Monthly Archives: July 2015

Shanghai Gold Exchange volume for the week ended July 24, 2015

31-Jul (Smaulgld) — Total gold withdrawals on the Shanghai Gold Exchange year to date are 1,410.56 tons.

Withdrawals on the Shanghai Gold Exchange are running 33% higher than last year.

Gold withdrawals on the Shanghai Gold Exchange the past two weeks were larger than the amount of gold delivered on COMEX during 2014 and greater than the amount of gold Germany has repatriated from the New York Fed since 2013.

[source]

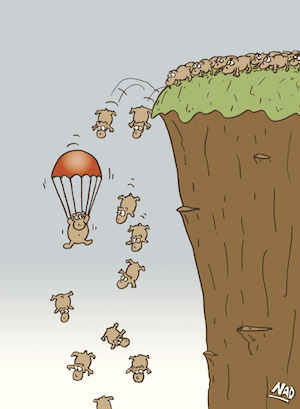

Who Really Benefits From Bailouts?

By Barry Ritholtz

31-Jul (BloombergView) — I always find it amusing whenever someone expresses surprise that the financial bailouts for Greece haven’t benefited Greek citizens. “Bailout Money Goes to Greece, Only to Flow Out Again” in the New York Times is just the latest example. “The cash exodus is a small piece of a bigger puzzle over why — despite two major international bailouts — the Greek economy is in worse shape and more deeply in debt.”

Unfortunately, this is a feature of bailout, not a bug.

A plethora of financial rescues during the past decades has proven quite convincingly that this isn’t an aberration. Follow the money instead of following the headlines. That’s how you learn who profits from a bailout.

Look around the world — Japan, Sweden, Brazil, Mexico, Ireland, the U.S. and now Greece to learn who is and isn’t helped by these enormous government-backed bailouts. No, it isn’t the Greek people, nor even their banks. They never were the intended beneficiaries of the bailouts, nor were Irish citizens in that bailout. Indeed, homeowners in the U.S. were little more that incidental recipients of aid as a percentage of total rescue spending.

You probably learned the phrase “moral hazard” during the financial crisis. In short, what it means is that the bailouts rescued leveraged, reckless speculators from the results of their unwise professional folly and gave them an incentive to do it all over again. They were and the intended rescuees.

[source]

PG View: Color me unsurprised.

The Daily Market Report: Gold Gains After ECI Miss Undermines September Rate Hike Expectations

31-Jul (USAGOLD) — Gold began the U.S. session somewhat defensive within the broad range that has dominated for the last two-weeks. However, the yellow metal rebounded sharply intraday after much weaker than expected employment cost data undermined the prospects for a September rate hike.

ECI rose a scant 0.16% in Q2, well below expectations of +0.6%. That’s the weakest quarterly rise in salary and wages on record. The annualized ECI rate slowed to +2.0% y/y, versus +2.6% in Q1.

Weakness in wages has been a persistent concern at the Fed and likely will figure into their decision whether to hike rates or not this year. At the press conference following the June FOMC meeting, Chair Yellen said, “There have been some tentative signs that wage growth is picking up. We’ve seen an increase in the growth rate of the (ECI).”

I don’t imagine she’d say anything like that today. In fact, today’s drop in yields and the dollar are reflective of diminished expectations that lift-off will occur in September. I remain skeptical that it will happen this year at all.

Gold was buoyed by the drop in the dollar, regaining the $1100 level intraday before gains moderated when Chicago PMI beat expectations. Then University of Michigan consumer sentiment was revised lower. As I suggested earlier in the week, given the unevenness of the “recovery,” the September FOMC meeting is going to be an interesting one.

A rate hike before year-end is anything but a sure-thing. As that become more apparent, unwinding of long dollar positions could accelerate. That’s going to put upward pressure on gold and put the squeeze on the shorts in the paper market.

Société Generale’s Albert Edwards warns that we’re hurtling toward an “even bigger version” of the 2007-2008 global financial crisis. He expects central banks to spool-up the printing presses yet again. “QE will be stepped up to such a pace that you will hear the roar of the printing presses from Mars,” said Edwards.

Gold is a “must-have” safe-haven investment according to Edwards. The time to get you safe-haven, your insurance, is before everyone else realizes they need it too. When it’s undervalued. Like gold is now.

University of Michigan sentiment (final) cut to 93.1 in Jul, below expectations of 94.0, vs 93.3 prelim and 96.1 in Jun.

US Chicago PMI rose to 54.7 in Jul, above expectations of 50.5, vs 49.4 in Jun.

Get ready to relive the 2008 crisis: Albert Edwards

30-Jul (CNBC) — Central banks in the Western world have set the scene for an “even bigger version” of the 2007-2008 global financial crisis, Societe Generale’s bearish strategist Albert Edwards has claimed.

In a research note on Thursday, Edwards said that China’s intervention to stabilize its volatile stock market was part of a larger global story, in which “rock bottom” interest rates and large fiscal deficits in the western world were pushing the global economy towards a fall.

“QE (quantitative easing) will be stepped up to such a pace that you will hear the roar of the printing presses from Mars,” Edwards said.

“I have not one scintilla of doubt that the western central banks have set us up for an even bigger version of the 2008 Great Financial Crisis.”

…Given his forecast step up in money-printing, Edwards said that gold, which tends to perform well during periods of high inflation, was a “must-have” safe-haven investment.

[source]

Russian central bank cuts key rate by 50 bps, as expected

31-Jul (Reuters) — Russia’s central bank cut its key interest rate by 50 basis points to 11 percent on Friday, slowing the pace of monetary easing compared with its earlier cuts this year.

The bank said in a statement on its website that despite a slight increase in inflation risks, the balance of risks was shifting towards a considerable cooling of the economy.

[source]

US Treasury yields fall on ECI miss

31-Jul (CNBC) — U.S. Treasury prices rose on Friday, the last trading day in July, after the second-quarter employment cost index missed expectations.

The yield on the benchmark 10-year Treasury notes, which moves inverse to the price, fell about 7 basis points to trade around 2.19 percent, after closing at 2.268 percent.

…U.S. wages and benefits grew in the spring at the slowest pace in 27 years, stark evidence that stronger hiring hasn’t boosted pay, according to the Associated Press.

The Labor Department said the employment cost index rose 0.2 percent in the second quarter after a 0.7 increase in the first quarter. Wages and salaries alone also rose 0.2 percent.

[source]

PG View: This certainly raises some doubts about a September rate hike. Lower yields are weighing on the dollar, which in turn has boosted gold, which is now up more than $11 on the day, and back above $1100.

Gold jumps as dollar and yields tumbles on ECI miss. Yellow metal now +$8 on the day and $18 off the intraday low.

US Q2 ECI +0.2%, below expectations of +0.6%, vs 0.7% in Q1; annualized rate drops to +2.0% from +2.6%.

Gold lower at 1083.50 (-5.49). Silver 14.60 (-0.134). Dollar easier. Euro higher. Stocks called lower. US 10yr 2.26% (unch).

What You’ve Heard About Gold and Interest Rates Is Dead Wrong

29-Jul (CaseyResearch) — If the Fed does raise rates in September, it will be for the first time since 2006.

Conventional wisdom says that rising rates are bad for gold. The argument goes that gold doesn’t generate income. So when interest rates rise, people prefer to own bonds and dividend-paying stocks instead of gold.

But it turns out that’s dead wrong. The price of gold actually goes up when the Fed raises rates.

HSBC’s Global Research team found that the price of gold has actually risen the last four times rate hikes began. A recent article by The Reformed Broker explained…

History shows that gold prices also fall leading into a rate hike and generally rise, though sometimes with a lag, after the first rate hike… Investors are apt to unload gold in anticipation of tightening monetary policies. This negative pressure is sustained until the Fed announces a rate hike, which then eases the negative sentiment towards the yellow-metal. This explains the subsequent rallies in gold that occurred shortly after the Fed announced the first rate hike in the last four tightening cycles.

This is an important finding. Most investors assume that higher rates will hurt gold. But the data shows that rate hikes have actually been good for gold in the recent past.

[source]

PG View: This is a topic we’ve covered in the past. With seemingly everyone still expecting the Fed to start its first tightening campaign in more than a decade sometime this year, perhaps gold owners should be looking forward to that day! And more importantly, taking advantage of the lower prices as paper gold owners fret over lift-off!

Confused about gold and the DJIA? Don’t be.

Thoughtful question from would-be gold owner/my answer

Michael,

I have been reviewing your web site and am impressed.

I currently have about $750,000 in cash, money market funds, equities and bonds. I am 74 and my wife is 72. We are both retired.The only fixed income we receive is $21,000 per year from social security, and $7,000 per year in bookkeeping fees earned by my wife. Our living expenses are about $75,000 per year leaving us a shortfall of about $36,000 per year. Our total net worth is about $2,200,000 (home is $1,500,000 of that).

When I read your article Choosing a Gold Firm about 3 weeks ago, I felt motivated to jump in to the gold market. However, it seems that the value of an ounce of gold has dropped to about $1,100. What confuses me is the fact that the DJIA, is right now less than it was at the first of the year. Based on what I thought I knew, I expected to see gold soaring, but the reverse is the case.

What should I do? Is gold at a bottom? Should I get in now, or wait?

BN

Charleston, SC

______________________

Hello, BN.

Gold rarely goes by a predetermined schedule. Some would say it is rather obstinate. It goes where it wants to go in its own time and there are all sorts of forces at play with respect to its pricing – a situation of which I am sure you are fully aware. I have never believed that people should own gold because they think it is going to soar in price in the short term. Gold is first and foremost portfolio insurance and a longer-term alternative savings plan where asset preservation is a key objective. Secondarily, it is an investment for capital gain. As a result, if one goes into gold ownership with the attitude that it is simply a workable alternative to stocks or bonds, then short term price fluctuations should not serve as discouragement to either current or would be owners.

None of the conditions that caused gold to rise from the $300 level to the $1800 level pre- and post-crisis have changed, and ultimately they could reassert themselves down the road perhaps in ways most of the analysts never dreamed. The reasons for owning gold are as strong today as they’ve ever been and perhaps even stronger given the socialized, artificial values at work in other markets.

It is unfortunate that you have come to this place in your life (at 74) only to find that your savings will not do for you what you had hoped and I empathize with that. Investors are forced into speculation in stocks, real estate and other ventures when they should be living off a fair annual return on their bank savings. I don’t think those circumstances are likely to change any time soon. If I were to guess at this juncture, I would say that even if we do get increases in interest rates, they will be small and nearly inconsequential and you will be in no better position than you are now.

From my perspective, gold is among the most undervalued of the major portfolio assets at this juncture. I am not the only one who believes that. Recently Interest Rate Observer’s James Grant announced “Mr. [Gold] Market is having a sale.” Similarly, Tocqueville’s John Hathaway commented that “Evidence suggests the bull market in gold is far from finished.” (More on that “Evidence” in an upcoming News & Views. Sign-up here to receive your complimentary issue by e-mail when released.) Contrary to characterizations in the mainstream financial media, global physical demand is soaring in the wake of the recent artificial price drop and very strong among our firm’s clientele. Web site visits to USAGOLD have increased markedly and inquiries are at a level not seen for years.

In short, a large segment of the public believes gold is a buy at these prices. Much of this is due to a major change in financial market psychology that has evolved over the past several years. Now there is a very large group of people out there who believe in gold, and not just in the United States. That belief cannot be suppressed no matter how hard the mainstream press tries. An equally large contingent understands that markets supported artificially are ultimately doomed to failure and potential collapse once the props come down.

In the end, you will need to make a decision on three matters:

1. “Do I believe that the current economic situation warrants hedging?”

2. “Do I believe that gold is the hedge that will get the job done for me?”

3. “Do I own enough gold with respect to my total portfolio to make a difference?”

If the answers in respective order are yes – yes – no, then you should add more gold to your portfolio and it should be in the proper form – gold coins held in your possession.

My continuing golden wishes to you and family,

MK

The Daily Market Report: Gold Slips as Dollar Firms Post FOMC, but GDP Disappoints

30-Jul (USAGOLD) — Gold began the New York session under pressure, weighed by a stronger dollar. The dollar had garnered that strength amid persistent expectations that the Fed remains on track for a rate hike this year.

The FOMC policy statement that came out yesterday was actually broadly interpreted as being more dovish than the previous. The committee members acknowledge ongoing concerns about weak inflation. The Fed said that its first rate hike in nearly a decade would be appropriate when they see “further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.”

With commodity prices tumbling to multi-year lows and energy trending lower once again, there’s not much to suggest that inflation is going to turn around anytime soon. That’s going to make the September FOMC meeting particularly interesting.

The first look at Q2 GDP came out this morning at +2.3%, which was below expectations of +2.7%. While a miss, the financial press is touting the return to growth after the terrible Q1 number. However, thanks to some additional seasonal adjustment, growth no longer contracted in the first three months of the year.

Q1 was revised to +0.6% from -0.2% previously. Q1-2014 also got revised higher, from -2.1% to -0.9%. If you don’t like the negative impact that winter might have on growth, seasonally adjust it out in order to fit your recovery scenario.

While the adjustments erased the small Q1-2015 contraction and negated more than half of the larger Q1-2014 contraction, overall growth since 2011 was adjusted lower to 2.0%. That’s a pretty weak “recovery”. In fact it is the weakest “recovery” in 70-years.

Call me crazy, but it’s certainly not the sort of recovery that would typically inspire the Fed to start a tightening campaign. Beyond the weak growth though, we have continued weak inflation. The Fed must also factor in the risks of a potential hard-landing in China and the reality that the Greek crisis is far from actually being resolved.

Economists React to Second-Quarter GDP: ‘By No Means Satisfying’

30-Jul (Wall Street Journal) — U.S. gross domestic product, the broadest sum of goods and services produced across the economy, grew by a seasonally adjusted annual rate of 2.3 percent in the second quarter of 2015, the Commerce Department said on Thursday. Here’s what economists had to say:

“As expected, much of the second quarter rebound in growth reflected a fading of the drag from net exports–they added 0.1 points to the growth rate in the second quarter after subtracting 1.9 points in the first quarter. Also, consumption accelerated to a 2.9% pace from 1.7% and government to +0.8% from -0.1%. Business fixed investment slowed to -0.6% from +1.6% and residential investment to +6.6% from +10.1%. In short, growth was much better in the second quarter than the first quarter, but still fairly moderate. Core inflation was up a bit on the quarter, but the trend has probably not changed yet. The pace for growth remains extremely weak by past recovery standards, but with potential growth weaker as well it appears to be more than sufficient to keep the unemployment rate coming down.” -–Jim O’Sullivan, High Frequency Economics

[source]

PG View: The first look at Q2 GDP missed expectations. While the double seasonal adjustment erased the Q1-15 contraction and trimmed the severity of the Q1-14 contraction by more than half, the overall pace of the “recovery” going back to 2011 actually slowed to 2.0% on average. That makes this “recovery” the weakest since the end of WWII.

US initial jobless claims +12k to 267k in the week ended 25-Jul, below expectations of 272k, vs unrevised 255k in previous week.

US Q2 GDP (advance) +2.3%, below expectations of +2.7%, vs upward revised +0.6% in Q1.

Gold lower at 1084.50 (-13.03). Silver 14.65 (-0.199). Dollar higher. Euro lower. Stocks called lower. US 10yr 2.29% (+1 bp).

Gold inches up after Fed leaves door open to Sept rate hike

29-Jul (Reuters) – Gold moved up a shade on Wednesday, but remained near last week’s 5-1/2-year low, after a U.S. Federal Reserve statement raised uncertainty about the timing of a possible interest rate hike, leaving the door open for September.

Following a two-day policy meeting, Fed officials said they felt the economy had overcome a first-quarter slowdown and was “expanding moderately” despite a downturn in the energy sector and headwinds from overseas.

The statement said the U.S. economy and job market continue to strengthen.

“(The) market can’t seem to decide whether the Fed has moved marginally farther away from a September hike,” said Tai Wong, director of base and precious metals trading for BMO Capital Markets in New York.

“Will need some FOMC members’ spin in the coming days for a bit more clarity.”

[source]

PG View: Let me see if I can predict the “spin”: The hawks will say a rate hike is warranted before year-end. The doves will say further patience is needed.

Fed, Citing Job Gains, Stays on Track to Raise Rates Soon

by Jon Hilsenrath

29-Jul (Wall Street Journal) — The Federal Reserve on Wednesday left its key interest rate near zero but cited progress in the U.S. job market, a sign it remains on course to raise interest rates in September or later this year.

At the same time, the central bank flagged a nagging concern about low inflation, which is creating caution among officials and could convince them to delay the first interest-rate increase in the benchmark federal funds interest rate in nearly a decade.

…officials said inflation continued to run below the Fed’s 2% objective and said they were continuing to monitor inflation developments closely, a sign of some trepidation about its low level.

The benchmark federal funds rate has been near zero since December 2008, or 2,417 straight days.

[source]

PG View: Soon, as in when the unemployment rate hits 6.5% soon?