europe,” he said, “It’s a no to the vision of Europe an infinite cage for its people. It is a loud yes to the vision of the Eurozone as a common area of prosperity and social justice.” The gamesman’s strategy is revealed. The psychological war begins. Finance ministries, treasuries and central banks the world over will be pulling all-nighters. The markets will begin voting shortly.

Shanghai stock crash shot of adrenaline for Chinese gold demand

Shanghai stocks have fallen nearly 30% since mid-June. The equivalent in U.S. terms would be for the DJIA to fall 6000 points to the 11,000 level – a crash by any definition. Most of the commentary on this important subject has centered around the potential contagion effect for stock markets in the rest of Asia and beyond. There is another aspect to the crash worth considering though, and that has to do with the effect it will have on Chinese gold demand. The Chinese people, it is well known, already have a cultural affinity to gold. That attachment just received a shot of adrenaline.

The creative destruction of the Fourth Turning – the latest from Neil Howe (The Fourth Turning)

From Erico Taveres’ just published interview of Neil Howe (Sinclair & Co, 7-2-2015)

“Well, look at it this way! If the S&P500 were to come down by 50% – and, my God, if we have a reversion to the mean in corporate earnings as well as a decline in some of these lofty PE valuations this might actually happen – look at the bright side. The Millennial generation can finally buy into America’s future at a good price. Look at what they are facing right now: very little return on their savings and very lofty prices that they have to pay to invest in their future.

So we often forget that these wrenching dislocating financial events, particularly for older generations, can create opportunities for the young, and often create space for something more durable for the times to be built.

I think we are going to see a lot of creative destruction both politically and socially. In fact we are seeing it this week with Grexit becoming widely recognized as more probable than not. I think this will lead to an unravelling of Southern Europe from the Euro and I think that the heightened tensions – from the Middle East to Putin’s Russia to the Far East – and again the fact that nobody is in charge, not even pretends to be in charge, will create problems.

For those of us remembering earlier times, this is disquieting, disorienting… I think better things will grow out of it, in fact they have to. Right now the youth of the world in the midst of these tensions are not happy. Their needs are not being met from the systems that are in place.”

So I’ll just summarize it with Schumpeter’s phrase: creating destruction. That’s how I prefer to see what happens in a Fourth Turning.

MK note: Neil Howe is the author with William Strauss of “The Fourth Turning” (1997). Those of you who have followed my writings over the years know that I consider that book one of the most important published over the past two decades. “The next Fourth Turning,” predicted Strauss and Howe, “is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation, and empire.” That prediction, eleven years before the event, turned out to be on the money. Howe now proclaims that the Fourth Turning indeed began with the financial meltdown in 2008 and is not likely to end until 2028.

FROM AN INTERVIEW WITH CHRIS MARTENSON (6/23/2013) –

“I am nervous. I am nervous about the future right now. I think we have a lot more deep issues, deep crises, to save in the economy. I am also very nervous about what I see geopolitically.

We cannot possibly afford the government we have promised ourselves. And, that will be a painful process of deleveraging, and it is not just deleveraging the explicit debt that we have already actually formally borrowed, it is all the implicit debt. And, I think we will deal with it, because we have no other choice.

But, my point is this: No one simply solves a terrible problem on a sunny day when they can afford, at least for the time being, to look the other way. Problems like that are faced when people have no other choice, and it is a really grim day. And, it is white-knuckle time, and horrible things are happening with markets around the world, or horrible things are happening, at least historically; we have seen that geopolitically around the world. And, that is when people are forced to act.”

________

Neil Howe’s website: Saeculum Research

Why do we celebrate the Fourth of July?

Something to help you start your holiday weekend on the right foot . . . . . . . . . . .

The interviewer says it best: “We are in trouble.”

First signs: Public back in gold market

According to a new report from the U.S. Mint, the American public is back in the gold market after a slow May. Sales of the U.S. gold Eagle in June were up 3.5 times over May and the best since January, traditionally a big month for gold. Gold Eagle sales went from 21,500 troy ounces in May to 76,000 troy ounces in June. Silver Eagle sales were up 2.4 times over May from 2,023,500 troy ounces to 4,840,000 troy ounces.

At USAGOLD we experienced a strong surge of interest in June as well, particularly toward the end of the month. Lower prices in June drove buying as well mounting concerns about Europe and what many believe to be an overvalued stock market.

The charts below not only show the surge in gold and silver Eagle buying since the 2007-2008 financial crisis, they show growth and permanence over the period with sales consistently registering at higher levels than before the crisis. The silver Eagle chart, in addition, demonstrates growing interest in silver as a safe-haven asset.

Additional note: If you like to monitor gold and silver bullion coin sales as a bellwether for public interest in the precious metals (and many people do), you will appreciate these pages built and maintained by Jen Hyde, our all-around website administrator. Under each annual bar chart, you will find commensurate monthly charts for the same item.

Also, those pages are part of our Charts & Stats pages – a popular section of USAGOLD that we refer to as “a website within a website.”