Author Archives: Daily Market Report

Daily Gold Market Report

Retirement

USAGOLD’s founder and former chief executive officer, Michael J. Kosares will be retiring in full over the next few weeks. As such, the Recommended Headline News and Opinion page, as well as the monthly Top Ten Headlines email service will both go on a brief hiatus. We will also be using this time to retool our Daily Market Report service, as we work to build a cohesive and consistent cross-platform presentation of all of USAGOLD’s original market commentary, analysis and opinion-based content. Our plan is to re-introduce all these services simultaneously in mid to late September.

––––––––––––––––––––––––––––––––

Gold grinds lower on China concerns and the prospect of higher rates

Saxo Bank sees the carrying cost as keeping a liked on the metal’s short-term prospects

(USAGOLD – 8/15/2023) – Gold continued to grind lower this morning as concerns about China’s economy and further rate increases pressed on short-term prospects. It is down $4 at $1905.50. Silver is down 17¢ at $22.50. Saxo Bank’s Ole Hansen sees the high cost of carry as one of the chief headwinds keeping a lid on the metals’ short-term prospects. “It’s clear,” he says in an analysis posted late last week, “that the bulk of the increase from next to nothing back in 2021 to the current 5.8% has been driven by the rising funding cost of holding a position in gold.”

“Looking at correlations to other markets,” he adds, “the biggest input currently is coming from movements in the dollar, and the greenback has seen broad strength this past week supported by higher bond yields adding downside pressure to the Japanese yen while other Asian currencies have struggled amid the aforementioned weakness in Chinese economic data. Apart from dollar strength hurting sentiment, we continue to see asset managers and long-term investors reducing their exposure to gold through ETFs. Since the May peak that followed the March banking crisis, total holdings in ETFs have slumped by 109 tons to 2821 tons and the lowest since January 2000.”

Daily Gold Market Report

Gold level this morning as the summer grind continues

Market Herald’s Robertson sees gold in a win-win situation

(USAGOLD – 8/14/2023) – Gold is level this morning at $1916.50 in subdued, featureless trading. Silver is off 2¢ at $22.76. The slow summer grind continues. It has been a perplexing time for gold, with many of the verities that have propelled the price in the past stood on their head, but Market Herald’s Coreen Robertson looks at the probabilities ahead and sees gold in a win-win situation.

“It maybe doesn’t like it, maybe isn’t the most exciting, but [gold] does well in that unicorn scenario of growth with low inflation,” she says in an interview recently posted at Stockhouse. “The other option is that we get a recession right now. So the two sides of the spectrum for a while, we’ll just continue down the middle, which is where we’ve been forever, not knowing which way we’re going to go. But when we do eventually choose a path, it’s either going to be the unicorn or it’s going to be the recession. And as we discussed before, gold very reliably does well in a recession. So I kind of think that no matter what happens, gold is well supported either as part of a broad metals bull market or because investors buy it in a recession.”

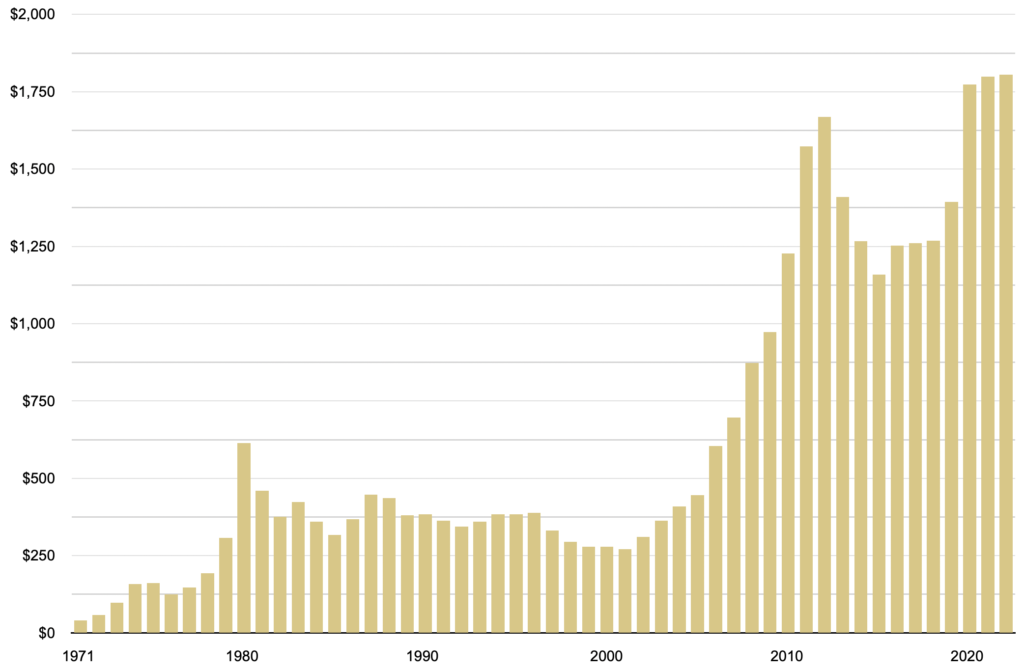

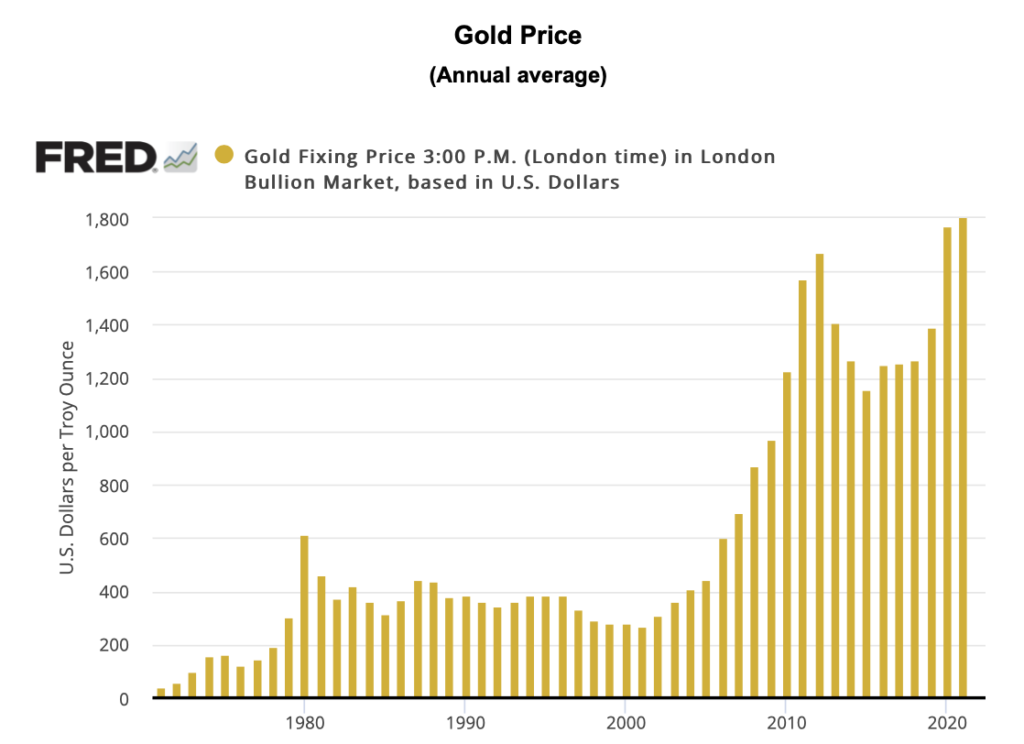

Average Gold Price

(1971-2022)

Chart by USAGOLD • • • Data source: Macrotrends.net

Daily Gold Market Report

Gold edges higher in quiet summertime trading

JPM forecasts $2175 gold price by year-end 2024, Poland buys more gold

(USAGOLD – 8/11/2023) – Gold edged higher in quiet summertime trading as yesterday’s benign inflation report failed to motivate traders and probably any real change of heart among Fed governors. Gold is up $6 at $1920.23. Silver is down 3¢ at $22.76. Since the June 1 beginning of the summer doldrums, gold is down 2.33%, and silver, always the more volatile of the two metals, is down 6.55%. JP Morgan weighed in on gold this morning. As reported by YahooFinance, it expects the metal to hit $2012 by the middle of next year and $2175 by year-end based mainly on a complete reversal of Fed policy from hiking to cutting rates and continued central bank stockpiling. Buttressing JPM’s call on central bank buying, Poland announced yesterday boosting its reserves by another 22.4 tonnes in July. Since January, it has added 72 tonnes to its holdings.

Gold and silver price performances

(Summer months, June 1, 2023 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold trades to the upside as markets await today’s consumer price report

Bloomberg says report will reveal a wave of disinflation

(USAGOLD – 8/10/2023) – Gold is trading to the upside this morning as the markets await today’s consumer price report. It is up $7.50 at $1924.50. Silver is up 18¢ at $22.88. Bloomberg economists say today’s numbers will reveal a wave of disinflation “driven mainly by the deteriorating economic landscape.” OCBC Forex strategist Christopher Wong told Reuters this morning that “Outlook for gold would regain shine when markets move in to price in greater probability of rate cuts and U.S. dollar softness. And this hinges on how entrenched the disinflation trend is.”

Market analyst James Hyerczk framed the inflation-gold–trader triangulation neatly in an overview posted at Forex Empire yesterday. “Navigating these waters teeming with unpredictability is challenging,” he says. “While certain Federal Reserve members hint at a cessation to the rate hikes, others postulate the necessity of more hikes to curb inflation. As all eyes turn to the imminent CPI revelation, gold and silver stand sentinel, mirroring the market’s faith, or the lack thereof, in the robustness of the economy.”

United States Inflation Rate

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold level as traders retreat to the sidelines ahead of tomorrow’s CPI report

‘Inflation is cooling, but prices are high, and Americans can feel it.’

(USAGOLD – 8/9/2023) – Gold is level this morning as traders took to the sidelines ahead of tomorrow’s pivotal inflation report. It is unchanged at $1928. Silver is down 8¢ at $22.78. According to Trading Economics, the consensus opinion is that CPI will come in at 4.1% annualized – down sharply from June’s 4.9%. Bloomberg ran a headline this morning that George Orwell might have appreciated: “Inflation is cooling, but prices are high, and Americans can feel it.”

China added gold to its national stockpile for the ninth straight month with analysts saying the PBOC is “just getting started,” according to a KitcoNews report. Similarly, the World Gold Council reports that gold bar and coin investment in the Middle East reached a ten-year high in the second quarter of 2023. Commerzbank says that gold needs rate hike expectations to “disappear” before it resumes its climb. The investment bank expects that to happen during the fourth quarter returning the metal to the $2000 level. [Source FXStreet]

Daily Gold Market Report

Gold drifts lower on sinking Chinese economy, caution ahead of inflation data

Mish Shedlock comments on favorable chart set-up for gold

(USAGOLD – 8/8/2023) – Gold drifted lower in early trading as China reported double-digit declines in both imports and exports, and investors took to the sidelines ahead of Thursday’s inflation data. It is down $11 at $1927. Silver is down 24¢ at $22.96. Mish Shedlock, the widely read editor of MIshTalk, recently had a few brief but supportive comments on the current technical set-up for gold. He says neither triple tops (like the one prominently displayed on the current gold chart) nor bottoms tend to hold. “If that view is correct,” he says, “gold is headed higher. Seasonally speaking, gold is heading into a favorable time of year. Finally, this has been a long 3-year consolidation period, with gold not too far from record highs.” He ends with some straightforward advice: “If you have faith in central banks, sell your gold. Otherwise, I suggest hanging on to it.”

Gold price

(Five year)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold trades cautiously to the downside ahead of inflation reports, bond sales

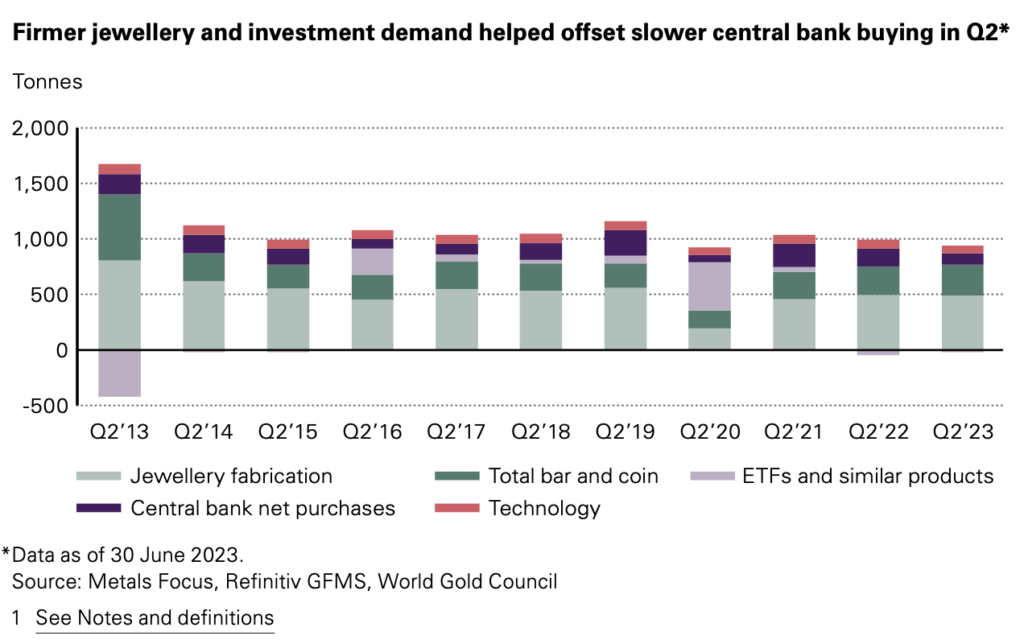

World Gold Council reports solid coin and bar demand for Q2-2023

(USAGOLD – 8/7/2023) – Gold is trading cautiously to the downside as it begins a week that includes the all-important consumer and wholesale inflation reports. It is down $7 at $1939. Silver is down 21¢ $23.50. Also on the agenda is a massive offering of Treasury notes and bonds, sure to be closely monitored by bond market participants.

The World Gold Council reports a net deceleration in central bank purchases during the second quarter (year over year) but a solid increase in bar and coin demand (+6%). Despite the decline in central bank demand from above-average in last year’s second quarter, WGC still sees it as “resolutely positive.” Total demand is up 7% over the same quarter last year.

Chart courtesy of the World Gold Council • • • Click to enlarge

Daily Gold Market Report

No DGMR today or tomorrow. Back Monday.

Below is yesterday’s report.

––––––––––––––––––––––––––––––––––

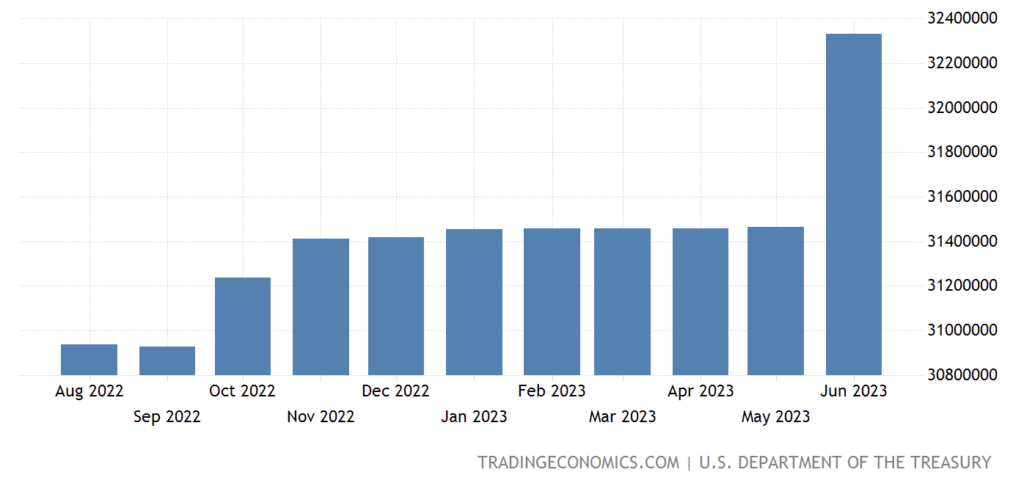

Gold marginally higher as Fitch downgrades US credit rating

Rating drop comes as the Treasury Department gears up for heavy debt issuance

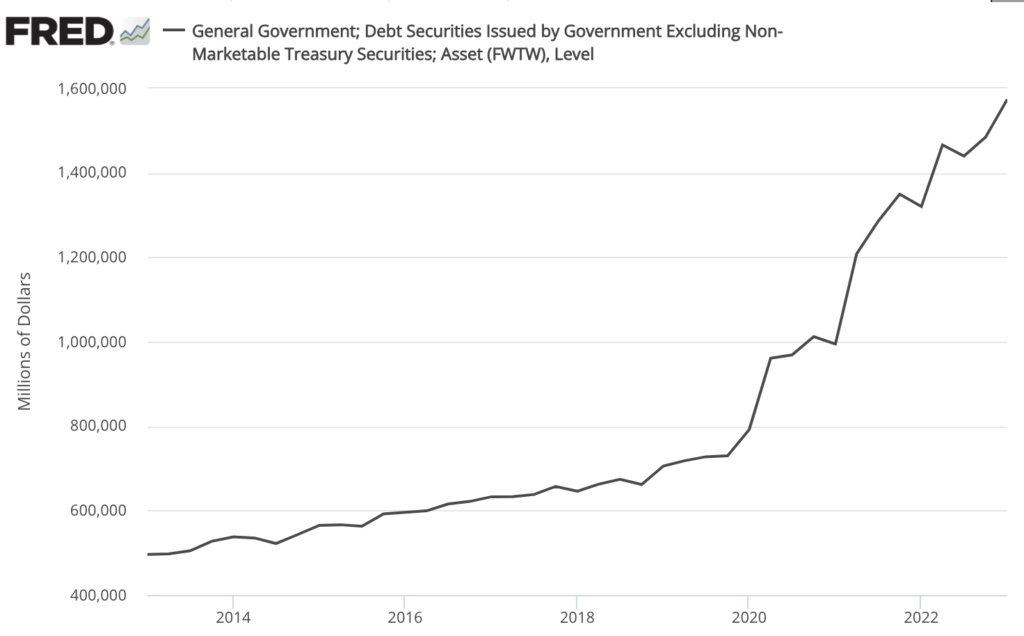

(USAGOLD – 8/2/2-23) – Gold was marginally higher in today’s early going as markets mulled over Fitch’s downgrade of US debt from AAA to AA+. The rating service cited tax cuts, greater fiscal spending, economic shocks, and continuing political gridlock as reasons for the rating demotion. Gold is up $2 at $1949. Silver is up 3¢ at $24.40. Fitch’s downgrade comes just as the Treasury Department gears up for a heavy debt issuance of $102 billion to replenish its coffers following the debt ceiling battle earlier this year. As shown in the chart below, the additions to the national debt in June were already notable.

“Last time S&P downgraded in 2011, the markets went nuts, although we are not seeing the same type of reaction in the early going, but things bear watching,” Marex analyst Edward Meir told CNBC this morning. Wells Fargo’s John LaForge told KitcoNews that “he expects growing debt in the U.S. to be a major bullish factor for gold that could support higher prices for at least the next three years.”

US Government Debt

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold down in lackluster trading pushed by stronger dollar

Credit Suisse sees new record high for later in year, then $2355

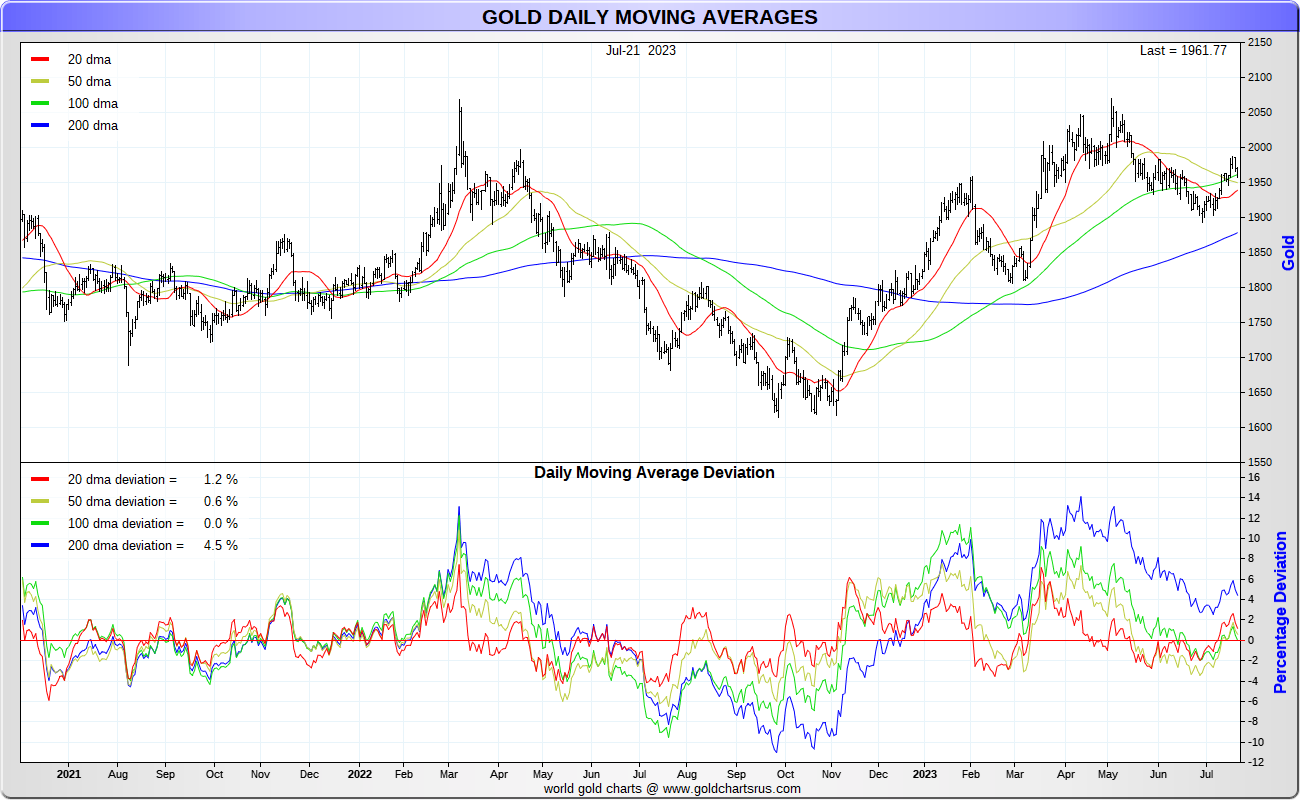

(USAGOLD – 8/1/2023) – Gold is down this morning in lackluster trading pushed for the most part by a stronger dollar. It is down $10 at $1957. Silver is down 29¢ at $24.54. Credit Swiss is not allowing the summer drag alter its bullish stance on the yellow metal.

“We maintain our long-held view,” it says in an advisory released yesterday, “for a major floor to be found the key rising 200-DMA of $1,883 and for an eventual retest of major resistance at the $2,063/2,075 record highs to be seen. We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move to $2,150 next, then $2,355/65.”

Chart by USAGOLD • • • Data source: Macrotrends. net

Daily Gold Market Report

Gold off to a slow start to begin the week

Morris finds relevance in central banks buying gold ‘out of choice’ not official dictate

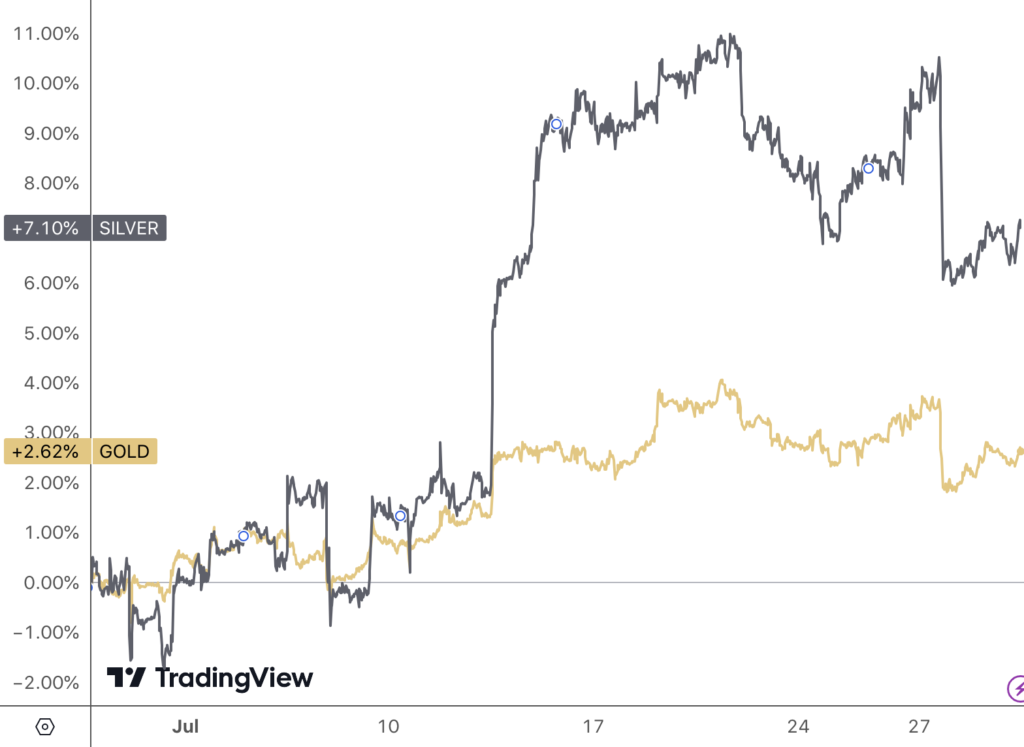

(USAGOLD – 7/31/2023) – Gold is off to a slow start to begin the week in sluggish summertime trading. It is level at $1961.50. Silver is up 5¢ at $24.46. On the month, gold is up 2.6% and silver is up a notable 7.1%. Charlie Morris, the UK-based financial analyst, offers an interesting take on the strong demand for gold among central banks.

“The remarkable thing,” says Charlie Morris in his most recent Atlas Pulse newsletter, “is that the gold standard withered in the 1970s, and other than the recent rumors surrounding a gold-backed BRICS currency, there has been no official need for central banks to own gold. They do so out of choice. It is remarkable how an informal gold standard of sorts is returning despite it being formally vanquished half a century ago. It means that gold is once again relevant despite that not being written down in the statute books.”

Gold and silver price performances

(%, July 2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold takes positive turn as Japan signals reversal of dovish monetary policy

‘The desire for gold is the most universal and deeply rooted commercial instinct of the human race.’

Gerald Loeb, Wall Street trader

(USAGOLD – 7/28/2023) – Gold took a positive turn this morning as Japan signaled it might begin reversing its dovish monetary policy – a move that surprised markets and sent the Japanese yen sharply higher in overseas markets. Gold is up $10 at $1959. Silver is up 19¢ at $29.39. “If inflation has indeed returned to Japan, which we believe it has,” says State Street’s Michael Metcalf, “the BoJ will find itself needing to raise rates just as hopes for interest rate cuts rise elsewhere. This should be a medium-term positive for the JPY [Japanese yen], which remains deeply undervalued.”

We came across this passage from a Dominic Frisby essay earlier this week and thought it worth passing along:

“The experience of beauty, whether derived from nature, art, music or even mathematics, correlates with activity in the emotional brain, the medial orbitofrontal cortex. Beauty has long been associated by philosophers with truth and purity – also qualities commonly associated with gold. Our instinct for gold and the emotions it inspires from beauty to desire are basic. There has not been a culture in history that did not appreciate the value of gold. It is a primal instinct. ‘The desire for gold,’ said Wall Street trader Gerald Loeb, ‘is the most universal and deeply rooted commercial instinct of the human race.’” [Source: MoneyWeek]

Daily Gold Market Report

Gold pushes higher in Fed aftermath

JPMorgan sees gold hitting ‘fresh records in 2024’

(USAGOLD – 7/27/2023) – Gold pushed higher in the aftermath of yesterday’s Fed hike and press conference. It is up $5 at $1978.50. Silver is up 13¢ at $25.12. The market reaction to yesterday’s events was generally subdued as Chairman Powell emphasized future decisions would be data-driven leaving market sentiment pretty much where it was prior to the meeting – up in the air and open to interpretation.

JP Morgan sees the Fed turning dovish by the second quarter of next year – a shift it believes will push gold to new record levels during 2024. “We’re in a very prime place,” says Greg Shearer, the firm’s director of commodities research, “where we think gold ownership and long allocation to gold and silver is something that acts as both a late cycle diversifier and something that will perform as we look to the next sort of 12, 18 months.… There is an eagerness here to really buy in and diversify allocation away from currencies.” [Source: Yahoo!Finance-Bloomberg]

Daily Gold Market Report

No DGMR today. Back tomorrow – 7/27/2023

Below is yesterday’s report

______________

Gold trades higher in run-up to Fed rate decision, press conference

Crescat predicts a powerful new wave of gold demand driven by a flood of government debt

(USAGOLD – 7/25/2023) – Gold is trading higher in the run-up to tomorrow’s Fed rate decision and press conference. It is up $7 at $1964. Silver is up 32¢ at $24.75. Crescat Capital’s Kevin Smith and Tavi Costa believe that the United States is immersed in a mounting debt problem that is weakening the dollar and creating an environment that will divert capital away from Treasuries and into gold.

“We believe a powerful new demand wave for gold is coming in the short term from both institutional and retail investors,” they say in a recent analysis posted at Zero Hedge. “In aggregate, global central banks are already ahead of the curve as they have been accumulating the monetary metal recently as a reserve asset in preference over USTs. Gold is a haven asset that can provide an inflation hedge while also offering strong absolute and relative real return potential in the stagflationary hard-landing environment that our models are now forecasting.”

Sources: St. Louis Federal Reserve [FRED], Board of Governors Federal Reserve

The new era of big government: Biden rewrites the rules of economic policy

Financial Times/Derek Brower, James Politi and Amanda Chu/7-11-2023

USAGOLD note: We do believe the fiscal madness unfolding in Washington will increase global gold demand, and ultimately translate to the price.

Daily Gold Market Report

Gold cautiously higher ahead of Wednesday’s rate decision

Ned Davis Research goes bullish on gold, bearish on US dollar

(USAGOLD) – 7/24/2023) – Gold is cautiously higher ahead of this week’s Fed meeting scheduled to culminate Wednesday with a rate decision and press conference. It is up $5 at $1969.50. Silver is up 4¢ at $24.73. Ned Davis Research recently downgraded the U.S. dollar from neutral to bearish, according to a Market Watch report late last week, and upgraded gold from neutral to bullish.

“When a global slowdown has been lacking,” says Tim Hayes, the firm’s chief global investment strategist, “the dollar has declined at a per annum rate of -1% whereas gold has gained 10% per annum…” Hayes points to an important technical indicator as further evidence of the changing dollar-gold scenario. In January, gold achieved “a golden cross, when its 50-day moving average rose above the index’s 200-day moving average, while the U.S. dollar saw a death cross.” Since the January crossover, gold is up 7.75%, and the US dollar index is down 2.2%.

Daily Gold Market Report

Gold moderately lower as investors brace for next week’s Fed policy meeting

Citibank says it only a matter of time until gold posts ‘fresh’ all-time highs

(USAGOLD – 7/21/2023) – Gold is moderately lower in quiet summertime trading as investors brace for next week’s Fed policy meeting. It is down $8 at $1964. Silver is down 3¢ at $24.79. A sharp drop in the Japanese yen (-1.1%) is not helping matters. Citibank is bullish on gold for the near term, according to a Bloomberg report published this morning, saying it has already benefited from loosening monetary policy, record inflows into ETFs, and increased asset allocation. As a result, it is only a matter of time, says the bank, until the metal posts “fresh” all-time highs. The report points out that prices for the metal have already posted new highs in every other G-10 and major emerging market currency this year. Silver, it says, will benefit from “demand for a store of wealth.”

Daily Gold Market Report

Gold nudges higher as traders remain cautious ahead of Fed

Wisdom Tree says gold could hit record high of $2500 over next twelve months

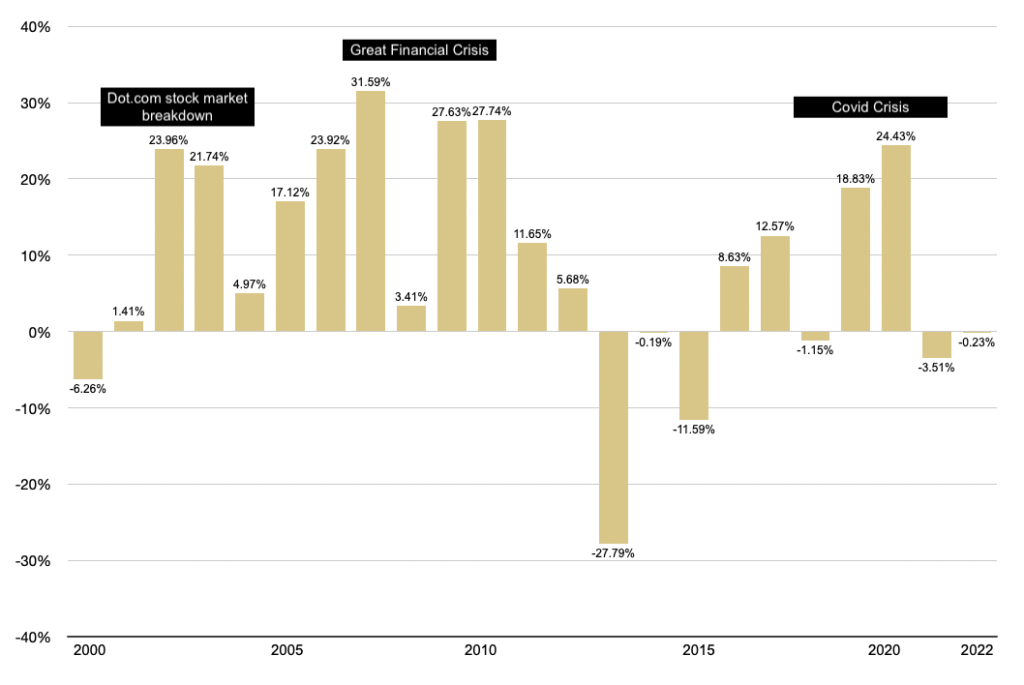

(USAGOLD – 7/20/2023) – Gold nudged higher this morning as traders remained cautious ahead of next week’s Fed rate decision. It is up $6 at $1984.50. Silver is up 7¢ at $25.27. “Chairman Powell’s press conference is the key focus,” Nationwide Life’s Kathy Bostjancic told Bloomberg this morning. “Powell and the FOMC have muddled their message to the markets. He has an opportunity to provide clearer guidance next week.” Wisdom Tree, the Dublin-based investment firm, says gold could hit a record high of $2500 per ounce within the next twelve months.

Citing the possibility of a recession as central banks continue to raise rates, Nitesh Shah, head of commodities trading at the firm, sees gold’s role as a portfolio safe haven coming into play. “Gold,” he says, “tends to perform well in times of economic stress.… [W]hen composite leading indicators turn strongly negative, gold performs positively while equities tend to be negative. Gold also outperforms Treasuries, which are seen as competing defensive assets.” [Source: TrustNet]

Gold percentage gains during times of economic stress

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge

Daily Gold Market Report

Gold down marginally as future Fed policy keeps traders on hold

Lundin says gold may be emerging from summertime lull ahead of schedule

(USAGOLD –7/19/2023) – Gold is down marginally in early trading as future Fed policy kept traders on hold. It is down $3 at $1978.50. Silver is up 3¢ at $ 25.16. Financial Times reports this morning that big banks are turning more bearish on the dollar as expectations of a soft landing grow. In keeping with that sentiment, Gold Newsletter’s Brien Lundin sees signs that “gold may be violating the typical seasonal trend by rallying ahead of schedule.”

“If seasonality were the only factor in play for gold,” he says, “I would expect gold to languish another couple of weeks or longer. But seasonal trends join a long list of other factors – for gold and every other asset class – in being overwhelmed by the influence of Federal Reserve monetary policy.… But a funny thing seems to be happening, right now, on the path to Powell & Co.’s next promised rate hikes. With inflation falling according to plan, the markets are looking beyond the central bankers’ next over-reaction via continued hikes and considering the big picture.”

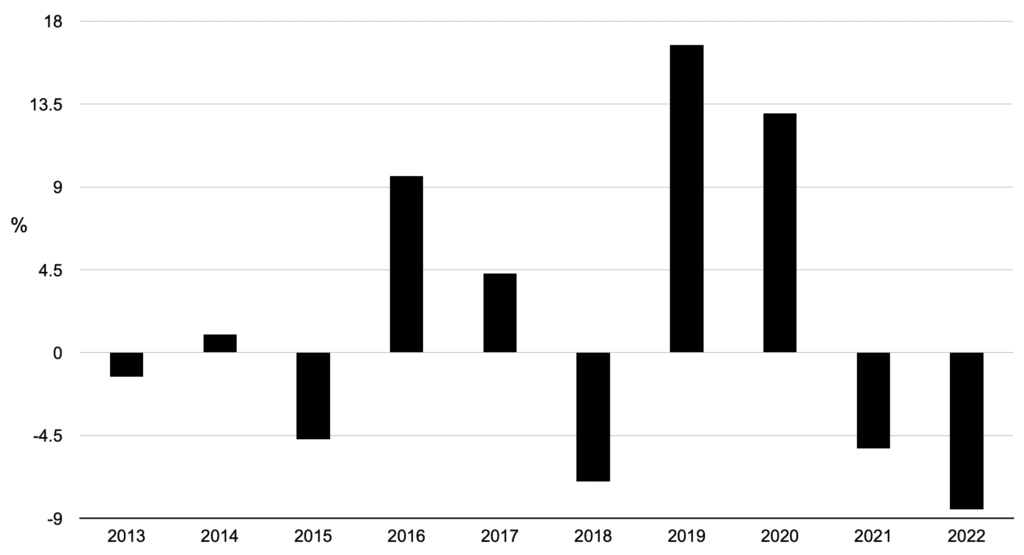

Editor’s note: Though summertime trading has a history of being sluggish, it doesn’t always mean the price will drop. Over the past decade, gold’s performance has been evenly split – five down years and five up years.

Gold’s price performance June through August

(2013-2022)

Chart by USAGOLD [All Rights Reserved]