The Daily Market Report: Gold Eases as Yellen Continues to Jawbone Rate Hike

25-Sep (USAGOLD) — Gold retreated modestly on Friday, retracing a portion of Thursday’s solid gains. However, the yellow metal appears poised to notch a second week of gains.

Gold was weighed somewhat after Fed chair Yellen said late on Thursday that a rate hike this year may still be appropriate. Equity investors were encouraged, seemingly believing that if the Fed still sees potential for tightening, the economy must be doing okay. The slight upgrade to Q2 GDP provided some additional credence to that scenario.

However, the economy appears to have slowed markedly in Q3. The Atlanta Fed’s GDPNow model projects the July-September quarter growth at just 1.4%. Those expectations, along with weak inflation, provides little incentive for the Fed to act.

In Japan, the economy contracted by 1.6% in Q2. While Japan is presently expected to avoid recession, growth is expected to be weak in Q3. Nonetheless, S&P downgraded Japan last week.

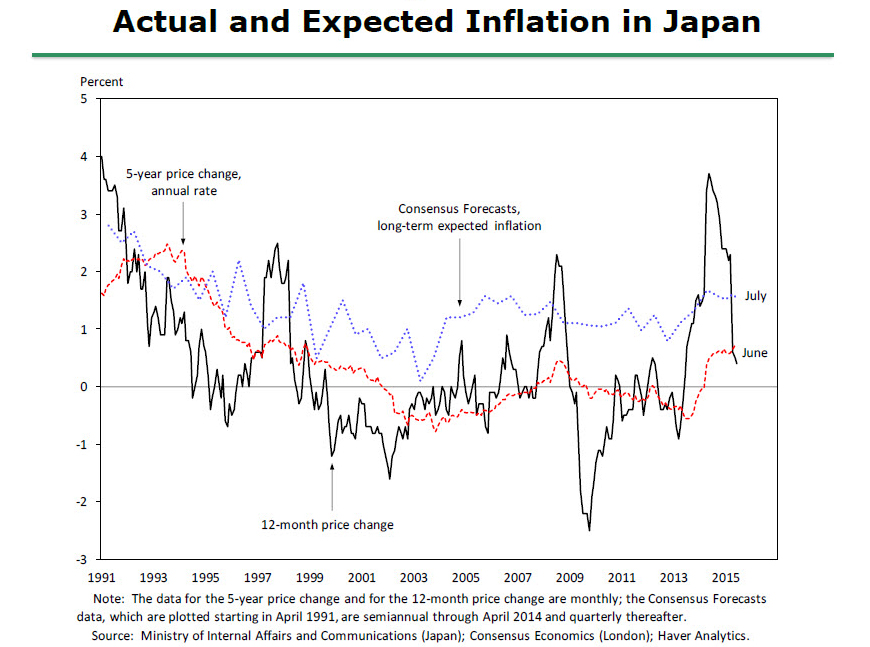

Today Japan announced that core inflation for August was -0.1%. That’s the first deflationary indication since April 2013 and comes after massive efforts on the part of the Abe government and the BoJ to stimulate both growth and inflation.

Clearly those efforts have failed thus far, but rather than write-off the Abenomics experiment, it’s time to double down again. Abe pledged to grow the economy by 20% to ¥600 trillion. “From today Abenomics is entering a new stage,” said Prime Minister Abe.

He didn’t say exactly what he meant by that, but presumably more quantitative and qualitative easing is in the offing. Analysts widely expected the BoJ to ease further before year-end, possibly as soon as October. Given that ZIRP, QE and QQE haven’t worked in successive previous efforts, surely it will work this time!

Circling back to the Fed, the Japanese experience has not gone unnoticed by Janet Yellen:

Figure 9

Yellen went on to say that “inflation may rise more slowly or rapidly than the Committee currently anticipates; should such a development occur, we would need to adjust the stance of policy in response.” There is certainly no indication at this juncture that inflation is going to rise faster than the FOMC anticipates, so one might expect a policy adjustment toward easing may be more likely.