Author Archives: Daily Market Report

Daily Gold Market Report

No DGMR Wednesday through Friday. Back Monday. Below is yesterday’s report.

_______________________________________

Gold’s reaction muted on this morning’s drop in headline inflation rate

Hickey says ‘gold does best when stocks are going down’

(USAGOLD – 6/13/2023) – Gold’s reaction to this morning’s drop in the headline inflation rate has been muted thus far. It is up $2 at $1962. Silver is down 2¢ at $24.10. The early reaction to major data releases is not always the real reaction. We should have a clearer indication of where we are headed by the end of today’s trading session. Short-term considerations aside, High Tech Strategist’s Fred Hickey believes that conditions are “perfect” for gold to go to record highs and that it will be propelled by a major correction in the over-valued stock market.

“Historically,” he says, “gold had two big bull markets prior to the current one. The first was in the 1970s. Importantly, gold would go up when the stock market went down. At that time, the price went up 73% in 1973, and another 60% in 1974 during that severe two-year stock bear market. The other big bull market was in the 2000s which was a lost decade for stocks. So again: gold does best when stocks are going down. That’s not the case right now, because the market is being held up by this FOMO move into these very dangerous big cap names, but that will eventually end.” [Source: the market NZZ]

Gold and stocks 1973-1974

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold up marginally as we begin what could be a turbulent week for financial markets

Saxo Bank sees the gold market as ‘resilient,’ maintains bullish outlook

(USAGOLD – 6/12/2023) – Gold is up marginally this morning as we begin what could be a turbulent week for financial markets. It is up $3 at $1966.50. Silver is down 3¢ at $24.34. The Treasury Department will conduct a run of bond auctions to replenish its depleted coffers on Monday and Tuesday. Headline inflation data is due Tuesday, and the Fed will announce its rate decision on Wednesday.

“Gold prices,” says Saxo Bank’s Ole Hansen in a report issued Friday, “continue to be directed by the ebb and flow of US economic data and with that speculation about the short-term direction of US rates.… While not ruling out additional short-term weakness, the market is showing resilience, with silver currently outperforming gold while the miners are still struggling to find a bid amid the current stock market rally.” Overall, the bank maintains a bullish outlook for the metal based on continued dollar weakness, recession risks, strong central bank demand, sticky inflation, and building geopolitical tensions.

Daily Gold Market Report

Gold drifts sideways as investors batten down the hatches

Dalio warns we are at the beginning of a debt crisis and worse times for the economy

(USAGOLD – 6/9/2023) – Gold is drifting sideways in early trading as investors batten down the hatches for what could be a turbulent upcoming week. It is down $1 at $1967.50. Silver is up 9¢ at $24.44. Today’s quiet follows a sharp turn to the upside yesterday after a greater-than-expected jump in unemployment claims. Next week, the Treasury Department will begin replenishing its coffers with a run of auctions on Monday and Tuesday. On Tuesday, the BLS will report on headline inflation for May. On Wednesday, the Fed will wind up its rate meeting with an announcement and press conference.

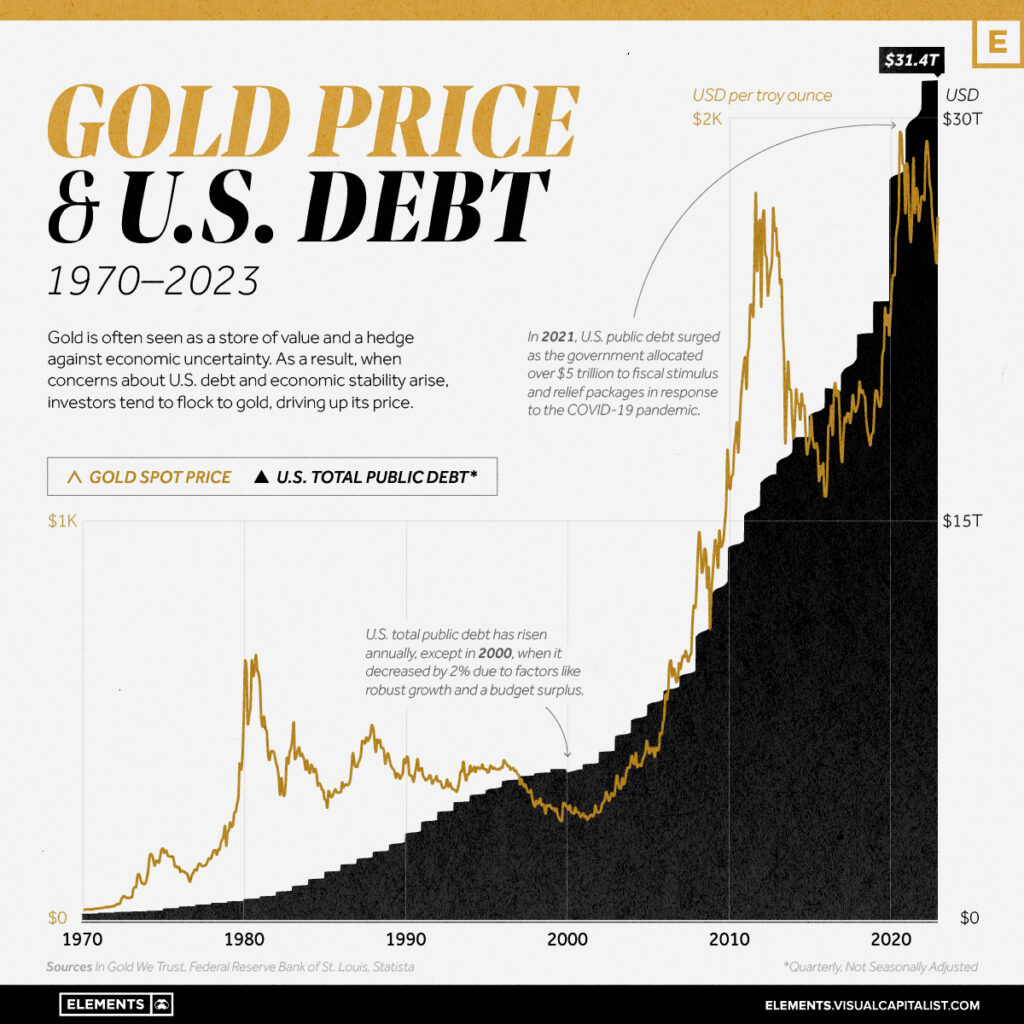

Ray Dalio, the outspoken founder of Bridgewater Securities, believes that we are in the early stages of a debt crisis and that the worst is yet to come for the economy. “In my opinion,” he told Bloomberg, “we are at the beginning of a very classic late, big cycle debt crisis, when the supply-demand gap, when you are producing too much debt and have a shortage of buyers.… What’s happening now, as we have to sell all this debt, do you have enough buyers? When I look at the supply-demand issue for that debt, there’s a lot of debt, it has to be bought and has to have a high enough interest rate.”

Visualization courtesy of Visual Capitalist com • • • Click to enlarge

Daily Gold Market Report

UPDATE – Goid’s sharp turn to the upside has to do with the surge in unemployment claims. It leaves room for the Fed to pause rates at next week’s FOMC meeting. It is up $28 at $1970. Silver is up 86¢ at $24.37.

__________________________________

Gold up marginally as choppy price performance continues

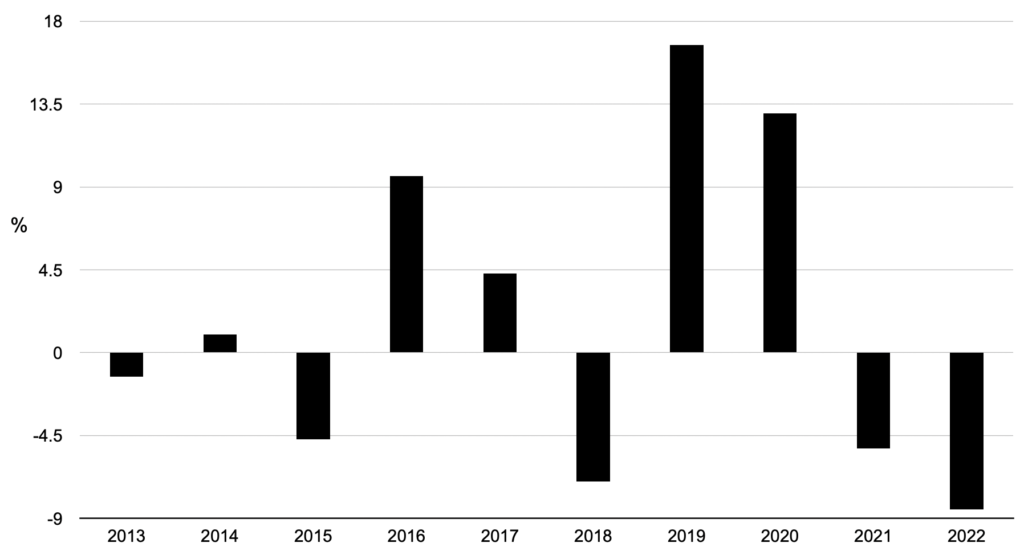

Five up years, five down years during the summer months since 2013

(USAGOLD –6-8-2023) – Gold is up marginally this morning in the follow-up to yesterday’s sell-off. It is up $7 at $1949.50. Silver is up 28¢ at $23.79.In a recent client briefing, Gold Newsletter’s Brien Lundin offers a couple of explanations for gold’s choppy price behavior over the past month.

“For gold,” he says, “it seems that algos are simply keying off the rising yields part of the equation and ignoring the cheapening currency implications.… Again, not much to report on, and certainly nothing different from what I’ve been saying over the past few weeks. The Fed is likely to pause at next week’s meeting, but I believe that gold and bonds are already looking ahead at the possibility of a pivot — actual rate cuts — by the fall. That would mean something more than a recession has popped up and, needless to say, this would be extremely bullish for metals and miners. In the meantime, we’re smack dab in the summer doldrums already.”

Editor’s note: Though trading and volumes in the gold market do tend to fade during the summer months, it has been a mixed bag over the past ten years in terms of price performance. We have had five down years and five up years, June through August, since 2013. Perhaps the old dictum to “sell in May and go away” is changing in this era of the portable office and instantaneous news availability.

Gold price performance

(%, June through August 2013-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: TradingView.com

Daily Gold Market Report

Gold seesaws quietly in a range ahead of next week’s Fed meeting

New China initiative could deliver a ‘demand shock’ in physical bullion market

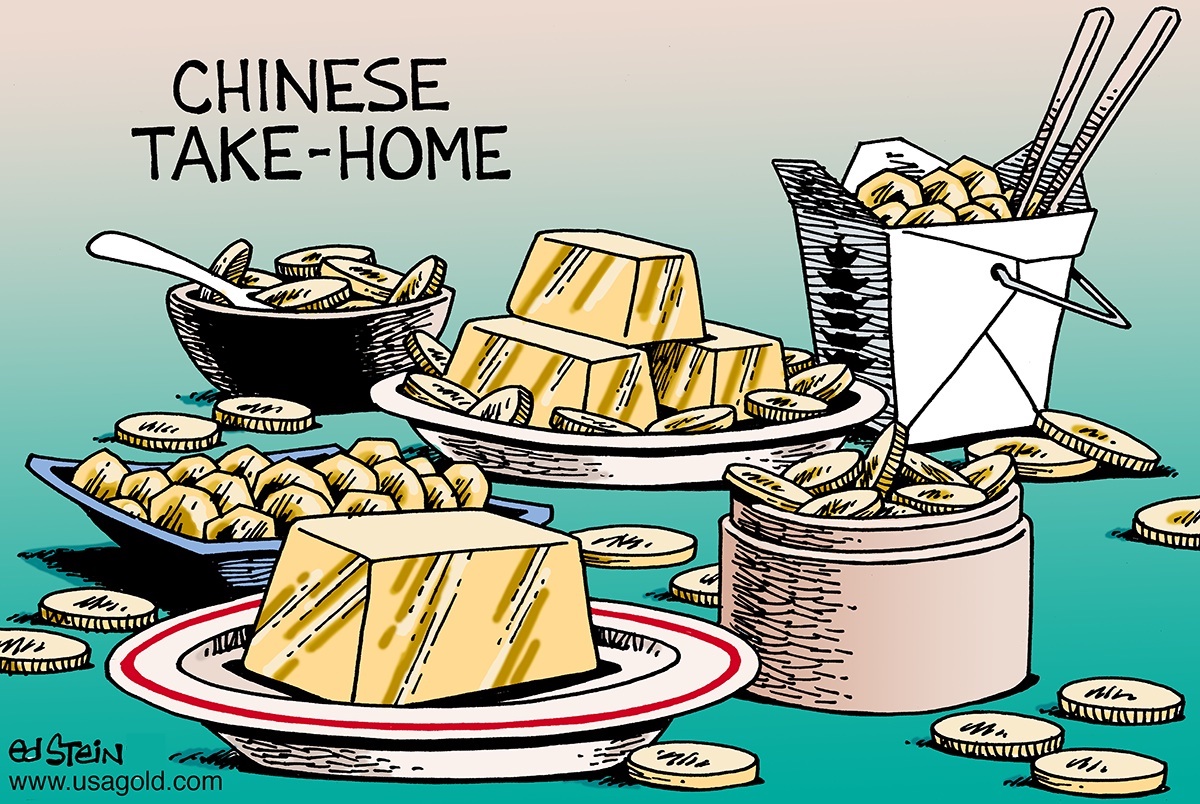

(USAGOLD – 6/7/2023) – Gold continued to seesaw quietly in a range as investors took to the sidelines ahead of next week’s Fed meeting. It is down $3 at $1964. Silver is level at $23.67. In an article posted st BarChart, analyst Levi Donohue says the gold market, courtesy of China’s banking system, is about to experience “a demand shock that is not being factored into current gold futures prices.”

Chines banks will make “it easy for millions of existing renminbi bank account holders to convert these cash savings into a deliverable physical silver or physical gold bullion with a click of the mouse from within their banking applications.” He advises Western precious metals investors to “brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the West have noticed.”

Daily Gold Market Report

Gold marginally higher as investors remain wary of inconclusive outlook

$1.1 trillion+ Treasury debt release muddies financial outlook

(USAGOLD – 6-6-2023) – Gold is marginally higher in early trading as investors remain wary of an inconclusive economic and financial picture. It is up $2.50 at $1966.50. Silver is up 11¢ at $23.71. One of the components of that muddied outlook is the $1 trillion+ tsunami of federal borrowing the Treasury Department is expected to unleash by the end of August. Many Wall Streeters are worried about the threat it imposes on the financial system. “This is a very big liquidity drain,” JP Morgan’s Nikolaos Panigirtzoglou told Bloomberg. “We have rarely seen something like that. It’s only in severe crashes like the Lehman crisis where you see something like that contraction.”

“Since the early 1970s, the logic for gold ownership has been inextricably bound to the cash flow problems of the federal government. As the national debt increased so did the well-documented damage associated with it – to the dollar, to financial markets and to the economy in general. Simultaneously, gold’s role as an inversely correlated portfolio hedge grew over that nearly one-half century as well.” – The National Debt and Gold: Here’s why the two have risen together since the 1970s and why the correlation is likely to continue

Daily Gold Market Report

Gold starts the week on the downside driven by speculators in the paper markets

WGC: Gold prices have increased by a robust 11% annually over the past 50 years

(USAGOLD – 6/5/2023) – Gold is starting the week on the downside as speculators reacted to the prospect of higher rates, entrenched inflation, and an alarmingly (in certain quarters) strong economy. It is down $6 at $1945. Silver is down 13¢ at $23.55. While the Fed and rates have dominated the paper trade over the past year, concerns about the financial system’s stability have driven record safe-haven demand in the physical market, particularly among central banks and private investors. (See interactive chart below.)

Pointing out that gold prices have increased by a robust 11% annually over the past 50 years, the World Gold Council says, “investors want protection in tough times—and historically, this is when gold shines moving higher when equities and other riskier assets are under pressure. Unusually though, gold can also move higher when these assets are in positive territory. This ability to perform in good times and bad is based on gold’s varied demand and makes it a uniquely efficient asset for an investment portfolio.” [Source: World Gold Council/Reuters]

Chart courtesy of the World Bank

Daily Gold Market Report

Gold’s response to this morning’s jobs numbers muted thus far

Fund giant Blackrock makes significant silver investment

(USAGOLD – 6/2/2023) – Gold’s response to this morning’s mixed payroll numbers has been muted thus far. It is down $5 at $1975. Silver is down 9¢ at $23.87. Payrolls exceeded expectations, while the unemployment rate was worse than expected. Bleakley Financial’s Peter Boockvar said that the markets are already pricing in a pause at the June Fed meeting and, as a result, today’s reports “won’t have much of an impact on markets.”

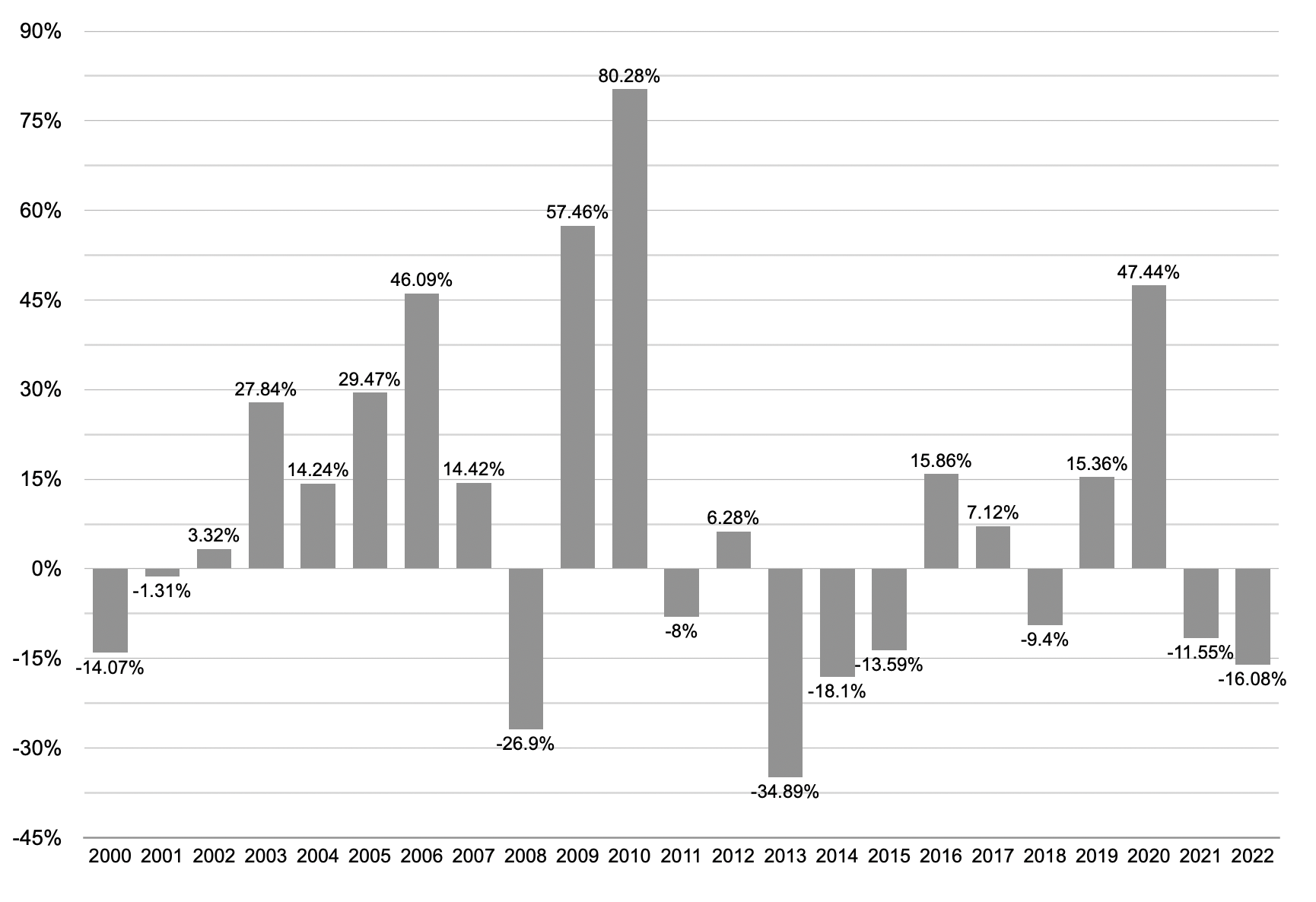

In an article posted earlier this week at FXStreet, The PckAxes’ Jon Forest Little points to the gold-silver ratio, now at 85:1, as an indicator that “something incredibly bullish” is looming in the silver market – something that has attracted the attention of the world’s largest money manager. The historical average is 40:1. “On March 8, 2023,” he writes,” BlackRock Inc., the world’s largest asset manager, disclosed in a regulatory filing that it had purchased 16.1 million shares of the silver exchange-traded fund (ETF) Sprott Physical Silver Trust (PSLV), representing a whopping 10.9% stake in the fund.” Little also cites a Citigroup analysis predicting silver will reach $30 per ounce within the next nine months. [Source: FXStreet]

Silver Annual Returns

(%, 2000 to present)

Chart by USAGOLD [All rights reserved, Data source: MacroTrends.net

Daily Gold Market Report

Gold pushes marginally this morning as debt ceiling concerns fade

WGC survey of central bankers reveals healthy future interest in gold as a reserve asset

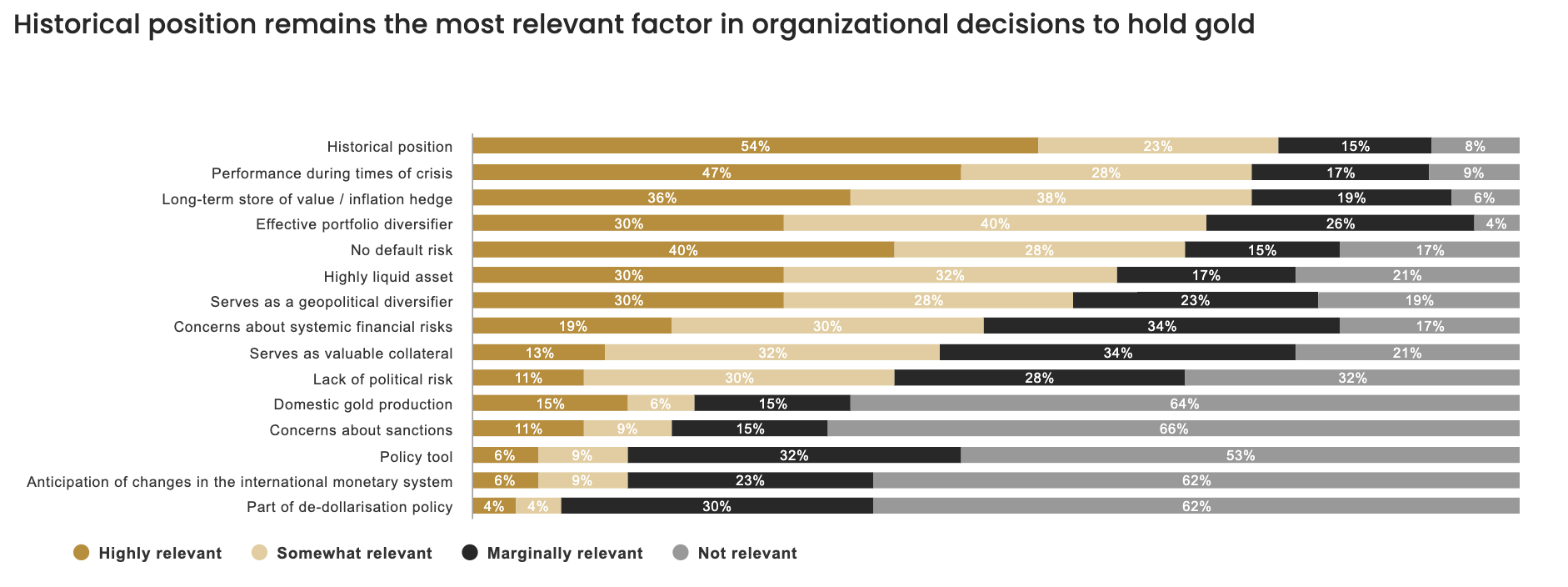

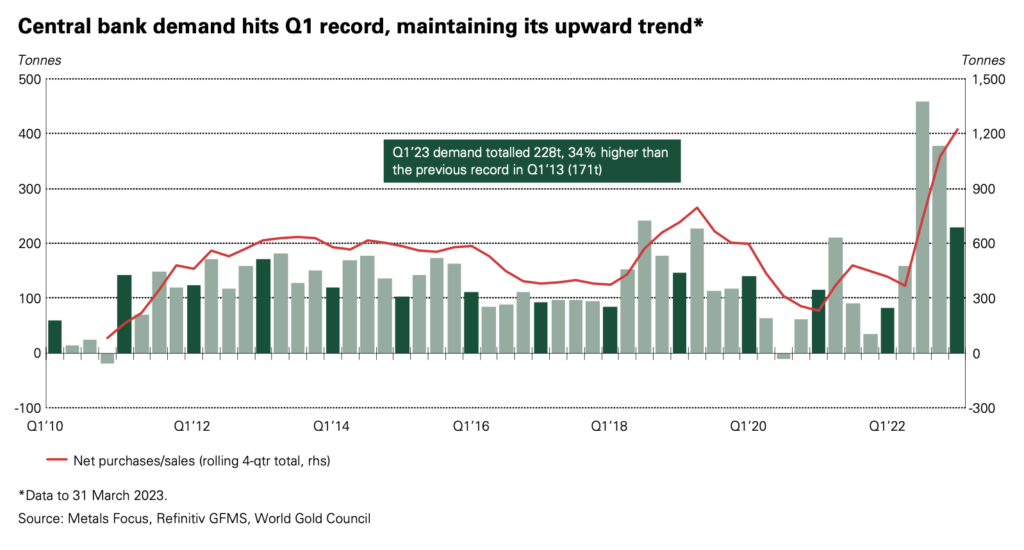

(USAGOLD – 6/1/2023) – Gold pushed marginally higher this morning as debt ceiling concerns faded and investors took to the sidelines ahead of Friday’s jobs numbers. It is up $5 at $1970. Silver is up 1¢ at $23.58. The World Gold Council released its annual survey of central bankers earlier this week, providing insights on the sector’s future interest in the metal as a reserve asset.

As most of you already know, demand from that quarter has been running at record levels, and according to the survey, that interest is likely to continue. Most notably, 62% say that gold will garner a greater share of reserves in the future up from 46% last year, while 24% expressed their intention to increase gold reserves over the next 12 months. In addition, says WGC, “central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys.”

Chart courtesy of World Gold Council • • • Click to enlarge

Daily Gold Market Report

Gold level ahead of Friday’s jobs numbers, today’s debt package vote

Saxo Bank’s Hansen says gold downside fueled by long reduction, not short selling

(USAGOLD – 6/1/2023) – Gold is level this morning ahead of Friday’s jobs numbers and a vote in the House of Representatives later today on the debt package. It is down $1 at $1960. Silver is up 8¢ at $23.34. “Hedge funds were net sellers of gold for a second week,” reports Saxo Bank’s Ole Hansen in a recent client advisory, “but interestingly the reduction was driven by long liquidation with no appetite for short selling despite the recent technical breakdown. Equally in silver the selling appetite was also muted while the copper net short was reduced by 27%, the first reduction following five weeks of constant selling that saw the net drop from a 20k net long to a 22.6k net short.”

Daily Gold Market Report

Gold gains ground as debt drama moves to the halls of Congress

Bridgewater sees subtle shift as central banks, investors turn to gold as a store of value

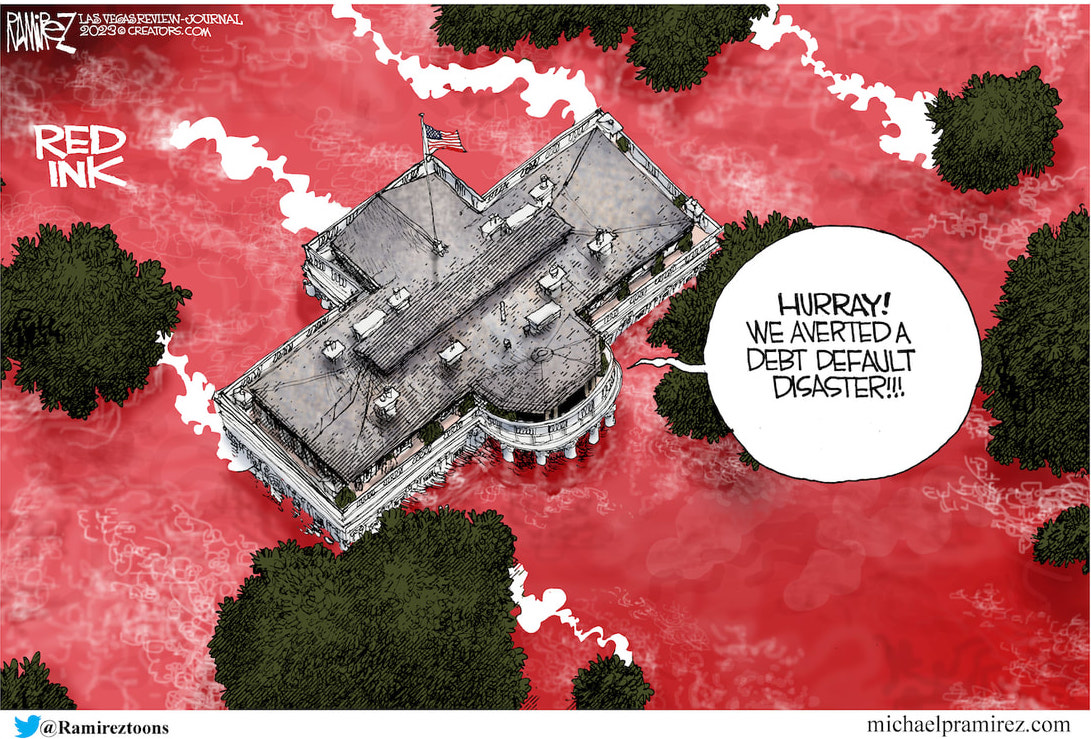

(USAGOLD – 5/30/2023) – Gold gained ground this morning as the still unresolved debt drama moved to the halls of Congress. It is up $16 at $1962. Silver is up 7¢ at $25.32. After all is said and done, Bloomberg points out in its morning advisory, the deal barely dents the $20 trillion in combined budget deficits projected over the next decade.

Bridgewater Associates, the world’s largest hedge fund, writes Financial Times’ Gillion Tett, believes that “the past 15 years of quantitative easing and recent high inflation have left central banks and retail investors alike reaching for gold as a store of value.” Moreover, investors have subtly shifted from “evaluating gold as an alternative to other dollar-denominated savings to increasingly evaluating gold as an alternative to the dollar.” She concludes that “gold is now a good barometer not just of global instability, but of US dysfunction too” and that America’s economic problems will not end with a debt ceiling deal. [Source: Financial Times]

Cartoon courtesy of MichaelPRamireiz.com

Daily Gold Market Report

No DGMR today. Below is Wednesday’s report.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gold trades higher reflecting the high degree of uncertainty in investment markets

This morning’s Financial Times features ‘The New Gold Boom: How Long Will It Last?’

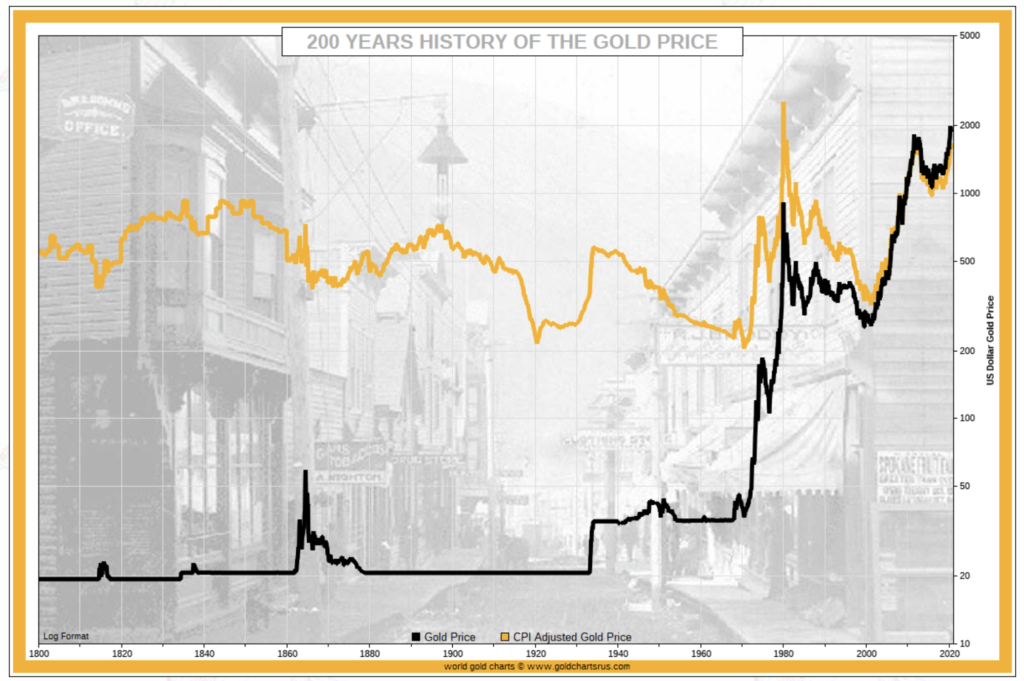

(USAGOLD –5/24/2023) – Gold is trading higher in the early going as markets continued to reflect a high degree of uncertainty about the debt ceiling and the general direction of the economy and investment markets. It is up $7 at $1984.50. Silver is up 1¢ at $23.49. It was a pleasant surprise to come across a feature article in this morning’s Financial Times under the provocative headline – “The New Gold Boom: How Long Will It Last?” Ashok Sewnarian, who manages a bulging private vaulting facility in London, sets the stage by saying clients “have a growing alertness to the new world order.… We have mistrust in the banks, huge inflation, and a global divide on reserve currencies.”

Citing “a rush to gold by the global elite,” FT goes on to say that “the revival in gold’s fortunes has central bank officials, fund managers and retail investors wondering whether the world is on the precipice of a new gilded period. Some forecasters reckon gold could escalate towards its real record high of nearly $3,300 per troy ounce in today’s dollars, set in 1980 when oil-driven inflation and turmoil in the Middle East capped a nine-year bull run unleashed by US president Richard Nixon cutting off the dollar from bullion.” The full article is highly recommended.

Inflation-adjusted price of gold

Daily Gold Market Report

Gold trades marginally lower as financial world awaits debt deadlock outcome

Where will the US find the buyers for the looming debt deluge if/when the deadlock ends?

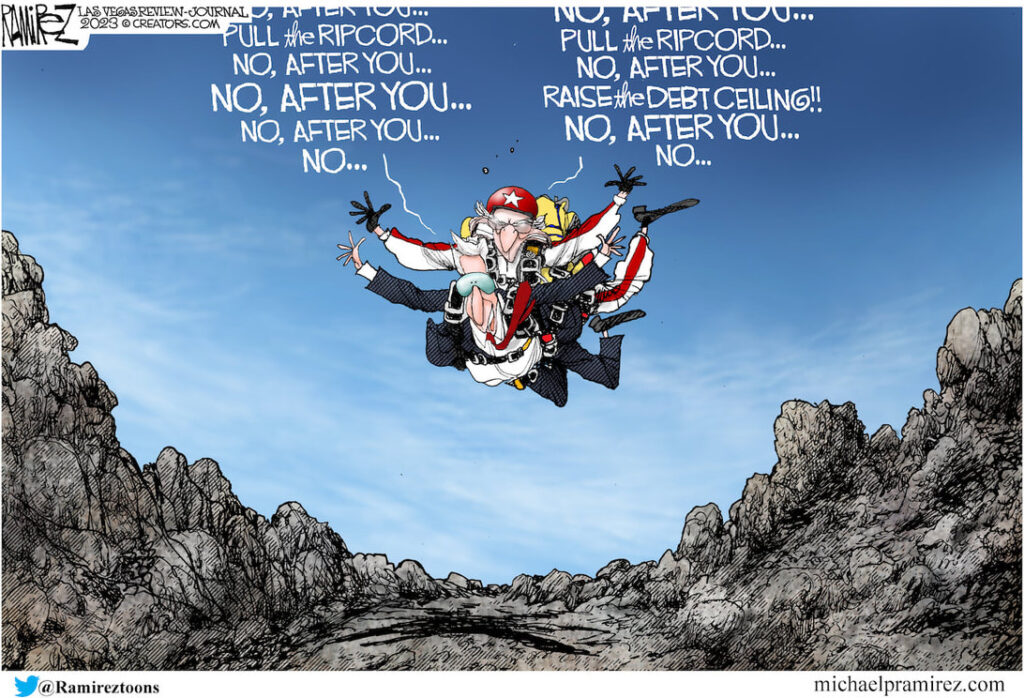

(USAGOLD – 5/25/2023) – Gold is trading marginally lower this morning as the financial world awaits the outcome of the deadlocked Biden-McCarthy negotiations. It is down $10 at $1949.50. Silver is down 12¢ at $23.03. Even as Wall Street frets about a possible federal government default and all it implies, a new worry has surfaced: Where will the United States find the buyers for the deluge of debt likely to follow a settlement? MarketWatch yesterday put that figure at $1 trillion by the end of August – five times the normal issuance over a three-month period.

Granite Shares’ Will Rhind attributes gold’s positive performance thus far in 2023 – up 7.6% – to investor concerns about a potential debt default with the banking crisis, a weaker dollar, and higher inflation also acting as tailwinds for the yellow metal. “The story is all about gold,” he says in a CNBC interview. ”[It’s] the only major metal to remain firmly in the green for this year.…Gold is really serving its purpose at the moment as a way for people to park money in a noncorrelated asset as they worry about what might happen. Certainly, [to] hedge themselves against the probability of something falling out of bed with the debt ceiling.”

Daily Gold Market Report

Gold pushes lower as investors remain on the defensive

Dimon, Pozsar warn of further problems in the banking system

(USAGOLD – 5/23/2023) – Gold pushed lower this morning as uncertainty prevailed over the debt ceiling, bond yields rose, and investors remained on the defensive over further problems in the banking system. It is down $14 at $1960. Silver is down 44¢ at $23.24. With bond yields rising, JP Morgan’s Jamie Dimon worries about further problems in the banking industry centered around commercial real estate loans. “I think everyone should be prepared for rates going higher from here,” he said yesterday at the bank’s investor conference. Dimon went on to say that “lenders should be prepared for benchmark lending rates to climb as high as 7%,” according to a report posted at Markets Insider.

Similarly, former Credit Suisse managing director Zoltan Pozsar described the turmoil at US banks as “basically lessons in not being able to run interest rate risk, not knowing how to make a loan that will be weathering a rising interest rate storm.” He cryptically added that the Fed is only addressing “half the problem” and likened its current rescue regime to “foaming the runway for any large banks that might be having problems.” [Source: Bitcoin Magazine]

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold subdued despite breakdown in debt ceiling talks, Powell’s hint at rate pause

UBS sees gold at $2100 by year-end, $2200 by March 2024

(USAGOLD – 3/22/2023) – Gold remained surprisingly subdued in early trading despite a breakdown in negotiations on the debt ceiling and Fed chair Powell’s hint that a rate pause was forthcoming. It is down $2 at $1978. Silver is down 3¢ at $23.90.

In a recent client update, Swiss-based UBS points out that, despite gold’s choppy trading of late, it is still 8.2% higher on the year and predicts “it’s likely to break its all-time high later this year with multiple mid-to-longer-term drivers.” Those drivers include “robust” central bank demand, “broad” US dollar weakness, and recession-related safe-haven flows. It sees gold hitting $2100 by year-end and $2200 by March 2024. “The direction of a weakening dollar is clear,” it states, “with the US Fed having signaled a pause in its current tightening cycle after 500 basis points of rate hikes over the past 14 months. Other major central banks, meanwhile, remain on track to do more to fight inflation.”

Daily Gold Market Report

Gold attempts to gain traction as we close out a less-than-stellar week

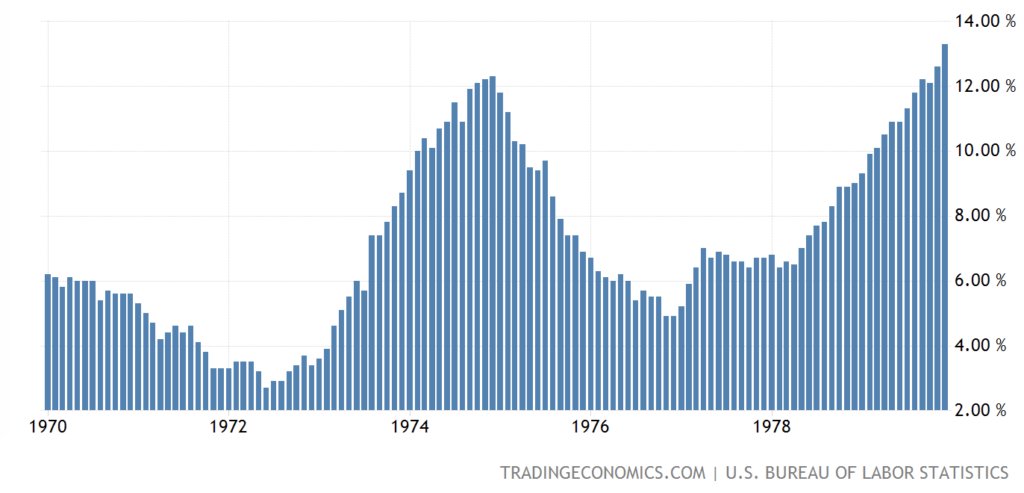

Bloomberg strategist: Current inflation lull perfect opportunity to load up on inflation hedges

(USAGOLD – 5/19/2023) – Gold is attempting to gain traction this morning as we close out what’s been a less-than-stellar week. It is up $7 at $1967. Silver is up 9¢ at $23.67. Saxo Bank‘s Ole Hansen sees gold as “consolidating within its well-established uptrend.” The bank maintains its “bullish outlook,” he says, “with the biggest short-term challenge being the risk of long liquidation from momentum-focused hedge funds, a group of speculators that have been strong buyers in recent months.”

Bloomberg macro strategist Simon White believes “the current lull in inflation offers the perfect opportunity to take advantage of cheap inflation hedges before price growth starts to accelerate again.” He goes on to say that “the stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a ‘one-shot’ problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation. Inflation hedges that look cheap today thus won’t be cheap for very long.” [Source: Zero Hedge]

Headline inflation during the 1970s

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold drifts lower as debt ceiling concerns dissipate

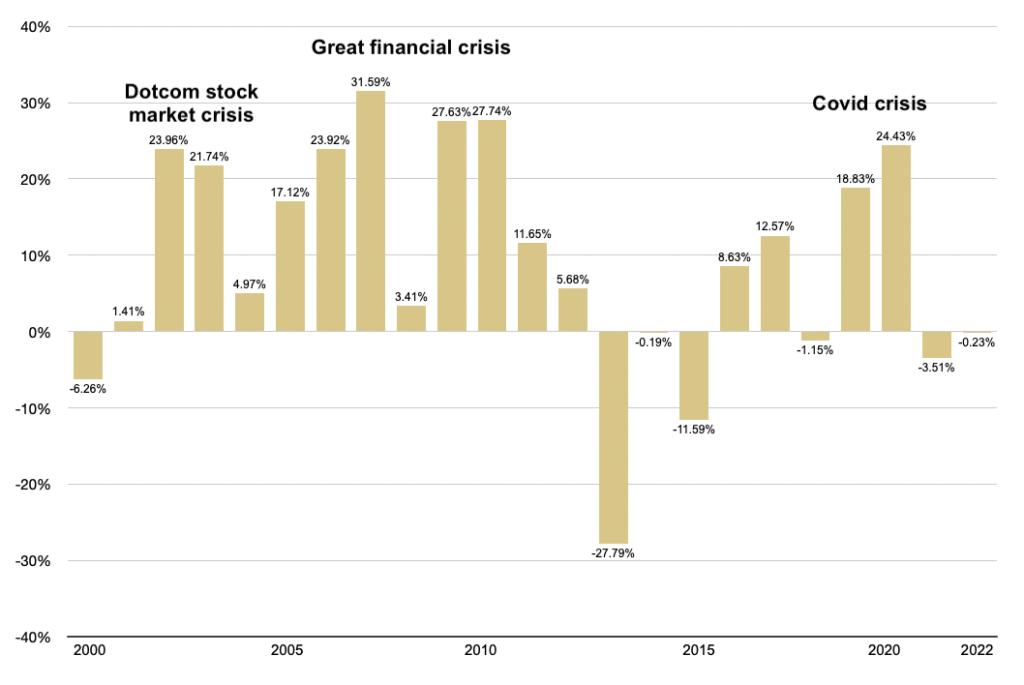

Grant calls Fed ‘the No. 1 problem in American finance.’

(USAGOLD – 5/18/2023) – Gold drifted lower this morning as debt ceiling concerns dissipated and rate uncertainty continued to hang like a dark cloud over financial markets. It is down $6 at $1977. Silver is down 22¢ at $23.60. James Grant, the editor of Grant’s Interest Rate Observer, believes the Fed is “problem No. 1 in American finance.” He says that the “past 10 or 12 years in respect to Fed policy and the general suppression of the rate of interest has sowed the seeds for the regional-banking problems, the debt drama, the debt ceiling.”

“I think that the basic idea of buying up bonds,” he told MarketWatch in an interview last week, “and thereby suppressing longer-dated interest rates in the hopes of generating rising asset prices and thereby stimulating the economy by dint of people spending the proceeds of their capital gains, this idea that the Bernanke Fed surfaced in 2010-11 I think it is a very, very dicey proposition longer term. I don’t think it work.” Grant says he has been identifying more things to sell than own in the present environment, but he remains bullish on gold.

Gold returns and financial crises

(2000-present)

Chart by USAGOLD [All Rights Reserved] • • • Data source: MacroTrends.net • • • Click to enlarge

Daily Gold Market Report

Gold continues to drift lower in aftermath to yesterday’s sharp sell-off

TD Securities thinks ‘selling exhaustion in precious metals could be imminent’

(USAGOLD – 5/17/2023) – Gold continued to drift lower in the aftermath of yesterday’s sharp sell-off driven primarily by less than accommodative Fed-speak and speculative selling once the metal broke below the $2000 level. It is down $6 at $1986.50. Silver is down 12¢ at $23.71. Investing.com says some called yesterday’s sell-off a “mini-crash” but contends gold’s upside “isn’t broken, but probably just chipped.” TD Securities found a positive in yesterday’s selloff. “Without an additional macro catalyst,” it says, “our positioning analytics highlight that selling exhaustion in precious metals could be imminent, barring a debt-ceiling catastrophe.…Gold prices are near all-time highs, but the positioning set-up remains inconsistent with a cycle peak.” [Source: FXStreet.com]

Daily Gold Market Report

Gold tracks to downside, hovers just above $2000 level

Dominant triple top pattern on gold chart a positive indicator, says Invezz

(USAGOLD – 5/16/2023) – Gold is tracking to the downside this morning and hovering just above the $2000 level. It is down $12 at $2007. Silver is down 32¢ at $23.86. “The $2,000 level,” says Saxo Bank, “remains supportive as two stabs at that price over the last seven trading days saw support coming in above that psychological level, but a backup in yields [is] holding traders back from leading an assault on the all-time highs of 2,075…” Invezz sees the triple top that dominates the five-year gold chart as a positive indicator. “Triple tops are reversal patterns,” it says, “but technical traders know that they rarely hold in the long term. Even if the market retraces from the current levels, it usually only does so to ‘build energy’ to break the horizontal resistance. All in all, gold looks bullish in this context. Bulls will likely buy any dips.”

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold inches higher in subdued trading as unresolved issues hang over markets

Researchers predict launch of new commodities supercycle, ‘very bullish’ on gold and silver

USAGOLD – 5/15/2023) – Gold inched higher in subdued trading this morning as a number of unresolved issues hung over financial markets. It is up $3 at $2016.50. Silver is level at $24.04. Capitalight Research’s Tom Brady and Chantelle Schieven believe we are headed for the boom phase of a new commodity supercycle that could last 10 to 20 years. Gold and silver, they show, have tracked supercycle booms in the past [Please see chart], and, as a result, they are “very bullish” on both metals over the long run.

“It is interesting to note,” they write, “that silver and gold prices appear to have increasingly trended in similar patterns to those of the industrial metals, particularly since President Nixon eliminated the backing of the US dollar with gold in 1971. Closing the gold window thus removed a very large non-industrial buyer of gold. Under the gold standard system, government could be counted upon to purchase mine production en masse at set prices, regardless of industrial growth or decline in any particular moment. Silver, with its broadening industrial demand, has been ~75% correlated with the Industrial Metals Index.” [Source: The Alchemist]

Gold, silver, and producer price index industrial metals

(1925 to present, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge