Author Archives: Daily Market Report

Daily Gold Market Report

Gold turns higher on shifting rate sentiment

Poszar: Gold back as a ‘theme’ as global ‘monetary divorce’ from the dollar gathers pace

(USAGOLD – 7/18/2023) – Gold turned higher this morning on continued dollar weakness and a general feeling that the Fed’s tightening campaign is nearing an end. It is up $9 at $1966. Silver is up 7¢ at $24.95. Treasury Secretary Yellen added to the shifting sentiment by saying yesterday that a cooling labor market was imposing disinflationary pressures on the economy.

Zoltan Poszar, the widely-followed ex-Credit Suisse analyst, told Bloomberg over the weekend that the global financial system is now engaged in a “monetary divorce” from the US dollar. “You know, these topics: de-dollarization, the re-monetization of gold, using central bank digital currencies to build out, to knit out a de novo financial system, you know, the petroyuan and the renminbi invoicing of commodities and traded goods going forward,” he explains.

And how will gold fare under such circumstances? “Gold,” he says, “is definitely something that’s coming back as a theme… we are seeing this more and more in the data that especially the countries that are not geopolitically aligned to the US are shunning Treasuries and shunning the dollar and they are buying gold instead.”

Daily Gold Market Report

Gold is off to a quiet start after last week’s strong showing

MarketWatch’s Arends says a portfolio that owns gold performs better than one that doesn’t

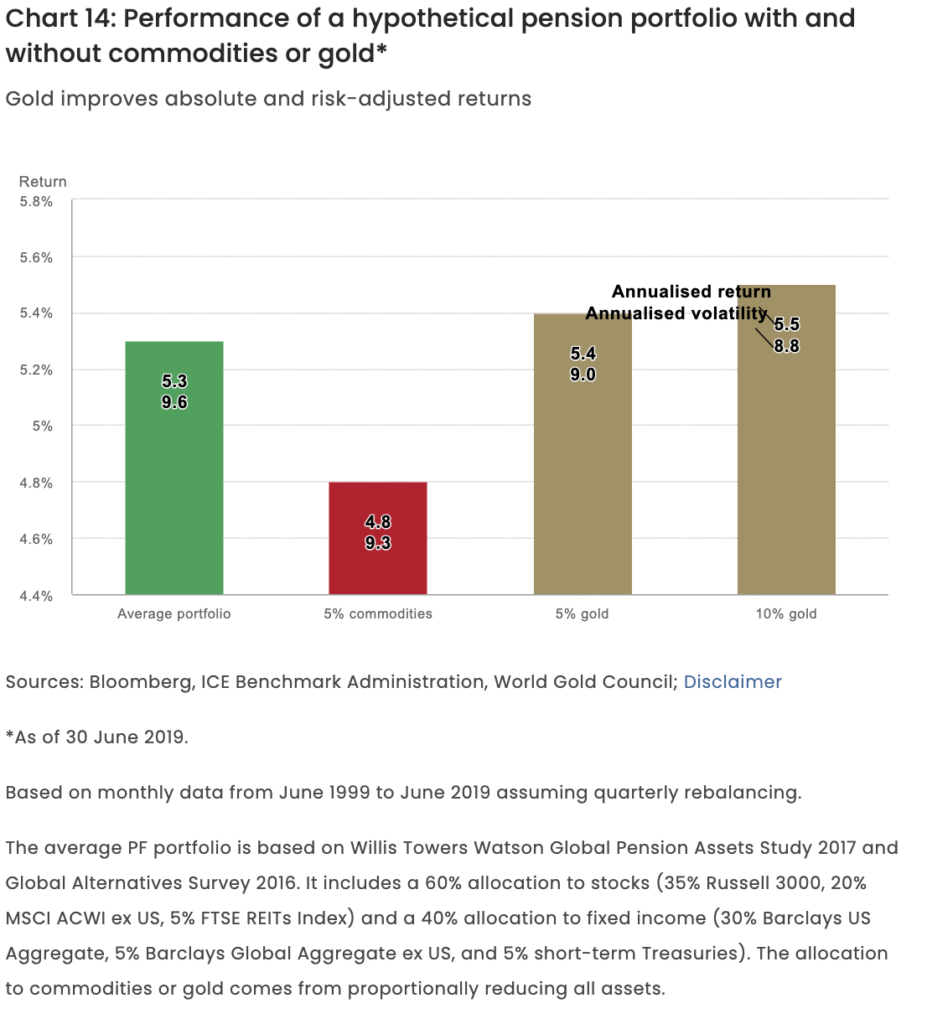

(USAGOLD – 7/17/2023) – Gold is off to a quiet start after last week’s strong showing. It is up $2.50 at $1960.50. Silver is down 12¢ at $24.91. MarketWatch columnist Brett Arends says that so far this year, you would have been better off in a portfolio that included a 10% gold diversification than one that didn’t. Moreover, it has outperformed the traditional 60/40 portfolio consistently for a very long time. He goes on to say that it isn’t so much that gold is a “great long-term investment on its own” but that it tends to do well when stocks and bonds don’t.

“The first thing is that over the past century,” he says in a recent column, “including some gold in your portfolio alongside stocks and bonds has genuinely added value. It has produced higher average returns, less volatility and fewer of those disastrous ‘lost decades’ where your portfolio ended up whistling Dixie.… The portfolio including 10% gold has beaten the traditional 60/40 by an average of 0.4 percentage point a year since President Richard Nixon finally killed the gold standard in 1971.”

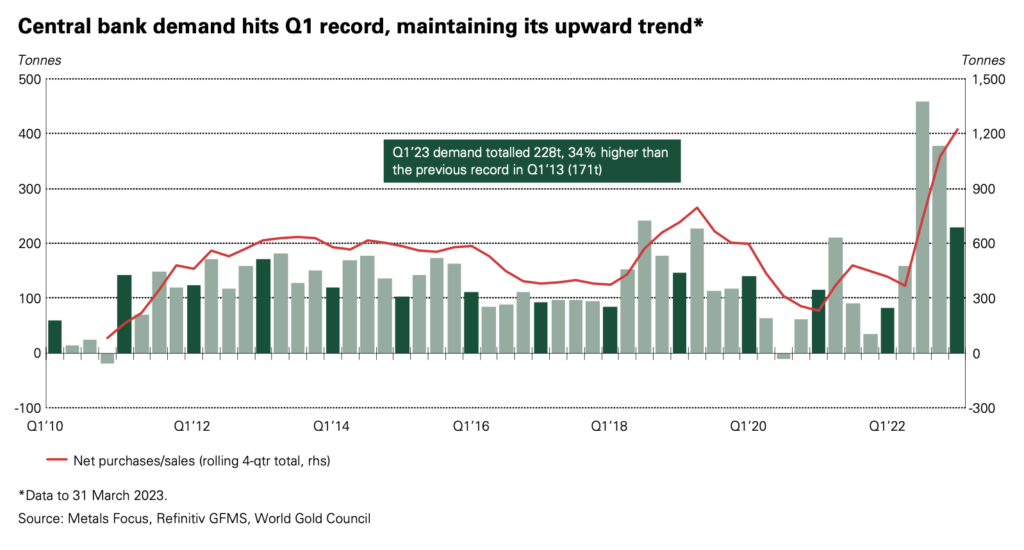

Chart courtesy of the World Gold Council

Daily Gold Market Report

No DGMR today through Friday. Back Monday. Below is yesterday’s report.

Golf trades to the upside in advance of tomorrow’s inflation report

Kentucky farmer unearths valuable hoard of US gold coins

(USAGOLD – 7/11/2023) – Gold is trading to the upside this morning before tomorrow’s inflation report. It is up $11 at $1939. Silver is up 9¢ at $23.26.Trading Economics puts the consensus expectation at 3.1% following May’s 4% reading. Core inflation is expected to come in at 5%, and that is the number that has policymakers worried. May’s reading was 5.2%. One very lucky Kentucky farmer recently unearthed a valuable hoard of 700 Civil War-era gold coins in his cornfield. Though the hoard has not been precisely valued, it includes eighteen 1863 $20 Liberty gold coins that could be worth as much as $100,000 each at auction. “The man whose name and location have not been revealed,” reports the National Post, “can be heard on a short video breathlessly exclaiming ‘this is the most insane thing ever,’ while digging the coins out of the dirt.”

Daily Gold Market Report

Gold drifts sideways ahead of Wednesday’s inflation report

increased number of countries repatriate gold from London vaults

(USAGOLD – 7/10/2023) – Gold is drifting sideways ahead of Wednesday’s inflation report with a significant drop in the headline number from 4% to 3.1% the consensus expectation. It is down $1 at $1926.50. Silver is down 3¢ at $23.13. An Invesco survey of central banks and sovereign wealth funds finds that an increased number of countries are repatriating gold from London vaults and other storage facilities, according to a Reuters report posted yesterday.

Invesco found that two developments over the past year triggered the shift – sanctions on Russia’s gold and currency reserves and a belief that “inflation in the coming decade will be higher than in the last.” Of the 85 sovereign wealth funds and 57 central banks surveyed, 68% said they were keeping their reserves at home compared to 50% in 2020.” Gold repatriation removes bullion from the leasing pool, which has acted as a drag on the gold price in the past. “We did have it held in London,” said one central banker, “but now we’ve transferred it back to [our] own country to hold as a safe haven asset and to keep it safe.”

Daily Gold Market Report

Gold inches higher ahead of today’s all-important unemployment, payrolls numbers

Goehring & Rozencwajg sets long-term price target for gold at $12,000 to $15,000 (!!)

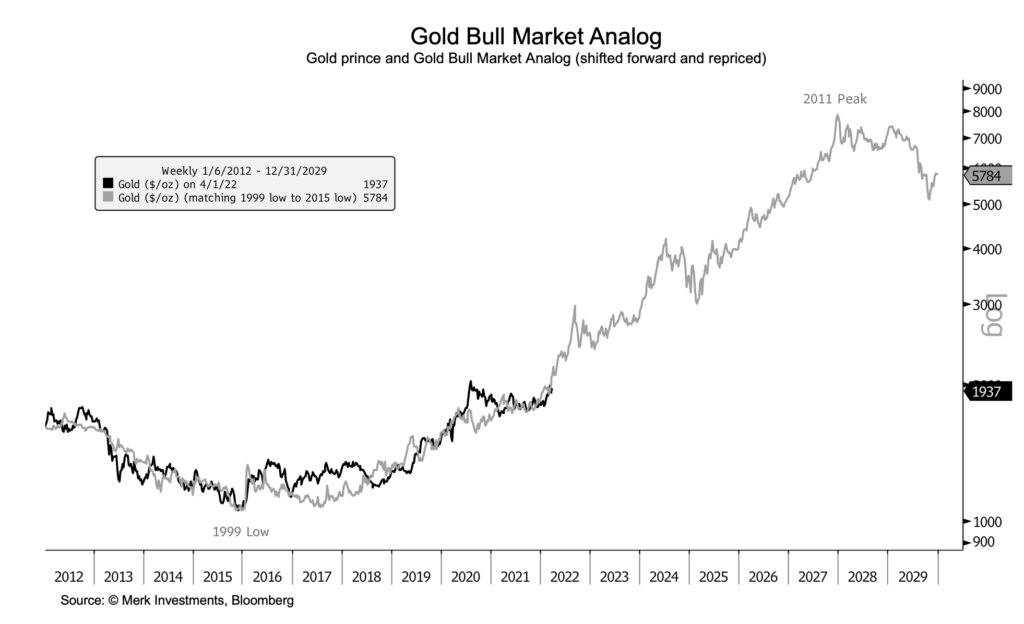

(USAGOLD – 7/7/2023) – Gold inched higher in early trading ahead of today’s all-important unemployment and payrolls numbers. It is up $6 at $1919.50. Silver is up 4¢ at $22.79. The bond market continued its plunge, with yields surpassing critical upside levels – 4% on the 10-year and 5% on the two-year. Goehring & Rozencwajg, the natural resource investment firm, caught our attention recently with a long-term gold price target of $12,000 to $15,000 an ounce. It’s been out of the gold market over the last two years, it says, but now it is getting back in.

“We think that gold has entered into a new phase of this bull market,” says Adam Rozencwajg in a recent interview. “It probably started in the third and fourth quarter of last year, and it really revolves around central banks’ behavior as much as anything else. I think it’s going to propel gold much much higher in this leg of the bull market.” As for the ultra-high price target, Rozencwajg says, “That’s always been our long-term price forecast on gold.”

Chart courtesy of Merk Investments • • • Click to enlarge

Daily Gold Market Report

Gold looks to solidify support just above the $1900 level

New survey shows Millenials have discovered gold

(USAGOLD – 7/6/2023) – Gold is moderately higher this morning as it looks to solidify support just above the $1900 level. It is up $12 at $1929.50. Silver is up 10¢ at $23.31. It could be a seesaw day in markets as traders brace for tomorrow’s unemployment and payrolls numbers. A recent State Street Global Advisors survey offers some insights into investor participation in the gold market.

“The study,” reports Vettafy, “includes more than 1,000 investors with at least $250,000 in investable assets. It showed a fifth of those own some type of gold exposure at an average of 14% of their portfolio. Just under half of those investors have gold exposure through ETFs. And a slight majority maintain exposure through physically holding the metal or owning gold mining stocks. Notably, 17% of Millennials surveyed had gold in their portfolios compared to 10% of Generation X and Baby Boomer respondents..… Nearly seven in 10 investors in the survey said they hold gold as a hedge against inflation and economic downturns.”

Daily Gold Market Report

Gold stuck in rangebound trading

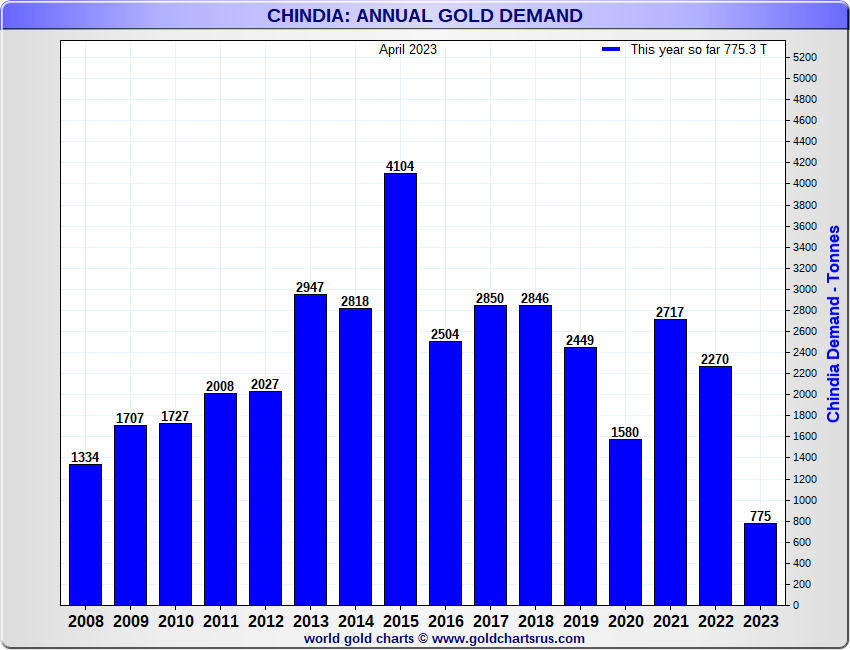

China and India account for 50% of annual gold demand

(USAGOLD – 7/5/2023) – Gold is marginally higher in quiet, rangebound trading, still dominated by rate and inflation concerns. It is up $3 at $1930. Silver is down 13¢ at $22.89. The “Great Gold Migration” from West to East has been a foundational element in gold’s strong showing over the past several years. Asia’s share of annual global demand has gone from 45% to 60% over the past three decades. China and India, the two largest consumers of physical gold, now account for almost 50% of global demand.

“The steady eastward migration of gold over the last three decades,” says Eric Gozenput in an article published last week at Value Walk, “underlines Asia’s growing economic prowess and its long-held belief in gold as an unwavering store of value. As the world moves into an increasingly uncertain future, this trend serves as a valuable lesson in financial resilience and the timeless value of gold.”

Chart note: According to the World Gold Council, the gold supply was 4,755 tonnes in 2022. Mine production was 3,612 tonnes.

Daily Gold Market Report

Gold marginally lower as we close first half and head into the long holiday break

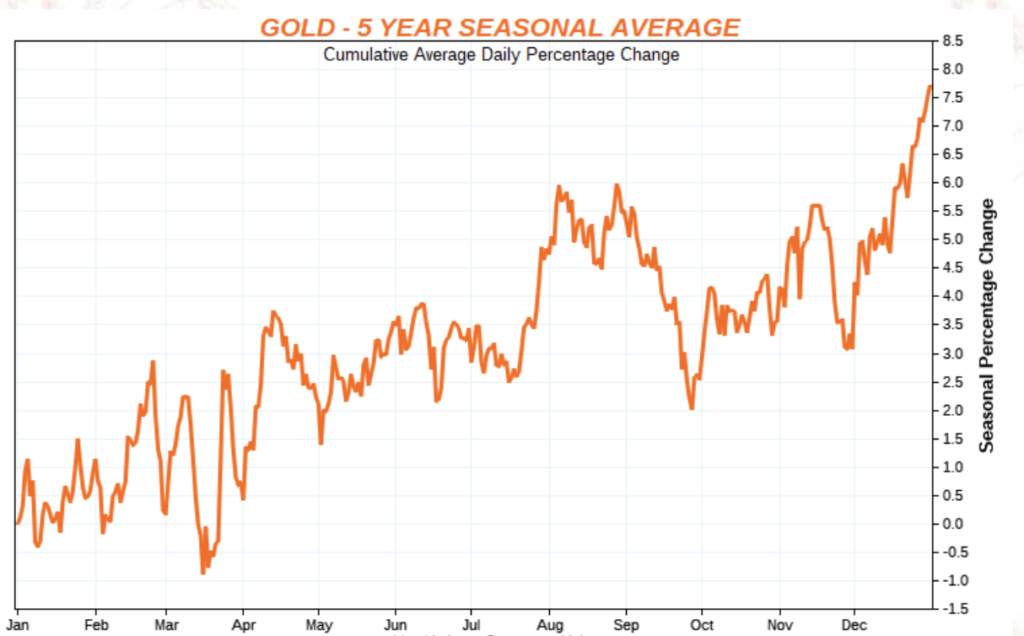

Lundin says we are fully into the seasonal doldrum of the metals

(USAGOLD 6/30/2023) – Gold is marginally lower as we head into a long holiday break. It is down $3 at $1907. Silver is up 17¢ at $22.48. The first half of the year has been a hard grind for gold, but it still managed to post a respectable 5.7% gain. Silver, always the more volatile of the two headline precious metals, was down 5.7%. Gold Newsletter’s Brien Lundin says, “we are fully into the seasonal doldrums for metals” with “much of the investing world on vacation or thinking about it.”

“Simply put,” he continues in an analysis released yesterday, “the only thing moving the gold market right now, or any other market for that matter, has been Fed rhetoric and actions. The expected pause in their June meeting had little lingering effect on gold, thanks to Powell and his compatriots ramping up the hawkish talk at that meeting and in the days since. In addition to that and the summer-time slowdown, we also have the deteriorating technical picture and the magnetic effect of the $1,900 price level.”

Chart courtesy of GoldChartsRUs

Daily Market Report

Gold marginally higher in lackluster summertime trading

Saxo Bank maintains a bullish outlook for the long run; sees headwinds short-term

(USAGOLD –6/29/2023) – Gold tracked marginally higher this morning in lackluster summertime trading. It is up $3 at $1913. Silver is up 17¢ at $22.93. Saxo Bank’s Ole Hansen says that though the short-term outlook for gold “remains challenged by the Fed’s prolonged battle with inflation,” it still has a bullish outlook for the longer tierm driven by a number of expectations – renewed dollar weakness, an eventual peak in interest rates, continued strong central bank demand, sticky inflation, and geopolitical tensions.

“On three earlier occasions during the past two decades,” Hansen points out in a detailed analysis released this morning, “a peak in US Fed funds rate supported a strong gold rally in the months and quarters that followed (See chart below), but with the timing of such a peak being postponed, short-term demand for ‘paper’ gold through ETFs and futures have suffered.… Total holdings in bullion-backed ETFs have seen a 42 tons reduction during the past month to 2888 tons, leaving it just 33 tons above a three-year low that was reached just before the March banking crisis triggered strong demand for havens, especially gold.”

Fed funds rate and gold price

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold pushes toward $1900 as recession worries fade

City Index: Market ‘technically driven with bears booking profits’

(USAGOLD – 6/28/2023) – Gold continued to push toward the $1900 mark as recession worries went into retreat and markets digested the prospect of more rate hikes moving into the second half of the year. It is down $7.50 at $1908.50. Silver is down 27¢ at $22.66. City Index’s Matt Simpson told Reuters this morning that “strong economic data strengthened the dollar and sent gold back towards its June low.” Current pricing, he says, appears to be “technically driven with bears booking profits.”

Daily Gold Market Report

Gold turns to the upside in quiet summertime trading

‘Where did all the silver go?’

(USAGOLD – 6/27/2023) – Gold turned to the upside in quiet summertime trading this morning as the prospect of more aggressive rate policies overseas weighed on dollar sentiment. It is up $5 at $1930. Silver is up 11¢ at $22.97. Pointing to record declines in silver vaulted in both London and New York, Wisdom Tree asks: Where did all the silver go? Then answers: To “retail dominated markets.”

“Despite initial enthusiasm for the metal among both investor segments (institutions and retail investors) immediately after the Ukraine war,” says the Dublin-based investment firm, “investment became bifurcated as the year progressed. Investment in bar and coin (net physical investment ex-exchange-traded product (ETP)), which was mainly retail investment, rose to new highs of 332.9 million ounces (10,356t), a 22% rise over the year and the fifth consecutive year of gain. In sharp contrast, ETPs saw their largest net outflows since 2011, down 11% year-on-year. Silver ETP investing is still very much driven by the institutional community.”

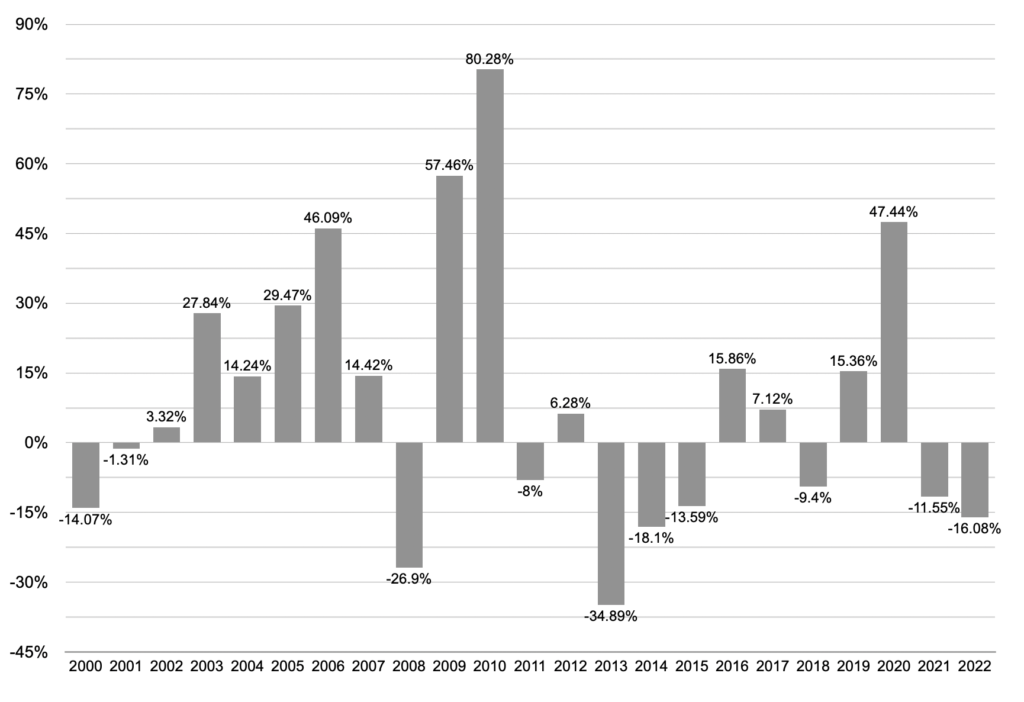

Silver annual returns

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge

Daily Gold Market Report

Gold tracks higher attempting to establish technical support above the $1900 mark

Societe General says gold could appreciate by end of the year in ‘lumpy moves’

(USAGOLD – 6/26/2023) – Gold is tracking higher as it attempts to establish technical support above the $1900 mark. It is up $11 at $1934. Silver is up 37¢ at $22.88. Societe General has a positive prognosis for the gold market as outlined in its recently published Commodities Outlook concluding that gold’s rally is “not over yet.”

“…[With] the low-hanging fruit in the inflation fight already picked,” it says, “our strategists’ anticipation is that the gold market will have to price in higher forward CPI projections. As a result, gold could appreciate by the end of the year in lumpy moves as the market adjusts its forward inflation expectations with the macro newsflow. As an additional driver, in a scenario of moderating US rates, USD might weaken, which could buoy gold. Our strategists see all of this unfolding against the broader, intact theme of central banks diversifying their holdings away from fiat currencies, notably the USD, into gold.”

Daily Gold Market Report

Gold turns to the upside as speculative selling takes a breather

Gold is down 2% on the week, but up 5.1% on the year

(USAGOLD – 6/23/2023) – Gold turned to the upside as speculative selling from the rate-cut trade appeared to be taking a breather – at least in the early going. Gold is up $6 at $1922. Silver is up 16¢ at $22.45. Gold is down 2% on the week, and silver is down almost 6.5%. To put the price picture in perspective, gold year to date is up 5.1% (after all is said and done), and silver, the more volatile of the two metals, is down 6.6%.

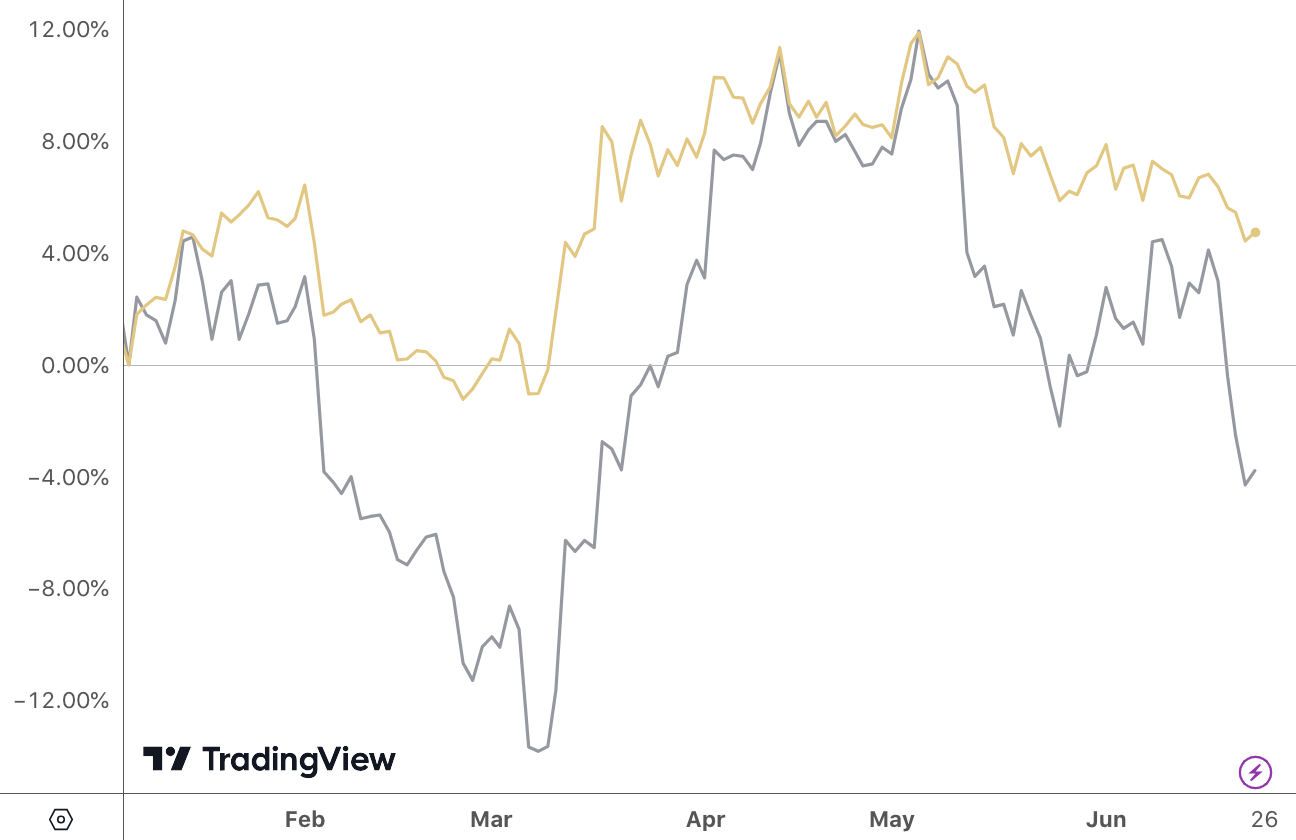

Gold and silver price performance

(%, year to date)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold marginally lower as summertime lull remains in full force

‘Gold’s price action less of an arrow and more of a feather’ – Ross Norman

(USAGOLD – 6/22/2023) – Gold is marginally lower this morning as markets continued to weigh the direction of Fed policy, and the summertime lull remained in full force. It is down $3 at $1931. Silver is down 2¢ at $22.70. Metals Daily’s Ross Norman offered an apt description of the current market in this morning’s Reuters gold report: “Gold’s price action is less of an arrow and more of a feather as it responds negatively to the latest hawkish tones coming from the Fed.” MKS Pamp’s Nicky Shiels told Ktco News yesterday that “[gold’s] been in no-man’s-land for too long, and the news cycle is simply slow, which usually implies a rerating lower in the near term.” She blames “predatory shorts” who entered after the last week’s strong housing report for gold’s recent $30 decline.

Daily Gold Market Report

Gold drifts sideways in quiet summertime trading ahead of Powell testimony

UBS sees upside potential for gold to $2100 by year-end despite recent headwinds

(USAGOLD – 6/21/2023) – Gold drifted sideways in quiet summertime trading ahead of Fed chairman Powell’s Congressional testimony later this morning. It is down $2 at $1936.50. Silver is down 10¢ at $23.11. Few expect much deviation from the post-FOMC meeting stance. Despite headwinds in the gold market of late including a 71-tonne reduction in central bank gold reserves in April (as reported by the IMF), UBS still sees upside potential for gold to $2,100 by year-end and $2,250 by mid-2024.

“Central bank demand for gold,” says the Swiss bank in a recent market update, “should remain healthy, despite the recent decline. The decline in official holdings reported by the IMF does not reflect a reduction in enthusiasm for gold among central bankers, in our view. The Turkish central bank was reported as the major seller, but the World Gold Council believes these sales were due to local dynamics rather than a change in the central bank’s long-term strategy.”

Chart courtesy of the World Gold Council • • • Click to enlarge

Daily Gold Market Report

Gold up marginally as investors mull over a historical oddity

HedgeNordic cites gold’s 7.7% annual return since 1971

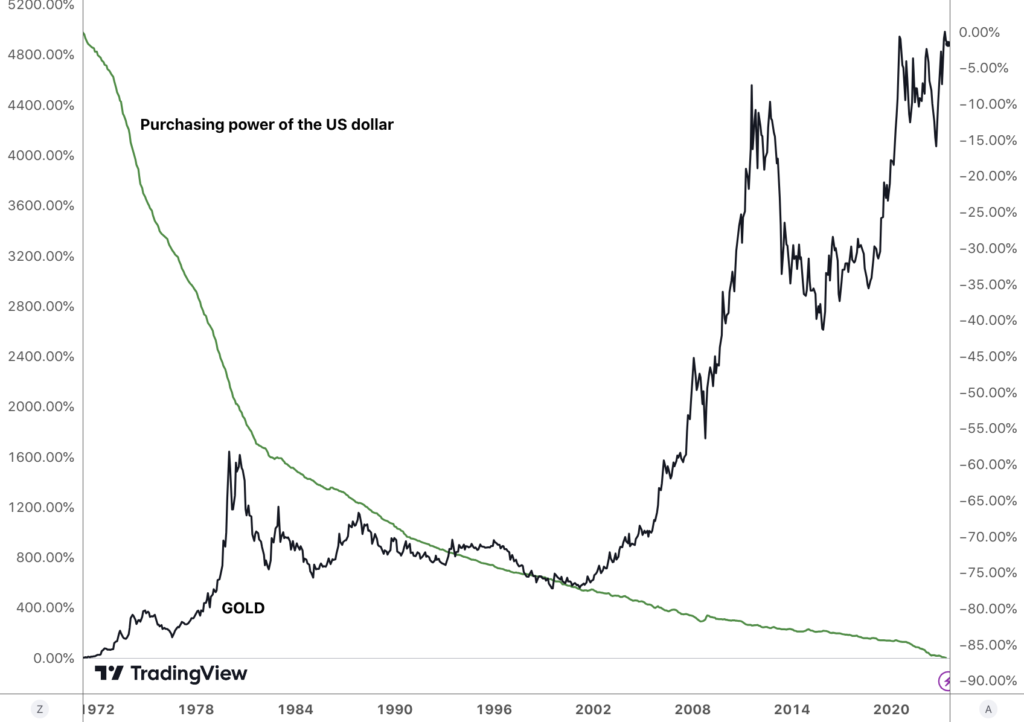

(USASGOLD – 6-20-2023) – Gold is up marginally this morning as investors mulled over the historical oddity of a Fed signaling higher rates to a financial community that believes it can’t or won’t follow through. It is up $3.50 at $1955. Silver is down 20¢ at $23.87. There is justification for the skepticism given the Fed’s long history of addressing crises with easy money policies – policies, Sweden’s HedgeNordic points out, that have undermined the purchasing of the dollar since 1971 and driven gold higher.

“Gold,” It says in a recently published advisory, “has delivered an annual return of about 7.7 percent in U.S. dollar terms since August 15, 1971, the day U.S. President Richard Nixon removed the U.S. dollar from the gold standard. Eric Strand, a precious metals specialist who manages the fund boutique AuAg Funds, offers a different perspective on this development. At an annual rate of 7.7 percent, ‘the U.S. dollar has experienced a cumulative devaluation of 97 percent relative to gold since the historic date of August 15, 1971.’ Strand considers gold as the unchanging benchmark and measures the development of fiat currencies in relation to gold.”

Gold and the purchasing power of the US dollar

(%, 1971 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold turns to the downside to start the week

Van Eck says ‘tail risks’ are driving the gold bull market that began in 2015

(USAGOLD – 6/19/2023) – Gold turned to the downside to start the week as markets pondered just what it was the Fed was trying to convey last week. It is down $8 at $1952. Silver is down 25¢ at $24.03. The Wall Street Journal’s Nick Timaraos challenged the Fed’s apparent indecisiveness with a straightforward question asked at the post-meeting press conference: “Chair Powell, what’s the value in pausing and signaling future hikes versus just hiking now?… Why not just rip off the Band-Aid and raise rates today?”

“Gold,” says Van Eck, the New York-based fund manager, “has been in a bull market for over seven years, rising 87% from its secular low in December 2015. However, unlike the steady and predictable bull market of the 2000s, this bull moves up, down and sideways in fits and turns that makes price targeting next to impossible. The main drivers of past gold bull markets are extraordinary tail risks and a falling dollar. We are living in an age of tail risks as the world goes through sickness, war, social disorder and financial stress that most people thought were relegated to the past. The level of tail risks today are at least as significant as past bull markets.”

Gold’s bull market trend since 2015

(After Van Eck’s chart published at the link below)

Chart courtesy of TradingView.com and Van Eck • • • Click to enlarge