Author Archives: MK

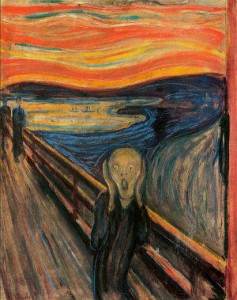

Why the Fed might not be able to put a stop to gold’s run

“‘If you look at gold on a very long-term basis, there is literally very little correlation between interest rates and gold,” Boris Schlossberg said Monday on CNBC’s ‘Power Lunch.’ ‘Basically, gold rose when interest rates rose in the ’70s, gold rose when interest rates declined in the ’90s,’ so the likely effect of Fed rate rises isn’t straightforward.”

Only the wisdom meted out by the market itself in countless situations down through the centuries carries any real value with respect to gold and gold ownership. In the end, the most enduring lesson history teaches us about gold is that it will protect its owners over the long run no matter what the central banks and governments dish out in the way of failed, or even successful, economic policy. It really gets down to a simple notion: One either believes in the transcendence of gold when it comes to matters economic, or one does not.

That is why the quote on our home page from Thomas Bailey Aldrich has been enshrined there nearly from day one of this website: “The possession of gold has ruined fewer men than the lack of it.” That simple bit of advice has not only protected our clientele over the years; it has built significant wealth. The Fed might attempt to put a stop to gold’s run in terms of the price, but it cannot put an end to global demand, or dislodge the metal of kings and the king of metals from the place it holds in the human heart.

Icahn video – Danger ahead

“It’s not will it happen, but when it will happen.” – Carl Icahn

MK note: I would like to add my endorsement of Carl Icahn’s video presentation to Pete’s (below). The title for the video is “Danger Ahead” and in it Icahn delivers a chilling analysis of where the actions of the Federal Reserve, Wall Street and America’s major businesses are likely to lead us. He also offers some ideas as to what can be done to alter the financial situation, i.e., “the dysfunction,” as he calls it, prominent in Washington and in America’s corporate boardrooms. Icahn notes that financial leaders in 2007 and 2008 did not warn the people and he wants to make sure that this time around financiers in the know, people like himself, fulfill their responsibility to get the word out and give investors time to act.

This is the man Donald Trump has named publicly as his choice for Secretary of the Treasury if he is elected president. Icahn came out recently as endorsing Trump for president. In this video he says Trump will wake up the country as to what’s going on and likens him to Teddy Roosevelt – someone who is not afraid to say “this is complete bullshit.”

If you decide to take Icahn’s advice to prepare, you should not just consider what you might want to sell, but what you might want to buy. If gold and silver come to mind, so should USAGOLD. Helping investors properly balance their portfolios is is what we are good at. Call the Trading Desk to have your questions answered, receive the proper advice for your particular situation.

Interview – Anonymous senior manager with top Swiss precious metals refiner

Audio/Physical Gold Fund/9-23-2015

MK note: If you want to hear it straight from the horse’s mouth, this is the interview you’ve been waiting for. It brings home the reality of the global physical supply problem and what its repercussions might be from the vantage point of an operating manager for one of the world’s top gold refineries. It is interesting to note that the gentleman interviewed, who sits at the center of the massive movement of physical metal from West to East, states that he “still cannot understand” how the price can be where it is today in the face of the massive demand he is witnessing first hand. Don’t miss this one. . . . . .

Janus’ Bill Gross tells Fed to `Get off zero now!’ as economies run on empty

Mainstream America is being cooked slowly alive. . . .

Bloomberg/Mary Childs/9-23-2015

“If zero interest rates become the long-term norm, economic participants will soon run on empty because their investments aren’t producing the gains or cash flow needed to finance past promises in an aging society, he wrote in an investment outlook on Wednesday for Denver-based Janus Capital Group Inc. That’s already beginning to happen in the developed world, where Detroit, Puerto Rico, and, he predicts, soon Chicago, struggle to meet their liabilities.”

MK note: This is the other side of the interest rate coin. If the Fed raises rates, all hell will break loose. . . . .And, if the Fed stays in the zero bound, all hell will break loose. Heads I win; tails you lose. Maybe we should recognize that France, Japan, Detroit, Puerto Rico and Chicago (to name a few) are likely to encounter difficulties no matter what the Fed does simply because from a business point of view governments far and wide have been poorly managed. As for the private investor, Gross is right when he points to the lack of return as a major problem among ordinary investors. We are made aware of it every day by prospective investors concerned about where the stock and bond markets might be headed, knowing full well there isn’t much in the way of yield available anywhere.

Goodbye Yogi. . .

I quoted him frequently in my writings, as did a lot of other people simply because somehow everyone knew what he meant and you really couldn’t argue with his logic. Some of the best from one of America’s preeminent philosophers, Yankee great, Yogi Berra (1925-2015):

On his approach to at-bats: “You can’t think and hit at the same time.”

On selecting a restaurant: “Nobody goes there anymore. It’s too crowded.”

On economics: “A nickel ain’t worth a dime anymore.”

On the 1973 Mets: “We were overwhelming underdogs.”

On how events sometimes seem to repeat themselves “It’s deja vu all over again!”

On baseball attendance: “If people don’t come to the ballpark, how are you gonna stop them?”

On a slipping batting average: “Slump? I ain’t in no slump. … I just ain’t hitting.”

On travel directions: “When you come to a fork in the road take it.”

On pregame rest: “I usually take a two-hour nap from 1 to 4.”

On battling the shadows in left field at Yankee Stadium: “It gets late early out there.”

On fan mail: “Never answer an anonymous letter.”

On being told he looked cool: “You don’t look so hot yourself.”

On being asked what time it was: “You mean now?”

On being given a day in his honor: “Thank you for making this day necessary.”

On a spring training drill: “Pair off in threes.”

On his approach to playing baseball: “Baseball is 90 percent mental. The other half is physical.”

On death: “Always go to other people’s funerals. Otherwise they won’t go to yours.”

On learning: “You can observe a lot by watching.”

On his team’s diminishing pennant chances: “It ain’t over `till it’s over.”

On the fractured syntax attributed to him: “I really didn’t say everything I said.”

From Fox News/9-23-2015

Fed officials make case for 2015 liftoff after September hold

Bloomberg/ Jeanna Smialek Steve Matthews Matthew Boesler/9-19-2015

“Three Federal Reserve policy makers argued on Saturday for lifting the central bank’s key interest rate before year-end, countering bets by many traders that the Fed will wait until 2016.”

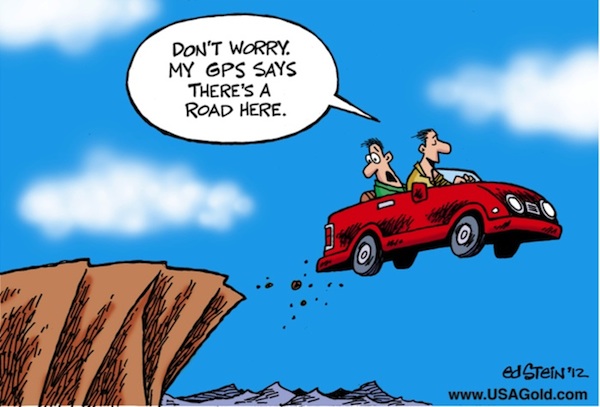

MK note: You had to know this was coming. If the story about the boy who called wolf suddenly jumped into your consciousness, it is not difficult to understand why. Consider for a moment having to put up with this until the Fed reconvenes in December. “Eight years after a financial crisis brought the world economy to the brink of collapse,” says Financial Times Sam Fleming, “central bankers are no wiser about what mixture of monetary, fiscal and financial regulatory policy can best assure stable long-term growth. Once again, the fate of the global economy rests on the judgement of a few individuals without reliable economic models to guide them.” In short confusion reigns, and it might be said, judging from this Bloomberg article, that some Fed governors were surprised by the stock market’s negative reaction after it decided not to raise rates last Thursday. It seems the Fed finds itself in a position similar to the two individuals in the cartoon below.

Mark Spitznagel: Stock market dramatically overvalued

“Ain’t seen nothing yet. . .”

“Great myths die hard. And I think what we’re witnessing today is the slow death of one of the great myths of human history: this idea that centrally planned command economies work, that they’re even feasible, and that they can be successful.

It’s one of these enigmatic mythologies of the last hundred years in particular that we’ve been grappling with, and here we are today yet again thinking about this. Let’s remember that in the last hundred years a lot of blood has been shed over this mythology. And here we are today, how did we get here again?”

Full video interview with Maria Bartiromo/Fox Business

MK note: The voice of reason. Listen to a deep-thinker get to the source of what ails the markets these days. He recommends cash. We would take the whole concept a step further and suggest a near-cash asset which is not simultaneously someone else’s liability. Spitznagel was one of Ron Paul’s economic advisors: “I think that another generation will look back and say ‘how could you have made that mistake all over again? How could you have failed to understand Hayek’s notion of the fatal conceit, that central planners can’t do better than the dispersed knowledge and signals of free market processes?'” Spitznagel reportedly made a cool billion on the August crash. . . . . . . .

Quantitative tightening

“It is neither the sell-off in Chinese stocks nor weakness in the currency that matters most. It is what is happening to China’s FX reserves and what this means for global liquidity. China’s actions are equivalent to unwind of QE or, in other words, Quantitative Tightenting.”

George Saravelos, currency strategist at Deutsche Bank/as published in this morning’s Financial Times (London edition), see Henny Sender’s column

MK note: This quote accompanies news today that China unloaded $93.9 billion in currency reserves in August, a record. One wonders how much of its reserves China is willing to surrender in order to boost the yuan and stem outflows, particularly when market forces seem caught up in enforcing the currency’s downtrend. Might be best to simply step out of the way and let the market sort this out on its own. Remember, it was the prospect of a drop in the yuan that drove gold higher a couple of weeks ago. Since then the market signals have been mixed at best until today’s announcement – coming on a day that the U.S. markets are closed. In the unlikely event that China continues with the reserve sales, our own Federal Reserve will need to confront a bond market being flooded with U.S. Treasury paper – quantitative tightening in the extreme and a conundrum to which Fed chair Janet Yellen would probably rather not have her name attached.

In that same column, Henny Sender ends with this:

“A combination of future Fed tightening, less money in need of recycling in the hands of oil producers and the uncertain consequences of changing circumstances in China is enough to turn most bulls into fearful bears.”

Sender’s reference to the recycling capabilities of oil producers probably has to do with a ready market for Treasuries being sold by China.

China SGE August gold deliveries phenomenal

SharpsPixley/Lawrie Williams/9-6-2015

“August is always a weak month for physical gold moving through China’s Shanghai Gold Exchange – or rather it has been up until now. The big months for SGE withdrawals are normally at the beginning and the end of the year ahead of The Chinese New Year holidays, while trading in the summer months is usually thin.

But not this year! Gold moving through the Exchange this August has totalled a phenomenal 301.96 tonnes bringing the year to date total to 1,718.2 tonnes, some 219 tonnes more at the same time of year than in 2013 when China consumed a record amount of gold by even according to the consistently much lower consumption estimates by the major precious metals analytical consultancies. . .

If SGE withdrawals continue at the average rate recorded so far this year, full year deliveries though the Exchange would come to around 2,580 tonnes – and this is certainly not an impossibility given that demand during the final quarter of the year usually runs strong. This figure is equivalent on its own to around 80% of global annual new mined supply at present.”

MK note: The impressive China gold saga continues. Much of this new demand has come, as we predicted in a Special Report back in July, the result of the Shanghai stock market meltdown. The Chinese people continue to accumulate physical metal and, as James Rickards points out in the interview linked below, so does the Chinese government. For those tempted to think that China’s interest in gold might be fleeting, the July Special Report will serve as an eye-opener.

There is no safe asset anymore

Interview of Marc Faber/Bloomberg/9-2-15

MK note: This interview is for those who like their analysis reduced to the nitty gritty – unpleasant as it might be to Bloomberg’s pundits. One of the interviewers cannot seem to get it into his head that it isn’t always about how much money an investor intends to make, but more about how he or she might protect wealth already attained.

“The printing of money has a very limited impact on creating wealth.” – Marc Faber

Simply put. Easily understood. And what money printing giveth, it can quickly taketh away. By the way, mining stocks, yes, but not before a strong position in gold and silver coins and bullion has already been safely tucked away. Mining stocks are not a store of value. They are stocks first, gold second.

Internal combustion – anatomy of a stock market top

“Over the past few months, we have detailed the systematic deterioration in the internals of the stock market. This trend recently reached depths historically seen only near major market tops. . . This piece covers the ‘internals’ of the stock market. Internals (or breadth) refer to the level of participation among stocks throughout the entire equity market. It includes metrics like the number of stocks that are advancing versus declining, the amount of volume in advancing stocks versus declining stocks, the number of stocks that are making new 52-week highs versus new lows, etc. In our view, strong internals, i.e., widespread participation among stocks, is an important ingredient of a healthy market.”

MK note: In this in-depth article Dana Lyons tells us why in the coming weeks and months the stock market might move south in a preordained fashion no matter the news – good or bad – based on the underlying fundamentals.

Richard Russell in a recent King World News interview:

“One thing I learned from Dow Theory is that once the primary trend starts its course, nothing will stop it. The primary trend of China and the world economy has turned negative, much to my disappointment. I believe the primary trend of the stock market and the economy has also turned down.”

Cramer says gold is the best insurance policy for your portfolio

“‘I think that 10 percent is the upper limit because I consider gold as an insurance policy, and no worthwhile insurance policy should be 20 percent of the money you have invested,’ the ‘Mad Money’ host said. Cramer recommends gold because it tends to go up when everything else is going down. It is the investors’ insurance against geopolitical events, uncertainty and inflation. Granted, this may sound like a terrible idea since gold has not done anything spectacular in a few years. However just as you wouldn’t own a home or car without insurance, you shouldn’t have a portfolio without gold.”

MK note: OK. Cramer’s on board. At USAGOLD, we recommend 10% to 30% gold diversification depending on your level of concern about the economy, current state of the equity markets, financial system, etc. Also, we would extend the hedging capability beyond inflation only, to deflation, disinflation and stagflation as well. Gold protects against any and all and no matter in which order they arrive.

Key trade in gold market signals China’s intentions

by Michael J. Kosares

Wall Street Journal/Ese Dheriene and Biman Mukherji/8-25-2015

“In recent years, China has come to shape the very way in which commodities are bought and sold, traditionally the preserve of financial centers such as London and New York. Late last month, the price of gold fell sharply, to a five-year low, within minutes of Asian markets opening. That came after almost five metric tons of gold—close to $200 million of the metal—was sold on the Shanghai Gold Exchange, according to ANZ Bank. The trade was seen by market participants as a key moment reflecting how China had moved Asian commodity markets away from just following the overnight pattern of U.S. and European trading.”

MK note: The premise of this article is that China will continue to play a key role in shaping commodities’ markets in the years to come, despite the current slowdown, based on its sheer scale. If you follow this blog, you already know of the infrastructure China is putting in place to influence the gold trade and insert itself as a third gold trading center along with London and New York. We should note that the five tonne trade cited above came after the price had dropped. Keep in mind that Shanghai is a physical market exchange. In other words, someone in China took advantage of the price drop to force the market into a delivery of five metric tonnes of the metal. You might recall too that there have been reports in the background of Goldman Sachs and HSBC looking to purchase significant amounts of physical metal for delivery around the time of the five tonne trade. Are the two events related? They very well might be. And this might be the very first signs of China flexing its muscle in the gold market in the way we outlined in this News & Views Special Report titled, The Shanghai stock crash and China gold demand.

Quoting that Special Report:

In addition, an institution wishing to bet against gold would be forced to do so by delivering the physical metal itself in kilo bar form (the standard trading unit) upon settlement – an expensive and cumbersome process likely to further discourage excessive speculation or attempts at price manipulation. Gold Forecaster’s Julian Phillips, who has analyzed activity in the gold market for a number of years, points out that the seminal changes taking place in the gold market centering around Shanghai “will allow Chinese banks to participate in the gold market on a global basis.” It will be a market, he says, “that is not distorted by the banks, their proprietary trading, or control of the gold distribution system globally. China will hold these reins.”

Gold as a wealth building asset – East and West

In short, the physical flow of metal – its purchase and sale in real terms – will govern pricing in Shanghai, not leveraged paper trades, as is the case in the West. This emphasis on physical pricing in Shanghai, particularly when the new Shanghai Fix comes into play later this year, could signal the birth of a whole new gold market unlike anything we have experienced since the United States detached the dollar from gold in 1971.

At the moment, there is a strong, steady flow of gold through the London-Zurich-Hong Kong-Shanghai pipeline. Should the supply slow, prices in yuan terms could receive a strong jolt. Don’t forget too that the newly structured London fix now includes one Chinese bank with perhaps two others soon to be accepted as members, the situation Julian Phillips touches upon above. These banks will be on the constant lookout for arbitrage opportunities that could be purchased and shipped to their home country. Competition, as they say, is good for the soul, and in this case, it could be curative.

______________________________________________________________

We invite you to sign-up for the service. It comes free of charge and you can opt out of the service at anytime. Last, we will not deluge you with e-mails.

Legendary Richard Russell warns stay out of the stock market after yesterday’s carnage, stick with precious metals

King World News/8-25-2015

“After yesterday’s carnage in global stock markets, the Godfather of newsletter writers, 91-year-old legend Richard Russell, warned people to stay out of the stock market. He also discussed the Fed, gold, silver and the possibility of hyperinflation.”

MK note: Those who have read my writings over the years know of my respect for Richard Russell. I have always appreciated his direct commentary and down-to-earth analysis drawn from many years experience analyzing markets. As for the final outcome, I find it interesting that his concerns about eventual hyperinflation echo those of another long-term analyst of note, James Sinclair – even as the economies of the world flirt with disinflationary disaster. Though I am not in concert with him on the Great Reset and the gold price forecasted, I find this interview of Sinclair with former ABC News and CNN business reporter Greg Hunter at least interesting and worth watching with respect to the causes and effects of the present situation in the financial markets. Sinclair doesn’t quote his sources but he passes along an interesting piece of advice he received with respect to gold: “You probably will not want to sell gold’s next rally.” Some of you might be aware of Sinclair’s long term ties to important, old-money Wall Street families. As I say, worth watching. . . . .

The troubling truth revealed by the stock market’s nosedive (Part 1)

Fiscal Times/Anthony Mirhaydari/8-24-2015

“A recent working paper by the vice president of the St. Louis Federal Reserve Bank finds that after six years of quantitative easing that swelled the Fed’s balance sheet to $4.5 trillion, ‘casual evidence suggests that QE has been ineffective in increasing inflation’ and only seems to have boosted stock prices.

Complaints once in the realm of conspiracy theorists wearing tin foil hats are now being embraced by the Wall Street establishment. In a note to clients, Deutsche Bank analysts warned that ‘the fragility of this artificially manipulated financial system was exposed’ and that ‘the only thing preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities.'”

MK note: For those who like to look a bit deeper, here’s the link to the St. Louis Fed paper referenced above. The point of all this is that QE post-2008 worked to save the financial institutions (at least some of them), but it didn’t work to save the economy. Thus, if the economy couldn’t be saved by QE previously, why would anyone believe that it could work to save the economy now. Thus, the “troubling truth” is that the Fed might be out of ammunition, an event causing a loss of faith on Wall Street and Main Street both. In some ways, that makes this breakdown closer to a 1929-style event (with the evident strong disinflationary bias in the economy) than 2008. Troubling indeed. . . . .

The troubling truth revealed by the stock market’s nosedive (Part 2)

Fiscal Times/Anthony Mirhaydari/8-24-2015

“Policymakers responded to the financial crisis with easy monetary policy and low interest rates. The critics — including us — argued against ‘solving a debt crisis with more debt.’ Put differently, we said that QE was necessary, but not sufficient for a recovery. We are now coming to the moment of reckoning: central bankers look naked, and markets have nothing else to believe in.” Alberto Gallo, head of credit research, Royal Bank of Scotland

Crudele says Washington attempting to rig the stock recovery, recommends “switching off” CNBC

How Washington will try to rig the stock market/John Crudele/ New York Post/8-24-2015

“One of these mornings — or overnight — some mysterious buyer will suddenly start purchasing an abnormal amount of Standard & Poor’s 500 stock index futures. So we get down to direct intervention — just like China did. Only Washington, with Wall Street as its co-conspirator, won’t be as sloppy as Beijing was. That’ll get the stock market moving higher and everyone will pretend that the buyers are just ordinary people who suddenly think Wall Street is oversold.”

MK note: In this cogent piece written two days ago, the New York Post’s John Crudele accurately predicted events and provided a pretty good summary on the true forces at work. He is not happy about the cozy relationship between Wall Street and Washington nor the coverage at our favorite stock-hyping cable channel (which he says “tens of thousands” have already abandoned). This piece will confirm what a lot of you are already thinking. . . . .

Today is options expiration day for the September gold contract

Link to options expiration calendar

MK note: For those of you new to the gold scene, the gold price has been known in the past to take a dump on options expiration dates – in fact in some circles it is an anticipated event. Those who underwrite gold “calls” benefit from every $5 decline in the metals’ price. No one knows for certain if these recurring expiry takedowns are a coincidence, chance events or engineered anomalies, though a good many over the years have speculated that the latter is the case. In the past, gold has often, but not always, recovered quickly from the onslaught. Given what else is on the table these days, one wonders how many of the big players will take advantage of this dump to stock up on physical.

By the way, today is also options expiration day for silver.

Vanishing Act: U.S. banks moved billions of dollars in trades beyond Washington’s reach

Reuters/Charles Levinson/8-21-2015

“The lobbying blitz helped win a ruling from the CFTC that left U.S. banks’ overseas operations largely outside the jurisdiction of U.S. regulators. After that rule passed, U.S. banks simply shipped more trades overseas. By December of 2014, certain U.S. swaps markets had seen 95 percent of their trading volume disappear in less than two years.

While many swaps trades are now booked abroad, some people in the markets believe the risk remains firmly on U.S. shores. They say the big American banks are still on the hook for swaps they’re parking offshore with subsidiaries.”

MK note: As Reuters notes, the derivatives positions moved offshore, but the systemic risk remains in the United States. In the event of another meltdown the “big five” will be directly affected and the federal government and Federal Reserve will be called upon once again to socialize both the risks and their effect. Too the very same specific instruments at the root of the 2007-2008 financial breakdown are alive and well in banking subsidiaries situated off shore and out of the reach of regulators. For the individual wondering whether or not the present systemic risks are something to worry about, this Reuters article will serve as a functional tutorial and warning shot across the bow.

Sell gold, buy Guaguin

Absolute Return/Gillian Kemmerer/7-23-2015