Author Archives: Dr. MoneyWise

The gift of gold, in short, is ……

Playwright and philosopher George Bernard Shaw once wrote, “You have to choose between trusting to the natural stability of gold and the natural stability of the honesty and intelligence of the members of the Government. And, with due respect for these gentlemen, I advise you, as long as the Capitalist system lasts, to vote for gold.”

Whether or not gold is the best basis for money may be a debatable point. On the other hand, whether or not private investors should own it because the money is not gold-backed remains a vital question. The gift of gold – the one passed from generation to generation and from ancient times to the present – is the protection it affords against profligate governments, an unpredictable economy, unstable financial markets, and a myriad of additional threats to private wealth. The gift of gold, in short, is peace of mind.

________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

The road to confetti is long and winding

“Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? . . . To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of

Dr. MoneyWise says. . . .Some think it takes an advanced degree in economics to understand the merits of a diversification in gold and silver when all it takes is a little common sense. Common sense ownership of physical metal saved the skeptical saver in the time of the French assignat inflation in 1789, the nightmare German inflation in 1923, the global bank collapses in 1932, the American stagflationary breakdown in the 1970s and Venezuela’s inflation in 2019 – even though those episodes span almost 250 years. As old Ben Franklin once said: “A change of fortune hurts a wise Man no more than a change of the Moon.”

_________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Dr. Moneywise

“In an economy buffeted by the ups and downs of farming and fishing, the people [of India] are used to buying gold after bumper harvests or fishing seasons and selling it after lean ones.” –– Vivek Kaul, Live Mint

Dr. MoneyWise says: “It’s all very simple. Own gold for a rainy day. Use it if and when that day arrives.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to make that rainy-day investment?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Scientists discover new structure in gold

that only exists at extreme states

Dr. Moneywise says: History teaches that under the crushing pressure of a financial meltdown, gold hardens the portfolio, making it more resilient!

Are you considering making your portfolio more resilient?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

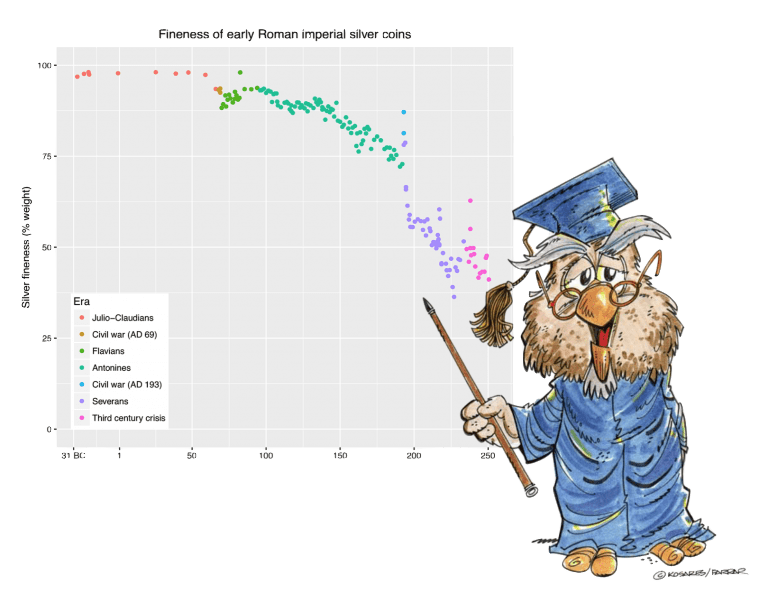

When in Rome. . .

“The coins’ excellent condition indicated that the owner systematically stashed them away shortly after they were made, the archaeologists said. For some reason that person had buried them shortly after 294AD and never retrieved them. Some of the coins, made mainly of bronze but with a 5% silver content were buried in small leather pouches. The archaeologists said it was impossible to determine the original value of the money due to rampant inflation at the time, but said they would have been worth at least a year or two of wages.” – The Guardian (11-19-2015) on a find of 4000 Roman silver coins buried in a Swiss orchard

“Salvian tells us, and I don’t think he’s exaggerating, that one of the reasons why the Roman state collapsed in the 5th century was that the Roman people, the mass of the population, had but one wish after being captured by the barbarians: to never again fall under the rule of the Roman bureaucracy. In other words, the Roman state was the enemy; the barbarians were the liberators. And this undoubtedly was due to the inflation of the 3rd century.” – Joseph Peden, Inflation and the Fall of the Roman Empire

“Now one interesting thing with all this inflation should be a great comfort to us: historians of prices in the Roman Empire have come to the conclusion that despite all of this inflation — or perhaps we should say, because of all of this inflation — the price of gold, in terms of its purchasing power, remained stable from the first through the fourth century. In other words, gold remained, in terms of its purchasing power, a stable value whereas all this other coinage just became increasingly worthless.” – Joseph Peden, Inflation and the Fall of the Roman Empire

Dr. MoneyWise says. . . .”In the wealth game, emphasize defense when you need to and offense when it makes sense. At all times, though, no matter how tempting the prospects for speculative gain, remain fully and judiciously diversified.”

Chart image courtesy of Nicolas Perrault III [CC0], from Wikimedia Commons

Market cycles will endure as long as humans exist

“Four of the most dangerous words in the investment world are ‘It’s different this time.’ When people use them, what they’re saying is that the norms of the past no longer apply. . .Both these

Dr. MoneyWise says. . . . Old Ben Franklin said it best. “By failing to prepare, you are preparing to fail.” And I will add, we do not know when the next crisis will begin, but begin it will. And when it does, only two kinds of investors will be there to greet it: Those who prepared and those who did not.

Looking to prepare for the next turn in the economic cycle?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

––––––––––––––––––––––––––––––––––––––––––––––––––

Let them go bankrupt!

“Without a lay-friendly book like [Dr. Mark Thornton’s] The Skyscraper Curse, millions more Americans will be duped by the next crash. They won’t understand the historically unprecedented and bizarre Fed program of quantitative easing, they won’t understand the impact of manipulated interest rates, and they sure won’t understand the gross malinvestment that levered up trillions of dollars in new business debt. Instead, we’ll hear about ‘unbridled capitalism’ and ‘unregulated markets’ as culprits. We’ll be told that extraordinary new measures are needed. More industries, and maybe even the banks again, will be bailed out.

Worst of all, the press will focus on what the Fed and Congress should do, rather than what they shouldn’t. The only real cure for too much debt is an orderly process of liquidation: let insolvent banks and debt-ridden firms go bankrupt, let their shareholders take a haircut, and let new

Dr. MoneyWise says: Anna Schwartz, who co-authored A Monetary History of the United States with Milton Friedman, very publicly recommended exactly the same remedy in 2008. Such comeuppance never occurred. The banks and other industries were bailed out, and we ended up where we are today – in a deeper hole than ever with the threat of an even more dangerous crisis than the last hanging over us.

Jeff Deist is the president of the Mises Institute.

––––––––––––––––––––––––––––––––––––––––––––––––––